2803 (HKD) | 9803 (USD)

A multi-factor approach to capture high quality contributors to China's real economy growth

3173 (HKD) | 9173 (USD)

Capture new economic engines in consumer, technology, healthcare sectors in a multi-factor approach

3151 (HKD) | 83151 (RMB) | 9151 (USD)

Leading technological innovation-based companies listed on the SSE STAR Board

3181 (HKD) | 9181 (USD)

An efficient solution to capture digital transformation, robotics & automation, and healthcare & life science innovations in Asia

2810 (HKD) | 9810 (USD)

A low cost building block capturing the leading powerhouses in Malaysia, Thailand, Indonesia, the Philippines and Vietnam

2804 (HKD) | 9804 (USD)

Efficient, in-time-zone access to capture exponential growth opportunities from Vietnam equities in a single trade

2817 (HKD) | 82817 (RMB) | 9817 (USD)

9177 (USD)

Unique, transparent and low-cost tool to conveniently access Long Duration China Government Bonds

3001 (HKD) | 83001 (RMB) | 9001 (USD)

First SFC authorized high yield bond ETF to capture attractive USD yield from a diversified basket of secured and senior USD China property bonds

3077 (HKD) | 9077 (USD)

9078 (USD)

Cash management tool with daily liquidity, minimal duration exposure, US treasury credit quality and little counterparty risk

3411 (HKD) | 9411 (USD)

Cash management tool with daily liquidity, minimal duration exposure, US treasury credit quality and little counterparty risk

3453 (HKD)

9159 (USD)

An efficient solution to capture digital transformation, robotics & automation, and healthcare & life science innovations in Asia

3478 (HKD) | 9478 (USD)

Asia's first ETF offering convenient access to Saudi Arabia government sukuk market through a one-ticker trade

featured insights & webinar

The risk profiles of Emerging Market (EM) investment grade (IG) vs their developed market (DM) peers are converging. In fact, amidst spending/borrowing excesses in the DM, rising long-term government bond yields, and recent cyclical lows in US corporate credit spreads, volatility for DM bonds has risen substantially since 2020, prompting the expression the “EM’ification of DM debt”. Meanwhile EM IG bonds have been relatively stable, and the search by asset allocators for alternatives to DM bonds will likely continue the pivot to EM IG bonds. Beneath the surface of the short-term volatilities and possibly a longer-term repricing of multiple assets, Asian IG bonds and Saudi government sukuks may just be the sweet spots for attractive, uncorrelated and resilient returns regardless which side one is at on the debasement debate. In this article, our Senior Advisor Say Boon Lim discusses how the asset allocators are increasingly turning to EM IG bonds as compelling alternatives to DM bonds, for which our Premia JP Morgan Asia Credit Investment Grade USD Bond ETF (3411/9411 HK) and Premia BOCHK Saudi Arabia Government Sukuk ETF (3478/ 9478 HK) would be useful allocation tools in this pivot.

Nov 10, 2025

China's biopharmaceutical industry is undergoing a landmark transformation, emerging from a period of profound recalibration to establish itself as a global powerhouse. Propelled by its talent, patient access, cost-efficient infrastructure, and catalysed by comprehensive government policies aimed at supporting the innovative drug value chain, the sector is experiencing a broad-based resurgence, with results beginning to show in earnings and valuations in the first half of the year. The journey, however, is just beginning, fueled by the impending global patent cliff and its strong value proposition: delivering high-quality, innovative medicines at an accelerated pace. This capability ensures China's biopharma sector an indispensable player in the global market, even in the face of possible geopolitical headwinds. In this article, we discuss about the leading innovators in the homegrown biotech landscape—companies well-represented in our Premia China New Economy ETF (3173/9173 HK) and Premia China STAR50 ETF (3151/9151/83151 HK), which have outperformed multiple benchmarks year-to-date and will continue to drive alpha returns for global investors, propelled by a revaluation trend driven by domestic policy tailwinds, strong external partnerships and a rising market value.

Oct 03, 2025

Vietnam stands out as Asia’s best-performing equity market in 2025, fueled by earnings recovery, policy support, and surging public investment. More importantly, Resolution 68 marks the country’s boldest reform agenda since Doi Moi—streamlining bureaucracy, empowering the private sector, and deepening capital markets—creating structural upside beyond cyclical drivers. With infrastructure projects worth over 10% of GDP, robust FDI inflows, and the potential MSCI/FTSE upgrade unlocking sizable foreign flows, Vietnam offers a rare blend of near-term catalysts and long-term growth. In this article, our Partner & Co-CIO David Lai discusses how Premia Vietnam ETF offers investors a diversified, transparent, and cost-effective vehicle that has consistently outperformed active peers—positioning portfolios to capture one of the most compelling reform-driven growth stories in emerging Asia.

Sep 12, 2025

China’s A-share market is turning the corner, as investors looking past weak data and piling back into growth. Signs of rotation by domestic investors from bank deposits and safe haven assets to equity market increasingly validate investor confidence is back. Policy momentum, attractive valuations, and light foreign positioning are fueling a durable rally, echoing the 2016 supply-side reform. Leadership is shifting decisively to innovation-driven sectors — from biotech and healthcare to solar, AI, and robotics — where structural growth and global relevance are accelerating, and are expected to be important focus in China’s upcoming 15th Five Year Plan. In this article, our Partner & Co-CIO David Lai and Portfolio Manager Alex Chu discuss why, with sentiment improving and risk appetite returning, the best way to play China’s new growth cycle is through high-conviction exposure via Premia’s STAR50 ETF and CSI Caixin New Economy ETF.

