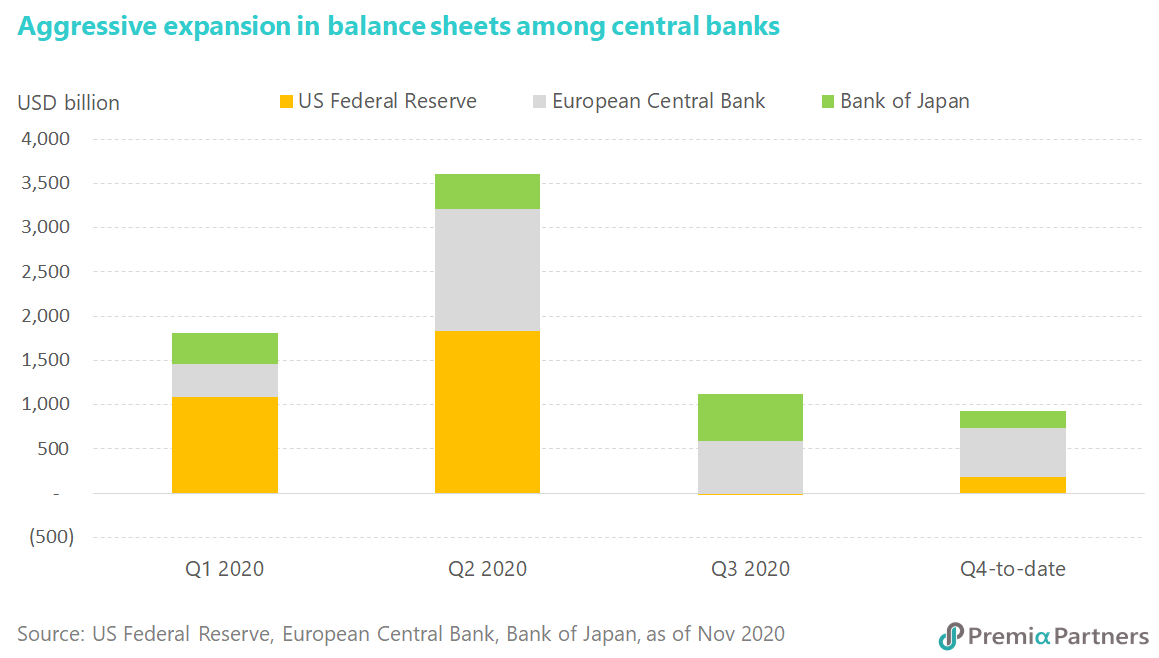

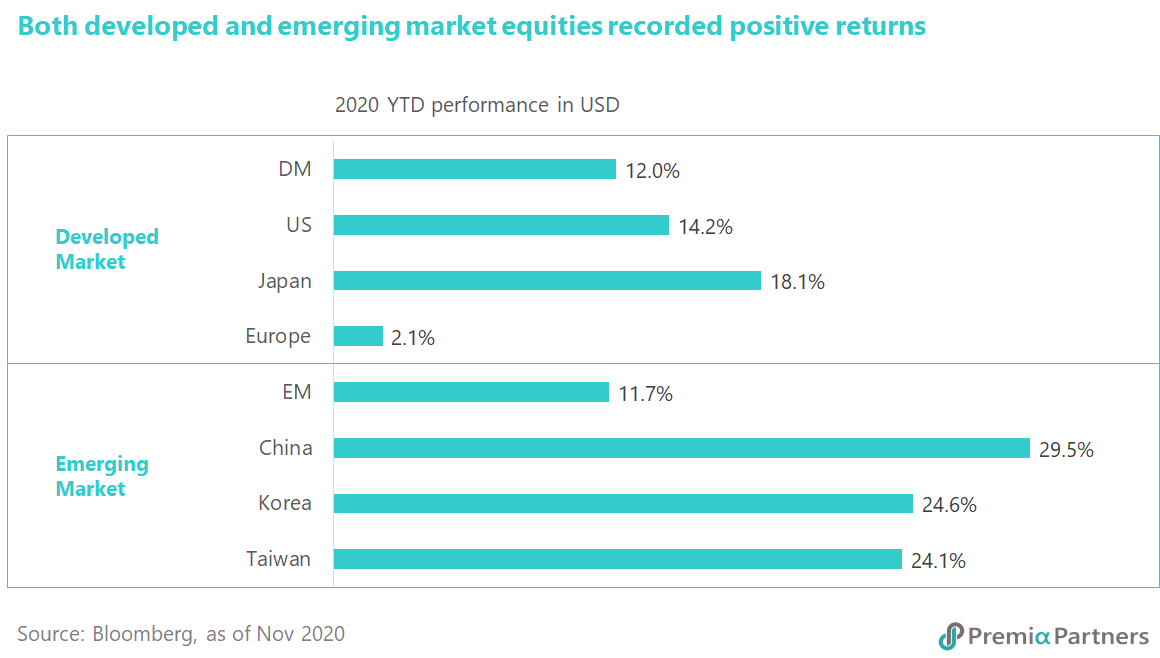

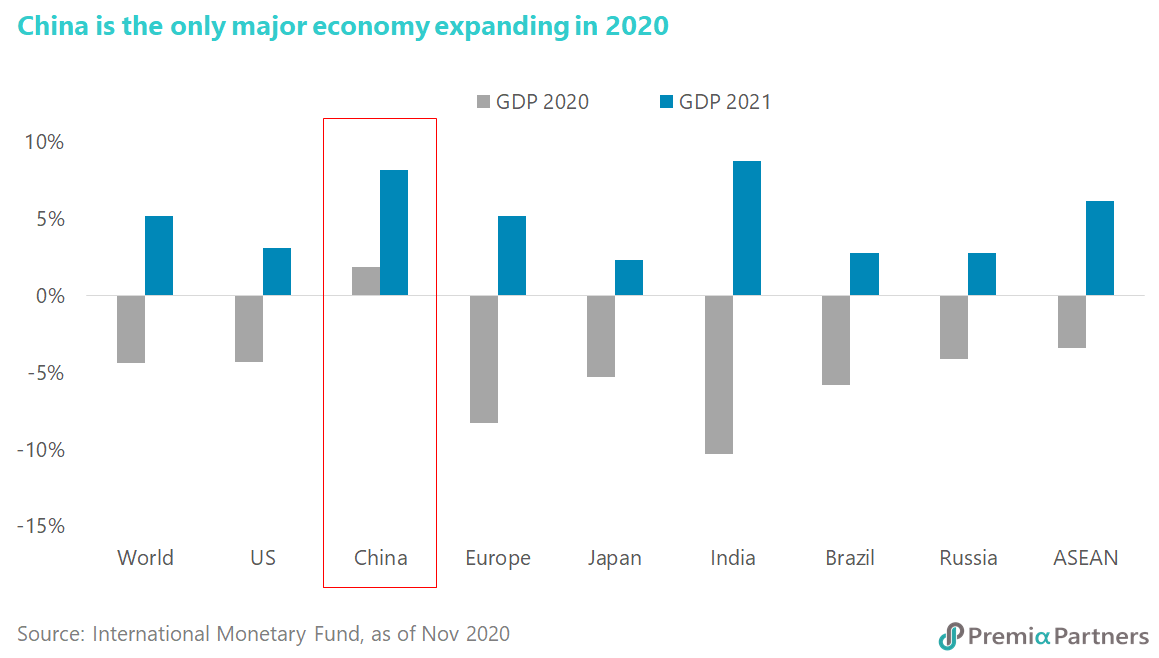

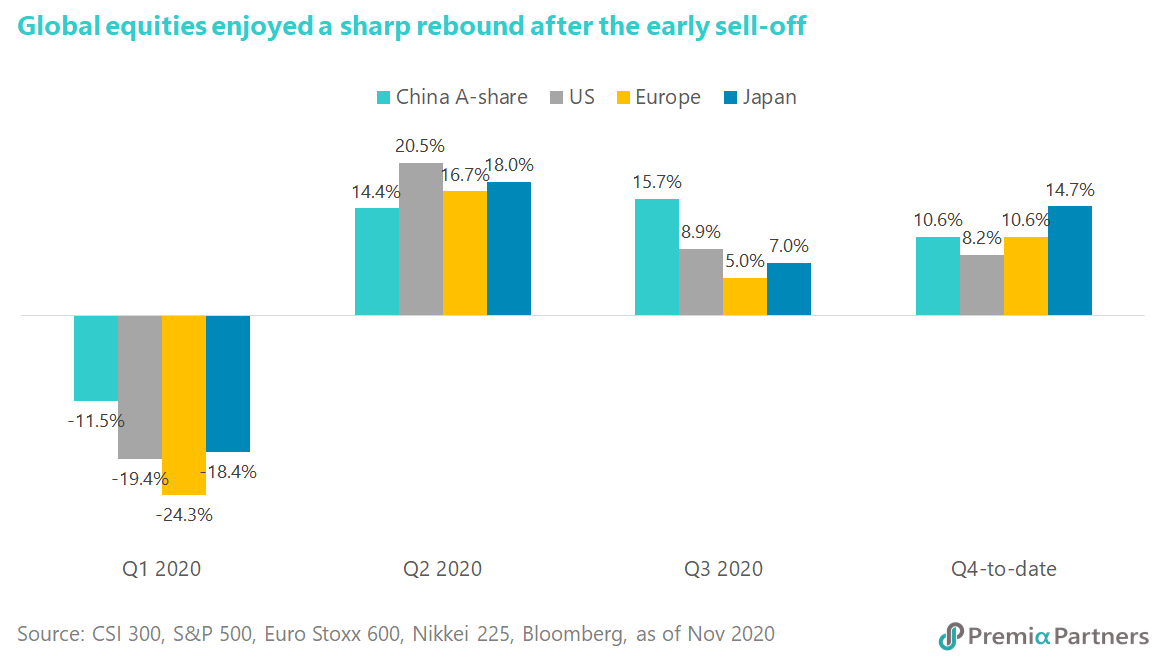

To summarize the year of 2020, the opening lines from Charles Dicken’s A Tale of twin cities sounds like an accurate description. It was certainly the best of times and the worst of times. Global equities have been doing reasonably well with developed market up by 12.0% and emerging market up by 11.7%. Fixed income managed to gain by 7.4% whilst gold price was up by 19.1%. On the other hand, real economy has been suffering from the pandemic with almost all major economies getting into recession. International Monetary Fund sees the world would contract by 4.4% in total output, the worst crisis since the 1930s Great Depression with -5.8% among advanced economies and -3.3% on developing countries. It is the first time in history that the whole world faces a massive lockdown with most economic activities suspended. No one could have possibly foreseen the dramatic change in our daily life such as working from home, attending virtual schools, joining webinars, holding e-meetings and shopping nearly everything online. For equity investors, this challenging year turns out to be rewarding for the ones who have patience and are willing to stick to the market. The scratch marks left by the bear's claws in the first quarter was sharply erased in the second quarter by the liquidity flooding orchestrated by the central banks worldwide. Global equities carried on the strong momentum in the second half of this year with a few markets including the US, Korea and Taiwan reaching all-time highs.

