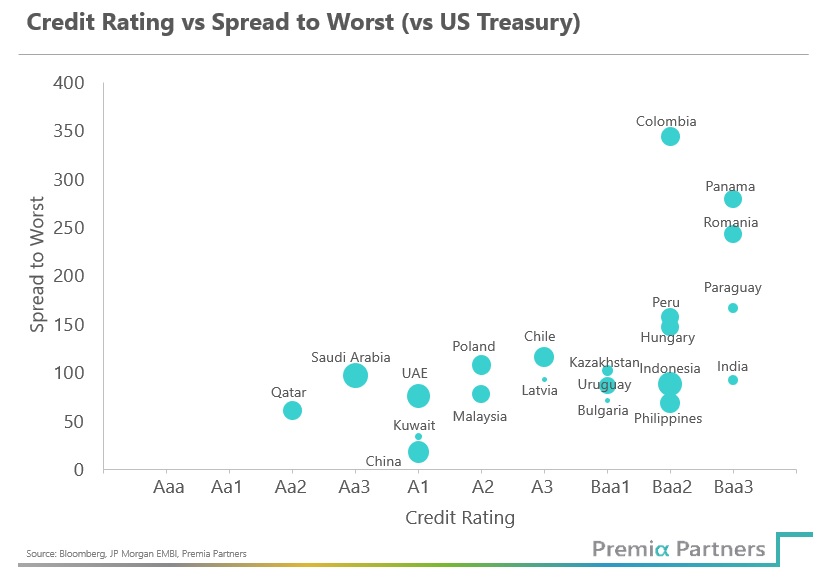

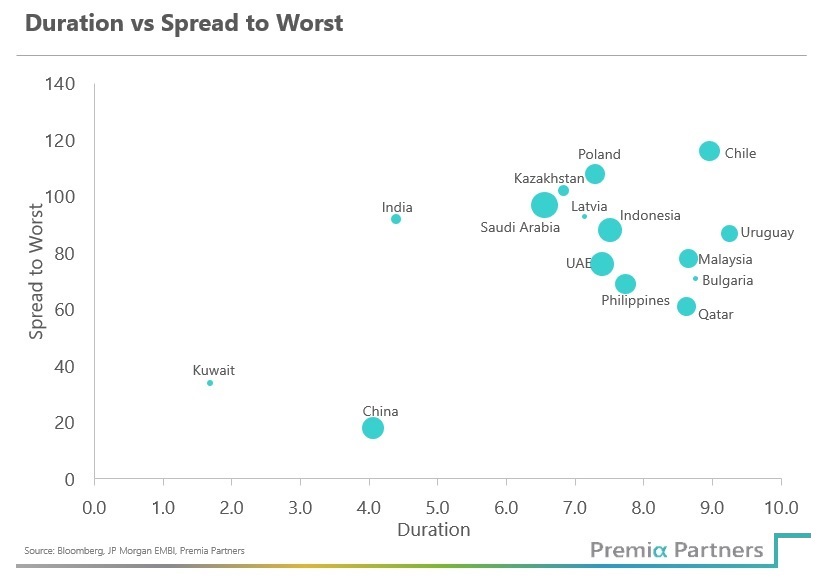

For fixed income allocators, the Saudi Arabia government Sukuk is an under-allocated bright spot. They offer significant yield pickup and very low correlations with other major assets, without compromising on quality. Among the global investment grade cohort, Saudi Arabia government debts, with Moody’s rating of Aa3 (and S&P and Fitch ratings of A/ A+) offer more attractive average yield spreads than many other countries with lower credit ratings. In terms of spread per unit of duration, Saudi Arabia sovereign debts also compensate investors with higher spread than a host of other countries with greater duration risk. Meanwhile, among countries with the same credit ratings, Saudi Arabia has a lower debt to GDP ratio than most in its peer group. The Kingdom’s debt to GDP ratio of 30% compares well even against countries with higher credit ratings. In short, while recent credit ratings upgrades acknowledge the greatly improved economic fundamentals underpinning Saudi Arabia sovereign debt, the bond market appears to have yet to fully price the changes, giving rise to pricing opportunities which the current ratings offer vis-à-vis similarly rated government bonds.

The debut of the Premia BOCHK Saudi Arabia Government Sukuk ETF – globally the first Saudi government Sukuk and pure investment grade government Sukuk ETF listed outside the Kingdom, and a first in Asia – now offers easy access to this diversification tool for investors in Asia that is in the same time zone. In addition, there are a number of significant tailwind drivers adding to the appeal of allocation for Saudi Arabia government Sukuk:

- Attractive yield pick-up (historically around 70-110 basis points) against comparable US Treasuries

- The Saudi Arabian Riyal peg against the US Dollar, giving it a currency stability advantage within the local currency Emerging Market debt space

