This week, we introduce the newest addition to our product suite – an MSCI Vietnam strategy.

The Investment Case for Vietnam Equities

1. Strong Economic Growth: rapid and stable GDP growth with a young and large workforce

2. Rising FDI and trade: popular FDI destination with increasing inflows and trade value that is overtaking neighbors

3. Growth of the consuming class: exponential growth in consumption from a significantly reduced poverty ratio and a rising middle class

4. Improved macroeconomic conditions: stable credit growth and monetary policy alongside solid currency control and strengthening reserves

5. Trade war benefits: arguably the biggest beneficiary of the trade war and the resulting review of global supply chains

Overview of the MSCI Vietnam strategy (click here to skip to this section)

1. Pure Vietnam exposure: the strategy tracks the MSCI Vietnam Index, which consists of only public Vietnam listed companies and may one day be added to MSCI EM hopefully

2. Physical replication: direct low-cost access to the Vietnam stock market

Click here if you’d like us to contact you about this upcoming strategy

WHY VIETNAM?

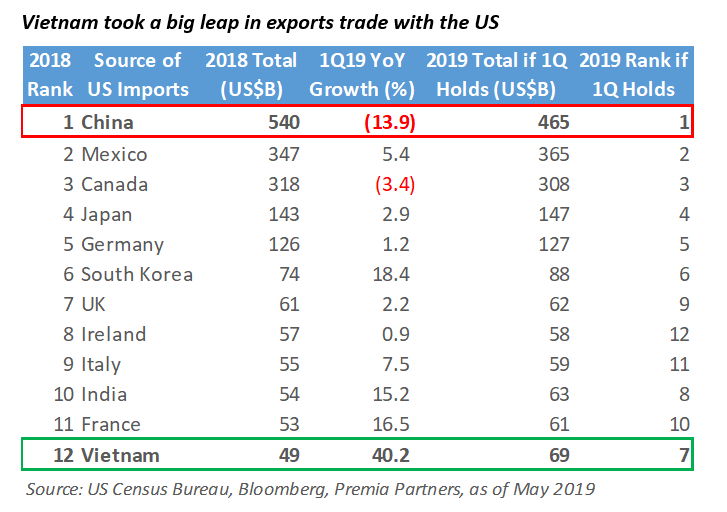

Vietnam has been a hot topic among investors since the trade dispute between China and the US began to escalate last year. The market sees Vietnam as the major trade war beneficiary – taking market share from China in manufacturing and exports. This story is not new – the relocation of global supply chains began over 10 years ago as corporations diversified their production base, taking advantage of both trade quota and cost benefits. The recent trade dispute is simply speeding up this shift. We can watch this play out in real time – China felt the heat in Q1 this year and saw its US exports drop 13.9% while Vietnam seized the opportunity and grew its US exports by 40.2% at the same time. If this trend continues, Vietnam will overtake the UK, Ireland, Italy, India and France as one of the biggest sources of US imports. In terms of GDP, Nomura estimates that Vietnam stands to benefit the most from the trade war. Its gain via additional US imports is to the tune of 8% of GDP, far head of the other top 5 beneficiaries, namely Taiwan (2.1%), Chile (1.5%), Malaysia (1.3%) and Argentina (1.2%).

We believe the time is right for a cost-efficient, physical and transparent ETF to offer access to Vietnam equities. Vietnam as an exposure has been in our roadmap for quite some time for 5 key reasons: strong economic growth, rising FDI and trade, growth of the consuming class, improved macro-economic conditions, and finally, the opening-up and potential upgrade of capital markets.

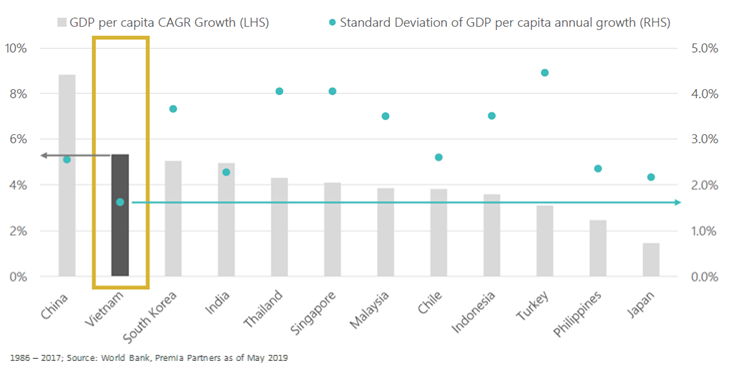

Vietnam has recorded high GDP growth in the past three decades, only lagging China among all the major economies globally. In addition, the volatility of growth is also one of the lowest, showing the quality and stability of its growth profile. As China slows marginally and undergoes structural change, Vietnam’s 2018 GDP of 7.1% already surpassed that of China (6.6%). The trend is likely to continue going forward – the Asian Development Bank estimates that Vietnam will grow at 6.8% and 6.7% in 2019 and 2010, compared to China’s 6.3% and 6.1% during the same period.

