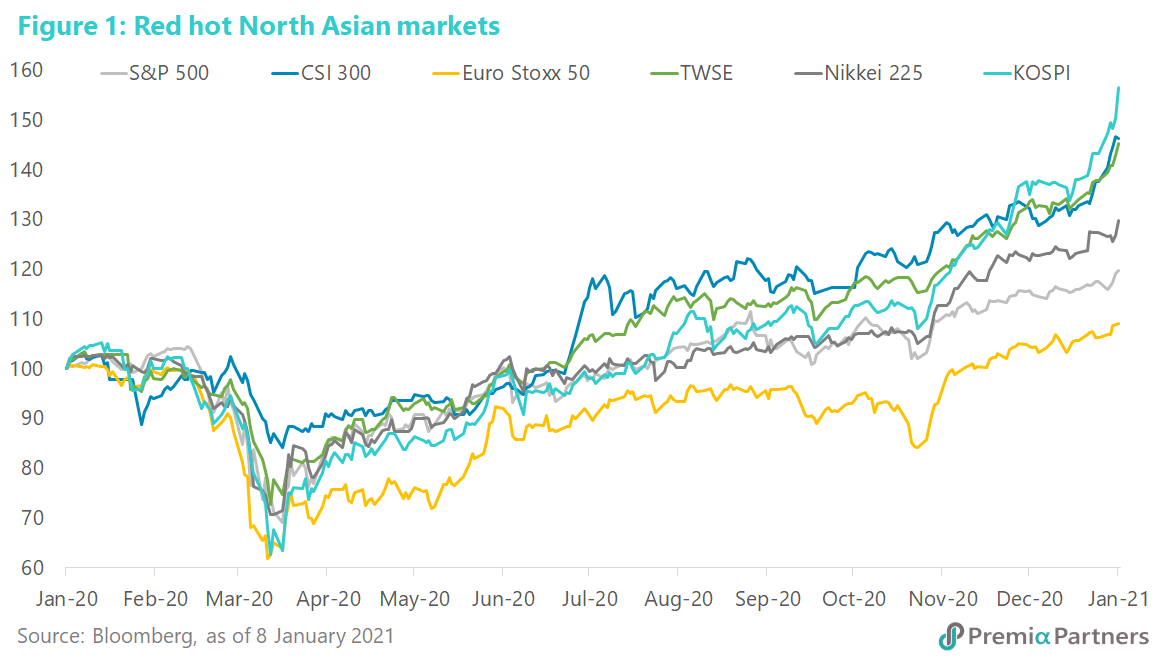

The red-hot performers of the past 12 months have been the broad market indices from North Asia – Kospi (44%), CSI 300 (34%), TWSE (30%) (figure 1).

Tech weighting would have helped but that’s not the full story. Yes, the heavy weighting of information technology and communication services stocks in Korea’s Kospi and Taiwan’s TSWE indices would have contributed to their outperformances vis-à-vis Europe. However, it doesn’t quite explain the Nikkei 225’s outperformance even against its United States counterpart. The S&P 500 has around 40% of its weight in information technology and communication services stocks while they are about 28% of the Nikkei 225.

Nikkei’s outperformance was in a year when the Yen had strengthened against the Dollar – from a USDJPY high of 112 in late February to an end of year close of 103. Over the past 15-16 years, the Nikkei 225 has traded positively correlated to the USDJPY – that is, it gains when USDJPY rises, that is, when Yen weakens.

There is another important contributor to that outperformance which may be more durable than the pandemic stock “fashion of the year” (i.e. tech stocks).

Growing economic integration. Largely unreported in the media (where you are more likely to read about the geopolitical tensions between China and its neighbours) is how the North Asian economies of Japan, Korea and Taiwan have benefited from China’s effective management of the COVID-19 pandemic. Indeed, with the signing of Regional Comprehensive Economic Partnership (RCEP), we are likely to see even more economic integration among the North Asian economies.