China is the only major economy that will see a positive GDP growth at 1.9% this year. It is such a sharp contrast compared to other emerging markets. Brazil and Russia are predicted to contract by 5.8% and 4.1%, respectively, while India's economy could shrink by 10.3%. China market has been outperforming the global equities on its successful control in virus spreading rapidly and effectively when the rest of the world is still struggling with increasing COVID-19 cases. On a quarterly basis, Chinese equities showed strong resilience in the first quarter without getting dragged into a bear market technically. They recovered all the losses in the second quarter and then began to outshine other markets in the second half of the year.

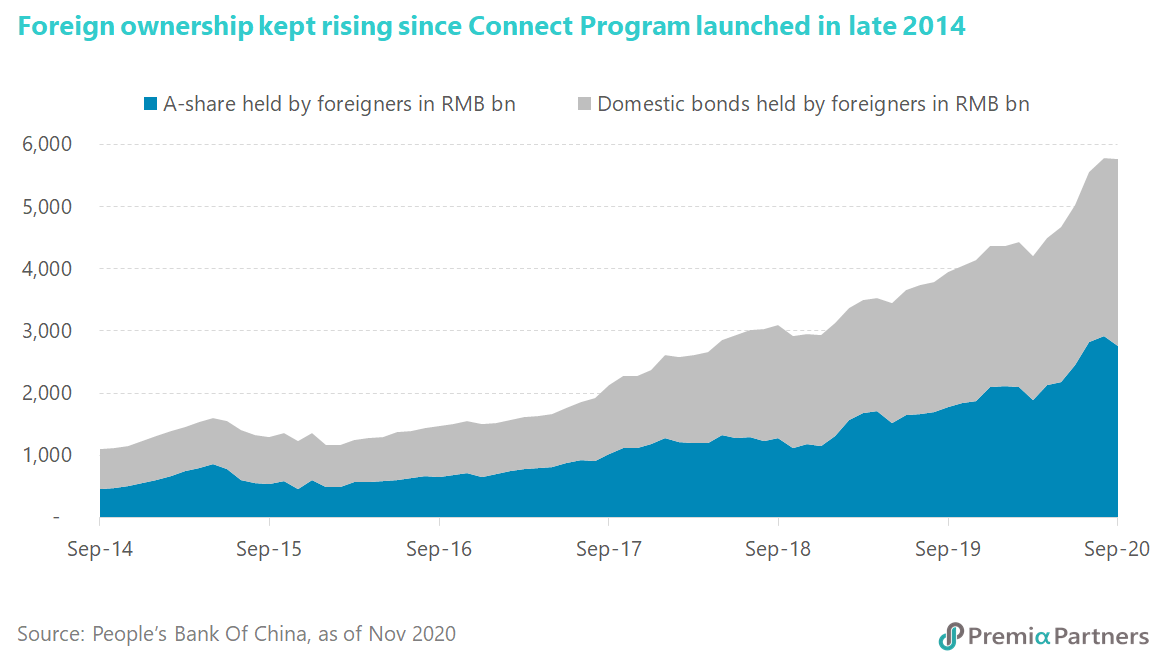

Along the solid recovery of the macro economy, the pace of the domestic capital market reform remains undisturbed. Both QFII and RQFII schemes are now combined into a single “Qualified Foreign Investors” regime and offshore institutions may get into derivative markets including financial futures, commodity futures and options. It will help increase investors’ flexibility to adjust their exposure efficiently based on different strategies and changing market conditions. Besides, foreigners may enter the bond repo market, allowing them to pledge notes they hold for cash, and potentially re-invest the proceeds in bonds. The STAR market, or Science and Technology Innovation Board, has been operating smoothly. Within the first 12 months since launch, there have been 140 companies listed on the STAR Market, with a total market value of more than RMB 2.8 trillion and a total of RMB 217.9 billion raised. The registration-based IPO system is now available in both STAR market and ChiNext board. Besides, the market is also welcoming the homecoming of Chinese ADRs. The companies would benefit from a better understanding of the domestic investors and an additional funding source; the investors are able to tap into the growth opportunities offered by these industry leaders which are now trading in the same time zone.