High and consistent economic growth of Vietnam

Vietnam has recorded soaring FDI over the last few decades, with net inflows hitting USD 14 billion in 2017, more than double the level of USD 6.7 billion a decade ago. Japan led all nations in FDI approvals for Vietnam, followed by South Korea, Singapore, Hong Kong and mainland China according to Ministry of Planning and Investment. The latest approved projects include the Hanoi "smart city" venture, in which Japanese conglomerate Sumitomo takes part, the liquid crystal display and camera facility investment by South Korea's LG group in the northeastern city of Haiphong, and a production base setup in the high-tech park in Da Nang by the leading global manufacturer of aircraft components, American Universal Alloy Corporation. Compared to its peer group in ASEAN, Vietnam recorded the highest FDI net inflows as a percentage of GDP in recent years. To maintain this path, the Government has committed to improving the business environment, increasing policy transparency, and safeguarding intellectual property rights.

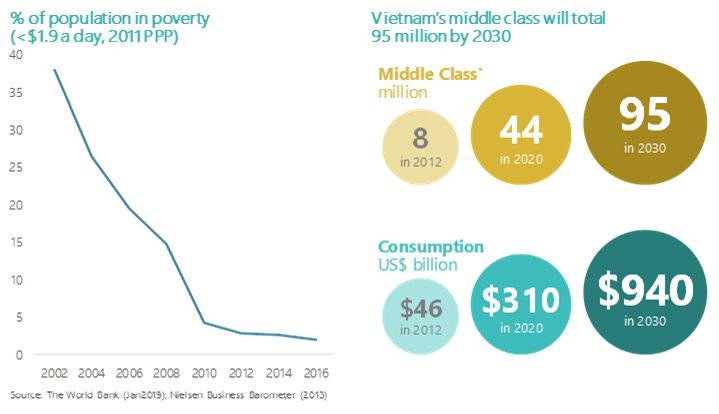

While the media always focuses on the Vietnam export growth story, we should also remember that Vietnam is a 100 million population country quickly moving into the consuming class. With the poverty headcount dropping quickly over the last 2 decades, Vietnamese people are more able to do necessity shopping such as food and beverages, which still account for slightly over 50% of overall household consumption. Like other developing nations, the middle class will expand together with the growing economy. By next year, the number of middle-class Vietnamese will total 44 million, 45% of the population, and the total consumption market will be USD 310 billion. By 2030, the same stats will more than double to a 95 million middle-class and total consumption of USD 940 billion. Consumers will no longer spend most of their money on food and beverages but will shift to consumer durables like autos and electronic devices. Going forward, there will also be enormous needs in service sectors, such as healthcare, education, and financial services.

Consumption pattern will change with increasing middle class

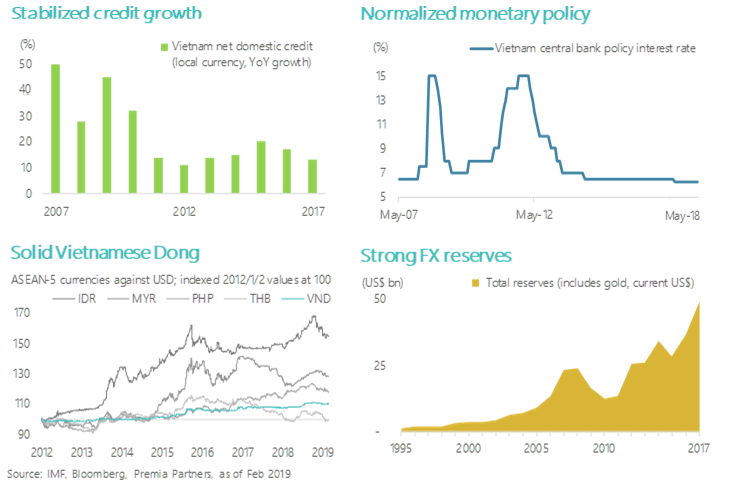

Some investors have memories of the boom-and-bust nature of a fast-growing economy like Vietnam. But in our review, we find relatively healthy macro conditions overall. For example, domestic credit growth reduced dramatically from 30-50% levels a decade ago to low teens today. Inflation also dropped from 20% in 2008 to below 3% today, leading to normalized interest rates that have been at 6.25% since July 2017. As the risk of inflation remains low in the near-term, there is further room for rate cuts by the central bank should economic difficulties lie ahead. The Vietnamese Dong, which is seldom mentioned by the market, has remained quite reliable with low volatility over the past few years, particularly compared to other ASEAN currencies. In addition, thanks to capital inflows and a trade surplus, Vietnam’s foreign reserves have increased steadily to a balance of USD 55 billion in 2018.

