EXECUTIVE SUMMARY

2019 saw expensive asset classes get more expensive, a global yield back-up replaced by a yield rally, continued outperformance of DM over EM and Growth over Value (notwithstanding a few wobbles). As we approach 2020, we review market behavior during the last 12 months, the risk and opportunities going forward and make a few observations about trends that will dictate returns.

Our observations?

Developed markets are overvalued, with this year’s multiple expansion running well ahead of economic and earnings data

Greater liquidity in developed markets has raised valuations, but fundamental growth prospects have deteriorated

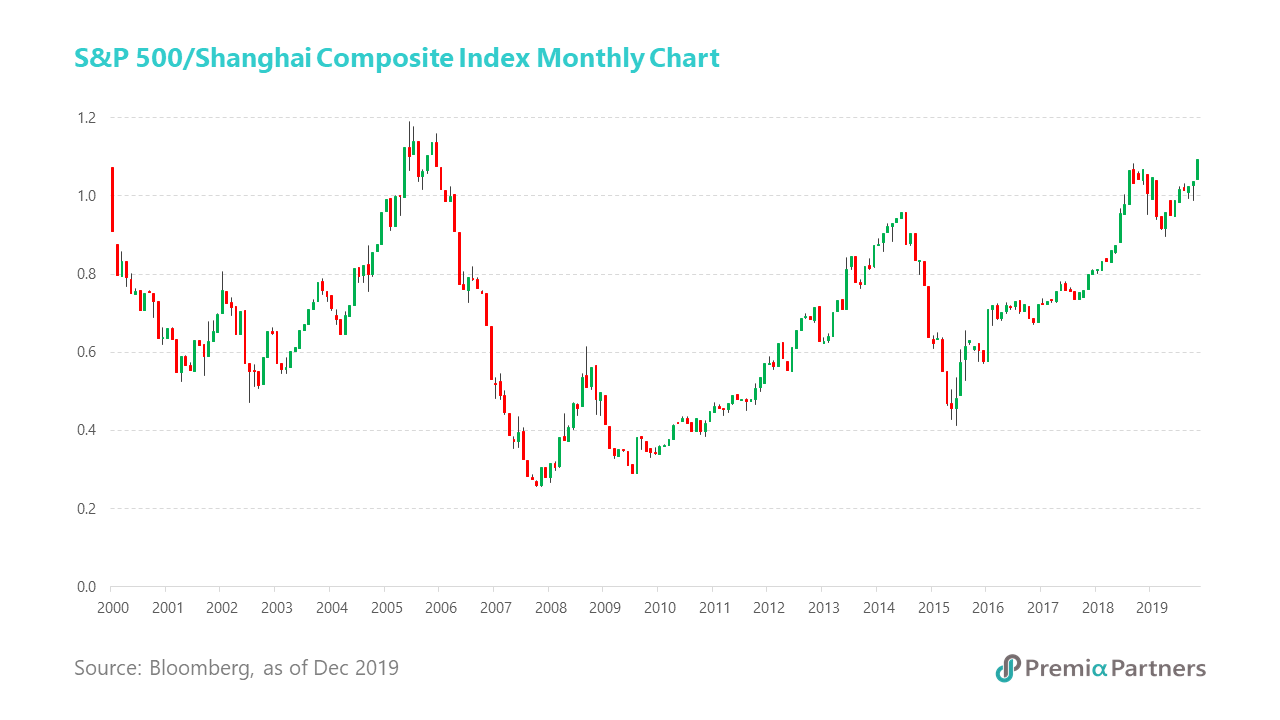

The relative return gap between US and China is near all time highs from ‘05

We expect 2020 to see a performance mean reversion as economic and earnings data is unlikely to support current valuations

Growth is likely to accelerate in EM and decelerate in DM, but markets are pricing in the reverse

Asian governments are more likely to support growth through liquidity measures, with higher absolute levels and a willingness to cut rates

Not all markets and sectors are created equal:

China’s slowdown is well known, but new economy growth remains strong as the government shifts its focus away from propping up traditional industries

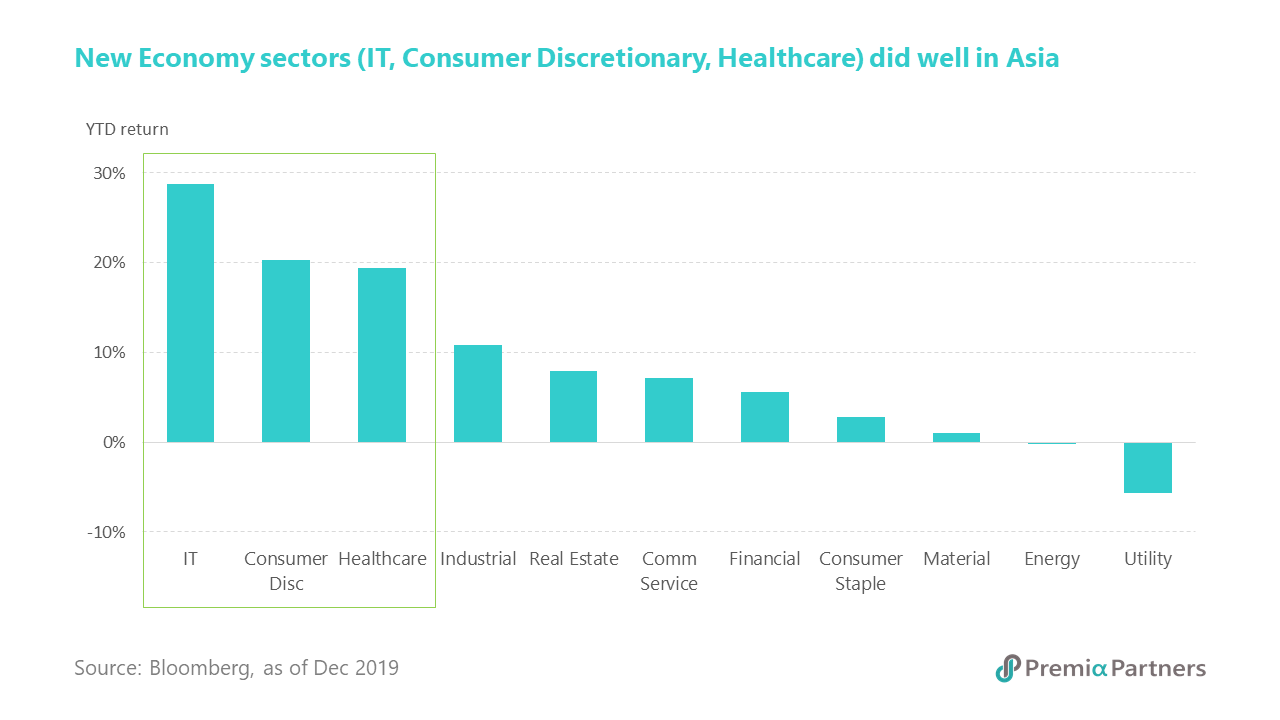

Across Asia, new economy sectors (technology, consumer discretionary and healthcare) outperformed and are likely to continue to do so in 2020

As global growth slows, capturing mega-trends will be key to outperformance. Our favorite themes going forward include:

5G & digital transformation

Silver economy

Supply chain shifts and trade recovery

Domestic brand consumption growth

Global equities in 1H20:

Streching on a rubber band

Technically overbought markets remain overbought and fundamentally overvalued markets at the start of 2019 have gotten even more overvalued.

