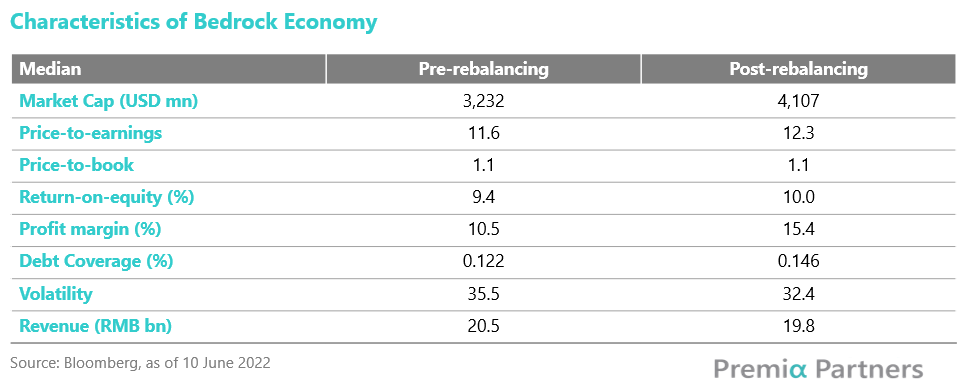

For CSI Caixin Rayliant Bedrock Economy Index, there were 109 changes among the underlying index constituents during the latest rebalancing in June. The one-way turnover ratio was 38.1%, similar to the historical range between 30% and 40%. The quality factors had more impact in this rebalance probably because the overall market valuation is in discount relative to the history. The ROE, profit margin and debt coverage improved after the rebalance, while the median of the price-to-earnings ratio increased slighty from 11.6 to 12.3 and the median of the price-to-book ratio stayed the same. In addition, the low-volatility screen did help reduce the portfolio’s risk, as shown by the volatility falling from 35.5% to 32.4%.

