In a market where the focus is now on bigger fiscal deficits, higher tariffs, faster inflation and higher government bond yields, particularly at the long end in the US and Japan, Asia Investment Grade USD Bonds and Saudi Government Sukuk are attractive alternatives to US Treasuries in diversified portfolios. Asset allocators should note their uniquely low correlations to US equity, US investment grade bonds, global investment grade bonds, and broader EM bonds making them valuable diversification tools. Whether deployed within traditional 60/40 US equity/bond allocations or portfolios with higher equity weightings, maintaining a sleeve of Asia USD Investment Grade Credits and/or Saudi Government Sukuk enhances the portfolio’s Sharpe ratio as a result of the higher yield and better credit quality. Crucially, both assets exhibit positive convexity – achieving greater price gains when US Treasury yields fall and milder losses when yields rise - positioning them as particularly valuable alternatives and hedges.

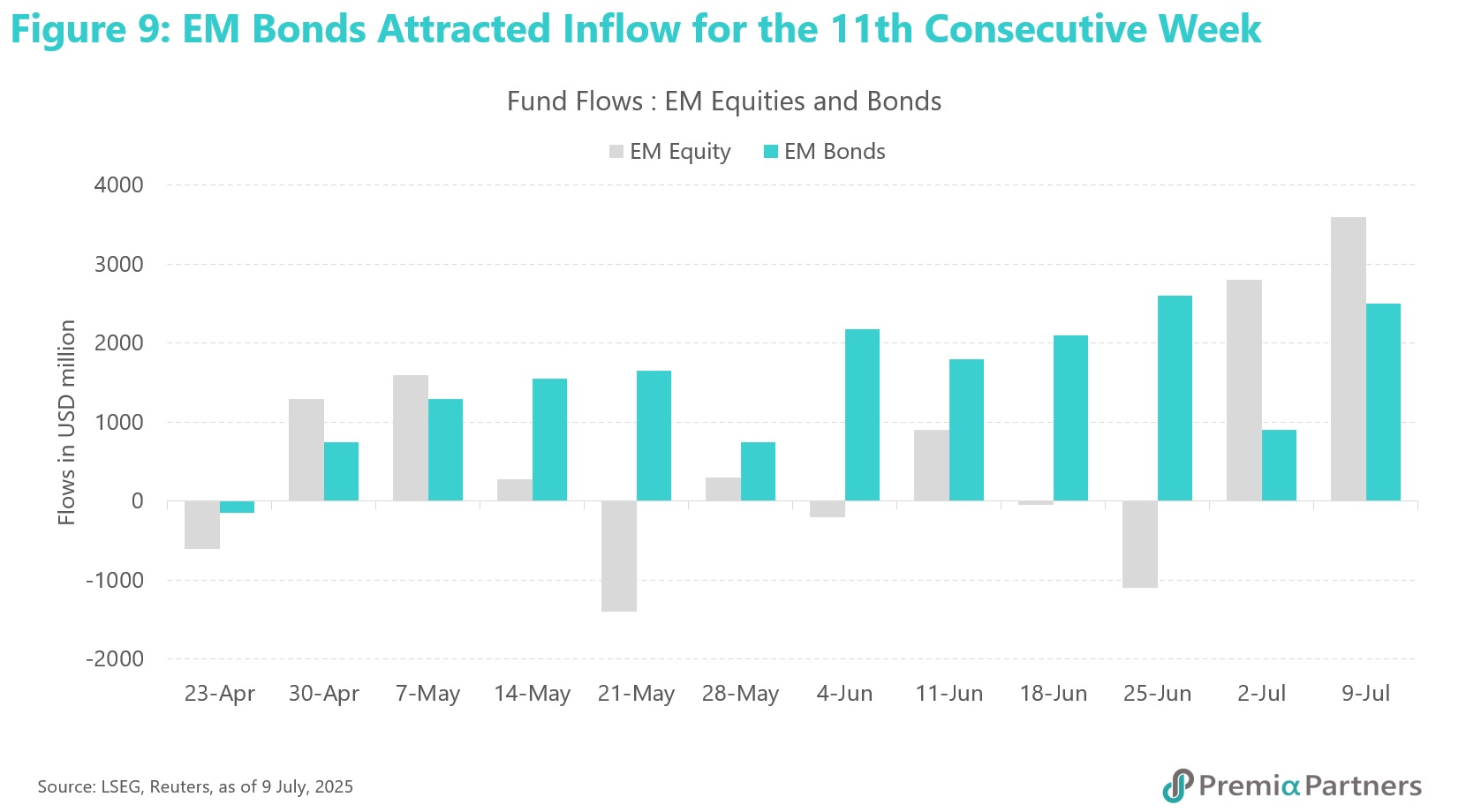

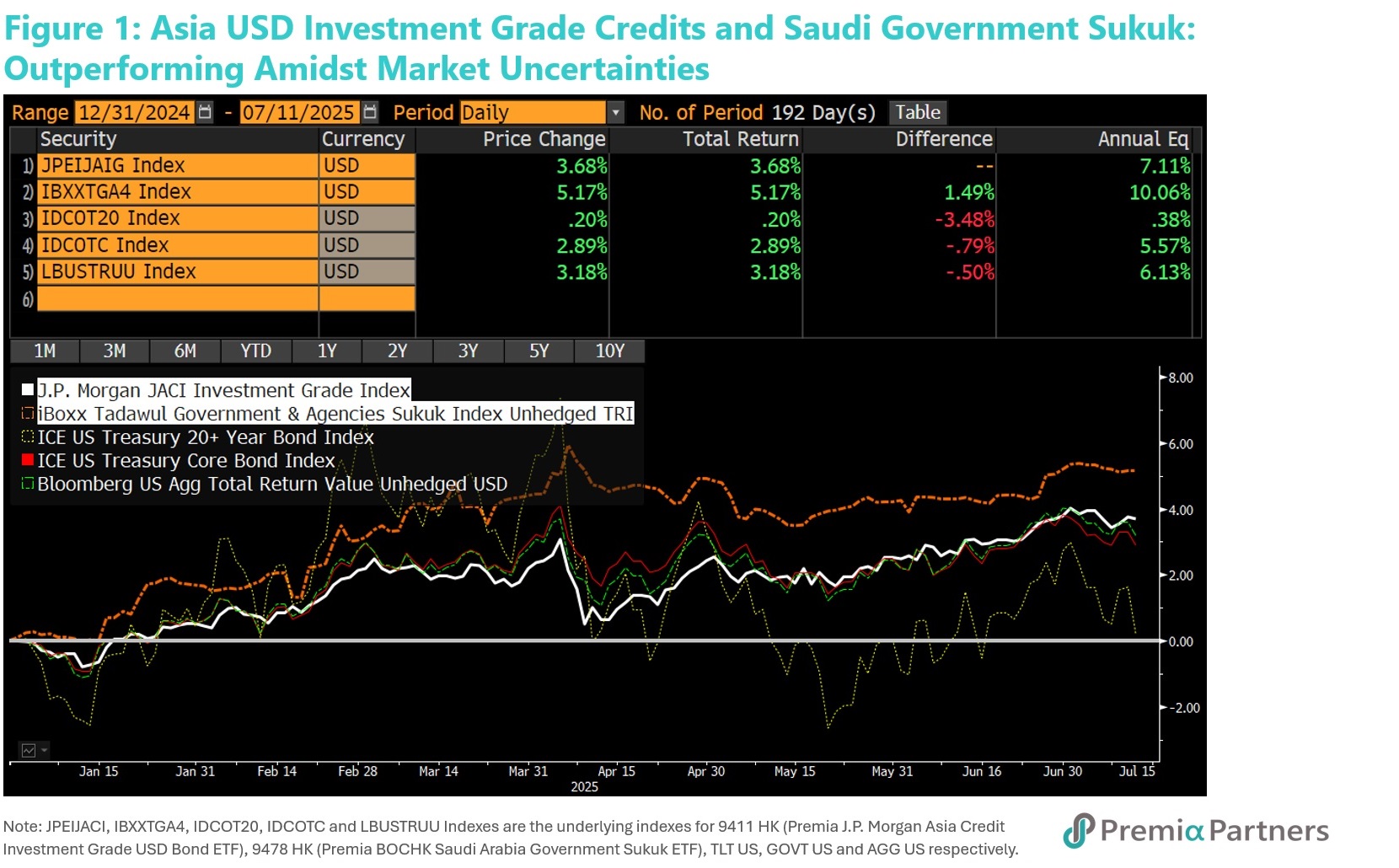

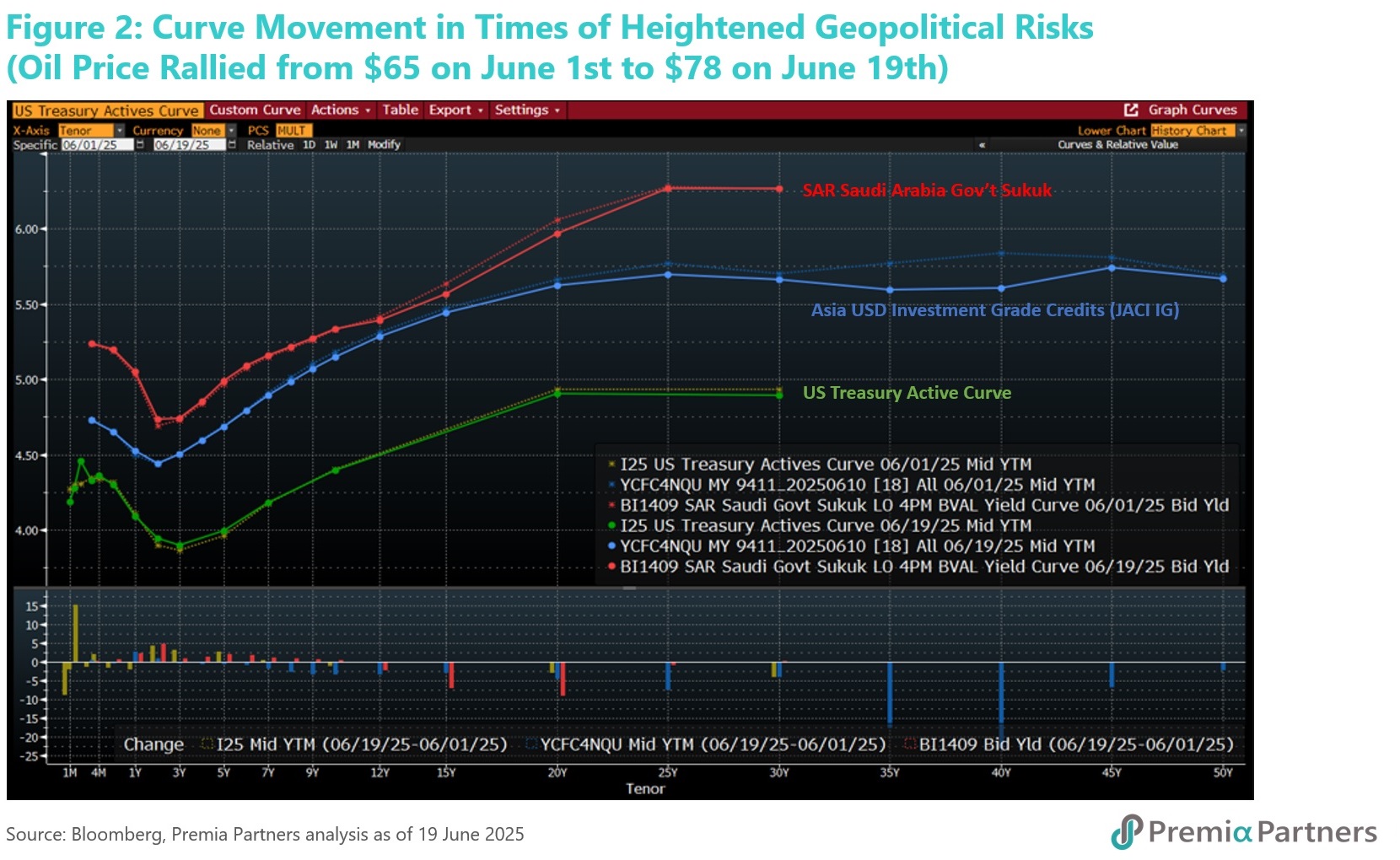

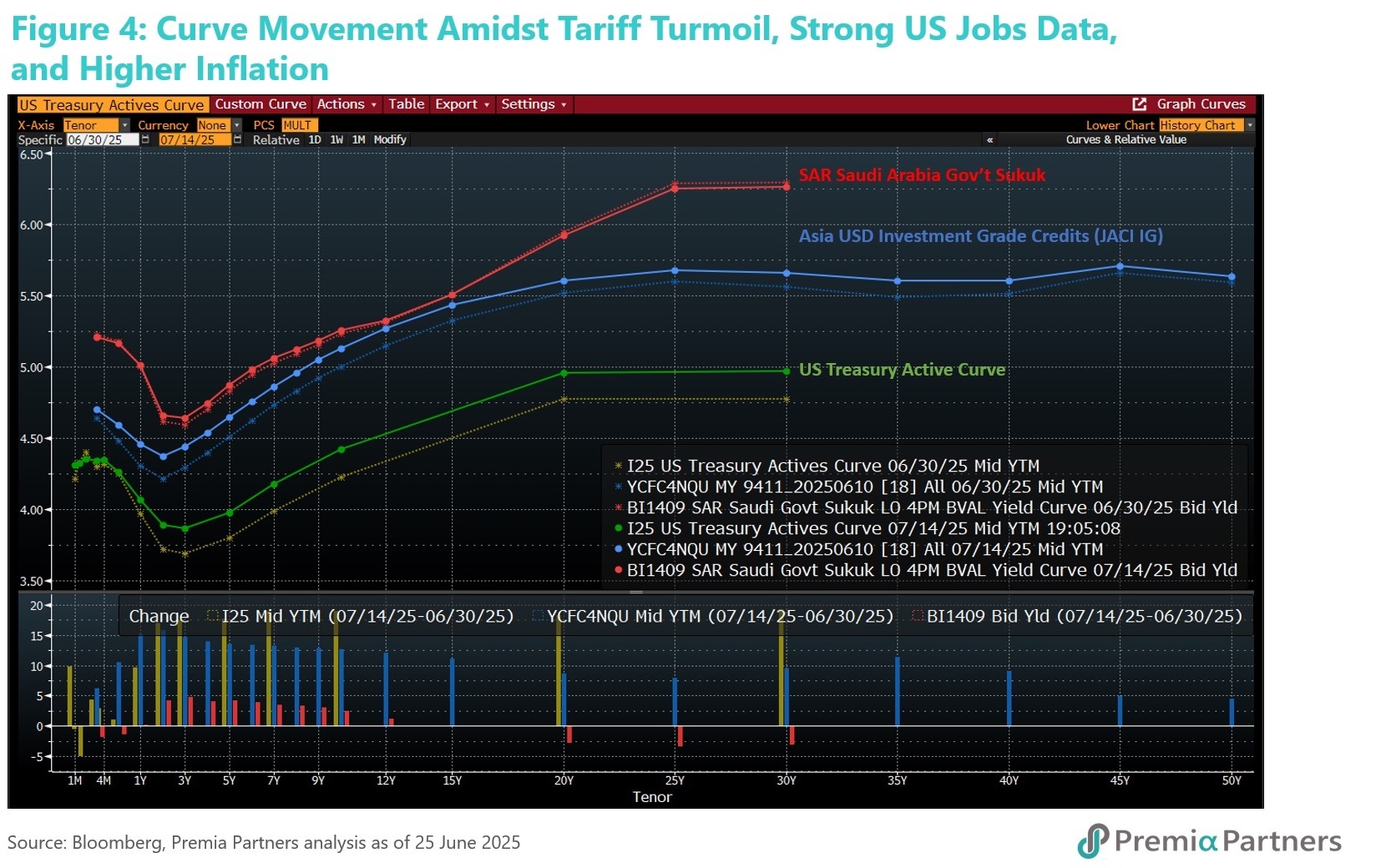

Our long-standing thesis on the resilience and stability of the Asia Credit Investment Grade USD Bond ETF and the Saudi Government Sukuk ETF has been supported by recent market developments. While the market faced multiple headwinds – notably from geopolitical tensions, oil price volatility, strong US economic data and trade war risks - the yield movements in Asia USD Investment Grade Credits and Saudi Government Sukuk have consistently been more favourable than US Treasuries, demonstrating positive convexity against changes in US interest rate expectations and yields. When US Treasury yields fell, these assets saw greater price gains, and when yields rose these assets saw less severe price declines (figures 1-4).

