featured insights & webinar

As cyclical movements would revert and short-term volatility hikes would calm, long-term strategic investors often look out for overarching secular or structural trends. Yet by definition, structural shifts and new innovations often take time. However, there can be catalysts! Witnessing a black swan can be a crisis, but like Winston Churchill advised – let’s not waste a crisis. So where do we look for growth opportunities?

Jun 12, 2020

The Two Sessions are always of interest to the market for the key economic policies unveiled by Chinese leaders. At this year’s Two Sessions, China decided not to set a GDP growth target for the first time in decades, raised the budget deficit ratio above a long-held “red line,” issued special treasury bonds for the first time in the last 2 decades, and rolled out a host of measures to buoy employment and support economic recovery from Covid-19.

Jun 10, 2020

IoT, or Internet of Things, has gradually become well-known to all as applications such as connected cars and smart home appliances gain popularity in the consumer space. As we have been advocating, enterprise digitalisation would be a game changing space to watch – and IIoT is one of the critical piece of it. In fact, IIoT is among the #NewInfrastructure agenda that was specifically mentioned as policy support priority in China. So what is IIoT? And why are the leaders resilient through and beyond COVID? In this piece, we will share the concept of IIoT (Industrial Internet of Things), the industry revolution in this space, and the implications to investors.

May 26, 2020

Given the trade tensions and looming risks of de-globalisation, it is likely that China will embark on a different growth path in the aftermath of COVID, and increasingly rely on domestic demand to drive growth. This structural shift holds significant implications for EM Asia. In fact, ASEAN replaced the European Union as China’s biggest trading partner in 1Q20. In this webinar, our co-CIO David Lai shares our research and insights on investing into ASEAN markets in light of the late COVID crisis, re-escalating US-China trade dispute and more importantly the gradual global supply chain reconfiguration.

May 26, 2020

China is in the early stage of restarting its economy, and China A shares market has held up relatively well compared to other global equities markets amid the COVID. In particular, our Premia China New Economy strategy has been very resilient throughout the crisis with YTD NAV performance of 10.7% (in CNY, as of May 26th, 2020). It has been consistently seeing inflows over the past months and is also among the best performing broad market China A ETFs globally. In this webinar, our co-CIO David Lai shares first-hand insights on the post-COVID impact, policy developments, and capital market flows of the Chinese market. As China recovers from the pandemic, how shall investors watch out for opportunities from the post-COVID recoveries, policy supports and new norms?

May 26, 2020

Vietnam government has started a gradual and orderly reopening since April 23rd, though the macro data was still weak as expected due to the lockdown around the world. After initially keeping the goal for 5% GDP growth this year the government revised growth target last week to a two-scenario range of 4.4%-5.2% if major trading partners can control the outbreak by end of Q3 and 3.6%-4.4% if by Q4. How are things doing in Vietnam at the moment? Is it the time to position for recovery? Here is a quick update on the various.

May 18, 2020

Given the trade tensions and looming risks of de-globalisation, it is likely that China will embark on a different growth path in the aftermath of COVID, and increasingly rely on domestic demand to drive growth. This structural shift holds significant implications for EM Asia. In fact, ASEAN replaced the European Union as China’s biggest trading partner in 1Q20. And as a result of the increased tension and US protectionist measures targeting China, and pressure for MNCs to choose which one they side with under the pretext of protection against production disruptions in China, ASEAN and notably Vietnam are clear winners. But a more nuanced picture is closer to the truth. That is, the shifts in supply chains are more likely to be gradual than dramatic.

May 18, 2020

Yes, possibly. The different approaches taken by the US and China towards managing COVID-19 has likely set the stage for a widening of the growth differential between the two countries. Immediately, the earlier reopening of the Chinese economy means China’s GDP will still show a bit of growth this year. This compares to the controversial, tentative easing of restrictions in the US, only in May. Even if the US gradually normalizes from here, its GDP for will end 2020 with a big hole, which will take three to four years to fill. If China maintains its productivity growth, it should be able to manage a long-term average GDP growth rate of around 5.8% a year. Meanwhile, long-term US GDP growth from 2022 onwards could ease to 1.5% on lower investment/lower productivity growth. Taking into account IMF projected growth rates for 2020 and 2021, China could overtake the US in Dollar terms by 2029.

May 13, 2020

We previously highlighted the gaming industry just after the coronavirus outbreak in Account of an atypical, tech-enabled CNY holiday. With the COVID-19 pandemic raging on globally and people spend more time at home social distancing, the gaming industry has shown greater potential of booming opportunities. The large demographic base of tech-savvy and mobile-first youths born in the digital era provided a strong head start for China, especially in eSports.