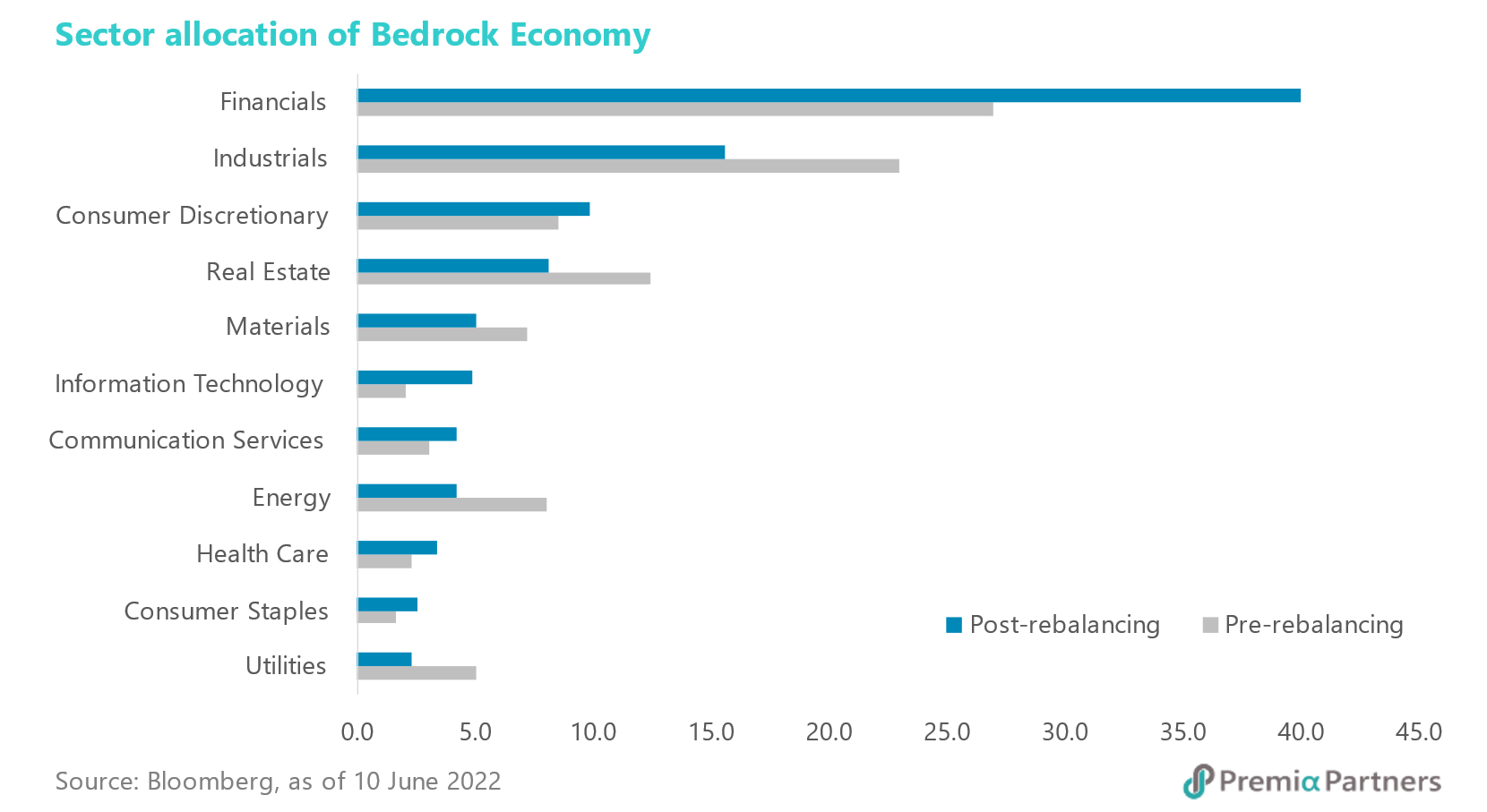

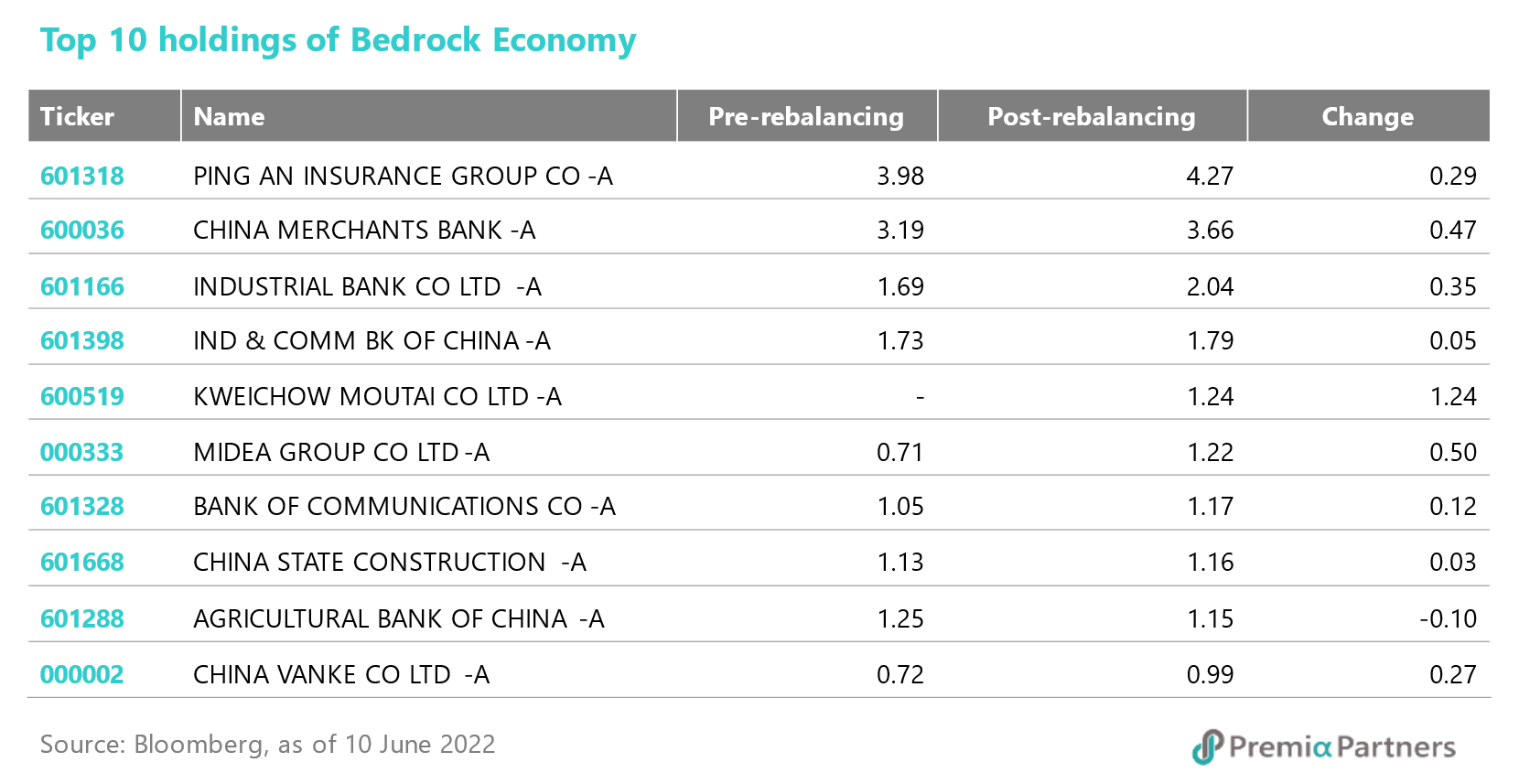

From a sector perspective, the major change was reducing exposure in Industrials, Real Estate and Energy, and increasing weights in Financials. Drilling down into sub-segments, the additions in Financials are mostly banks and brokers, while the deletions in Industrials and Real Estate are mostly construction companies and real estate developers. The deletions in Energy involved some upstream companies related to coal production. Although the changes in Cosumer Staples are not significant, one of the additions from this sector manage to get to the Top 10 holdings, which is Kweichow Moutai.

