China's biopharmaceutical industry is undergoing a significant transformation, evolving from a generic manufacturer into a global powerhouse that licenses out "First-in-Class" and "Best-in-Class" therapeutics. This new era is defined by a potent combination of domestic policy tailwinds, strategic international licensing deals, global patent cliff and an unparalleled capacity and scale for rapid innovation, positioning China not merely as a participant but as an essential competitor poised to reshape the future of innovative drugs.

Forging a world-class ecosystem through domestic reform

The catalyst for this ascent is a comprehensive overhaul of the domestic ecosystem. Just five years ago, China's industry relied heavily on Western companies for access to leading drugs. Today, it is making massive investments in research and development to create its own therapies, from the PD-1/PD-L1 space to cutting-edge modalities like T-cell engagers (TCEs), dual immuno-oncology combinations, and bispecific antibody-drug conjugates (ADCs).

A decade of deliberate regulatory reform has streamlined the entire drug development lifecycle, powering a paradigm shift in China's pharmaceutical industry. The government's strategic support for the entire innovative drug value chain has been pivotal, most notably through the dramatic acceleration of approval timelines by the National Medical Products Administration (NMPA). NMPA has dramatically streamlined the drug development lifecycle, cutting the standard review period for drug applications from 200 to 60 working days and clinical trial application approvals from 60 to just 30 working days1. The expedited pathway, combined with parallel processing and proactive agency guidance, enables a rapid increase in the number of homegrown innovative drugs. The pipeline has nearly doubled from 2,251 in July 2021 to 4,391 in January 20242, according to Nature Reviews Drug Discovery. In 2024, the NMPA approved a record 48 innovative drugs, with 43 more approved in the first half of 2025—a 59% year-over-year increase.

This progress signifies a move from generic manufacturing and "me-too" innovation to a focus on developing "First-in-Class" and "Best-in-Class" therapeutics, solidifying China's position as a hub for novel drug discovery.

The ‘licensing-out’ model: A strategic gateway to the global stage

China's robust domestic foundation has become the launchpad for an ambitious globalization strategy, primarily through outbound licensing agreements, or "license-out" deals. In this model, Chinese biotechs grant overseas or global rights for their proprietary assets to international pharmaceutical giants, who then handle subsequent clinical development, regulatory approvals and commercialization.

