The outlook for Developed Market credits for 2025 is challenging. The US rate cutting cycle is near an end. If the resurgence in inflation from middle of last year continues, the rate cutting cycle may have only another 25 basis points left. US Treasury yields have been surging on a combination of concerns over a revival in inflation, surging government debt supply and lower foreign institutional and Federal Reserve buying. Meanwhile, Japan is unlikely to avoid continuation of its gradual rate rises. All of this is set against the backdrop of cyclical low US corporate credit spreads.

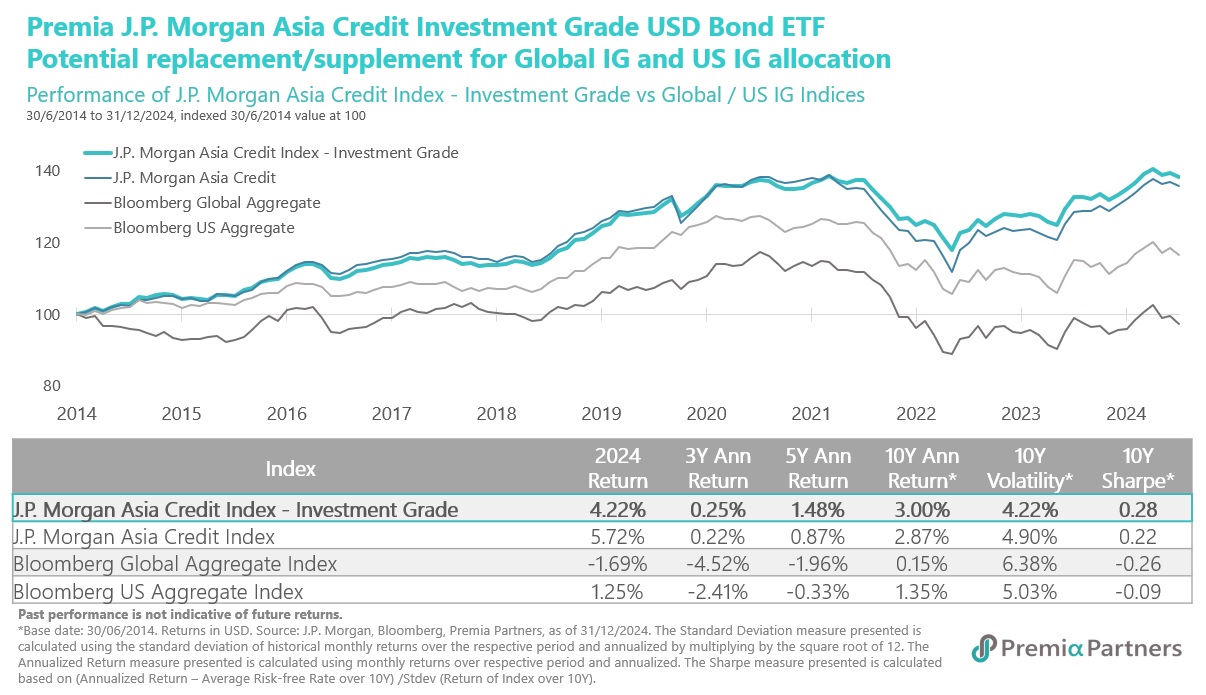

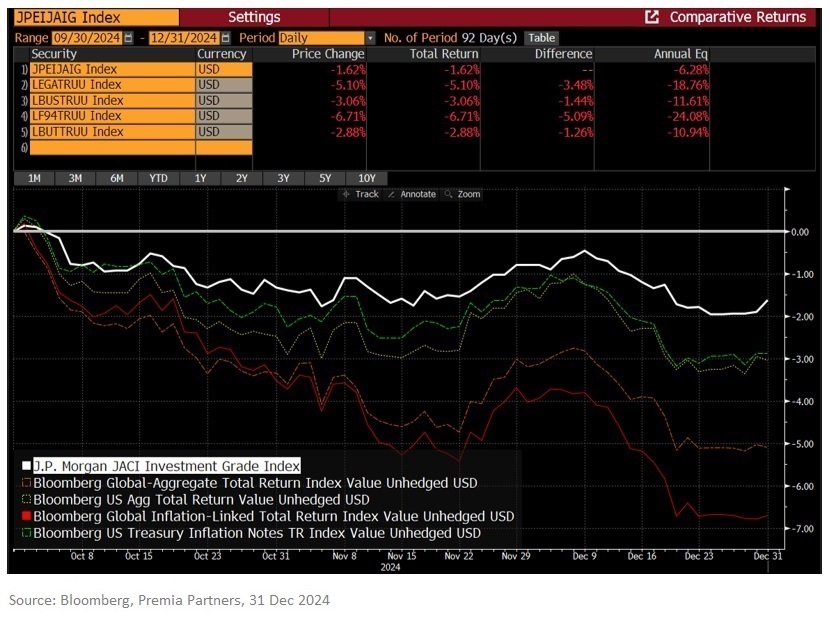

In 2024, Asia ex-Japan investment grade credits (using the JACI IG Index as a proxy) outperformed their global peers (on the Bloomberg Global Aggregate Index and the Bloomberg US Aggregate Index). It also outperformed the most common core fixed income allocations in global IG and US IG despite US rate cuts. Late in 2024, concerns grew over the outlook for US rates and yields under Trump 2.0 policy pledges of more government spending and huge tariff hikes.

Investors looking for inflation hedges may be considering US Treasury Inflation Protected Securities (TIPS) and those with a favourable view of growth may be thinking of high-yield bonds.

But note that the JACI IG index outperformed the other global IG assets including the global IG, US IG and US TIPS. Further, JACI IG is expected to provide a more favourable risk/reward ratio versus high-yield bond assets given the uncertainties going forward. We believe JACI IG will likely maintain this trend of outperformance if US policy and inflation uncertainties continue through the remainder of the year.