- Historical resilience through the cycles – even during oil shocks

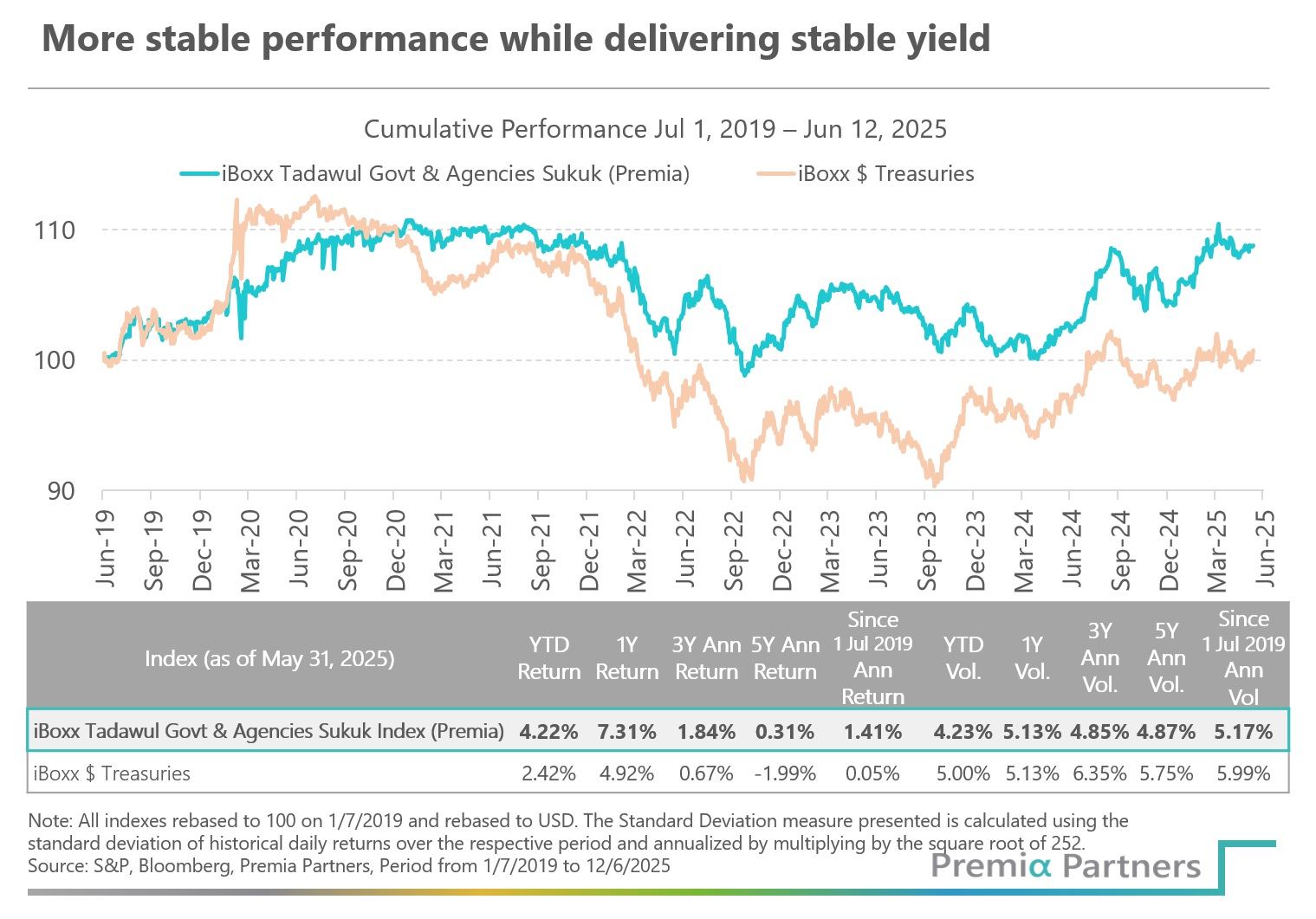

- Portfolio construction benefits from low correlation of 0.21 between Saudi government Sukuk and broader Emerging Market bonds, and 0.39 against US Treasuries

- Upcoming potential inclusion in the Bloomberg Emerging Market Local Currency Government Index (EMLCTRUU) and JP Morgan Government Bond Index-Emerging Markets (GBI-EM) likely to drive more passive flows

*********************************************

Saudi Arabia’s economic transformation offers new supply of high- quality sovereign Sukuk. While Sukuk, or Shariah-compliant bonds, have been around for a long time, investor access to high-quality sovereign Sukuk from the Gulf region has been limited. But that is changing.

Saudi Arabia, the largest economy in the Gulf and home to an ambitious national transformation agenda under Vision 2030, is rapidly becoming a more accessible and relevant player in global debt capital markets. Premia BOCHK Saudi Arabia Government Sukuk ETF, which tracks the iBoxx Tadawul Government & Agencies Sukuk Index, aims to offer investors a convenient and efficient way to tap into this evolving opportunity.

Unlocking similar time-zone access to investment grade government Sukuk for Asian allocators. Asia is home to a significant and growing population of Islamic investors. Yet the region remains underserved in Shariah-compliant fixed income products. Even beyond religious considerations, investment grade government Sukuk are gaining attention for their potential to enhance portfolios through diversification, currency stability, and solid risk-adjusted returns.

While there has been increasing interest from international allocators, access to the Saudi government Sukuk market has not been so straightforward in the past – until the debut of the Premia BOCHK Saudi Arabia Government Sukuk ETF, as globally the first Saudi government Sukuk and pure investment grade government Sukuk ETF listed outside the Kingdom, and a first in Asia.

