Macro Developments and Factor Performance

In our assessment of last year’s action in mainland stocks, we noted a number of positive developments occurring in Q4, including supportive policies in the property sector, an easing regulatory stance toward big tech, and—most significantly—policymakers’ December decision to abandon strict pandemic containment measures and let China’s economy reopen. At that time, we commented that the A shares rally underway through the end of the year was largely driven by domestic investor sentiment as opposed to hard data. There would naturally be some lag before favorable macro trends began showing up in official macro releases and companies’ financials. Now, a few months into China’s zero-COVID exit, data abound to support traders’ optimism at the end of 2022.

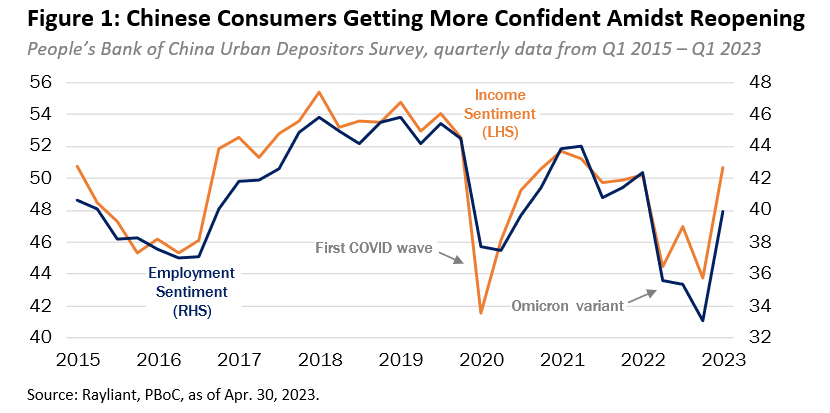

For one thing, first-quarter GDP hit the tape, growing 4.5% year over year, a figure that was ahead of economists’ expectations and way higher than the paltry 2.9% reported in the prior quarter. Much of the surprise came from skyrocketing retail sales, perhaps a sign that pent-up consumer demand and a hoard of pandemic-era household savings are beginning to see the light of day amidst China’s reopening. Given strength in the retail sector, it will come as little surprise that consumer sentiment data also showed continued momentum in the first quarter, with the People’s Bank of China urban depository survey notching sharp gains with respect to expectations for both income and employment (see Figure 1, below): a necessary precondition, one imagines, for a sustained recovery in demand.

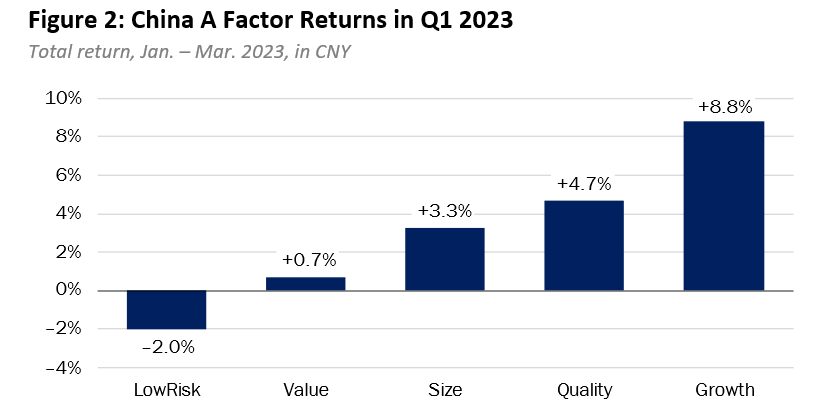

At the factor level (see Figure 2, below), the only negative performer was Low Risk exposure, snapping an extended winning streak—but not a surprise, given rising markets are a serious headwind for the factor as a result of its tilt against stocks with the greatest beta sensitivity. At the end of 2022, we noted the modest outperformance of Growth and Quality factors, predicting stronger performance to such exposures as the economic rebound gained steam and fundamentals began to matter more. Those expectations came to pass in Q1, with Growth and Quality surging.

Even the Value factor produced slightly positive alpha for the quarter, as stocks experiencing the poorest performance leading up to the mainland markets’ trough in October have since rallied back the hardest as China’s macro conditions have improved. Finally, the Size factor continued its run in Q1, posting strong results in part due to the prominence of smaller firms among skyrocketing growth stocks, but also because of a belief among domestic investors that is against a backdrop of escalating geopolitical tension with the United States, China’s push for technological self-sufficiency would offer support for tiny home-grown players in the sector. Along those lines, turnover recorded for small cap stocks on the Shanghai Stock Exchange’s Star growth board hit record highs in April.

Index Performance and Outlook

As mentioned, positive developments on the domestic policy front pushed A shares higher in Q1, with the CSI 300 Index rising for a second consecutive quarter to close up +4.7% (CNY) year-to-date at the end of March (see Figure 3, below). Despite experiencing the second-largest bank failure in U.S. history when Silicon Valley Bank collapsed in mid-March, stocks in the S&P 500 Index posted a +7.0% gain for the quarter, in part on hopes that inflation would continue softening and that stress in the U.S. banking sector could prompt the Fed to pause the present tightening cycle and move to monetary easing by the end of the year. Emerging Markets equity performance was positive for the quarter, riding high on improved sentiment for global demand in light of China’s reopening, though enjoying more subdued gains than DM stocks, with the MSCI EM Index adding just +3.6% in Q1, versus a +7.4% increase in the MSCI World Index.