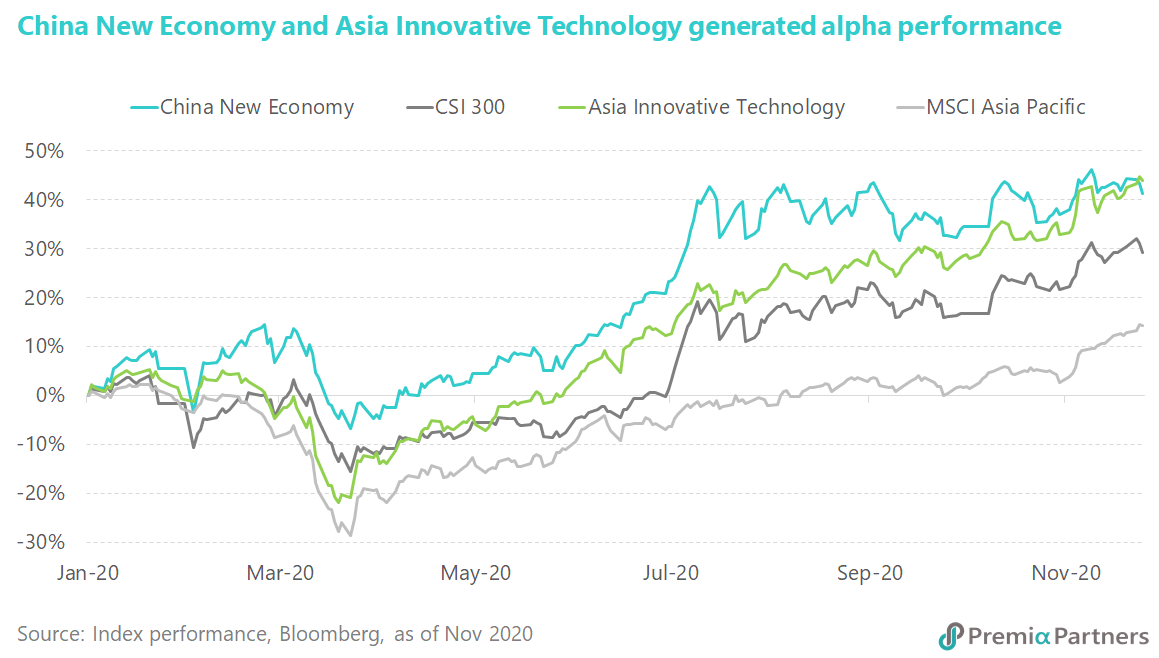

Among the investment products offered by Premia, Premia CSI Caixin China New Economy ETF (3173.HK) and Premia Asia Innovative Technology ETF (3181.HK) stood out with the total return of 40.0% and 42.0%, respectively. For the former, it is immune from the excessive volatility caused by external frequent risk on & risk off sentiment as China A-share is mainly driven by domestic liquidity. The theme of new economy is taking advantage of the structural economic change and the new user behavior formed under the pandemic. That explained why well diversified growth-biased portfolio across information technology, healthcare, consumer discretionary, industrials, and materials managed to outperform all major China indices. For the latter, it is supported by the fast control of COVID in North Asia, including China, Japan, South Korea and Taiwan. The fund’s focus in digital transformation, robotics and automation, life and health science just hit all the right spots. The innovative companies of the underlying fund either accelerate the growth rate of their existing businesses like streaming entertainment or create new revenue streams such as remote working and vaccine development. To put it simple, picking the right exposure and sitting tight would be among the best strategies this year.

Looking forward to the year of 2021, global economy will likely look brighter after the slump caused by the pandemic. A significant year-on-year GDP growth is widely expected ahead with the high hope of successful launches of vaccine in coming months. Corporates will resume their business expansion plans whilst consumers will start their spending spree with a long list of pent-up demand. China recovery will carry forward the current strong momentum with the kick-off of the 14th five-year plan between 2021-2025. China's growth will accelerate to 8.2% next year, the IMF said in the World Economic Outlook. The proportion of worldwide growth contributed by China is expected to increase from 26.8% in 2021 to 27.7% in 2025, which is 15% and 17% points, respectively, higher than the U.S share of expected global output. Equity market should be positive with the support of rebounding earnings, which would increase substantially comparing to the low base. The unattractive low yield environment in the fixed income market will channel fund flows into equities steadily. Increasing the proportion of equity in asset allocation is essential for investors in near future as the low interest rate phenomenon will stay and the expected return of bonds is not sufficient to justify the embedded risks. We believe that investors may pay attention to the following key themes in the capital market in 2021.

I. Healing relationship between China and the US

Compared to the impetuous and uncoordinated governing style under Trump, Biden's administration is expected to be more diplomatic and pragmatic in handling foreign policy. According to the survey done by the American Chamber of Commerce in Shanghai, US firms broadly view the prospect of a Biden’s government favorably and expect the US-China relationship will become more stable than it was in the past four years, though it is unlikely to return to the pre-2016 paradigm. 62.9% of the respondents have become more upbeat about their business prospects in China, 35.5% see no change, and 1.6% are more pessimistic. Nearly 57% of the respondents do not foresee trade restrictions or tariffs to increase.

