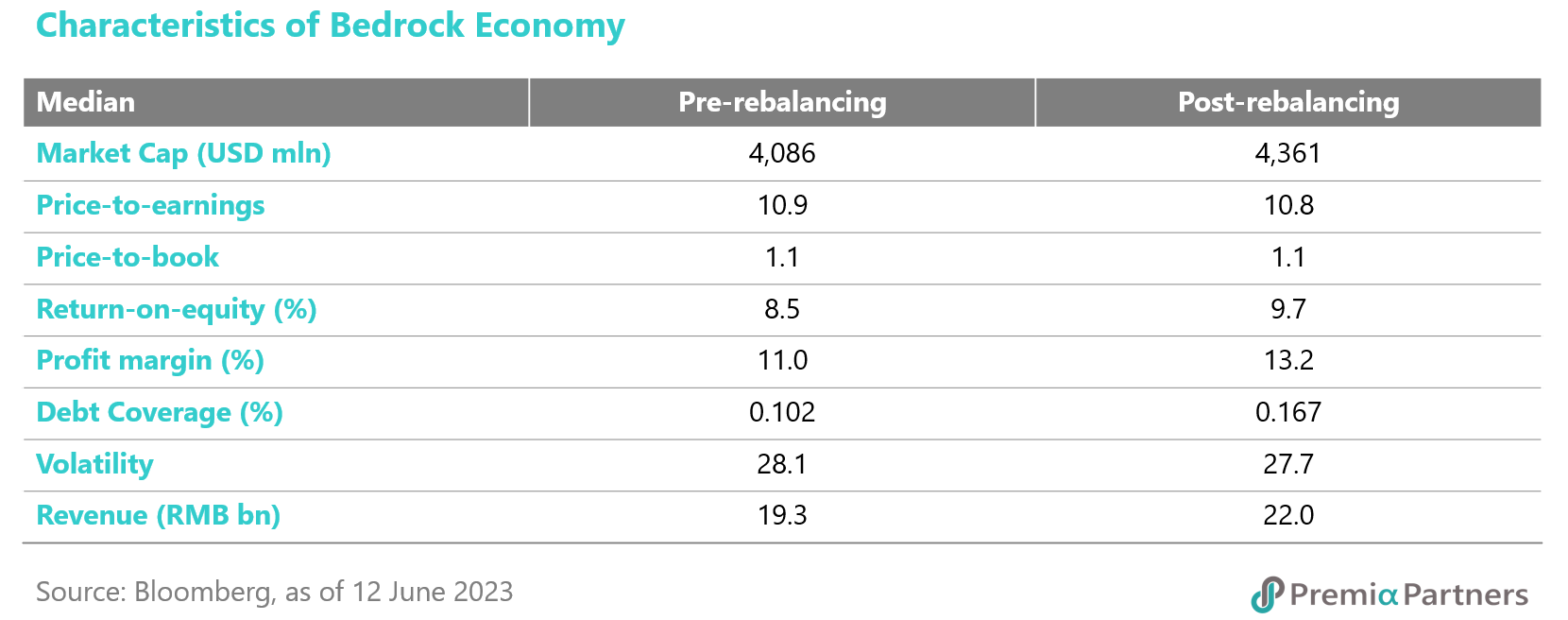

For CSI Caixin Rayliant Bedrock Economy Index (Bedrock), there were 92 changes among the underlying index constituents during the latest rebalancing in June. The one-way turnover ratio was 30.7%, at the lower end of the historical range between 30% and 40%. All the valuation, quality and volatility factors had some impact in this rebalance. Both the price-to-earnings ratio and the price-to-book ratio were almost unchanged at around 11 and 1.1, respectively. The ROE, profit margin and debt coverage improved after the rebalance, while the low-volatility screen did help reduce the portfolio’s risk, as shown by the volatility falling from 28.1% to 27.7%.

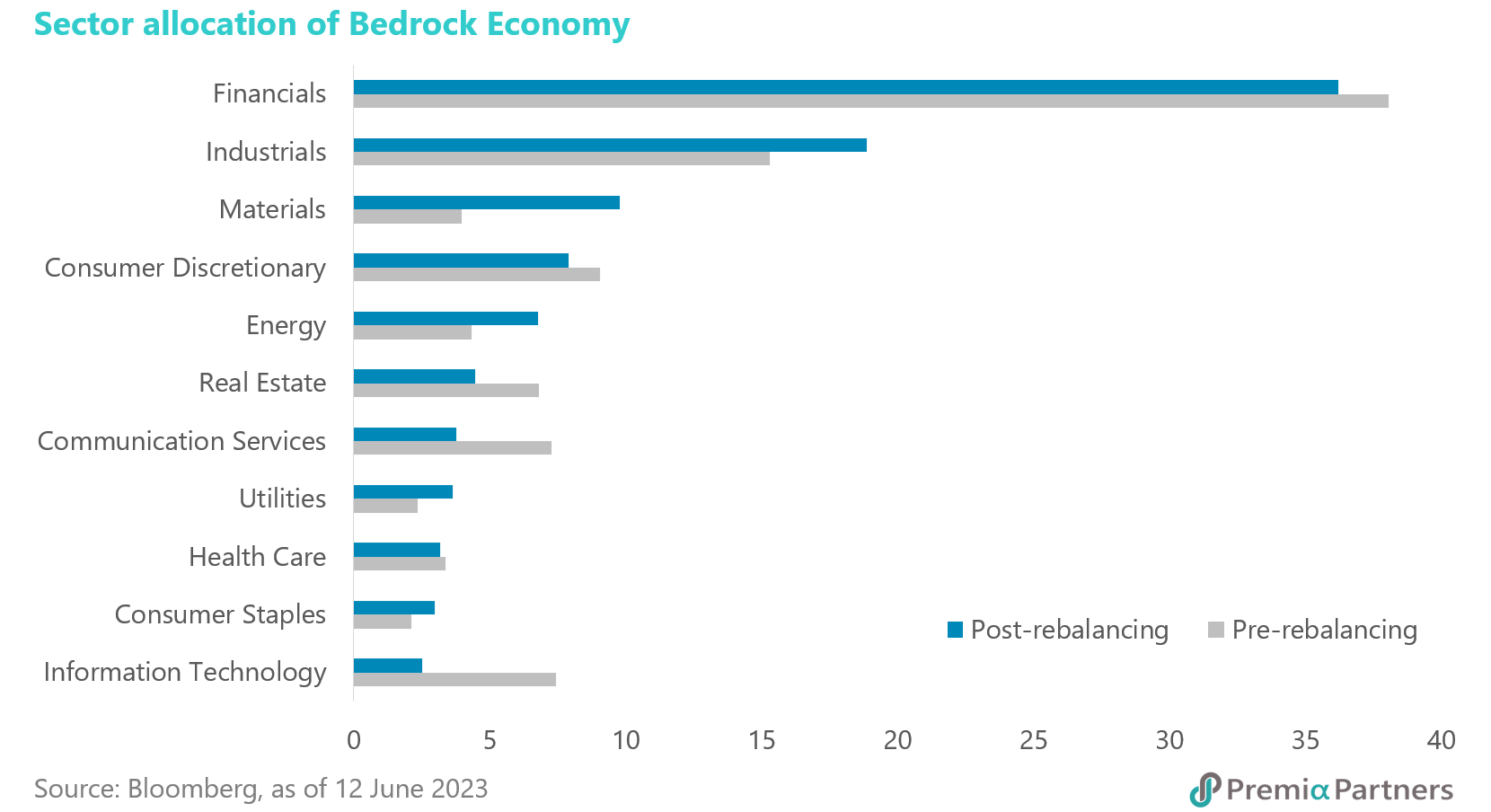

From a sector perspective, the major change was increasing weights in Materials, Industrials and Energy, and reducing exposure to Information Technology, Communication Services and Real Estate. Drilling down into sub-segments, the additions in Materials are mostly chemicals and metals & mining companies while those in Industrials are construction & engineering companies that should benefit from the government investments in infrastructure. CNOOC was the most significant addition among the Energy stocks and was the first time to be included in the index after it returned to the Shanghai Stock Exchange last year. The deletions in IT and Communication Services were mostly electronic equipment and media companies, while those in Real Estate were developers.