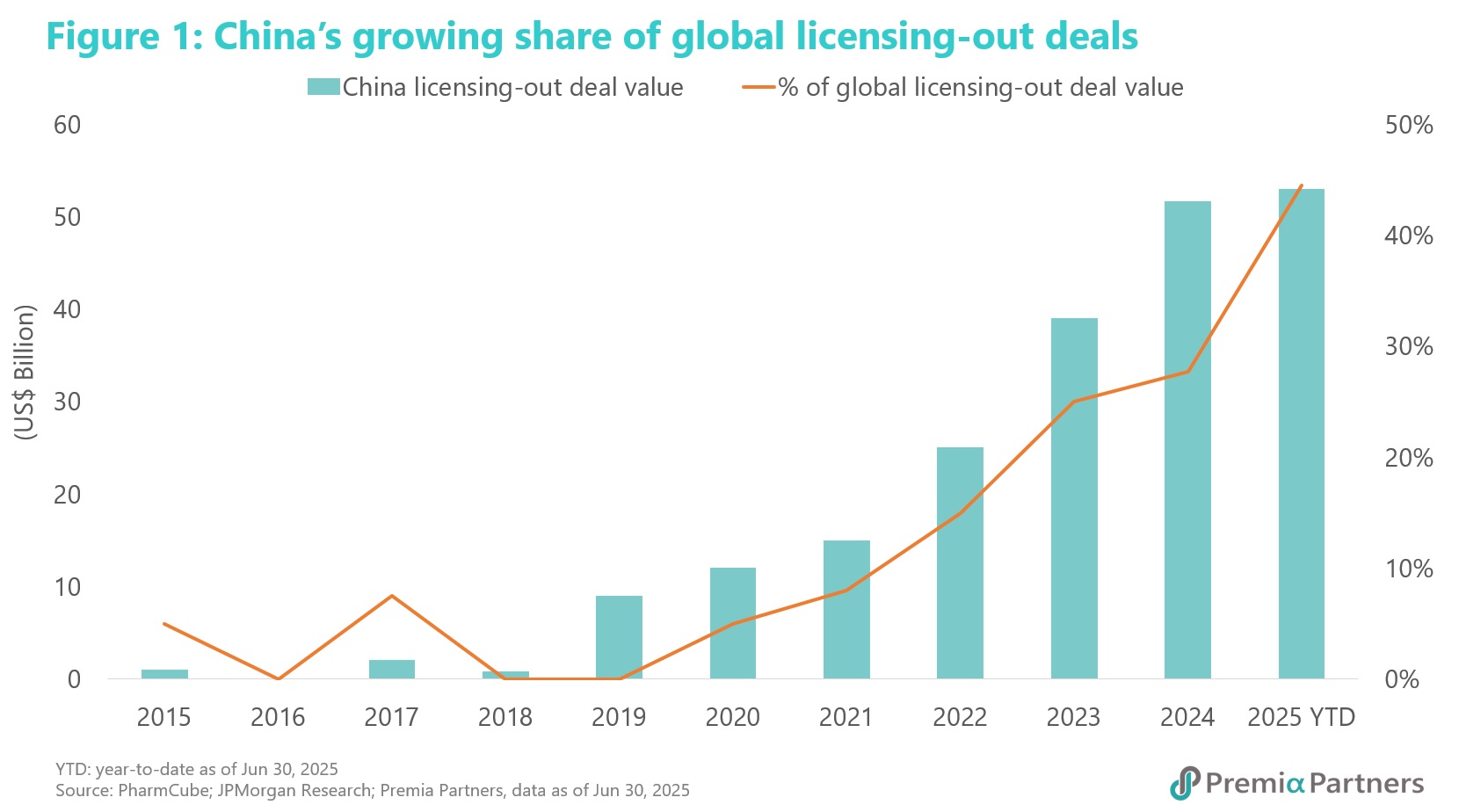

This approach has proven exceptionally successful in both deal value and deal volume, with 2023 marking a milestone year when the value of outbound deals surpassed inbound transactions for the first time. The momentum has only accelerated in 2024, with license-out deals exceeding US$51.9 billion, a 27.4% year-on-year increase that captured nearly a third of the global total. In the first half of 2025 alone, China's deals accounted for 44.5%3 of the global total.

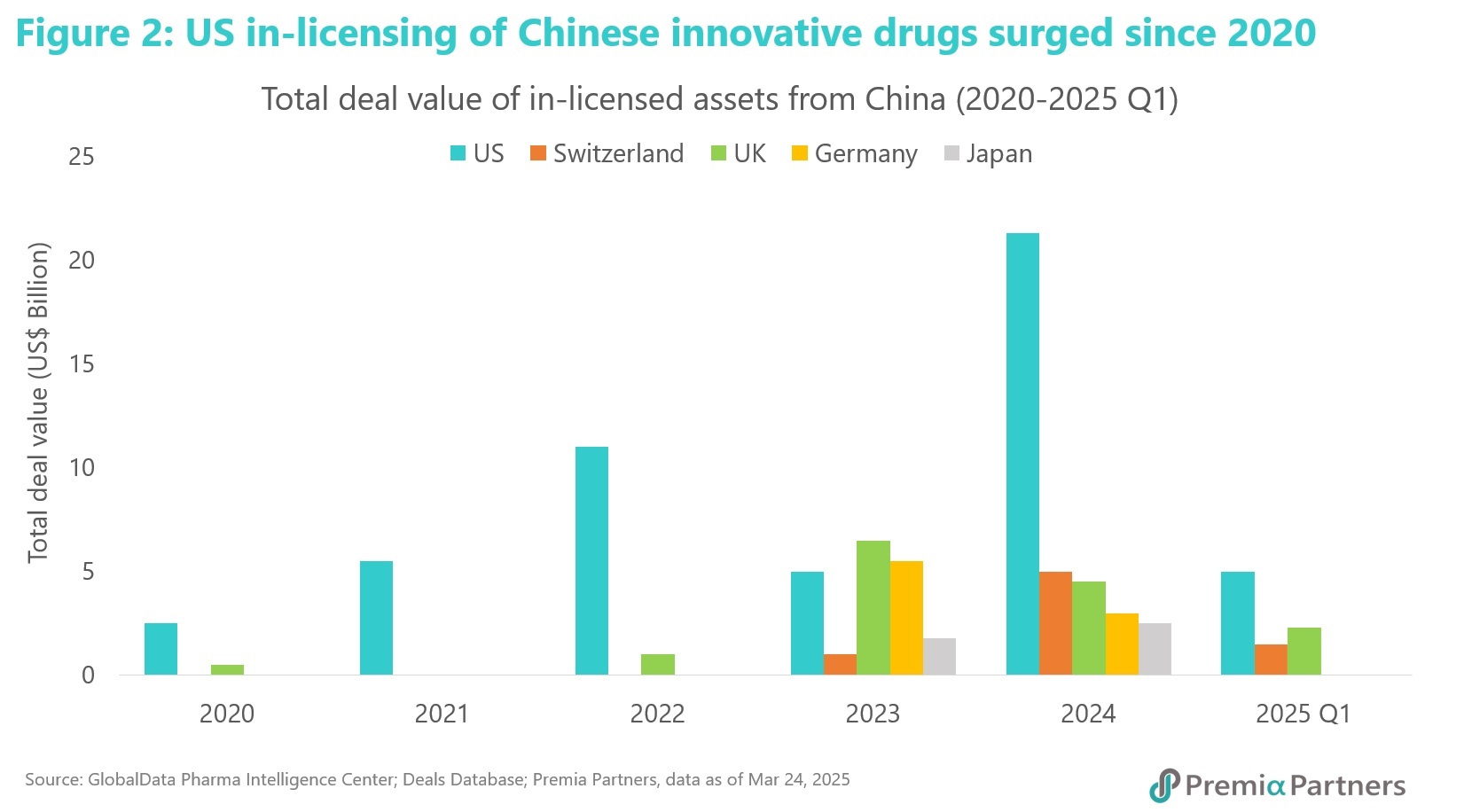

This dynamic creates a powerful market pull, with US and European firms actively seeking to license promising clinical assets, spanning from traditional small molecules to cutting-edge modalities like cell and gene therapies and ADCs. Since 2024, the total value of US in-licensed drug candidates from Chinese biopharma companies has surged by 280%4, according to GlobalData. Similar trend also emerges in other regions in last two years, including UK, Germany and Japan.