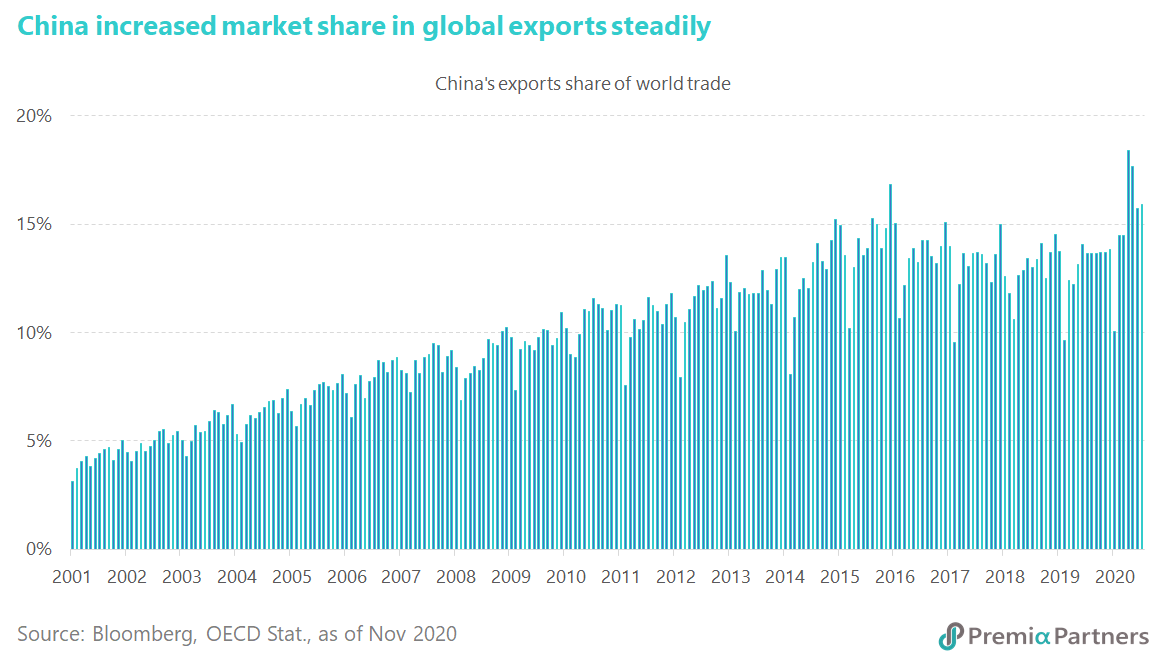

Global trade begins to show some green shoots in recent months, but more slowly than China's trade. The World Trade Organization lately forecast that global merchandise trade in 2020 would fall by 9.2%, while the IMF is now projecting a 10.4% decline in world trade volume, including goods and services. It is rational to estimate a comeback of global trade amid the ending of the lockdowns and the less hostile trade policy under Biden. Regionally, the signing of RCEP bolsters optimism that Asian trade integration will continue apace in the future, leading to a gradual shift of global economy to the east. Analysts see the agreement will be effective in mid-2021, and the GDP of these 15 countries involved in RCEP will eventually be accounting for 50% of the world’s total output by 2030. For investors, the traditional cyclical plays in Asia driven by the upcoming pickups in exports may offer an interesting trading angle amid the deep discount in valuation and the near-term sector rotation. A more harmonic geopolitical background will certainly help support Chinese yuan and reduce the China equities' risk premium.

