Macro Developments and Factor Performance

The last few months marked another volatile quarter for global equity markets, with Trump 2.0 trade policy setting the stage for continued uncertainty over the health of global economic growth and the future of what has been a particularly strained relationship between the world’s two biggest economies. Roughly four months on from Washington’s much-hyped April 2nd “Liberation Day” announcement of sweeping tariffs, there has been much negotiation and a number of new deals struck, though many of the details have yet to be sorted. Meanwhile average tariff rates on America’s imports remain higher than they have been in nearly a century. As such, it may be a surprise, looking at returns for U.S. and Chinese stocks, to see both markets posting gains in Q2. So, why haven’t persistent trade tensions had a more negative impact on major markets’ equity beta in recent months?

In fact, the initial reaction to U.S. tariff announcements was very negative, as traders riding out early-April’s white-knuckle ride in global stocks will remember, with stocks taking the administration’s threats at face value and baking in the stagflationary hit economists expected from levies reaching as high as 50%. Before too long, though, investors tallying White House flip-flops—including incessant delays in the implementation of tariffs, and an initial deal with China that seemed considerably more favorable to Beijing—came up with a new way to play market dips: the “TACO trade”, predicated on a belief that “Trump always chickens out”, making tariff-induced drawdowns a buying opportunity. That change in sentiment is clear from a look at the almost ‘V-shaped’ bounce seen in many emerging market indices, including the CSI 300, as the month of April wore on.

On the fundamental side, it also helped that U.S. macro data throughout the second quarter showed little impact of trade policy uncertainty, leading stocks to discount earlier fears of a weakening economy. While we suspect tariffs will inevitably boost U.S. inflation and hinder growth more as the second half proceeds, we do see any moderation of Washington’s extreme initial threats as a win for investors, at the margin. The lack of a big hit from tariffs shows up in China data, too, including reports on the country’s export activity (see Figure 1, below), where we might expect trade frictions to have been most pronounced.

Surprisingly robust orders to China’s other trading partners—which likely included “transshipments” to the U.S. rerouted to avoid hefty levies—were enough to boost total exports to positive growth throughout Q2, in spite of rising tariffs. Focusing on direct shipments to American ports, although the sharp drop in April is apparent, so too is positive growth in March, which included front-loading of orders to get ahead of expected “Liberation Day” hikes, and some obvious improvement through the end of June, reflecting a de-escalation of trade tensions after talks in Geneva and London during the second quarter yielded a 90-day pause on some tariffs and a temporary agreement. As of this writing, the two nations were meeting again in Stockholm and had extended the tariff truce by an additional three months.

