Investors may be disappointed that China market rally is now taking a break since bottoming out in late October. Market sentiment on China shifted dramatically from “un-investable” a few months ago to one of the favourites after the reopening. The pro-growth policies, a loosening monetary environment, low pricing pressure and attractive valuation all contributed to the strong performance between November and January. Since then, Chinese equity has entered a phase of consolidation alongside the global risky assets. One of the triggers behind the risk-off action is the hawkish tone released by the Federal Reserve as the US inflation seems to be more resilient than economists’ forecast. The expectation of a US rate cut in the second half of this year is now becoming a false hope, while the interest rate ceiling this round may lean towards the level of 5.5% rather than 5% foreseen previously. The heightened geopolitical tension over the “balloon” floating over the US soil also provided a timely excuse for tactical profit takings.

The key questions investors should ask themselves are whether China is an overcrowded trade, and the rally is largely done. At Premia, we do not think so.

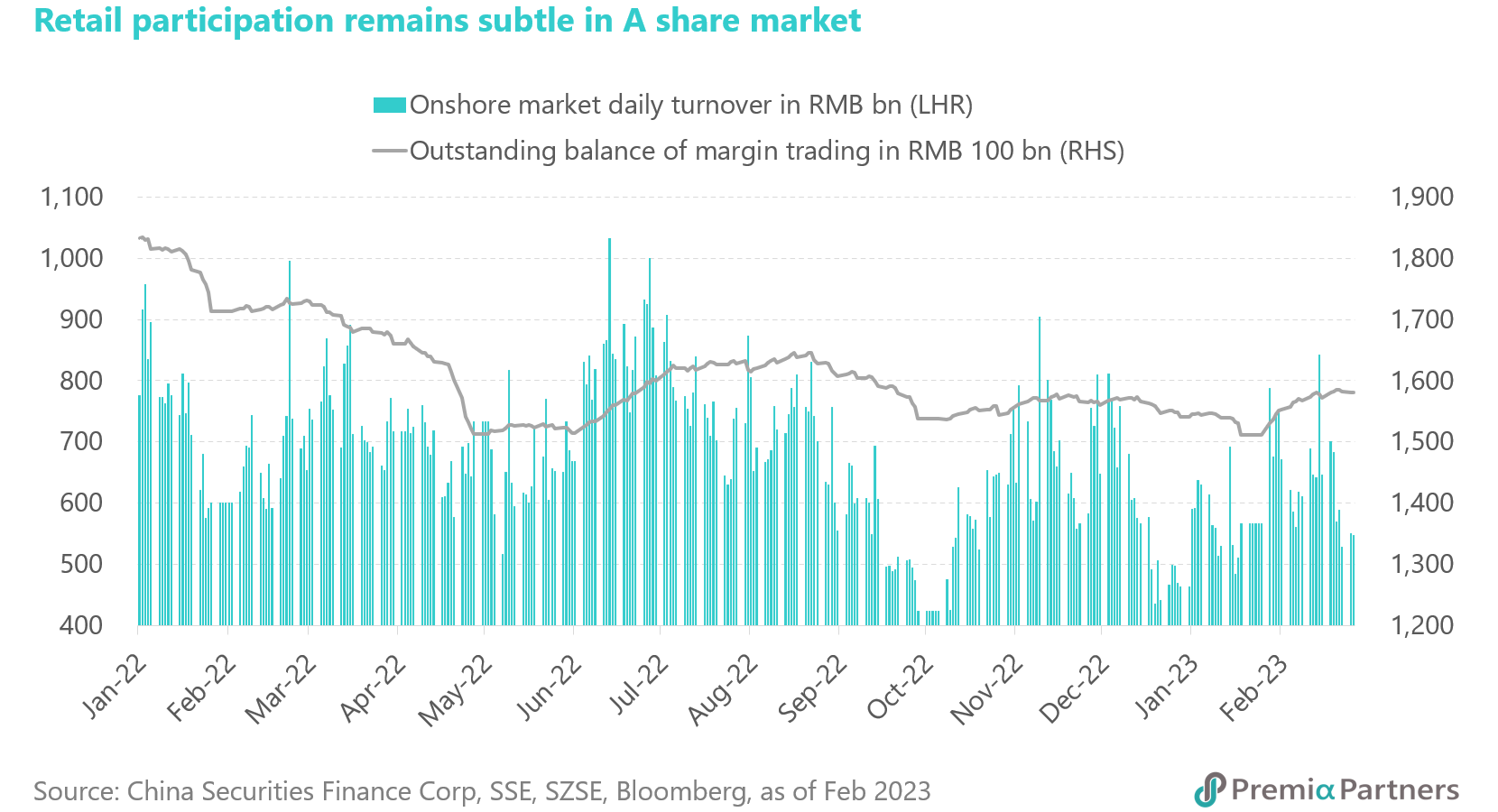

Both emerging market specialists and regional investors may have an equal-weighted or over-weighted position in China to enjoy the rally in the past few months, but global funds including the US-based managers are still underweighted in China. The view of international investors in Chinese equity remains diverged, without reaching a consensus amid the ongoing noises related to the US-China relationship, housing market concern and leadership change. In addition, the domestic retail participation stays subtle in the stock market as indicated by the mild increase in margin financing activities and daily turnover, showing that China is yet to be an overcrowded trade.

Fundamentally, China is in an initial stage of its economic recovery, so it is premature to conclude the stock market is already fully priced in all the positive factors. Most economic data such as PMI, retail sales and industrial production are expected to show continuous improvement in coming months. There is no doubt that the new economic team that takes charge officially after the “Two Sessions” in March will have strong incentives to prioritize economic growth. Corporate earnings’ upward revision is highly possible in the second quarter when management teams and analysts gain greater clarity on the business outlook, with more government’s top-down supportive policies beginning to filter through to the real economy. Consumer and corporate confidence may also climb gradually, leading to higher consumption spending and capital expenditure for the rest of the year.

