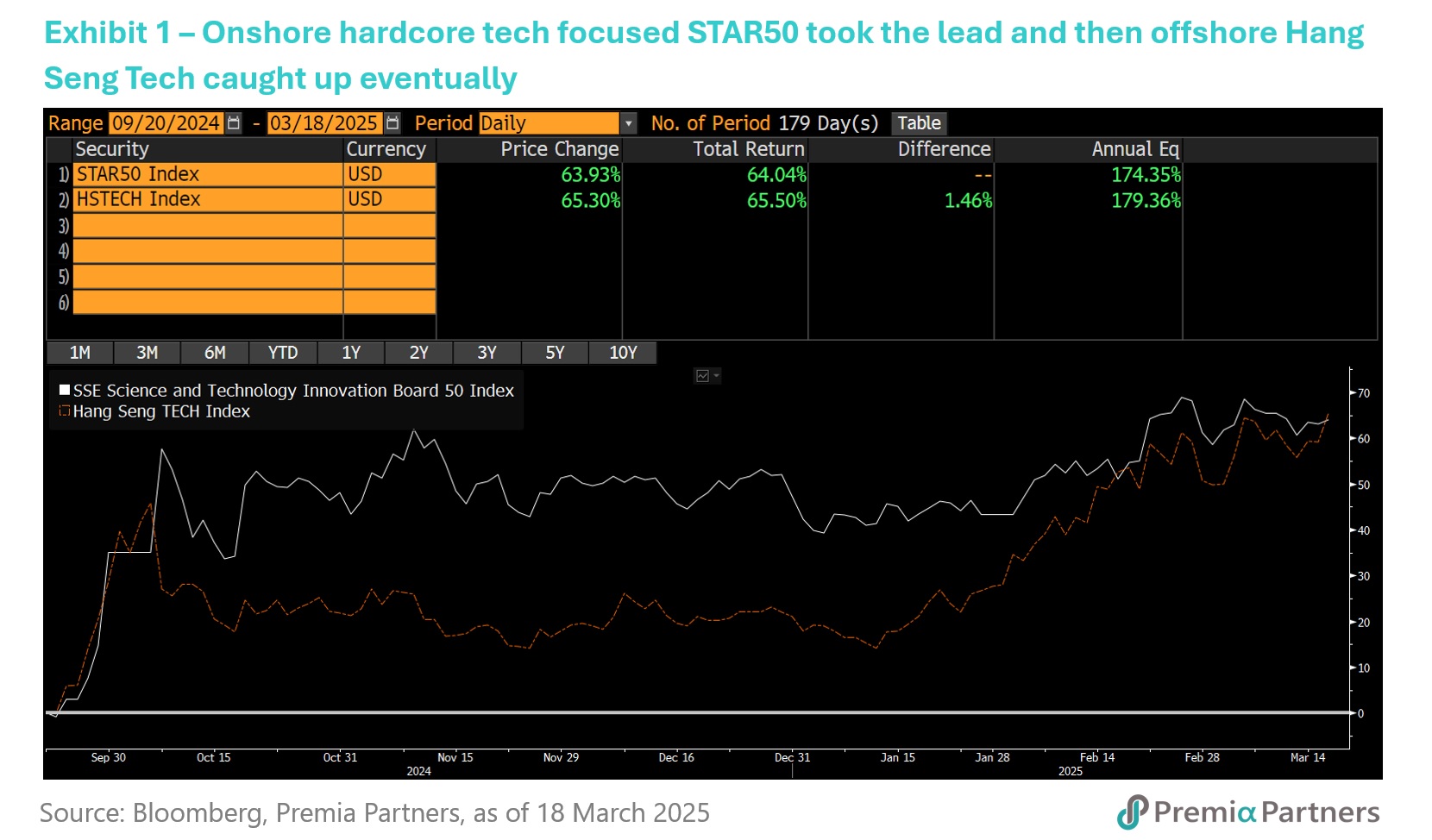

In contrast to A shares, H shares rallies have been more volatile, and returned most of the initial gains after a-week-long trading and only resumed the rally after the surprised launch of DeepSeek and the subsequent meeting between President Xi and the private entrepreneurs – which also drove the record Southbound flows to the H shares market as domestic investors and hedge funds sensitive to the policy shift rotated to H shares (Exhibit 1).