Key reforms by Saudi Arabia’s National Debt Management Center (NDMC) and the Tadawul exchange have improved the transparency, liquidity and accessibility of Sukuk. The launch of this ETF is timely, given the favourable developments in Saudi Arabia across multiple fronts, including policy, infrastructure and macroeconomics.

Credit ratings upgrades are testimony to the big improvements in macroeconomic fundamentals underpinning Saudi Arabia government bonds. Saudi Arabia has enjoyed recent upgrades in its sovereign credit ratings from major global agencies, reflecting its progress in economic diversification and fiscal management. Moody’s upgraded Saudi Arabia’s rating to Aa3 with a stable outlook on November 22, 2024. S&P Global Ratings raised the long-term sovereign credit rating to A+ from A on March 14, 2025, and Fitch has affirmed its A+ rating with stable outlook. The agencies cited factors such as stable fiscal performance, healthy foreign reserves, and improved revenue diversification.

Looking ahead, S&P Global Rating’s recent upgrade of Saudi Arabia’s credit rating reflects confidence in the country’s economic fundamentals despite the headwind in the oil price and a higher fiscal breakeven. S&P’s analysis underscores that, although the price of oil is still significant, it is the long-term trajectory of the market and the government’s reform momentum that truly matters.

Beyond strong fiscal buffers, economic diversification, and a conservative debt profile, the Saudi Arabia government’s demonstrated ability to adjust spending and raise non-oil revenues demonstrates crucial policy flexibility.

Vision 2030: The strategic plan that is rapidly transforming Saudi Arabia from oil dominance to global integration. Key to Saudi Arabia’s transformation over the past decade has been its Vision 2030 strategic initiative to diversify the Kingdom’s economy away from oil. Saudi Arabia has lifted non-oil exports by 113% between 2016 and 2024. Over the same period, non-oil revenues rose from 27% of total government revenue to 40%. The improved credit ratings reflect increased investor confidence in the Kingdom’s economic trajectory.

HRH Crown Prince Mohammed bin Salman famously said in a 2023 interview that “the greatest success story of the 21st century, is Saudi Arabia”. And Vision 2030, which encompasses those transformative reforms, is a national reinvention initiative that is taking the Kingdom from its well-known oil dominance to accelerated and comprehensive integration with the world.

Under its Vision 2030 initiative, the country is actively diversifying its economy, investing in capital markets infrastructure and connectivity, tourism and hospitality, healthcare, technology, infrastructure, logistics, green energy and more. While a lot of media attention had been directed towards the high-profile NEOM project—including The Line, a futuristic smart city, and Trojena, a year-round ski resort in the desert – the Vision 2030 initiative is much more multi-faceted. The transformational reforms encompass far reaching and impactful developments across a wide range of strategic sectors, and provide the bedrock for the economic, social and cultural transformations that are powering and shaping the Kingdom’s future

Youth-driven AI Push and Entrepreneurship. Over 70% of the population in the Kingdom is under the age of 35. This is a globally connected, tech-savvy cohort. They are ready to engage in 21st-century cultural conversations and exhibit a strong entrepreneurial spirit. 90% of the adult population believe there are good business opportunities, and 86% feel capable of start-ups, according to a GEM KSA report. This has rapidly transformed Saudi Arabia into the MENA region's largest and most-funded startup ecosystem in just five years, driven by investor confidence, available late-stage capital, and government initiatives.

The nation's USD 100 billion AI initiative, Project Transcendence, backed by the Public Investment Fund, fosters partnerships with established tech companies to boost AI infrastructure and start-ups. The newly-launched AI company, Humain, is at the centre of Saudi Arabia’s efforts to become a global AI hub. Recently, the company announced a partnership with NVIDIA, which develops special computer chips known as graphic processing units – or GPUs – for AI. NVIDIA will support the creation of AI data centres in Saudi Arabia by exporting “several hundred thousand” of its most advanced GPUs over the next five years. Humain will also deploy an AI platform developed by NVIDIA to enable industries to create digital twins, virtual replicas of physical environments that aim to enhance efficiency and sustainability.

Alongside its partnership with Nvidia, Humain also announced a new US$5 billion partnership with Amazon Web Services. This will help build a suite of AI infrastructure in Saudi Arabia.

Women’s empowerment and sports for inclusion. Women’s empowerment is also an important milestone that has transformed the economy. In fact, the women labour force participation rate has increased dramatically, reaching 33.5% in Q3 2024, up from 22.8% in 2016 and achieving the original 2030 target of 30% a decade early, prompting a revision to a more ambitious 40% target. The percentage of Saudi women in middle and senior management roles has increased dramatically from 21% in 2017 to 44% in 2024.

Through Vision 2030, women’s participation in sports grew by more than 150%, now just 2% behind men. Last year, the Saudi national women's football team entered the FIFA World Rankings for the first time, demonstrating the sport's rising popularity among women. The nation will further showcase its rich sporting heritage and world-class infrastructure by hosting the FIFA World Cup 2034.

