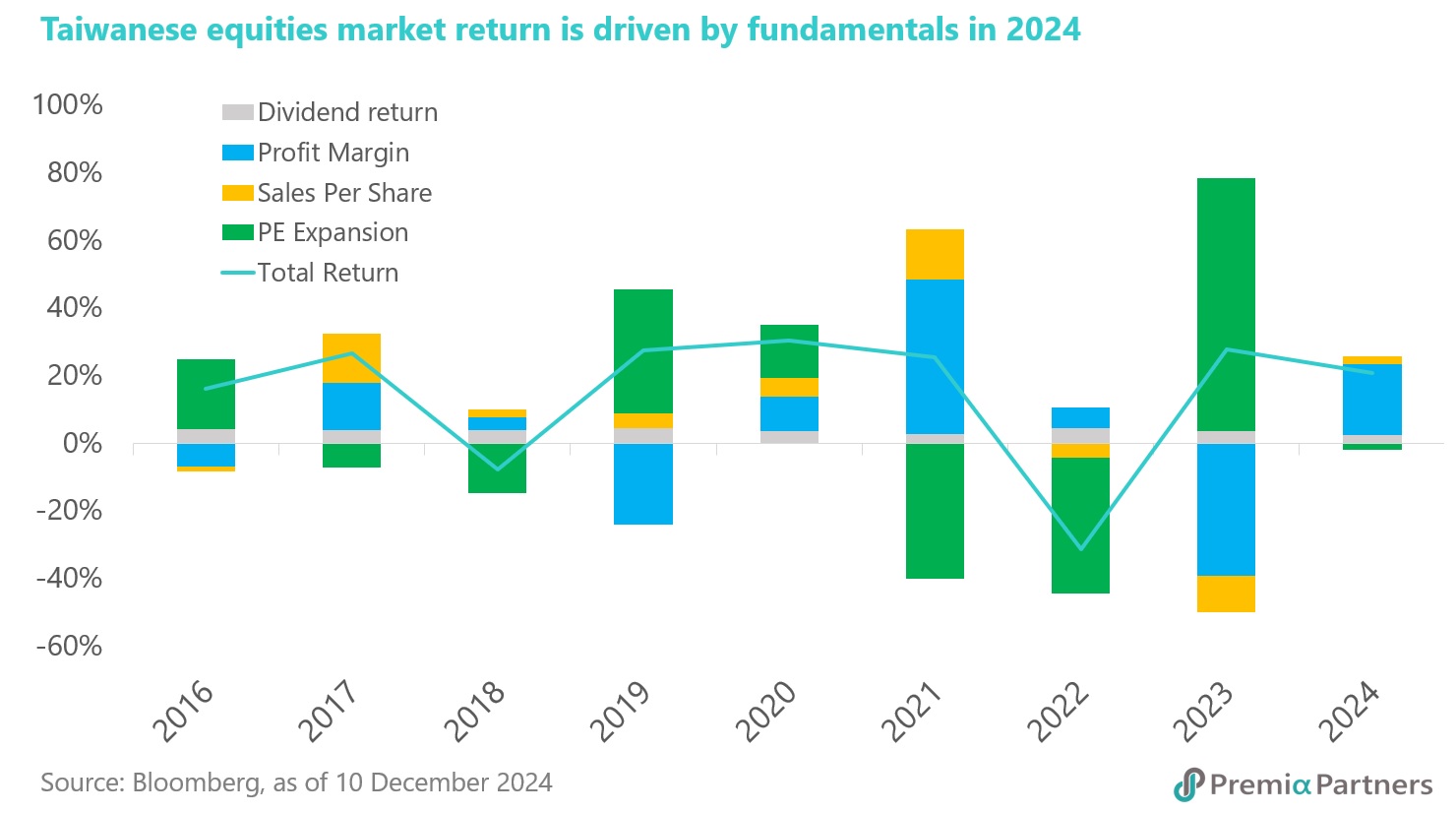

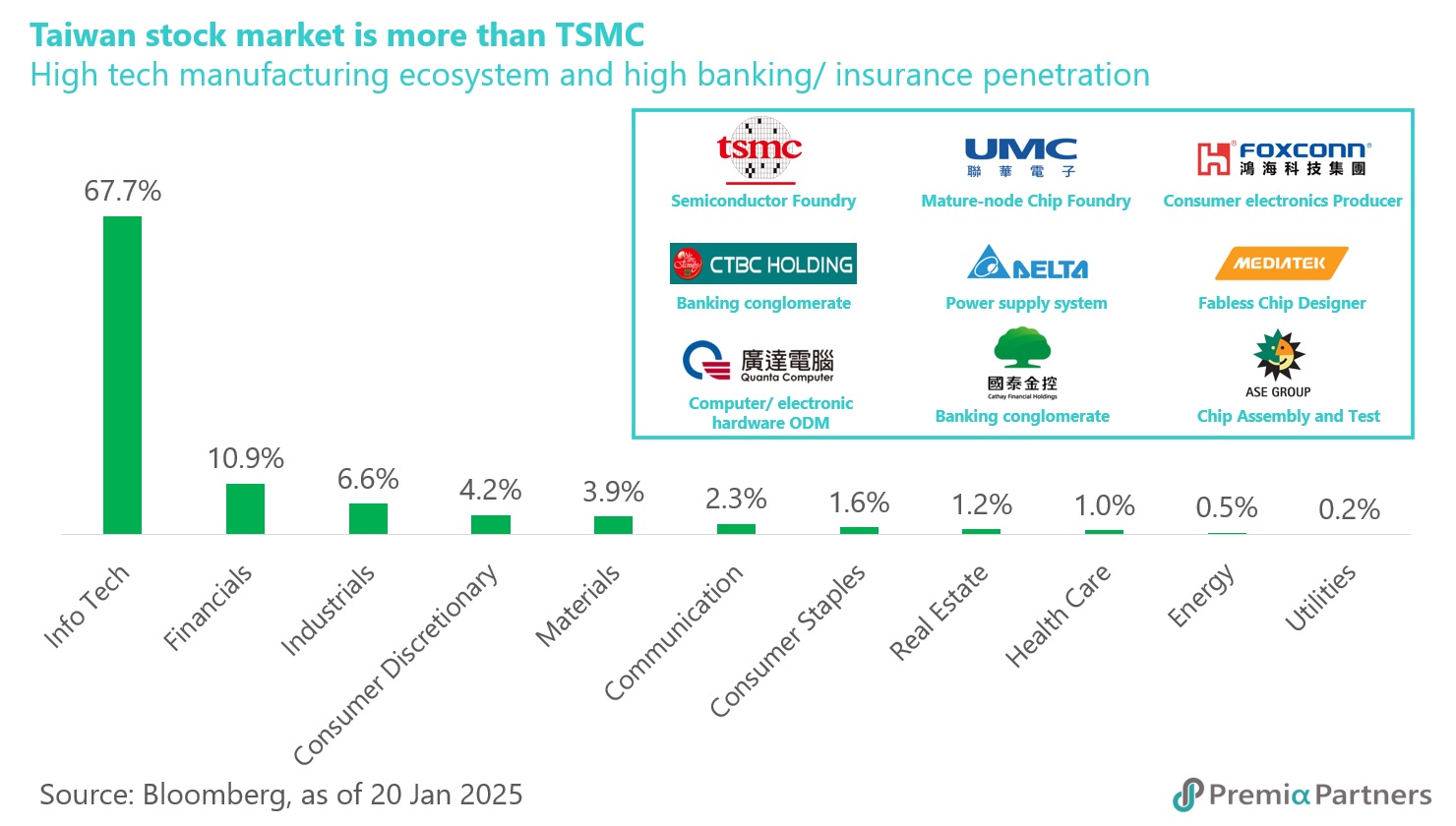

Robust market performance in 2024 marked a switch from PE multiple expansion to profit and sales growth. Taiwan's technology-driven equity market enjoyed exceptional strength in 2024, with returns of more than 20% for the year, building on the impressive 27% gain in the prior year. This sustained success is primarily attributable to the dominance of Information Technology companies, which constitute approximately 66% of the Taiwanese equity market's weighting. The remarkable performance is particularly evident in the contribution of the top three companies: Taiwan Semiconductor Manufacturing Company (TSMC), Hon Hai Precision Industry (Foxconn) and MediaTek, which collectively accounted for roughly 80% of the market total return in 2024. This surge in share prices