From a sector perspective, the major change was increasing weights in Materials, Industrials and Energy, and reducing exposure to Information Technology, Communication Services and Real Estate. Drilling down into sub-segments, the additions in Materials are mostly chemicals and metals & mining companies while those in Industrials are construction & engineering companies that should benefit from the government investments in infrastructure. CNOOC was the most significant addition among the Energy stocks and was the first time to be included in the index after it returned to the Shanghai Stock Exchange last year. The deletions in IT and Communication Services were mostly electronic equipment and media companies, while those in Real Estate were developers.

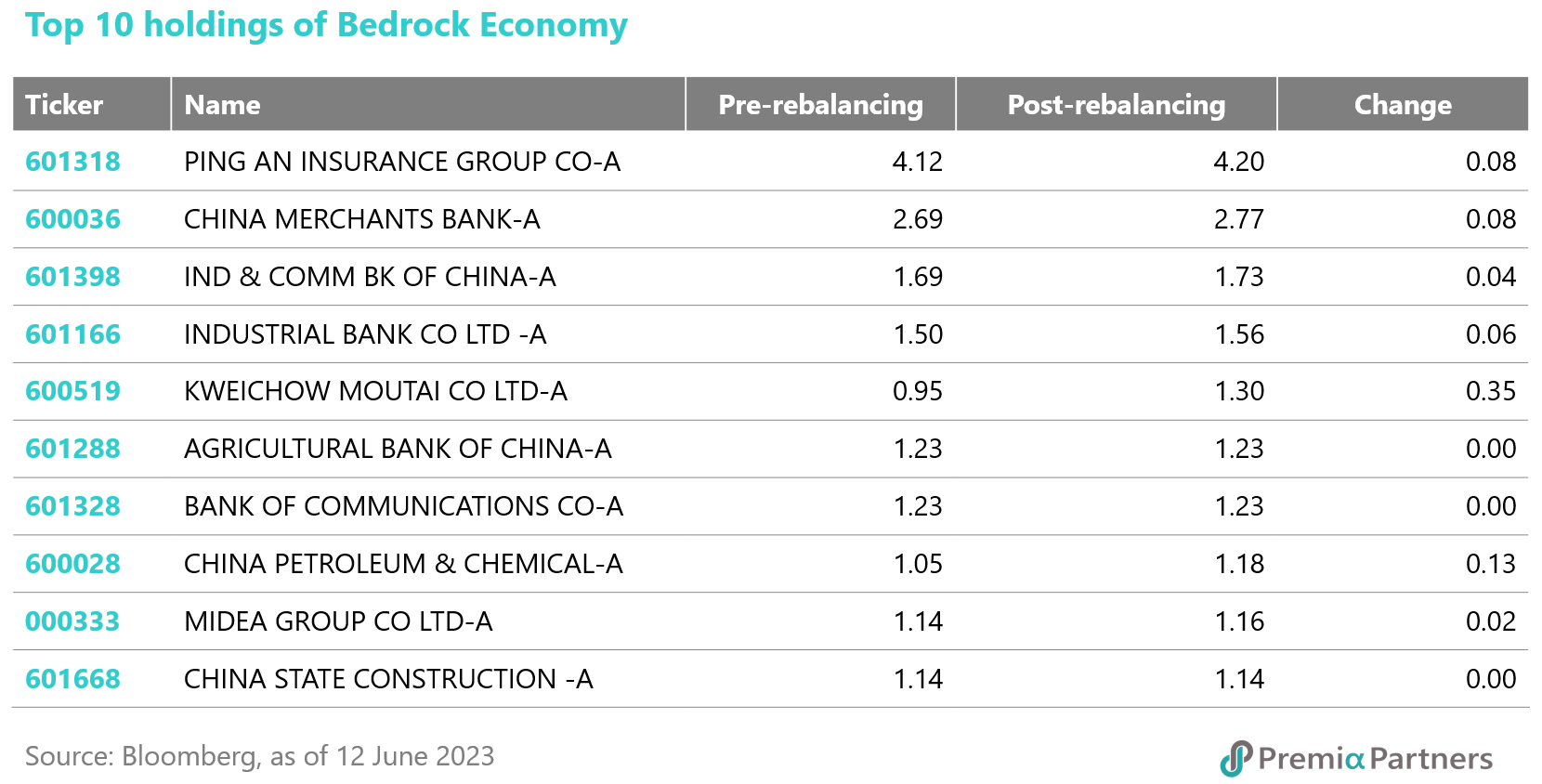

Kweichow Moutai (600519) and China Petroleum & Chemical (601328) managed to get to the Top 10 holdings after a slight increase in weightings, while China State Construction (601668 CH) was included as China Telecom (601728), Shanghai Rural Commercial Bank (601825 CH) and Shenzhen SED Industry (000032) were no longer in the Top 10 holdings. The first two got trimmed down in weightings while the last one got removed.