Investing in infrastructure and hospitality. Saudi Arabia has become one of the fastest-growing destinations in the world, attracting 30 million international visitors last year. It hosts many mega industry events and marquee international events. They include sports tournaments and organisational and industry summits such as the FII Summit, Leap Conference, Formula 1 Saudi Arabian Grand Prix, WTT Saudi Grand Slam, and WTA Finals. It will also be hosting the inaugural Olympic Esports Games, ATP Next Gen Finals, the Saudi Snooker Championship, the 2025 Asian Indoor and Martial Arts Games in Riyadh, the 19th AFC Asian Cup in 2027, the 2029 Asian Winter Games and 2034 FIFA World Cup, among many others.

With 255 tourism infrastructure projects valued at USD 1.7 trillion, the kingdom is on track to meet its Vision 2030 goal of 150 million visitors annually. The tourism sector, which contributed more than 10% to Saudi Arabia’s GDP, has surpassed its 2030 target seven years ahead of schedule.

The Riyadh Metro launch is one of the world’s largest urban transit projects, with 6 Lines and 85 stations running through a total length of 176 km, with a daily capacity of 3.6 million passengers.

Positioning itself as a hub for artificial intelligence and digital infrastructure, Saudi Arabia is also embedding AI into urban development. AI is also being deployed to streamline traffic systems and enhance energy efficiency.

Major Reforms underway for the Kingdom’s Debt Capital Markets. The NDMC (National Debt Management Center), Edaa (Securities Depository Center Company), Euroclear, and Tadawul (Saudi Exchange) have been involved in reforms and advancements within the Saudi Arabian debt market, and have been working together to enhance the market's infrastructure, accessibility, and international integration, particularly for debt instruments like Sukuk and bonds.

For instance, Edaa recently launched OTC (over-the-counter) settlement for listed debt instruments using the Delivery versus Payment (DvP) mechanism. Meanwhile, Euroclear has established a post-trade link with Edaa to enable international investors to participate in the Saudi debt market. This link facilitates access to Saudi debt instruments and allows direct settlement with Euroclear Bank.

On its part, Tadawul has been supporting diversification of the economy by facilitating IPOs, attracting international investors and building connectivity with global markets. It has been engaged in many new launches and market reforms to integrate with international conventions and industry standards. Last year saw a flurry of non-oil company share sales, from F&B startups to commercial and healthcare services companies, diversifying a stock market traditionally dominated by banks and petrochemicals. This shift is also reflected in a changing business entity profile, where private firms are actively joining the IPO pipeline alongside state-owned entities.

Today, the Tadawul is already the largest stock exchange in the Middle East, and the 9th largest stock market among the 67 members of the World Federation of Exchanges and is the dominant market in the Gulf Cooperation Council (GCC). It is also an affiliate member of the International Organization of Securities Commissions (IOSCO), the World Federation of Exchanges (WFE), and the Arab Federation of Exchanges (AFE).

Foreign ownership in stocks listed on the Saudi Exchange has been on the rise over the past five years, with the value of holdings climbing from US$42 billion in 2020 to approximately US$90 billion in 2024. Bolstered by a gradual opening of regulatory regimes to foreign investors, Tadawul has seen a rise in qualified foreign investors (QFI), with the number reaching 4,200 since the program launched in 2015.

The National Debt Management Centre (NDMC), which is responsible for managing the government's debt, including Sukuk issuances, has enhanced its monthly issuance programme to create an on-the-run cohort, supported by enhanced facilitation through designated primary dealers with improved liquidity. To attract more international investment, the NDMC is also launching new rules to streamline licensing, eliminate prior approvals, and significantly reduce paperwork and bureaucratic hurdles.

All these developments have enhanced the Kingdom’s credibility in international capital markets.

A Capital Market in Ascendancy. The IMF is expecting Saudi Arabia’s real GDP to grow 3% in 2025 and 3.7% in 2026, outpacing the global average of 2.8% and 3.0% over those two years. Inflation is forecast to remain subdued at just over 2%, while the government’s fiscal deficit is expected to remain modest despite elevated infrastructure spending.

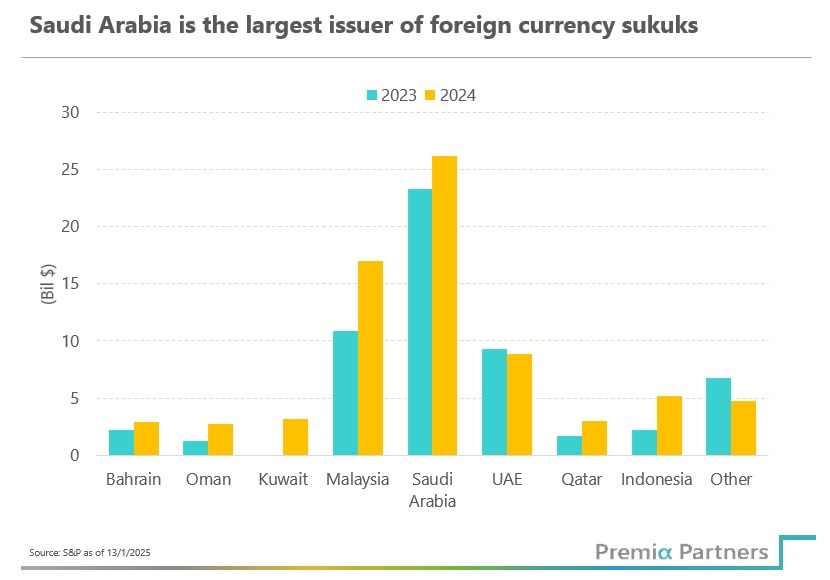

Meanwhile, Saudi Arabia has rapidly ascended to become a heavyweight in global debt markets. In 2024, it surpassed both China and South Korea to become the largest USD-denominated debt issuer among emerging markets, raising USD 73.1 billion. It also now leads the global foreign currency Sukuk market, outpacing Malaysia, the UAE and Indonesia.