reflects not just hype, but a fundamental shift: While 2023 gains were largely fueled by PE expansion driven by AI optimism, 2024's success stemmed from tangible improvements in profit margins and sales growth, with relatively stable PE ratios. This suggests a transition from AI hype to demonstrably robust revenue generation driven by the technology. The 2025 outlook for the Taiwan equity market however presents a more nuanced opportunity set, influenced by several interconnected factors.

1. Elevated valuations, geopolitical risks, and the volatility conundrum

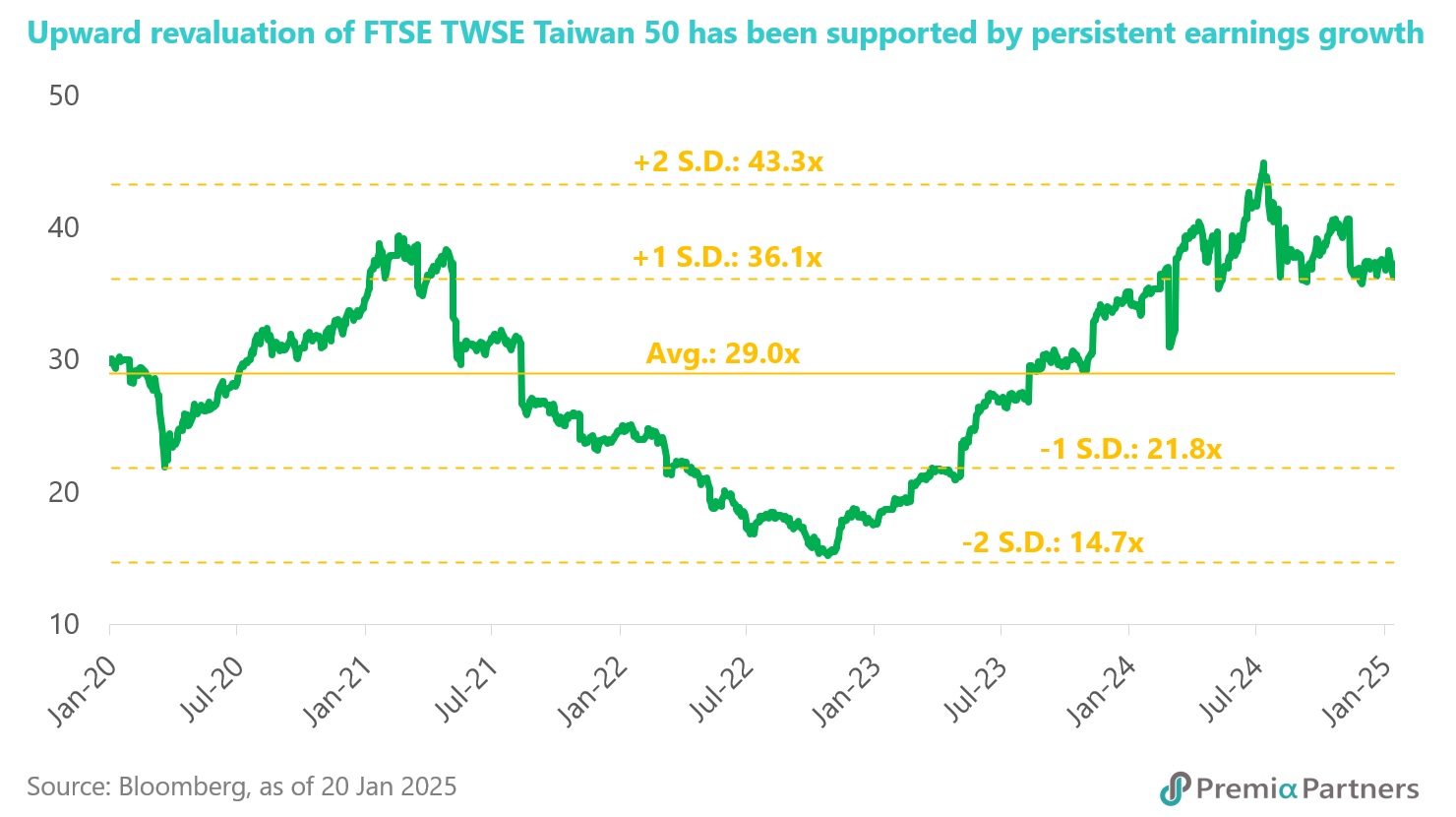

The flagship FTSE TWSE Taiwan 50 30% Capped Index USD (NTR), after pushing to new heights in 2024 and trading at more than 2 standard deviations from its five year historical average of 27x P/E, recently stabilized at approximately 34.1 times P/E.

