Macro Developments and Factor Performance

Following news on China throughout Q3, it would be easy to imagine the macro picture had gone from bad to worse. The nation’s property sector went through another painful wave of negative sentiment as massive developer Country Garden plunged into distress, while many pundits voiced doubt the modest stimulus offered up so far by policymakers would accomplish the high-quality growth they are targeting, let alone give a sufficient kickstart to struggling consumer and business confidence.

Yet, despite these potent headwinds over the last three months, according to China’s Q3 GDP data, released in mid-October, last quarter may have actually seen China’s economy start to turn the corner. Year-over-year, the GDP expanded 4.9% in Q3, surpassing economists’ consensus forecast of 4.4% growth, putting China’s increase in GDP over the first nine months of the year at 5.2%, and giving the world’s second-largest economy a good shot at hitting its “around 5%” target growth number—which a few months ago seemed to be fast slipping away.

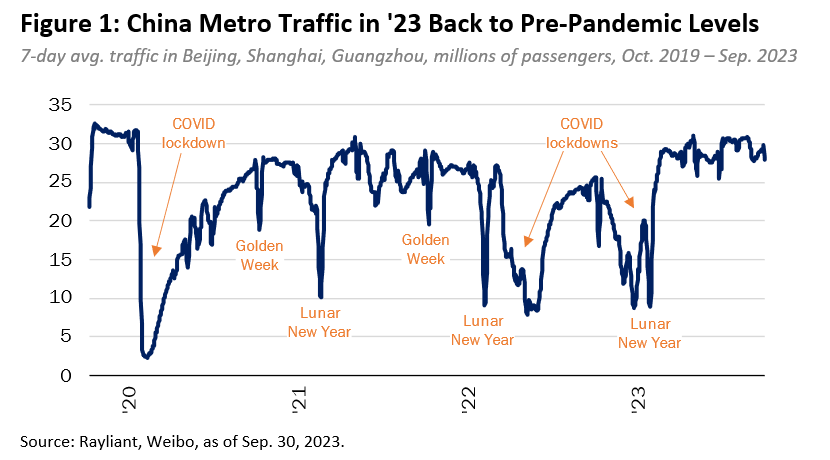

As we suggested last quarter, it’s fairly plain to see that the obstacles to a stronger zero-COVID exit recovery did not result from an inability of consumers to spend and businesses to invest. We know that during the pandemic, Chinese households’ already high savings rate went even higher, building up plenty of excess cash with which to ‘revenge spend’ upon reopening, and with public health restrictions lifted, mobility is no longer an issue (see Figure 1, below). Likewise, monetary stimulus enacted over the past year has provided Chinese firms with plenty of liquidity—they just haven’t drawn on it.

Rather, the challenge has been that consumers and companies haven’t shown a willingness to make big ticket purchases or meaningful investments, because sentiment about China’s prospects and those of the world economy have been so glum. Of course, there is little Chinese policymakers can do about potential cracks in US economic growth (though America just posted its own 4.9% GDP number for Q3, year-over-year). But we also suggested last quarter that we expected Beijing—having failed to achieve a self-sustaining recovery with cheap talk alone—to start pumping in the targeted stimulus. That is exactly what happened beginning in August, and we credit those policy moves, particularly in terms of support for infrastructure and manufacturing, with helping to get GDP growth back on track.

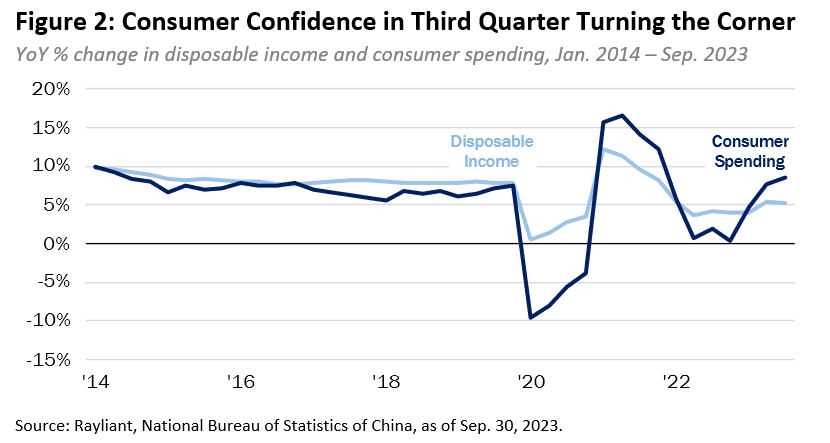

A natural benefit of delivering some good news on growth is that it allows for confidence-boosting official messaging that restores the people’s faith in China’s economy, despite households concerns about declining income and notwithstanding the real pain being felt in China’s real estate sector (although support for the property market was finally beginning to show up in Q3, albeit mostly in Tier 1 cities). Indeed, while Chinese households’ disposable income has been flagging in recent months, consumer spending has continued to move up (see Figure 2, below). That likely precludes the need for the kind of massive stimulus we saw around the Global Financial Crisis—which we never expected this time around, in any case—and we see an impressive RMB 1 trillion of additional central government bond issuance in Q4, announced in late October, as going toward more of the same targeting support witnessed last quarter.