Why Asia USD Investment Grade Credits and Saudi Government Sukuk?

The strategies stand out for their combination of higher yields (4.8% Asia USD Investment Grade Credits / 4.9% Saudi Government Sukuk), lower corporate and government leverage, and comparable or superior credit ratings versus global peers. Further, their better fundamentals and higher yields suggest further opportunities for spread compression ahead.

Their relatively shorter duration (4.5 years for Asia USD Investment Grade Credits / 5.7 years for Saudi Government Sukuk) also reduces sensitivity to interest rate volatility.

Unlike US Treasuries, both strategies also allow investors to sidestep specific US Treasury risks, especially in long duration US Treasuries:

- US Inflation Risk: With shorter duration than US IG bonds, Asia USD Investment Grade Credits / 5.7 years for Saudi Government Sukuk are less sensitive to US interest rate hikes if inflation resurges.

- US Debt Issuance Risk: Asia Investment Grade historically lowers issuance when yield rise, while Saudi Arabia adopts a conservative approach to debt issuance focused on fiscal sustainability. Both assets should have limited exposure to the coming US Treasury issuance shock, expected to reach US$1 trillion in the second half of this year, caused by large US fiscal deficits.

- UST Downgrade Risk: Asia USD Investment Grade Credits and Saudi Government Sukuk avoids regulatory issues like forced selling by Hong Kong’s MPF funds triggered by a US credit rating downgrade. HK MPF have up to HKD484bn (US$61bn) in US Treasuries.

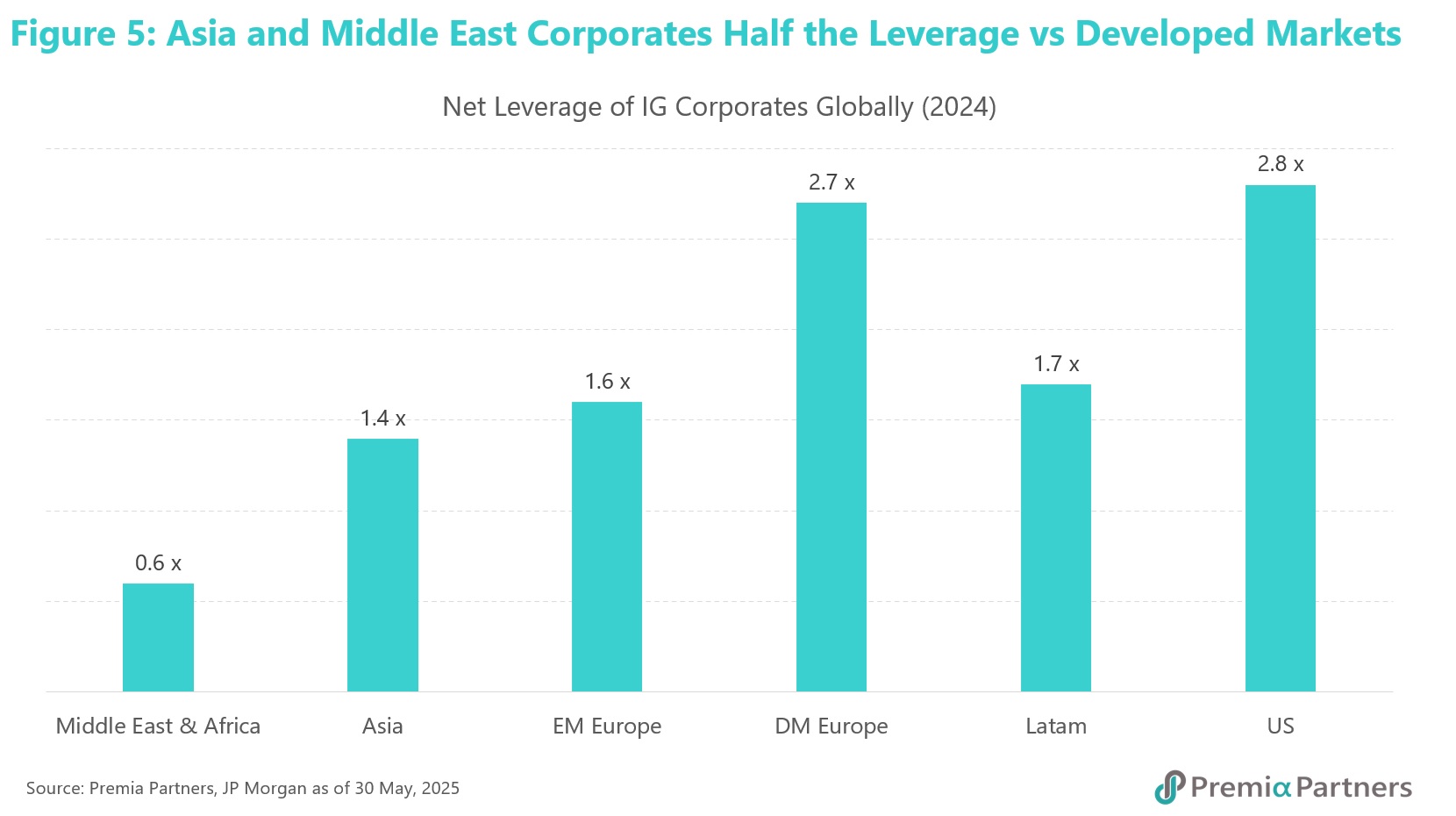

The structural strength of Asia USD Investment Grade Credits and Saudi Government Sukuk is anchored in their conservative leverage profiles, prudent fiscal management, and robust issuer quality. Generally, issuers in the Asia USD Investment Grade Credits and Saudi Government Sukuk markets maintain significantly lower debt levels than their counterparts in the US and Europe (figure 5).