Great “melt-up” in US equities despite slowing economic growth. The S&P 500 is up some 26% for the year to date. That surely wasn’t because of economic growth, which eased from 3.1% q/q in 1Q2019 to 2.0% q/q in 2Q2019 and 2.1% q/q in 3Q2019. 4Q2019 GDP is likely to see more of the same, with the Conference Board talking about 2% q/q. This should result in an overall deceleration of GDP growth from 2.9% for 2018 to 2.3% for 2019.

US corporate earnings have stagnated. It’s not because of corporate earnings growth either. Refinitiv expects S&P 500 earnings to stagnate in 2019 with nominal growth of 1.3% for the year. Against that, the S&P 500’s forward price to earnings (P/E) ratio is now around 19x. That’s a pretty lousy P/E to earnings growth ratio and is significantly above the 5-year average P/E of 17x. On the Shiller CAPE ratio, nothing has changed. US equities are trading at a cyclically adjusted P/E ratio similar to that seen just before the Great Crash that marked the beginning of the Great Depression, and only historically exceeded by the CAPE seen just before the Nasdaq Crash.

Europe is in an earnings recession and its economy is struggling to keep its head above water. The full year should see the European economy grow by only around 1%. Meanwhile, European stocks have suffered three consecutive quarters of y/y earnings contraction, with the decline deepening to -6.6% by 3Q2019. Yet, the Euro Stoxx 50 gained 21% year to date.

Japan is struggling with a series of zeros. Japanese GDP growth has been decelerating, from 0.5% q/q in 1Q19, to 0.4% q/q in 2Q19 and 0.1% q/q in 3Q19. Earnings for Nikkei 225 companies are likely to post a second consecutive year of decline, with net profits likely to fall 4% this financial year, according to an analysis by Nikkei. This takes the total net earnings decline from the financial year 2017 to 10%. However, the Nikkei 225 was up 20% year-to-date.

So, it wasn’t about the economy and it wasn’t about earnings. What was it about then?

It’s all about the money – cheaper and more of it. It was about renewed interest rate cutting, monetary reflation around the world, and the expectation that this will lift economic activity and corporate earnings in 2020. That last point is worth repeating – it was about the “expectation” (i.e. this is by no means a done deal) that the renewed monetary stimulus will boost the economy and earnings. M3 money supply growth has been accelerating in the US and the Euro Area. There has historically been (generally) a positive correlation between M3 money supply growth and corporate earnings. That is what the market is already pricing in.

So, as fast as US real bond yields have been falling, equities’ earnings yields have been falling even faster. Independent research house TS Lombard estimates that the US equities risk premium has fallen from 8.1% at the start of the year to around 6.9% by late November, below the long-term average of 7.9%. Real yields have fallen too, from 1% to about 0.1%, but the decline hasn’t been enough to offset the drop in the earnings yield, says TS Lombard.

Key risks: how much further can the “rubber band” of valuations be stretched by hope? So, developed market equities, particularly US stocks – powered by hope – are stretching on the “rubber band” of valuations. The risks are heightened.

A lot of optimism is already in the price. For starters, a modest revival in economic and earnings growth is likely to already be in the price, given where P/E ratios and the equities risk premiums are, particularly for US equities.

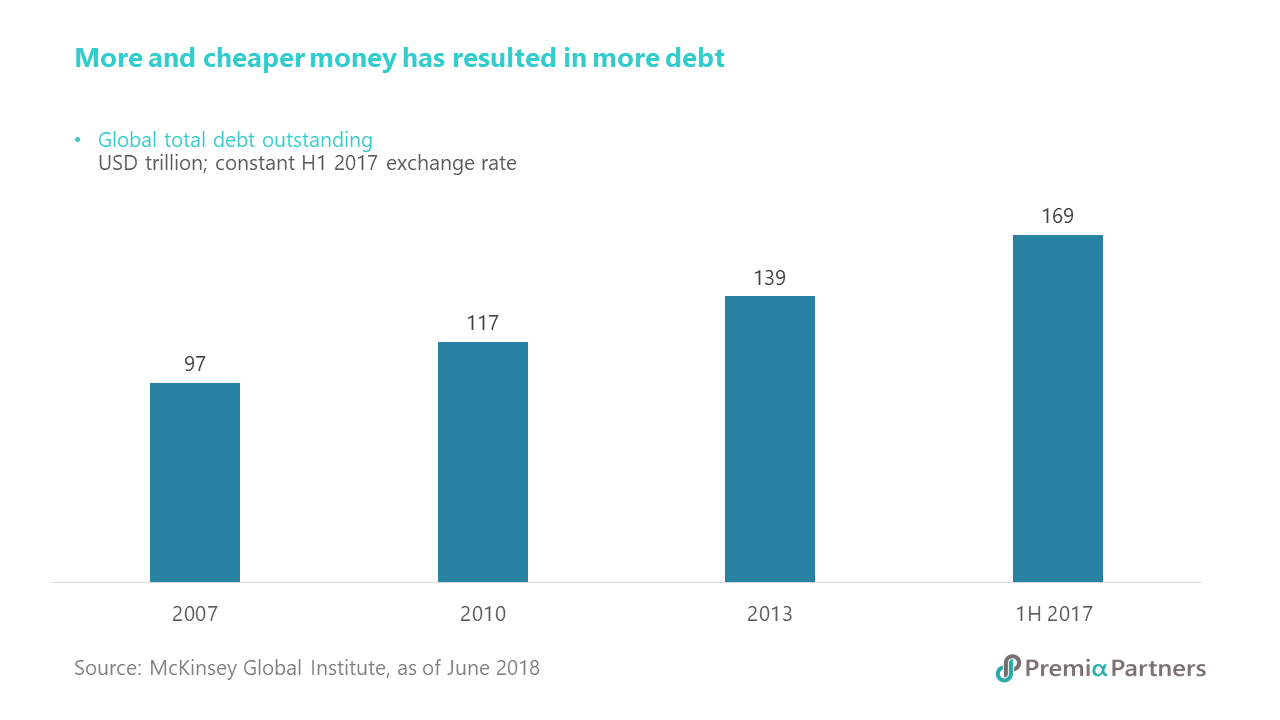

Policy makers in the Developed Markets are doubling down on dubious strategies. Even if renewed monetary stimulus does revive economic growth, it is likely to be more borrowing from future demand. Intuitively, there should be a limit to this, unless we accept the possibility of infinite rate cuts (into the negative it must be reminded) and “printing” of money.