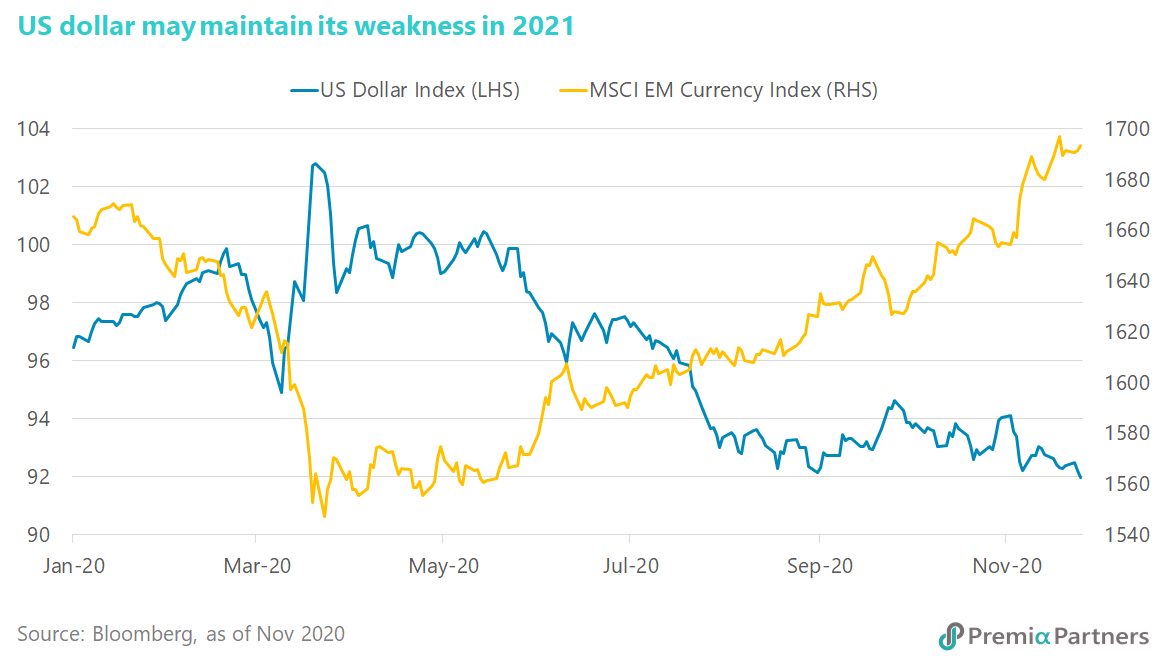

II. Weak dollar and rebound of emerging markets

Dollar Index has fallen by 4.5% in 2020 and the negative views may still be intact in 2021, with a vaccine-driven return in risk appetite post COVID-19. Cyclical and structural drivers remain bearish for the buck, and geopolitics would add further fuel into the downtrend with the US renewed conventional approach to foreign policy. The continuous low interest rate and rising deficit in the US do not help as well. The long-term narrowing growth differential between the US and other advanced economies has been confirmed and leaves the dollar exposed. The IMF Economic Outlook report forecasts US economic growth will slow to 1.8% in 2025 from 3% in 2018, versus expected growth of 1.4% in euro-zone GDP in 2025 compared to 1.8% in 2018. Dollar may drop as much as 20%, according to the analyst at Citigroup. Should the US yield curve steepen as inflation expectations rise, this will incentivize investors to hedge currency exposure. Given this setup, there is the potential for the dollar’s losses to be front-loaded, with the currency spiraling lower sooner.

The knee-jerk sell-off in dollar may trigger international funds pivoting back to emerging markets particularly emerging Asian currencies and assets on the back of their stronger fundamentals. Indeed, foreign investors are piling money into major Asian equity markets outside of China at the fastest pace in seven years in the fourth quarter this year, as vaccine successes add to the global risk-on mood. Nine regional stock markets have lured a combined USD 48 billion since the beginning of October, the most since the fourth quarter of 2013. Japan is leading the way with USD 27.4 billion, followed by India at USD 9.2 billion and South Korea at USD 6.4 billion. When investors increase their risk appetite and have more confidence holding foreign assets, ASEAN markets would easily be the destination for capital seeking decent returns.

III. Beginning of 14th five-year plan in China

The release of the final version of the 14th five-year plan may have to wait until the National People’s Congress held in March 2021, but the policy direction highlighted in the fifth plenary session is loud and clear. It includes replacing high-speed growth with high-quality growth, rebalancing its economy with supply-side structural reform, expanding domestic demand whilst continuing to support international export markets, driving modernization through innovation and technological advancements, and promoting high-end, intelligent and green production.

The dual circulation policy will play a central role. This two-pronged development strategy involves mutual reinforcement of domestic and international markets to spur long-term and sustainable consumption patterns, to hedge against external shocks and instability in the global environment. The implication for investors is that investment growth opportunities will be abundant in the domestic market. Investing “in China, for China” may come into fashion and indeed a necessary strategy for many businesses. That said, President Xi pledged that China would not engage in decoupling, in an address to the regional leaders during Asia Pacific Economic Cooperation summits earlier. China will not reverse course or run against the historical trend by decoupling or forming a small circle to keep others out. Opening up to the outside world is a basic national policy, and it will not waver at any time.

Chinese equities will benefit from the promising growth of the underlying macro situation. Besides, China A-share is largely under-owned by offshore investors. According to China Securities Regulatory Commission, foreigners now hold about 5% of Chinese equities, way below the more than 30% in markets like Japan and South Korea. Within the market, new economy stocks in strategic technology and innovation related industries may maintain the valuation premium due to government support and solid growth profiles. It is worth noting that many of these industry leaders are only listed in the A-share market and not typical top holdings of cap weighted A-share indices.

IV. Be mindful of defaults risks

It may sound counterintuitive that default risks will rise when global economy is set to rebound soon. However, with the diminishing excessive liquidity coming from the central banks post pandemic, corporates may have to face the real challenges in meeting their debt obligation. As economic activities resume and social stability is no longer a concern, commercial banks will start showing no mercy in calling loans from the indebted companies and allowing market-oriented bankruptcy to happen.