In government bonds, for instance, Saudi Arabia has a gross debt to GDP ratio of just 30% and boasts a remarkable net negative debt-to-GDP ratio when factoring in its sovereign wealth funds (SWFs) and reserve assets. Similarly, Indonesia, ranked among the top ten issuers in the JACI IG ETF, reports a net debt-to-GDP ratio of just 36.1% for 2024 - substantially lower than many advanced economies, with the US at 93.6% and Germany at 59.7% for 2024, according to S&P.

The corporates issuers in the Premia Asia Credit Investment Grade USD Bond ETF are high quality companies from the likes of Alibaba, Tencent, Singapore Telecom, TSMC, AIA Group, and Reliance Industries. These companies are global and regional leaders in their respective industries and the strength of their credit quality is underwritten by their strong balance sheets and consistent earnings. This strong foundation is further reflected in the average leverage ratio of IG corporate issuers in Asia and Saudi Arabia, which is much lower than that of their Developed Market peers in Europe and the US, reinforcing the resilience and stability of these assets.

Positive momentum in credit development in Asia USD Investment Grade Credits markets across sovereign, quasi and corporates. Sovereign issuers in Asia USD Investment Grade Creditshave mostly seen their ratings affirmed or outlooks upgraded over the last two years, and some are even being considered for ratings upgrades. For instance, Hong Kong’s rating was affirmed and its outlook upgraded from negative to stable by Moody’s in May 2025, Philippines’ outlook was upgraded from stable to positive by S&P in Nov 2024, opening the door to an A-rating from BBB+. Malaysia may also receive a credit rating upgrade to A this year from Fitch.

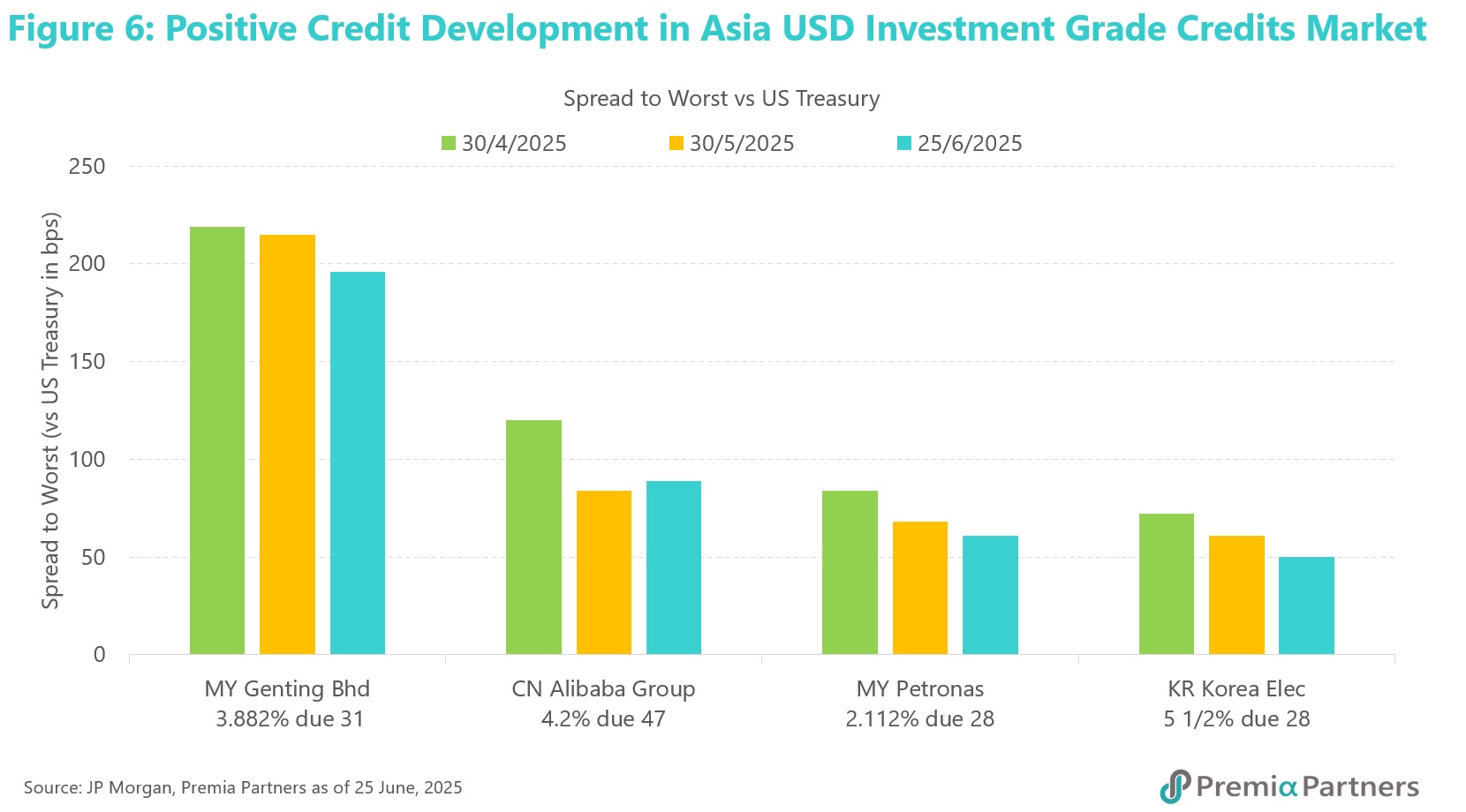

Meanwhile, Asia’s high-quality corporates demonstrated resilience versus other emerging markets, supported by strong fundamentals and favourable bond supply/demand dynamics. This strength is evident in recent movements in spreads (figure 6) and positive credit developments for these issuers in the ETF:

- Alibaba (A rated) – its spread tightened amidst strong Chinese bank demand, supported by robust free cash flow and a large net cash position

- Genting Malaysia (BBB rated) - showing sequential earnings recovery and improving fundamentals

- Petronas (A Rated) – its credit strength is driven by its robust standalone financial profile, demonstrated by a long-term net cash position, strong cash flows, and prudent financial discipline, with significant external revenue from exports

- Korea Electric (AA Rated) – its credit profile is primarily supported by substantial government backing and its near-monopoly in South Korea’s electricity sector

These corporate issuers highlight the appeal of high-quality Asian issuers as global investors seek diversification amidst increased volatility and outflows from US markets.

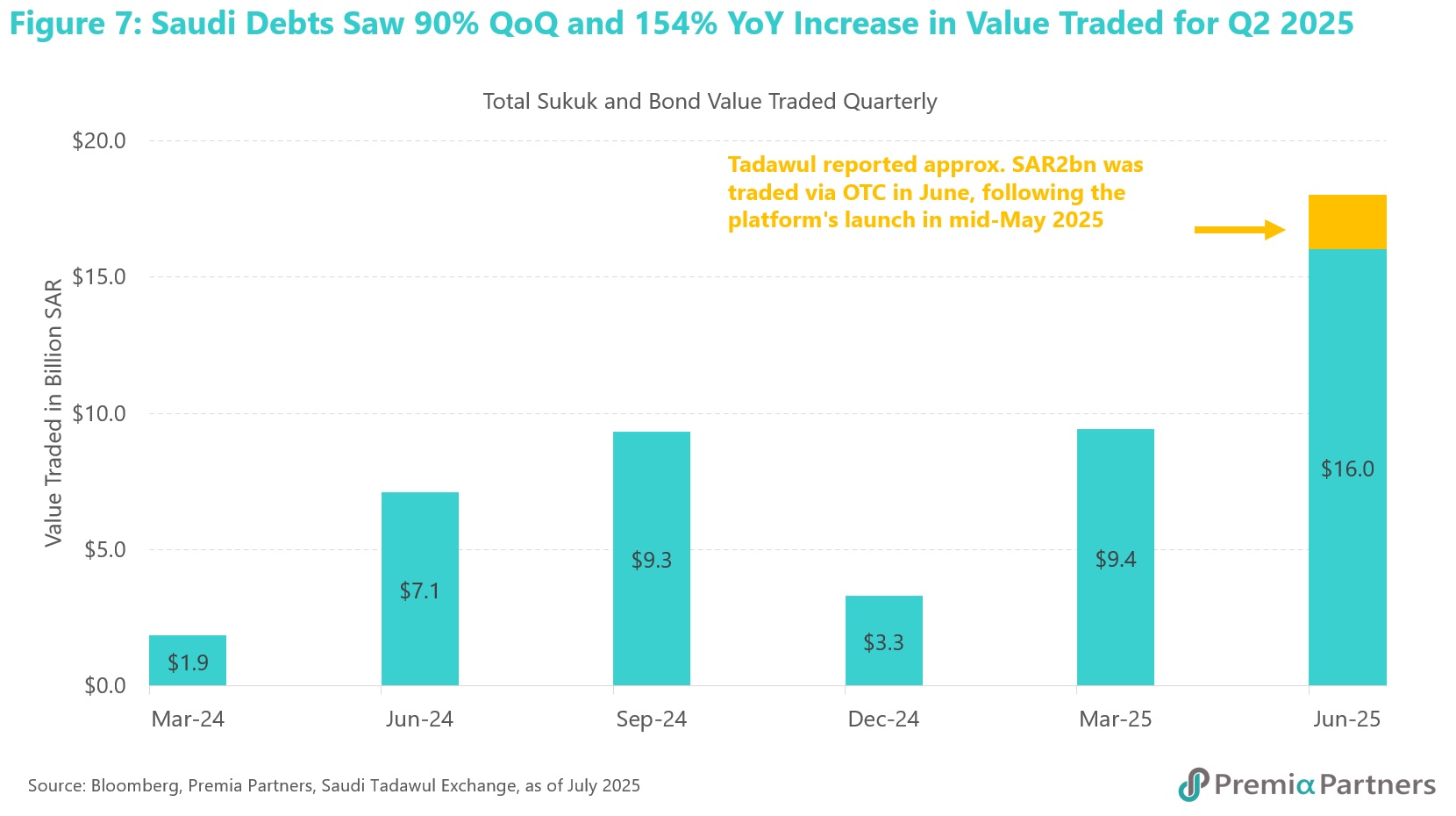

Positive momentum in index inclusion for Saudi Government Sukuk. Secondary market liquidity is highlighted as one of the key considerations for index inclusion in the JP Morgan Government Bond Index – Emerging Markets (GBI-EM). Saudi Arabia has executed a set of strategic initiatives to enhance the liquidity and price formation of the Saudi fixed income market. Central to this progress was the launch of the fixed income market maker framework by Tadawul in January 2025, followed by Edaa’s introduction of the OTC settlement framework in May 2025, and the Capital Market Authority’s (CMA) approval of TradeWeb’s license as an alternative trading system in July 2025.