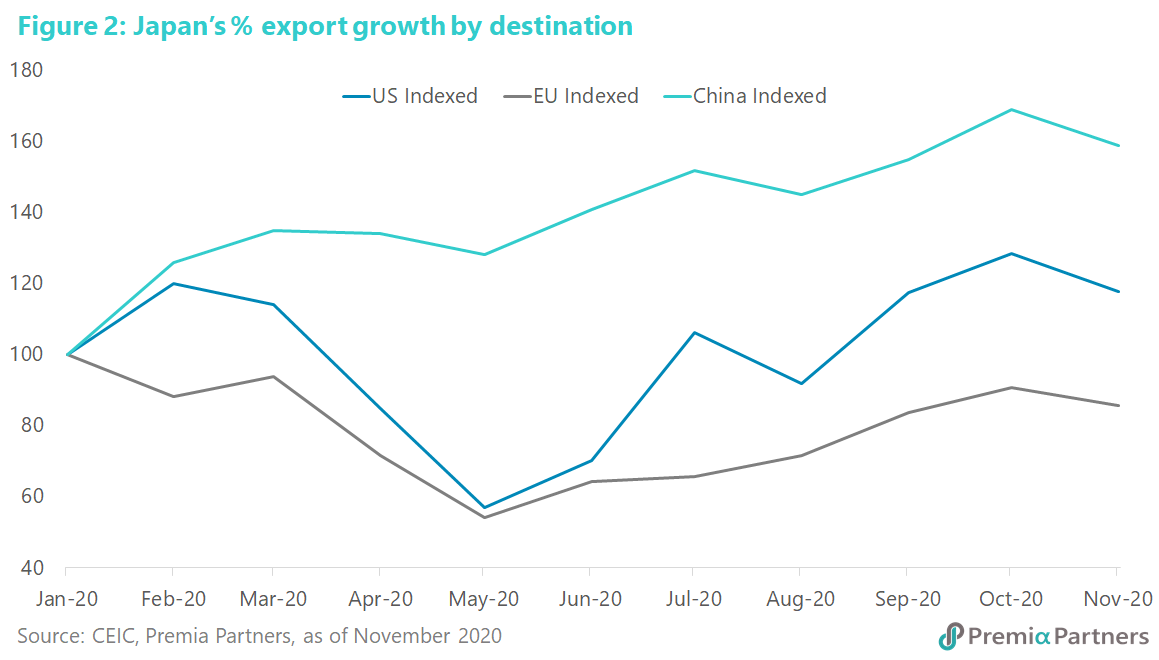

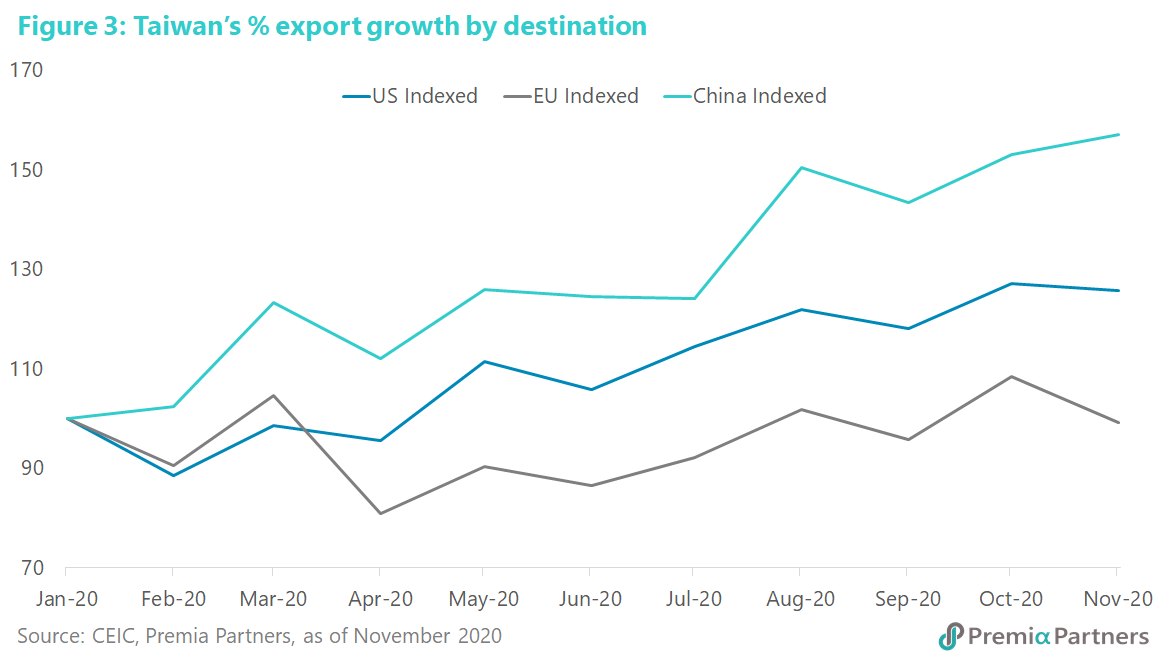

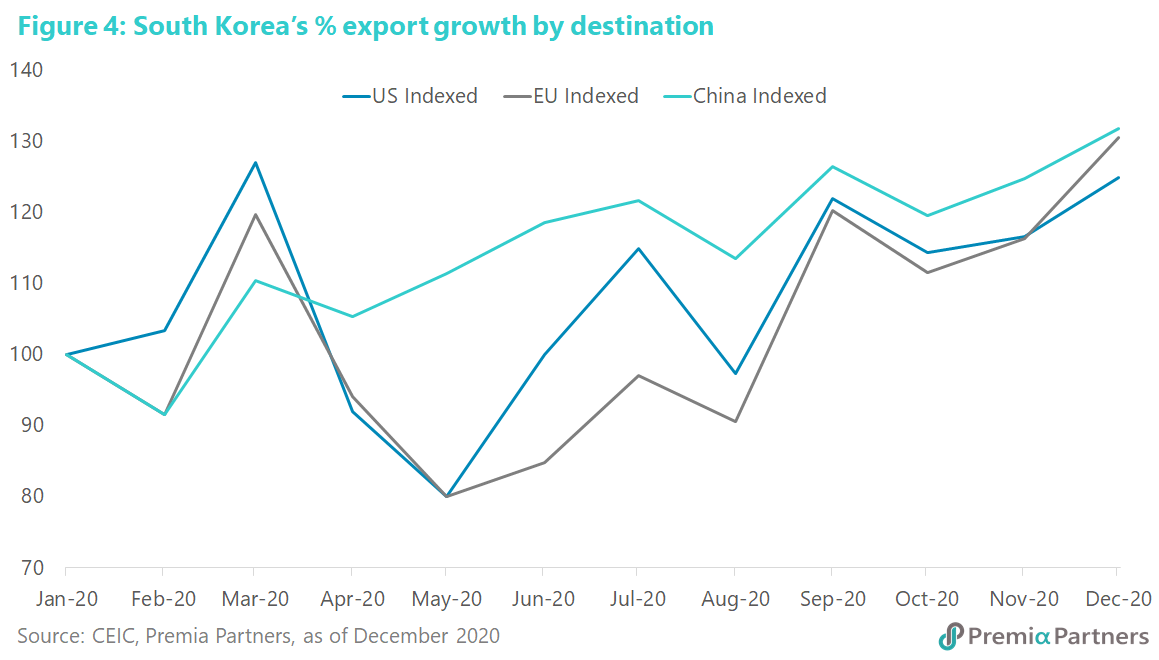

Mainland China leads export growth for Japan, Korea and Taiwan. Japan, Korea and Taiwan trade data (in US Dollar terms) show how export growth to mainland China have largely eclipsed that to the United States and Europe. Both Japan and Taiwan have grown their exports to mainland China by almost 60% for the year to November 2020. Export growth to the US lagged very significantly, while exports to Europe have yet to recover to levels at the start of the year (figures 2, 3). Although South Korea lagged Japan and Taiwan in growth of exports to China, it still managed a 32% increase for the period from January to December 2020, still ahead of growth of exports to Europe and the United States (figure 4).

With economies contracting in the United States and Europe, China has become “buyer of last resort” for North Asia. Most forecasts have the US and Europe growing again this year – according to the International Monetary Fund by 4.7% for the European Union and 5.2% for the United States. Yet, the spread of a more infectious strain of COVID-19 makes forecasts more unpredictable than usual. China’s aggressive, and to date very effective, system of localized lockdowns, test and trace, makes its economic prospects more visible. The IMF is predicting a 7.9% growth for China this year, and this should continue to boost regional economies’ exports to China.