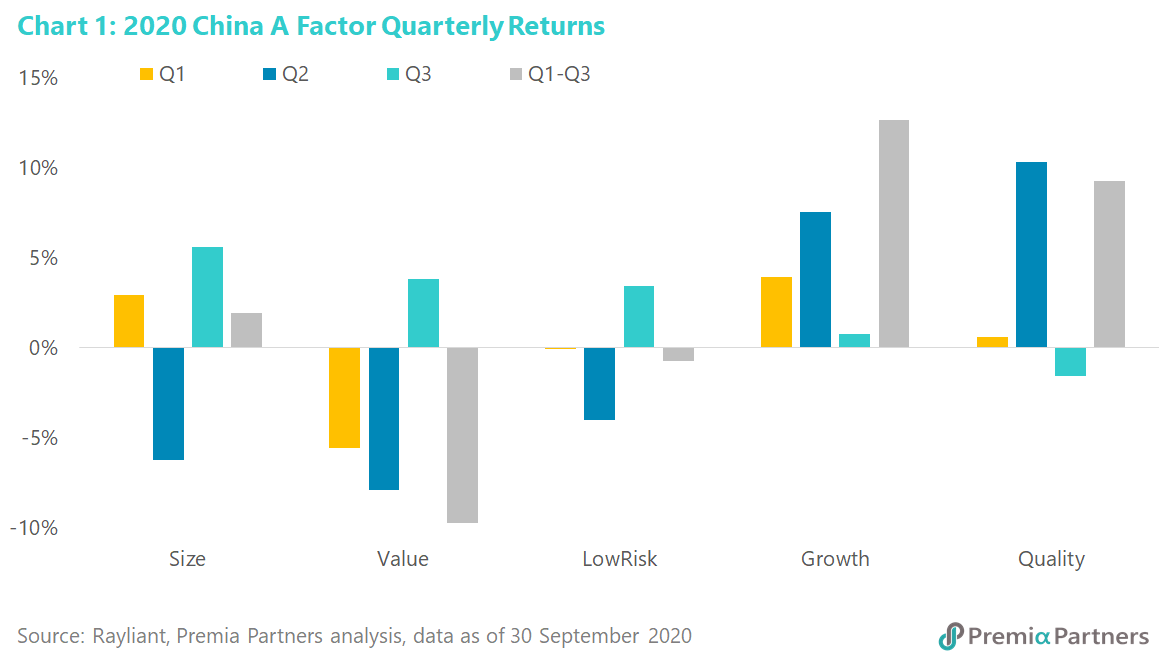

As business activities in China mostly resume to a normal level, we also observed some mean-reversion in factor returns. While still the best performing factors year-to-date, Quality and Growth factors slowed down in Q3 and posted 0.8% and -1.6% in return, respectively. Size, Value and LowRisk factors, on the other hand, have posted better results compared to those in the previous quarter. As mentioned in the previous article Why Chinese market is likely to continue outperformance, the overall market sentiment for China A shares have been improving significantly and therefore providing favourable environment for small Size and very possibly a Value reversion.