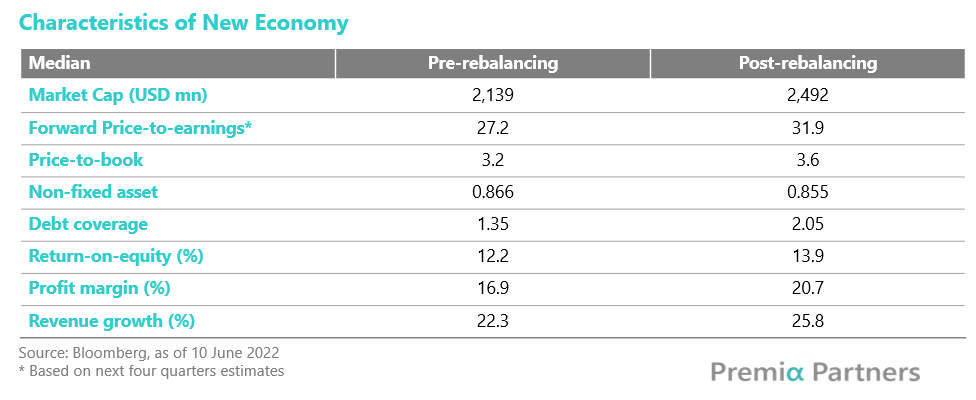

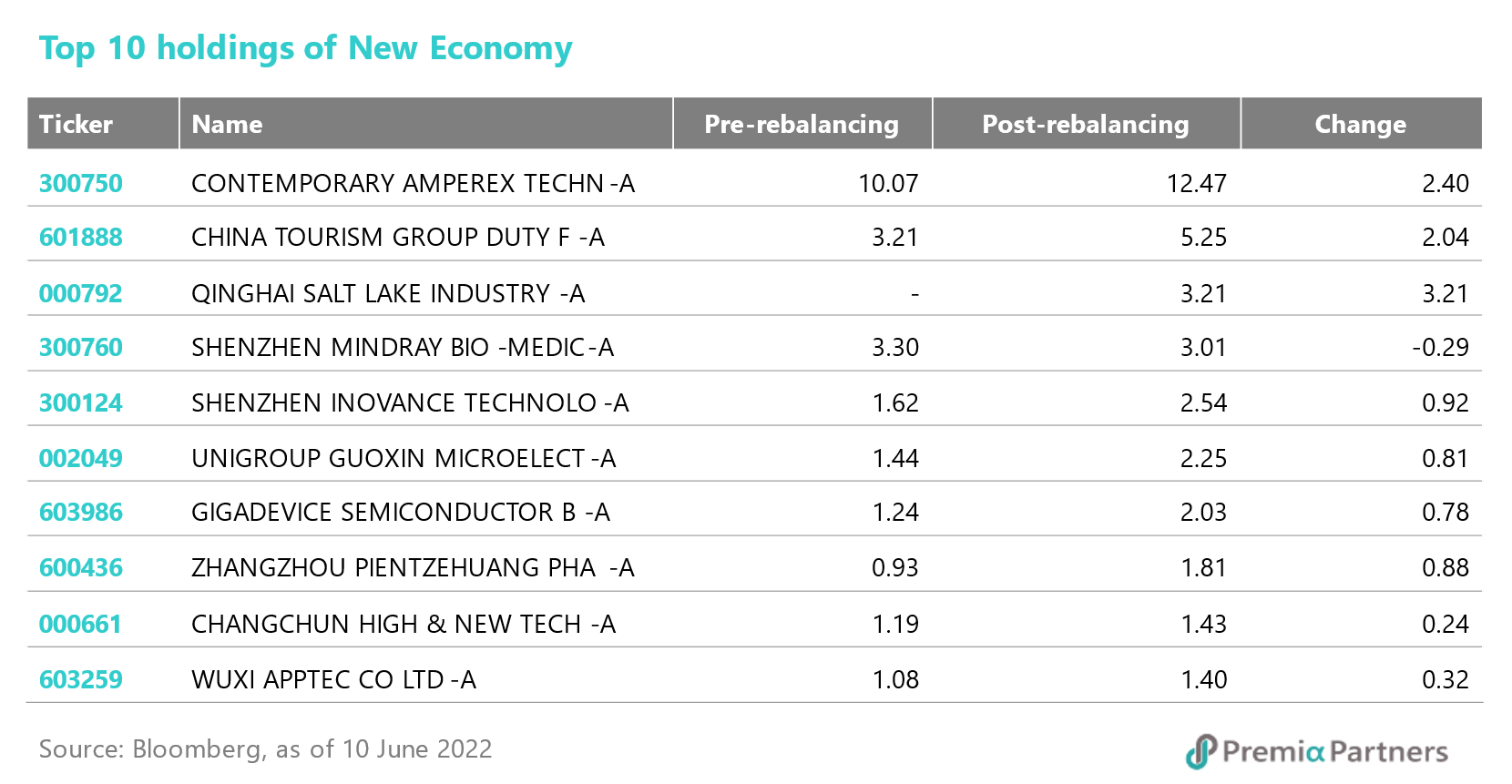

For CSI Caixin Rayliant New Economic Engine Index, its turnover rate was similar to the previous rebalance. There were total 109 replacements, and the one-way turnover was around 45.0%, around the same level of last annual rebalance. In terms of financial health, the updated basket of stocks continued the trend of higher quality in general with significant improvement seen in debt coverage (1.35x to 2.05x), return-on-equity (12.2% to 13.9%) and profit margin (16.9% to 20.7%). On top of that, the index consistuents are expected to grow faster with the estimated revenue growth rising from 22.3% to 25.8% after the resuffle.