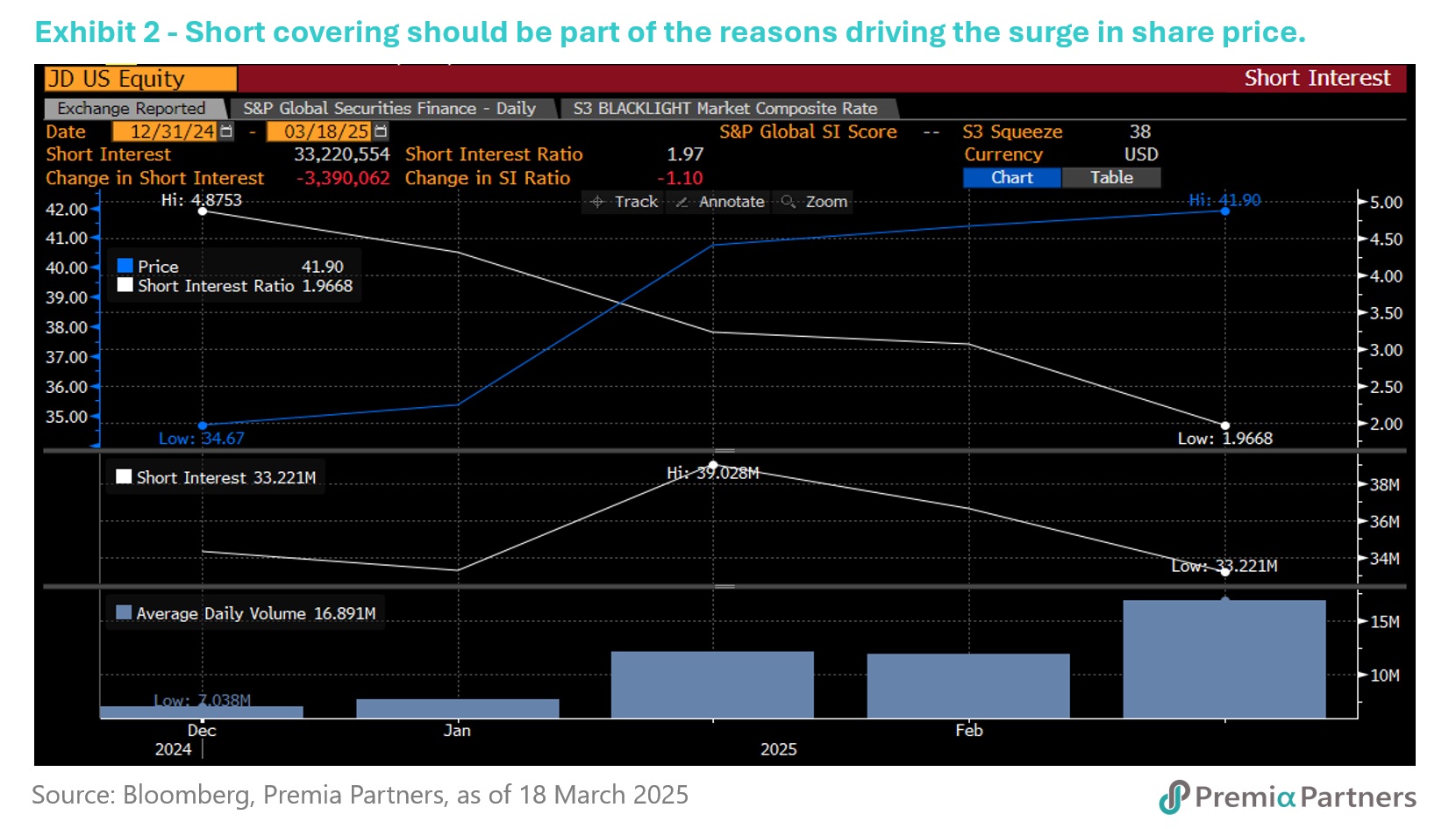

The short covering may contribute to the recent outperformance of the offshore Chinese names as well. Taking JD.com as an example, you may see its short interest has reduced substantially since late January alongside the surge in its share price (Exhibit 2).

That said, the catch up of H shares is largely done now, with their total return on par with their A shares peers’. We reinforce our view that risk-on sentiment will return to onshore investors in the next phase of the rally, driven by unique characteristics of the A shares market:

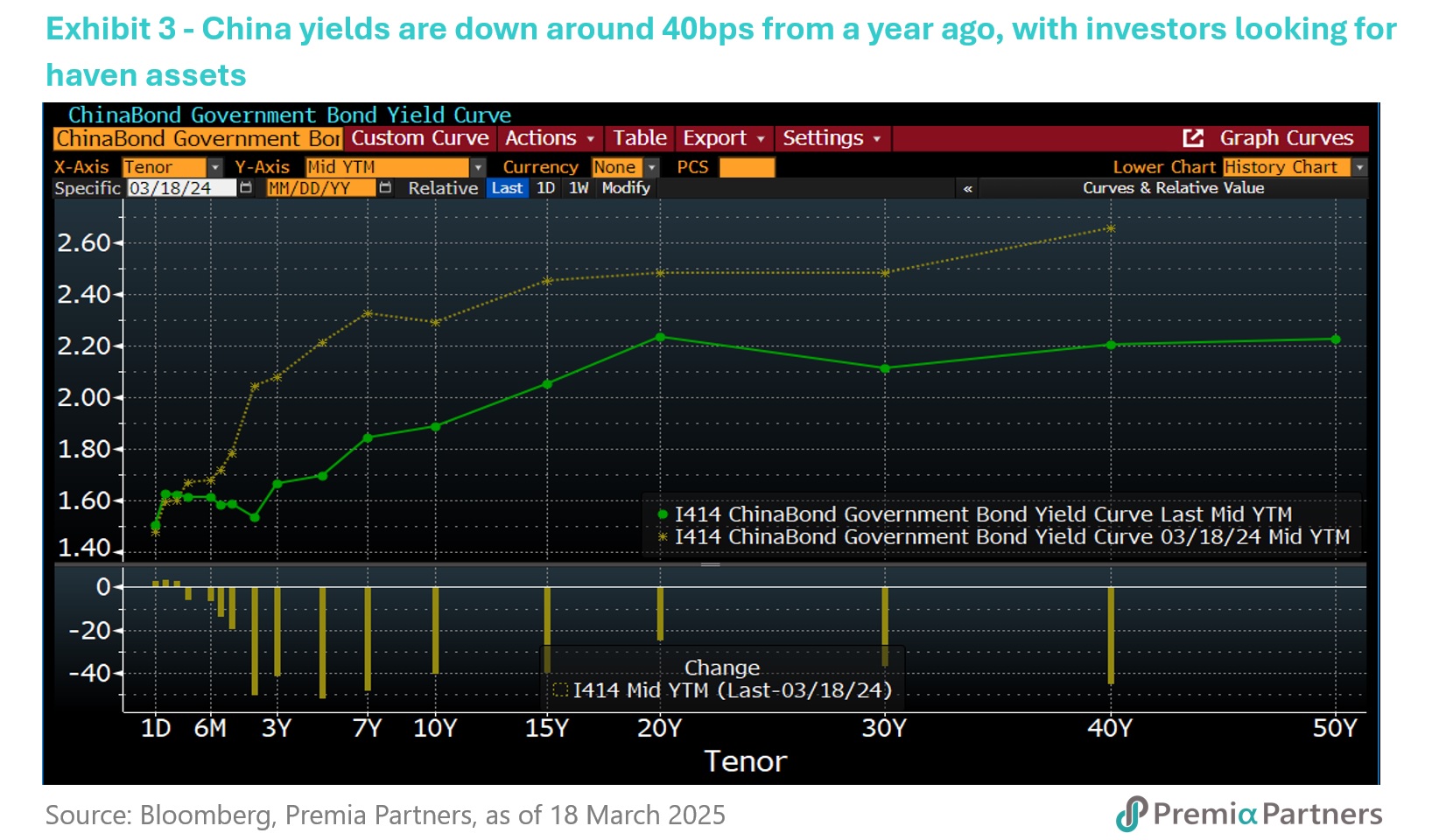

- The onshore market is bolstered by increasing liquidity from domestic monetary easing.

- Investors have been favoring low-risk fixed-income assets like CGBs, pushing yields to historical lows (Exhibit 3).

- Long-term investors, including pension funds and insurance companies, are requested to increase their stakes in A shares.

- Many policy-supported stocks in hardcore tech sectors, such as semiconductors, robotics, and AI, are exclusive to the onshore market