The strong factor performance highlighted above drove the CSI Caixin Rayliant New Economic Engine Index and the CSI Caixin Rayliant Bedrock Economy Index, tracked by Premia’s 3173 HK/9173 HK and 2803 HK/9803 HK ETFs, to solid performance again in Q1, with the portfolios gaining 8.2% and 7.6%, respectively, for the quarter, putting both well ahead of the CSI 300 Index. Low Risk was a slight headwind for the bedrock index, though it was more than made up for by the strategy’s tilts toward Quality and, to some extent, Growth—the latter manifested in following weeks as an SOE re-rating/revaluation theme—which also boosted the new economy index for the quarter. The aforementioned rally in small cap stocks once again benefited both strategies’ measured tilt toward smaller stocks. At the sector level, the bedrock index’s overweight to lagging Real Estate and Financials and an underweight to IT stocks hurt amidst a tech-driven growth boom during Q1, although an overweight to Communication Services and excellent selection within both sectors boosted performance. By contrast, the new economy index benefited from both strong stock selection and positive allocation effects, the latter driven by an underweight to Financials and the growth-oriented strategy’s overweights to Information Technology and Communication Services; the index’s large overweight to Health Care was a detractor in Q1, though stock selection within that sector was stronger than in any other for the index.

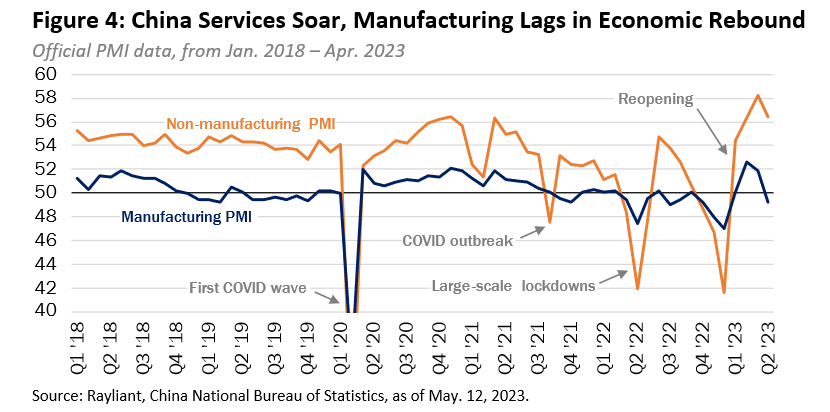

As the first quarter drew to a close, the rally in A shares seemed poised for a transition. Strong domestic sentiment on China’s December reopening had taken stocks considerably above their late-October lows. Most observers seemed to recognize the challenge in parsing turn-of-year data reflecting the temporary pain of China’s COVID ‘exit wave’, yet there was clearly a desire by investors to see more tangible evidence of a sustained recovery in China’s growth before bidding valuations to an even greater rebound. This tension was apparent in reactions to China’s first-quarter GDP. We mentioned that most of the upside surprise came from a 10.6% March increase in retail sales, much higher than the 7.5% increase forecasters expected. Of course, it’s not surprising that retailers, especially services providers, who struggled the most under last year’s lockdowns, saw the biggest immediate benefits from dismantling of the zero-COVID policy. With the second quarter well underway, attention has moved to the stark divide between services and manufacturing in the rebound. As Figure 4 (below) illustrates, not only has manufacturing lagged significantly in China’s reopening: with the April figures, we actually saw the sector fall back into contraction territory.

Indeed, although industrial production posted a year-over-year increase of 3.9% in March, higher than the 2.4% year-to-date gain seen in January and February, that still fell short of economists’ very optimistic forecasts. A key factor holding back Chinese manufacturing has been a worsening outlook for global demand in the face of restrictive central bank policy throughout most of the Western world. Even amidst China’s supportive policy environment, Chinese firms seeing the writing on the wall for the global economy will be tempted to withhold from aggressive restocking and rebuilding capacity after earlier front-loading the more immediate orders. Along those lines, while manufacturing investment recorded 6.2% growth in March, that represented a significant deceleration from the 8.1% growth witnessed in December notwithstanding the surprise jump in March exports, as Chinese manufacturers still tend to take a more conservative stance on the risk of investing ahead, especially after experiencing cash depletion during the pandemic lockdowns. As ongoing banking turmoil in the US suggests, Fed policy will continue showing up on a long lag, promising to further dampen US and European demand for exports.

Despite these challenges we remain optimistic. To a large degree, the path China’s recovery takes from here will depend on policymakers’ response to the story unfolding in the charts above. Consumer sentiment continues to improve, to be sure, but still falls far short of pre-pandemic levels. Businesses face uncertainty not only with respect to domestic consumer demand, but also in terms of a particularly bleak global economic environment. The original premise of China’s zero-COVID exit policy was that an economic recovery would be increasingly driven by domestic consumption, and that state stimulus in 2022 with an emphasis on infrastructure spending would give way in 2023 to household spending and business investment from the private sector. What we have witnessed thus far is consumer activity concentrated in services, especially tourism, restaurants and leisure—definitely not enough to get China’s economy where government and investors want it to be. The irony however is that this may actually provide more tailwind instead, from the silver lining of further stimulus in the second half, further boosting growth and employment, which are what both the central and local governments are increasingly focusing on.

We find it encouraging to see the bedrock and new economy indices’ factor tilts perform so well in a recovery that hasn’t yet put a spotlight on themes central to each strategy. Going forward, we expect policymakers to promote domestic consumption, of course, but we also believe an obvious target of policy support through the rest of this year will be a nurturing of innovation in China’s new economy. Such development plays into the nation’s strategic objectives in maintaining its competitiveness with the U.S. amidst rising geopolitical tensions and global economic stress that underscore China’s desire for both economic and technological self-sufficiency. We believe both trends will benefit high-quality companies selected within the bedrock and new economy indices as China’s rebound proceeds in the second quarter and beyond.

*****************************************************************************************************

Dr. Phillip Wool is the Global Head of Research of Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.