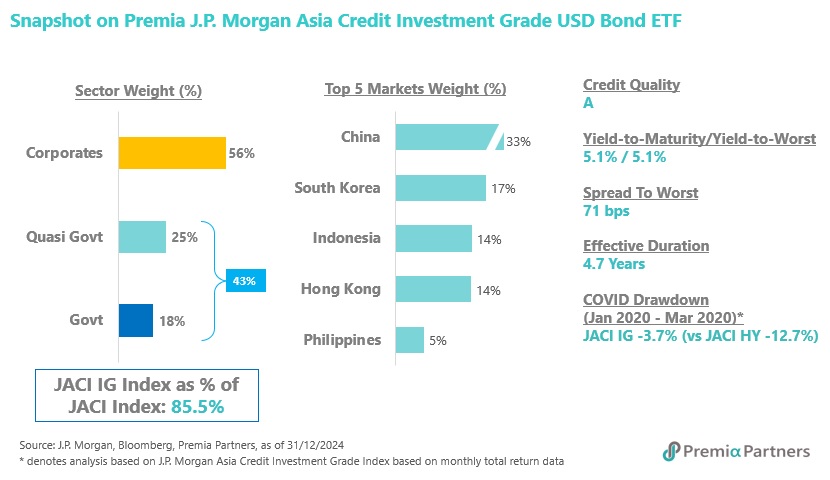

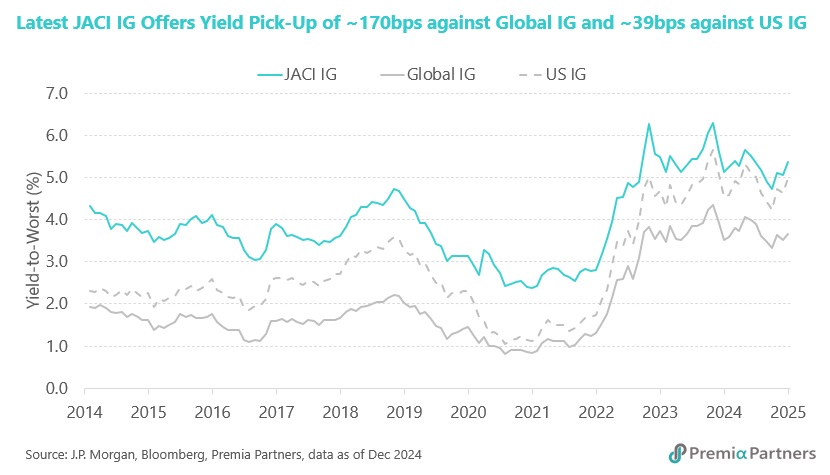

Shorter duration and higher yields. The strong performance of JACI IG can be attributed to several factors, and this is likely to continue into 2025. One key factor is JACI IG's lower effective duration of 4.7 years, compared to 6.5 years for the Global Aggregate and 6.0 years for the US Aggregate. This shorter duration benefited from the steepening yield curve and rising long-term yields. Additionally, during this period, JACI IG provided an average yield pick-up of approximately 157 bps over Global IG and about 39 bps over US IG, resulting in higher returns for investors.

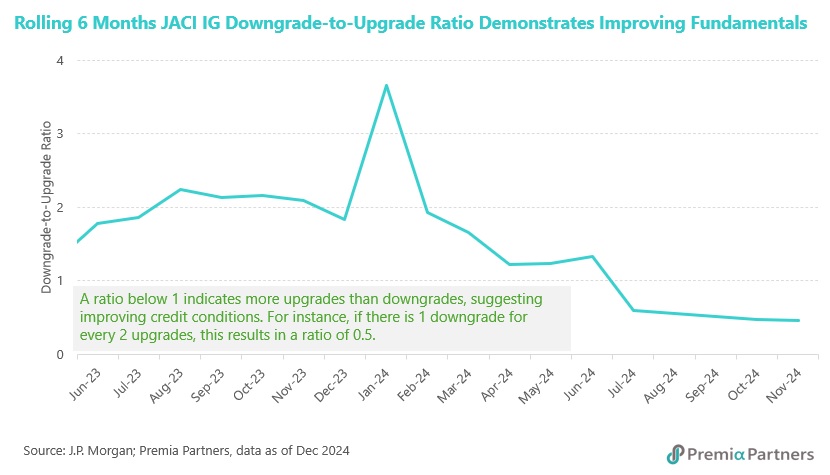

Credit upgrades as a potential source of outperformance. Further, strong economic growth in Asia has translated into a stream of credit upgrades since the beginning of the year. The downgrade-to-upgrade