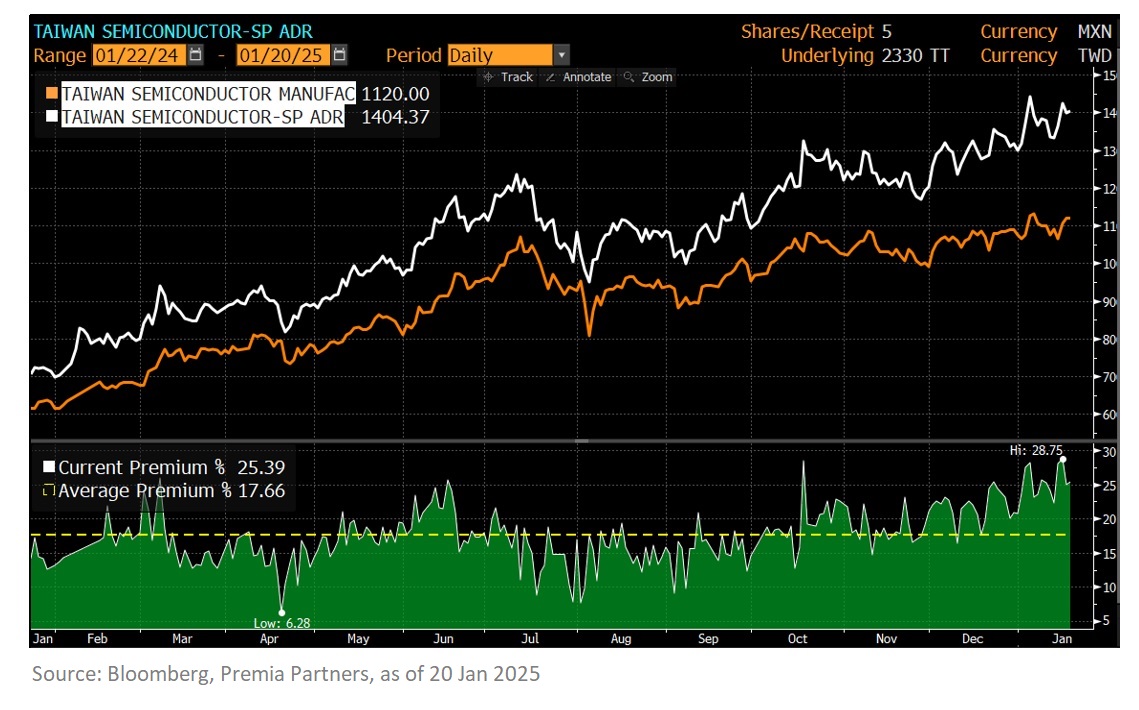

To some investors it may still represent a higher valuation level than their psychological anchor, and it could raise concerns about potential volatility. It poses vulnerability to market corrections with a fall in the ADR premium. However, this elevated valuation also reflects investor confidence in the sector’s prospects. In fact, much of this valuation comes from bets on TSMC, whose ADR has persistently traded at around 20% premium to its primary listing at home, reflecting its position of being the concentrated single stock bet by foreign investors for their semiconductor/ Asia tech allocation.

There is also geopolitical uncertainty which is a wildcard for global allocators. The return of a Trump Administration and its potential trade policy risks represent a major source of uncertainty for export oriented emerging market economies. Imposition of new tariffs or trade restrictions could significantly impact Taiwanese exports, affecting the entire economy and investor sentiment. A stronger US dollar, and the possible consequences of a combination of the new Administration’s policies, would add another layer of complexity, potentially reducing the competitiveness of Taiwanese exports.

However, the market’s strong projected earnings growth for 2025 mitigates some of these risks. Following a 25% surge in 2023, index earnings are anticipated to climb another 35% in 2024, followed by projected, albeit moderated, 12.8% growth in 2025. This continued strong growth from a higher base reflects confidence from local management which culturally tends to lowball estimates. This could provide a cushion against valuation concerns.

TSMC's management, recognizing the early stages of the AI era and the strong demand for leading-edge nodes, has raised its 2024 revenue growth target to approximately 30%, reflecting confidence in the sector's long-term prospects. And it is not only TSMC. Many other Taiwanese tech leaders are seeing record order books as global demand for AI, data centers, power management systems and related ecosystem buildout continue to surge. In fact, many high tech manufacturers in Taiwan are global leaders in these areas, and stand to benefit in ways not dissimilar to Levi’s and providers of tools and shovels during the Gold Rush, who benefited regardless of where miners eventually found gold.

Market reaction to geopolitical uncertainties remains a wild card. The interplay between higher than historical average valuations, significant geopolitical risks, and strong but moderating earnings growth will ultimately determine the level of market volatility in 2025. Notably, this volatility could be partially offset by robust participation from domestic retail investors, who are actively investing through ETFs. This trend was evident in 2024, when, despite a peak in net inflows from foreign investors in March, the market continued to rise until July. Although foreign investors shifted to net outflows by the end of 2024, the market demonstrated strong resilience, maintaining high levels throughout the year.