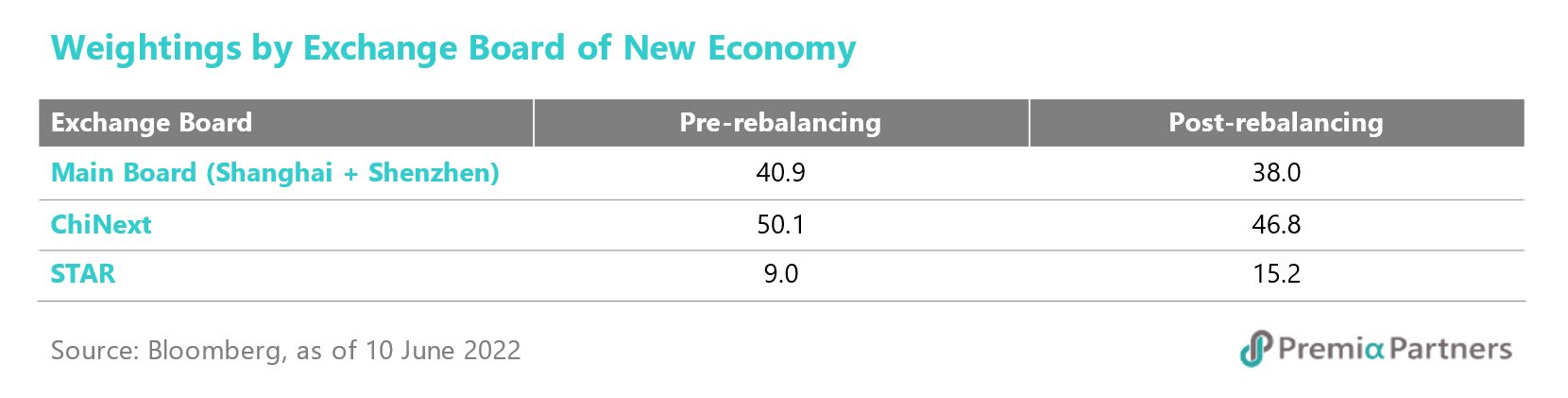

The Index PE after rebalance has increased from 27.2 to 31.9 due to the inclusion of more companies listed on the Science and Technology Innovation Board (STAR) in Shanghai, which have a higher PE than the stocks listed on the main board. The STAR was set up to support high-tech industries and strategic industries, such as New Generation IT, High-end Equipment, New Materials, New Energy, Energy Conservation & Environmental Protection, and Biomedicine which are all related to the New Economy. The STAR board companies’ weightings in the Index jumped again from 9.0% to 15.2% after the increase from 0% to 8.5% in the previous rebalance.

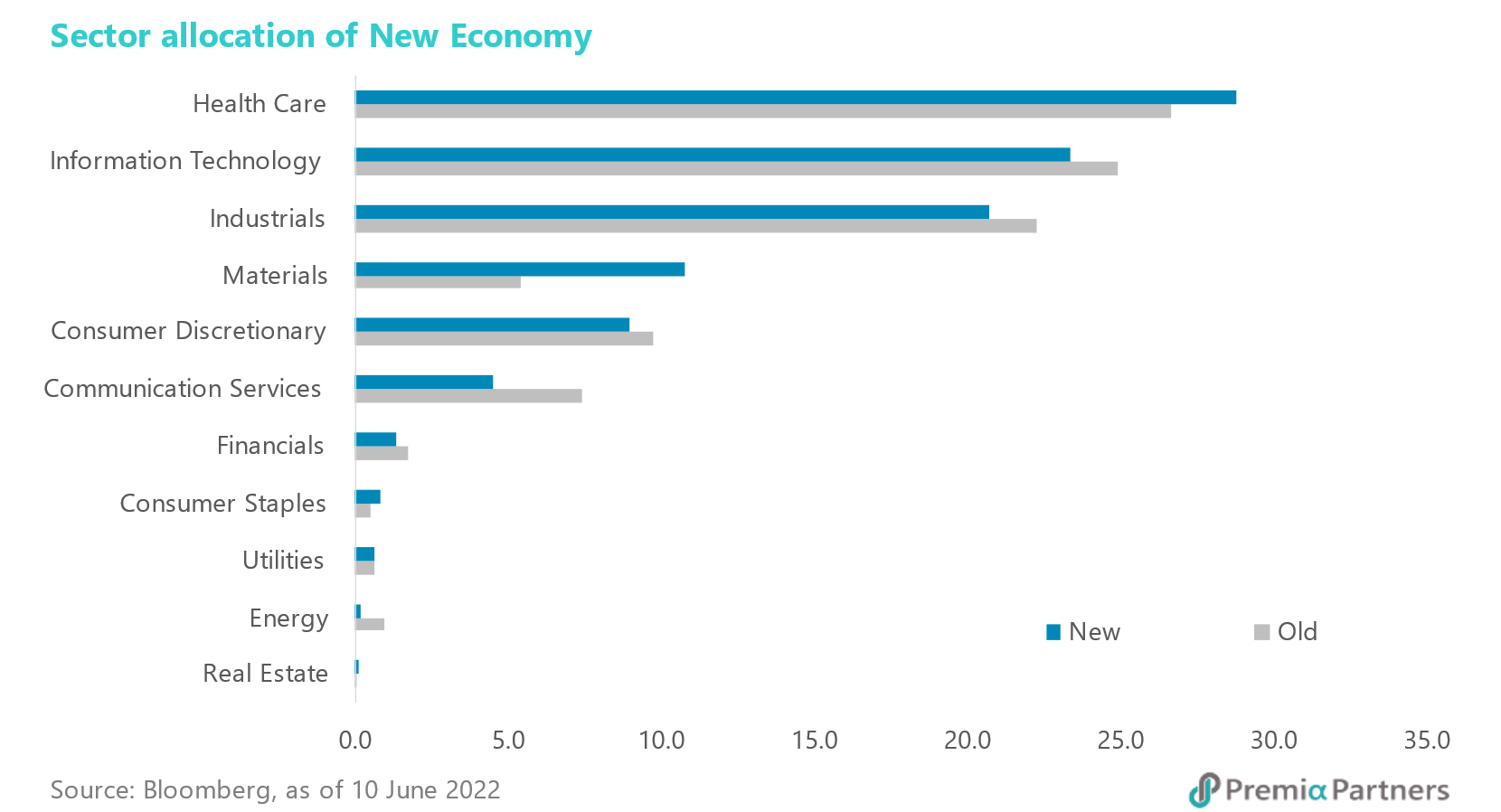

From a sector point of view, the major change is a reduction in Communication Services, Information Technology, and Industrials versus an increase in Materials and Health Care. The reductions in Communication Services are mainly Media companies such as publishing and advertising firms. On the contrary, not all sub-sectors in Information Techonology got decrease in weighting. The Index was selling most of the sub-sectors, except Semiconductors companies which are mostly listed on the STAR board.