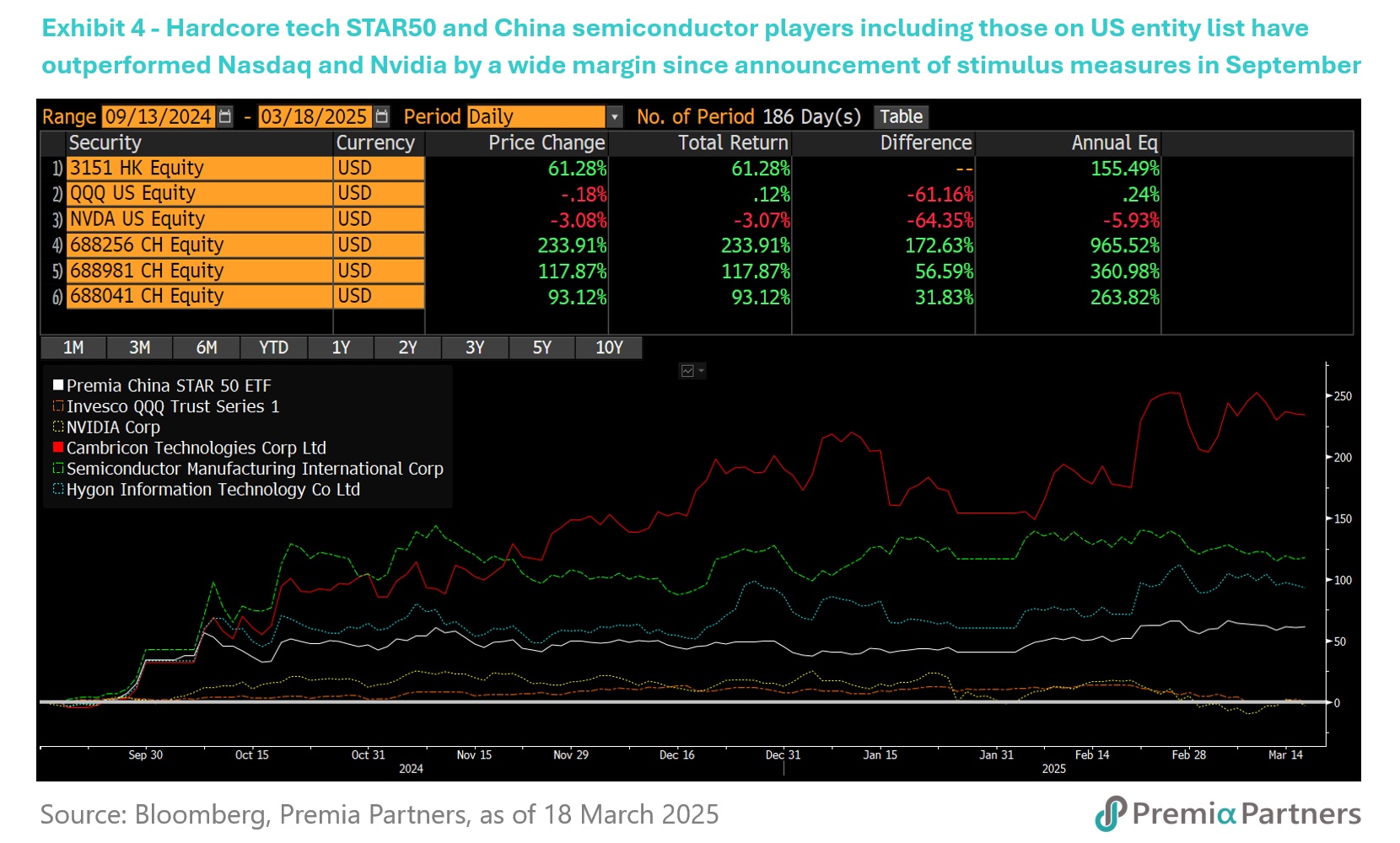

In the hardcore tech space, some sanctioned stocks have done really well outperforming broad market benchmark since the September trough – e.g. SMIC, Hygon as they benefitted from policy support, government contracts and in general increasing domestic substitution as Chinese companies intensify collaboration and research and design efforts to integrate higher level of domestic components (exhibit 4). This has supported the improved fundamentals and positive earnings revisions for these companies also.