2. The continuing AI revolution: A multi-year growth driver

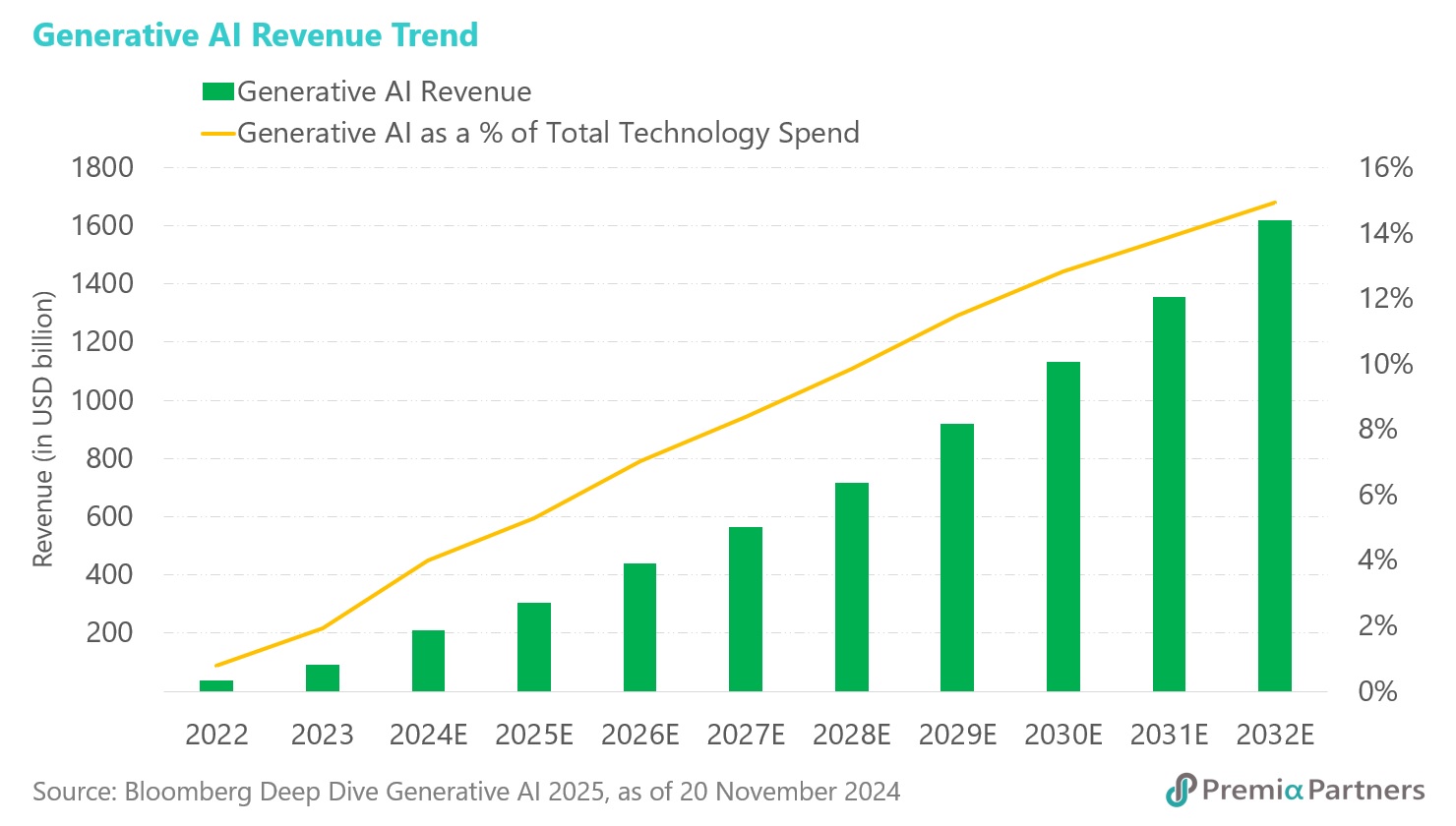

The AI revolution remains a powerful long-term growth driver for Taiwan's tech sector, leveraging its strategic dominance in semiconductor manufacturing. In Bloomberg’s Deep Dive Generative AI 2025 report, its forecast of a US$1.6 trillion generative AI market by 2032 (37% CAGR) highlights the immense potential. TSMC's generative AI segment is poised for even more rapid growth, potentially reaching 50% CAGR. The burgeoning AI server market, projected to reach US$317 billion by 2032 (21% CAGR), presents another significant opportunity.

TSMC's technological edge in advanced nodes is expected to remain dominant through at least 2026, as highlighted by Bloomberg Intelligence. Samsung's struggles with 3nm yields and uncertainty surrounding Intel's foundry strategy following its CEO’s retirement solidifies TSMC's leadership. TSMC’s plan to more than double its CoWoS capacity in 2024, with a likely repeat in 2025, along with the tripling of its chip-packaging unit sales over the next three years, underscores its aggressive growth strategy. These advanced packaging technologies (CoWoS 2.5D and SoIC 3D) are critical for next-generation data center AI chip production and generative AI adoption in personal computing devices.

Hon Hai's planned increase in AI server shipments from Q1 2025, and Goldman Sachs' projection of a 30% contribution from AI server revenue in 2025, further reinforce this long-term growth trajectory. Increased supply of Nvidia GPUs and new configurations with GB200 chips are likely to unlock additional upside in the coming quarters.

While TSMC is a central player, the Taiwanese equities market encompasses a robust supply chain in high-tech manufacturing. That includes companies like Asia Vital Components (AVC), which specializes in liquid cooling solutions crucial for AI servers. Additionally, the market features a substantial presence in the banking and insurance sectors, which are expected to benefit from rising demand fueled by the wealth effect stemming from global AI demand and a dynamic local stock market.