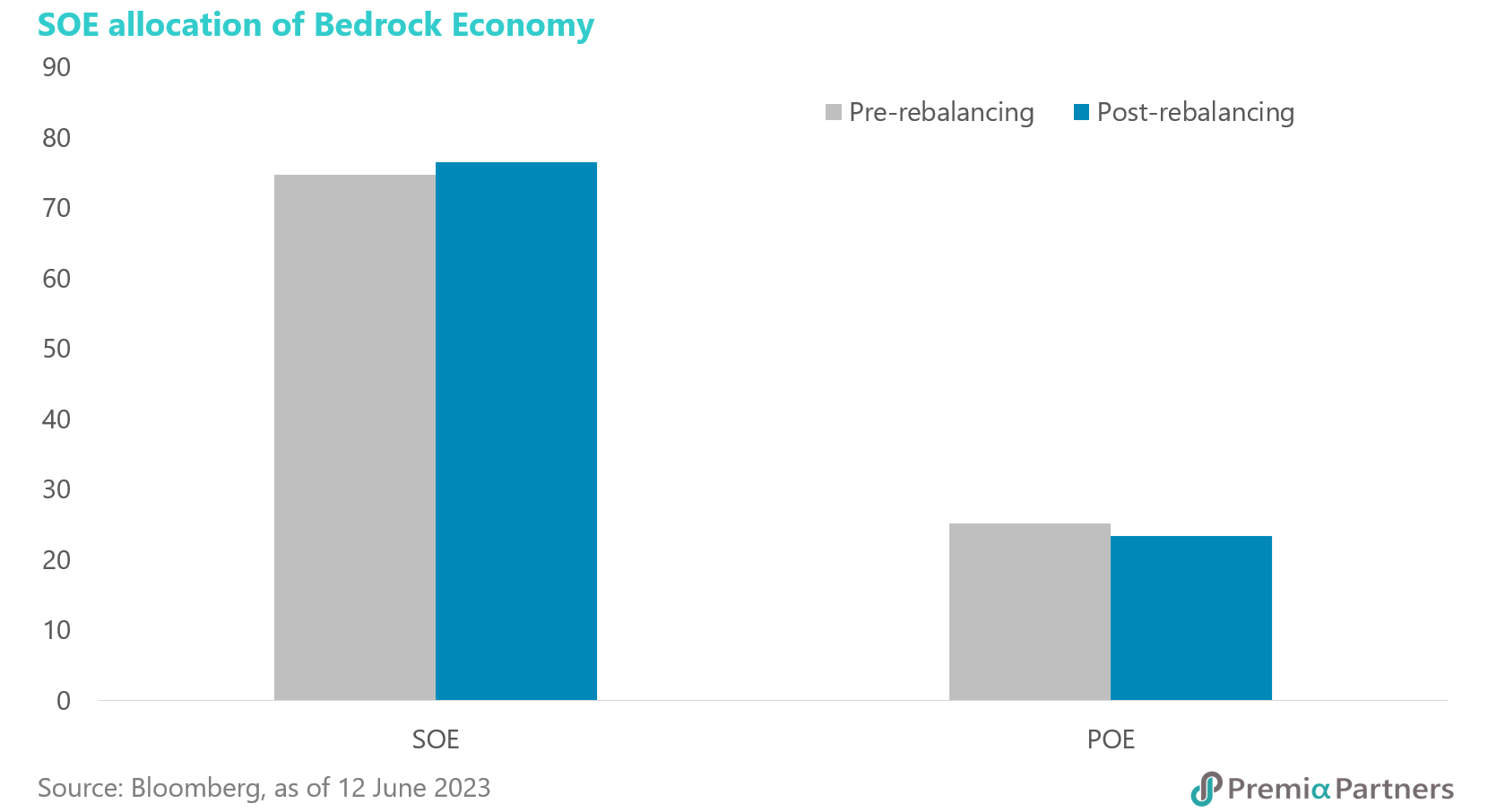

Bedrock’s weights in SOE had a slight increase from 74.7% to 76.6% after the rebalance. As such, Bedrock would still be an optimal vehicle to gain exposure to the SOE reform and revaluation theme which have become important, as the China government would like to improve the SOE efficiency and promote tech innovation to achieve self-reliance and price stabilization to benefit more people.

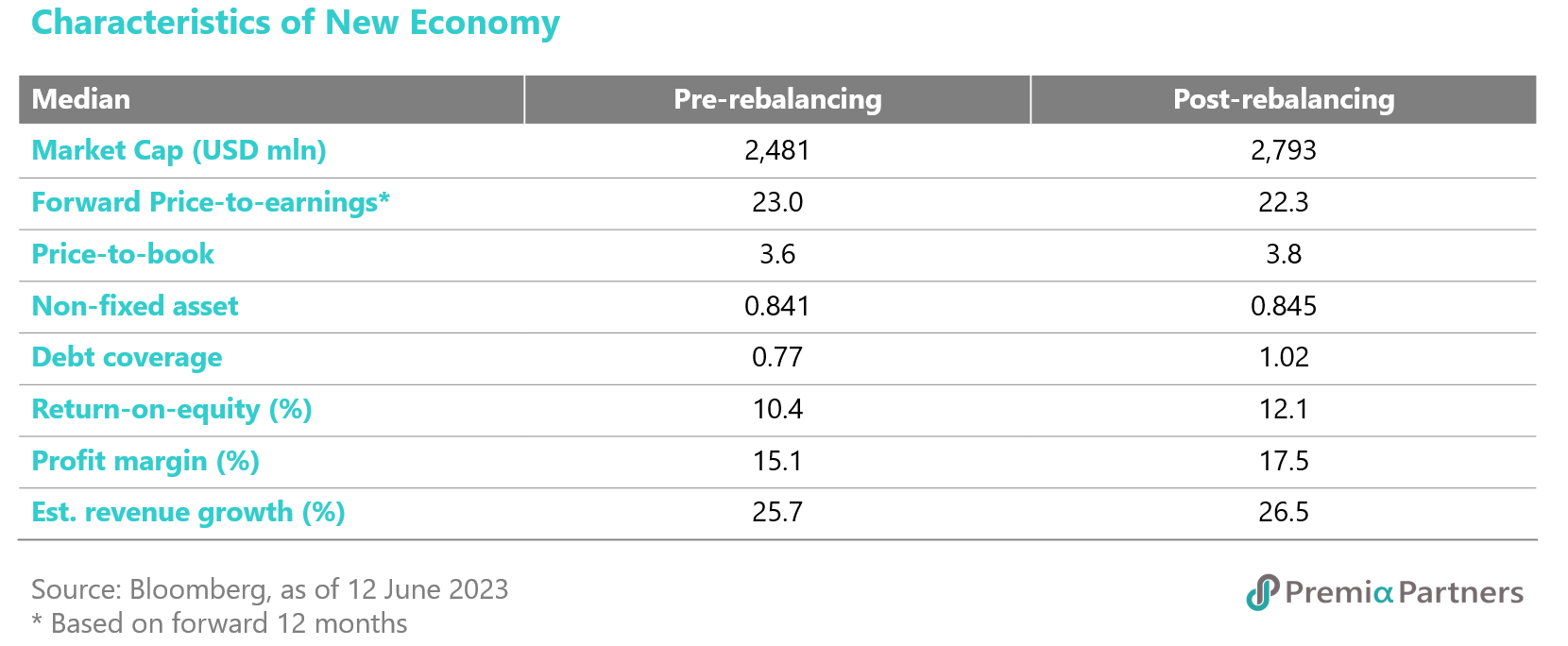

For CSI Caixin Rayliant New Economic Engine Index, its turnover rate was similar to the previous rebalance. There were a total of 110 replacements, and the one-way turnover was around 46.0%, around the same level as the last annual rebalance. In terms of financial health, the updated basket of stocks continued the trend of higher quality in general with improvement seen in the debt coverage (0.77x to 1.02x), return-on-equity (10.4% to 12.1%) and profit margin (15.1% to 17.5%). On top of that, the index constituents are expected to grow faster with the estimated revenue growth rising from 25.7% to 26.5% after the reshuffle.

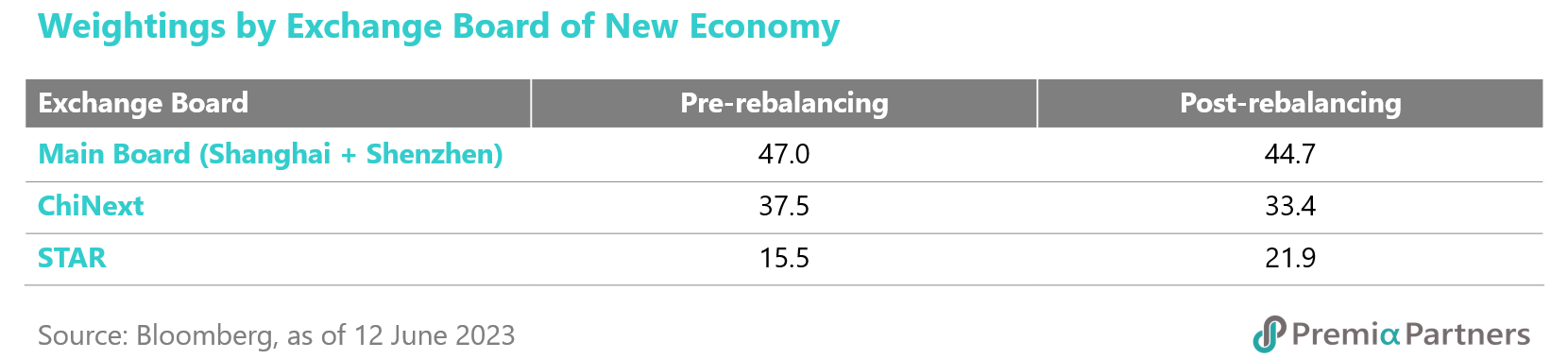

The STAR board companies’ weightings continued the uptrend and increased from 15.5% to 21.9%, mainly adding IT companies related to semiconductors and new materials companies that have applications in the battery, biomedicine and recycling business. As the STAR board had more listings and became more mature, the valuation level became more reasonable. The substantial increase in STAR didn’t have an impact as before on the Index forward PE and PB, which only changed from 23.0 to 22.3 and from 3.6 to 3.8, respectively.

The STAR board companies’ weightings continued the uptrend and increased from 15.5% to 21.9%, mainly adding IT companies related to semiconductors and new materials companies that have applications in the battery, biomedicine and recycling business. As the STAR board had more listings and became more mature, the valuation level became more reasonable. The substantial increase in STAR didn’t have an impact as before on the Index forward PE and PB, which only changed from 23.0 to 22.3 and from 3.6 to 3.8, respectively.

