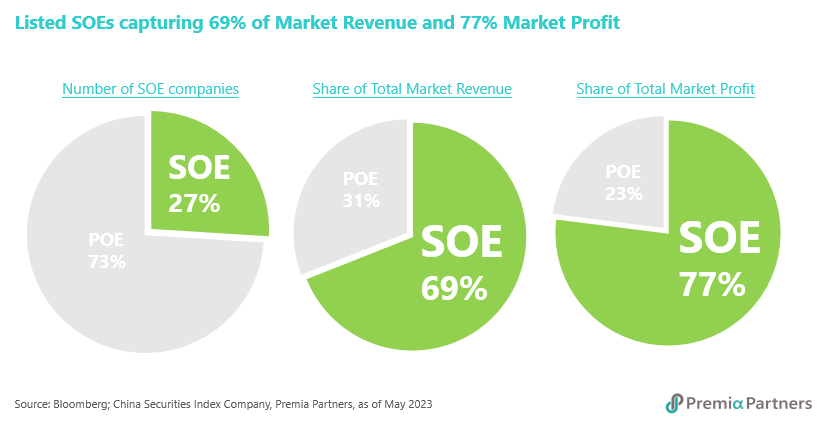

SOEs have always played a vital role in China’s economy, accounting for 30% of GDP, 46% in fixed asset investment and 25% of national tax revenue. Even though there are only about 1,300 SOEs out of a total of 4,763 listed companies in Mainland China, they are capturing 69% of the market revenue and 77% of the total profits. Most leading listed companies across key industries, including banks, insurance, brokerage, oil & gas, chemicals, coal, power, telecom, construction, Chinese medicine and liquor, are SOEs. Based on the latest report from the Ministry of Finance, SOEs remained resilient and delivered a strong set of results in the first quarter of this year, with operating income and net earnings increasing 6.6% YoY and 12.4% YoY, respectively. That said, SOEs are lagging behind POEs in a few fundamental metrics such as return on equity, profit margin and asset turnover. It explains why SOEs usually trade at a lower valuation multiple in the stock market.

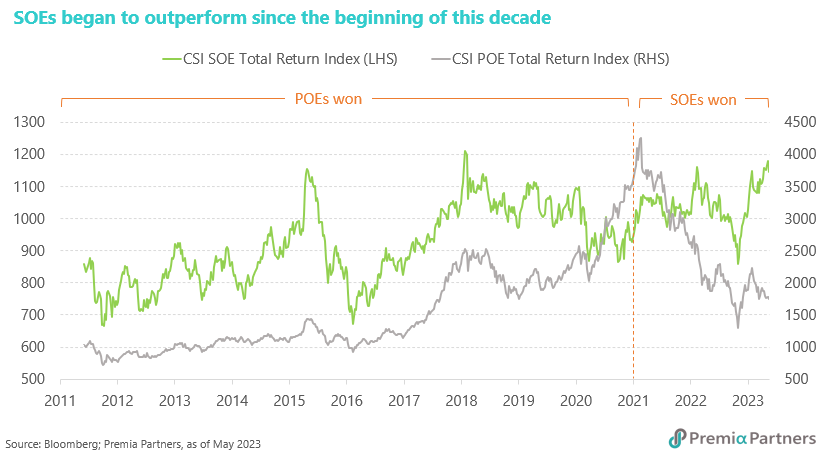

Performance-wise, SOEs in the A-share market underperformed significantly in the decade between 2011 and 2020, in which POEs went up 2.5 times in total return versus SOEs’ mere 12%.

The tide began to turn since then, with SOEs recorded a positive move of 21.6% whilst POEs suffered a great loss of over 50% from the beginning of 2021 till now. The timing was in sync with the implementation of the government’s 2020-2022 action plan, which built on decades of efforts to transform SOE into competitive and modern enterprises. The three-year action plan has improved the corporate governance of the SOEs. According to the office of the State Council leading group for SOE reforms, about 13,000 subsidiary enterprises of the centrally administered SOEs and about 25,000 subsidiary enterprises of locally administered SOEs have established boards of directors. Since 2020, the average annual investment growth rate of strategic emerging industries of central SOEs has exceeded 20%. Chinese SOEs are playing an increasingly important role in the global arena, with a total 99 of them were included on the 2022 Fortune Global 500 List.

The State-owned Assets Supervision and Administration Commission (SASAC) of the State Council is now pushing a new round of reforms through specific official directives, market consultation documents and policy announcements. The latest initiatives would focus on encompassing SOE restructuring, strategic positioning, corporate governance and capital allocation efficiency.