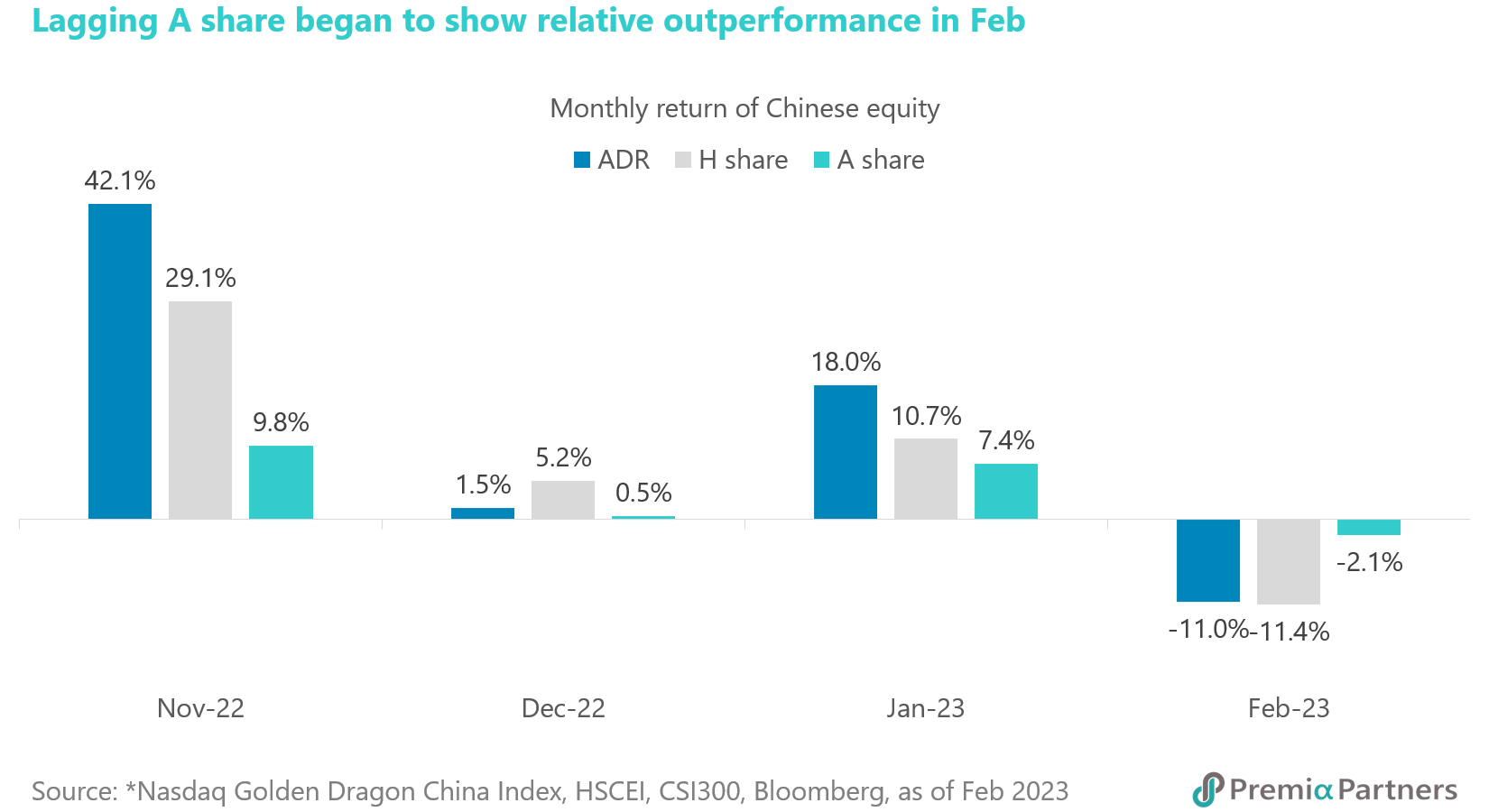

That said, investors should place their bets strategically within China space in order to capture the next up leg. The offshore platform-based companies outperformed significantly due to their prior deep correction and a slowdown in regulatory crackdown. Investors, however, should understand that these quick and easy trades are basically gone after the strong rebound in the first round. These offshore tech names are probably not the ones to lead or add to the required technological breakthroughs going forward in China. Indeed, the National Radio and Television Administration is now studying measures to curb addiction among youths to short videos, a blow to an already limping video streaming industry, while JD.com is launching a subsidy campaign that has sparked fresh worries of a price war in the e-commerce sector. In a foreseeable future, these platforms may have to spend most of their efforts to reinvent their business models. It is likely that they will neither grow rapidly in earnings nor get re-rated in valuation.

