The Chinese Government’s encouragement of consumer spending – started in 2024 – may have been a factor behind the late year rise in spending. A recent State Council executive meeting, presided over by Premier Li Qiang, outlined further policy support for domestic consumption. A statement issued after the meeting called for “strong support to increase household incomes, promote reasonable wage growth, broaden property-related income channels, and enhance consumption capacities.” The meeting “emphasized the importance of focusing on consumption sectors with a strong spillover effect and large growth potential to tap into consumption potential.”

China’s consumer spending growth has been better than the gloomy media portrayals suggested. The negative media portrayal of consumer spending in China misrepresents the state of the economy and obscures the underlying investment opportunities amidst changing patterns of consumerism. The narrative of “sluggish” consumer spending in China is misleading on three fronts. Generally, the reports: 1) Focus on recent headline retail sales growth figures compared to higher historical growth, without mentioning that the recent growth rates have been higher than US figures which have by contrast been touted as strong; 2) ignore important shifts in consumption patterns beneath the headline growth figures, which provide a more nuanced picture of where business and investment opportunities may lie; 3) overlook a larger story – that a significant portion of China’s consumption is likely understated as a result of methodological differences between the way China measures consumption versus the West.

By comparison, the “weak” retail spending growth in China has actually been higher than that in the US. Yes, China’s retail sales growth slowed to 3.5% in 2024, down from 7.2% in 2023. However, to put that in perspective, the comparable US retail sales growth figure (including food services) for 2024 over 2023 was estimated by the US Census Bureau at only 2.6%.

Of course, the US had an overall higher rate of growth in retail spending from 2021 to 2024, because it never had a nationwide “stay-at-home” policy during the pandemic. The various states/territories pursued their own policies, and restrictions were generally lifted by the end of 2020. China only started reopening in early 2023.

Since reopening, comparing total retail sales in 2024 to that for 2022, the CAGR for China’s retail sales was 5.3%. Over that same period, the CAGR for US retail sales was 3.1%.

Yes, there are subtleties and complexities in these comparisons which can be argued over for hours. But the point here is simply that, for starters, China’s retail sales growth is not as bad as the media has made it out to be.