ratio had been trending down during 2024, indicating improving credit conditions for the underlying issuers in JACI IG. Notably, this happened against a strong US dollar backdrop and a steepening yield curve as the market started pricing in coming policy changes under the Trump 2.0 administration.

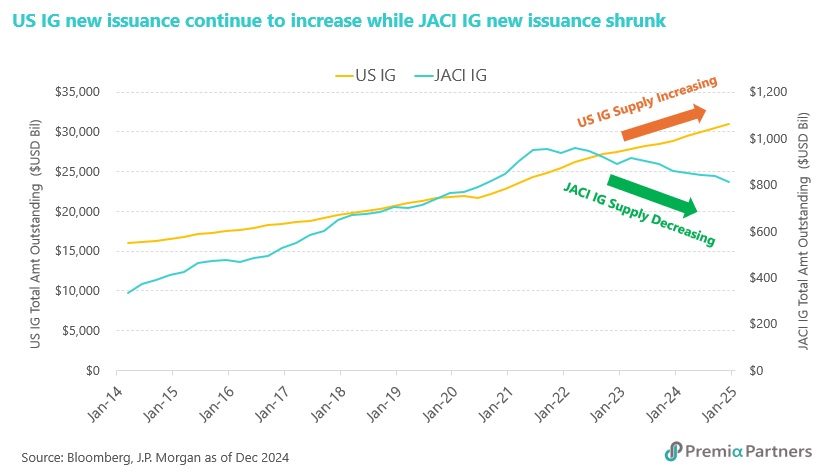

Asia issuance dynamic contributing to resilience of JACI IG. The issuance dynamic is another source of allocation alpha for JACI IG. Over the last few years, when yields increased, it became less appealing for Asian issuers to issue new debt in US dollars. So, when yields rise, Asian dollar credits experience more resilient bond pricing because the supply of Asian dollar credits diminishes, and the spread remains tight. For instance, in November 2024, China issued USD-denominated government bonds at a very tight spread, which began trading with a negative spread.