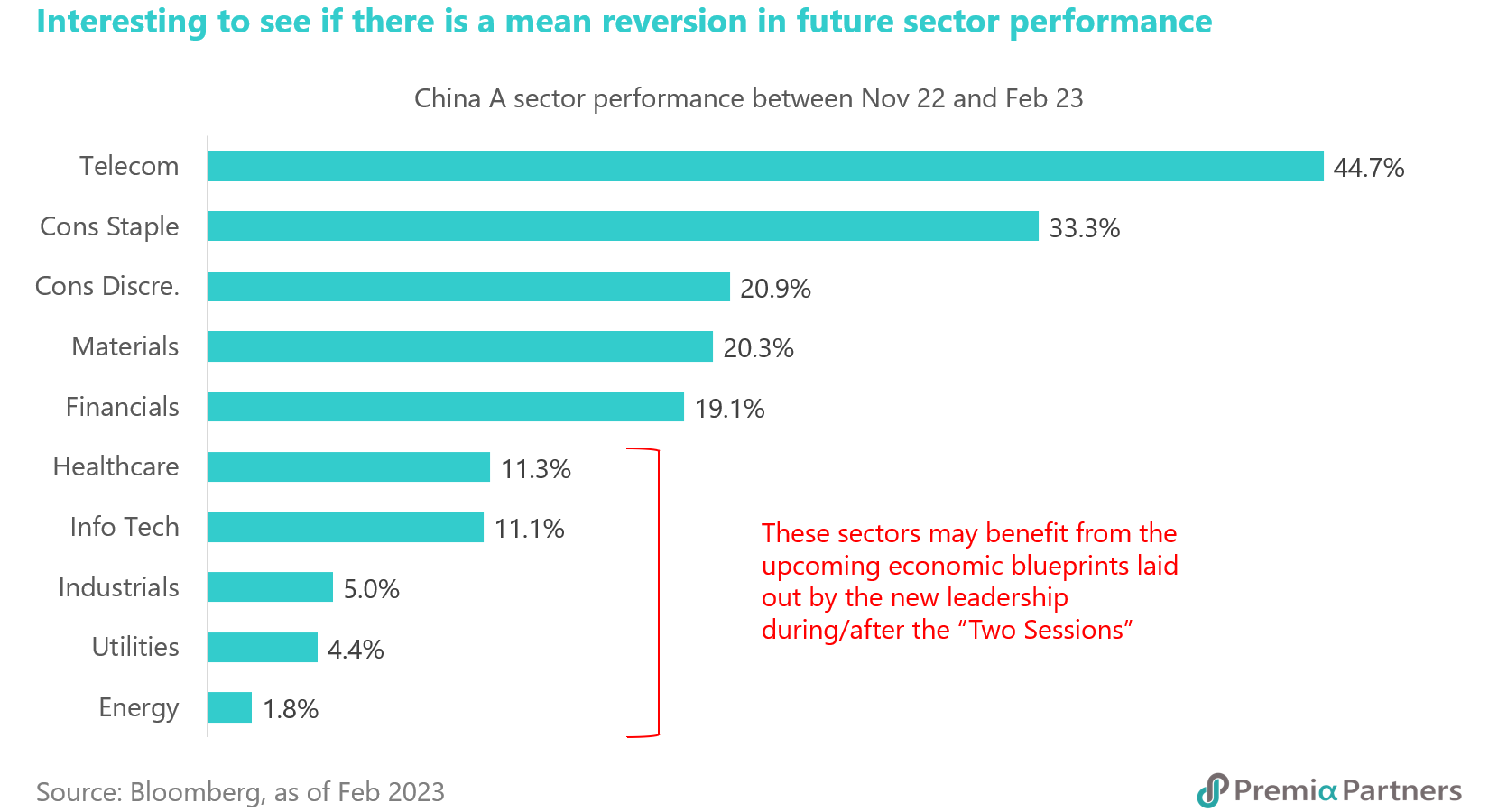

The upcoming opportunities would be found in the A-share market, which seems to be the best candidate for a catch-up play. From fund managers’ perspectives, it makes perfect sense to take profit from the offshore platform-based names to the onshore policy supported sectors now. The switch aligns with the timing of the “Two Sessions” – The National People's Congress and the Chinese People's Political Consultative Conference. The new leadership team will take over and begin to layout the blueprint of the economic growth. It is highly probable that major themes such as technological advancement, industrial automation, biotech and green economy will become the market focus once again. Investors may also consider shifting from the first-phase reopening beneficiary like consumer goods including baiju to the second-phase growth drivers that may gain on capital expenditure like industrials and hardcore tech. Analysts see increasing numbers of new projects kicking off recently to help drive economic activities.