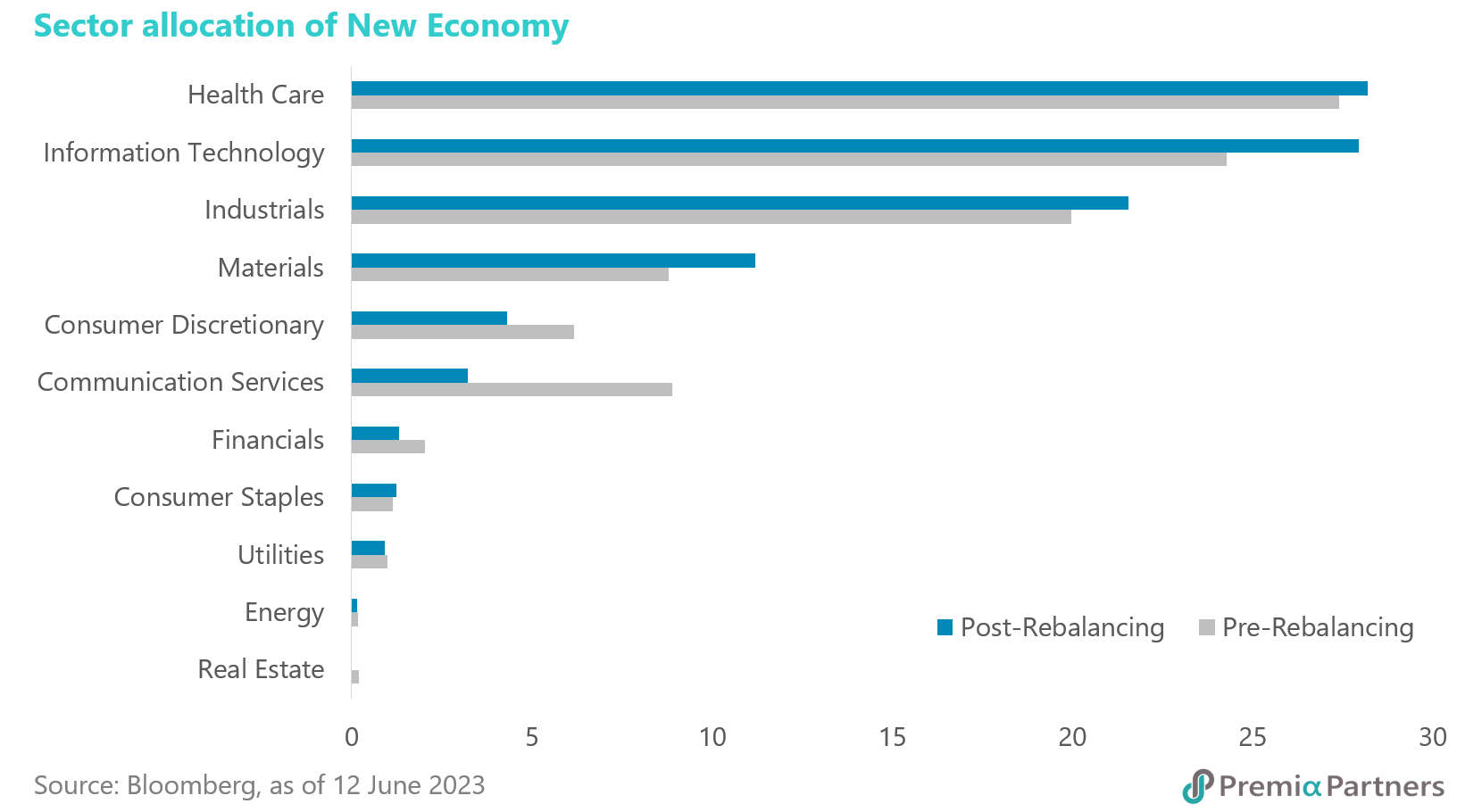

From a sector point of view, the major change is a reduction in Communication Services and Consumer Discretionary versus an increase in Information Technology and Materials. The reductions in Communication Services are mainly media companies such as publishing, advertising and gaming firms, which have seen a surge in prices and become expansive in valuation terms as investors think that they will benefit from the development of AI. On the contrary, the majority of the decrease in Consumer Discretionary was from the deletion of China Tourism Group Duty Free (601888) which saw a slump of almost 20% in revenue in the latest fiscal year.

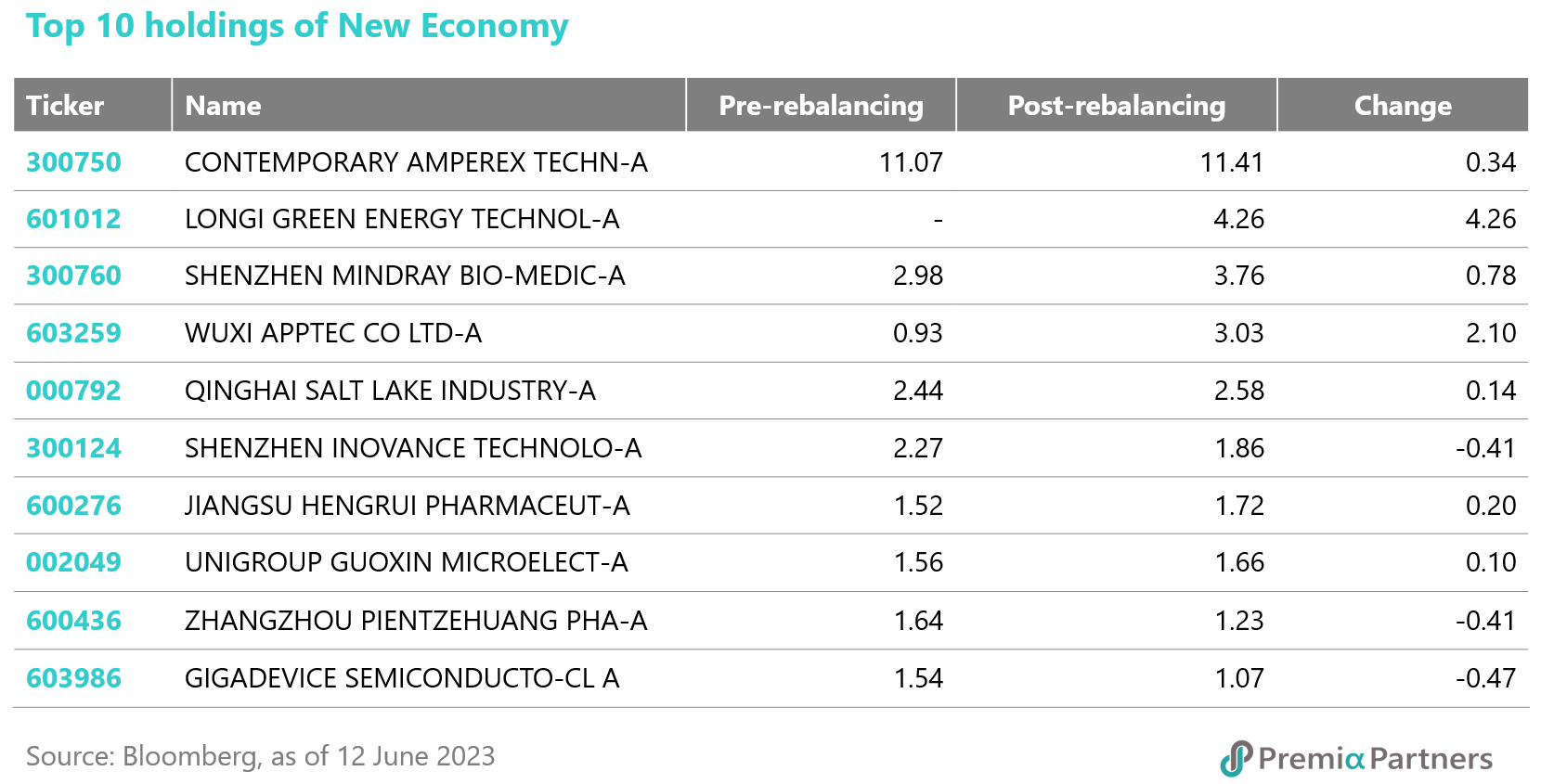

Apart from the additions of IT and new materials STAR board companies as mentioned above, another major addition would be Longi Green Energy Technology (601012) which is a global leading wafer manufacturer and solar PV solution provider. For Materials, a notable addition would be Canmax Technologies (300390) which produces lithium electric materials that are used in producing EV batteries and its clients include CATL and Sharp.