Tradeweb, as a licensed Alternative Trading System (ATS) for Saudi Sukuk and debt instruments, will bring enhanced transparency, efficiency, and liquidity to Saudi Sukuk. Tradeweb is a globally recognized electronic trading platform, facilitating over US$2.6tn in average daily volume across major bond and derivatives markets, and has a proven track record of boosting liquidity and transparency in global markets. For example, after Tradeweb launched as the first electronic trading platform for China Bond Connect, the monthly average daily trading volume for Chinese bonds rose nearly fivefold to around RMB6.8bn (US$950mn) within the first year. Tradeweb’s entry is set to further boost secondary market liquidity in the Saudi Government Sukuk market.

These reforms have driven significant improvements in market accessibility and efficiency, positioning Saudi Government Sukuk for upcoming inclusion in major indices such as the GBI-EM. Reflecting the impact of these initiatives, the latest quarter saw approximately 90% QoQ and 154% YoY increase in the value of Sukuk traded as listed and OTC (figure 7).

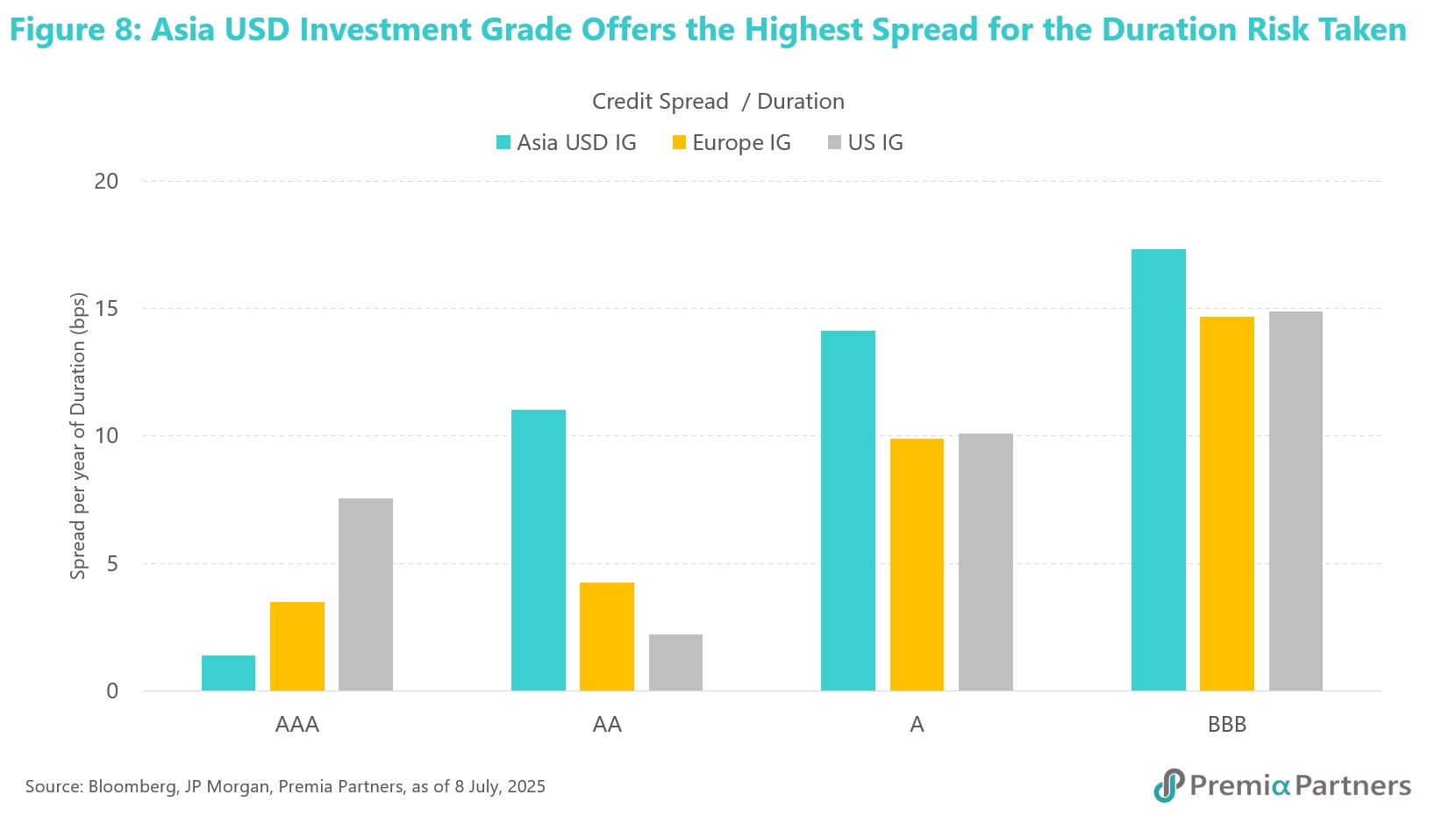

Saudi Government Sukuk and Asia USD Investment Grade Credits markets offer compelling risk/reward profiles compared to US and European Investment Grade bonds. Asia USD Investment Grade bonds typically provide higher yields and wider credit spreads, even after adjusting for credit ratings and for their duration risk (figure 8). And this is evidently true for the rating buckets from AA to BBB which accounts for 98% of the Asia USD Investment Grade Credits strategy. Higher spread/duration is key to delivering high risk-adjusted return, especially in an asset that has had zero credit defaults after the GFC. And by having a lower duration, the strategy is less susceptible to volatility from interest rate speculation.

