It's all about renewable energy and storage – ask Nvidia. Nvidia CEO Jensen Huang recently commented that "the ultimate challenge for AI lies in harnessing solar energy and energy storage." Goldman Sachs Research reinforced this notion, suggesting AI infrastructure as the next phase after the AIGC (artificial intelligence generated content) boom represented by Nvidia. A recent research report by Alex de Vries from Vrije Universiteit Amsterdam estimated that by as soon as 2027, AI could require as much as 134 TWh of electricity per year – which is approximately the annual consumption of Netherlands or Sweden.

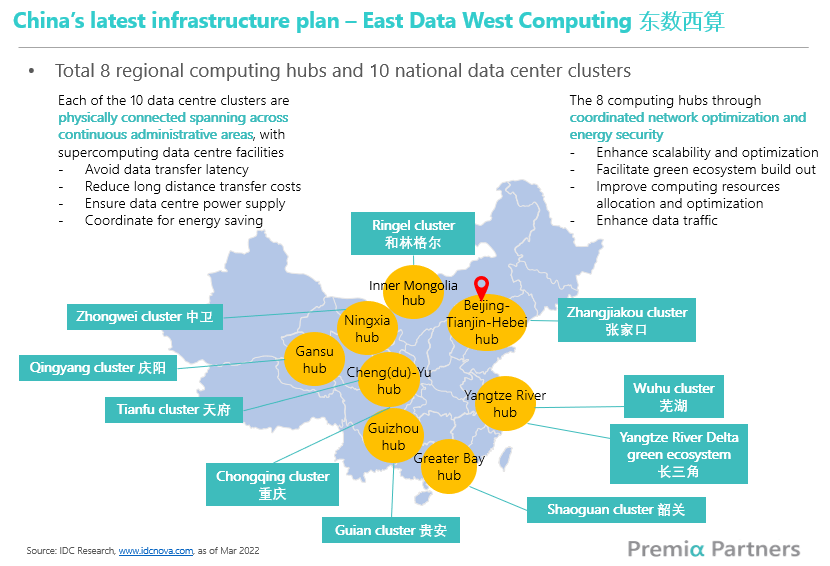

China’s East Data West Computing initiative brings together green energy, energy storage, data centres and a massive leap in computing power. In this regard, China’s strategic initiative of “East Data West Computing” (EDWC) is one of the most important and integral parts of China's AI infrastructure development. It encompasses and connects the strategic build out of China’s data centers, deep learning platforms, computing hubs, as well as energy storage, smart grids, intelligent power systems, renewable energy networks and more technology-enabled infrastructure spanning all of China as a coordinated network optimized for energy and network efficiency.