Aug 26, 2025

China's STAR Market appears poised for a major growth surge, fueled by a wave of innovative robotics companies set to launch their initial public offerings. Leading industry players, including Unitree, Zhiyuan Robot, Jaka Robotics, Fine Motion Tech, and Sichuan Tianlian Robot, are all in the IPO pipeline. In this article, we will introduce these firms that are at the forefront of technological innovation in humanoid and industrial robotics, whose momentum is expected to accelerate, driven by ongoing industry innovation and the favorable policy tailwinds of China's upcoming 15th Five-Year Plan.

Aug 25, 2025

Even for the prepared and informed, at the recent World Artificial Intelligence Conference (WAIC 2025), China has still taken the world by surprise with the debutante of its fleet of over 150 AI-powered humanoid robots. Indeed 2025 marks the beginning of commercialization and production of these futuristic robots, now made reality. While humanoid robots have captured the imagination of the popular media, there has been a more important revolution in the broader robotics industry, where China has emerged, as the global powerhouse, just as it did in renewable energy and electric vehicles. In this article, we discuss how humanoid industrial robots have quickly been integrated in China’s production lines, filling the productivity void from the country’s aging population, while further driving down the manufacturing production costs with high degree of automation with these embodied AI applications.

Aug 06, 2025

Chart Of the Week

David Lai , CFA

CFA

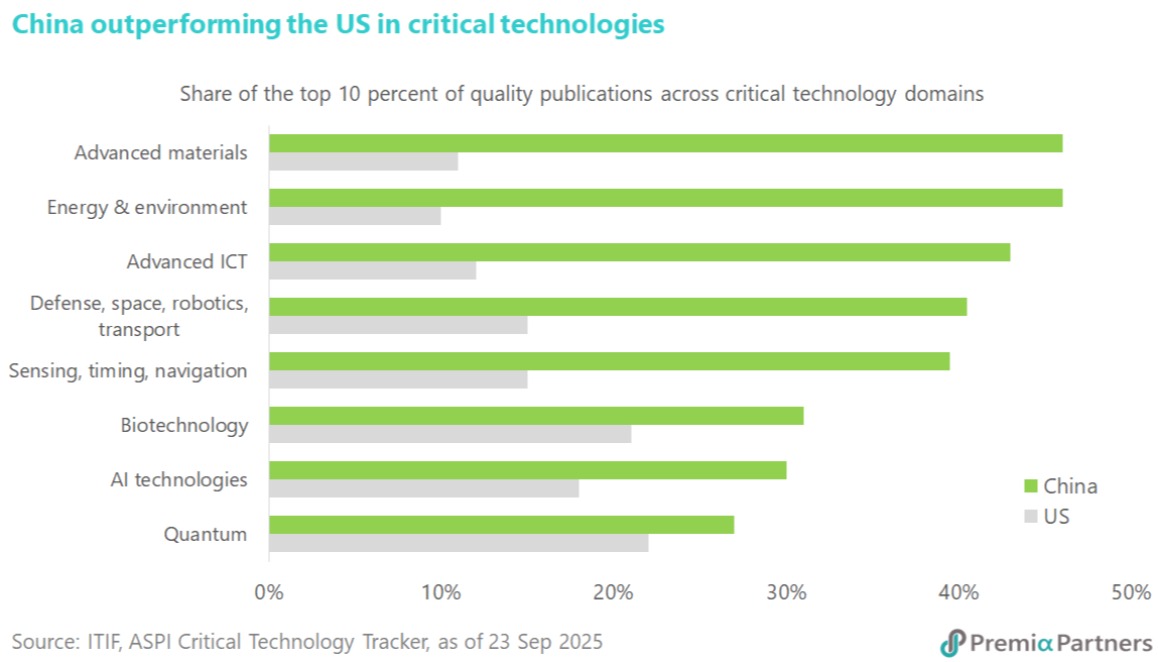

China’s rapidly advancing innovation ecosystem has positioned the country as a pivotal force in the global technology landscape. Its sustained commitment to research, strategic industrial policy, and talent development has enabled China to build deep expertise across a broad range of frontier technologies. Information Technology and Innovation Foundation (ITIF), a non-profit policy think tank based in Washington, D.C., highlights the scale of this progress. China now produces an increasingly large share of global scientific publications and patents, reflecting both the breadth and maturity of its research output. Momentum is particularly strong in high-growth areas such as robotics, advanced batteries, clinical biotech trials, quantum communication, artificial intelligence, advanced materials —fields where China’s state-supported infrastructure and robust innovation pipeline are translating into commercially meaningful breakthroughs. Further evidence from the Australian Strategic Policy Institute’s Critical Technology Tracker reinforces this trend. The analysis shows China holding a leadership position in the majority of the 64 critical technologies assessed, underscoring the effectiveness of its long-term investment in science, engineering, and education. China’s emphasis on STEM talent cultivation has created the world’s largest cohort of technical graduates, providing a deep and scalable foundation for continued innovation. These structural strengths—ranging from its research base to its industrial execution—collectively support a long runway of technological development and commercialization. For investors aiming to gain exposure to this accelerating innovation cycle, our Premia CSI Caixin China New Economy ETF and Premia China STAR50 ETF would be the essential tools.

Dec 08, 2025