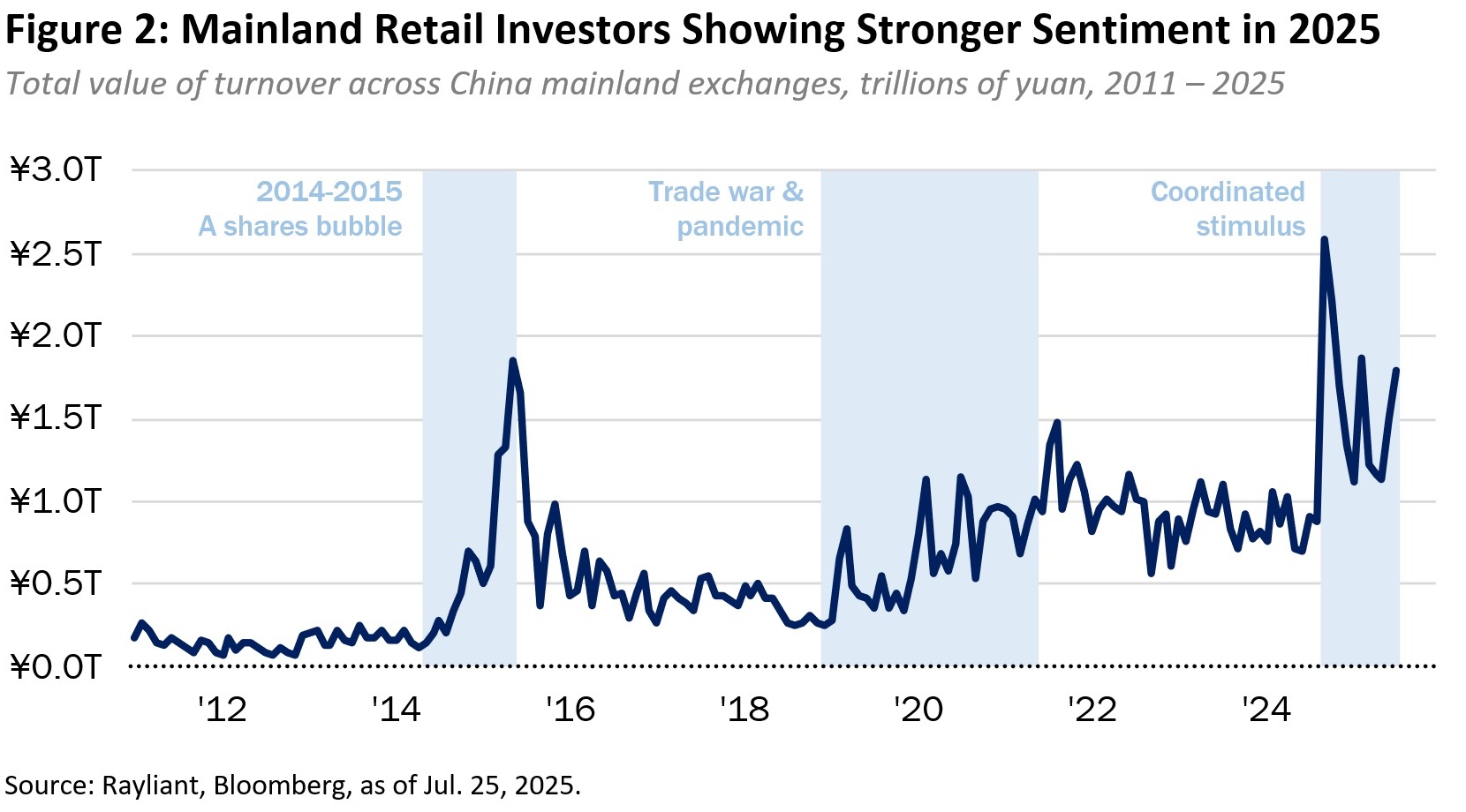

The avoidance of a massive blow to exports in Q2 no doubt contributed to another critical element for onshore China equity success: continued improvement in stock market sentiment on the part of domestic investors, evidenced in elevated trading volume recorded on mainland exchanges in Figure 2, below. Turnover has spiked during past market rallies, including the runup in A shares observed during a 2014-2015 bubble in onshore stocks, and the extended bull market that gained steam during the last Trump trade war against China. The most recent boom in turnover began last September, when coordinated announcements of monetary and fiscal policy stimulus sent mainland investors on a stock-buying spree; despite some ups and downs since then, the average level of traders’ confidence remains historically elevated.