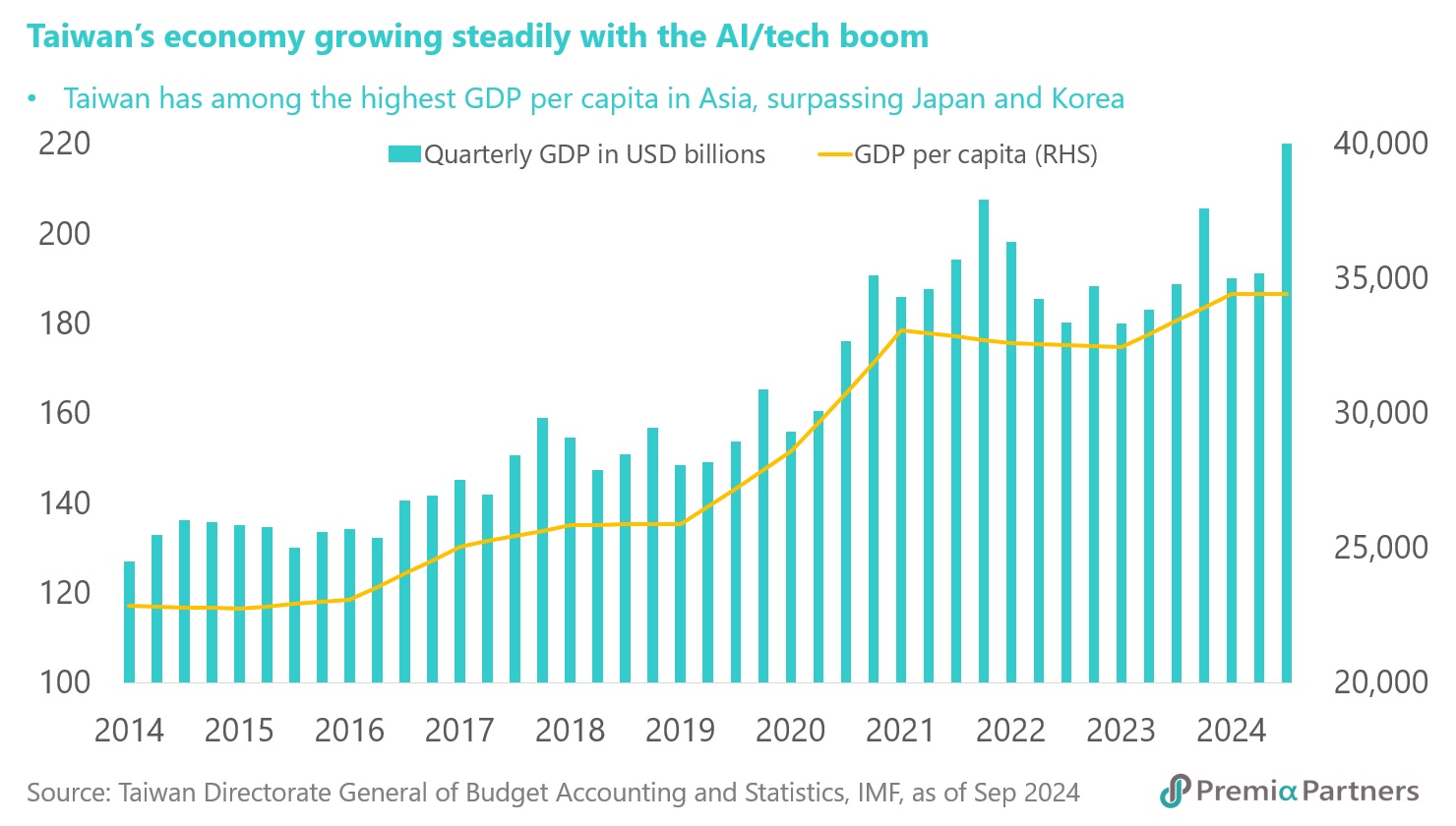

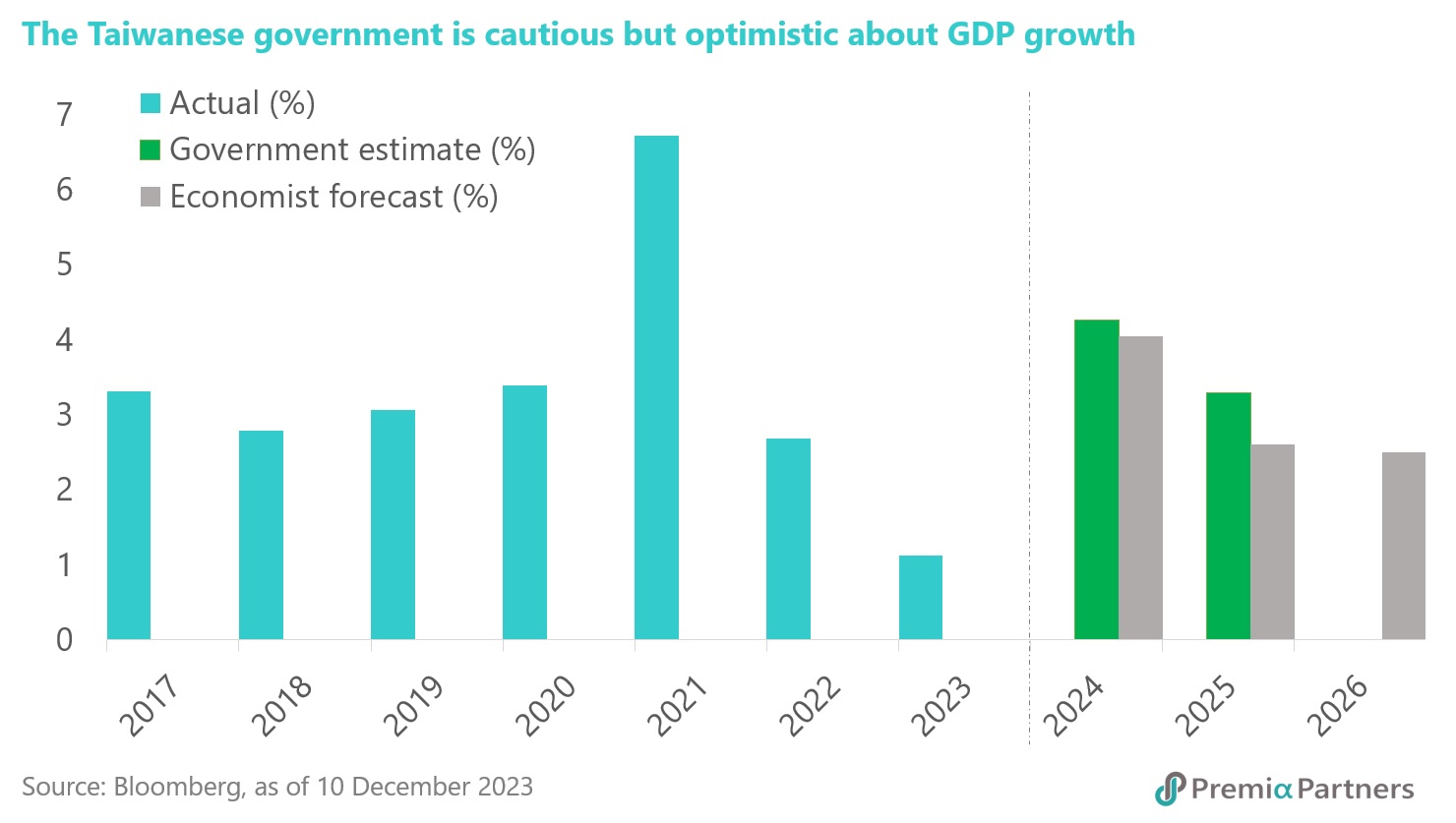

3. Economic growth and geopolitical headwinds: A nuanced, strategic balance

Taiwan's projected 3.29% GDP growth for 2025 is set against significant geopolitical uncertainties stemming from US-China trade relations. While export markets have been successfully diversified, reducing over-reliance on China, the US remains a crucial market for Taiwan's technology sector. The Directorate General of Budget, Accounting and Statistics (DGBAS) acknowledges the risks of reduced global trade volume, but suggests that potential US tax cuts could mitigate some of the negative impacts by boosting US demand and imports.