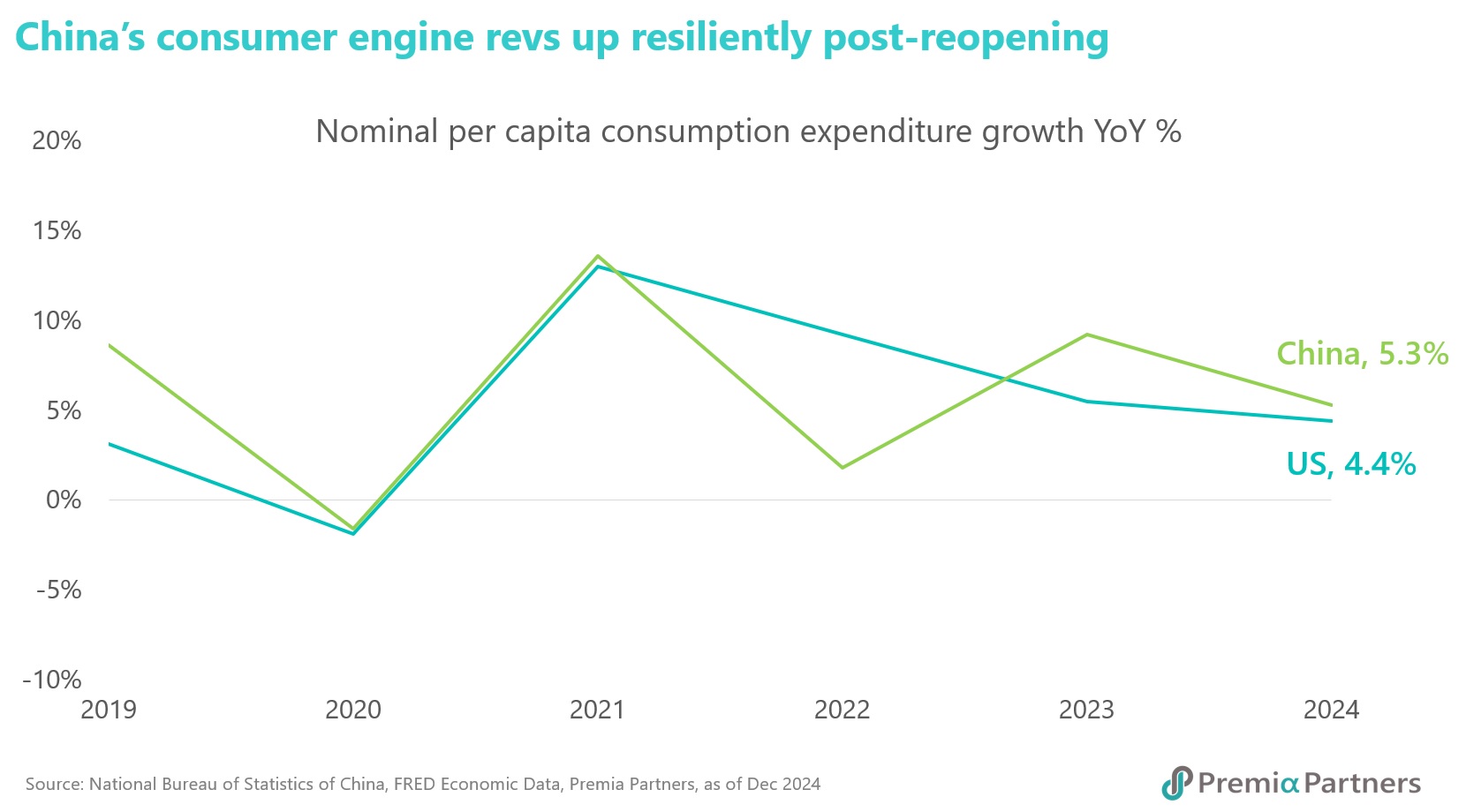

China’s per capita consumer spending growth for 2024 was also higher than that of the US. US per capita personal consumption expenditures grew 1.8% in real terms (inflation adjusted) in 2024 over 2023. In China, per capita consumer spending – which is broader than retail sales – grew 5.1% in real terms in 2024 over 2023. This was in line with disposable income growth of also 5.1%. Unadjusted for inflation, the per capita consumer spending growth rate for China was 5.3%. Despite higher inflation in the US, the nominal per capita personal consumption expenditures growth rate in the US was still lower, at 4.4% for 2024. (Note that in China, retail sales cover goods including F&B. Consumer spending is a broader category, covering goods and services.)

The impression presented that Chinese consumer demand is too weakened to recover to the pre-pandemic level is also misleading. It is true that the headline growth rate of retail sales has not recovered to the pre-pandemic levels of 7%-8% per annum – but it is growing nonetheless from now a very large base. In fact, the size of the retail market has increased from CNY 41.2 trillion in 2019 to CNY 48.8 trillion in 2024. With the post-pandemic reopening, retail sales CAGR from 2022 to 2024 was 5.3%.

So what really happened? It’s a sea change in the consumer behaviours post-covid that also shifted the consumption basket and utility curves for Chinese consumers.

At the high level, opportunities in Chinese consumer spending have shifted to become much more online retail oriented post COVID.

Value for money and intelligence tax - there was 7.2% year-on-year growth in online retail sales last year. That was accompanied by a 21% surge in postal and express delivery volume. An important part of that trend towards online retail is the rapid and convenient “price discovery” that allows consumers to obtain information on prices, quality and value attributes of different products and vendors at their finger tips 24/7 online and from social media across most retail categories – such that there is almost nowhere to hide for those providing commoditized products and services and necessitate very diligent differentiation and innovation by providers to stay competitive. In fact, most Chinese buyers these days would check out in Xiaohongshu (Little Red Note) or other social media platforms for reviews before making purchases these days. It is no longer just for saving money, but rather seeking “value for money” and to avoid overpaying “intelligence tax” have become prevalent beliefs. Indeed why pay 3x if something costs a fraction of the price somewhere else.

Instant gratification - in the same vein, under this hyper-competitive e-commerce landscape, next-day interprovincial delivery is the norm, and 24-hour same-city service is outdated. Speed is paramount; retailers are now delivering nearly instantaneously. Supermarket chains like Walmart, Sam's Club, and Freshippo offer 30-minute to 1-hour same-city delivery, and Sam's Club even pioneers half-day cross-border delivery from Shenzhen to Hong Kong.