For the record, rates are negative in the Euro Area and Japan. In the US, the lower bound hit zero in 2008. They attempted to “normalise” from late 2015 to mid-2019. Yet, they are now going back down again. The lower bound is now down to 1.5%.

While risk assets are cheering rates going back down again, this really should be a worry, because the historical average rate cuts required to lift the US economy out of recession is 500 basis points. We now have only 150 basis points to cut before returning to zero again. Markets have effectively been cheering policy failure – the failure to sustainably revive economic growth.

Central Bank balance sheets are bloated everywhere. In Europe and Japan, the situation looks pretty much like QE Infinity. In the US, the Fed’s attempt to run-down the balance sheet has failed. Overnight lending rates spiked recently, forcing the Fed back into the business of buying bonds.

And given ultra-low, zero or even negative rates and yields, we shouldn’t be surprised that the result is a ballooning of debt.

When markets stop cheering the present (monetary stimulus) and start worrying about the future, policy exhaustion is anybody’s guess. But great caution on risk assets would appear to be justified as we enter 1H2020.

Searching for value from here:

Will 2010’s dominance by Developed Markets continue?

For the reasons outlined above, the case for “growth” is unconvincing. In the US, for example, S&P 500 Consumer Staples have been outperforming S&P 500 Materials since May this year. This would not be the case if the growth thesis was more convincing.

A serious global recession is not likely at this stage. Yet, the global economy will slow into 2020, with the Euro Area flatlining and Japan a mild recession candidate.

Against that, remember that the S&P 500 is up 26%, the Euro Stoxx 50 is up 21% and Nikkei is up 20% year to date. Forward P/E valuations for developed markets are elevated relative to emerging markets. MSCI US forward P/E is 18x, MSCI EMU and MSCI Japan are both at 14x, and MSCI Emerging Markets is 12x. Within Emerging Markets, MSCI China’s forward P/E is lower still at 11x. It is trading at a P/B of 1.7x, against 3.5x for the MSCI US.

The cycle of relative performance between the US and Chinese equities markets appear to peak again. This and lower valuations could encourage some rotation and diversification out of Developed Markets into Emerging Markets, particularly Chinese equities.

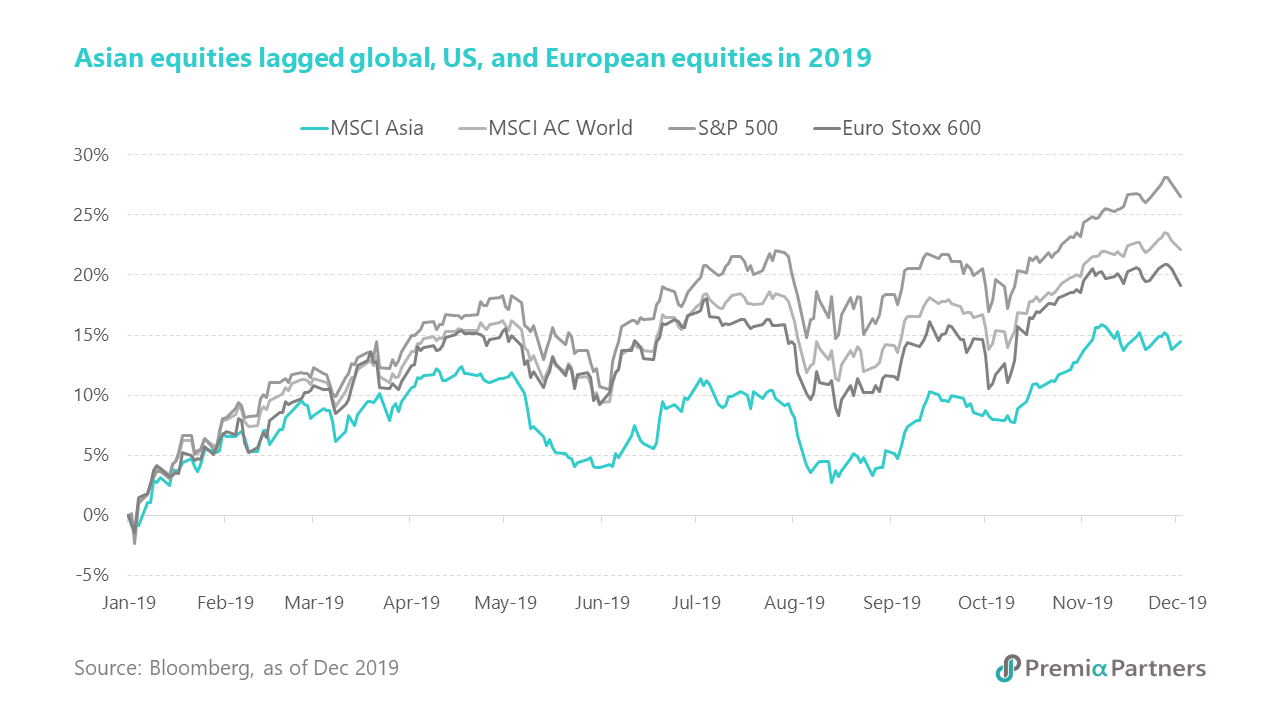

Asian equities, alongside global equities, recorded a decent double-digit return in 2019, reversing the terrible loss seen the year before. Despite uncertainties such as trade war, global economic slowdown, Brexit and rising geopolitical risks remaining unresolved, all major Asian stock markets except Malaysia and Indonesia managed to go up during the year.

Undoubtedly the sharp turnaround of the interest rate cycle in the US played a key role. The Federal Reserve changed from a tightening stance since 2016 to a cumulative 75 basis point rate cut in the second half of 2019. Accommodative policies by other central banks also helped support global equity markets.