Further, Taiwan's crucial role in the global semiconductor supply chain and AI ecosystem gives it a considerable buffer amidst fluid geopolitical dynamics. Given the essential nature of Taiwan's advanced chip manufacturing capabilities for both US and Chinese technological ambitions, the likelihood of either country imposing significant tariffs or initiating direct military conflict is arguably low. Both would likely prioritize maintaining access to Taiwan's technological capabilities. In fact, this strategic reality suggests that the potential upside—continued access to this technology—significantly outweighs the downside risks of trade friction. A stronger US dollar, while posing a challenge to export competitiveness, is partially offset by the anticipated lowering of interest rates by the Federal Reserve, potentially attracting foreign investment into Taiwan.

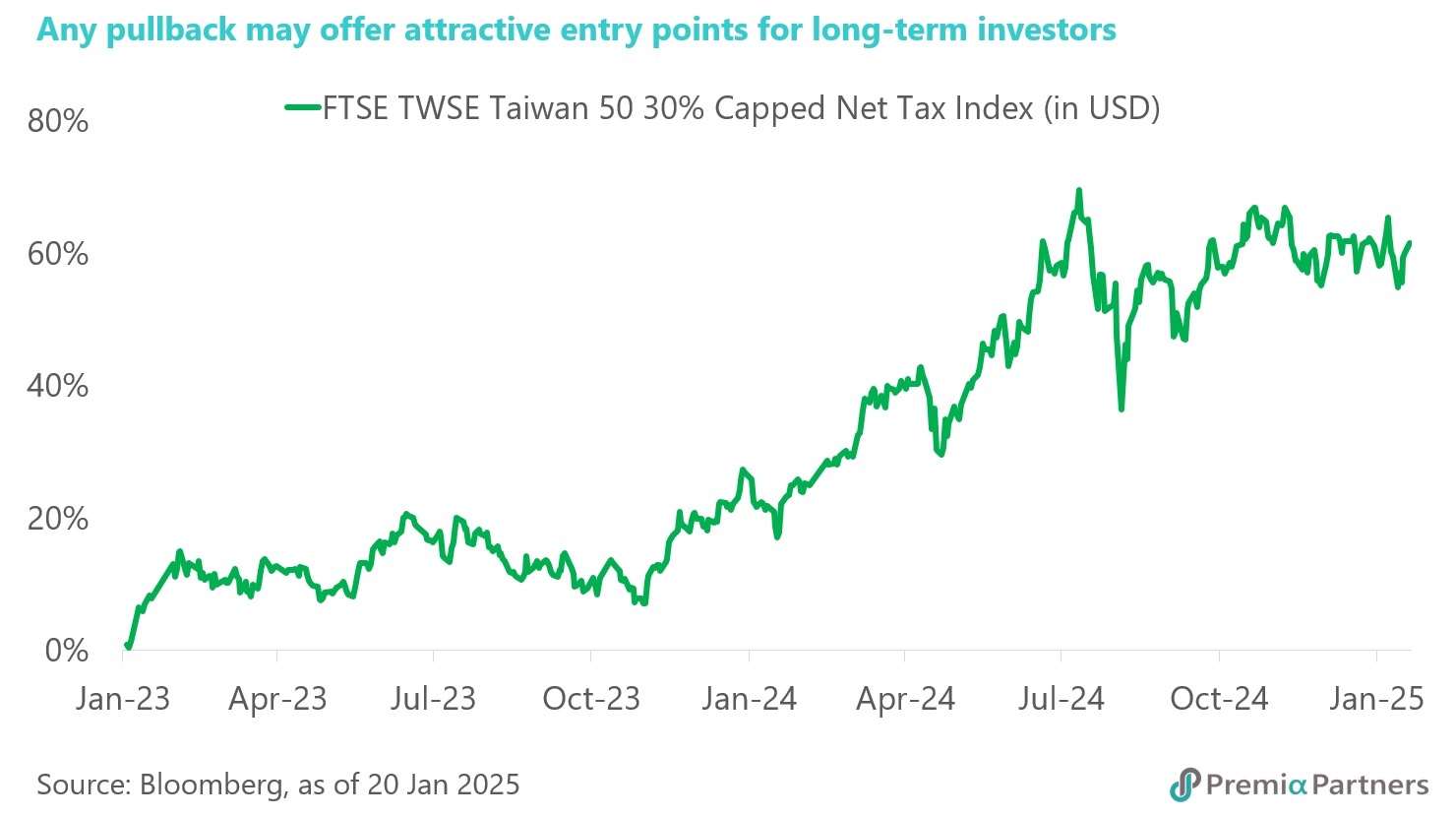

4. A long-term investment perspective

