Global asset managers are eyeing energy storage as the “next big thing in net zero”, reads the headline in a recent Asian Investor Magazine article. Indeed, the International Energy Agency recently said that energy storage needs to increase six-fold globally to enable the world to meet 2030 targets outlined at the COP28 climate conference.

Given the inextricable links between energy-hungry Artificial Intelligence and renewables, energy storage and smart grids are a necessary “final mile solution” in the intensifying AI race. They provide the critical capability to store and dispatch huge quantities of uninterrupted renewable energy/power on demand without compromising emission reduction targets.

At the global level, it seems inevitable that demand for computing resources will outstrip the current power grid capacity to support it, potentially setting a speed limit on the further development of AI. But the challenge also brings opportunities as developments for solutions come online.

In this regard, China is uniquely positioned to tackle the related challenges of AI and renewable energy with its rapid development and upgrades of energy storage systems and smart grids. In fact the country has long been studying intertwined strategic relationship between AI, technology and energy, and studiously incorporate such thinking into its Five Year Plans, and which are subsequently being rolled out as China’s East Data West Computing (EDWC) initiative.

In a recent insight, we wrote about China’s “power infrastructure” – which spans a national computing power network; data centre clusters; centres for the development/training of large language models; and abundant green energy integrated with massive energy storage facilities – as the critical enabler for AI-development.

In this article, we zoom in on China’s capabilities – and investment opportunities – in energy storage as the linchpin that matches renewable energy production with industrial demand.

In particular, energy storage systems (ESS) will be critical as bridges between renewable energy generation and electricity-intensive industries. Further, they serve as resilience/reliability buffers for stored renewable energy, available on tap for later use. This is critical as uninterrupted electricity supply is critical for running AI and high-level computing models. Indeed, high-end manufacturing which demands high precision also have zero tolerance for even small power interruptions.