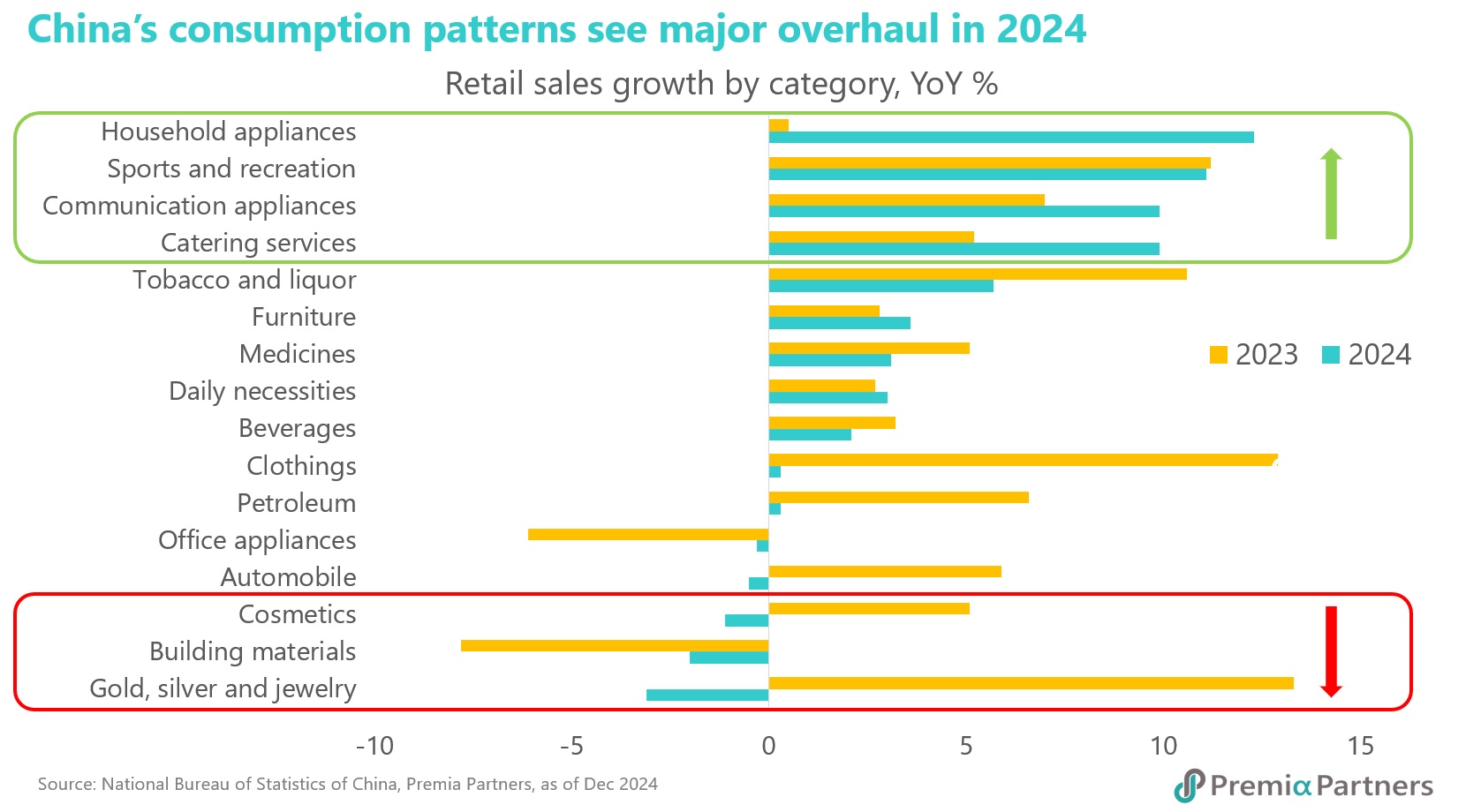

So, this is the new normal in Chinese consumption. Consumers now prioritize quality, value and practicality, benefiting from fee-free delivery on e-commerce and chain store purchases, and enjoying post-purchase price protection. This 'new normal' extends beyond staples, with near double-digit growth in demand for essential discretionary items—sportswear, communication devices and home appliances. It is not just about having stuff; it's about having good stuff and a good life.