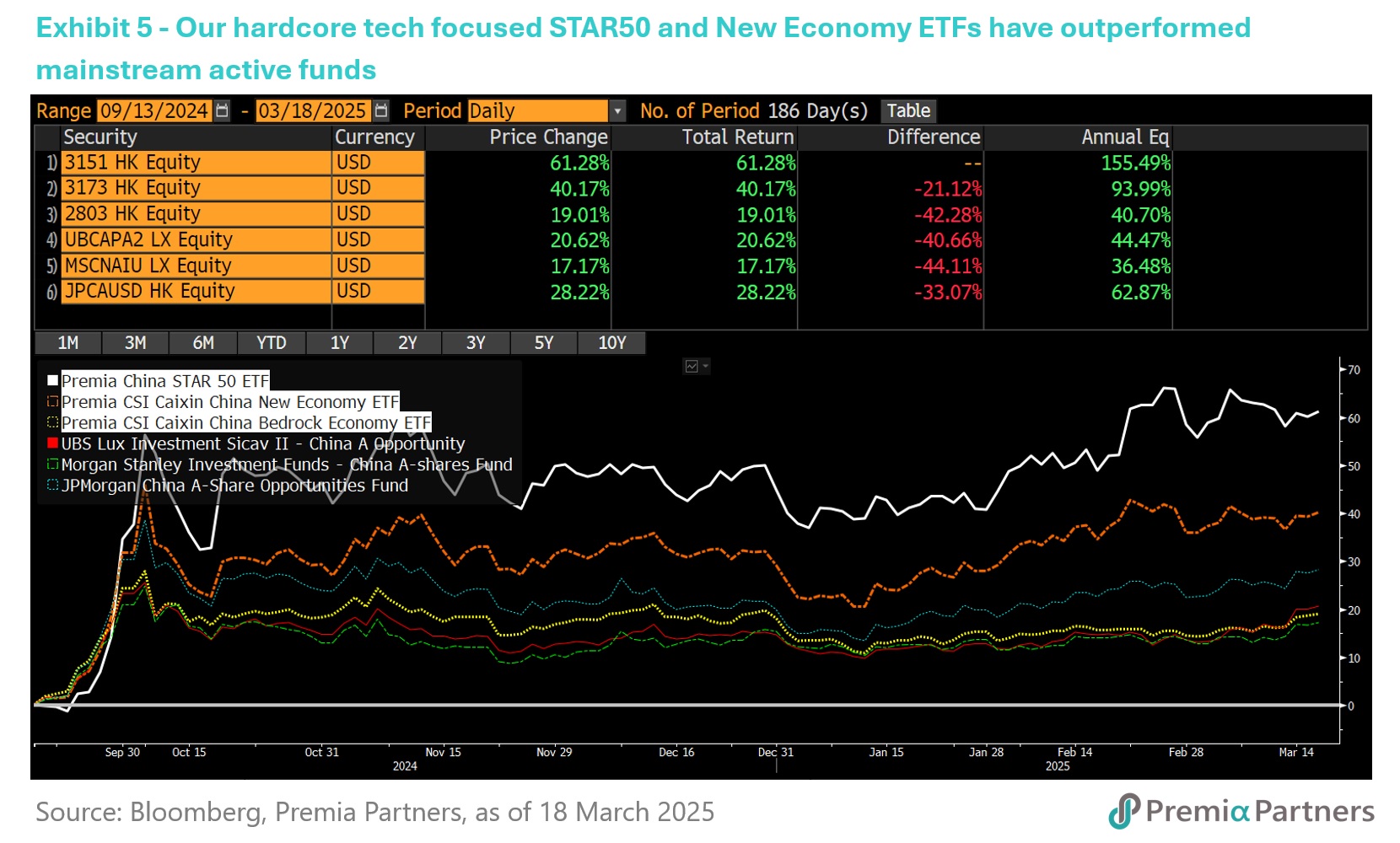

On the other hand, as traditional long only active funds historically tend to focus on mainstream mega/ large cap players, it would take longer for them to reconfigure research focus to cover and develop conviction bets in the hardcore tech space. Some active managers would use hardcore tech focused ETFs for portfolio completion/ as placeholders for the space, while others that maintain light positioning for the space tend to lag in the rally (exhibit 5).