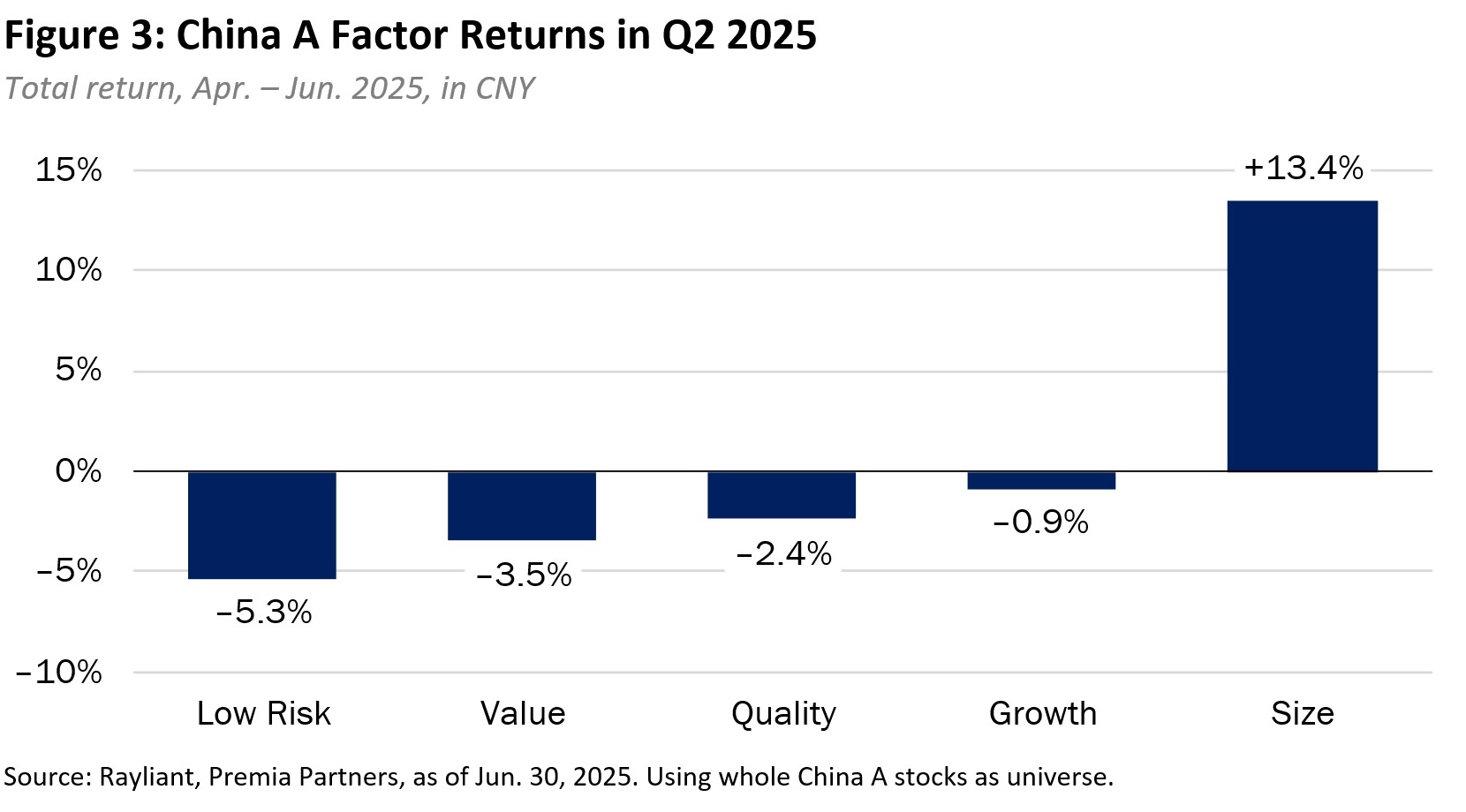

From an alpha perspective, as the breakdown of second-quarter factor performance in Figure 3 illustrates, below, strong investor sentiment does not necessarily translate to outperformance for tilts toward companies with typically favorable features. As was the case in the first three months of the year, and as can often be the case in markets driven by emotion rather than fundamentals, overweights to lower-risk stocks with cheap valuations and strong quality characteristics were broadly negative in Q2. The size factor, by contrast, again posted remarkably good performance—indeed, its best quarter in at least seven years—in part driven by heightened retail investor enthusiasm, which usually boost smaller companies’ shares. As we noted last quarter, small caps, which tend to be oriented toward the domestic economy are not only expected to be more robust to trade policy uncertainty, but are also often the precise sort of tech or industrial firm in line to benefit from onshore stimulus designed to counteract falling exports if trade tensions flare up going forward.