Taking a factor perspective on Q3 performance (see Figure 3, below), we were not surprised, given such negative sentiment during the quarter and a moderate drawdown in the broader market, to see Low Risk and Value factors put in the best performance of factors we were tracking over the last three months. The Size factor also extended its winning streak, with a tilt toward smaller stocks yielding strong performance again in the third quarter. By contrast, the Quality and Growth factors reversed course in Q3, posting losses in recent months after making gains through the first half of the year. It is worth noting that these latter two factors seek to profit by using financial data to identify stocks with strong accounting characteristics and favorable growth features, irrespective of valuation, and can sometimes suffer when market action is driven more by sentiment than underlying fundamentals.

Index Performance and Outlook

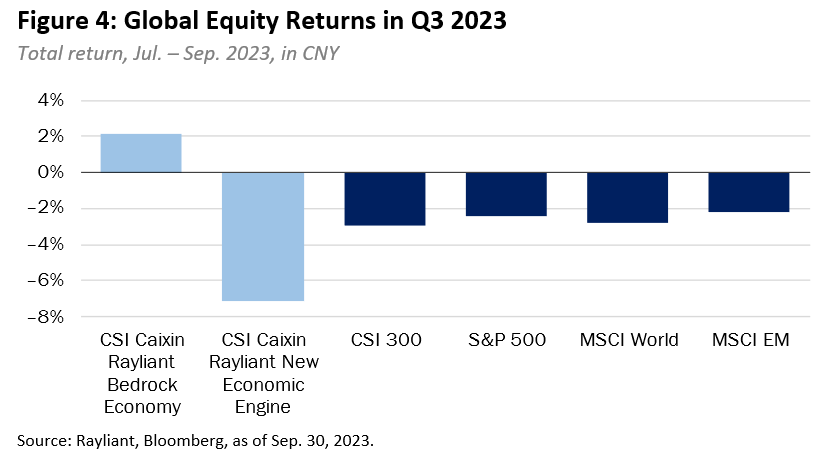

Drama in China’s property sector and a continuation of negative sentiment from the second quarter led A shares in the CSI 300 Index down by -2.9% (CNY) over the three months ended September 30th (see Figure 4, below). Stocks in the U.S. likewise slid during Q3, with the S&P 500 Index declining -2.4% as the September FOMC, despite choosing to ‘pause’ on rate hikes, also delivered a dot plot reinforcing its theretofore unheeded “higher for longer” mantra; Treasury yields subsequently surged as investors sold off their stocks and bonds. Developed markets stocks were generally weaker in Q3, with the MSCI World Index down -2.8% for the quarter, also suffering from fears that soft landing hopes might give way to a downturn after all, along with the timeline for easing by the Fed and other major central banks pushing deeper into 2024. Broader emerging markets in the MSCI EM Index, arguably even more sensitive to Fed policy and weighed down by China’s economic troubles, nevertheless only declined -2.2% for the quarter, perhaps a sign of how cheap EM stocks already looked heading into July.

Just like in the second quarter, negative sentiment and broad market weakness in China gave way to disappointing performance for the CSI Caixin Rayliant New Economic Engine Index (tracked by Premia CSI Caixin China New Economy ETF), which declined by -7.1% in Q3, while the CSI Caixin Rayliant Bedrock Economy Index (tracked by Premia CSI Caixin China Bedrock Economy ETF) again proved resilient, actually gaining 2.1% for the quarter. Both strategies benefited from a measured tilt toward smaller companies’ shares, but it was Value and Low Risk exposures within the bedrock index that sustained its positive performance amidst challenging market conditions. Quality and Growth exposures both worked against the new economy index in the third quarter. Allocation effect accounted for a majority of underperformance for the new economy index, with a meaningful structural underweight to Financials representing the largest drag, followed by the portfolio’s large overweight to Information Technology, by far the worst-performing sector in the CSI 300 over the last three months—though, interestingly, stock picking within that sector was strongest, demonstrating the value of the index’s factor tilts. Allocation and selection effects contributed almost evenly to bedrock index outperformance, with an overweight to Financials and underweight to IT stocks (the mirror image of the new economy index), providing the biggest boost.