Global patent cliff: Creating immense demand for quality innovative drugs

A significant external driver of this global appetite for Chinese innovation is the looming global patent cliff, which could be the most significant one in pharmaceutical history. According to DrugPatentWatch, from 2025 and 2030, a cohort of the world’s top-selling drugs are set to lose market exclusivity, placing over US$200-230 billion5 in annual revenue at risk for Western pharmaceutical companies. This imminent revenue chasm is forcing these giants to aggressively replenish their pipelines, through internal R&D, M&As or in-licensing deals.

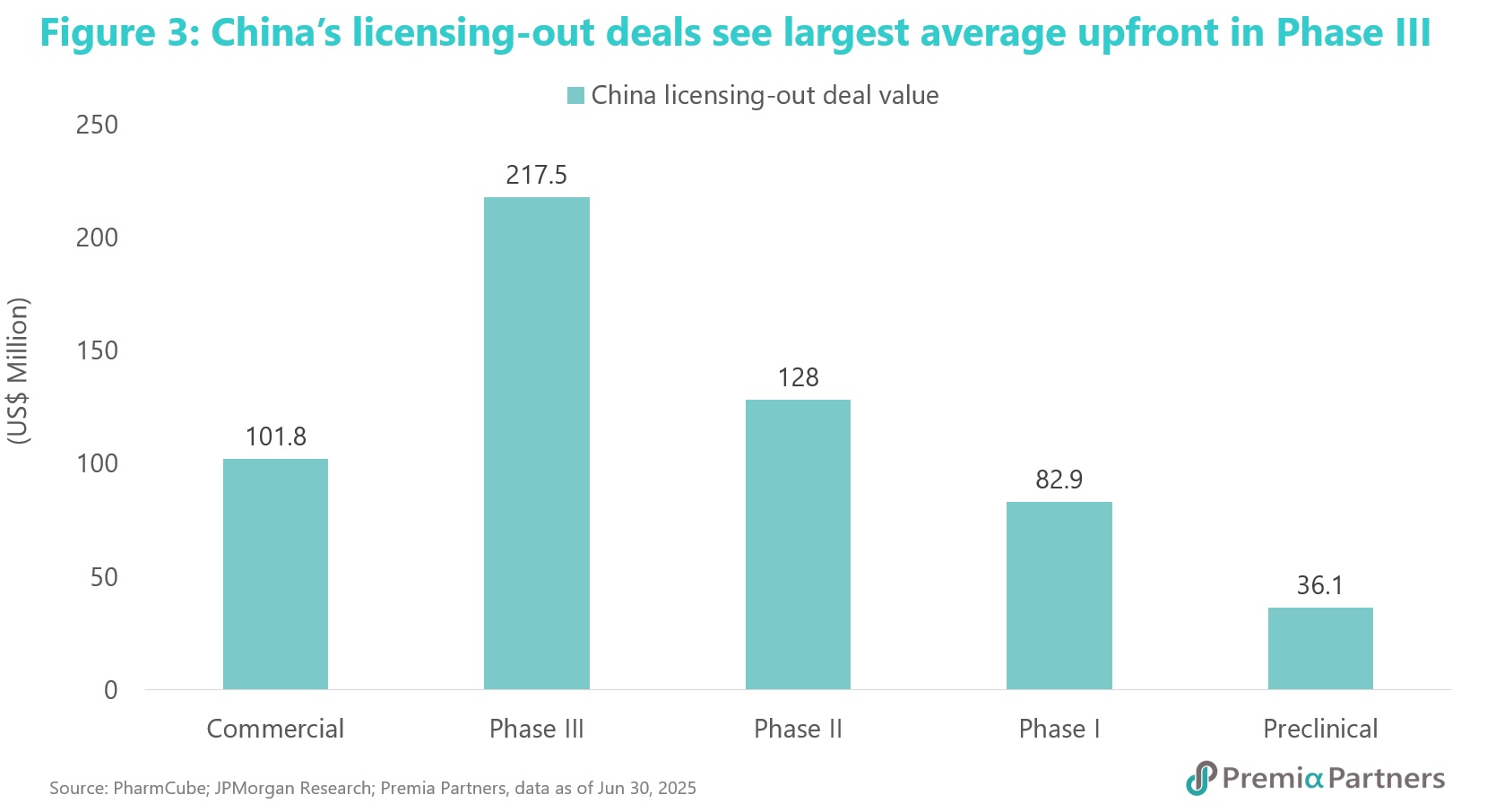

Chinese biotechs, with their burgeoning portfolios of novel therapies, have emerged as high-potential assets and a premier source for this innovation, not only in cost but also in quality. Recent data shows that overseas companies are often willing to pay a premium for Chinese assets, a fact that upends the "low-cost competition" stereotype. Data also shows that the average upfront payment for oncology and immunology licensing deals originating from China—at US$215 million and US$383 million, respectively—is higher than the global average of US$193 million and US$177 million3.