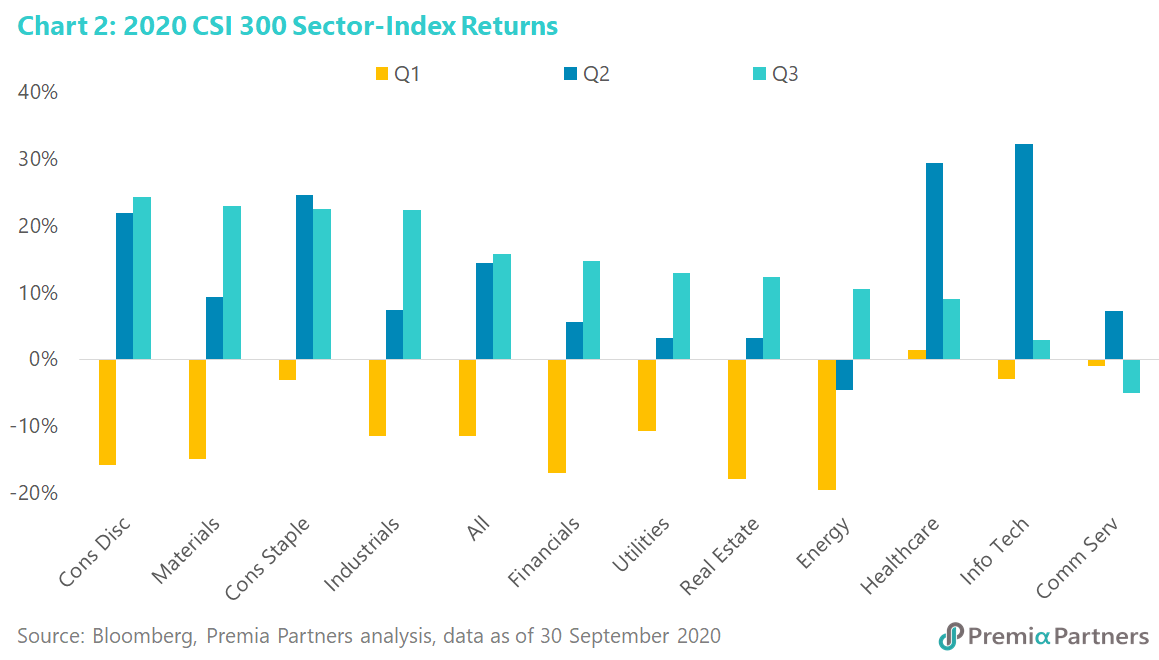

As the economy gradually resumes to almost full capacity, we have also observed interesting rotation in sector returns (Chart 2). While Technology and Healthcare sectors were the most resilient during the COVID period, they experienced mean-reversion in Q3 with the lowest returns. On the other hand, Consumer sectors continued their momentum from Q2 and continued to post strong returns. This is consistent with domestic consumption being the key driver of China economy since the international lockdowns. In Q3, we have also finally seen strong recoveries from Materials, Industrials, Financials, Utility, Energy and Real Estate sectors, indicating market confidence toward a full post-pandemic recovery.