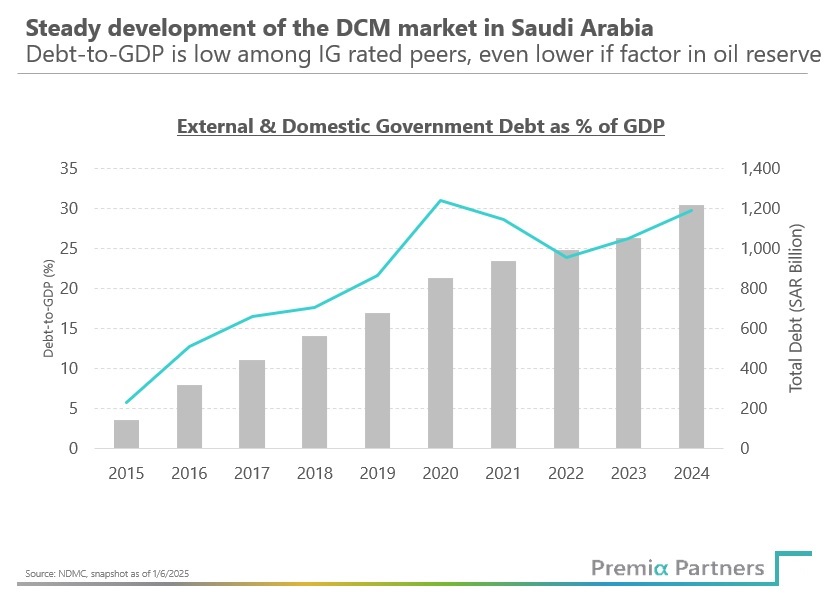

Total outstanding KSA government Sukuk has tripled since early 2020, driven by growing institutional demand and broader confidence in the Kingdom’s fiscal trajectory. The surge in issuance has not dampened investor appetite. Instead, it has helped foster a deeper and more liquid secondary market.

Rising international demand for diversification away from Developed Market government debt positions Saudi Arabia Government Sukuk well as emerging staple allocation tool. Saudi Arabia’s credit ratings upgrades are in stark contrast to Moody’s recent downgrade of the US sovereign credit rating to Aa1, citing rising debt levels and growing interest burdens. Moody’s was only the latest to downgrade the US, following earlier downgrades by S&P and Fitch. The combination of the downgrade, rapidly rising US government deficits and debt, the inflationary risk from higher tariffs, and the rising term premia have created uncertainties. As a result, demand for alternatives to US Treasuries is growing, particularly in Asia.

Attractive source of uncorrelated return, stable income and attractive yield. In fact, beyond sound macroeconomic fundamentals, the Saudi Government Sukuk ETF offers valuable portfolio construction benefits. Sukuk demonstrates low correlation with both equities and other fixed income instruments. The correlation between Saudi government sukuk and broader emerging market bonds is just 0.21. Against US Treasuries, the figure stands at 0.39.

This low correlation is particularly important at a time of increasing policy unpredictability in the West, including shifting tariff regimes in the US.

Yield pickup without compromising quality. Yields on Saudi government Sukuk currently exceed comparable US Treasuries by 70 to 110 basis points. Testimony to the government’s fiscal prudence, Saudi Arabia has a low debt to GDP by the standards of its IG peers. At year-end 2024, Saudi public debt stood at SAR 1.19 trillion—30% of GDP—well below global norms, giving it ample room to manoeuvre fiscally while maintaining investor confidence.

In this context, Saudi Arabia’s government debt to GDP ratio of 30% compares very well against that for the US government which has a figure of 124% and rising, although the US enjoys a higher credit rating at Moody’s Aa1. While Japan is only one notch lower than Saudi Arabia on Moody’s credit rating scale at A1, its government debt stands at 237% of GDP.