YOLO (You only live once) and the services and lifestyle spending boom. Looking at the 2024 numbers, service sales jumped 6.2% year-on-year, a solid 3% ahead of goods sales. Diving into the drivers, transportation and communication services are blowing up, with double-digit growth. Basically, people are all about experiences and living their best lives. They are more inclined to invest in quality-of-life improvements, such as dining, travel and leisure activities.

18% surge in domestic tourism and 50% growth in live concerts. Spending on travel and entertainment has also witnessed a significant uptick, driven by young Chinese consumers. In the first three quarters of 2024, domestic tourism spending reached CNY 4.35 trillion, up 18% year-on-year. Live entertainment is also seeing explosive growth, with stand-up comedy shows and concerts up 53% and 50%, respectively, compared to 2023.

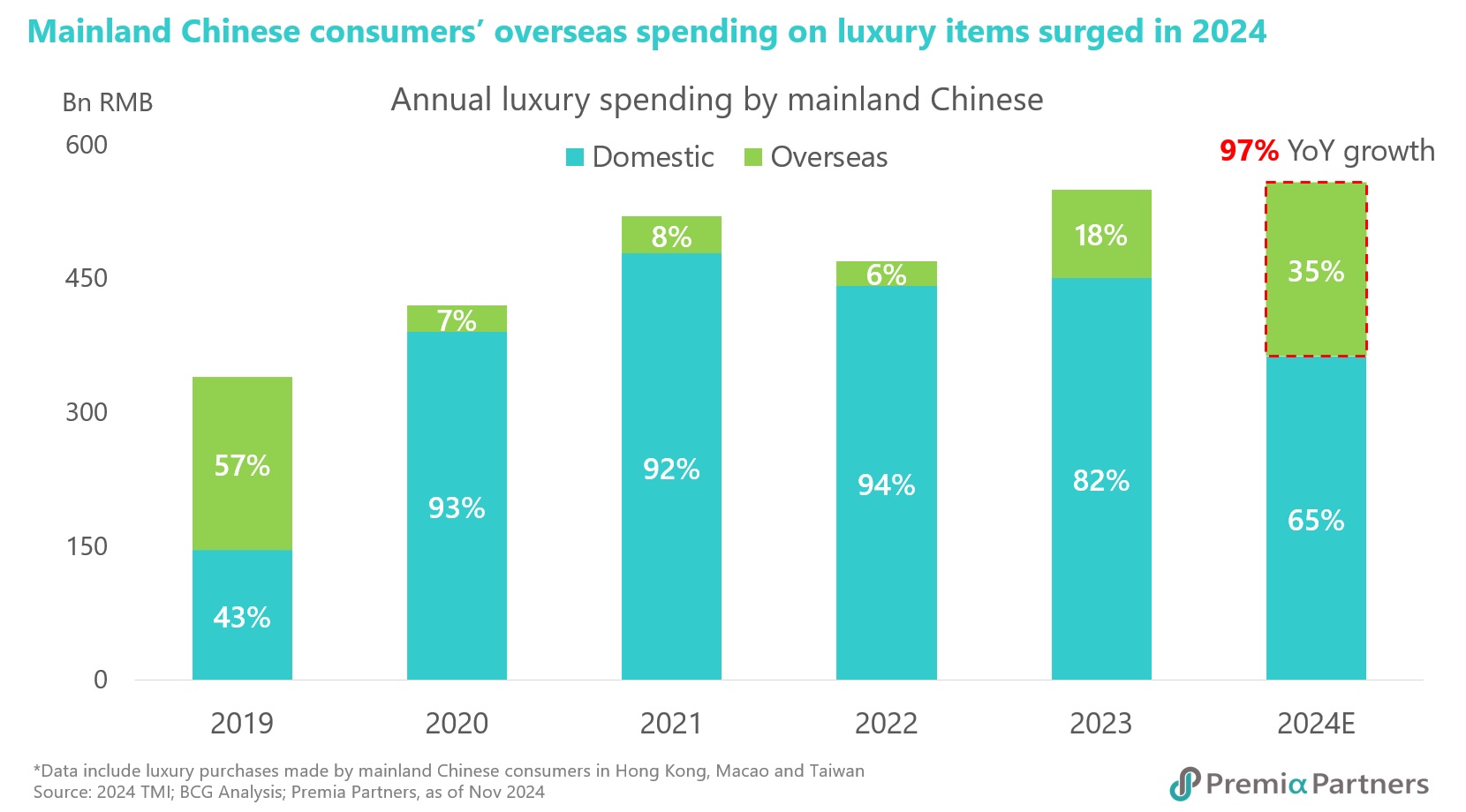

Luxury spending contracted in 2024 – but it is a much more nuanced phenomenon that consumption downgrade does not explain it. Bain & Co estimated that the luxury goods market in China fell 18%-20% in 2024 over 2023. This is a volatile market. Note that Bain & Co estimated it grew by 12% in 2023 over 2022. Part of that would have been due to the resumption of outbound tourism in 2023, gaining momentum into 2024, with industry estimates pointing to a stunning figure of 60% year-on-year growth in outbound tourism in 2024. That means a surge in the leakage of luxury goods sales overseas. Indeed, BCG Consulting estimated that overseas spending on luxury goods by Chinese consumers skyrocketed by 97% last year.

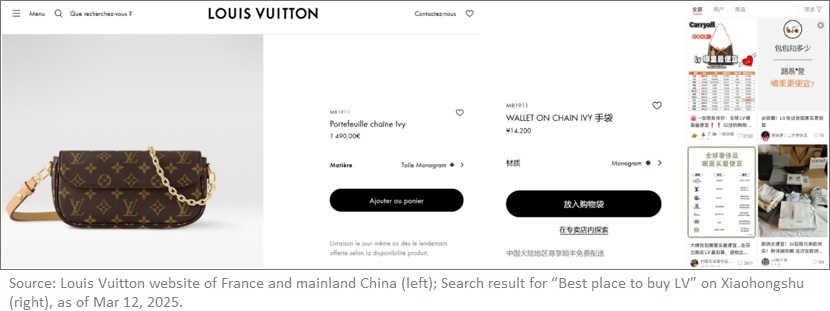

Chinese consumers are astute spenders. If the savings from buying luxury goods overseas could potentially cover a round-trip flight, why not take the opportunity for a leisure tour and kill two birds with one stone? For instance, a Louis Vuitton Ivy bag costs EUR 1,490 in Europe versus RMB 14,200 (approximately EUR 1,790) in China—a 20.1% markup, excluding