Improving macro condition in Vietnam

To a lot of participants’ surprise, Vietnam overtook Singapore as the largest IPO market in ASEAN in 2018. It is very likely to remain in the top spot this year as the government targets to fasten the privatization plan with more listings including Mobifone, Vietnam Posts & Telecom, and Agribank. Vietnam’s equity market cap is expected to go from 60% of GDP today to 100% in 2020 and 120% in 2025. On the regulatory side, the regulators are working to open the market further in order to fulfill the requirements of foreign investors. One of them will be the removal of foreign ownership limits (FOL), which is currently 49% for general industries and 30% for the nation’s socio-economic safety and security such as banking and transportation. By January 2020, the FOL of most companies will be removed entirely except a few sensitive industries, which will be subject to a higher FOL of ~50%. Interestingly, some sector leaders like Saigon Securities in brokerage, Vietnam Milk in dairy, and Sabeco in beverages, have already been granted a completed removal of FOL.

FOL changes show the authority’s willingness to expand capital markets

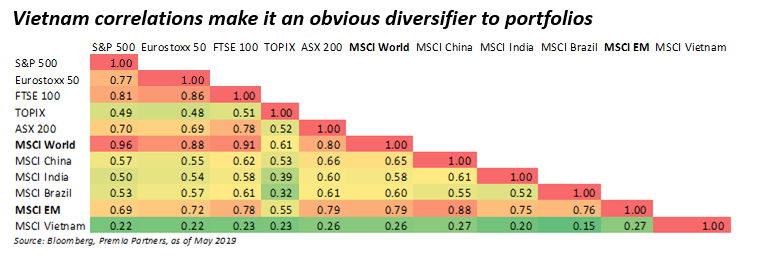

Lastly, many investors may not be aware that Vietnam is officially a Frontier Market (FM), a status below Emerging Markets (EM). Vietnam is currently in the same bucket as Kuwait, Morocco, Kenya, and Nigeria. We believe that in addition to the expected higher economic growth and corporate earnings, a potential upgrade will be one of the major catalysts for Vietnam soon. The State Securities Commission of Vietnam announced that it will introduce changes to achieve promotion to EM. For example, covered warrants will be launched later this month to provide tools to control risk, attract foreign investors and boost market liquidity. Vietnam has much progress to make – it is classified as a lower-middle income speculative market with restrictions in several elements key for global investors. That said, FTSE Russell already added Vietnam to its watchlist for a possible upward reclassification in the future. MSCI is also monitoring the situation closely and reviewing whether the market meets the criteria for watchlist inclusion and potential upgrade. For now, though, there is a silver lining – Vietnam offers EM level and quality growth (if not better) but FM level correlations.

Vietnam correlations make it an obvious diversifier to portfolios

WHY THE MSCI VIETNAM strategy?

As with every Premia product launch, our Vietnam strategy was borne out of client frustrations. When we launched 2810.HK – our Emerging ASEAN ETF – clients were intrigued by its Vietnam allocation and lamented that there was no good way to access Vietnam as a single country exposure. We were surprised – given the points above, we expected to see plenty of useful and efficient access options. Turns out that is not the case. There are 4 main ways investors access Vietnam equities today:

1. Inefficient ETFs: existing ETFs are either synthetic (incur high swap costs, not always disclosed), domiciled in the US (incur withholding tax), don’t offer pure Vietnam exposure (invest in other country “related” stocks) or are domiciled in Vietnam (incur costly onshore setup)

2. Closed-end funds: volatile premium/discounts measured in terms of %, high fees, delayed holdings transparency, limited liquidity and out-of-time-zone trading

3. Open-end mutual funds: high fees and mixed alpha – Vietnam’s market inefficiency meets very low liquidity and high transaction costs for active positions

4. Direct stock positions: costly onshore setup for small portfolio allocations

Our mission is to improve the Asian beta landscape and solve investor challenges into Asia. This is an obvious example of an exposure that needed us to act.