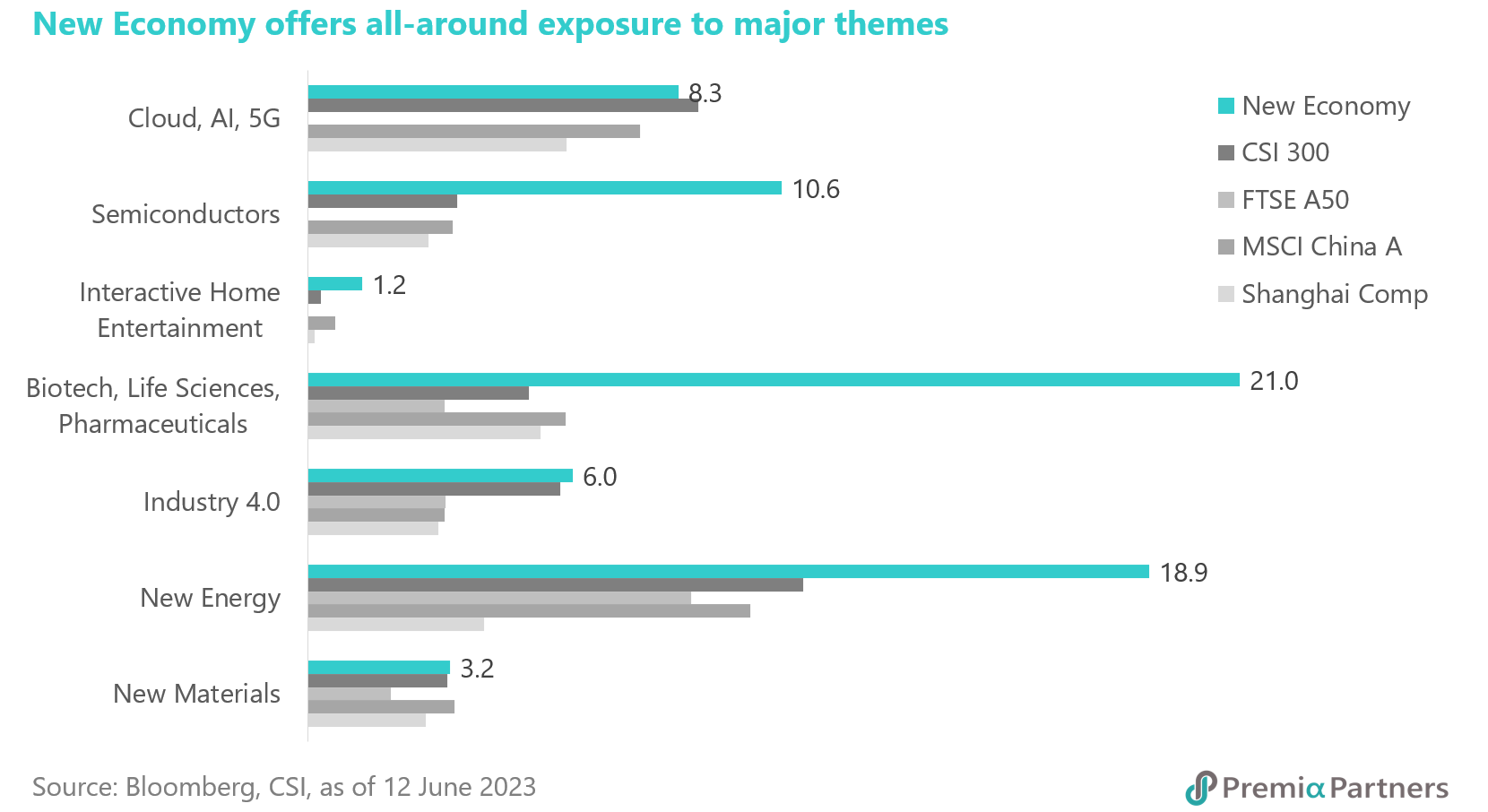

Albeit the changes between and within the sectors, the Index continued to have all-around exposure to the megatrends, especially in Semiconductors, Biotechnology and New Energy, than other major indexes and allowed investors to gain exposure to all major themes in one product.

