2803 (HKD) | 9803 (USD)

A multi-factor approach to capture high quality contributors to China's real economy growth

3173 (HKD) | 9173 (USD)

Capture new economic engines in consumer, technology, healthcare sectors in a multi-factor approach

3151 (HKD) | 83151 (RMB) | 9151 (USD)

Leading technological innovation-based companies listed on the SSE STAR Board

3181 (HKD) | 9181 (USD)

An efficient solution to capture digital transformation, robotics & automation, and healthcare & life science innovations in Asia

2810 (HKD) | 9810 (USD)

A low cost building block capturing the leading powerhouses in Malaysia, Thailand, Indonesia, the Philippines and Vietnam

2804 (HKD) | 9804 (USD)

Efficient, in-time-zone access to capture exponential growth opportunities from Vietnam equities in a single trade

2817 (HKD) | 82817 (RMB) | 9817 (USD)

9177 (USD)

Unique, transparent and low-cost tool to conveniently access Long Duration China Government Bonds

3001 (HKD) | 83001 (RMB) | 9001 (USD)

First SFC authorized high yield bond ETF to capture attractive USD yield from a diversified basket of secured and senior USD China property bonds

3077 (HKD) | 9077 (USD)

9078 (USD)

Cash management tool with daily liquidity, minimal duration exposure, US treasury credit quality and little counterparty risk

3411 (HKD) | 9411 (USD)

Cash management tool with daily liquidity, minimal duration exposure, US treasury credit quality and little counterparty risk

3453 (HKD)

9159 (USD)

An efficient solution to capture digital transformation, robotics & automation, and healthcare & life science innovations in Asia

3478 (HKD) | 9478 (USD)

Asia's first ETF offering convenient access to Saudi Arabia government sukuk market through a one-ticker trade

주요 인사이트 & 웨비나

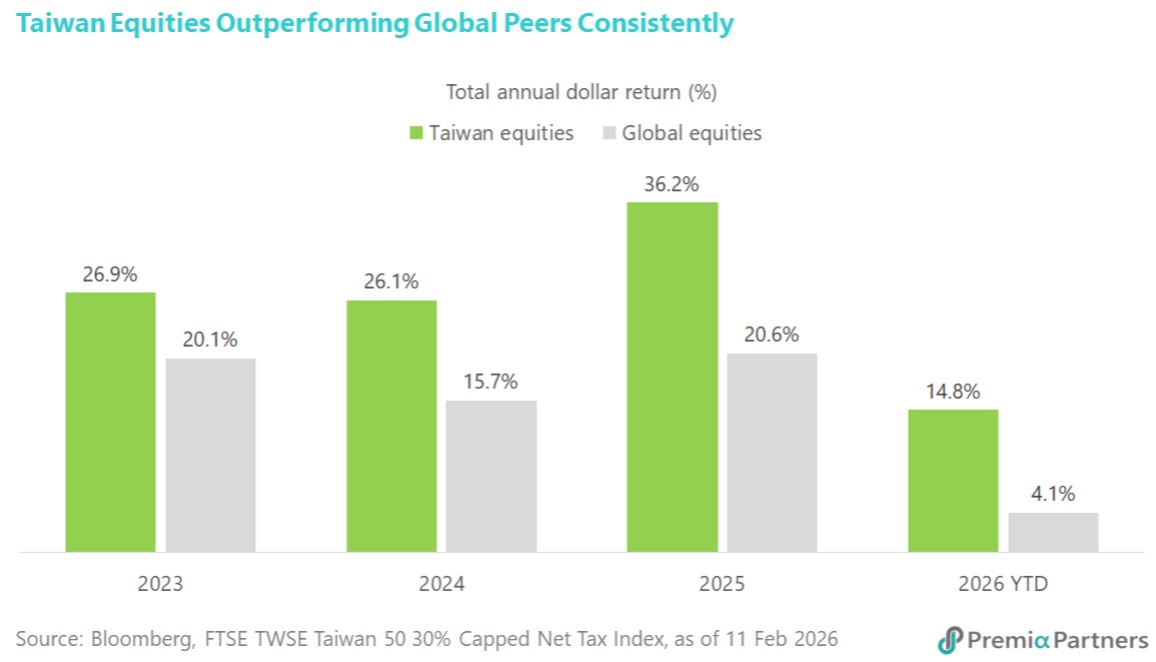

With many of the global leading high tech manufacturing players, the Taiwan stock market sits at the confluence of the global tech super cycle, robust earnings growth and modest valuations, and is home to many global leading Asian technology players. The fundamental tailwinds that drove the Taiwanese stock market’s outperformance from 4Q25 are likely to continue carrying the rally in 2026. Indeed, the Taiwan market appears to be in the early stages of its outperformance cycle. In this article, our Senior Advisor Say Boon Lim explores why in addition to TSMC, the blue chip cohort from Taiwan offers global investors a unique diversification opportunity, providing exposure to technology super cycle beyond US big tech names, complemented by its attractive valuations and low correlations with other major asset classes.