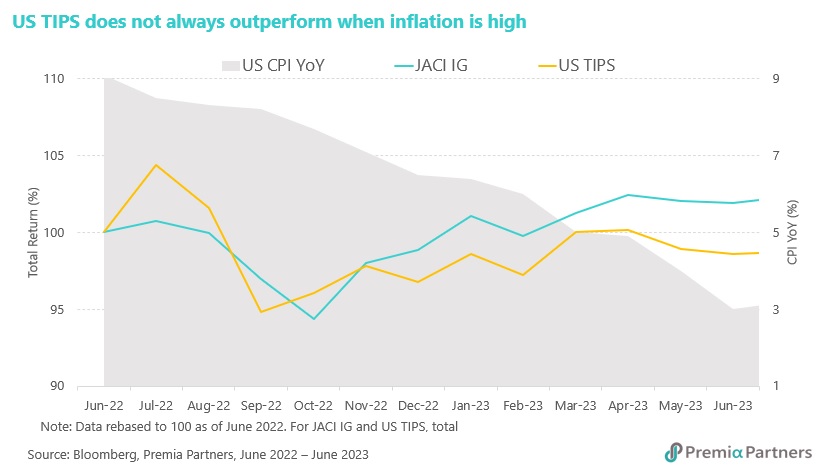

The paradox of US TIPS underperforming nominal bonds just when inflation protection is most needed. Looking beyond JACI IG, some investors are considering US TIPS to protect against the potential reemergence of inflation, but they will likely be disappointed. US TIPS are designed to protect against inflation by adjusting their principal value based on changes in the Consumer Price Index (CPI). However, its performance is not tied to inflation on an absolute basis but rather to the level of inflation relative to the market’s expectation. In other words, when inflation is anticipated and already priced into the market, TIPS may underperform relative to nominal bonds.

This was the case in 2022, when despite the inflation rate still running rampant at well above 7%, US TIPS suffered losses of 6.3% over the period. Widespread outflows in US TIPS funds followed as TIPS underperformed nominal bonds just when inflation protection was most needed. Further, for the period between June 2022 to June 2023 when inflation was still well above 3%, US TIPS underperformed nominal bonds and JACI IG.

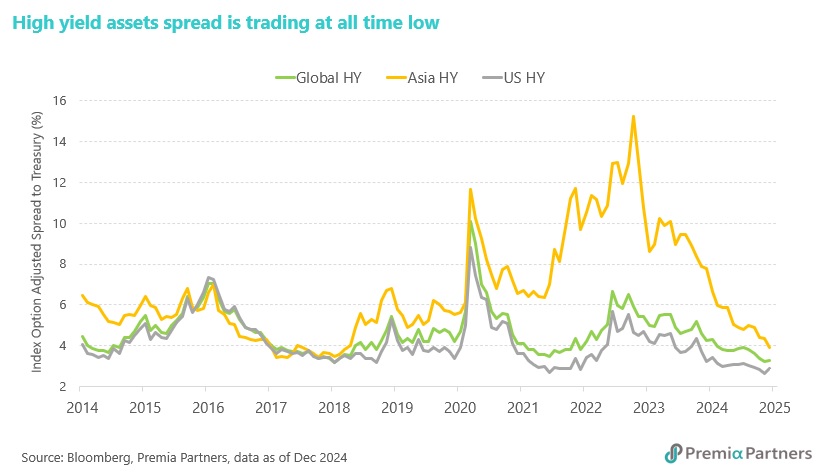

Unfavourable risk-reward balance for high yields at the current spread. High yields in the sovereign external debt market generated significant returns for 2024. However, the potential for a new wave of defaults highlights the precarious situation for emerging market (EM) debt investors. Ethiopia recently became the latest developing nation to default on its debt payments, doing so in late 2023. The IMF is negotiating with Argentina, one of its largest debtors, to potentially replace and expand its existing $44 billion agreement, especially as Argentina faces $9 billion in interest and principal payments on hard currency bonds due next year. Meanwhile, countries like Pakistan and Nigeria are allocating over 30% of their revenues to cover coupon payments.