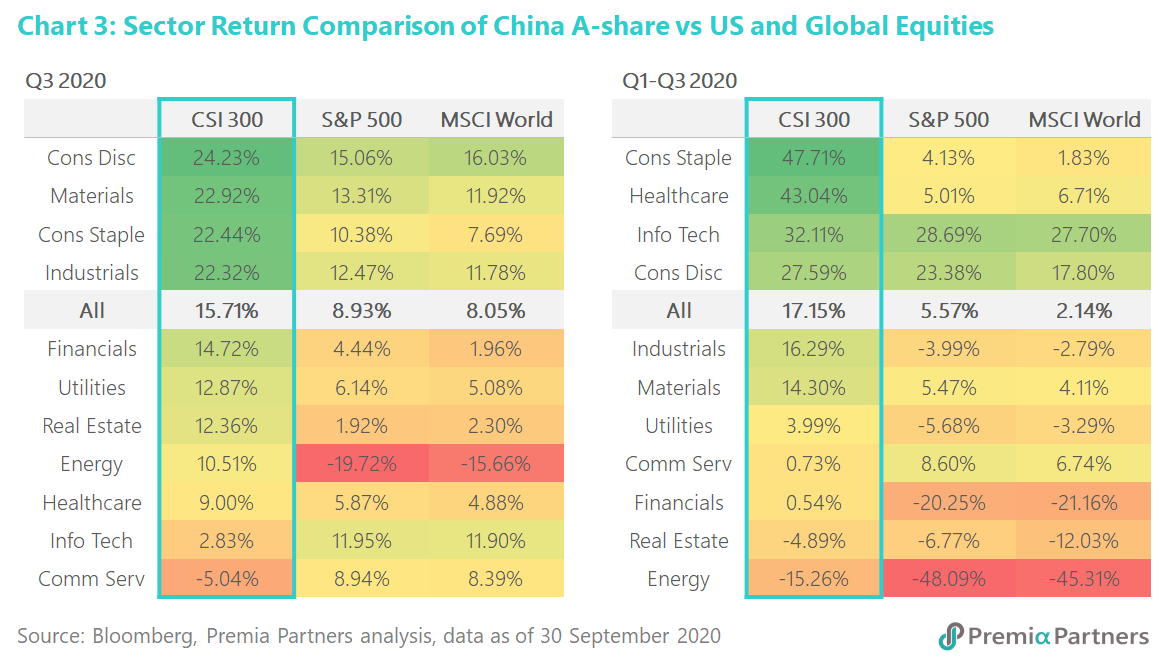

Compared to the US and global equity markets, China A shares continue to outperform. In fact, apart from Communications, China A shares outperformed US and Global equities across all sectors for the first 3 quarters of 2020 (Chart 3).

Implications from The 14th Five-Year Plan

China’s 19th Central Committee of the Communist Party of China (CPC) was recently held with the renewed national strategy outlined in the 14th Five-Year Plan (2021-25). Policy tailwinds have always been significant drivers to equity performances in China A shares, especially given the strong retail trading behaviour exhibited in the market. So what are some policy tailwinds from the 14th Five-Year Plan?

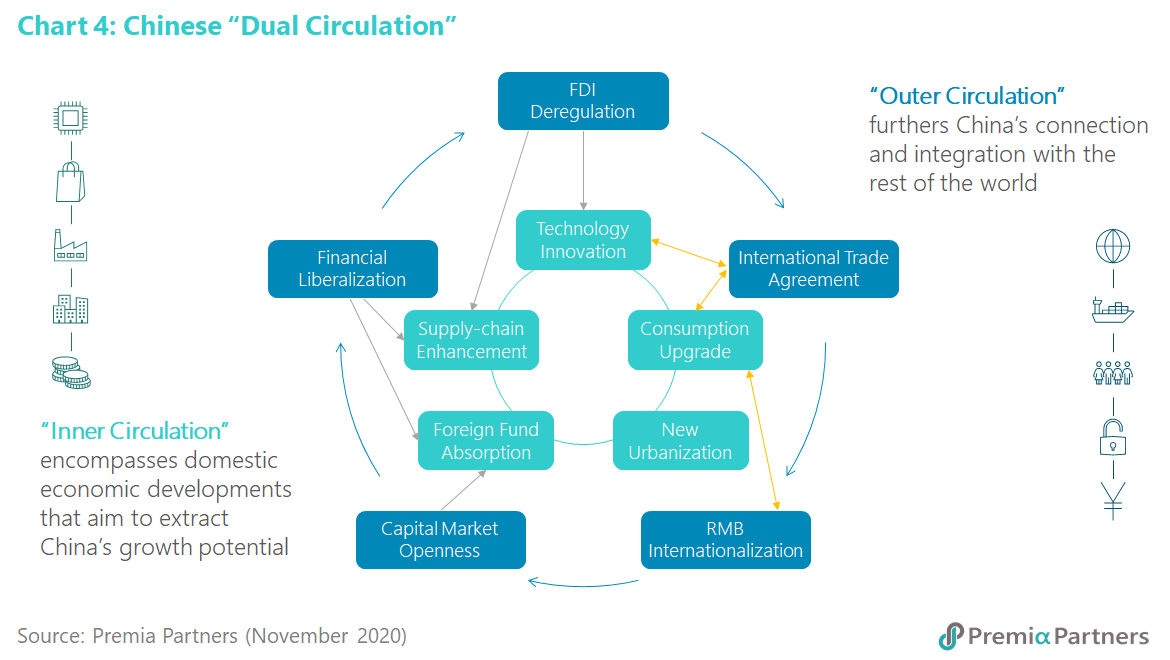

In short, Chinese 14th Five-Year Plan emphasizes the importance of “high-quality” economic development, while less so on the absolute volume of growth. The concept of “Dual Circulation” has been announced by the authority – in which its traditional emphasis on growth through exports will be bolstered by a renewed focus on spurring domestic demand (Chart 4). That is, in light of the US-China tech war and other geopolitical concerns, China is aiming to develop homegrown advance technologies. In particular, below are the three key beneficiary areas that worth investors’ attention:

· Consumption Upgrade: high-class consumption, digital economy, silver economy, education, etc;

· Technology Advancement: new infrastructure, third-generation semiconductors, smart city, medical informatization, etc;

· Economy Greenization: alternative energy, energy storage, new energy vehicles, new materials, etc.

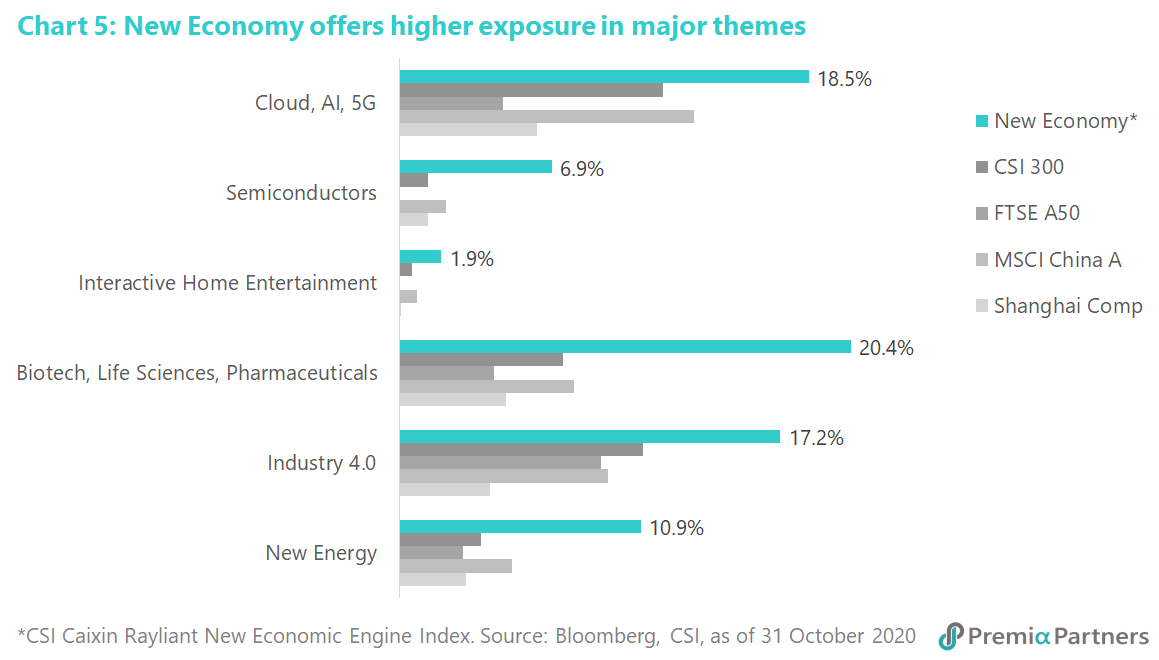

Therefore, despite the mean-reversion drawback in Q3, we believe “Quality Growth” will continue to be the main tone of China A equities. Our Premia China New Economy ETF (3173 HK) has outperformed the CSI 300 tracker (83188 HK) by 16% YTD return and reached US$312 million in AuM with US$151 million inflows YTD (as of 6th November), making it the 4th largest China A-share ETF in Hong Kong. With favorable exposures to industries with supportive policy tailwinds (Chart 5), we are optimistic in the strategies ability to capitalizing on these “high quality” growth opportunities.