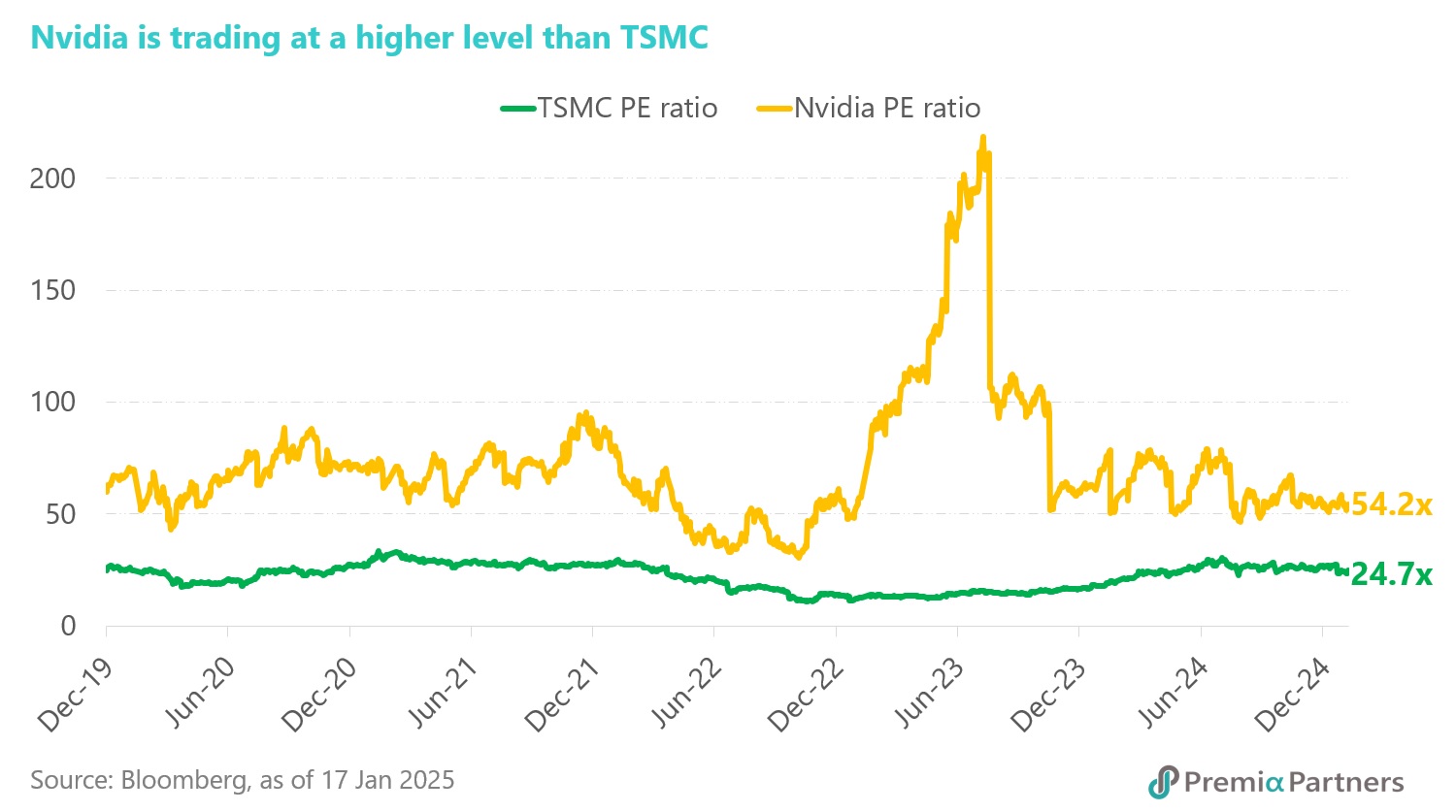

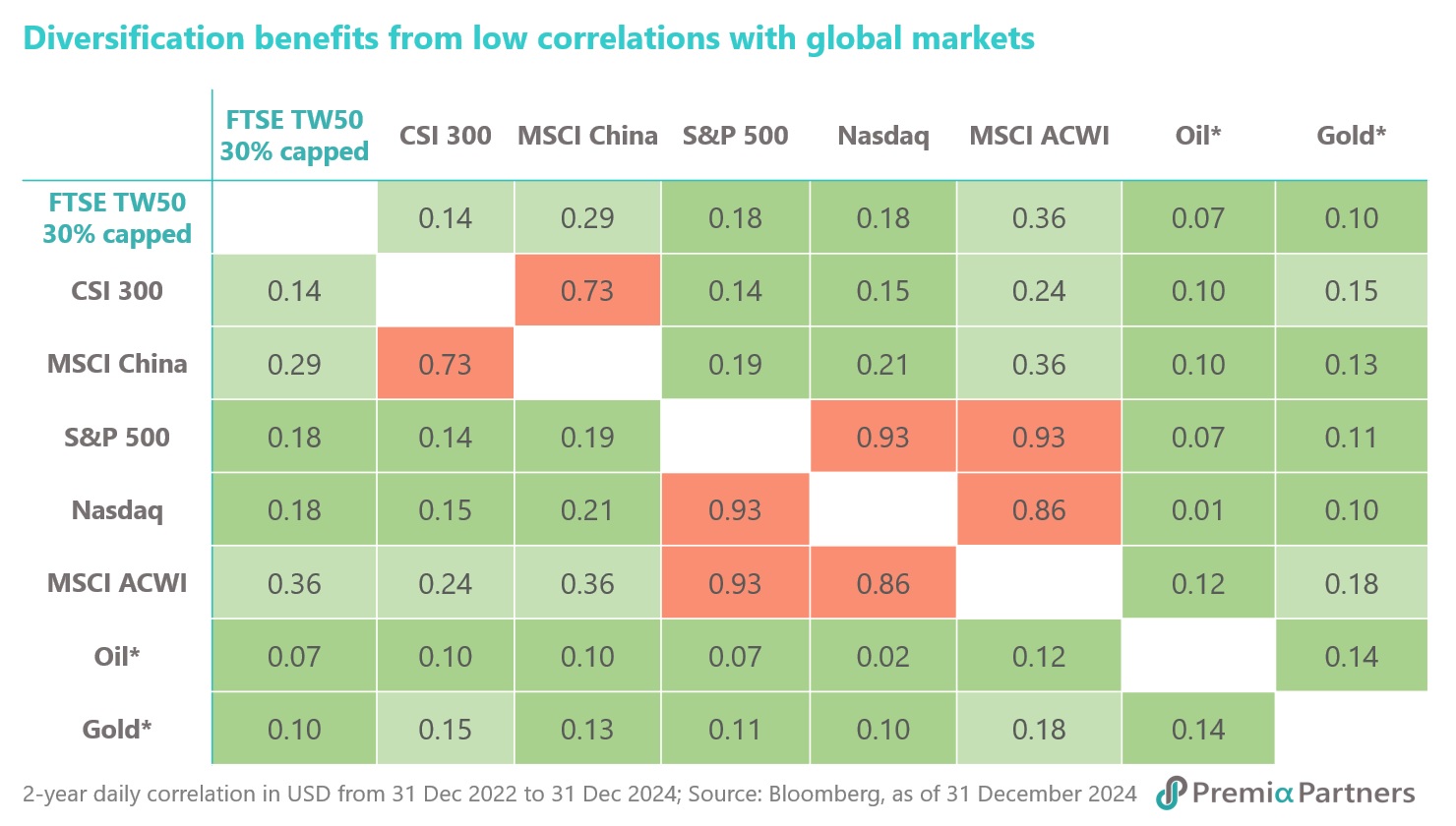

While near-term market volatility and uncertainty are expected, the fundamental strengths of Taiwanese equities, particularly within the technology sector, suggest that long-term investors should view market corrections as potential buying opportunities. Taiwan's global dominance in semiconductor manufacturing and the sustained growth prospects in this AI era make it a compelling long-term investment, and a very unique AI play that could enhance risk-adjusted returns, given the market’s remarkably low correlation with other asset classes across US, China, world equities and even gold or oil. For investors who have been overweight US tech or have maintained concentrated single stock bets in Nvidia, broad market allocation to Taiwan would be particularly worth considering for uncorrelated alpha and portfolio diversification.