The slowdown in the interest rate descent not only affects sovereigns but also the broader market. If the rate descent disappoints further, the issuers of high-yield corporate bonds are likely to face a significant increase in borrowing costs. Initial signs of stress are evident, as defaults on leveraged loans – primarily those tied to floating interest rates – have surged to a four-year high. Additionally, rating agencies such as Moody’s anticipate that default rates for US high-yield bonds will rise in 2025.

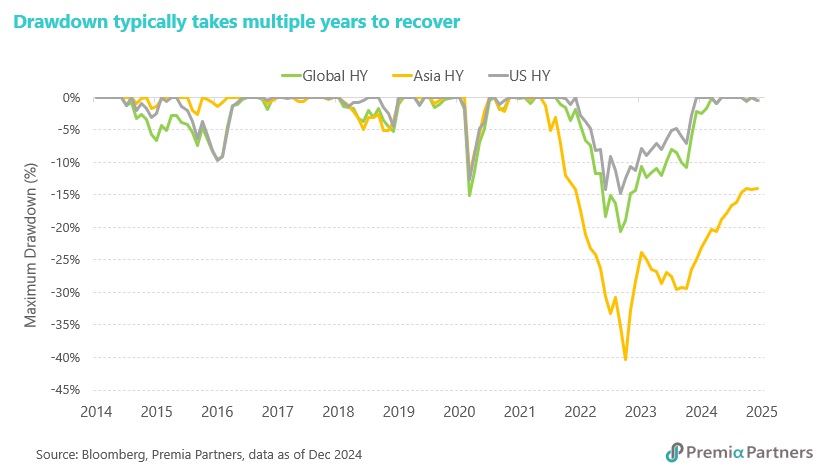

The risk-reward profile for high-yield bonds appears increasingly unfavourable at current spread levels, particularly given the potential for drawdowns. As spreads tighten, the opportunity for significant capital gains diminishes while the risks associated with defaults and economic volatility remain high. Currently, spreads are near their historical low, limiting the risk premium investors can expect to receive in exchange for taking on additional credit risk. Any macro shock could be a catalyst for high yield drawdowns, making high-yield investments less appealing compared to other assets that may offer better risk-adjusted returns.

Developed Market bond markets’ valuations are vulnerable to underpriced risks. Looking ahead, the current valuations in the U.S. risk asset market seem to underprice the risks associated with ongoing uncertainties. Key threats include persistent inflation, slower-than-expected economic growth (particularly in Europe), and other concerns such as the potential impact on Japanese Government Bonds of BOJ rate hikes, which could trigger a yen carry trade unwind and contribute to a global growth slowdown. Meanwhile, the Federal Reserve is late in its easing cycle, with the market currently pricing in just 1.5 rate cuts (as of 8 Jan 2025) this year. Indeed, a continuation of the US inflation resurgence from mid-2024 poses an outside risk that the Fed might have to end its rate cutting cycle at the current level.

These factors have not been fully incorporated into current market valuations, indicating that investors may be underestimating their potential impact. Additionally, stretched valuations in U.S. risk assets suggest that investors are likely to rebalance their portfolios towards bonds as they seek safer investment options in an increasingly uncertain environment. The problem here is that both US stocks and bonds are burdened by valuations that are generally approaching historical highs – hence the idea of diversifying into Asia ex-Japan IG credits.