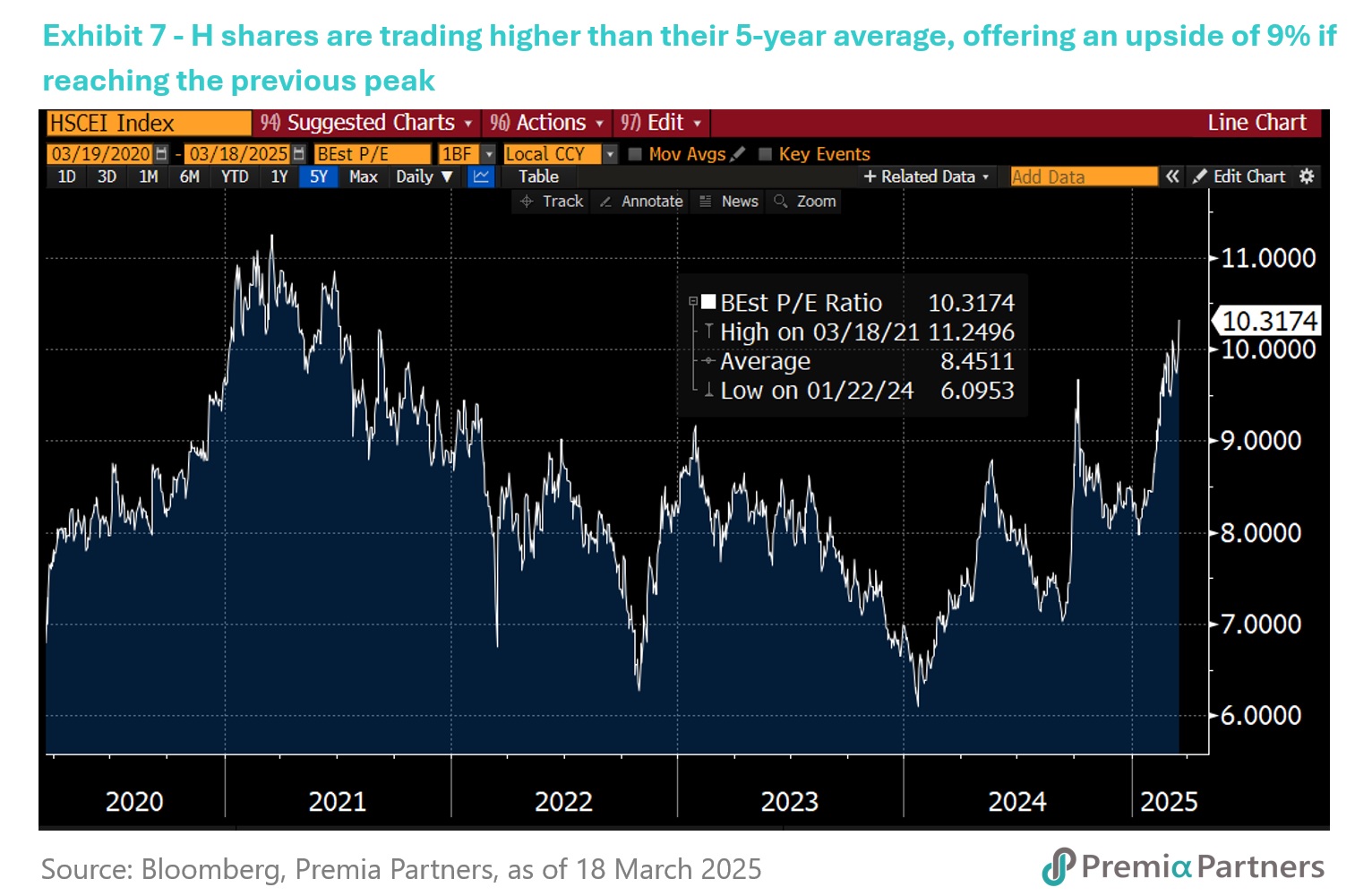

From the valuation perspective, A shares are trading close to their recent 5-year average in terms of 12-month forward P/E (Exhibit 6), while H shares are trading way above their 5-year average (Exhibit 7) now after close to 30% rally YTD. If benchmarking their previous peaks in 2021, A shares would have an upside of 31.6% whilst H shares would have an upside of 9% only. This trend algins with brokers’ recommendation, like Goldman Sachs expecting higher return in the onshore market (+19% in A shares vs +10% in MSCI China). The A-H premium chart also indicates that the current level is close to the bottom trading range in the past 5 years, suggesting A shares are relatively cheap from a historical data perspective (Exhibit 8).