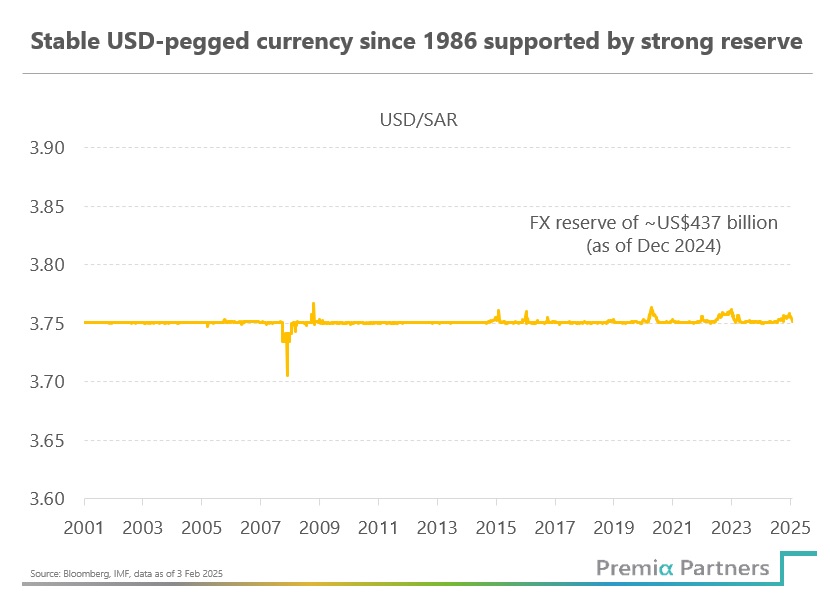

Note also that because of the longstanding SAR peg to the US Dollar, SAR denominated sukuk are not encumbered by the currency volatility of other local currency Emerging Market bonds.

Comparing spreads in the hard currency space – using JP Morgan EMBI data – Saudi Arabia hard currency bonds offer higher spreads to worst (against US Treasury) than many other emerging market bonds with lower credit ratings and greater duration risk. This is another example of the bond market apparently not fully pricing in the quality of Saudi Arabian government bonds.

Currency Predictability. Importantly, local currency Saudi government sukuk securities benefit from the SAR’s longstanding peg to the US Dollar at 3.75—a monetary anchor that has held firm since 1986, supported by over USD 400 billion in foreign reserves. So, it is not burdened by the currency volatility usually associated with EM local currency bonds.

For USD-based investors, this offers currency predictability and minimal foreign exchange risk, while the Kingdom’s low inflation and prudent fiscal policy further enhance its appeal.

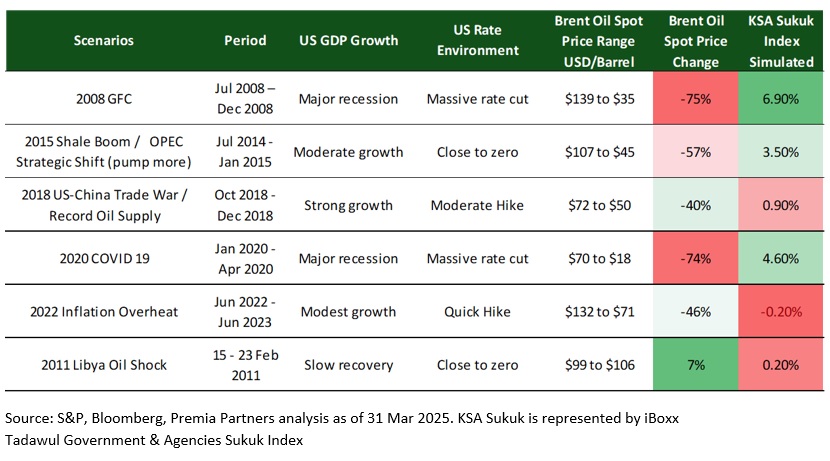

Resilience of Saudi Arabia government Sukuk through cycles. Simulated historical analysis reveals the robustness of Saudi Arabia’s Sukuk market during oil price volatility. In simulations of past oil shocks – such as the 2008 Global Financial Crisis and the 2020 COVID pandemic-driven and collapse – the index underlying the ETF consistently demonstrated resilience during these events. This stability under pressure highlights the robustness of Saudi Arabia’s Sukuk market.

Index inclusion. More passive flows are anticipated for Saudi Arabia Sukuk in tandem with their index inclusion trajectory. In 2022, S&P iBoxx and FTSE Russell added Saudi Arabia government Sukuk to their widely followed local currency Emerging Markets government bond indices. FTSE Rusell’s Emerging Markets Government Bond Index (EMGBI) added Saudi Arabia Sukuk with a weight of 2.75%. S&P iBoxx added Saudi Arabia Sukuk to its Global Emerging Markets Local Currency Bond Index at 2.20% weight.

Additionally, Bloomberg and JP Morgan have placed Saudi Arabia’s SAR-denominated government Sukuk on their watchlist for potential inclusion in the Bloomberg Emerging Market Local Currency Government Index (EMLCTRUU) and JP Morgan Government Bond Index-Emerging Markets (GBI-EM). The pro-forma estimated weight for Saudi Arabia’s exposure is 5% and 5.46%, respectively.

Saudi Arabia is collaborating closely with global partners to address feedback from index providers, focusing on rapidly improving market infrastructure and secondary market liquidity. This includes a comprehensive primary dealer network with banks such as Goldman Sachs, JP Morgan and HSBC. Moreover, there is an increasing number of index providers, such as S&P/iBoxx creating dedicated indices which include Saudia Arabia’s SAR-denominated and USD-denominated Sukuk. This development is expected to enhance market accessibility and secondary market liquidity, which are key considerations for both global and regional index inclusion.