In addition, SOEs must evolve to meet the changing needs of China, i.e., safeguarding the country’s economic development, particularly in advanced technology and its national security at a time of rising geopolitical tensions. The measures include: (i) launching a program for SOEs to be benchmarked against world-class enterprises in terms of value creation; (ii) adjusting the performance evaluation system; and (iii) further deepening SOE reforms, promoting the high-quality development of central SOEs, encouraging their listings and stabilizing capital markets.

In the near term, SOEs will likely act as a growth stabilizer to support and power domestic economic recovery and offset the external weakening demand. SOE investment tends to accelerate when POE investment declines, as was clearly the cases in 2008-09, 2015-16 and 2022. In the longer term, analysts view that China will make SOEs not just more efficient but also more innovative, as well as counting them on energy and food security.

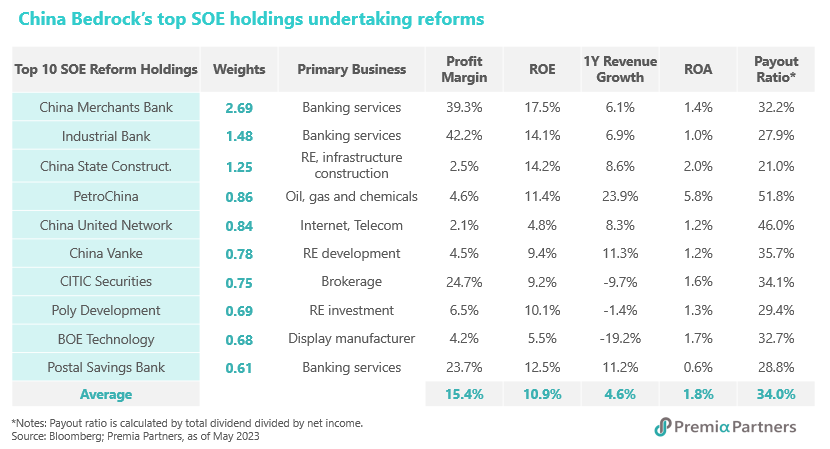

The new key performance indicators include also metrics not dissimilar to fundamental quality factor also: stability of cash flow and earnings quality, stressing the importance of ROE and the operating cash flow to revenue ratio - underscoring the message Beijing has been reiterating through its 14th Five Year Plans and government working plans for sustainable growth with quality, instead of simply growing big with white elephant projects without substance. It is also important to note SOEs are specifically encouraging to beef up R&D spending as well as take the lead in rolling out green infrastructure – with corresponding KPIs to track progress at SOE and affiliated local government levels.

Given they tend to be in more traditional industries with almost boringly stable fundamentals and lack of exciting growth stories to tell, SOEs have long been overlooked and undervalued by the market, even though some of these companies are operating in oligopoly environments with steady cash flow and consistent, high dividend payout ratios. Compared to high growth peers, investors often do not fully appreciate the value embedded. Market sentiment, however, has gradually changed in the past few months, as investors rush in to get exposure in SOEs for their re-rating potential after finally starting to absorb and decipher Beijing’s messages for SOE revaluation and value extraction. A few onshore asset managers have launched new funds immediately to take advantage of the market rally.

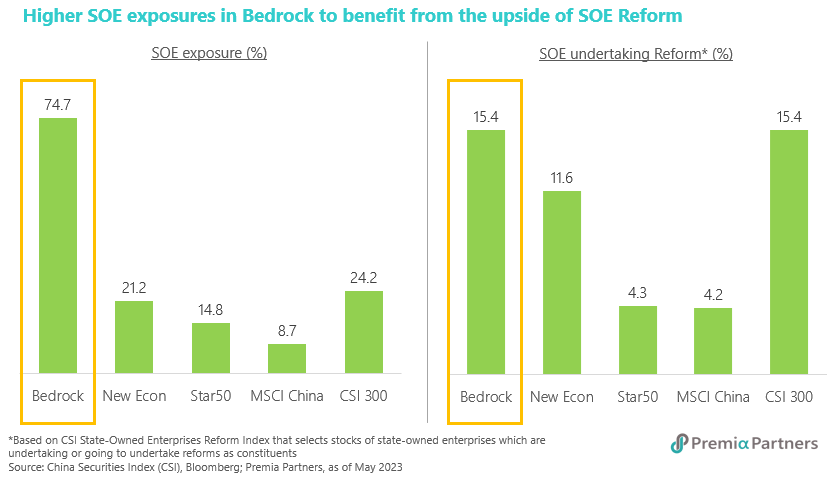

That said, investors should understand that SOEs will likely face strong obstacles and may take extended time in transforming themselves. Instead of buying any listed China’s SOEs indiscriminately in the market, Premia CSI Caixin China Bedrock Economy ETF (2803.HK) can be an optimal choice for investors to participate in the SOE theme. Its diversified portfolio with 300 mid-to-large caps emphasizing value, quality, low volatility and size offers the good mix to investors.