2025 – a year of continued growth and cautious optimism for Taiwan

The 2025 outlook for the Taiwanese equity market presents a compelling case for cautious optimism. The strength of the AI boom and Taiwan's leading position in semiconductor manufacturing suggest significant long-term growth potential. While geopolitical uncertainties and above average valuation for individual stocks such as TSMC may from time to time introduce near-term volatility, it remains an attractive source of uncorrelated alpha and dividend yield for global allocators with opportunities beyond TSMC.

Premia FTSE TWSE Taiwan 50 ETF which covers the largest 50 companies listed in Taiwan by market capitalization and contribute to ~80% of listed revenue, provides investors with a cost-efficient vehicle to capitalize on attractive entry points in any market pullback, enabling participation in the long-term growth trend in the emerging AI era. For non-US investors, as a low-cost HKEx listed ETF, it also does not attract US withholding tax, aligns with trading hours of the underlying Taiwan market, and enjoys the efficient HKEx ETF regime where there is no stamp or estate duty, no withholding tax, and no dividend or capital gains tax.

Premia FTSE TWSE Taiwan 50 ETF’s top holding TSMC reported its record profit in Q4 2024 and expects revenue will grow about 25% on the back of AI-related demand. AI-related revenue to grow 45% annually for next 5 years. TSMC and much of Taiwan’s companies have been critical upstream suppliers to Nvidia, AMD and many others AI players, yet the share price had been lagging and is due for a catch-up, as TSMC and the broader Taiwan market offers compelling value as a defensive AI play.

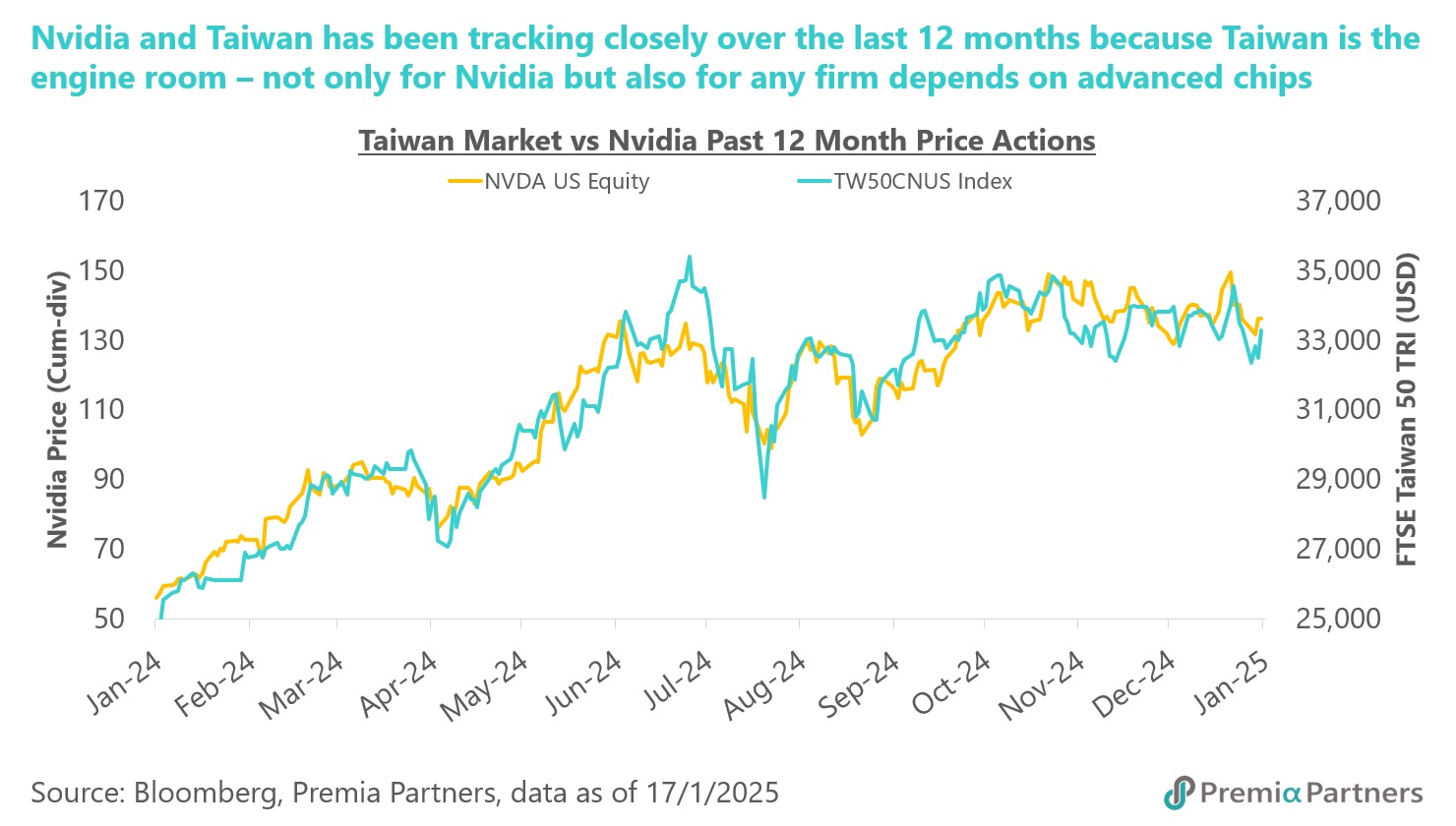

To put it in perspective, over the last 12 months while FTSE TWSE Taiwan 50 index had been tracking Nvidia share price closely but, the index’s total market cap is only about half of Nvidia’s market cap, yet FTSE TWSE Taiwan 50 boasts 6.6 times more revenue and 1.8 times more net income than Nvidia, along with twice the net cash reserves. This financial strength makes Premia FTSE TWSE Taiwan 50 ETF a more diversified and defensive play within to gain exposure to the AI theme. This may be particularly relevant as Nvidia starts to see more competing solutions on markets (e.g. AMD MI300X and custom chips built by cloud solution providers).