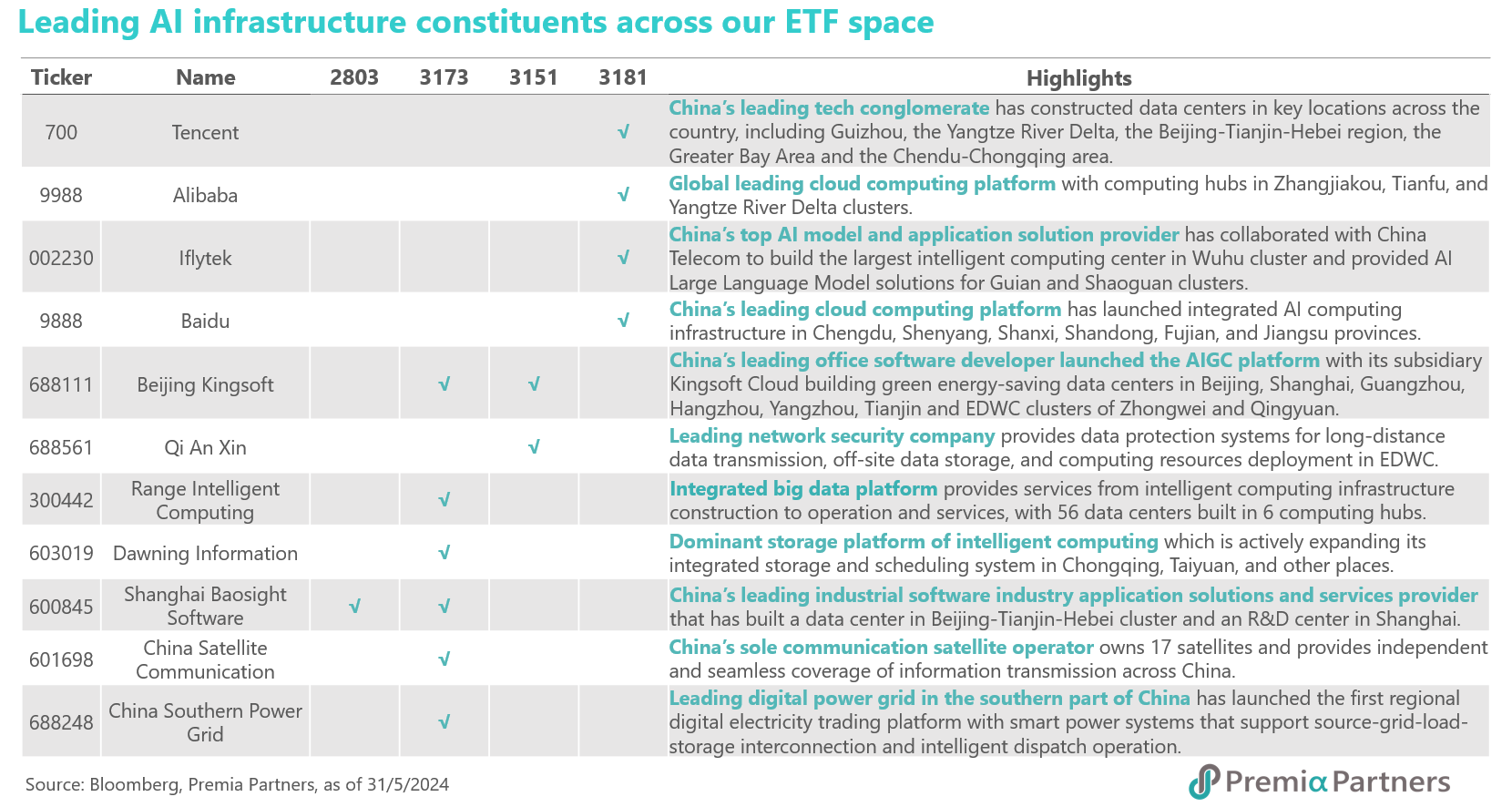

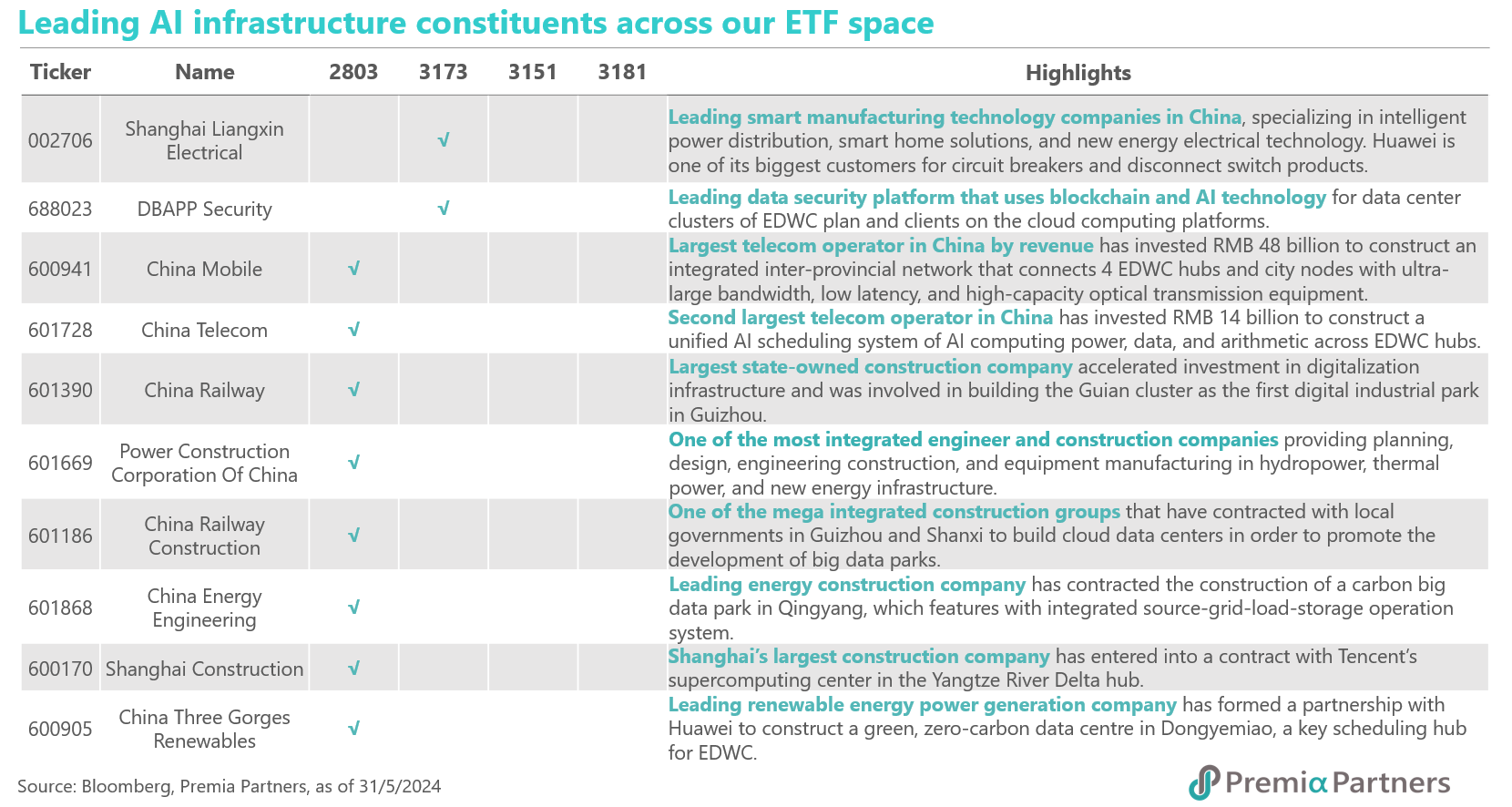

The "East Data West Computing" (EDWC) initiative was first proposed in early 2022. It covers the build out of ten high-density, energy-efficient, and low-carbon data center clusters across eight hubs. This initiative will enhance data quality and leverage each region's unique strengths in market access, technology, talent and capital to build an integrated computing network.

The construction of intelligent data centers at the provincial level has already been progressing rapidly, facilitating the integration of regional clusters into a national computing power network.China's national plan outlines a goal of increasing computing power by over a third and establishing 50 intelligent computing centers by 2025. Intelligent computing power differs from general-purpose computing power generated by CPUs. It utilizes GPUs, FPGAs and AI chips to address more advanced needs such as text, image, video generation and complex logic reasoning. As of March 2024, over 30 cities are actively building intelligent computing/data centers, with several in Nanjing, Changsha, Wuxi, Ningbo and Hangzhou already operational.

The benefits of this AI infrastructure extend beyond merely scaling up computational power. It also enables the development of scheduling centers and the development and training of large language models (LLMs) and the development of application layers for multi-model operation. The latter – that is, development/training of LLMs and development of application layers for multi-modal operation – holds significant growth potential, with global technology advisory firm IDC predicting a 20% compound annual growth rate (CAGR), to reach a market value of US$26.4 billion by 2026. Significantly scaling up AI computing power provides capacity to address the growing demand fueled by China's digital transformation and technological advancements. With 19 companies such as Baidu, Alibaba, Huawei, Tencent, and others actively developing LLMs in 2023, the demand for intelligent computing power has witnessed exponential growth. Baidu's ERNIE Bot alone boasts gaining over 200 million users within a year.

Consider the potential computing power shortage when GPT upgrades to subsequent versions, or in the event of similar advancements for other LLMs: It could mirror the 24-fold increase in the number of GPUs used in training GPT4, compared to GPT3. Beyond AIGC, China vigorously promotes innovations such as autonomous driving, smart cities and fintech, all of which are heavily reliant on substantial intelligent computing power.

By the end of 2022, China's total national computing power reached 180EFLOPS, with intelligent computing power accounting for 22%. Upon completion of all EDWC nodes and hubs by 2025, the total computing power is projected to reach 300EFLOPS, with intelligent computing power exceeding 35%, according to government plans. This development will alleviate the high cost and shortage of computing power in eastern regions by enabling the deployment or leasing of power from western intelligent computing clusters, ultimately addressing regional development imbalances.