Meanwhile, as JP Morgan has moved Qatar and Kuwait to Developed Markets, Saudi Arabia is well on track to become the highest-rated sovereign issuer remaining within the emerging market index. This shift would enhance its role as a quality anchor within the emerging market hard currency debt universe. As international investors gain confidence in Saudi Arabia's sovereign credit rating and its growing role in the global bond landscape, it is likely to attract more capital. Increased demand will improve liquidity and pricing for these sukuk.

The Case for Allocation. In an investment climate marked by rising interest rate uncertainty, changing global power dynamics, and elevated equity market valuations, Premia BOCHK Saudi Arabia Government Sukuk ETF provides a rare combination of yield, safety, and diversification. For yield-seeking investors, this is not just about religion or geography, it’s about opportunity.

Efficient access through a one-ticker trade: Premia BOCHK Saudi Arabia Government Sukuk ETF. As Asia’s first ETF that focuses on investment grade government Sukuk, the Premia BOCHK Saudi Arabia Government Sukuk ETF is now listed on the Hong Kong Stock Exchange with two trading counters: HKD (3478) and USD (9478). It is also globally the first Saudi Arabia government sukuk ETF listed outside the Kingdom, providing the unique and convenient access for international investors.

It is a particularly timely tool for investors looking for pure investment grade sukuk allocation tools to rotate to from concentration in other investment grade fixed income space that may be subject to more heightened risks of market volatility and credit rating migration.

With total expense ratio of only 0.35% per annum — it is also among the most cost efficient tool globally for similar offerings.