Feb 02, 2026

Analysts including JP Morgan, Goldman Sachs, Morgan Stanley, HSBC, and Standard Chartered are generally bullish on Emerging Markets (EM) for 2026, citing dollar weakness, AI growth, and affordable valuations. Within EM, EM ASEAN is an under-appreciated sweet spot that blends value, yield and structural upsides. In this article, our Senior Advisor Say Boon Lim discusses how the region transitions towards more domestically-driven growth, with macro tailwinds from significant foreign direct investments, public infrastructure spending, and robust exports fuelled by AI demand and global supply chain dynamics.

Jan 19, 2026

As markets enter 2026, the need for diversification has gained an urgency not seen since possibly at the peak of the Nasdaq Bubble in year 2000. Both US stocks and corporate credits are priced for perfection in an economy that has been held up by stretched fiscal and monetary stimulus. The sales pitch of “American exceptionalism” may be wearing thin. US Big Tech is overpriced and may have overinvested in AI. Meanwhile, the labour and consumer markets are weakening even while inflation remains stubborn. The long-end of the Treasury yield curve has started ignoring rate cuts – a sign of concern about the sustainability of US government debt. In this article, our Senior Advisor Say Boon Lim discusses the urgency of diversification away from US-overpriced assets, while China and emerging ASEAN markets present compelling complementary attributes for diversified multi-asset portfolios.

Jan 13, 2026

China approaches 2026 on a firmer economic and market footing, supported by clearer policy direction and a maturing innovation ecosystem. While growth may ease slightly from recent levels, structural themes—ranging from advanced manufacturing upgrades to measures addressing excess capacity—are set to shape the early phase of the 15th Five-Year Plan. Domestic investors are gradually shifting from deposits toward higher-return financial assets, adding resilience to onshore markets. In fixed income, moderating yields and strengthening demand for RMB-denominated assets create a more constructive backdrop for China government bonds. In this article, our Partner & Co-CIO David Lai discusses how these developments foster a more stable and attractive investment landscape, offering compelling opportunities to express China exposure across both equities and fixed income.

Jan 13, 2026

AI was the common theme for growth across markets last year. S&P500 and Nasdaq delivered +17% and 21% respectively in USD terms for FY2025, while China broad market (CSI300) rallied 21%, and China tech outperformed with +46%, Asia tech was up +45% and Taiwan stock market gained +40%. Going into 2026, few would dispute drivers for stock market performance would continue to be innovation-led opportunities. In this article, we discuss tailwinds from the hardcore tech especially AI infrastructure, semiconductor, robotics, and biotechnology, where technological breakthroughs, accelerated commercialization and improved earnings growth and profitability support further re-rating actions ahead. This is where our Premia China STAR50 ETF and Premia China New Economy ETF focus on, and would serve as efficient and optimized vehicles to provide direct access to the leading beneficiaries that are poised to define China's economic trajectory in 2026.

Jan 13, 2026

Following a historic breakout in 2025, the Premia Vietnam ETF rallied a stunning 73% (total return in USD NAV) in 2025, while the broad market also rallied 39%. The market is now transitioning from recovery in sentiment to a phase of progressive policy execution, including the "Doi Moi 2.0" reforms (Resolution 68). These reforms offer unprecedented policy support for the private sector. And the mandate to nurture 20 globally competitive large private firms provide strong cases for revaluation opportunities for large cap leaders. In this article, we will explore why Vietnam remains a compelling market in 2026 amidst imminent FTSE Emerging Market upgrade. Our Premia Vietnam ETF—with its focus on private sector champions and Small-Mid caps—is distinctively positioned to capture the specific beneficiaries of these structural shifts.

Jan 13, 2026

주간 차트

David Lai , CFA

CFA

Taiwan's economic outlook is experiencing a significant uplift, driven by the burgeoning AI revolution and a recently cemented trade pact with the US. Economic growth forecasts for this year have been upgraded to an impressive 7.7%, a substantial increase from the 3.5% projection made in November. This revised outlook anticipates Taiwan's GDP reaching an unprecedented USD1tn, marking a historic achievement for the island. Fueling this robust growth is an expected surge in exports, now projected to rise by 22.2% in 2026, a sharp acceleration from the earlier 6.3% forecast. These positive revisions reflect a broad consensus among financial institutions, with Bank of America nearly doubling its growth prediction due to “relentless global demand“ for Taiwan's advanced tech hardware, including critical AI chips and servers. The enhanced capital expenditures by cloud providers, exceeding initial expectations, further underscore the formidable strength of AI-related infrastructure. The strategic trade agreement finalized between the US and Taiwan earlier this month is a pivotal catalyst, set to reduce average tariff rates on Taiwanese exports to the US from nearly 36% to ~12%. This landmark deal, hailed as a shift from “defense to offense“ by Taiwan Premier Cho Jung-tai, will cement Taiwan’s position as an economic powerhouse. The tangible impact of these developments is already visible in Taiwan's equities market, which has seen remarkable performance. The stock market has advanced by at least 25% for three consecutive years, with a further ~15% gain to a new record in 2026 alone. For institutional investors looking to capitalize on this strong structural uptrend in Taiwan equities, the Premia FTSE TWSE Taiwan 50 ETF presents an optimal and strategic investment vehicle to capture this solid growth story.

Feb 23, 2026