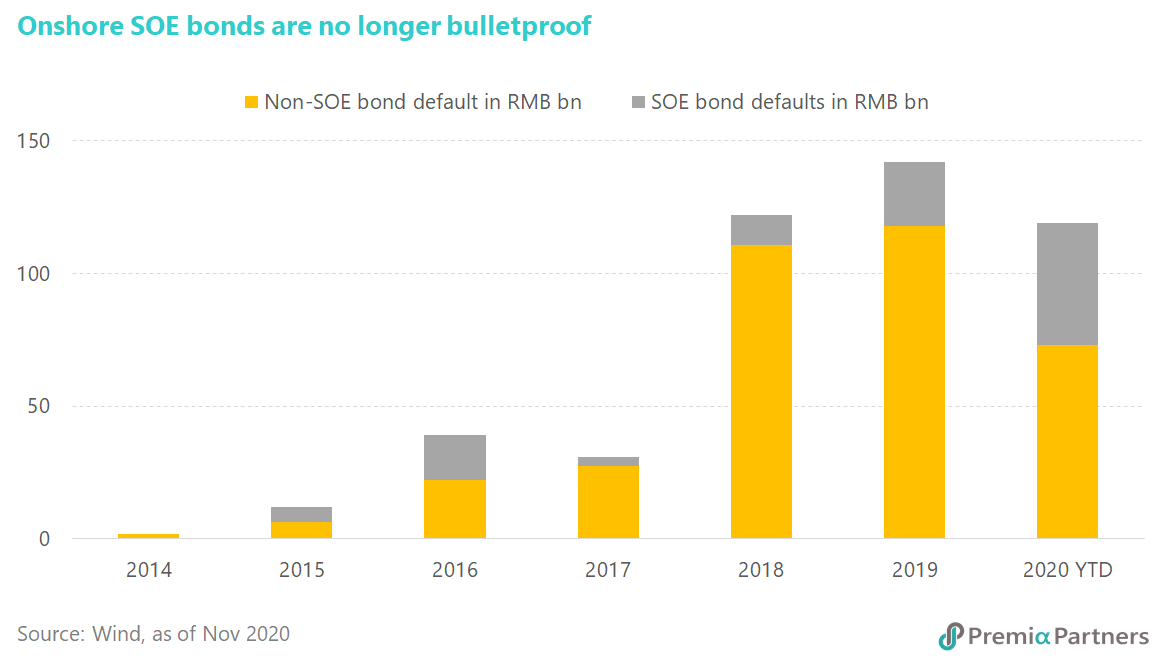

China’s corporate debt defaults have exceeded RMB 100 billion for a third consecutive year. The anticipated dial-back of stimulus measures will put more strain on delinquent firms in repaying their lenders. Financial regulators have vowed a zero-tolerance approach to violations in the bond market after a series of missed repayments by a few high-profile state-owned enterprises (SOE) borrowers such as Yongcheng Coal & Electricity, Tsinghua Unigroup and Brilliance Auto Group. Their defaults caught investors off guard and might set off a chain reaction affecting other SOE debt issuers and local government financing vehicles. The pace of SOE defaults rose significantly in 2020, with 10 state-owned issuers defaulting on a total of RMB 54 billion of bonds, or 42% of total defaults. In the past five years, 25 SOEs defaulted on a total of RMB 157 billion of bonds, or about a third of total defaults.

Investors may need to reprice the risks involved since Chinese government is not standing behind the SOE as the last resort of funding anymore. The biggest challenge for the government is how to push forward the marketization restructuring of SOEs while avoiding local credit collapses that could spark a domino effect and weigh on the economic recovery. Financial health check on both equity and bond becomes more important and investors should not assume anyone is too big to fail in future.

V. Climate change and green economy

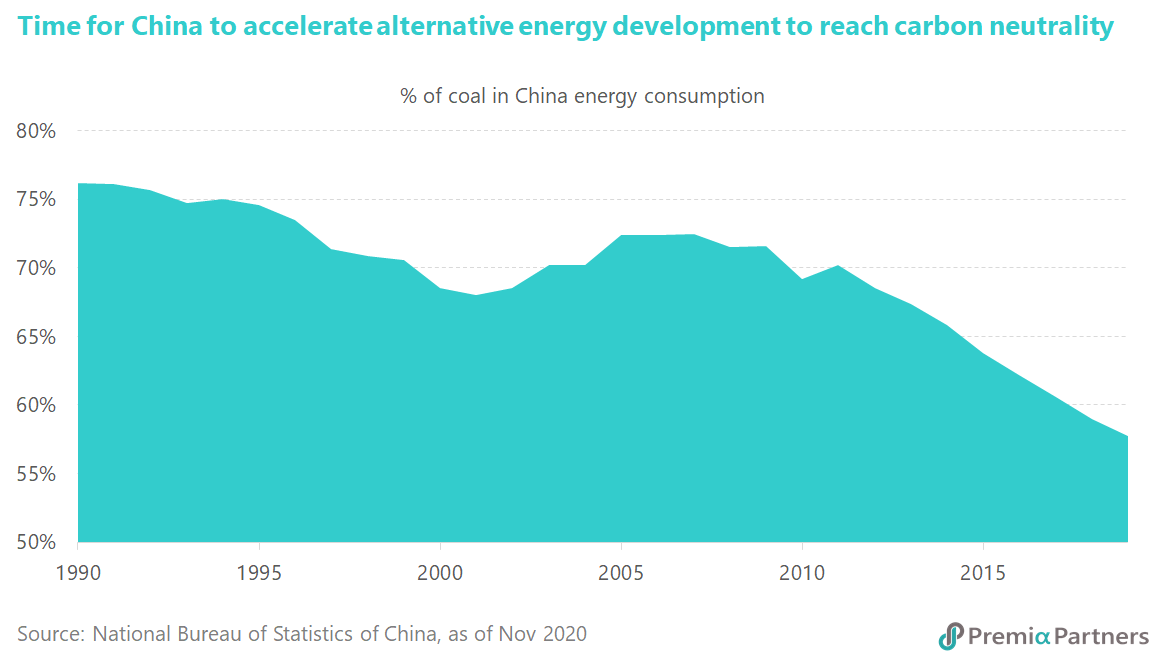

President Xi reiterated the goal that China will reach peak carbon emissions before 2030 and stunned the climate community by pledging that it would become carbon neutral by 2060. Although some critics may see the plan is a calculated geopolitical move to show Beijing’s leadership over Washington in climate agenda, it takes a lot of courage for the country to set a bet-zero emission pledge. Coincidently, a few other Asian countries such as Japan and Korea have announced similar plans to make sure their economies are greener. China is now the world’s largest energy user with the highest greenhouse gas output, consumes 50% of coal produced worldwide annually, and is the top importer of oil and natural gas. Boston Consulting Group said the carbon neutrality goal was closely aligned to the target set by the Paris Agreement but would require Beijing to go even further. It estimated that China would need to invest close to RMB 100 trillion on climate measures over the next three decades, or about 2% of its cumulative gross domestic product for the 2020-50 period.