Chinese biotechs have primarily licensed out oncology assets, which account for ~60% of all out-licensing deals over the last decade. Furthermore, there is a strong positive correlation between upfront payments and the development stage of the asset, with an average upfront payment of over US$210 million3 for Phase III clinical trial assets, reflecting a rational match between asset quality and valuation.

Core advantages in clinical speed, scale and sophistication

China's competitive advantage extends beyond its innovative pipeline and is rooted in an unparalleled capacity for speed, scale and sophistication. It is believed that three key factors are driving interest from international pharma companies:

- Solid R&D Capabilities: A proven track record of discovering innovative drugs.

- Faster Development Speed: Accelerated timelines, especially during preclinical and early clinical stages.

- Improved IP Protection: Growing recognition and trust from overseas regulatory agencies like the FDA and EMA.

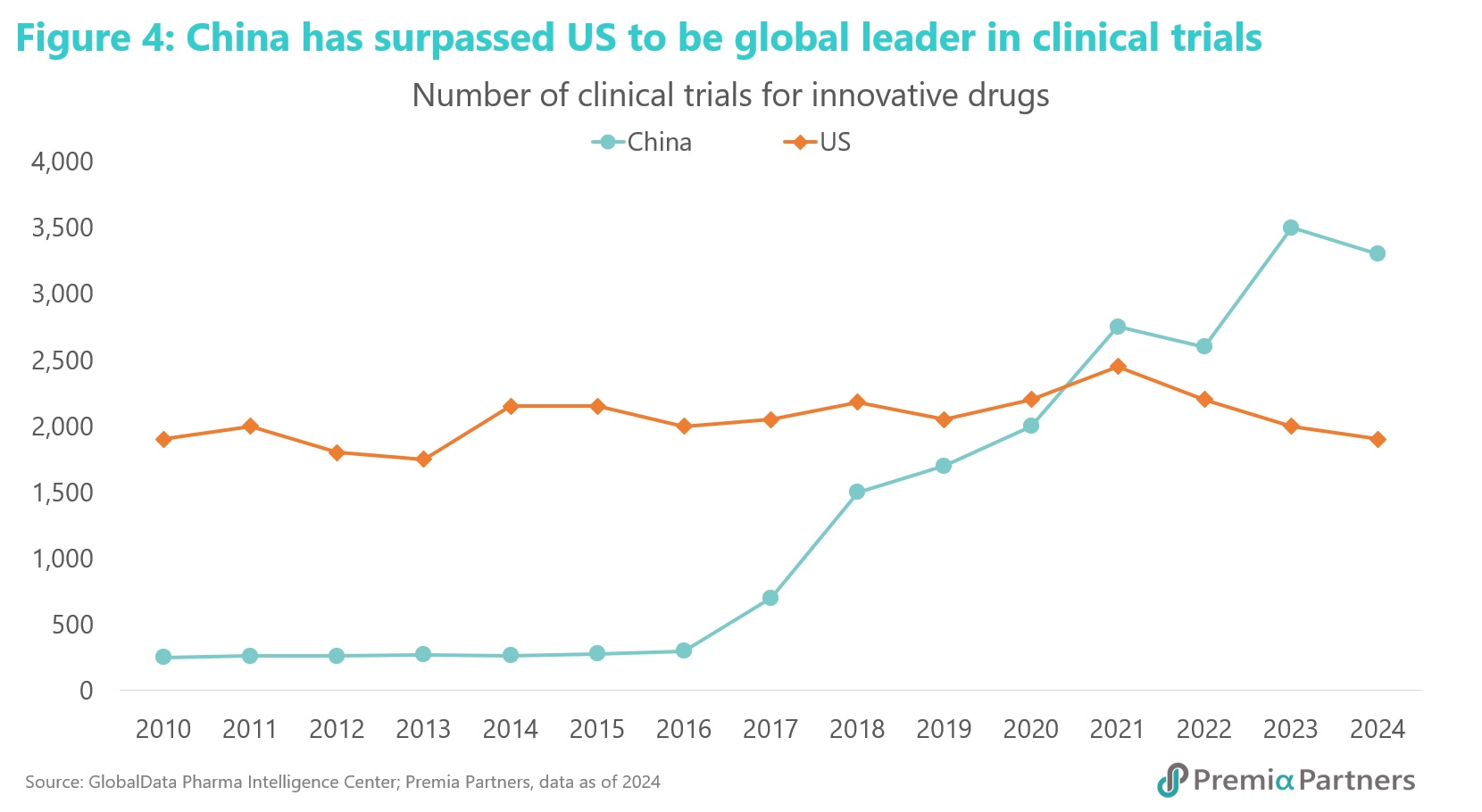

GlobalData revealed in February 2025 that China now leads the world in the number of initiated clinical trials, and crucially, the per-patient cost remains lower than in the US thanks to its vast patient population, which accelerates recruitment. According to an analysis by McKinsey & Company, Chinese biotechs can move from target discovery to candidate confirmation 50-70%6 faster than the global average, a velocity enabled by the adoption of AI-driven discovery platforms and massive influx of talent and capital.