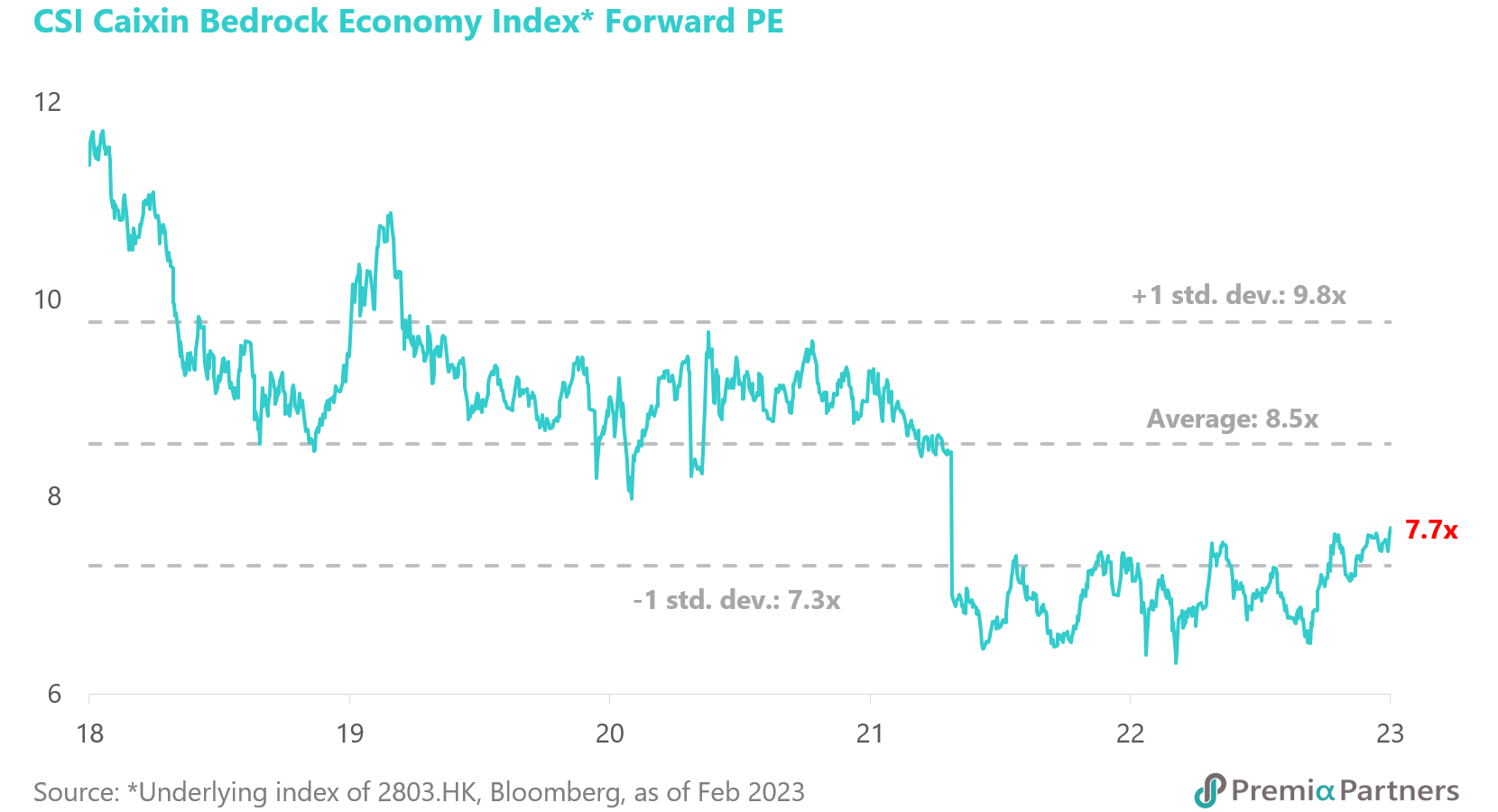

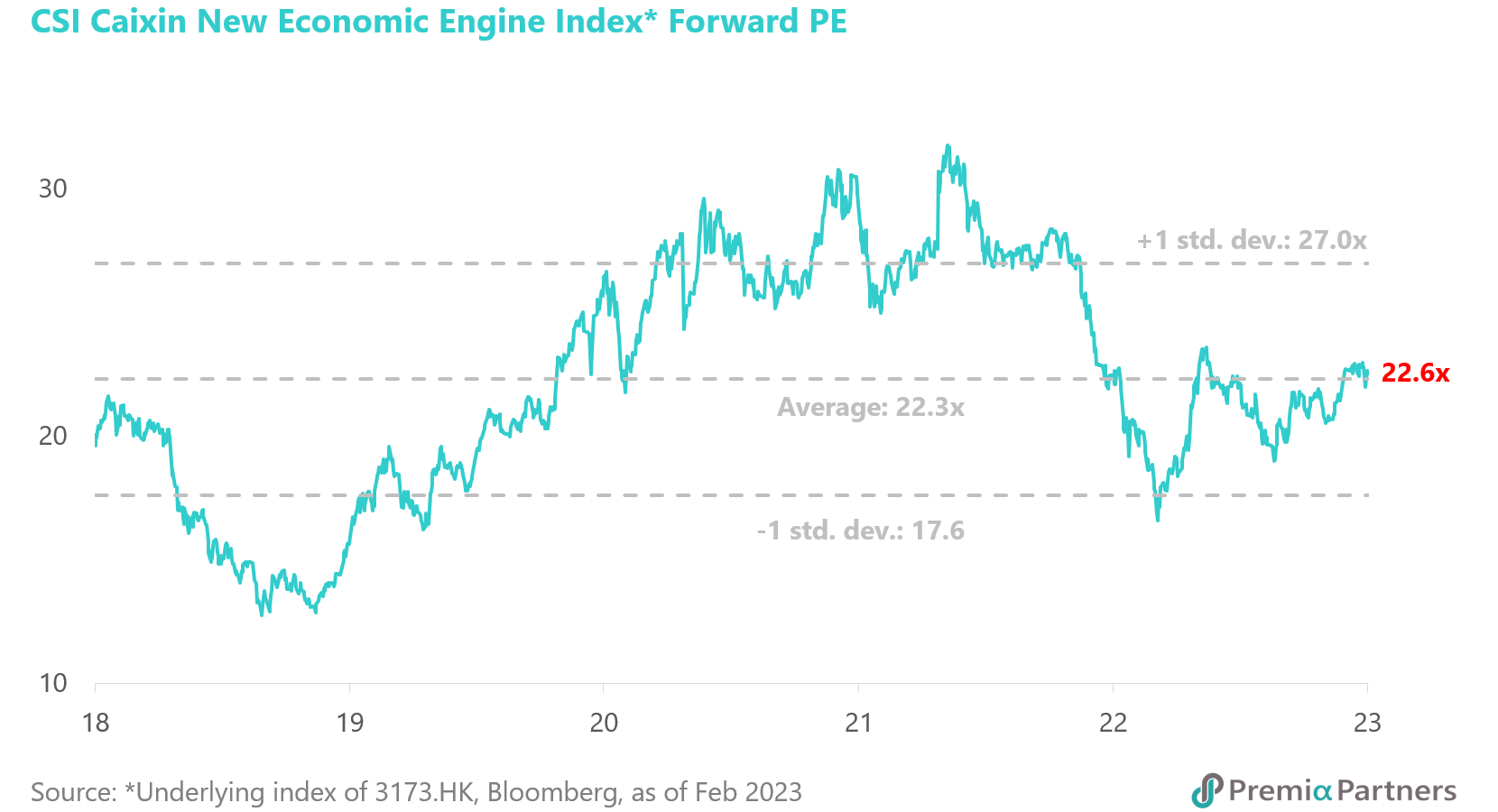

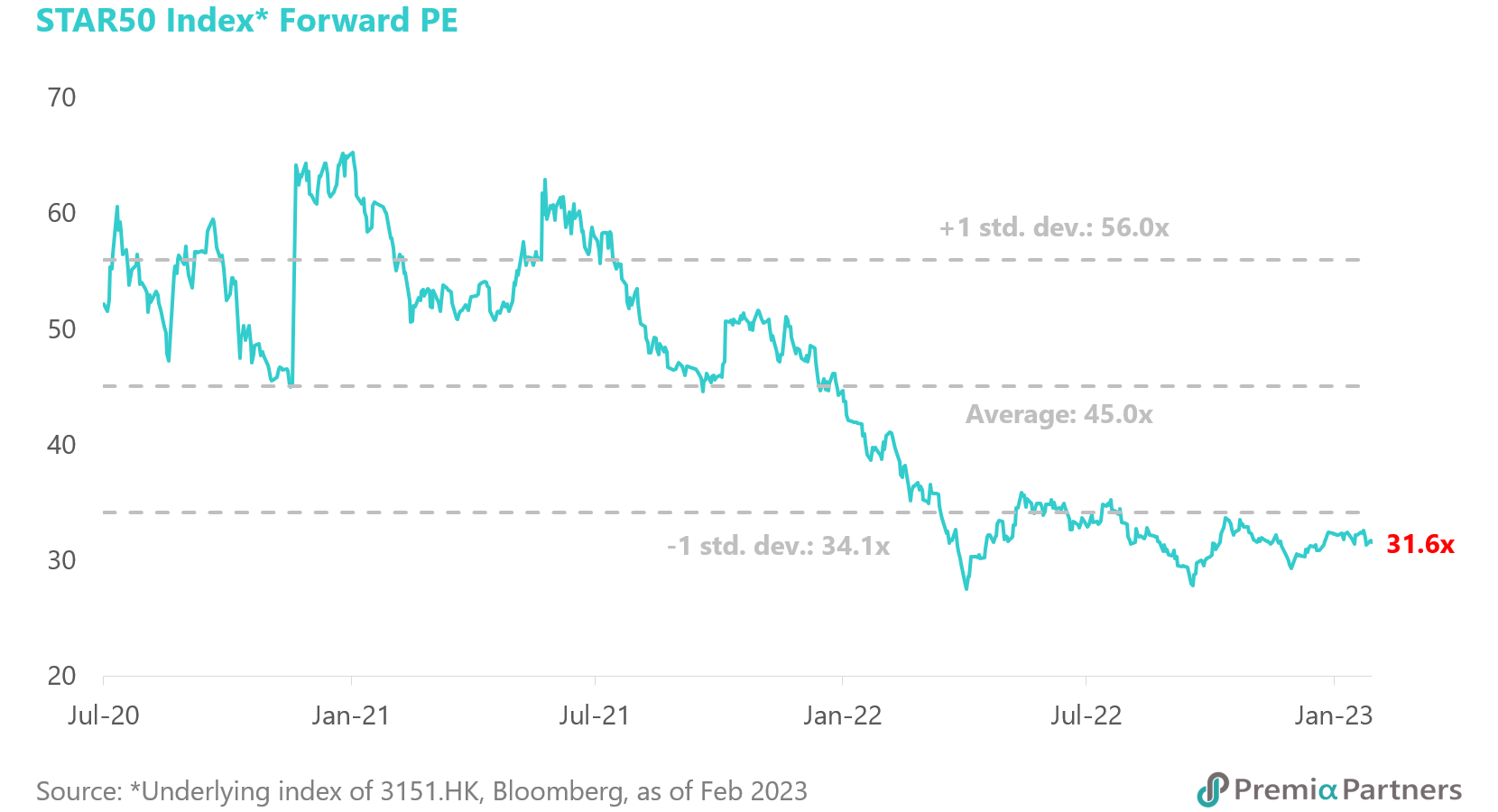

Valuation-wise, A-share market remains attractive. Our multi-factor focused Bedrock Economy is trading at a 12-month forward PE of ~7.7x, close to 1 standard deviation below the 5-year historical mean. Its value, quality and low volatility approach continues to outperform the broad market in the first two months of 2023, after delivering significant outperformance last year. Our growth-biased New Economy is trading at a reasonable multiple of ~22.6x, on par with its historical average. The strategy targets to capture the sustainable growth in urbanization, automation, technological development, consumption upgrade and aging population. Our policy supported STAR50 is trading at a discounted multiple of ~31.6x, more than 1 standard deviation below its average since index launch. It invests in the emerging hardcore technology leaders across semiconductors, artificial intelligence, new materials, green energy and biotech.

In short, we see Chinese equity should do well on improving fundamentals, but a simple beta strategy that worked in the initial non-discriminative rally is no longer effective in the next round. Now it’s time to go specific – looking for exposure offering quality with either deep value or solid growth. Within China space, A-share seems to provide stronger upside amid higher immunity from international funds’ redemption, more policy supported sectors/names, and gradual increase in domestic retail participation.