For investors, there are a few takeaways from the country’s ambitious transition: (1) An aggressive capacity installation in clean energy, like 9-time expansion in solar and 7-time increase in wind power by 2060; (2) Fossil fuels will drops from 85% to 25% in energy mix, reducing the demand in oil and coal; (3) The development of electric vehicles will speed up with more cars powered by electricity than gasoline or diesels by the mid-2030s; (4) Emerging technologies in hydrogen power and carbon capture/storage could advance.

Actionable ideas and how Premia’s offerings fit into the big picture

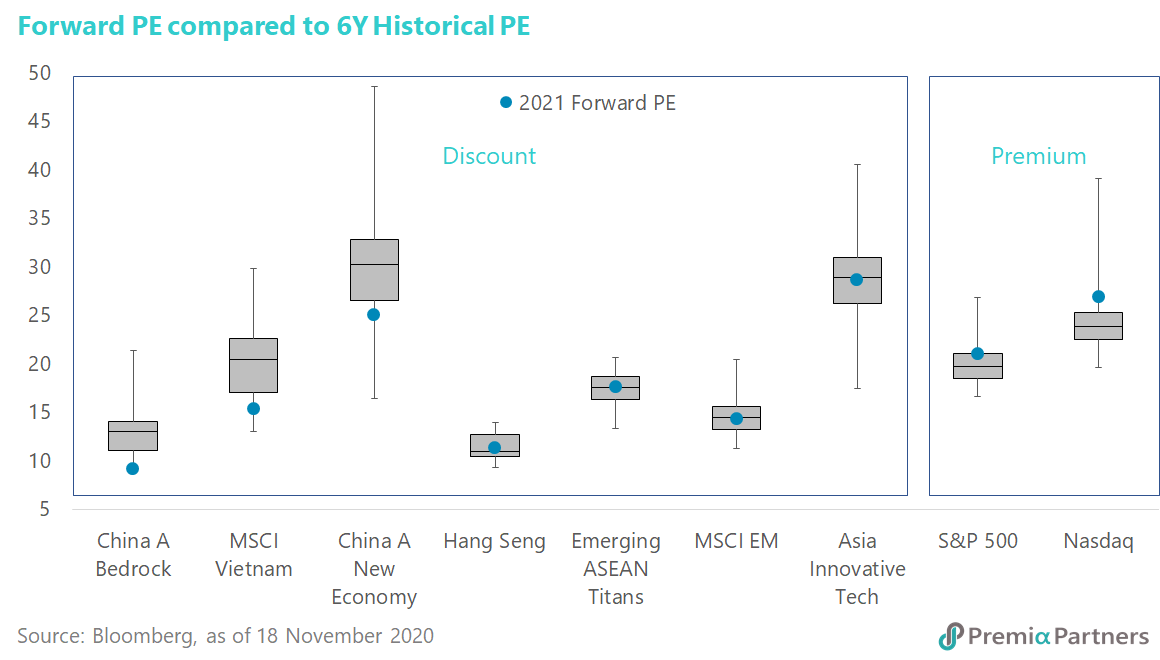

Premia CSI Caixin China Bedrock Economy ETF (2803.HK) – This multi-factor approach emphasizing value, quality and low volatility is appropriate for investors trying to profit from the sector rotation in near-term. Its diversified basket with a balanced sector exposure may help generate alpha performance potentially when market is narrowing the deep discount offered by the value stocks.

Premia CSI Caixin China New Economy ETF (3173.HK) – This strategy leans towards stocks with light-asset models, stronger financial positions and better growth prospects in information technology, healthcare, consumer discretionary and communications. New economy space is clearly benefiting from policy support and showing a clear roadmap in medium-to-long term.

Premia Asia Innovative Technology ETF (3181.HK) – It utilizes FactSet’s Revere Business Industry Classification System to identify the Asian leading innovators riding on the megatrends of digital transformation, robotics & artificial intelligence, health and life science. The result is an equal-weighted portfolio of the top 50 industry leaders in China, Japan, South Korea and Taiwan.

Premia Dow Jones Emerging ASEAN Titans 100 ETF (2810.HK) – The fund invests in the emerging ASEAN markets including Indonesia, Thailand, Malaysia, the Philippines and Vietnam, which may be a catch-up play on low-yield environment, macro recovery and weak US dollar ahead. In the medium-term, the region is supported by increasing urbanization, rising consumption, booming infrastructure and favorable demographics.

Premia MSCI Vietnam ETF (2804.HK) – It invests in the leading Vietnamese stocks. Vietnam is expected to be among the fastest growing economies with a GDP growth of 6% to 7% in the next few years and fits perfectly to the “China plus one” model when multinational companies are reconfiguring their supply chains, looking for alternatives from China.