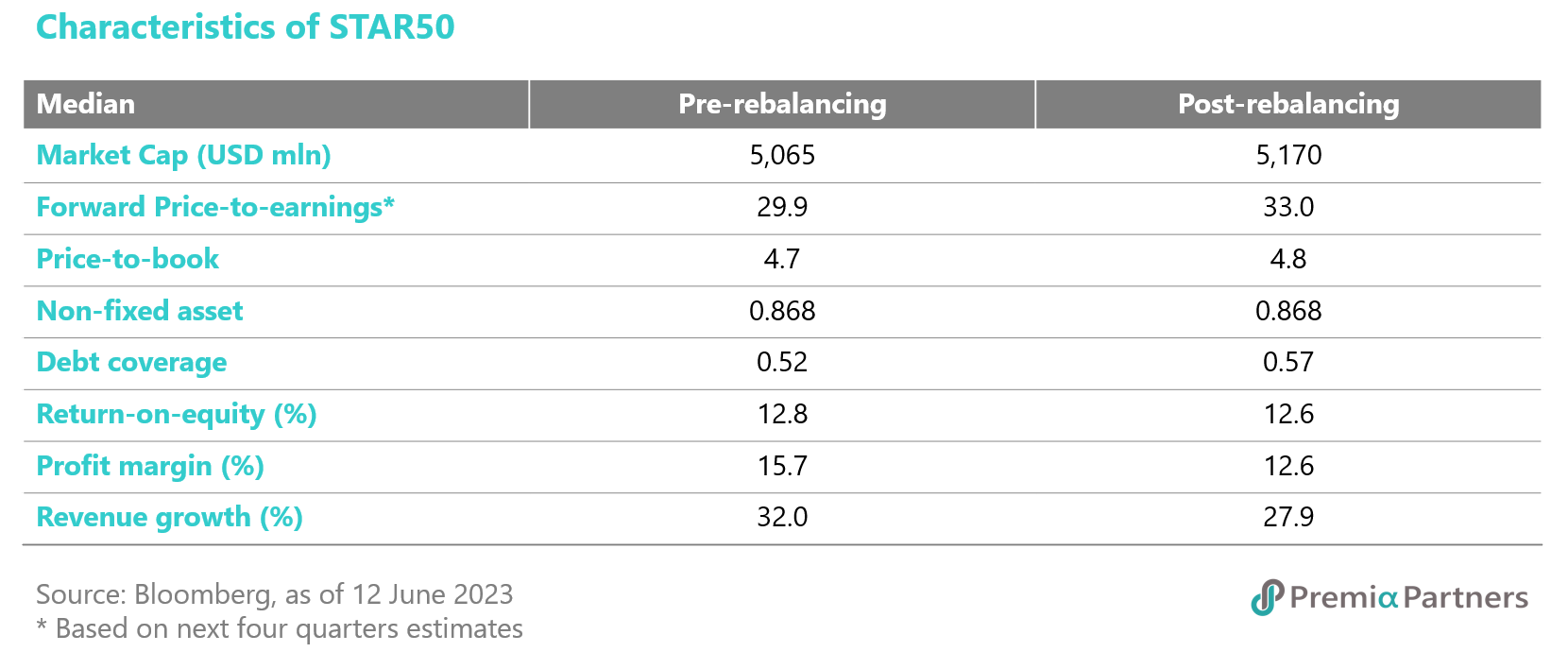

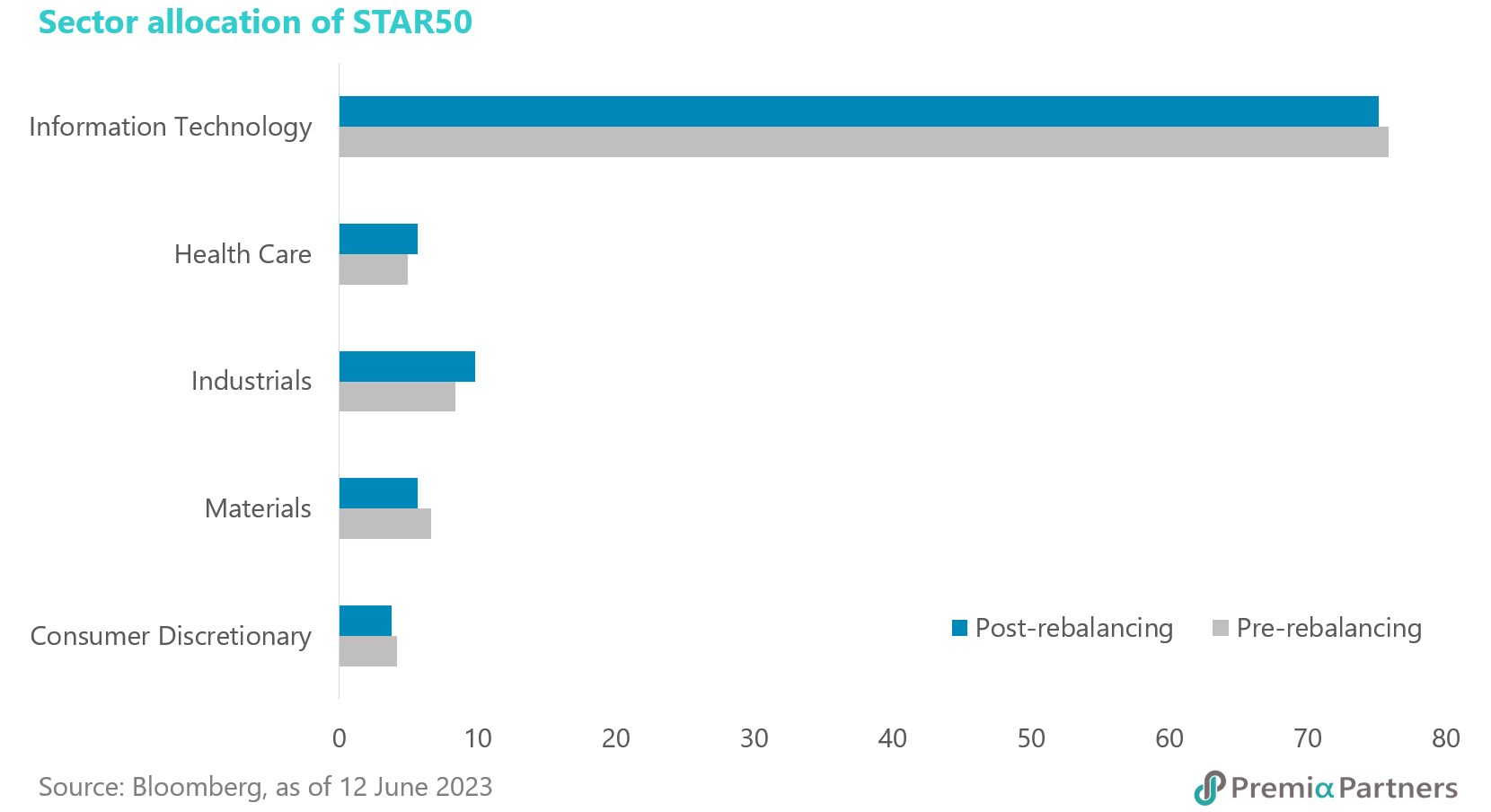

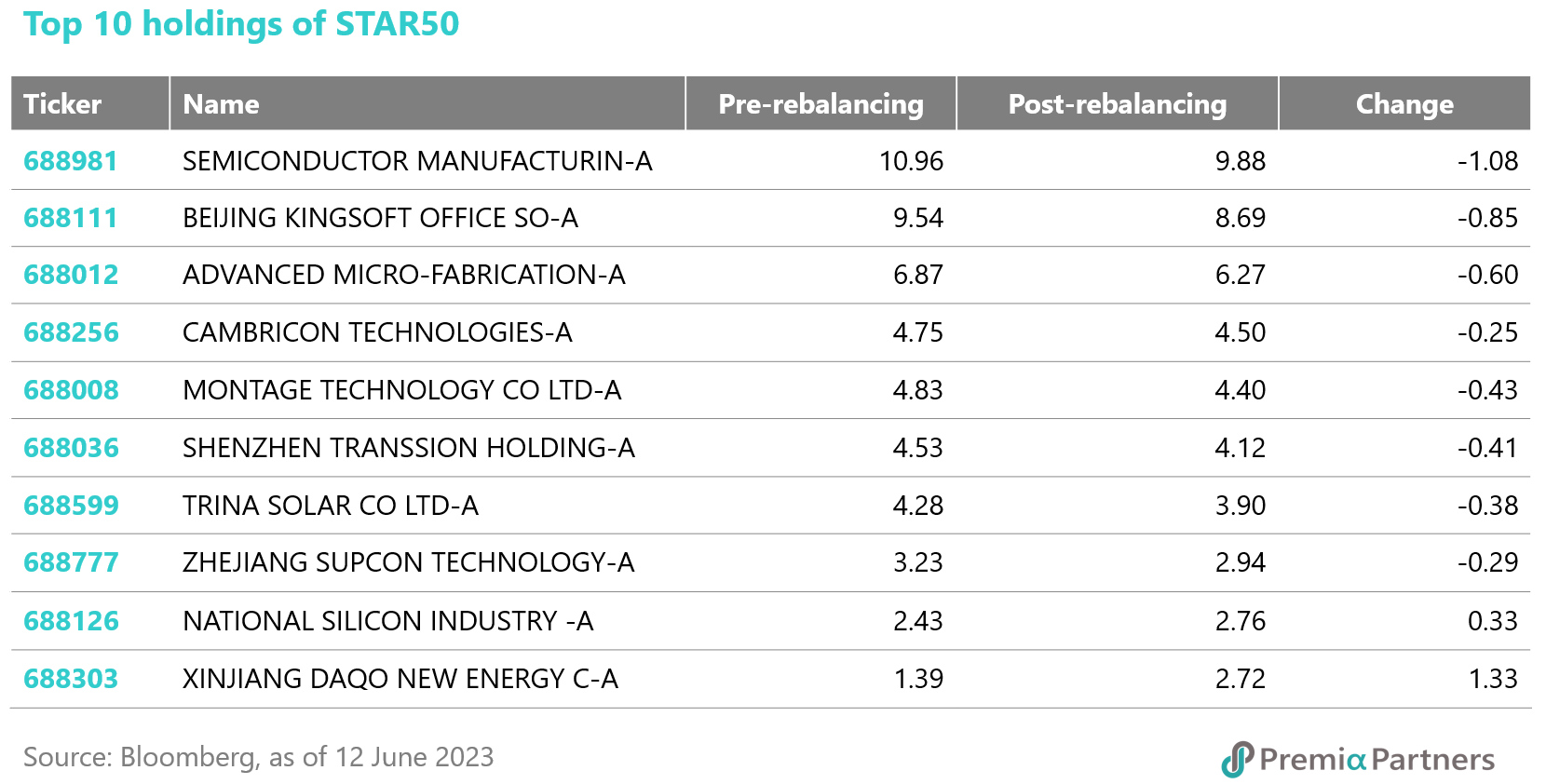

For SSE Science and Technology Innovation Board 50 Index, there were 2 changes among the underlying index constituents during the latest rebalancing in June. The one-way turnover ratio was 8.1%. The two additions are MGI Tech (688114) and AVIC Chengdu UAS (688297). MGI Tech is a biotech company that specializes in laboratory automation and gene sequencer products while AVIC Chengdu UAS is an industrial company that produces unmanned aerial vehicles. Since the index selects stocks by market cap, it is not surprising to see that the median of the market cap after the rebalance increased slightly to 5.2 billion USD. On the other hand, there are not many changes in terms of the value and quality factors, and so are the sector allocation and top 10 holdings.