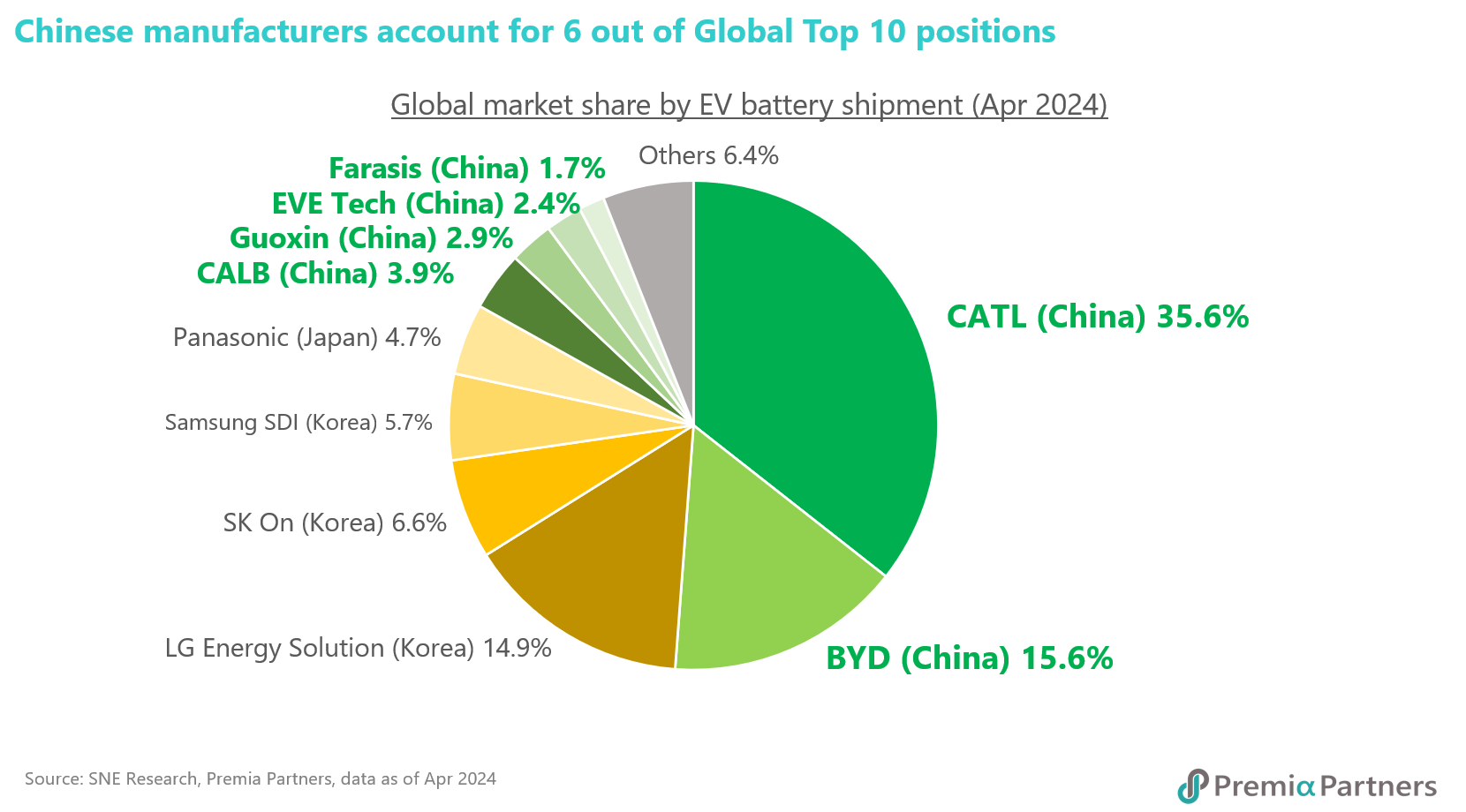

ESS is a global challenge, with the International Energy Agency recently estimating that the world needs a “sixfold” increase in energy storage by 2030 – with batteries “leading” the growth – if it is to meet global climate targets. A late 2023 Reuters survey found that 43% of respondents from the energy industry said their companies were planning investments in energy storage in the next three years. China is uniquely positioned for this investment opportunity as the global battery supply chain leader.

The AI race and the energy-hungry behemoths supporting it. Data centers are electricity-hungry giants, and they are also critical infrastructure for the development of AI. The AI race is intensifying. Big Tech companies are racing against each other for the latest AI features, applications and user traffic. Governments have also joined the race for so-called “sovereign AI”. Data centers are critical infrastructure in these endeavours, supporting, among other things, high performance computing, storage and data management.

Data center electricity consumption to quadruple by 2030. The IEA reports data centers consumed 460 terawatt-hours (TWh) of electricity in 2022—more than France's annual consumption. This figure, representing 2% of global electricity use that year, is projected to double by 2026 and quadruple by 2030. While the starting point may seem like a small percentage, the impact of such growth will be massively disruptive given that the overall energy consumption growth rate has been relatively stagnant in recent years. Beyond the data center industry, high-end manufacturing sectors, including semiconductors, automotives and production of solar panels and wind turbines, are also huge consumers of electricity and demand reliable, uninterrupted, and cost-effective power supply.