Index Performance and Outlook

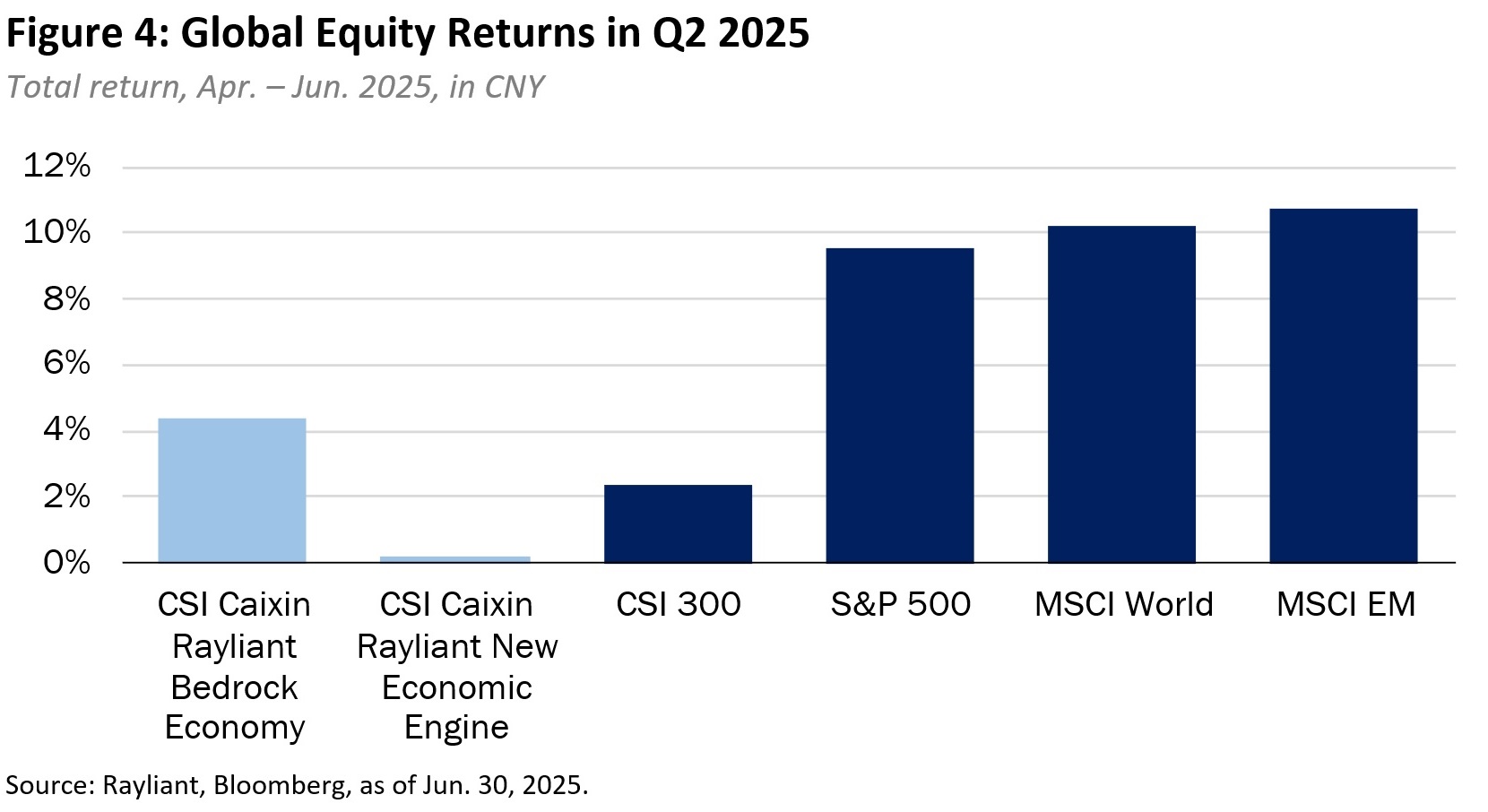

After a modest decline in the first quarter, A shares investors were surely happy to see the CSI 300 Index rise by 2.4% (CNY) over the three months ending June 30th, 2025 (see Figure 4, below), though broader emerging markets saw bigger gains in Q2, with the MSCI EM Index rallying around 10.7% (CNY) as traders priced in an improved outlook for tariff negotiations with the US and a higher likelihood that the global economy would enjoy a soft landing. U.S. stocks—which had suffered a meaningful drawdown the prior quarter, as traders looked ahead to potential “Liberation Day” macro fallout at the beginning of Q2—surged by 9.5% (CNY) in the second quarter, reflecting a strong risk-on sentiment that concentrated on stocks in the technology sector; developed markets outside the U.S. showed slightly stronger returns, advancing 10.2% for the quarter.