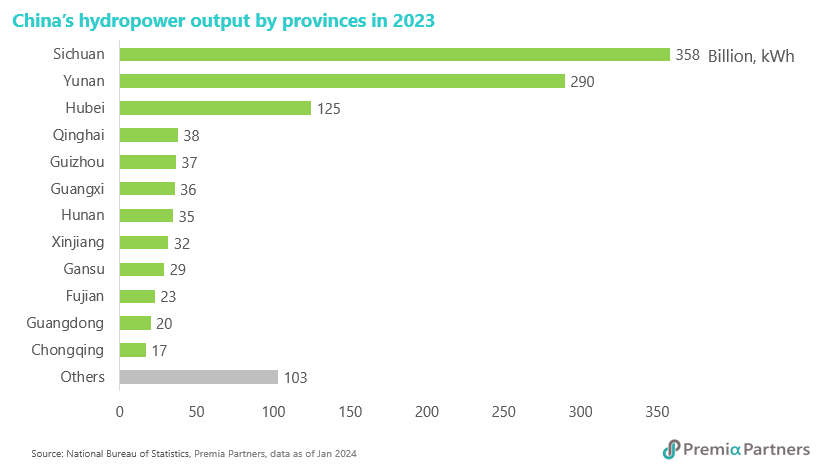

Supporting this robust intelligent computing power is also a focus on low-cost, green electricity generation and energy storage. In Sichuan Province, which is home to many technology and technology-enabled industrial and EV companies in China, hydropower already accounts for 85% of the province’s generation mix. It is also home to the largest and tallest hydro-solar project in the world. In normal times, the surplus is exported to more developed coastal regions such as Shanghai, Zhejiang and Jiangsu, which have higher population density and energy demand.

Fueled by continuous supply chain innovation and technology-driven initiatives, China has emerged as the undisputed global leader in cost-competitive renewable energy. This relentless focus has slashed China’s solar PV and offshore wind turbine costs by 80% and 56% respectively in the last decade already, compared with global peers, according to the International Energy Agency (IEA) and China’s Wind Energy Association. These efforts have not only made solar and wind more affordable electricity options but also paved the way for a net-zero future.

Under the East Data West Computing initiative, larger data centers will be strategically located in western regions with abundant renewable energy sources such as solar, wind and hydropower, further benefiting these already well-developed renewable energy industries. Energy storage infrastructure is equally important, considering the risk of power outages caused by droughts or floods. So, uninterrupted supplies of water and power are crucial for high-end manufacturing and an efficient computing environment. This quest for high quality, uninterrupted power supply is a long game.

Power generation aside, China's energy storage sector has also seen a near fourfold increase in capacity, thanks to advancements in lithium-ion battery technology. By the end of 2023, the sector reached 31.4GW, as reported by the National Energy Administration. Leading Chinese battery companies such as CATL, BYD and EVE Battery have already established long-term plans. Notably, CATL recently pioneered the world's first mass-producible battery with zero degradation in its first five years of use. This breakthrough significantly extends battery lifespan and creates a coveted, virtually ageless energy storage system for at least the first five years of operation.

An important game changer would be ability to transfer excess clean energy to where it is needed via more electricity lines, or by holding more of the energy in storage systems - as Large-scale energy and storage integration will transform the power system from a traditional, load-centric approach to a more comprehensive model that integrates source, grid, load and storage.

Grid operators are already meeting the challenge, by increasing spending by 25% over the first four months of the year to RMB123bn or US$17bn. The current electricity models used by China's State Grid Corporation and Southern Power Grid enable not only precise load forecasting and electricity price predictions but also facilitate remote monitoring through off-peak scheduling across regions. Additionally, smart grids can automatically locate and fix faults, restoring power within seconds, compared to the eight hours required for manual repairs.

Recently China’s National Energy Administration (NEA) said it will accelerate transmission projects, with the goal of completing 37 major power lines and starting construction on another 33 by the end of the year. It aims to keep pace with a record-setting boom in renewables that has put the electricity network under unprecedented strain.

Last but not least, major telecommunication companies such as China Telecom, China Mobile and China Unicom are also actively developing their own projects, including computing and data centers and partnerships within the ecosystem, to increase network bandwidth, improve transmission speeds and reduce network latency and transmission costs.

For investors interested in gaining exposure to China’s AI industry, the EDWC theme would be an important module in the value chain to consider, outside of the typical semiconductor and AI application basket.

- Our Premia CSI Caixin China New Economy ETF (3173) and Premia China STAR50 ETF (3151) are uniquely positioned to capture the rally in the high-tech space, spanning AI, 5G and Cloud (17% of 3173 and 70% of 3151); Semiconductors (11% of 3173 and 49% of 3151); and New Energy (19% of 3173 and 12% of 3151).

- Investors seeking to complement their portfolios with more balanced, lower beta exposure can consider our Premia CSI Caixin China Bedrock Economy ETF (2803), which delivered a year-to-date NAV return of 8.7% in HKD as of May 31, outperforming both the CSI 300 and the Shanghai Stock Exchange Composite Index. The strategy incorporates value, low volatility, quality and size factor screens, with around 70% of its constituents being quality State-Owned Enterprises with stable cash flows and robust dividend yields. It is also a well placed tool for China allocators, for portfolio completion and risk management purposes.

Bloomberg columnist David Fickling recently wrote that “Chinese clean technology isn’t “artificially cheap,” as Joe Biden said in trying to justify higher tariffs. It’s just cheap — and the world needs it to meet the energy transition challenge”. In fact, low-cost clean energy and related technology infrastructure are also critical for efficient transition to the increasingly more technology enabled, AI-powered world.