This efficiency is further supported by an incredible growth in patent applications—a 379% increase7 in the last decade (2014-2024), according to WIPO data, a rate unmatched by any major country, including the U.S., which saw a 10% increase during the same period. This is also reflected in infrastructure, with Beijing and Shanghai far outpacing global hubs like Boston in the under-construction space for new life science labs and R&D facilities. As of the end of 20247, Beijing had 7.35 million sq. ft under construction and Shanghai had 6.4 million sq. ft, followed by Boston (3.88 million), San Francisco (2.7 million), and London (2.7 million), according to a CBRE April report.

Rise of a cohort of ambitious and sophisticated companies

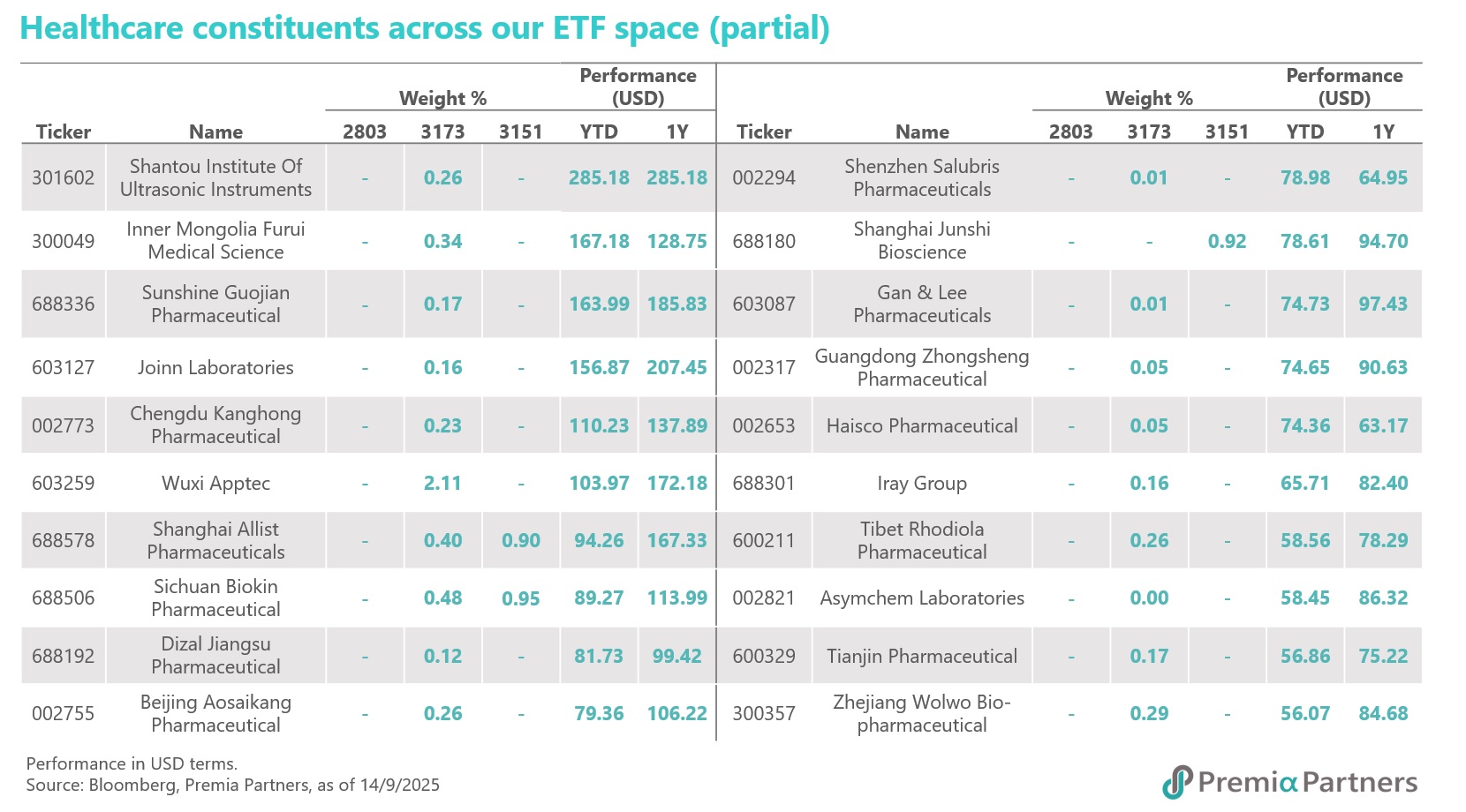

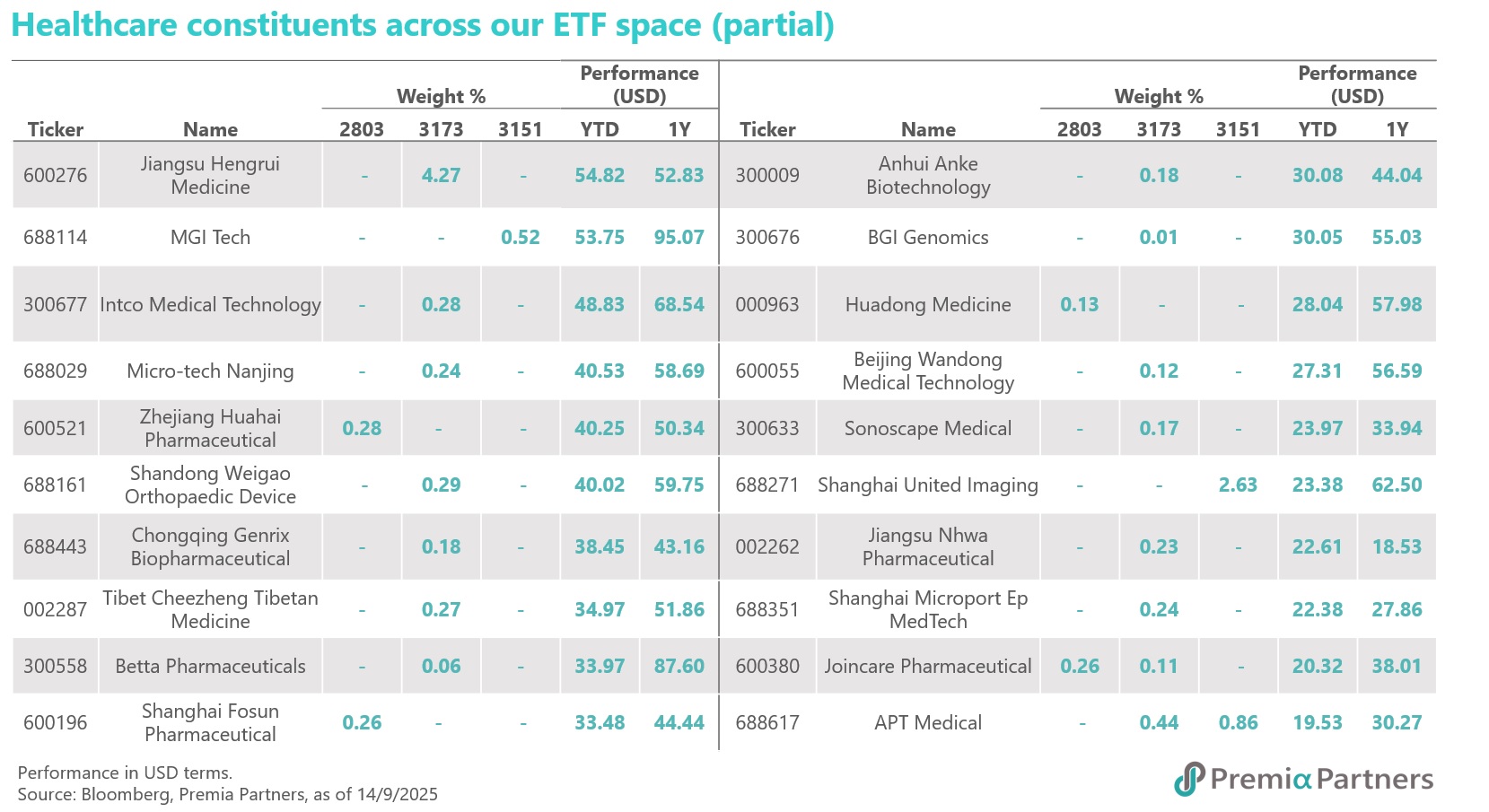

This ecosystem has cultivated a new class of sophisticated companies. Jiangsu Hengrui Medicine, a representative of established domestic players, has leveraged its strong innovative strength to expand internationally through in-licensing, out-licensing and strategic partnerships. Its massive $5.7 billion deal in May 2024 to license its GLP-1 portfolio to US-based Kailera Therapeutics marks a clear signal of its global ambitions. This is further evidenced by its March 2025 deal with Merck for the cardiovascular drug HRS-5346, a major July 2025 deal with GSK for a series of drugs, including the COPD drug HRS-9821, and a September 2025 deal with Braveheart Bio for the cardiac drug HRS-1893.

3S Bio, the parent company of Sunshine Guojian (a constituent in our Premia China New Economy ETF), has made landmark agreement with Pfizer for its PD-1/VEGF bispecific antibody in May 2025, a transaction featuring a record-setting US$1.25 billion upfront payment that underscores a new record for a Chinese outbound biopharma licensing agreement.

WuXi AppTec, operating a unique CRDMO (Contract Research, Development, and Manufacturing Organization) model, provides an integrated, end-to-end platform for biopharmaceutical discovery and manufacturing. The company's efficiency is highlighted by its transition of 158 molecules from the research to the development phase in the first half of 2025. In early April, its two API (Active Pharmaceutical Ingredient) sites passed FDA inspections with zero deficiencies, further underscoring its manufacturing expertise.

Sichuan Biokin Pharmaceutical licensed a cancer drug patent worth as much as US$8.4 billion to a multinational pharmaceutical company Bristol Myers Squibb (BMS) in 2023 and received down payment of US$800 million in 2024, which supported the company’s turnaround from losses to profits.

