Professor Andrew Cuthbertson, the Chief Scientific Officer of ASX-listed biotech company CSL Limited, told the media this week the markets were complacent about COVID-19. There was a lot still unknown about the virus, with implications for the supply chain, and the market’s “yawn” was “ill-informed.”

In a simpler manner, a newspaper headline from early February summed up Professor Cuthbertson’s sentiment thus: “Disconnect? Global Stocks Rise Despite Virus”.

Let’s connect the “disconnects”: It’s not that the market is “ill-informed” about COVID-19. Markets are full of very well-informed people whose job is to pore over the details of myriad situations that might impact investments.

Companies are already issuing COVID-19-related earnings warnings and governments have turned gloomy on growth and budgets. For example, the Singapore government has slashed 100 basis points off its 2020 GDP growth forecast range.

It is true there are sections of the market which may – depending on their trading time frames – react sharply either way to news flow. But the bigger picture – the medium-term (6-12 month) fortunes of the markets – are decided by forces far bigger than COVID-19, as frightening as the numbers of infected and the mortality rate might be right now.

As I noted in an insight written late January here, markets are forward looking; they “follow the money”; and are quite unresponsive to human suffering.

To summarise: “The bottom line is that epidemics/pandemics and even natural disasters tend not to change underlying trends in markets. If they were bullish before the epidemic/pandemic or natural disaster, the events may pause the market’s ascent, but generally not derail it. If the underlying trend in the market was bearish, the events tended to accelerate the downside. They generally don’t create the bearishness to begin with.”

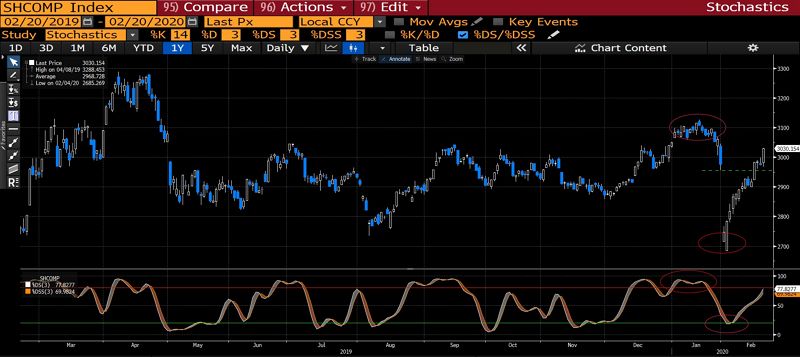

Let’s look back at the behaviour of the Shanghai Composite Index from the start of the year. The SHCOMP peaked on January 14, 2020, after a 9% gain from December 3, 2019.

Slow-burn, early warnings of a mysterious virus started late December. They didn’t damage sentiment on the index. But SHCOMP was already near-term, technically overbought or approaching overbought on a range of technical indicators – e.g. momentum and price oscillators such as MACD, RSI and Stochastics. See below example of the SHCOMP with slow stochastics.

Note that the Index was already in correction mode by the time the Chinese government put Wuhan into lockdown. Yes, the news sent the SHCOMP sharply lower. With the long Chinese New Year market closure, the market “gapped down” when it reopened.

But SHCOMP bottomed one day after the market re-opened, on a near-term, technically oversold position. And it has been rallying even as the news deteriorated rapidly.

Source: Bloomberg, as of 20/2/2020

Of course, one reading is Professor Cuthbertson’s “market is complacent” view. Another reading – the one I favour – is “the market understands but is looking at other things”.

The market is not thinking of economic growth this quarter, which it already understands will be awful. It is thinking the full year and indeed, next year. It was already thinking last week of the stimulus which is today reality. The People’s Bank of China has cut its 1-year medium-term lending facility rate from 3.25% to 3.15%. That’s only for starters. More is coming. More rate cuts, Reserve Requirement Ratio cuts, lending facilities, and open market operations are all possibilities, becoming more likely the longer COVID-19 runs.

The “steady as she goes” approach to monetary and fiscal policy which I expected for 2020 before the outbreak of COVID-19 is now out the window.

The Chinese government will go as hard towards stabilising the economy as it has been going on containing the COVID-19 outbreak. The balance between deleveraging and growth has been upset by COVID-19. China’s policy makers will likely put their feet on the accelerator pedals – both fiscal and monetary stimulus – to restore that balance. The likely result will be a growth rebound in 2Q20 to make up for 1Q20.

Fixed Asset Investment (FAI) growth, which had come down to 5.4% y/y in 2019 (from almost 14% five years ago) is likely to be the vehicle to boost economic activity. This will be funded by an increase in local government bond issuance.

China was already on this path last year. Chinese authorities last year brought forward CNY 1 trillion in special purpose bond allowances intended for 2020, boosting local government bond issuance power. This was a hefty 47% on top of the 2019 quota of CNY 2.15 trillion.

This is likely to accelerate further this year. Fiscal stimulus is also likely, targeting labour-intensive service industries.

So, stay calm and carry on. Focus on underlying trends before COVID-19 instead of being whipsawed by very short-term moves.

To be clear, this is not to suggest that markets will continue upwards across the board. To reiterate, history tells us that epidemics/pandemics do not change the underlying dynamics of economies and markets. To get a sense of where markets are likely to go over the next 12 months, cut out the noise of the 24-hour market news flow, and focus on fundamental and technical trends that prevailed before the disease outbreak.

Beyond the near-term reactions, the US markets are technically overbought and fundamentally expensive, both short-term and medium-term. The Euro Stoxx 50 also looks technically overbought.

The underlying trend for the developed markets – particularly the US – is they are at the tail end of their bull moves. They could edge up a bit more but the risks are biased much more on the downside.

Chinese equities on the other hand have priced in a lot of bad news and are fundamentally much cheaper than developed market equities. They have been trading in a broad sideways range for a while, and COVID-19 is unlikely to change it either way. Ironically, in the midst of so much gloom, Chinese stocks have outperformed US equities since 4 February, and they could prove more resilient than US equites in 2020.