The time has come – Federal Reserve chair Jerome Powell finally signalled that rate cuts will likely start in Sep at Jackson Hole, though his remarks offered few clues as to how the Fed might proceed after its Sep gathering. While extending duration in US Treasuries has been a popular approach as the Federal Reserve signals an imminent shift towards Fed rate cuts. This strategy may involve purchasing treasuries direct or via exchange-traded funds (ETFs) designed to track the performance of mid- to long-term Treasury securities. On the surface, the strategy appears to be a straightforward decision given the assumption that falling interest rates will lead to rising bond prices, thus potentially generating attractive returns. However, this approach is not without its complexities and risks in practice.

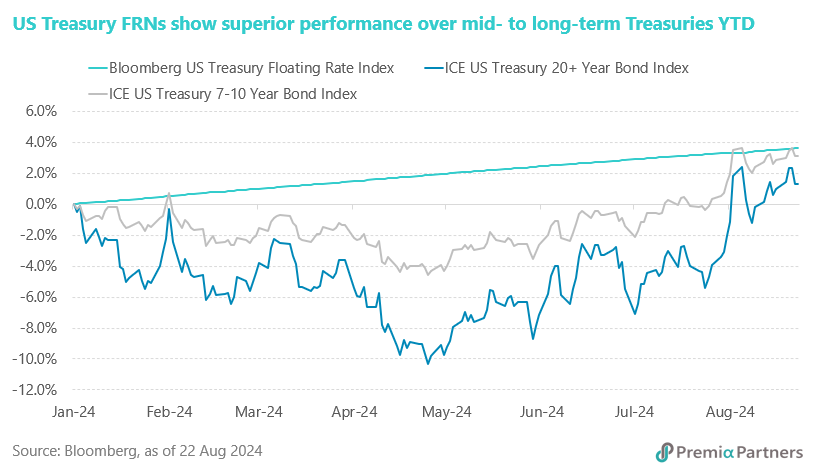

First, it is crucial to acknowledge that this strategy assumes a high degree of certainty regarding the timing and scale of Federal Reserve rate cuts. Such certainty is elusive in the ever-changing landscape of capital markets. The capital markets are characterized by inherent unpredictability, and the simple act of extending duration in Treasuries does not always translate into higher yields or favorable risk-adjusted returns, particularly in the context of an inverted yield curve. For example, the 20+ year Treasury bonds have demonstrated significant volatility, as evidenced by their over 10% drawdown during the first four months of this year. This considerable decline underscores the inherent risk of relying solely on duration extension as a strategy in the current environment. The substantial drop in bond prices highlights how sensitive long-duration Treasuries can be to interest rate changes and market fluctuations, which can undermine their appeal as a stable investment option.

Recent developments have added further complexity to the investment landscape. The Federal Reserve's July meeting minutes, coupled with an unexpected slowdown in the US labor market, have sparked speculation about the timing of the Fed's next rate cut. Currently, market expectations are centered around a potential cumulative rate cut of 1% by the end of the year. This expectation implies that the Fed might implement a 50-basis-point cut at one of its remaining meetings in 2024. However, given the prevailing inflationary pressures—despite a decrease from peak levels, inflation remains above the Fed's long-term target of 2%—and the proximity of a presidential election, it is reasonable to anticipate a more cautious approach from the Fed. The central bank is likely to favor incremental adjustments, potentially implementing cuts of only 25 basis points per meeting rather than the more aggressive reductions anticipated by the market.

In light of these uncertainties and the current inverted yield curve, US Treasury Floating Rate Notes (FRNs) present a compelling alternative for investors seeking diversification and stability. Unlike traditional fixed-rate Treasury securities, FRNs offer a more adaptable solution for managing cash. One of the key advantages of FRNs is their liquidity, which allows investors to exit their positions without sacrificing accrued interest. This feature provides investors with the flexibility to quickly access funds for urgent needs or to seize new investment opportunities as they arise.

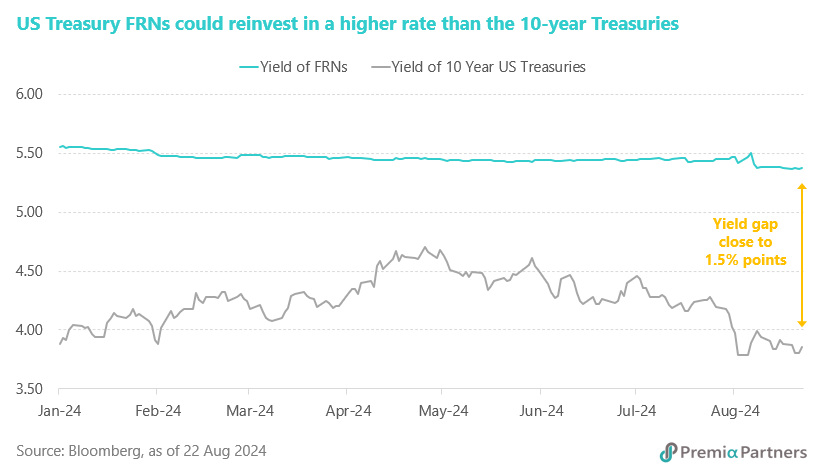

FRNs are benchmarked to the 13-week Treasury bill rate, which is closely aligned with the Fed's official rate. This linkage provides a level of protection against interest rate fluctuations, making FRNs a more stable option compared to traditional deposit accounts. Deposit rates can fluctuate significantly based on banks' liquidity conditions. When banks have ample liquidity, deposit rates may decrease, posing reinvestment risks for investors. In contrast, FRN coupon rates are adjusted periodically in line with the prevailing 13-week Treasury bill rate, which is more stable and predictable compared to deposit rates. This mechanism provides a buffer against interest rate volatility, enhancing the attractiveness of FRNs in uncertain economic conditions. Moreover, FRNs offer a virtually risk-free profile compared to bank deposits, which are subject to default risk. The security provided by FRNs stems from their backing by the US Treasury, making them a lower-risk investment relative to deposits held at financial institutions that may face solvency issues.

FRNs now yield more than many mid- to long-term fixed-rate Treasuries. With FRN yields close to 5.3% and the 10-year US Treasury yield below 4%, FRNs present an opportunity for potentially higher returns in the short term. This is particularly relevant if the Federal Reserve refrains from making dramatic interest rate cuts and if long-term Treasury bonds do not experience significant price corrections.

For investors and allocators, while extending duration in US Treasuries may initially appear to be a viable strategy in anticipation of Federal Reserve rate cuts, it is important to recognize the associated risks and uncertainties. The volatility experienced by long-duration Treasuries and the cautious stance likely to be adopted by the Fed make FRNs an appealing tool for diversification, cash management and portfolio completion. For investors looking to take advantage of the stability and higher yield of FRNs, the Premia US Treasury Floating ETF (Distributing Unit Class) and the Premia US Treasury Floating ETF (Accumulating Unit Class) are worth considering. Both ETFs invest in a diversified basket of US Treasury FRNs, providing investors with exposure to this attractive asset class which offers solid risk-adjusted returns – and are very cost efficient designed for non-US investors without the complications of US or Hong Kong withholding tax or stamp duties.