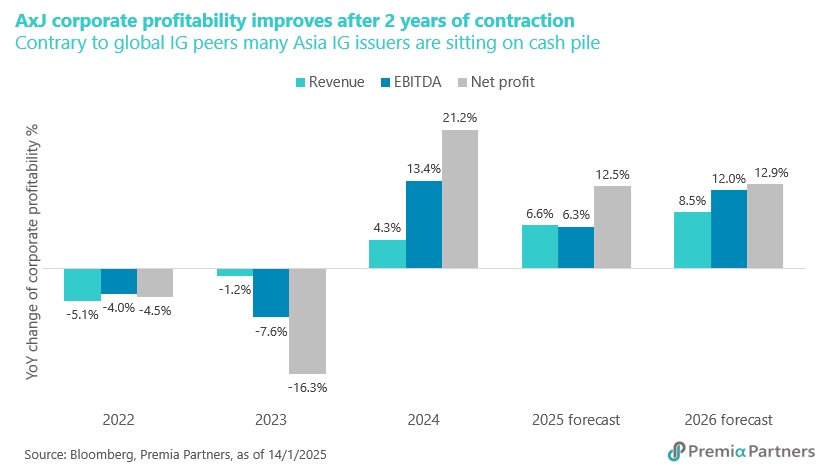

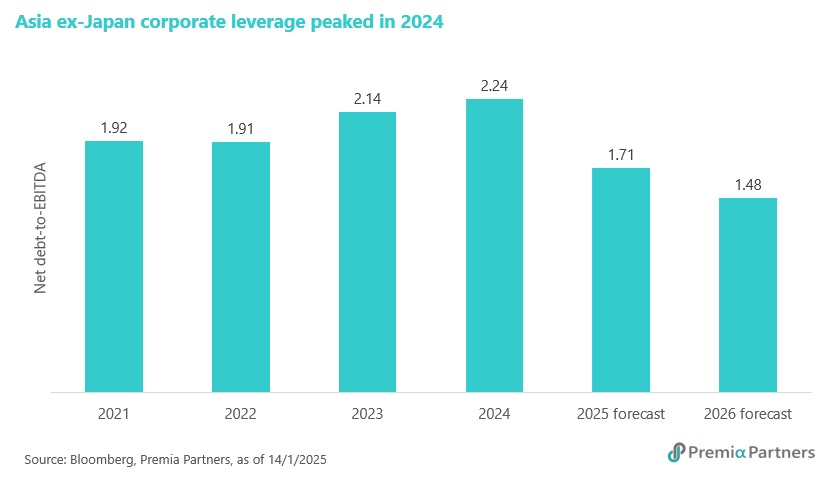

Asia ex-Japan is likely to see lower rates in 2025, amidst GDP growth that is way over that in Developed Markets. Much of Asia ex-Japan have either seen peak rates or are in the early stages of cutting cycles. Yet, the region is projected to experience GDP growth of 4.5% in 2025, significantly outpacing the United States, Europe and Japan, which are forecast to see GDP growth rates of 2.1%, 1.3% and 1.2%, respectively. Moreover, many companies in Asia ex-Japan reported double-digit growth in net profit in 2024, and this trend is expected to continue into 2025 and 2026, accompanied by a decrease in net debt-to-EBITDA ratios. Overall, the economic fundamentals in Asia remain robust.

Trump 2.0 risks for Asia ex-Japan may have been exaggerated. As we argued in our Emerging ASEAN Outlook, the market may have overpriced the risks of Trump 2.0. The bottom line is the US will import even more as the Government ramps up growth through deficit financing. Indeed, by definition in the national income accounting identity, its trade deficit will increase as its budget deficit rises. The sources of imports may change but the supply chain adapts through trade diversion – most of which will continue to be sourced from Asia ex-Japan. Meanwhile, China still has more policy room for manoeuvre to adapt to Trump 2.0.

Positioning to mitigate risks. The Premia J.P. Morgan Asia Credit Investment Grade USD Bond ETF (3411 HK/9411 HK) stands out as a favourable option providing around 4.7 years in duration exposure while getting additional spread against USTs for income. Meanwhile, the favourable issuance dynamic should support bond prices in case yields face upward pressure. These attributes position investors well to mitigate risk during periods of volatility. As the economic landscape evolves, maintaining a balanced portfolio that includes high-quality bonds may be essential for navigating the uncertain terrain ahead while capitalizing on potential income opportunities.