Saudi Government Sukuk typically offer attractive yield premiums of 70-110 basis points over comparable US Treasuries despite the issuer maintaining investment-grade ratings (Moody’s Aa3, S&P A+, Fitch A+). The Saudi Riyal (SAR) also provides currency stability, thanks to its stable peg to the USD at 3.75, backed by over US$400bn in foreign reserves. Furthermore, the low correlations to other assets (0.21 with emerging market bonds, 0.39 with US Treasuries) make it an exceptional diversifier for any global bond portfolio. To understand more about the Saudi Government Sukuk opportunity, please see our latest Premia Insight “Saudi Arabia Government Sukuk ETF: A Timely Allocation tool for Asian Investors Seeking Yield, Stable Income and Uncorrelated Return through Diversification”.

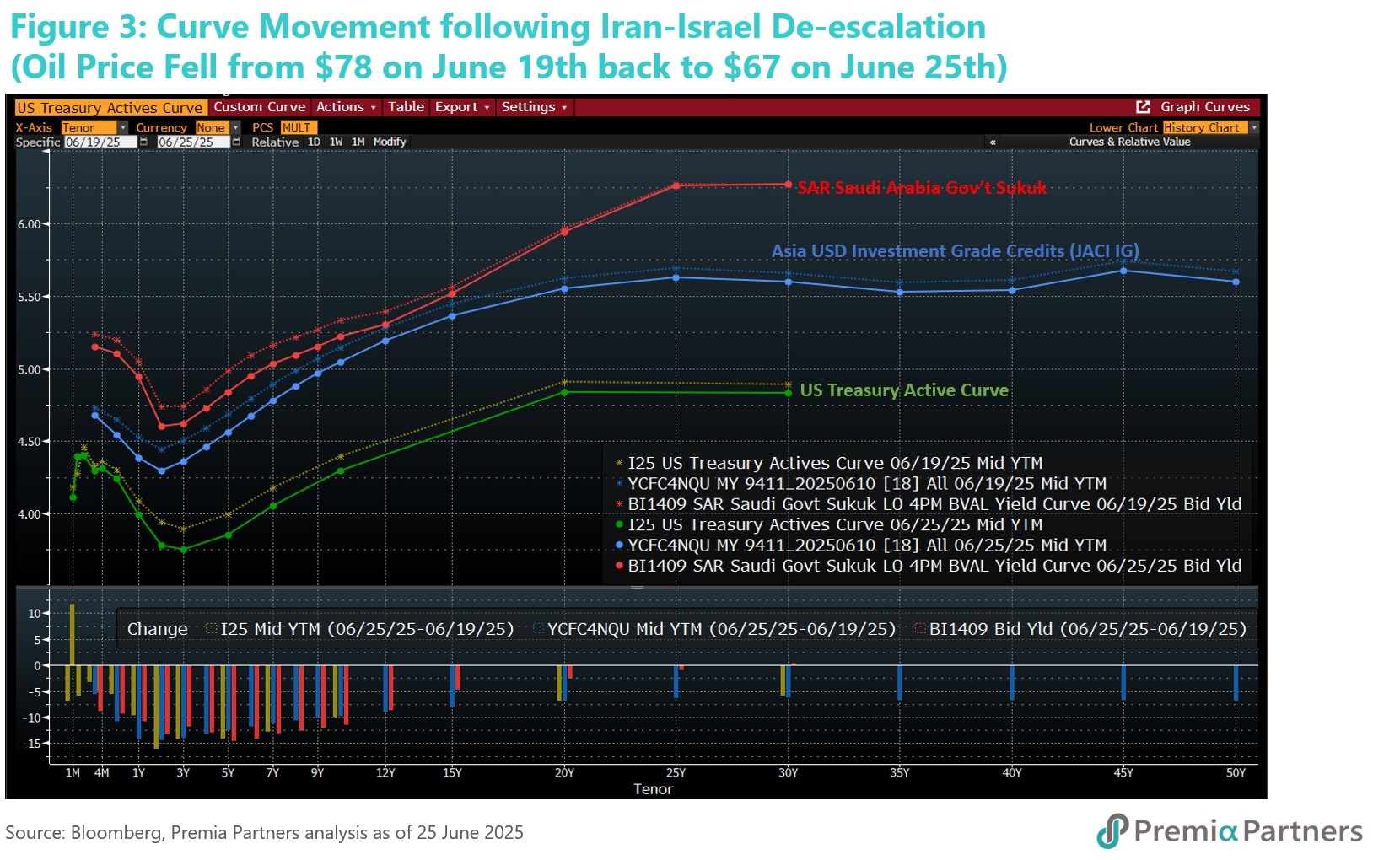

As investor rotation away from US Treasuries gains momentum, alternative fixed income opportunities such as Asia USD Investment Grade Credits and Saudi Government Sukuk are becoming increasingly attractive. YTD EM bond funds have attracted strong inflows (figure 9). With the market focus shifting to US fiscal imbalances, the inflationary impact of higher tariffs, and upcoming Federal Reserve decisions, Asia USD Investment Grade Credits and Saudi Government Sukuk - both maintaining healthy spreads over US Treasuries - are likely to see continued spread compression, underpinned by strong regional fundamentals and favourable dynamics.