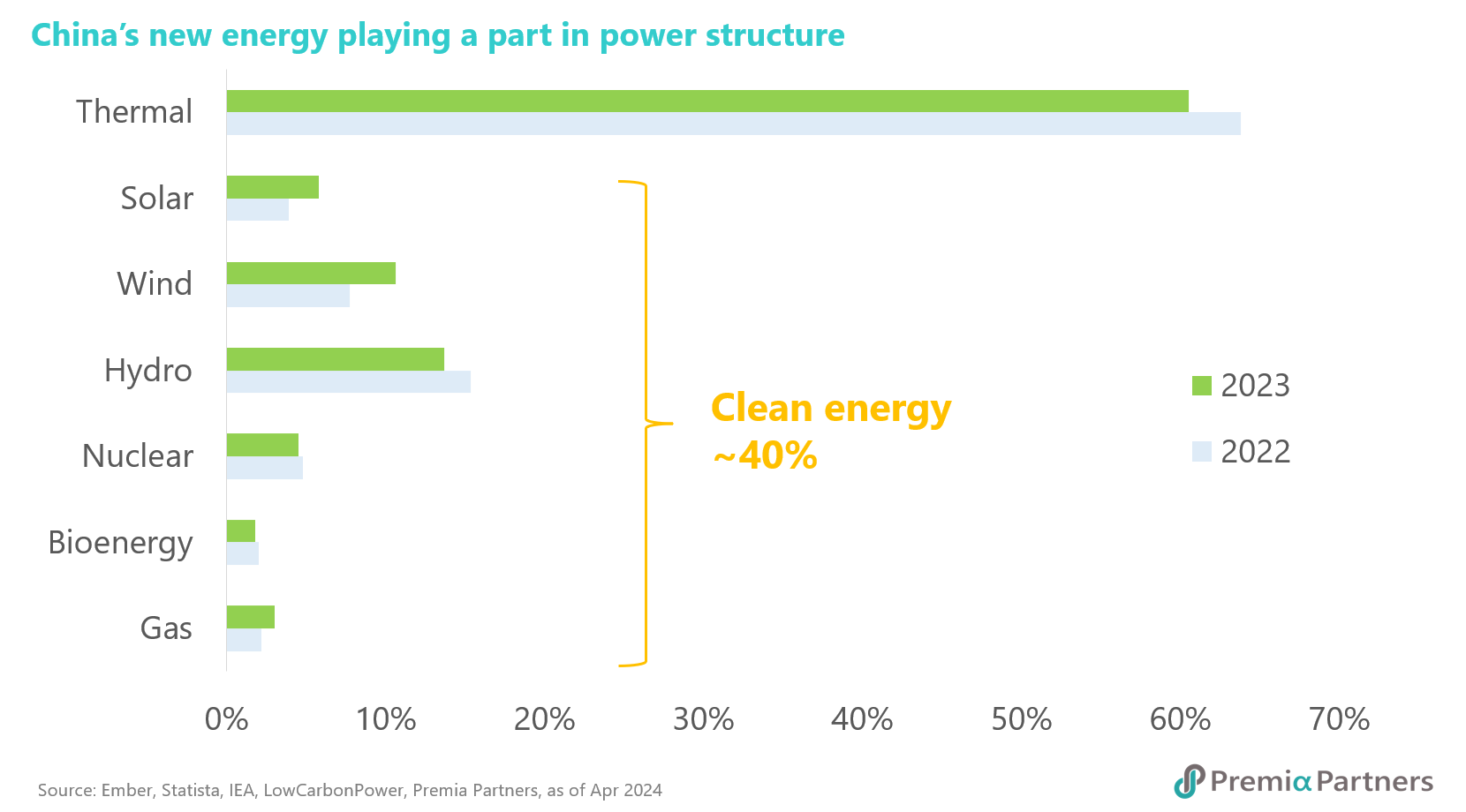

Soaring electricity consumption has exacerbated grid challenges, particularly in countries with substantial data center investments. Ireland epitomises this strain, with data centers consuming a staggering 53% of its renewable energy supply in 2022 and projected to outstrip this supply entirely by 2034 according to Bloomberg. This trend, replicated in nations like Saudi Arabia and Malaysia, highlights the acute pressure on power grids. However, China's robust renewable energy generation, which contributes almost 40% of its power generation in 2023, provides a significant buffer against the projected 8% increase in electricity consumption driven by its expanding data center industry, as per IEA forecasts.