On the additions, the increase in the weightings in Health Care mainly go to the Health Care equipment firms listed on the STAR board, while the increase in Materials is almost attributed to one company, Qinghai Salt Lake Industry, which has also become one of the Top 10 holdings in the index. One of Qinghai Salt Lake products is lithium carbonate which is a compound used to make EV batteries.

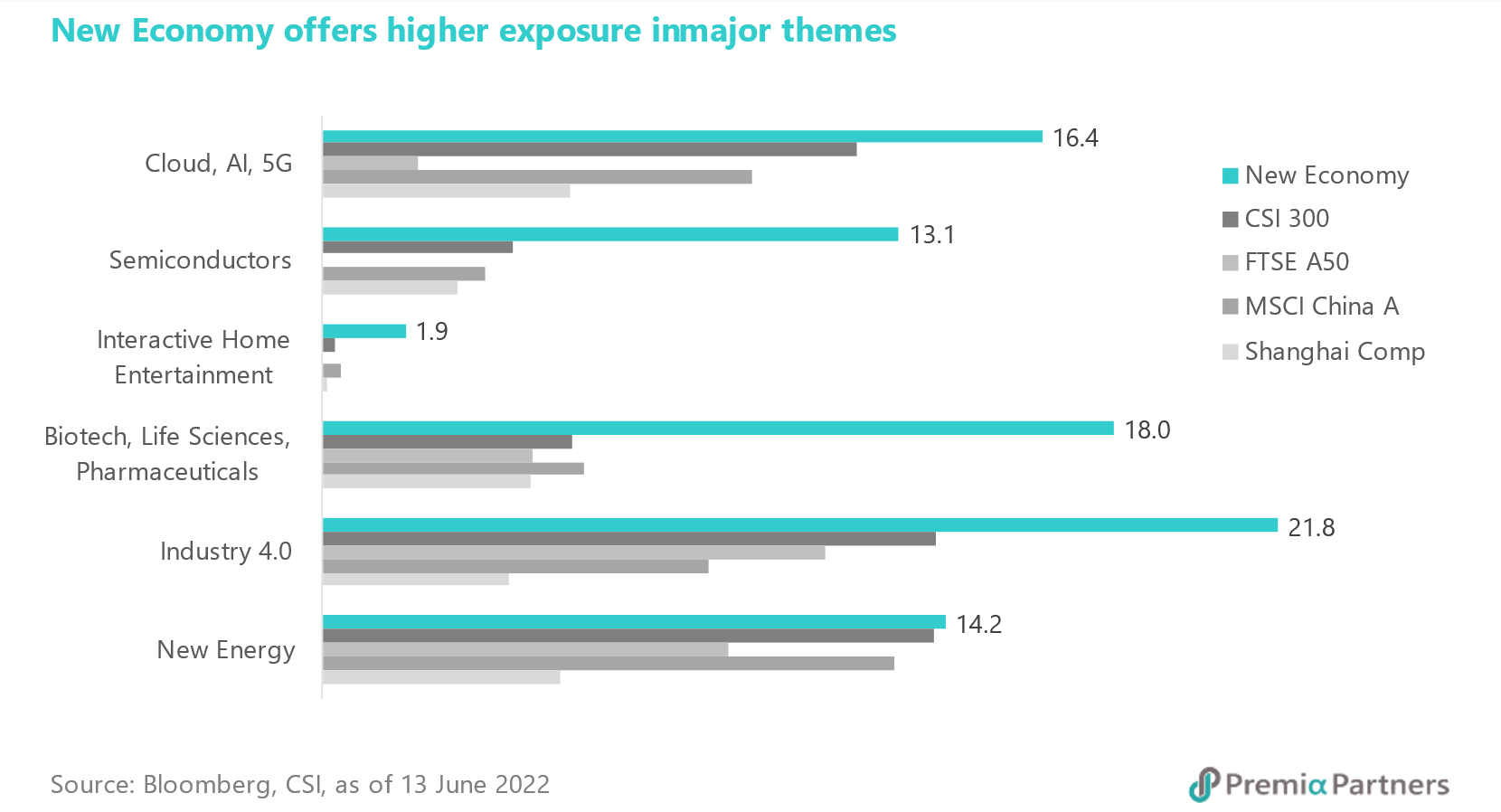

Albeit the changes between and within the sectors, the Index continued to have higher exposure than other major indexes in the megatrends, such as Cloud, AI, 5G, Semiconductors, Biotechnology, New Energy, etc., and allow investors to gain exposure in all major themes in one product.