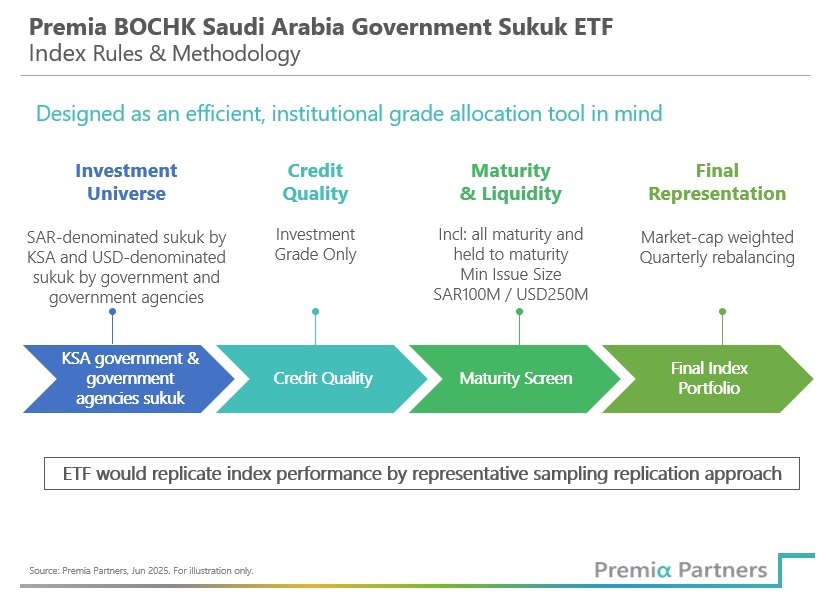

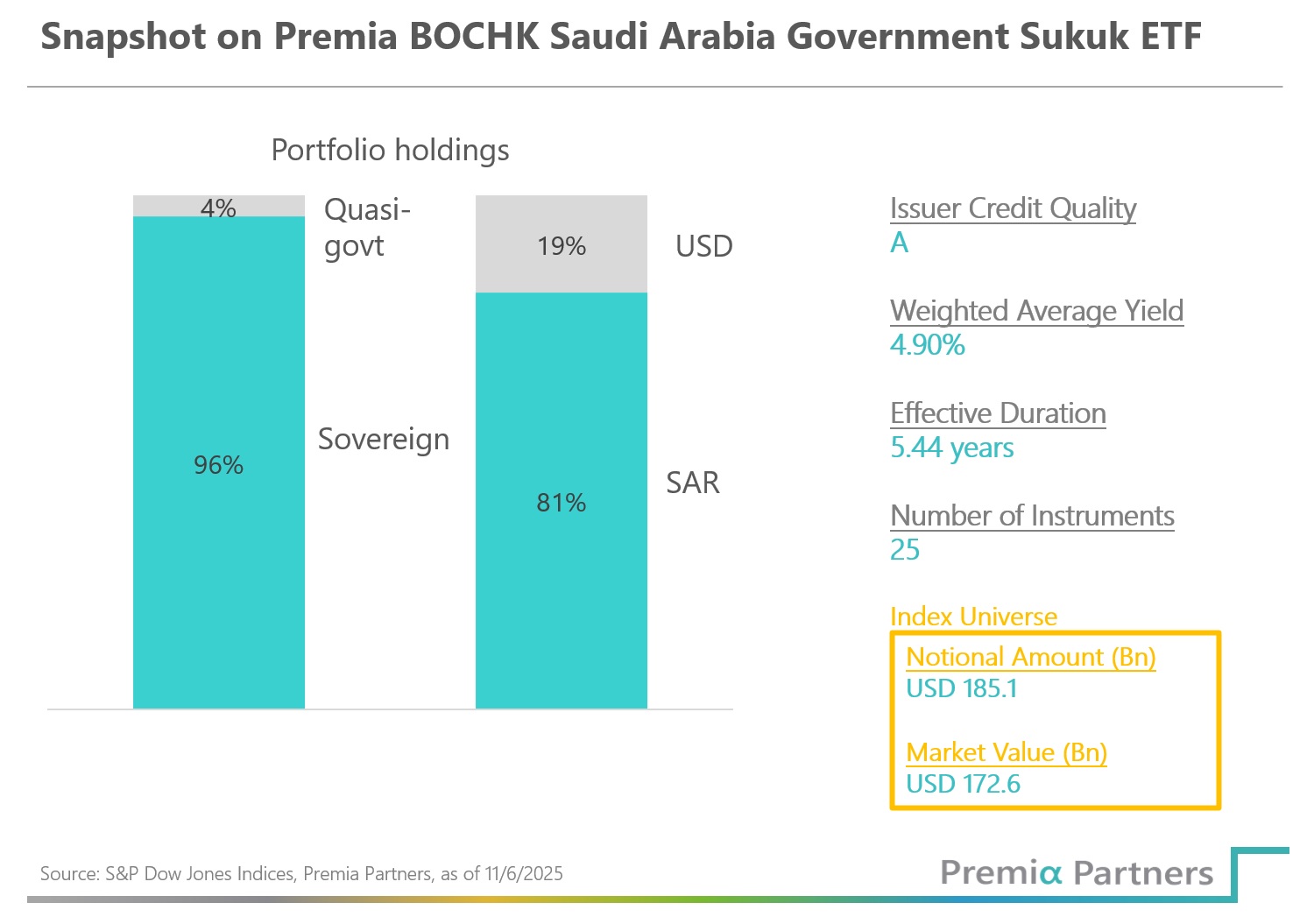

Index methodology and strategy profile. The ETF tracks the iBoxx Tadawul Government & Agencies Sukuk Index, which represents a diversified universe of Sukuk issued by the Saudi government. This includes SAR-denominated Sukuk from the government and USD-denominated Sukuk from both government and quasi-government entities, such as the Public Investment Fund (PIF).

To be included in the index, the Sukuk must be investment grade and have a minimum notional amount of SAR 100 million or USD 250 million. There is no minimum maturity requirement, and all Sukuk are held to maturity. The index is market-cap weighted and rebalanced quarterly to reflect market developments.

Effective duration of the basket would be below 6 years, as the underlying index comprises mostly short to mid-duration bonds, with maturities between 1 to 10 years. This duration spectrum is comparable to intermediate US Treasury benchmarks but with better yield and volatility characteristics.

Performance wise, the iBoxx Tadawul Government & Agencies Sukuk Index has outpaced US Treasury indices on a risk-adjusted basis over one, three and five-year periods, with lower volatility—a key metric for institutional and retail investors alike.

An allocation tool that unlocks liquidity and supports the virtuous cycle for the Kingdom’s debt capital market development. Roughly 80% of the index is invested in SAR-denominated Saudi government sukuk, with the remaining 20% in USD issues. The index also includes a small allocation (~4%) to quasi-sovereign issuers such as the Kingdom’s sovereign fund - the Public Investment Fund (PIF). This cohort historically has exhibited superior stability among the government sukuk peers, and constitutes the majority of the Saudi Arabia government debt issuance historically.

As the Kingdom’s debt capital market reforms and extension of connectivity with international ecosystem continues, this in particular is also expected to benefit significantly from improving liquidity, broadening and deepening of the investor community domestically and abroad, as well as index inclusion of the Kingdom’s local currency debt in mainstream emerging markets and global indices – meanwhile this ETF would also provide virtuous feedback loop in this journey, through facilitating the broadening and deepening of a more diverse international investor base including Asia, which in turn would enhance and unlock liquidity for the SAR government sukuk as well.

For Asian and international allocators looking for diversification tool, and wish to build exposure to this attractive space in the emerging market cohort, access is now a very simple one-ticker trade on HKEx – without the need to open new accounts!

The ETF also enjoys the benefits of HKEx listed fixed income ETFs: including waiver for stamp duty, HKEx trading tariff and the minimum stock settlement fee. There is also no withholding, capital gains, dividend nor estate tax for HKEx listed ETFs.

In addition to fostering connectivity and facilitating flows between the Hong Kong and Saudi Arabia capital markets at this important juncture when availability of relevant tools is particularly important, for us it is also a very special project that aligns with the philosophy we have always believe in – to build institutional grade, efficient building blocks for investors and allocators to solve their pain points in accessing investment opportunities.

Amid the current market environment, what the late Nobel laureate and father of modern portfolio theory Harry Markowitz said has never been more true – “diversification is the only free lunch in investing”.

At Premia Partners it is our goal to build an ETF platform that add value to investors through consistency, thoughtfulness, respect and be mindful of investor needs as we build the ETF products and their features catering to relevant use cases. It is thus very important for us that we partner with you in this journey. This is what the word “Partners” in Premia Partners is really referring to.

We hope this would be a useful tool relevant for your allocation needs, and would very much welcome your support and insights. We would love to discuss more together, and if there is anything we can assist, please do let us know!