Both the CSI Caixin Rayliant Bedrock Economy Index (tracked by Premia’s 2803 HK/9803 HK ETFs) and the CSI Caixin Rayliant New Economic Engine Index (tracked by Premia’s 3173 HK/9173 HK ETFs) posted positive performance in the second quarter, with the former beating the CSI 300 Index, increasing by 4.4% (CNY), and the latter trailing the broad onshore market, gaining just 0.2% in Q2. Weakness in most smart beta exposures clearly worked against the two strategies’ factor tilts over the last few months, strongly offset by another stellar quarter for the size factor, which plays into both strategies’ measured bias toward investment in some companies down the market cap scale. From a sector standpoint, Financials turned out to be the biggest contributor to Bedrock strategy outperformance in the second quarter—both a substantial overweight to the Financial sector, by far the highest-returning segment of the A shares market in Q2, as well as strong stock selection within the sector. Along those lines, the biggest detractor within the underperforming New Economy strategy was an underweight to Financials, followed by relatively weak selection among Industrials.

So, where do we see things going entering the second half of 2025? Like many observers of China’s economy and markets, we were encouraged to see the country’s GDP come in 5.3% higher, year-over-year, for the first half (though we were less surprised by it than the consensus forecaster, as prior commentaries will attest). Also, there are other positives to which we have already pointed: policymakers’ skillful navigation of a difficult environment for trade and a good recent trend in onshore investors’ sentiment toward stocks. An objective evaluation, on the other hand, must acknowledge that domestic consumption, outside of trade-in programs expanded to include consumer electronics, has yet to improve; likewise, private sector investment—looking beyond the tech sector, which has been lifted by DeepSeek and the AI theme—remains stagnant. Those negatives are, perhaps, most clearly visible in a deflationary trend afflicted both consumer and producer prices (see Figure 5, below).

As we have remarked before, weakness in consumer and business confidence are unlikely to improve without bigger stimulus, though it is hard to predict precisely when that might come. To be fair, Beijing hasn’t been entirely quiet on that front: It was last September’s dual announcements of monetary and fiscal accommodation that led to the prominent spike in investors’ excitement we graphed earlier, and the consumer trade-in programs we just mentioned have gradually ramped up as trade threats escalated during the first half of this year. But economists have noted a clear downward trend in the percentage of China’s government spending targeted to support consumption in recent years, and both households and businesses will likely want to see more than a few months’ data in 2025 to convince them Beijing is serious about paying out state funds to help kickstart domestic consumption.

So, will bullish investor sentiment be rewarded or disappointed in the second half of this year? We’re encouraged by a few things. For one, we note that the current pause on tariff increases is a temporary one, and China will need to promote a stronger domestic economy if it means to insulate its growth from future trade threats on the part of its principal economic rival. While that is definitely a long-term project, it has to start somewhere, and we expect increased clarity on Trump’s endgame in the current round of trade hostilities should give Beijing more confidence in sizing up its stimulus efforts. Thinking shorter-term, we actually see further stimulus as necessary if China intends to hit its “around 5%” GDP growth target for 2025, as the “payback” associated with front-running of imports in the export data depicted before becomes a headwind in the second half.

We close this quarter’s comments at the micro level, with mention of another trend we have been following with some optimism: President Xi’s recent calls for a stop to “involution”, the profit-squeezing price wars that have become an unfortunate feature of China’s business environment. We see it as one more example of Beijing’s dedication to promoting high-quality growth through policies meant to correct imbalances that have been building and hampering a new phase in China’s economic development for some time. It is also one more development that we think works in favor of stocks selected for our new economy and bedrock portfolios—companies with strong fundamentals and intelligent exposure to China’s innovation and consumer growth. We are hopeful the second half of 2025 sees onshore stocks making good progress on both fronts.

*****************************************************************************************************

Dr. Phillip Wool is the Global Head of Research of Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.