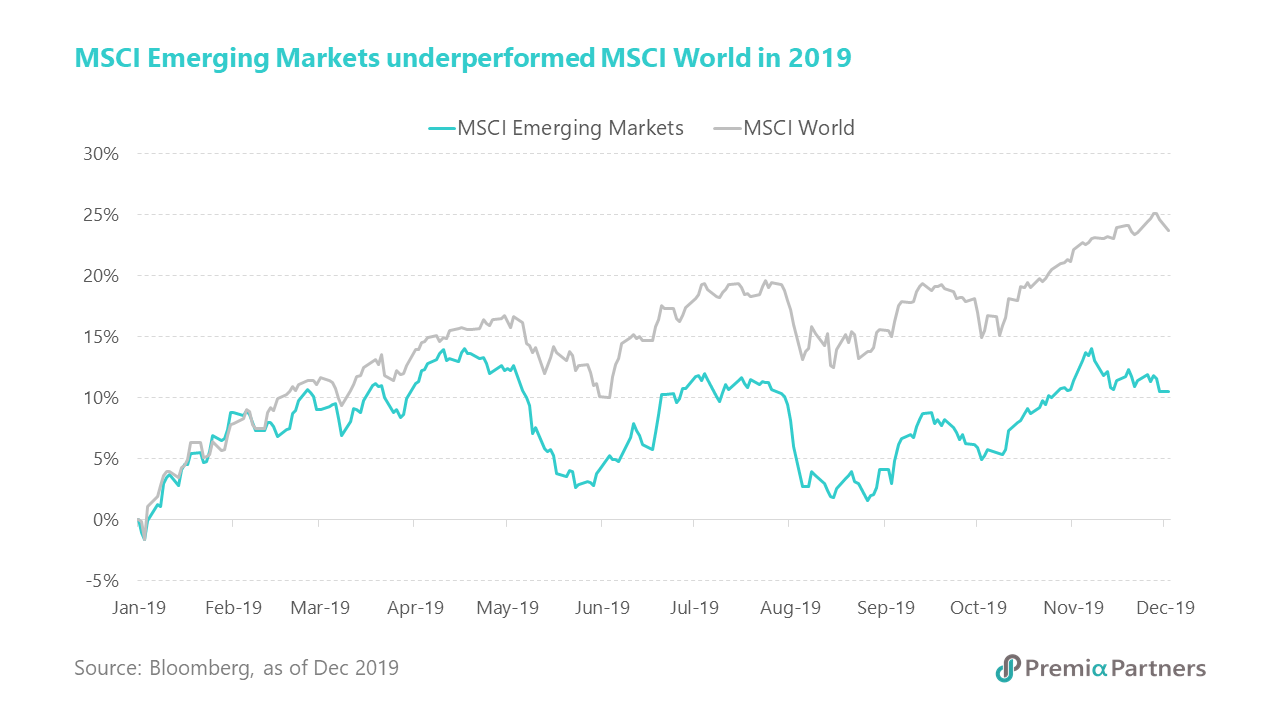

Returns were not uniform, however, with Asian equities underperforming the US and Europe. Put simply, developed markets outperformed emerging markets by a large margin – 13.2% points. Some investors attributed this performance gap to investors believing that globalization, a dominant driver of EM development for many decades, is no longer sustainable.

Growth improvements are entirely EM. The IMF estimates global growth of 3.9% in 2019, a fall from 4.5% in 2018, before growing to 4.6% in 2020. The improvements are entirely EM: shallower recessions in stressed countries, such as Turkey, Argentina and Iran, and a pick-up in growth after a 2019 stall in recovering countries, such as Brazil, Mexico, India, Russia and Saudi Arabia.

Switching from pessimism to optimism through 2019. Many investors missed a market rally in early 2019 – being pessimistic about market prospects as equities rallied in Q1. As we approach year-end, this pessimism has turned to optimist for developed markets in 2020. The CBOE Volatility Index (VIX), a benchmark tracking market risks, is now hovering at less than half of the level seen in early 2019. Investors are likely not prepared for any sudden shocks.

Developed markets are not in better shape today than 12 months ago. As we have mentioned in our review of economic growth and corporate earnings earlier, nothing has changed fundamentally in developed markets during the year. On the contrary, investors seem to have neglected the continued improvement in fundamentals throughout Asia.

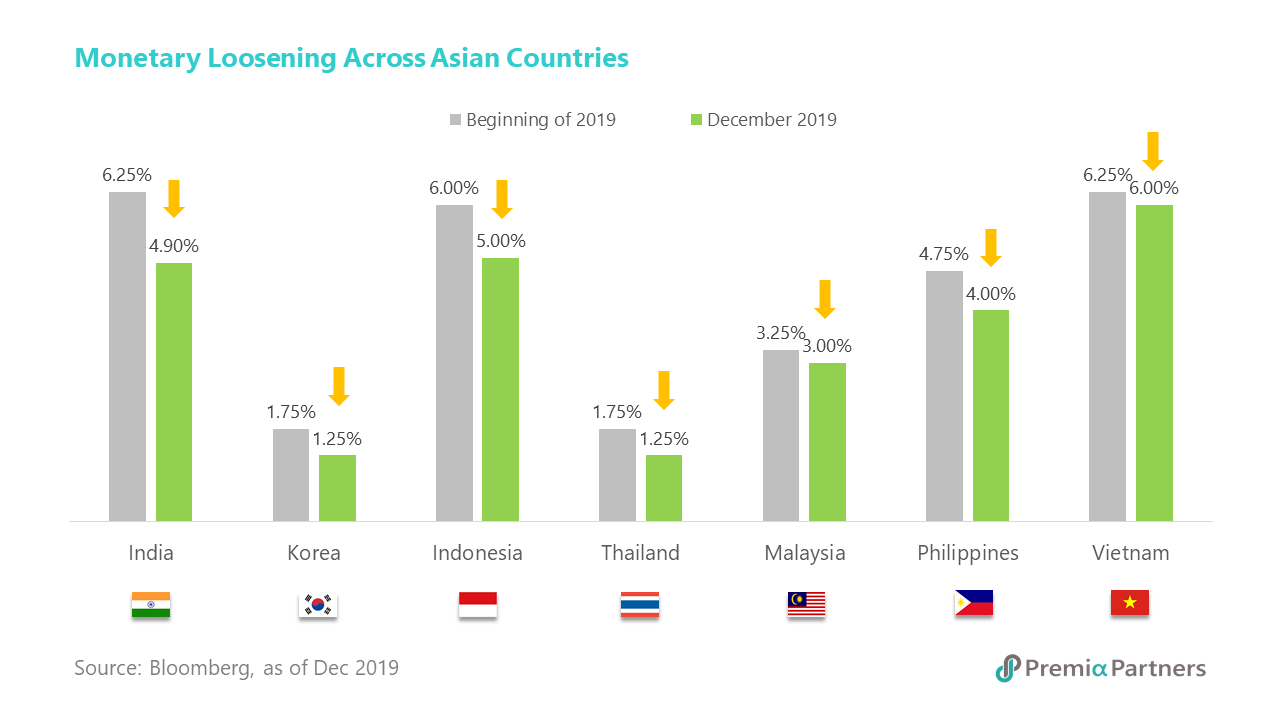

Asian fundamentals and liquidity support a mean reversion next year. Asia is still the major driver of global growth and Asian equities overall are trading at a discount to US and other developed markets. As such, a mean reversion is highly probably over the next 12 months, with Asian equities likely to outperform. Liquidity should not be a concern in 2020 as most Asian central bankers are proactively adjusting monetary policies – we’ve seen loosening measures and multiple rate cuts across the region in 2019, including China, Korea, India, Indonesia, Malaysia, the Philippines and Vietnam. More specifically, emerging Asia will have more room for further rate reduction as the absolute levels of benchmark rates are higher than in developed countries, where there is much less room to manoeuvre. Inflation, just like in developed markets, is subdued and provides plenty of room for central banks to continue their dovish stances.