the 10-15% tourist tax refund. When considering a 30% price difference on multiple luxury items, the savings become significant enough to fully finance their travel. Consequently, savvy shoppers who can travel frequently purchase luxury items abroad, while those who cannot turn to the second-hand market for more affordable options. These days there are so many Xiaohongshu KOLs (key opinion leaders) who help people scrutinize and strategize ways to make the most out of every penny, everyone can potentially become a savvy shopper.

Mindset shifts and rise in sales of second-hand luxury goods as young consumers increasingly accept pre-owned goods for value and environmental awareness. As part of that shift, there has been a surge in second-hand luxury goods sales. Chinese consumers, especially those in the 15-45 age group (which accounts for half of China’s population), are drawn to the value proposition of second-hand luxury goods, viewing them as a cost-effective and environmentally conscious way to access premium products.

Growing popularity of minimalism and concepts from Japanese organizing consultant Marie Kondo, have also driven young consumers’ mindset shift, and they are happy to possess the luxury goods for only the finite period of time before switching to another, rather than hoarding every piece of luxury bags and forming ever growing clusters at home. According to Market Monitor data, the size of the second-hand luxury goods market reached CNY 26 billion in 2023, with a year-on-year growth rate of 14%. In the first half of 2024 alone, the market generated CNY 14.5 billion in revenue, and it is projected to exceed CNY 29.7 billion for the entire year.

This is not a peculiarly Chinese phenomenon. For example, there has been a similar boom in the second-hand luxury goods market in Japan, with JapanToday citing “A-list celebrities…..spotted in the country shopping for vintage luxury goods — Kim Kardashian, Jennifer Lopez, Hailey Bieber, Megan Thee Stallion and David Beckham, just to name a few.”