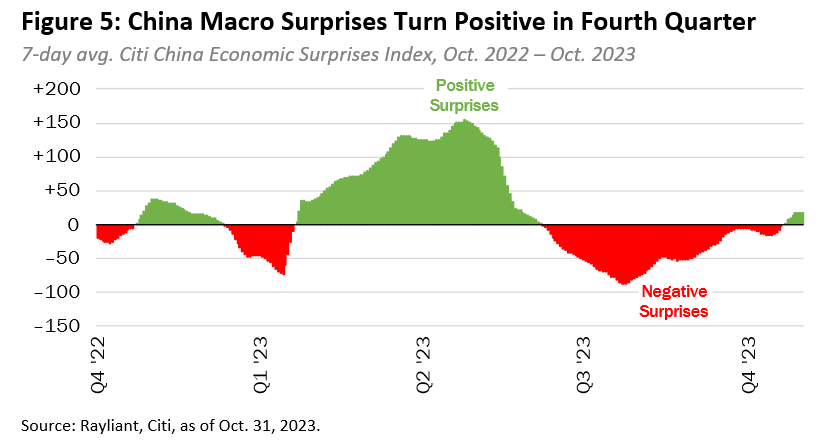

Entering the fourth quarter, we see ultra-low mainland sentiment—toward both the stock market and the domestic economy, more generally—building since earlier this year as not only pricing Chinese stocks at extremely compelling valuations versus developed and emerging market counterparts, but also having set a very low bar against which future economic developments will be judged. One can see the effect of unreasonably dour expectations and a genuine building of macro momentum in an obvious turn toward positive surprises on a host of economic releases that took root in Q3 (Figure 5, below).

Beijing, in our view, has recognized that mere promises of stimulus to come would not do the job of rekindling consumers’ and companies’ confidence. Policymakers now appear ready to proceed in earnest with the actual stimulus. Once again, this will not be the ‘bazooka’ type fiscal spending undertaken in response to the Global Financial Crisis. Instead, we expect targeted stimulus that focuses on strategic areas that might be loosely described as representing national pride and security: things like homegrown technologies, e.g., in the semiconductor space, that serve to counter America’s attempts at containing China’s growth; EV and the clean energy ecosystem, doubling down on ‘green’ initiatives announced over the last two years; health care and pharmaceuticals; and, not surprisingly, state-owned companies central to China’s brick-and-mortar economy, along with firms in the military sector. It will not be lost on those familiar with the bedrock and new economy indices how closely aligned many of these themes are with those portfolios’ structural sector-level tilts. Indeed, we expect the indices to benefit greatly from this policy focus.

As if the challenging global macroeconomic backdrop facing investors was not enough, the month of October has brought with it a significant escalation in geopolitical tensions, particularly in the Middle East. Although drama playing out on the world stage is as complex and interconnected as ever, we continue to see the US-China relationship as one of the more straightforward plotlines to follow. We note that it is rare for the incumbent ‘number one’ and up-and-coming ‘number two’ players to get along well, in any context, and that is just the situation the US and China find themselves in today. But the two need one another! As the biggest debt-financed consumer economy on the planet, continually rebalancing its workforce toward the service sector, America will increasingly rely on China’s incredible capacity to manufacture, export and save. We see the two nations as a perfect fit: destined to maintain their love-hate relationship—and represent the world’s twin growth engines—for many years to come.

Ultimately, as China’s market approaches the end of another very eventful year, we believe the negative sentiment we have mentioned throughout this commentary in a number of dimensions—from the state of the Chinese consumer to property market stress, from potential policy errors to surging geopolitical strife—sets A shares up for a potential run as soon as the tide has demonstrably turned. Indeed, as highlighted above, we have already begun to see signs of that, giving us hope the wait for more favorable conditions is nearly over. From a sector perspective, as mentioned, many of the themes that we expect to characterize measured and sustainable policy support over coming quarters are precisely aligned with sector-level construction of the bedrock and new economy indices. That is not a coincidence: It is a result of recognizing and incorporating into the strategy those elements we knew to be critical drivers of growth in China’s old and new economies. From a factor perspective, the new economy portfolio’s quality growth exposure is effectively levered to the upside surprises we see as significantly undervalued at this moment, while the bedrock index should continue to benefit from value and quality exposures, allowing us to identify true bargains poised for revaluation.

*****************************************************************************************************

Dr. Phillip Wool is the Global Head of Research of Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.