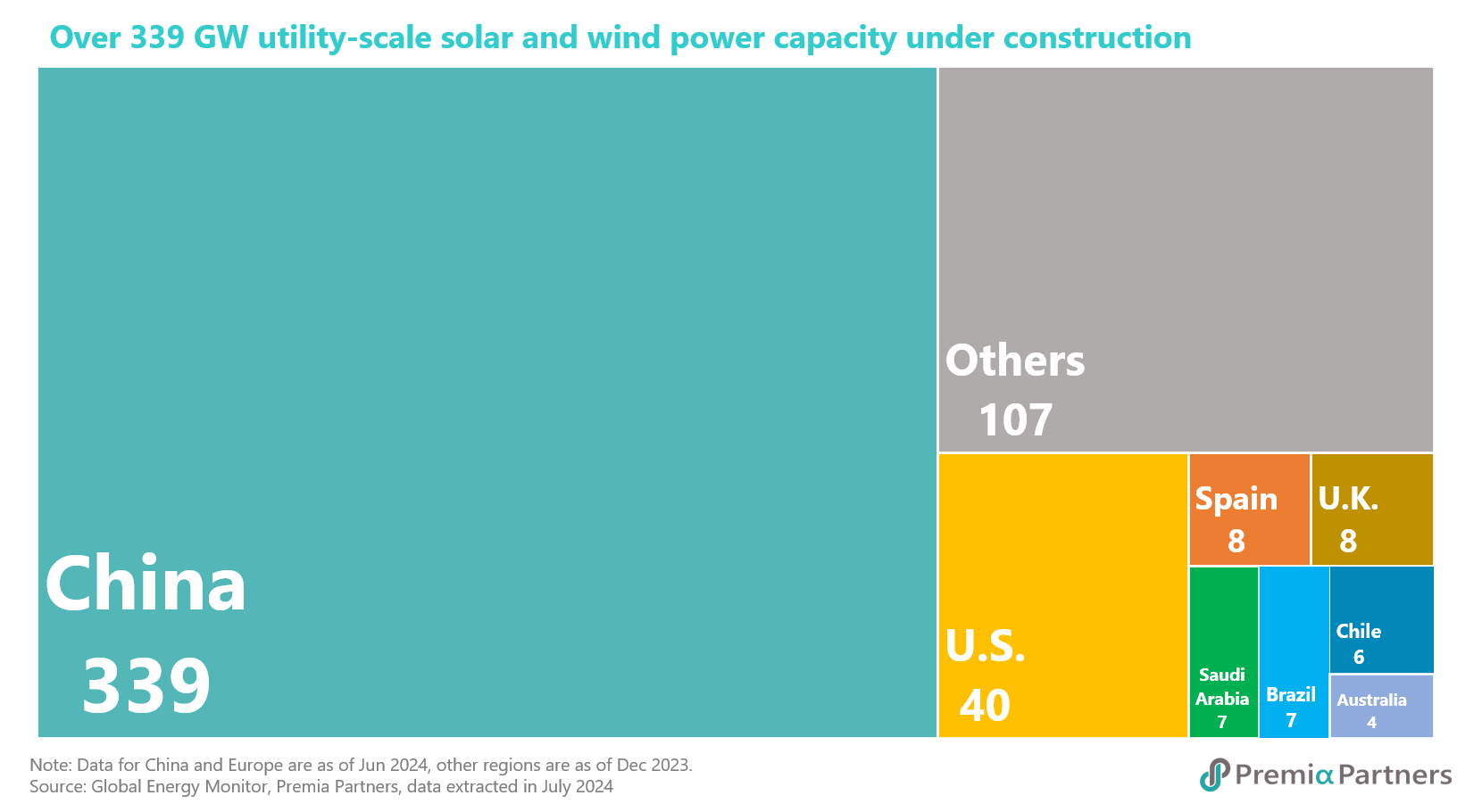

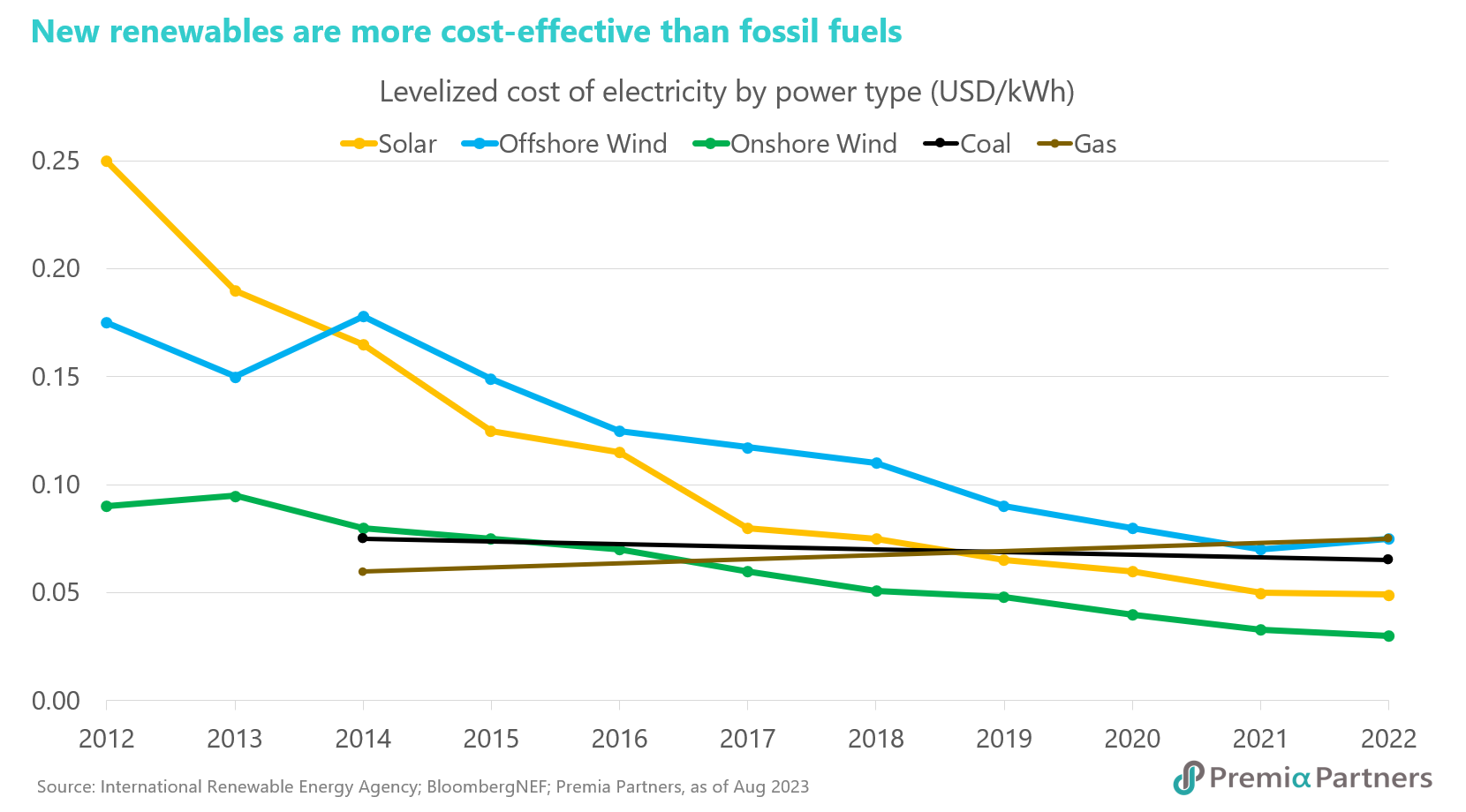

China solution #1: Rapid expansion of renewables capacity is driving huge reductions in costs. By the end of 2023, China had amassed a formidable 1.05 billion kilowatts of installed wind and solar capacity, propelling its share of total installed capacity from 29.6% to 36% in a single year. Western provinces, including Qinghai, Gansu, and Ningxia, have emerged as renewable energy powerhouses, boasting installation rates of 50%-70%. Moreover, China's unparalleled project pipeline, encompassing nearly two-thirds of the world's utility-scale solar and wind projects—a staggering 180 GW and 159 GW respectively—is currently under construction. The rapid expansion of renewable energy has driven down China's levelized cost of electricity (LCOE) for solar, onshore and offshore wind by 40%-70% compared to other Asian countries, making the transition from fossil fuels to clean energy increasingly attractive for both domestic and international consumers.