May 11, 2020

Some of you or your kids might have just started your animal crossing journey as the newest social activity amid the COVID lockdown. In fact, it was estimated that the global video game market generated over USD 150 billion in revenue by the end of 2019. Within video gaming, eSports, also known as Electronic Sports, which often takes the form of organized, multiplayer video game competitions has evolved over the last decade, into a significant, professional industry already. Global revenue in esports is estimated to be over 1 billion US dollars, and China currently accounts for about 20% of it. In this mini-webinar, we hope to share with you the latest interest findings about the virtual land of video gaming, eSports, and live streaming in China!

May 08, 2020

BY TOPICS

Chart Of the Week

Alex Chu

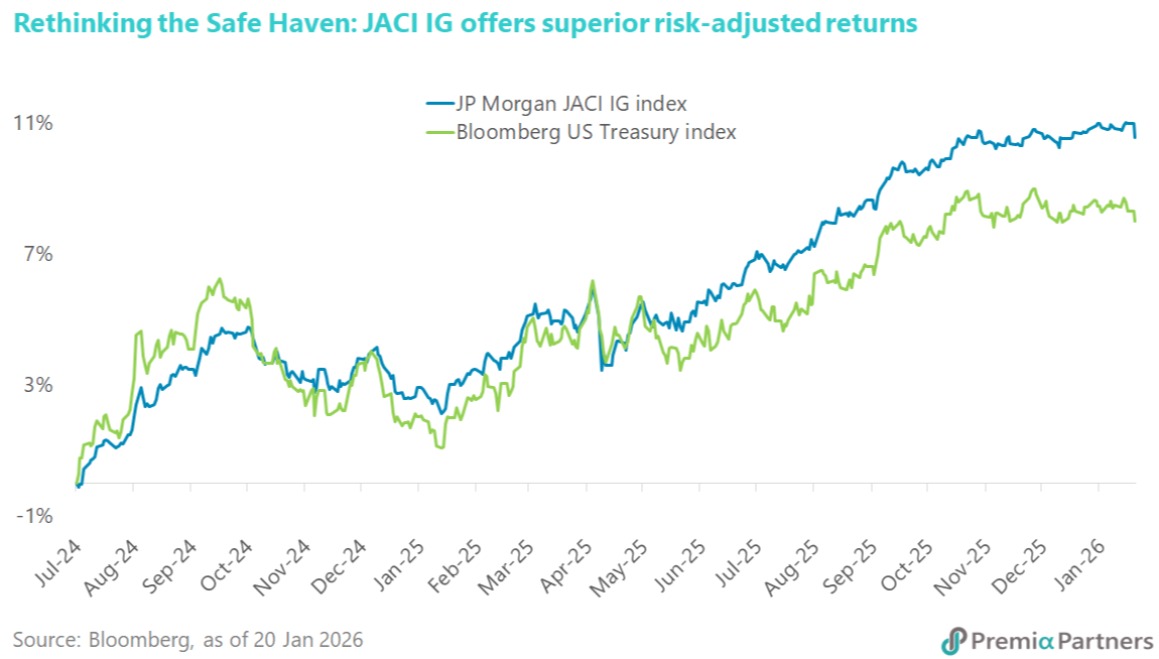

The immediate threat of a US-EU trade war has subsided with President Trump’s sudden reversal on tariffs, but the underlying tensions remain unresolved. Denmark has already denied the existence of any deal to cede Greenland, suggesting this reprieve may be temporary. This constant policy whiplash reinforces the view of major institutional investors like AkademikerPension that US Treasuries are increasingly fraught with headline risk. As their CIO notes, the 'massive credit risk' posed by US governance issues means investors must look beyond the immediate news cycle and plan for a future where US assets are no longer the sole definition of safety. This environment validates the case for Asia Investment Grade (IG) as a superior alternative. The asset class is not only shielded from Western political brinkmanship but is also undergoing a positive transformation. We are seeing a healthy diversification in issuers, highlighted by Kuaishou Technology entering the market to fund its AI ambitions. This signals that Asia IG is evolving from traditional sectors into a dynamic, tech-forward asset class. For investors seeking stability without sacrificing growth, the Premia J.P. Morgan Asia Credit Investment Grade Bond ETF offers diversified exposure to these solid sovereign and corporate credits, serving as a prudent hedge against the unpredictable winds of Washington.“

Jan 28, 2026