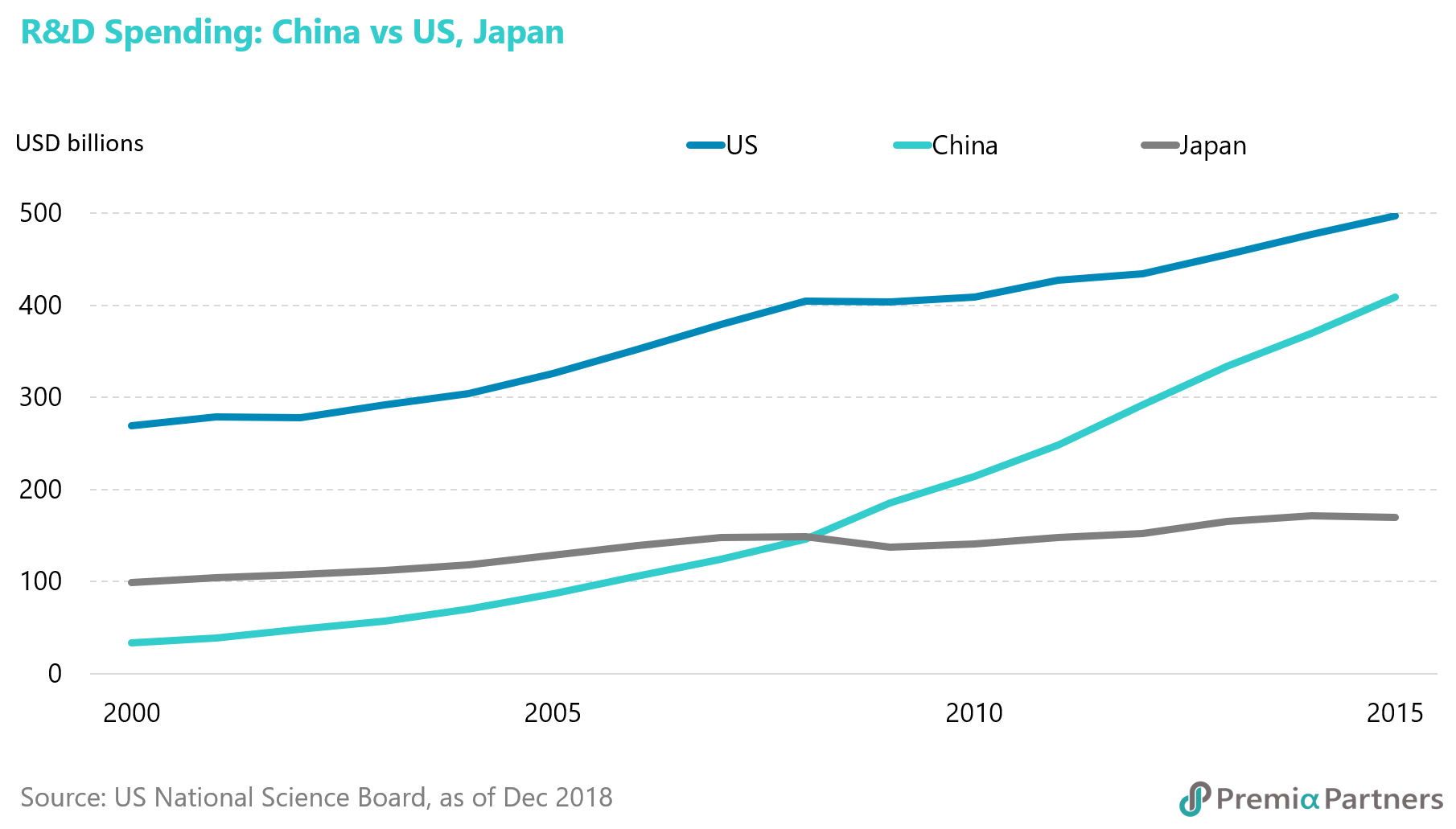

China in the spotlight Even with slower GDP growth, the Chinese consumer market could grow from $5 trillion a year to $12 trillion a year by the 2030s. See my summary of Chinese consumption here. Put that in context – the US current account deficit is around $0.5 trillion a year. So, the US needs a more engaged Chinese consumer. Indeed, trade tensions between the US and China can be seen through the lens of the US’ need for a more engaged Chinese consumer rather than a well thought through US desire to decouple from China. There are other areas in China which will grow rapidly, offering investment opportunities: Technology: China’s R&D expenditure is growth that came out of nowhere. In PPP dollars, China’s expenditure on R&D has exceeded Japan, the EU and is possibly only a few years away from catching up with the US. Healthcare: Expenditure per capita in China on healthcare has just about doubled between year 2000 and 2016, far exceeding the growth rates in the developed world. But its per capita spending is still a tiny fraction of the OECD average. In 2016, it spent $398 per person versus $4700 in OECD countries and nearly $10,000 in the US. There is a lot more room for growth. | ||

| ||

China is not immune from a global slowdown, but it has more policy ammunition than is appreciated. To be clear, China’s economy will slow down as well in 2020. It runs a lower budget deficit to GDP than the US and its reserve requirement ratio for the major banks is 13%. In the US, it is lower at 10%. Its benchmark lending rate is 4.15%. The Fed’s target rate is back down to 1.5%. And China has $3.2 trillion in foreign currency reserves. |

Asian equities:

Not all countries and sectors are created equal

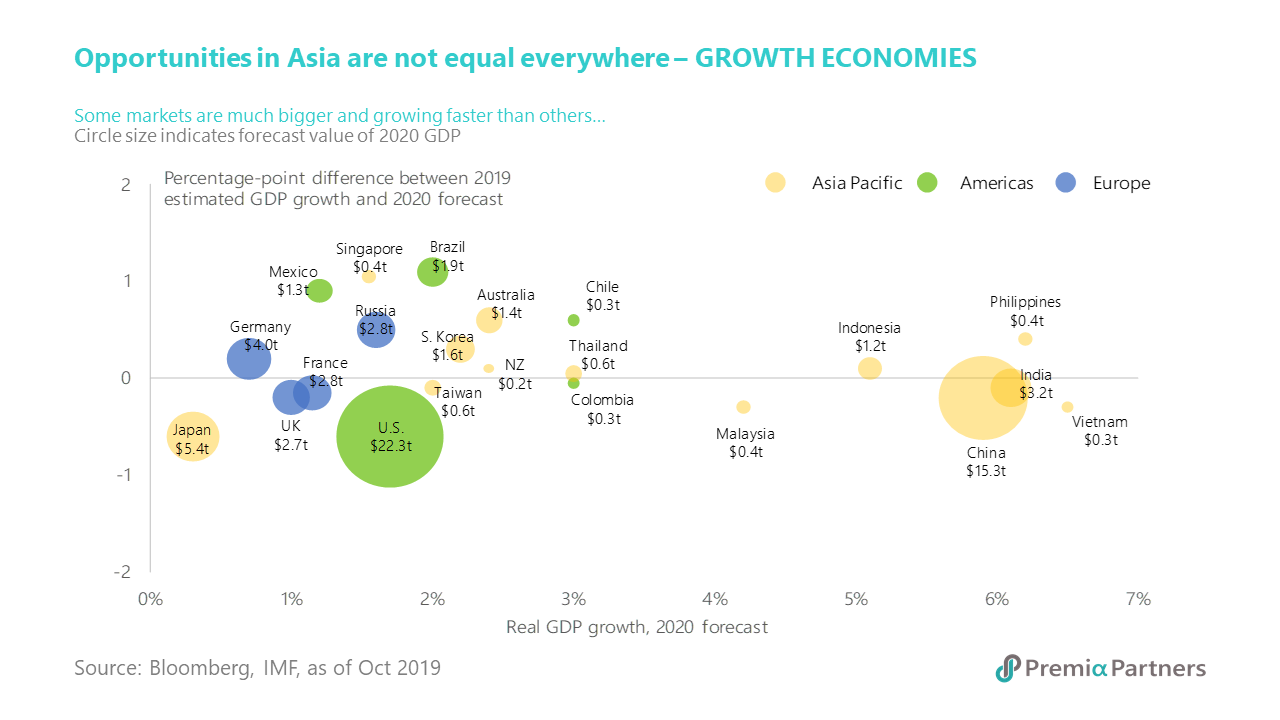

With economies globally slowing down, it’s more important than ever to get the growth bets right. In our view, Asia must be approached granularly, targeting growth economies and growth sectors. Instead of investing in Asia broadly without distinction, one should pick the right exposure in terms of individual markets and specific sectors that offer stronger sustainable growth.

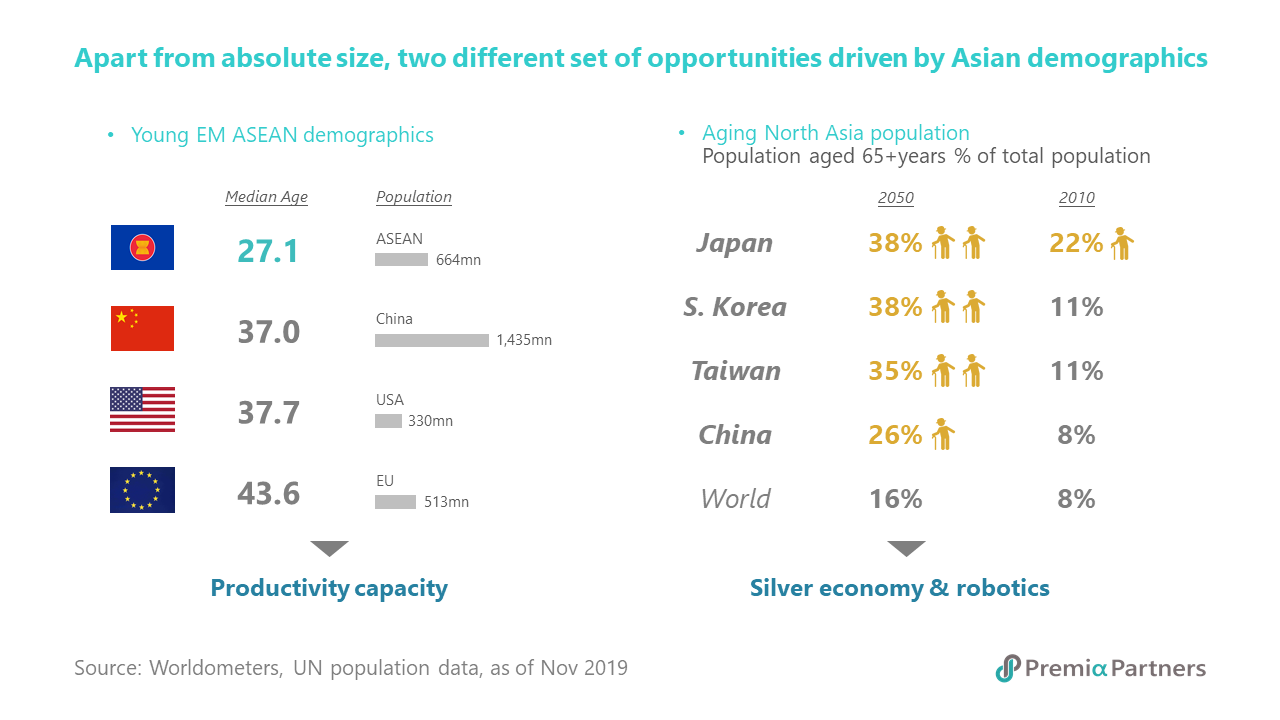

Asia is where the growth is. Looking at 2020 GDP forecasts, it’s easy to see that developed economies are likely to grow below 2%, expanding slower year-on-year. Within Asia, the forecasts vary – from ~0% in Japan to over 6.5% in Vietnam. For top-down asset allocators, it is essential to narrow the list and target markets with better macro prospects. Emerging Asia countries – China, India, Indonesia, Malaysia, the Philippines and Vietnam – are likely to grow above 4% in 2020. A handful may even accelerate their growth on the back of newly elected governments. India, the Philippines and Indonesia are implementing economic reforms that include tax reduction, increased infrastructure spend, domestic consumption targets and regulatory easing. In addition, the trade war impact will decrease as corporates have begun to adjust their supply chains and target customer base.

“When one door closes, another opens; but we often look so long and so regretfully upon the closed door that we not see the one which has open for us,” said by Alexander Graham Bell, the inventor of the world’s first functional telephone and the co-founder of AT&T in the 19th century. For any successful investor, one should adopt a similar adventurous mindset to keep looking for emerging opportunities instead of holding on to false hope with non-performing assets.

China’s slowing economy presents a similar dilemma. The market is uncertain on how to treat China – on one hand the economy is slowing and on the other, it’s still the fastest growing major economy by far. Finding growth is difficult if searching where investors searched before. Fading demographic dividends, weakening demand in commodities, falling exports amid trade tension and bad debts piling up in banks are all the obstacles that one must avoid in order to find growth beneath.

The long-term trends of urbanization, consumption upgrade, technological advancement, and rising healthcare penetration remain intact in China. In fact, the story is not just about China. Across Asia, 2019 saw the emergence of new economy sectors as key drivers of return.