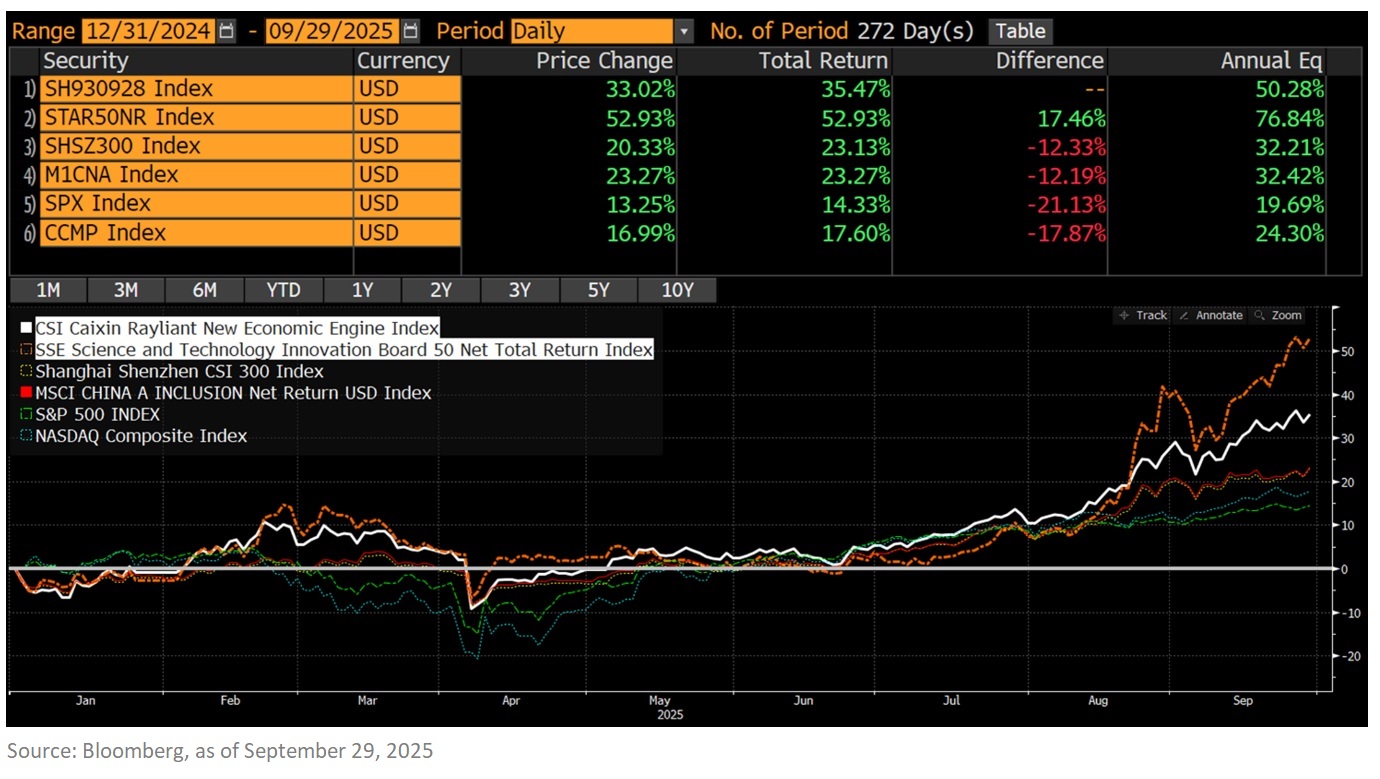

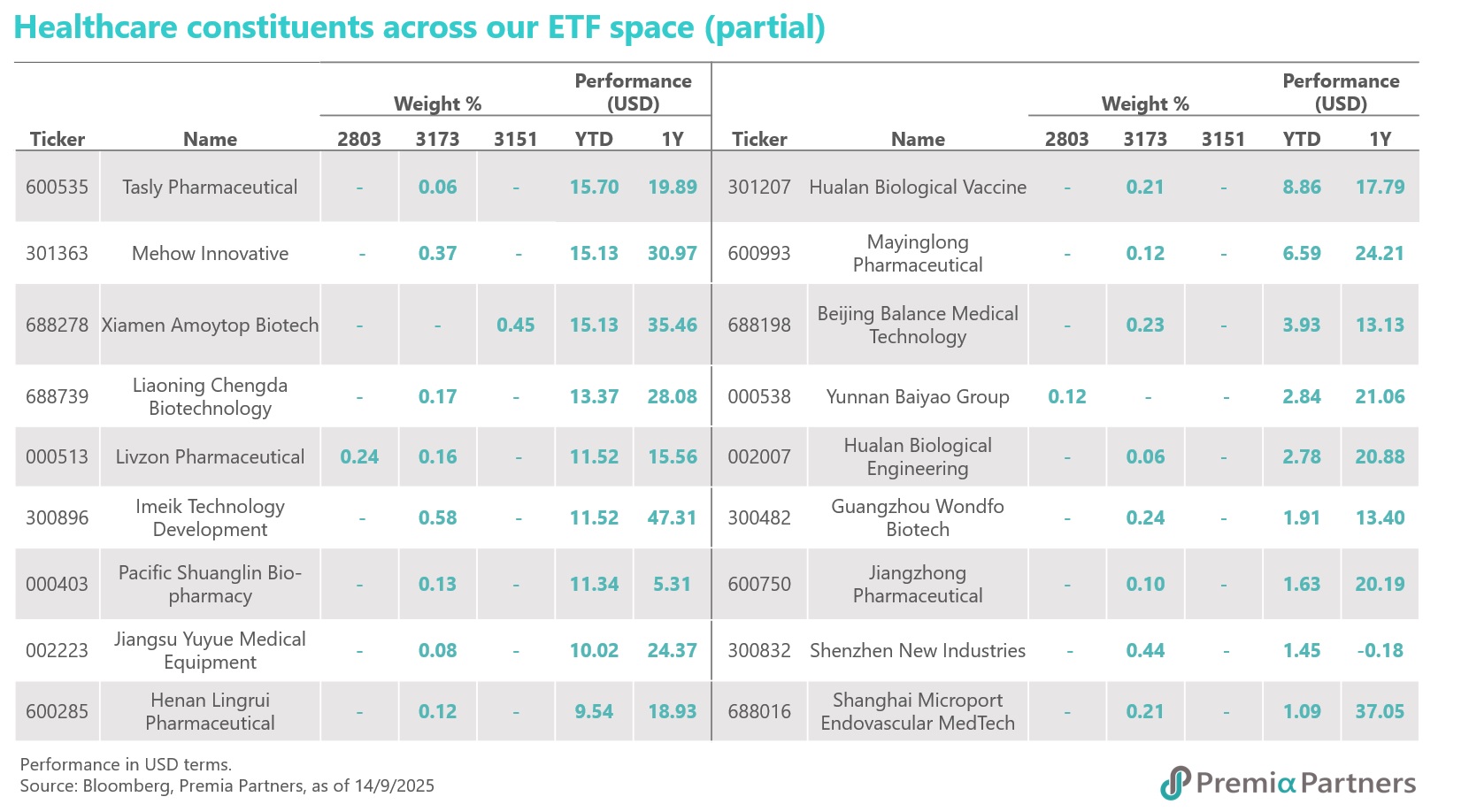

These companies mentioned are all well-represented within our Premia China New Economy ETF (3173 HK / 9173 HK) and Sichuan Biokin is also covered in our Premia China STAR50 ETF (3151 HK/9151 HK/83151 HK). As of 29 September 2025, both ETF have delivered strong performance, with NAV returns of 35.47% and 52.93% year-to-date in USD terms respectively. These funds are ideal tools for capturing China's innovative drug growth drivers, with a meaningful allocation of 19% and 9.8% to the healthcare sector, especially financially healthy with strong R&D leaders in biotech, medical equipment, and diagnostics & research. Beyond healthcare, both ETF offer diversified exposure to other high-growth sectors, including AI, Semiconductors, New Energy, and Industry 4.0 themes, providing a comprehensive investment solution for long-term growth.

Navigating geopolitical headwinds: Resilience amidst rising tensions

Despite its remarkable ascent, the industry is not immune to challenges, particularly from rising geopolitical tensions. Policies such as the proposed US BIOSECURE Act have introduced uncertainty and threatened to disrupt established supply chains. While potential restrictions are always a double-edged sword that might hamper the R&D pace and pipeline progress for multinational corporations, they will not stop the innovative drivers of Chinese biotech firms.