Show me the value – Chinese consumers have become more discerning. This growing discernment means a trend from “luxury” goods to “quality” goods – brands increasingly need to justify their brand value with fundamental qualities to resonate with Chinese consumers that have grown in sophistication and pickiness due to availability of ever expanding cohorts of domestic and international brands across wide-ranging price and quality spectrum. For example, in 2024, Ralph Lauren expanded its presence in China with around 30 new stores, while Amer Sports, the parent company of high-end sportswear brand Arc'teryx, saw its revenue in China surge by 52% in the first half of the year as it quickly became the brand of choice among avid sports fans looking for high performance apparel. Similarly, while Adidas lost market share, Lululemon reported a 39% increase in revenue in mainland China during the first half of 2024 as it successfully established itself as the preferred fashion brand among not only yogis but fashion design-minded young consumers.

Premiumization has shown continued strength in the cosmetics segment. There is an evident trend in China's beauty market where premiumization, particularly within the ultra-premium tier, remains robust despite retail sales data indicating a decline amid a broader trend of rationalized spending. A Goldman Sachs' report indicates a US$33 billion premium market in 2024, maintaining a 47% share of the total beauty market—a level comparable to mature markets South Korea and Japan, and sustained throughout the pandemic. The resilience of the ultra-premium segment, with a 4% CAGR from 2021 to 2023, contrasts sharply with the mass market's -3% CAGR, demonstrating a nuanced market where established consumers maintain spending, and lower-tier cities offer future potential for premium brand expansion.

Growing pride in cultural identity. There has also been a trend among Chinese consumers towards cultural pride – with more spending on, for example, fashion wear that features traditional elements of China’s cultural identity. This is particularly evident in the rising popularity of Hanfu (汉服) and Song Jin (宋锦), new Chinese-style clothings that have captured the hearts of young consumers since the 2020s. The allure lies in their premium textiles–think satins, feathers, and silks – which beautifully showcase traditional Chinese aesthetics while remaining adaptable for contemporary events, including gatherings, weddings and professional wear.

After the phenomenal success of China’s first AAA game “Black Myth: WuKong” that topped the Steam charts with all time highest concurrent player count of 37 million, China’s recent animated blockbluster "Ne Zha 2" is another great example.

During the Spring Festival period, it grossed a staggering US$1 billion out of a total box office of US$1.3 billion. Chinese moviegoers lauded the film, celebrating its being an entirely Chinese production, coming a long way from initial rejections from overseas workshops, to overcoming by rallying together 138 domestic animation companies across China, and putting together over 1,900 special effects shots over five years - it is a respected piece of art and testimonial of how industry collaborations came to become a well-established ecosystem in China. The film's visual artistry masterfully blends traditional Chinese aesthetics—think Dunhuang murals and ink painting—with cutting-edge animation technology. Moreover, the courage and “never give up, fighting spirit”, friendship and honour, and familial love resonated deeply with audiences, tapping into core aspects of Chinese traditional moral values and cultural heritage.

For investors and businesses, both the growth rate and the absolute size of the market matter. So, despite the disruption of the pandemic, in the period 2019-2024, the value of China’s retail market, on the average USDCNY exchange rates of the relevant years, grew by around the entire GDP of Poland. If we assume the recent CAGR of 5.3% continues over the next ten years, the increment in the Chinese retail market would, on the current exchange rate, be around US$4.6 trillion.

Consider also that international comparisons may have undervalued China’s household consumption as a percentage of GDP. The often- repeated line that China’s household consumption lags the West at 38% of GDP is likely wrong because of differences in calculations and methodologies. As we explained in this insight, adjusting for these differences, China’s household consumption could be higher by another 10% of GDP.