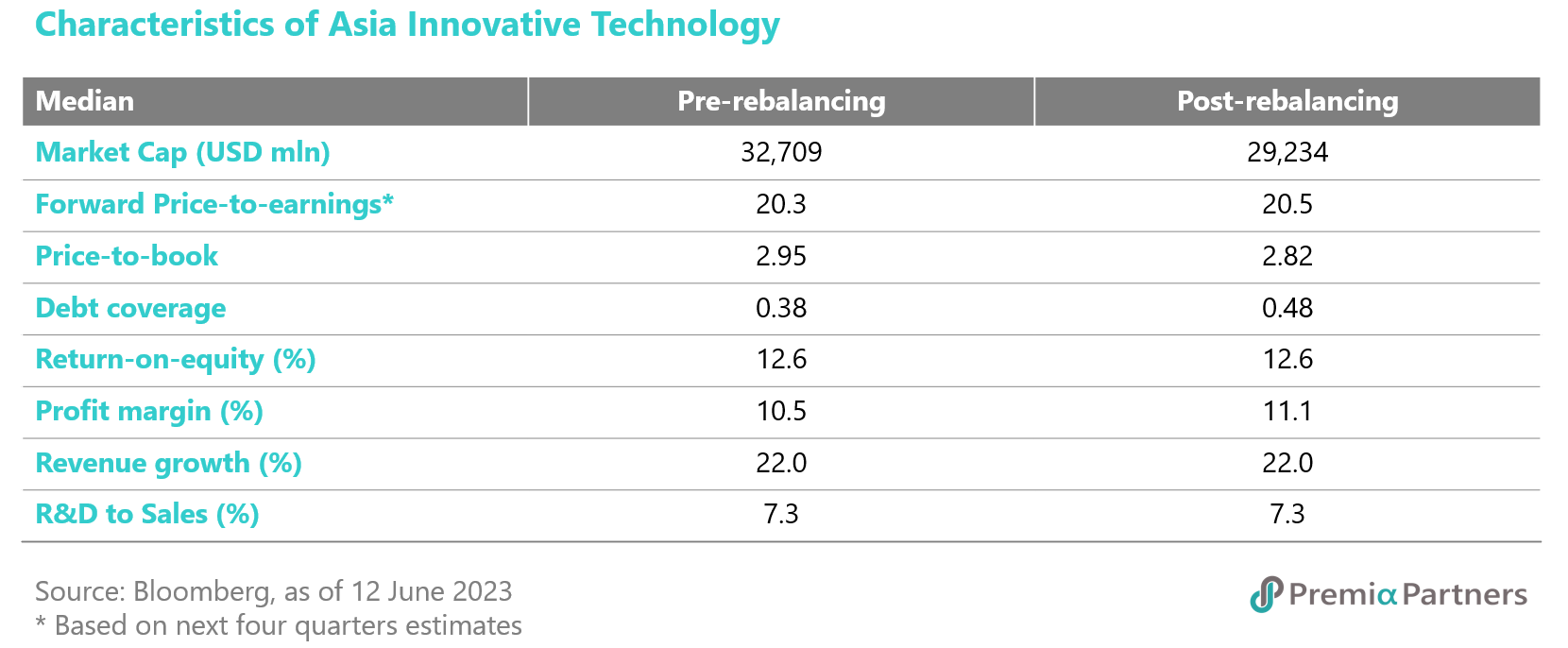

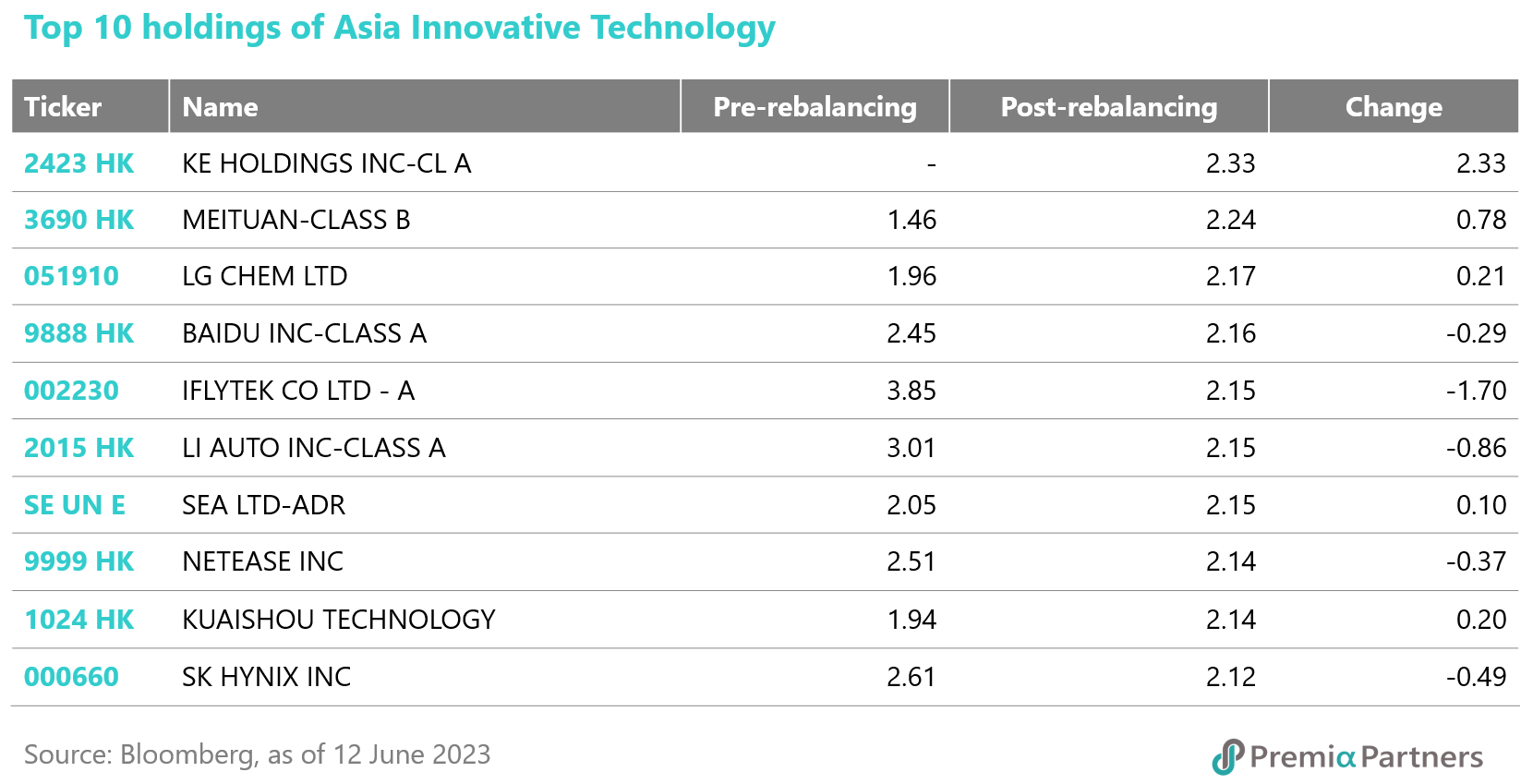

For Premia FactSet Asia Metaverse and Innovative Technology Index, there were 5 changes out of 50 stocks with a oneway turnover of 17.9%. The more interesting stock among the additions would be Delta Electronics (Thailand) which is the first Thailand stock to be included in the index. Its main business is to design and manufacture power systems that have a wide range of applications, especially in EV and data centers, the two high-growth areas due to the uprising usage of EV and AI applications.