The industry has demonstrated significant resilience against previous wave of restriction. The global pharmaceutical supply chain is deeply integrated, and the scale, cost-efficiency, and expertise of Chinese contract research and manufacturing organizations are difficult to replicate in the short term. The urgent need for innovation to offset the patent cliff creates a powerful commercial imperative for Western pharma to continue collaborating with Chinese partners. In response to political headwinds, Chinese firms are also strategically diversifying their partnerships, strengthening ties with companies in Europe, Japan and other regions.

Ultimately, the industry's core value proposition—delivering high-quality, innovative medicines at an accelerated pace—serves the universal goal of improving global health. This compelling logic often transcends political friction, ensuring China's continued role as an indispensable node in the global biopharmaceutical network.

Source:

- National Medical Products Administration, Notice on issuing the pilot program for optimizing the review and approval of clinical trials for innovative drugs, Jul 31, 2025

- Nature Reviews Drug Discovery, Chinese innovative drug R&D trends in 2024, Jul 31, 2024

- JPMorgan research report, China Healthcare: still in earnings innings; Insights from China vs. Global innovative drug out-licensing deals, Aug 4, 2025

- GlobalData, Large pharma drug licensing from China reaches record high at 28% in 2024, Apr 9, 2025

- DrugPatentWatch, The multi-billion dollar countdown: decoding the patent cliff and seizing the generic opportunity, Sep 9, 2025

- The Chosun Daily, Exclusive: Chinese innovative drug market to become world's third by 2028, Sep 3, 2025

- CBRE, Global life science atlas, Apr 11, 2025