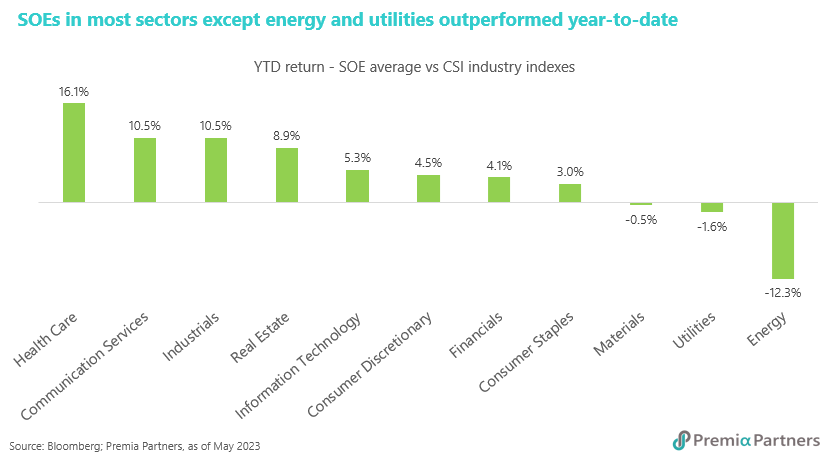

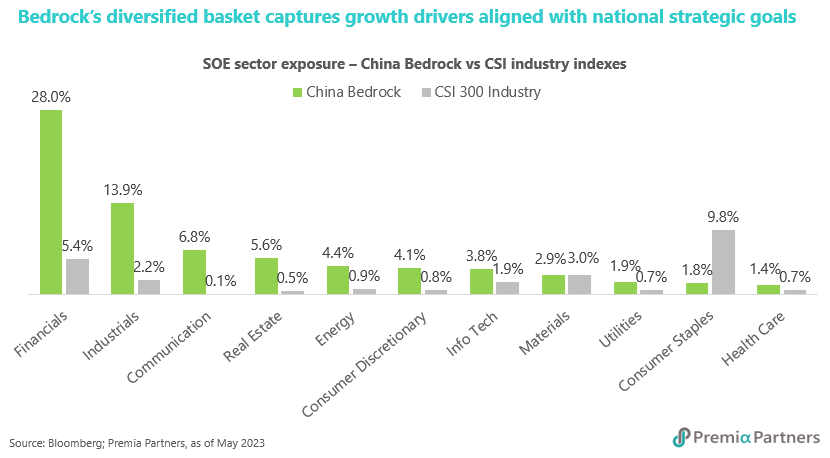

Sector-wise, there is also a high degree of overlaps with essential reform opportunities in key areas, such as financials, industrials, communication services and energy and align well with the country’s strategic goals, especially with regard to growing China into a high-tech, modern society on national security, technology and healthcare self-sufficiency, and carbon neutrality. Importantly it is also worth noting that these sectors also are less susceptible to regulatory and default risks but instead are beneficiaries of policy tailwinds and resource supports.

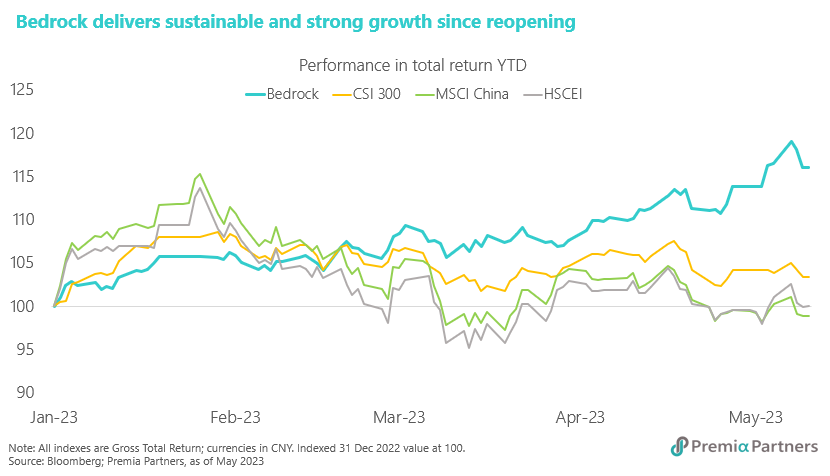

The ETF’s underlying index, CSI Caixin Rayliant Bedrock Economy Index, has significantly outperformed other mainstream China indices including CSI 300 Index, MSCI China Index and Hang Seng China Enterprises Index to-date this year. Its higher portion in SOE exposure certainly helps, but rather than indiscriminately allocating to both winners and losers, the strong performance and alpha have really been generated by its multi-factor methodology in a fundamental driven approach not dissimilar to what active managers would consider, only in a more transparent, rule-based manner.