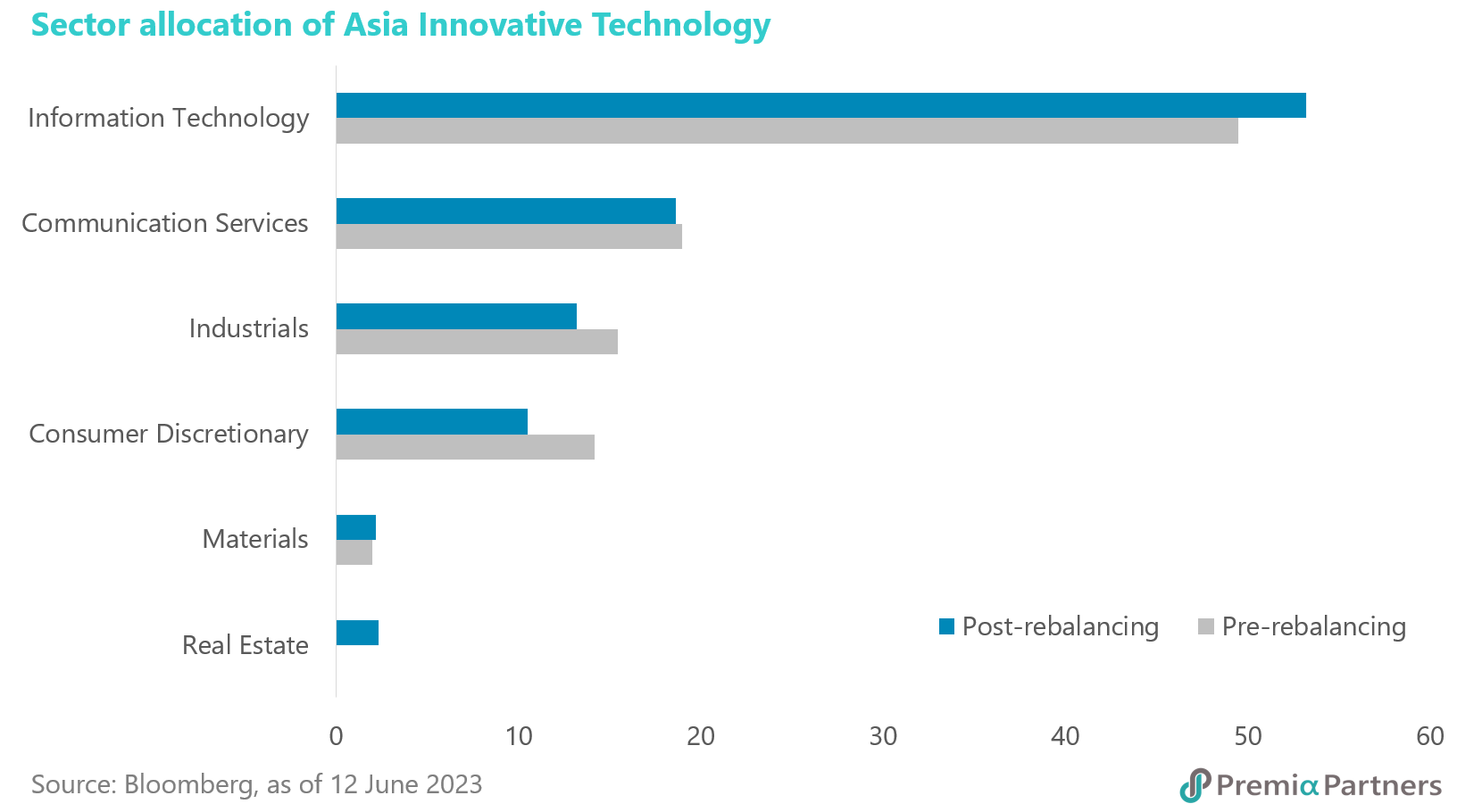

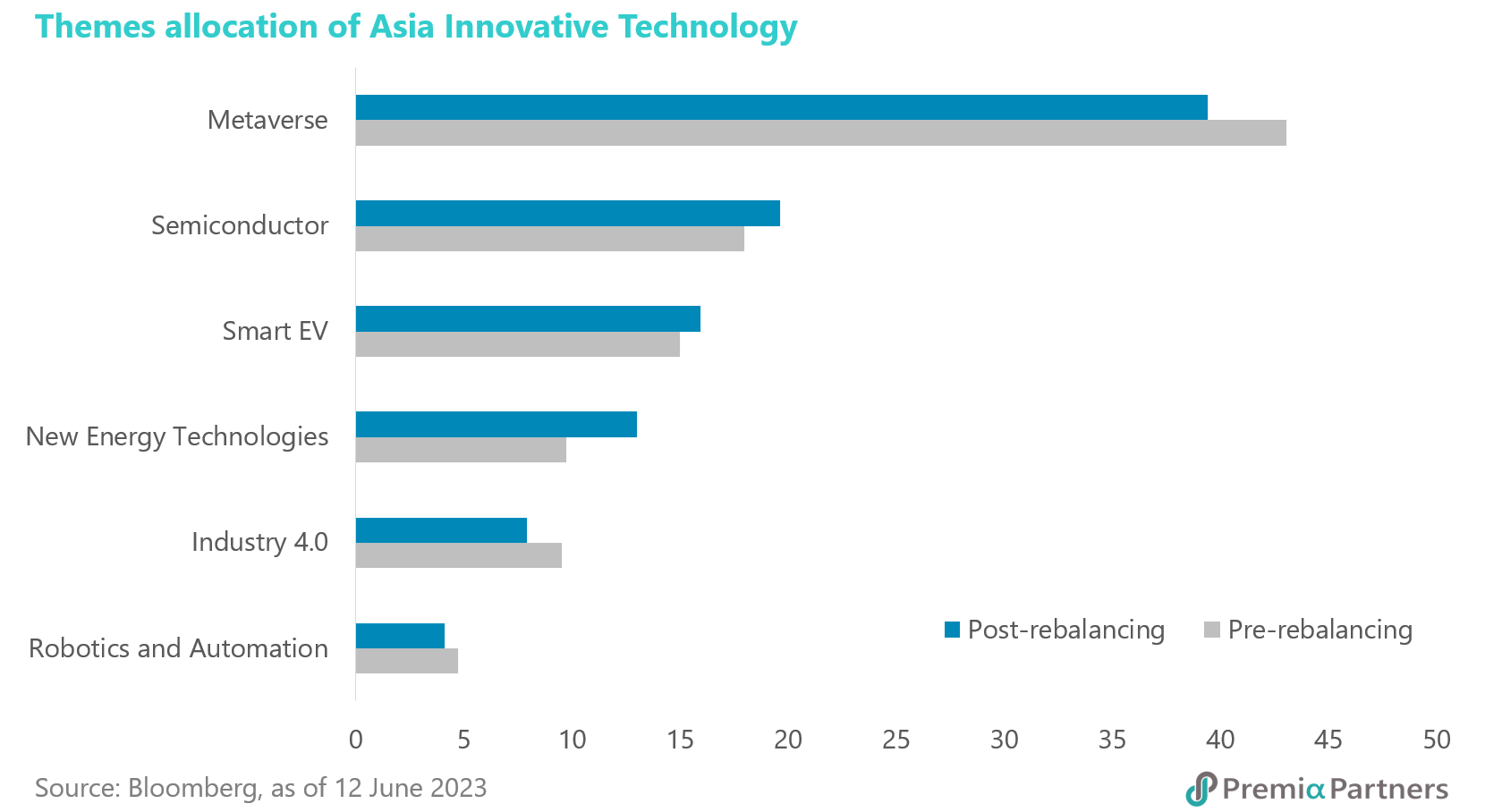

Since the revenue growth and the R&D to sales are one of the selection criteria in the new methodology, both of them are maintained at a relatively high level after the rebalance. The index’s quality and valuation factors are maintained at around the same level after the rebalance. In terms of the sector and theme allocation and the Top 10 holdings, the changes are not material and are mostly due to the recapping to 2% for each individual stock.