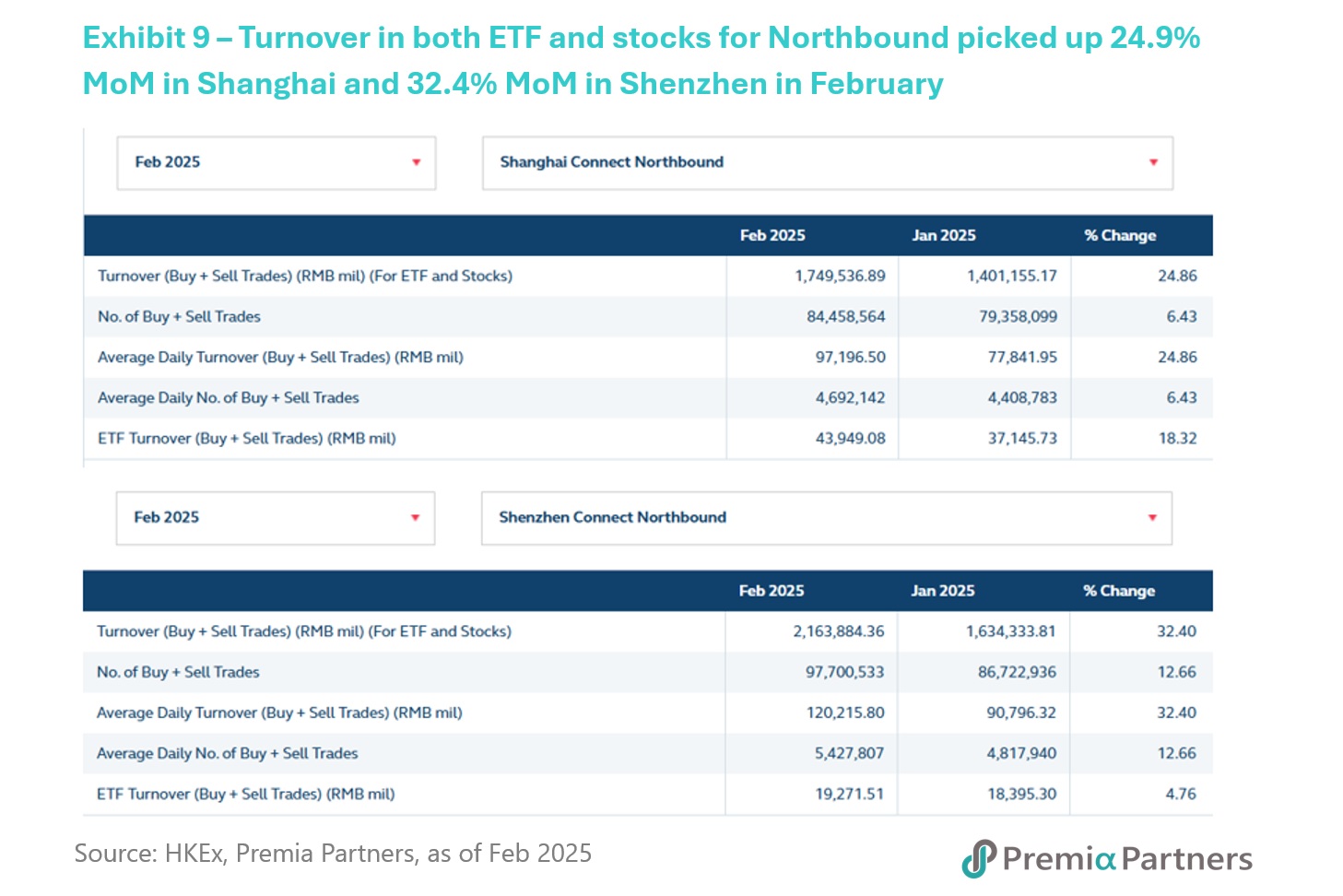

Flows wise, we may look at the total volume pick up measured by HKEX in both Northbound trades in Shanghai and Shenzhen, indicating interest on A shares from international investors are increasing (Exhibit 9). Chinese equities saw investment from foreign domiciled funds of USD 3.8 billion in February after withdrawals since November, according to Morgan Stanley. Onshore investors also increased their participation in the A shares market, as shown by the rising amount of margin financing, which hit RMB 1.95 trillion, the highest level since June 2015 (Exhibit 10).

If you're looking to explore opportunities in the A-shares market, our Premia China ETF offerings are designed to meet a variety of needs. The Premia China STAR50 ETF focuses on cutting-edge technology, featuring a portfolio of 50 emerging Chinese leaders in key strategic industries. The Premia CSI Caixin China New Economy ETF aims to capture China’s megatrends, including urbanization, consumer upgrades, an aging population, and technological advancement. Meanwhile, the Premia CSI Caixin China Bedrock Economy ETF employs a multi-factor strategy, seeking to generate alpha through quality, value, low volatility, and size.