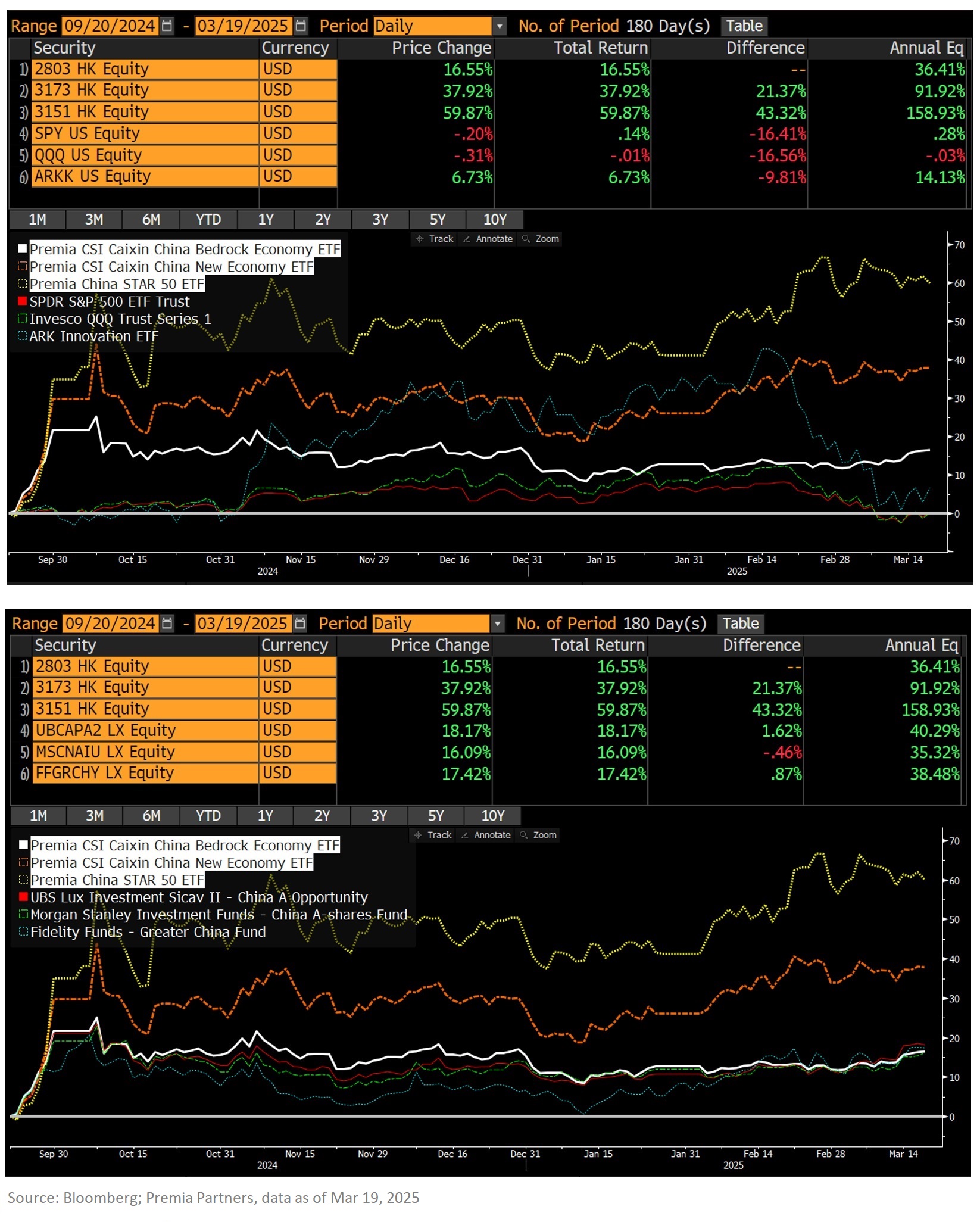

The recent TikTok refugee migration to Xiaohongshu (Little Red Notes) might have provided the international community already a glimpse of these exciting developments in Chinese consumerism and the world of wide ranging, affordable goodies in contrast to sticky inflation situation in many countries. Meanwhile for investors interested in increasing exposure to China’s emerging industries and segments, Premia China New Economy ETF (3173 HK/9173 HK), Premia China Bedrock Economy ETF (2803 HK/9803 HK), and Premia China STAR50 ETF (3151 HK/ 9151 HK) with their 14%, 12% and 5% exposure on consumer sectors respectively would be very well placed to capture the relevant opportunities. The ETFs have achieved USD NAV returns of 37.9%, 16.5% and 59.9% as of March 19th since China launched stimulus package last September, and offer promising opportunities to capitalize on the rising middle class and consumption upgrades amid robust government stimulus policies in China.