Let’s start with answering the simple question – what is the MSCI Vietnam strategy?

The MSCI Vietnam Index is a simple market-cap beta index that follows MSCI’s global rules. It covers 85% of Vietnam’s free-float market cap and may hopefully will be the index that is included in EM one day, if/when Vietnam qualifies. If you want exposure to Vietnam, please stay tuned.

So what do I actually own?

The MSCI Vietnam strategy will physically own stocks in the MSCI Vietnam Index. We will trade and hold assets onshore. Here’s a snapshot of what the exposure was at the end of March:

How is the MSCI Vietnam strategy different from existing ETFs?

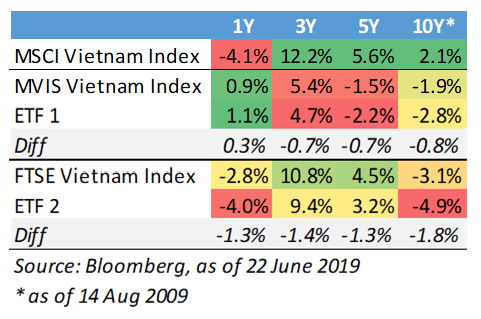

We covered the inefficiencies of existing offerings above, but these aren’t just theoretical concepts. They impact returns. Below is the historical performance of MSCI Vietnam vs existing ETFs following other indices. Big picture observations – existing ETFs either materially underperform their benchmarks due to high overall costs (ETF 2 – 1.8% annual drag over 10 years adds up) or their benchmark materially underperforms overall (ETF 1 & 2). As mentioned above, we designed our upcoming strategy to be simple and efficient. An efficient way to quickly and easily obtain exposure to Vietnam equities today.

How does the Vietnam strategy compare to closed-end and open-end active funds?

Beyond the obvious – it is a beta exposure, fees are lower, lower premium/discounts than closed-end funds, you know what you own daily and can trade daily – there is no simple answer. Each active fund is different. However, let’s zoom in on fees, premium/discounts and performance. Below are a few summaries of fee language from existing funds:

Fund 1: 2% on first US$1.25B, 1.75% on next US$0.25B, 1.5% on assets above US$1.5B

Fund 2: 1.75% per annum, up to 1.5% further via performance fee up to max 3.25%

Fund 3: 5% of NAV for initial charge and 1.5% per annum

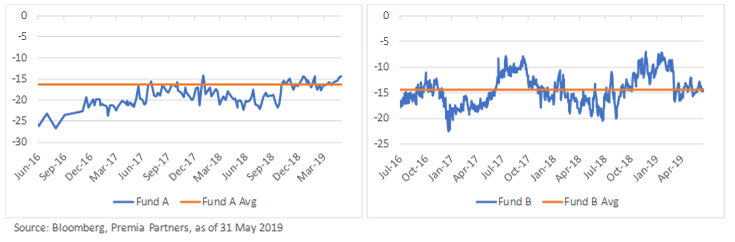

In addition, closed-end funds suffer from extreme premium/discounts. Unlike ETFs, there is no mechanism to keep price close to NAV, so investors are subject to large price swings. Some will argue that buying anything at a discount is good. The question, however, is whether that same exposure can be sold at a smaller discount. Managers are unlikely to buy back shares as their primary revenue source is fees based on size of the fund. We believe the premium/discounts swings will persist and discounts will get worse when investors want to sell. Below are the last 3 years of discounts from 2 of the largest closed-end Vietnam funds.

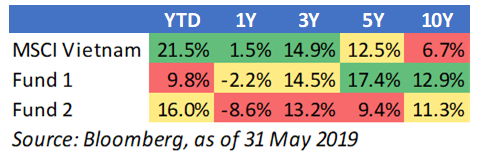

Lastly, a common investor observation is that inefficient markets require active management. This is largely acknowledged to be true. However, liquidity presents a challenge to this hypothesis as active investors have more concentrated positions and trade more often. Though they may outperform at times, in less efficient markets the periods of underperformance are brutal. See below the performance of MSCI Vietnam vs 2 of the larger active Vietnam funds during the last few years. Over the last 3 years, the active funds have underperformed. In one case, by as much as 10% in one year. You have to go back 10 years (when Vietnam wasn’t yet on most investors’ maps) to see clear outperformance by both funds.

That just about sums it up. Vietnam is an up and coming market that you can consider adding to your portfolio. It’s a 100-million-person country growing at 6-7% a year. It’s not yet in EM so you may want to make an active asset allocation decision to own it.

Regards,

David