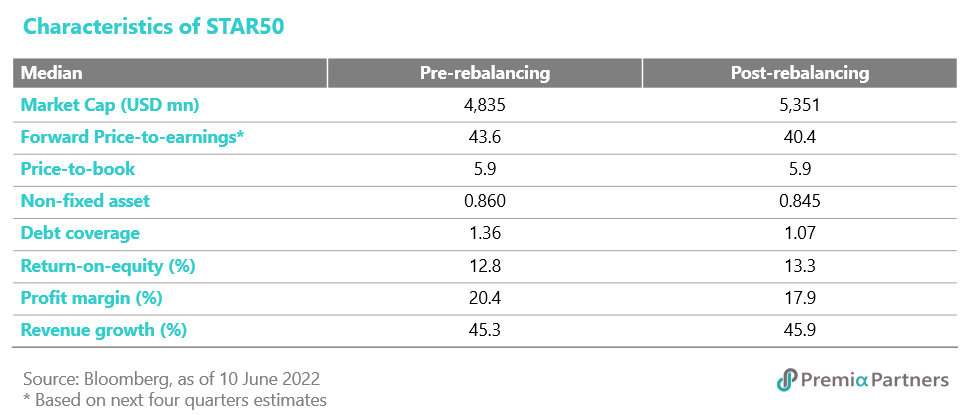

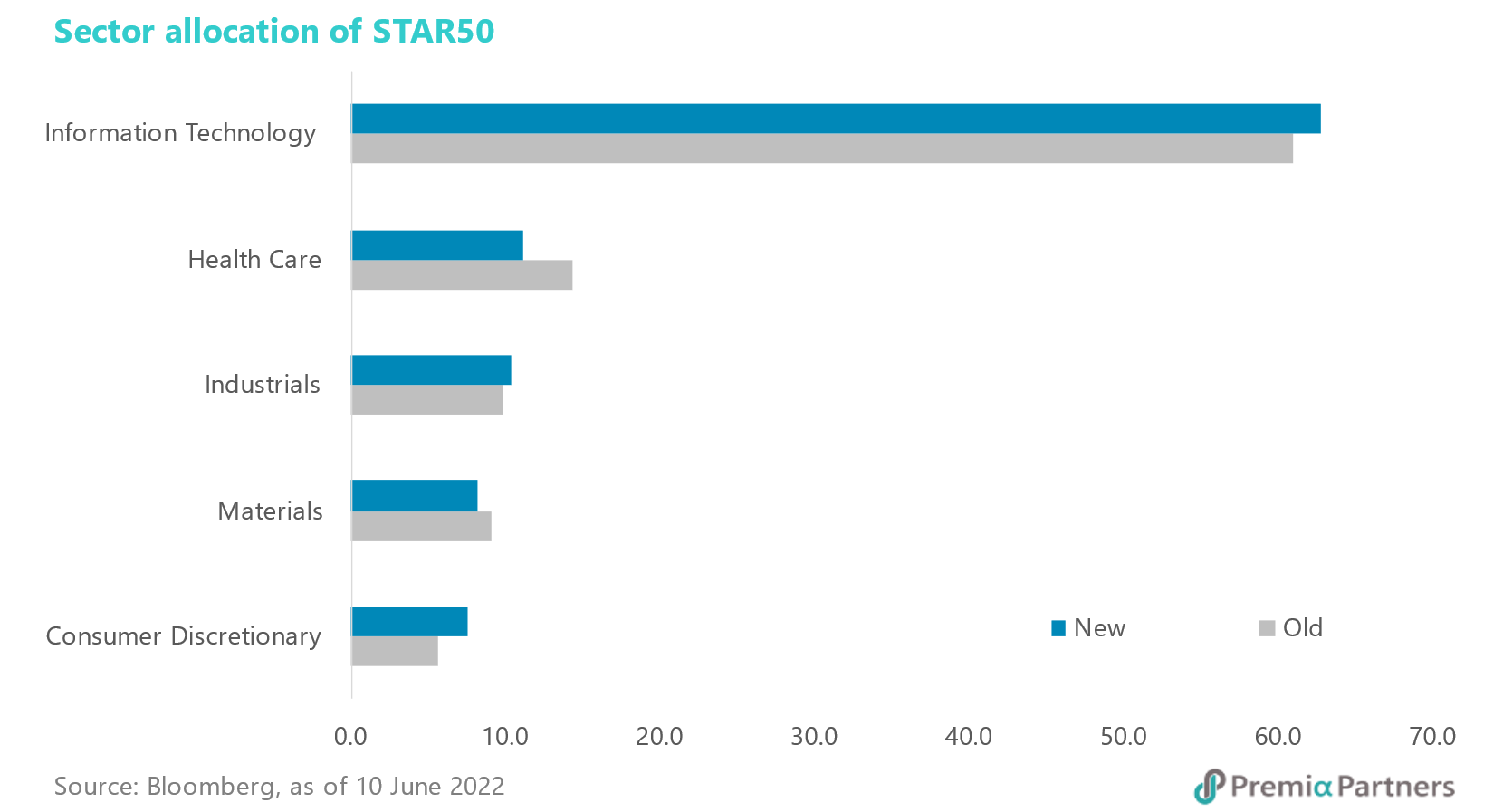

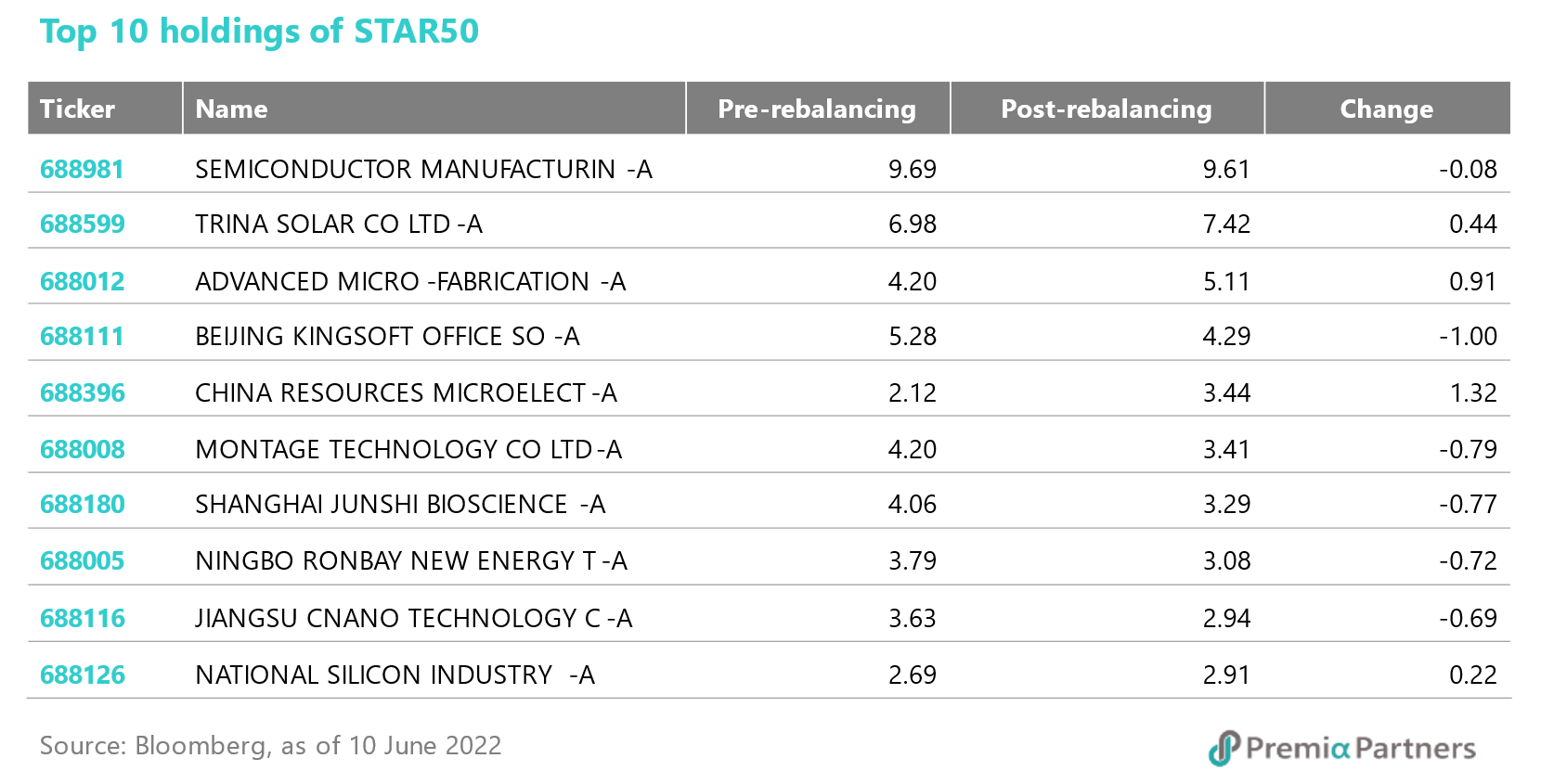

For SSE Science and Technology Innovation Board 50 Index, there were 5 changes among the underlying index constituents during the latest rebalancing in June. The one-way turnover ratio was 14.3%. Since the index selects stocks by market cap, it is not surprising to see that the median of the market cap after the rebalance increases slighty to 5.4 billion USD. On the other hand, there are not much changes in terms of the value and quality factors, and so is the sector allocation and top 10 holdings.