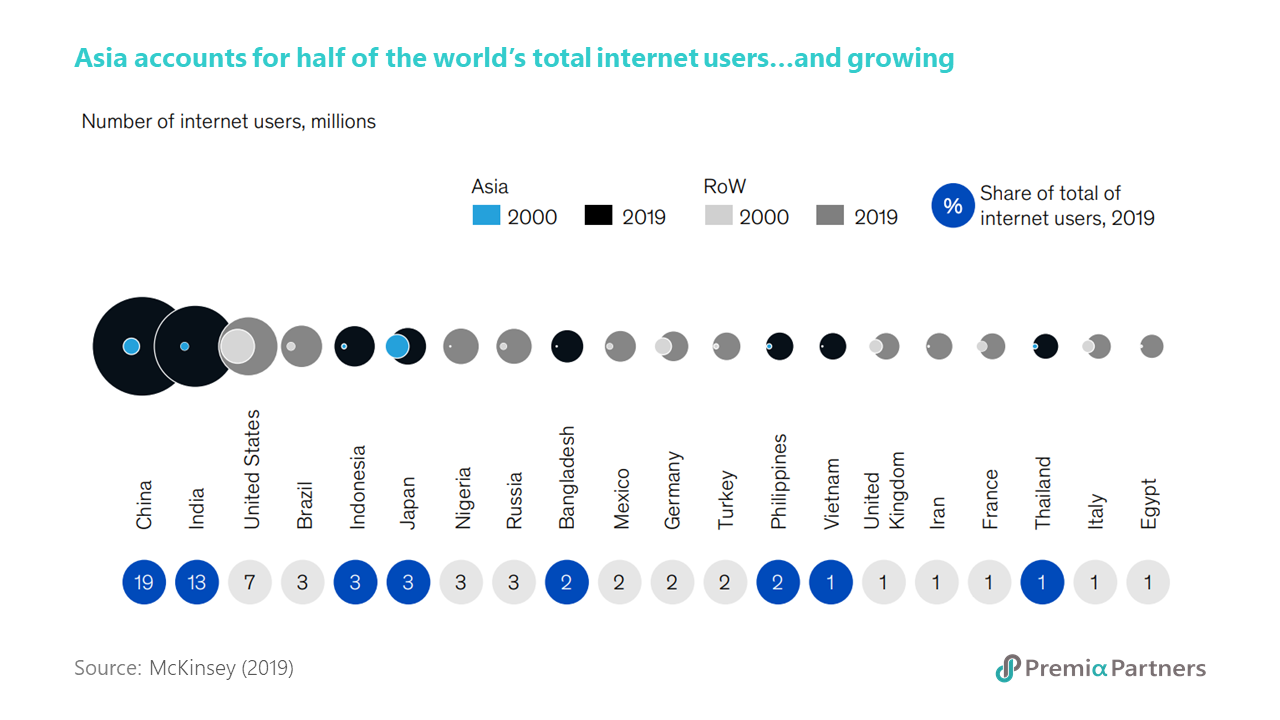

New economy sectors will continue to drive returns going forward. Asia’s next decade will see the region transition from manufacturing to creation. Mega trends like digital transformation, life sciences and robotics and automation are all happening in the region faster than elsewhere. As an example, the internet use base in Asia now accounts for half of the world's total users. China and India are the top two countries, with a combined market share of 32%, compared to only 7% for the US.

Going thematic:

The only way to capture exponential growth

So where should investors focus instead of trade talk news or Trump tweet soundbites? We believe the following investment themes are worth exploring in 2020:

5G & DIGITAL TRANSFORMATION.

The successful and oversubscribed secondary listing of Alibaba in Hong Kong revealed that investors are hungry for Asian innovative technology exposure. Asian consumers are early adopters of new technology, illustrated by how we shop, entertain, dine, commute and work. What’s lost on global investors is how much this is being driven by Asian companies, not global ones. Tencent, Nintendo, NCSoft and NetEase for gaming; Huawei, TSMC, SK Hynix and Mediatek for digital infrastructure; Xiaomi, Samsung, Haier and Sony for smart home devices; Fanuc and Keyence for robotics and factory automation. The list goes much longer if unlisted unicorns like Grab from Singapore, Go-Jek from Indonesia, Ant Financial and Didi Chuxing from China are included. These companies are largely present only in Asia, yet already are world leaders in their fields. 5G commercial services are just beginning in selective regions like South Korea but are likely to approach mass adoption in 2020 and 2021 as more manufacturers bring 5G capable devices to market. Global 5G smartphone subscriptions will be 11 million by end of 2019 and 72 million by end of 2020. But researchers at Ericsson expect the worldwide 5G population to rise to 627 million just two years later. With low-latency and high energy efficiency, 5G will bring innovative applications in virtual reality, augmented reality, cloud computing, Internet of things, and digital health within reach.

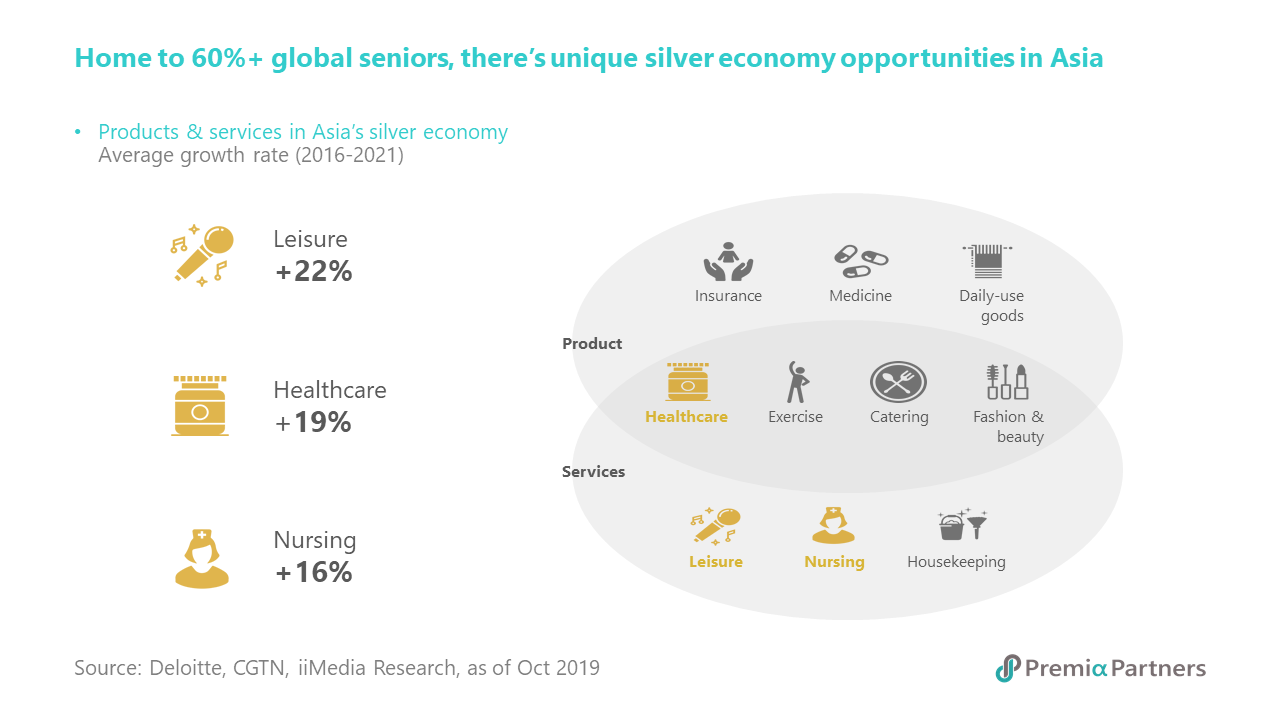

SILVER ECONOMY.