China solution #2: One of the world’s longest high-voltage direct current (HVDC) transmission lines and the sharing of renewable energy from China’s resource rich North-west to users in the industry-intensive East. The 2,383-kilometer Jiuquan-Hunan transmission link plays a critical role in China’s strategic East Data West Computing initiative. The line – which rates as one of the three longest HVDC transmission lines in the world – spanning a similar distance as Brazil’s Belo Monte-Rio De Janeiro and Rio Madeira transmission lines – balances electricity supply from the abundant wind and solar resources in the western part of China to consumers in the intensely industrialised eastern regions.

By leveraging energy storage and advanced grid technologies, this initiative seeks to bridge the geographical divide between renewable energy sources and data-intensive operators. The Northwest, abundant in wind and solar resources (contributing a third and nearly 60% of the national total respectively), is ideally suited for large-scale renewable energy projects. Meanwhile, the hydropower-rich Southwest (Sichuan, Chongqing, and Yunnan provinces generates 70%-90% of their electricity from hydropower) can meet local energy demands and export surplus power. To balance the energy equation, the energy-intensive East can import surplus power from the West, creating a nationwide integrated energy ecosystem.

China solution #3: A smart grid which holds the “forgotten key to decarbonisation”. So as mentioned above, China’s solution is more than just a transmission line. It is also about “advanced grid technologies”. In a recent report, KPMG called smart grids “the forgotten key to decarbonisation”, offering, among other things, cost savings, resilience/reliability, and flexibility. KPMG was looking at it at the global level. China’s response ticks all the same boxes.

Integrating a vast array of renewable energy sources places immense strain on power grids. In response, China has proactively invested in grid modernisation, seamlessly integrating solar, wind, and energy storage into a unified smart grid system. This synergistic approach effectively functions as a virtual power bank, storing surplus renewable energy during off-peak hours and discharging it during peak demand to stabilise grid operations. Consequently, this not only moderates price fluctuations but also significantly reduces the risk of power outages or interruptions while preserving the grid's low-carbon profile.

Notably, up to 80% of the electricity powering ten national data center clusters is currently sourced from clean, renewable energy on a continuous basis. The average price of green electricity produced from renewable energy has experienced a substantial drop, falling from RMB 25 to just RMB 1 per MWh (equivalent to 1000 KWh) between May 2023 and May 2024.

In fact, China’s AI and technology-enabled processes have been providing strong positive feedback loop to the country’s energy management as well, which would be important driving force in managing its net zero trajectory while balancing need for affordable energy for the population, and other developmental priorities. AI-driven grid enhancements optimise grid performance by employing predictive analytics to balance supply and demand. By forecasting peak and off-peak electricity consumption, AI enables the grid to prioritise low-carbon energy sources, reducing reliance on carbon-intensive fuels. The recent Paris Olympics showcased the transformative power of this technology. Alibaba Cloud's energy management platform, deployed across 35 Olympic venues, harnessed cloud data and advanced AI models to optimise energy consumption, achieving a 50% reduction compared to the Rio Olympics in 2016.

China solution #4 – energy storage to deliver the “final mile”. This is a global challenge. A recent IEA report concluded that overall energy storage capacity needs to increase sixfold by 2030 worldwide to meet climate and energy targets outlined at COP28. And “rapid expansion” of usage of batteries will be needed to drive that “sixfold increase in global energy storage,” IEA said.

“In less than 15 years, battery costs have fallen by more than 90%, one of the fastest declines ever seen in clean energy technologies. The most common type of batteries, those based on lithium-ion, have typically been associated with consumer electronics. But today, the energy sector accounts for over 90% of overall battery demand. In 2023 alone, battery deployment in the power sector increased by more than 130% year-on-year, adding a total of 42 gigawatts (GW) to electricity systems around the world,” it said.