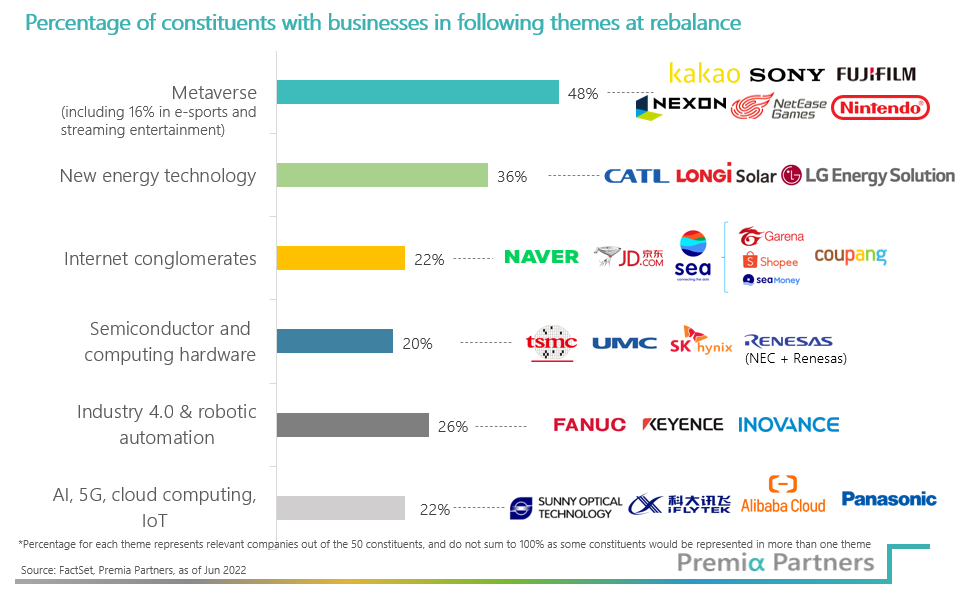

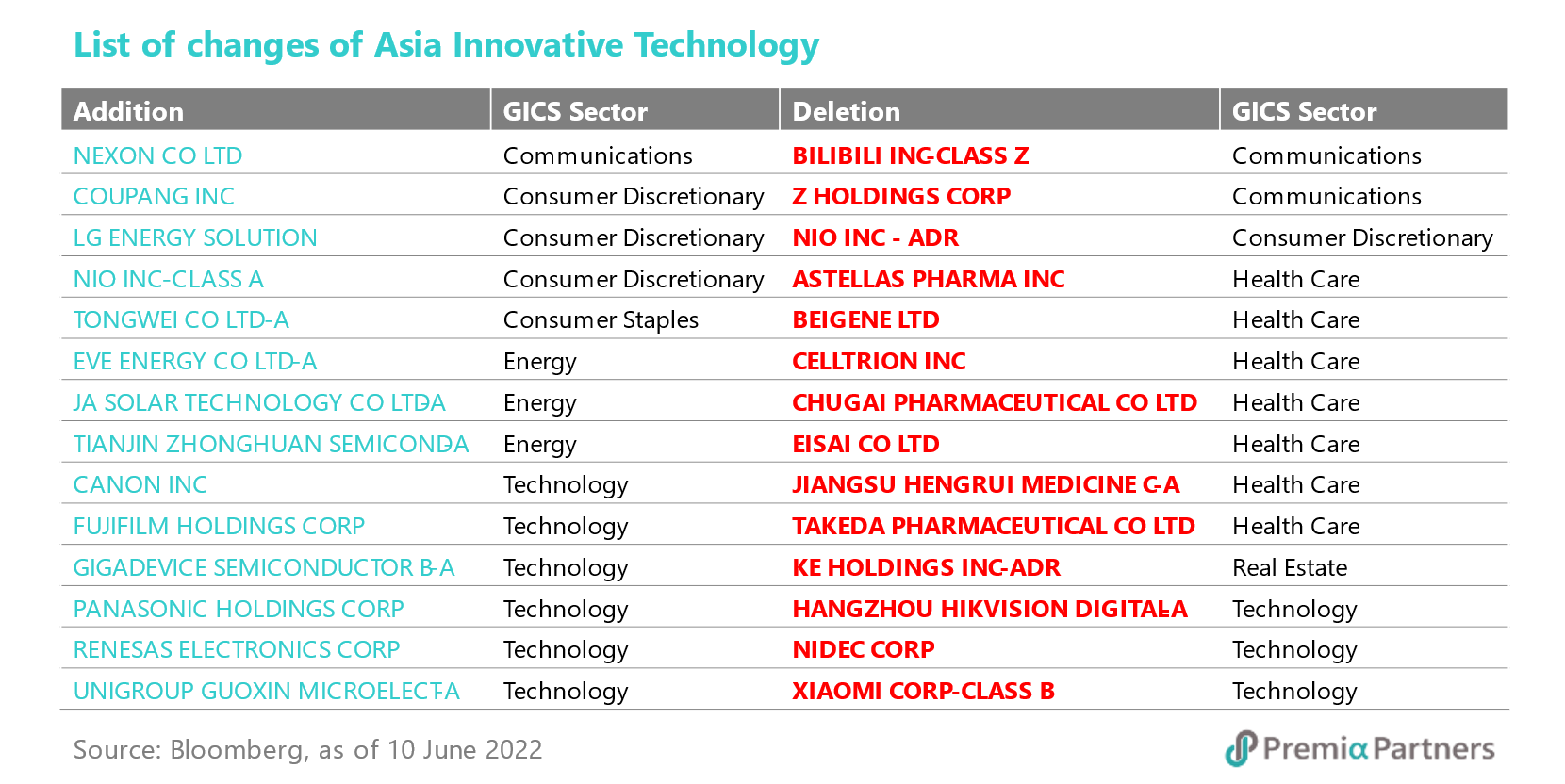

For Premia FactSet Asia Metaverse and Innovative Technology Index, there were 13 changes out of 50 stocks if excluding NIO Inc which was switching from the ADR to the shares listed in Hong Kong, due to a re-classification of the primary shares by the index company. The number of changes are more significant than the previous rebalance given the index metholodogy update, which dropped the non-innovative technology related Biotechnology sub-sector to better focus on the innovative technology themes in the Information Technology. Metaverse which previously is a theme under Digital Transformation related sub-sectors, is also separately highlighted as a pillar theme under this index update. More details could be found in our article Updates on Premia FactSet Asia Metaverse and Innovative Technology Index.

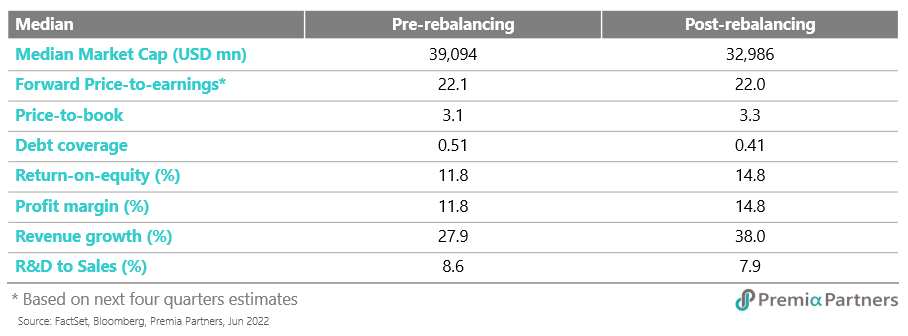

Since the revenue growth and the R&D to sales are still one of the selection criteria in the new methodology, both of them are maintained at a relatively high level after the rebalance. At the same time, the index sees some improvement in the quality factors, ROE and profit margin, while the value factors, price-to-earnings and price-to-book, are maintained at around the same level.

In terms of theme allocation, the weightings in the Biotechnology are mostly reallocated to the Smart EV, the Semiconductor and the New Energy, while the Metaverse remains as the largest weighted theme as similar to digital transformation which has become a staple skill, many of the innovative technology players also have metaverse related businesses. Since the index targets for equal weighting at the rebalance, the Top 10 holdings are all at around 2%, and 8 out of the 10 (if including NIO) are carried forward from the previous basket. The other two are Tongwei Co Ltd, which has a substantial business in photovoltaic new energy, and Unigroup Guoxin Microelectronics Co Ltd, which mainly produces telecom smart card chips, memory chips and special integrated circuits.