The topic North Asia’s aging population has been widely mentioned for a few years and always seems like a distant event for capital markets. 2020 may be the year to start taking it seriously as the shift will happen in less than a decade. Japan’s population peaked at 128 million in 2010 and fell by 444k in 2018 with only 918k babies born, the lowest since such statistics were first complied in 1899. The 2019 Revision of World Population Projects predicts the proportion of people aged 65 years and older in Japan will increase from 28% today to 38% by 2050, while the overall population will shrink by nearly 20%.

South Korea is in slightly better shape – population peak of 51 million will happen in 2024 and head down gradually. The shift is part of a rising social phenomenon: the Sampo Generation, in which the word ‘sampo’ means to give up three things: relationships, marriage and children. The average South Korean woman has just 1.1 children, vs a global average of 2.5.

China is slightly better than Korea – the Chinese Academy of Social Science estimates 2029 as peak population before entering an unstoppable and fast decline. By 2050, those aged over 60 could reach 487 million, about one third of the population. Governments and corporates across North Asia are introducing new policies, products and services to cater for ageing population needs. We will start seeing more investment opportunities in the fields of insurance, healthcare, fitness, leisure, and nursing, etc.

A NEW ERA OF SUPPLY CHAIN SHIFTS & TRADE RECOVERY.

First and foremost, it’s important to state that tariffs around the globe are unlikely to be removed completely. We are not living in a fairy tale with everybody living happily ever after. Even if China and the US can reach their phase-one agreement over the next few weeks or months, it is rational to expect continued negotiations and disagreements. Other countries will continue to be dragged into bilateral or multilateral trade talks, including so far Mexico, Brazil, Argentina, Korea, Japan, and Europe.

Second, shifting of global supply chains is normal and frequent. China’s tenure was long, but just like factories moved from US/Europe to north Asia in the past, they will move on from China to Southeast Asia in the future. Even without trade tensions, corporates have woken up to the low-cost bases available in other parts of Asia.

Competitive wages are of course not the only thing attracting corporates to review their global setup. A skilled, well-educated workforce, good infrastructure and a strong network of free trade agreements, including being part of the ASEAN Free Trade Area and EU-Vietnam FTA are also factors. Since last June, 33 listed Chinese companies have informed the regulators of their plans to set up or expand production abroad. Nearly 70% of the 33 companies cited Vietnam as their preferred destination, while the remaining 30% chose Cambodia, India, Malaysia, and Thailand.

Third, a recovery in technology hardware trade throughout Asia is highly probable. Korea has now seen 12 straight months of weak tech sector exports. But 5G transformation is simply not possible without trade. Increased spending on 5G networks, smart devices, data centres and AI will cause trade for tech components like memory chips to bottom out in pricing and recover in 2020.

DOMESTIC BRAND CONSUMPTION GROWTH.

As per capita income rises in Asia, the consumption power of Asia’s mass affluent population is becoming a force to be reckoned with. Asians are now spending more on things they want in addition to things they need. The consumer patterns of Asia’s middle class will drive demand for many industries including food & beverages, automobiles, catering, travel, and education.

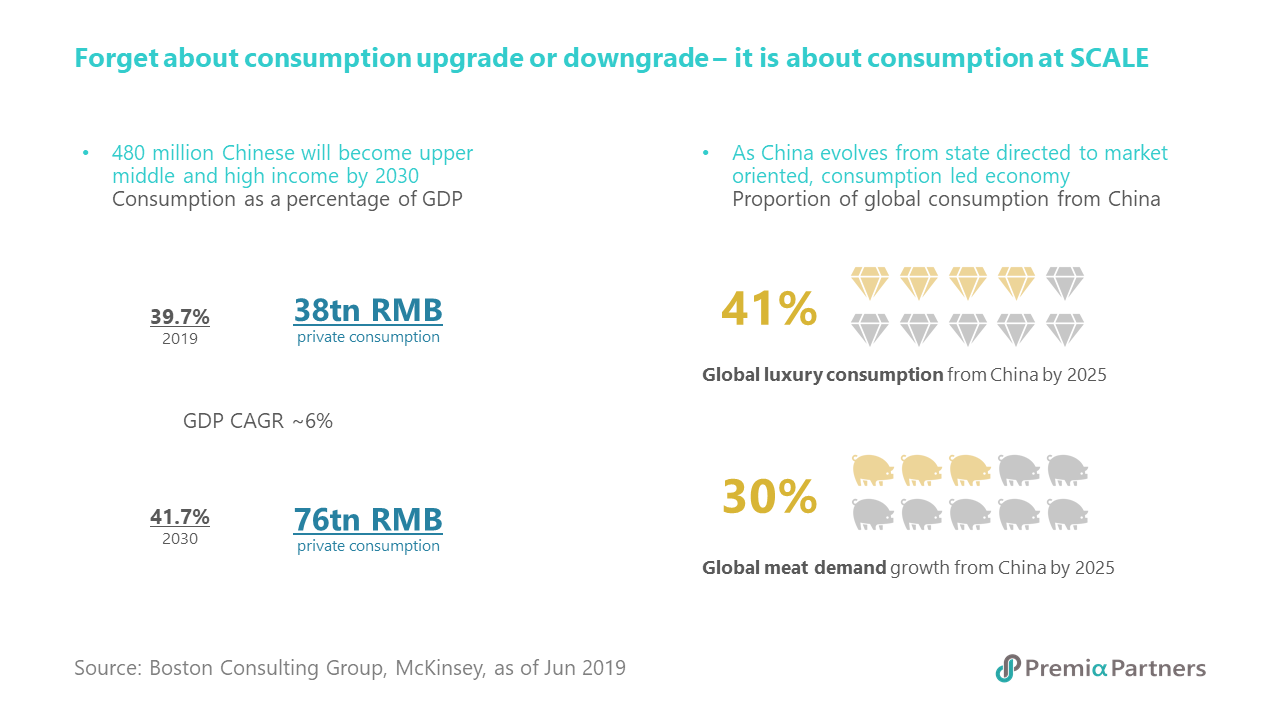

It’s not about consumption upgrade or downgrade but about scale consumption in Asia. Take China as an example – private consumption will double 10 years from RMB 38 trillion to RMB 76 trillion, even with economic growth decelerating to ~6% annually. McKinsey expects that there will be at least 480 million upper middle- and high-income class Chinese by 2030. This group of consumers will purchase 41% of worldwide luxury goods and 30% of global meat by 2025. The stats are similar for new middle-class consumers coming from ASEAN and India. Ultimately, size does matter.

One criticism of the Asian consumption trend is a long-term strong preference for foreign luxury goods and brands. Multinational corporations did well in the past and penetrated Asian markets successfully. Their market shares were high – as much as ~50% in sportswear and ~55% in beauty & personal care. But times are changing. The post-90s generation is starting to lose this bias against domestic brands; in fact, they are starting to choose them over foreign brands more often, such as choosing Anta KT5 over Nike LeBron 17 for footwear, Jollibee over McDonald’s for quick meals, Oppo over Samsung for smartphones, Gentle Monster over Ray Ban for sunglasses, and Sulwhasoo over Lancome for cosmetics. The change of preference will help a lot of local brands to grow significantly in near future.