It is encouraging to see the numbers of new COVID-19 inflections has been decreasing in China in the past couple of weeks. Investors may now switch part of their focus to the work/production resumption to see if China economy can pick up pace steadily. Based on the sources such as coal consumption, labor migration, freight logistics and urban civil transportation, a few sell-side houses estimate that the latest production resumption is about 60-70%, meaning that the economy is running at two-third of its normal level. Using a different set of data such as construction materials, provincial releases on industrial enterprises restate date, and local media reports about staff availability, Bloomberg drew a very similar conclusion. With the assistance from technology, Baidu suggested the active working population should be at 57% based on its proprietary migration index. One may also refer to the following situations to have a better gauge:

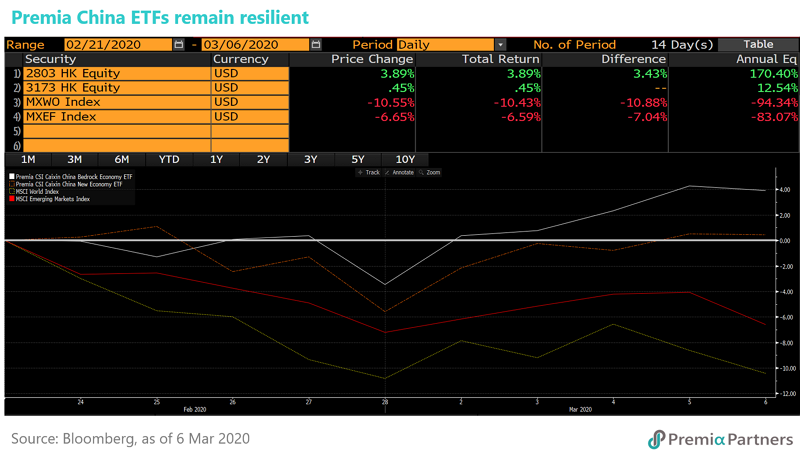

Power generation: The daily coal consumption as measured by the six major power generation groups reached 70% of pre-Lunar New Year levels, versus 95% in the comparable year-on-year basis, according to Morgan Stanley analysts.

Shipping: Calling at ports rose rapidly since the second week after the prolonged Lunar New Year holiday and have surpassed 2019 levels by end-February, according to data tracked by Clarksons Research, a maritime brokerage and consultancy.

SOEs and SMEs: State media reported that most SOEs have resumed work and production is running at a rate of 90%, whilst Ministry of Industry and Information Technology disclosed that 52% of SMEs have resumed work.

Infrastructure: Ministry of Transport said that railway construction projects and civil projects have resumed work at the rates of 77.8% and 59.3%, respectively.

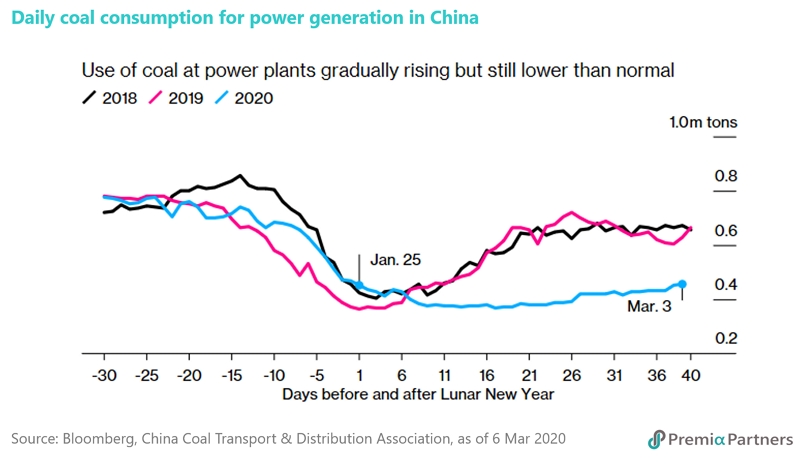

It is probable that China could be one of the markets that recover from the latest correction on the back of gradual resumption in economic activities and further stimulus. If investors would like to seek opportunities to accumulative the right exposure of China market, both of our Bedrock Economy ETF (2803.HK) and New Economy ETF (3173.HK) should be considered in the radar screen. Bedrock Economy seems to be a preferred choice at the moment given its defensive nature emphasizing good value, high quality, and low volatility. The uncertainty of the global market may last for a while and the risk-off sentiment may be the mainstream. Alternatively our New Economy may outshine if looking beyond all the short-term noise in the market, as the latest virus outbreak is a strong proof that “new economy” are shaping our daily life in remote working, cloud computing, streaming entertainment, online learning, innovative biopharma, robots and automation, etc. New Economy infrastructure such as 5G, data centers, and industrial internet of things is expected to accelerate as well.

Exhibit 1: Coal consumption has been picking up gradually

Exhibit 2: 2803 and 3173 managed to record positive return during the volatile market in the past two weeks