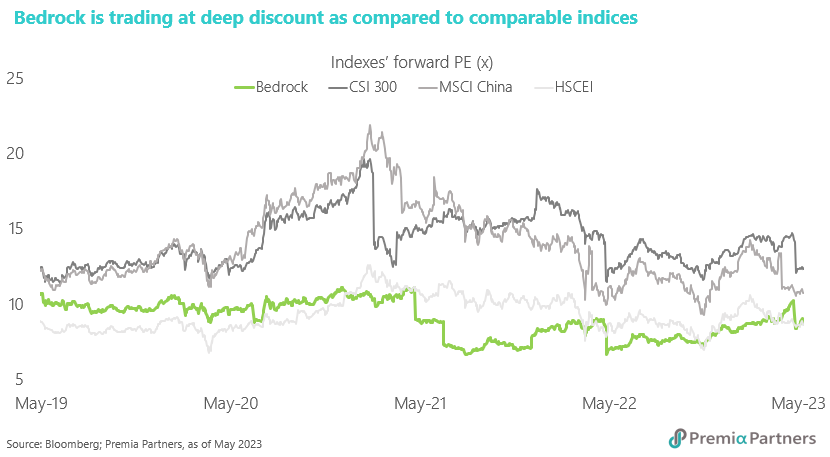

The index is still trading at an attractive forward multiple of 8.7x in PE and 0.9x in PB, and attractive dividend yield of 4.0% for 2023, or 7.7x in PE, 0.83x in PB and 4.5% in dividend yield for 2024 as of May 19, 2023. There should be ample runway for SOE share prices to continue with the re-rating and re-valuation trajectory, based on the current low valuations, improving profitability and capital expenditure growth potential.

In terms of prospective re-rating opportunities, Goldman Sachs recently highlighted that if SOEs’ equity risk premium were to retrace to the current mid-point between SOEs and POEs, the potential gains for the SOE sector could be around 23% as the SOEs unlock values and recalibrate with corresponding new multiples. In the hypothetical scenario where both SOEs and POEs are subject to similar form of regulatory condition on a largely level playing field, the valuation upside of SOEs could be as high as 60%.

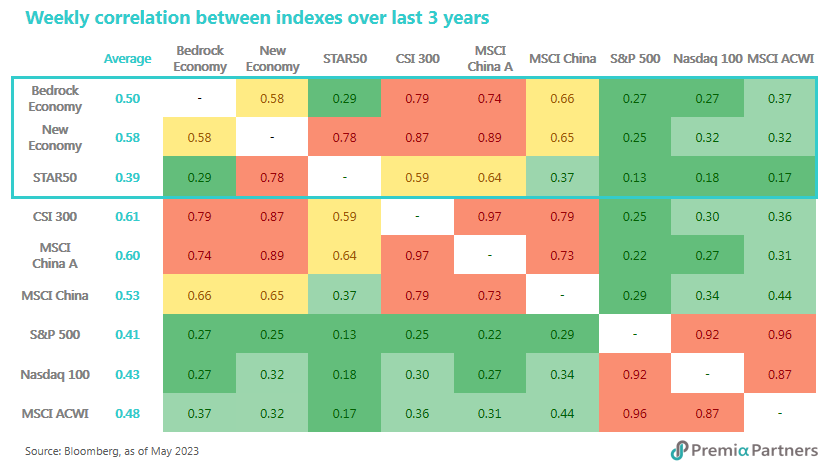

Outside of traditional economy sectors and existing contributors to China’s current GDP, our Premia CSI Caixin China New Economy ETF (3173.HK) and Premia China STAR50 ETF (3151.HK) also cover important SOE constituents in the new economy and hard core technology space that are key actors to release values for China’s strategic growth industries in the ensuring decades. These diversified strategies would augment well the traditional China strategies for portfolio completion and low-correlation/ diversification, and are also convenient tools for sector/ factor rotation and tactical allocation from time to time.

With the sheer size of the relevant SOE cohort and collective value these companies would unlock, this would be an important space to watch out for opportunities. Dismissing SOEs as a boring trade may be a dated strategy for China investors, as leading SOEs defy conventional stereotyping with exciting re-rating and revaluation actions in the new normal.