In China, robust energy storage systems (ESS) are pivotal to modernising power grids and solving the last mile bottleneck. ESS primarily store electrical energy in various forms for later release, thereby balancing supply fluctuations across different time periods and alleviating stress on the power system's generation, transmission, distribution and consumption.

According to 2023 data, lithium-ion batteries account for 97.4% of China's newly installed energy storage projects, primarily due to their low cost, short construction cycle, and flexible integration with the grid. However, the relatively short average discharge duration (approximately 2.1 hours) of current liquid lithium-ion batteries has led to increased interest in semi-solid-state and all-solid-state batteries, which offer higher energy density, longer discharge duration (more than 4 hours) and improved safety.

China’s development of all solid-state batteries will take energy storage to a higher level. To fast track and coordinate industry efforts in building a robust supply chain for solid-state batteries by 2030, the Chinese government set up a consortium early this year – the China All-Solid-State Battery Collaborative Innovation Platform (CASIP) – bringing together government, academia and industry, including EV battery leaders CATL and BYD. Commercialisation of all-solid-state batteries is anticipated as early as 2026, positioning them as a disruptive technology and a focal point for industry investment.

Beyond balancing supply and demand, ESS will enable China to build high reliability in supply to industries with zero tolerance for power interruption. Grid operators can leverage ESS to regulate power demand by storing excess electricity during off-peak hours, ultimately reducing energy costs. Nevertheless, peak-valley pricing strategies can only modulate flexible/elastic demand and do little to address the surging rigid/inelastic computing requirements that far exceed historical levels, resulting in significant power gaps and heightened demand for renewable energy. This is particularly critical for data centers running advanced AI models and high-precision manufacturing sectors, where even momentary power outages are intolerable due to the need to restart entire processes and the risk of damaging expensive servers and machinery.

The prevalent approach employed by both China's State Grid and Southern Power Grid is to integrate improved energy storage systems, data centers, and transformers in key data clusters across the Yangtze River Delta, Pearl River Delta and Hangzhou, thus forming a unified computing power network under the East Data West Computing initiative.

As the global battery supply chain leader, China is driving energy storage innovation. Domestic giants CATL, BYD and EVE Energy are rapidly enhancing battery technology, extending capacity, lifespan and reducing costs. Recent market data from the Shanghai Metals Market reveals a substantial 20% decline in standard energy storage battery prices between late 2023 and mid-2024. Coupled with decreasing solar module costs, solar-plus-storage projects have become significantly more financially appealing. Citi Research forecasts a promising return on investment exceeding 8% for these projects.

The world is sitting up and paying attention to energy storage. At the global level, according to a 2023 Reuters Events Energy Transition Insights report, energy storage will be the priority technology for energy transition investments in coming years. The report, which surveyed 580 energy industry professionals, said 43% of respondents stated that their organisations planned to invest in energy storage within the next three years.

In China, as the East Data West Computing initiative continues to gain pace in its second year, development of data centers, clean energy infrastructure and power grids increasingly roll up for economies of scale that will unlock substantial value across the entire ecosystem.

Investors seeking to capitalise on this transformative megatrend, including in energy storage, should closely monitor our products.

- Premia CSI Caixin China New Economy ETF (3173) and Premia China STAR50 ETF (3151) are uniquely positioned to capture the rally in the high-tech space, spanning AI, 5G and Cloud (21% of 3173 and 72% of 3151*); Semiconductors (8% of 3173 and 53% of 3151*); and New Energy (16% of 3173 and 10% of 3151*).

- Premia CSI Caixin China Bedrock Economy ETF (2803) which delivered a year-to-date NAV return of 4.6% in HKD as of Aug 15, outperforming both the CSI 300 and the Shanghai Stock Exchange Composite Index.

* As of Aug 15th 2024