China is now the world’s biggest market and producer of robots. It now accounts for over 50% of all the annual installations of industrial robots in the world. It now produces more than a quarter of the world’s industrial robots, most of which are installed domestically.

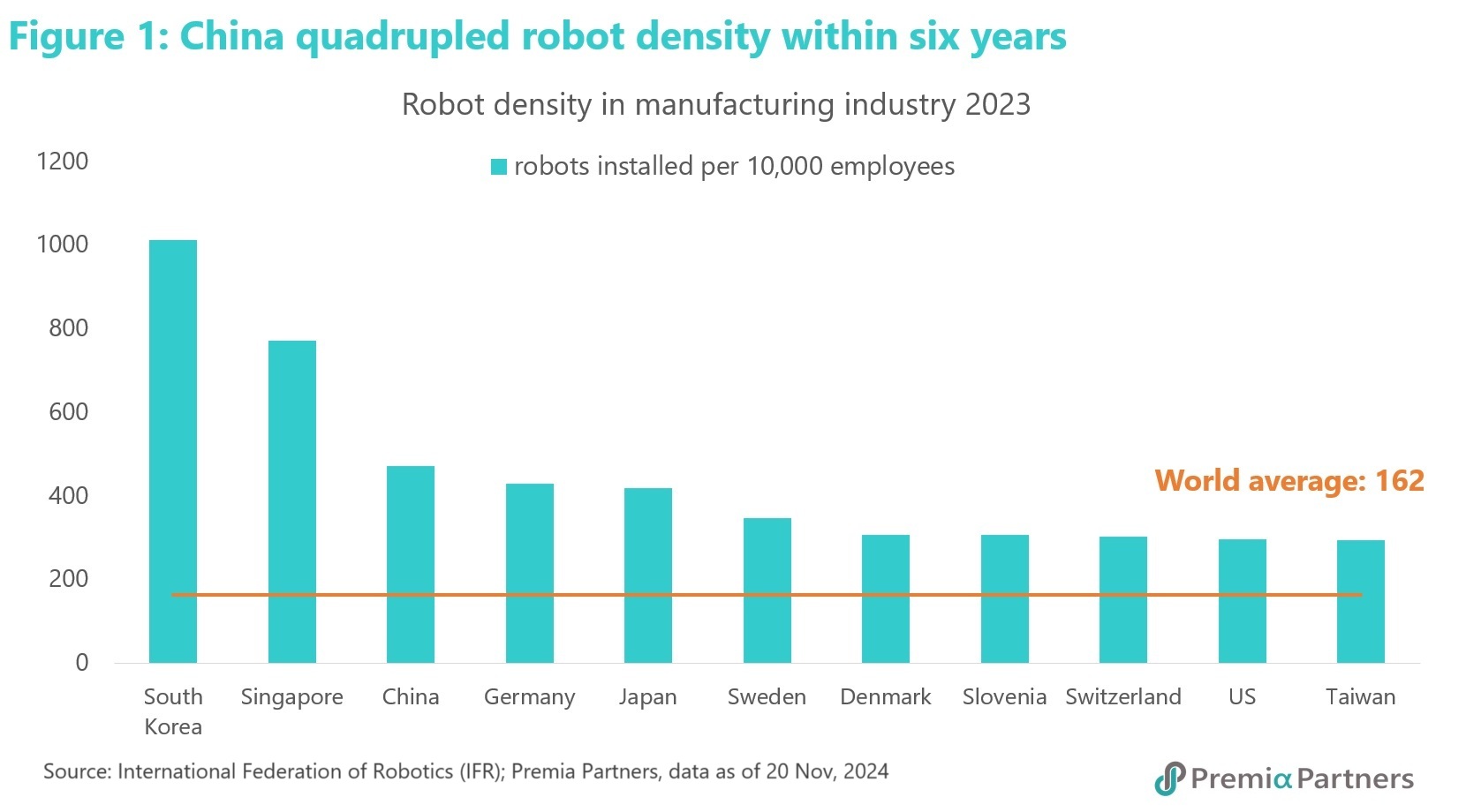

Exports, while still relatively small at less than 5% of total production, are growing very rapidly. China has the third highest robot density in the world – defined as the number of robots per 10,000 of employees – next only to South Korea and Singapore. This is quite a feat, considering it has the world’s largest workforce – 24x the size of the workforce in South Korea. The speed of the adoption of robotics in China has been astounding, with that density rising fourfold in just six years, between 2017 and 2023.

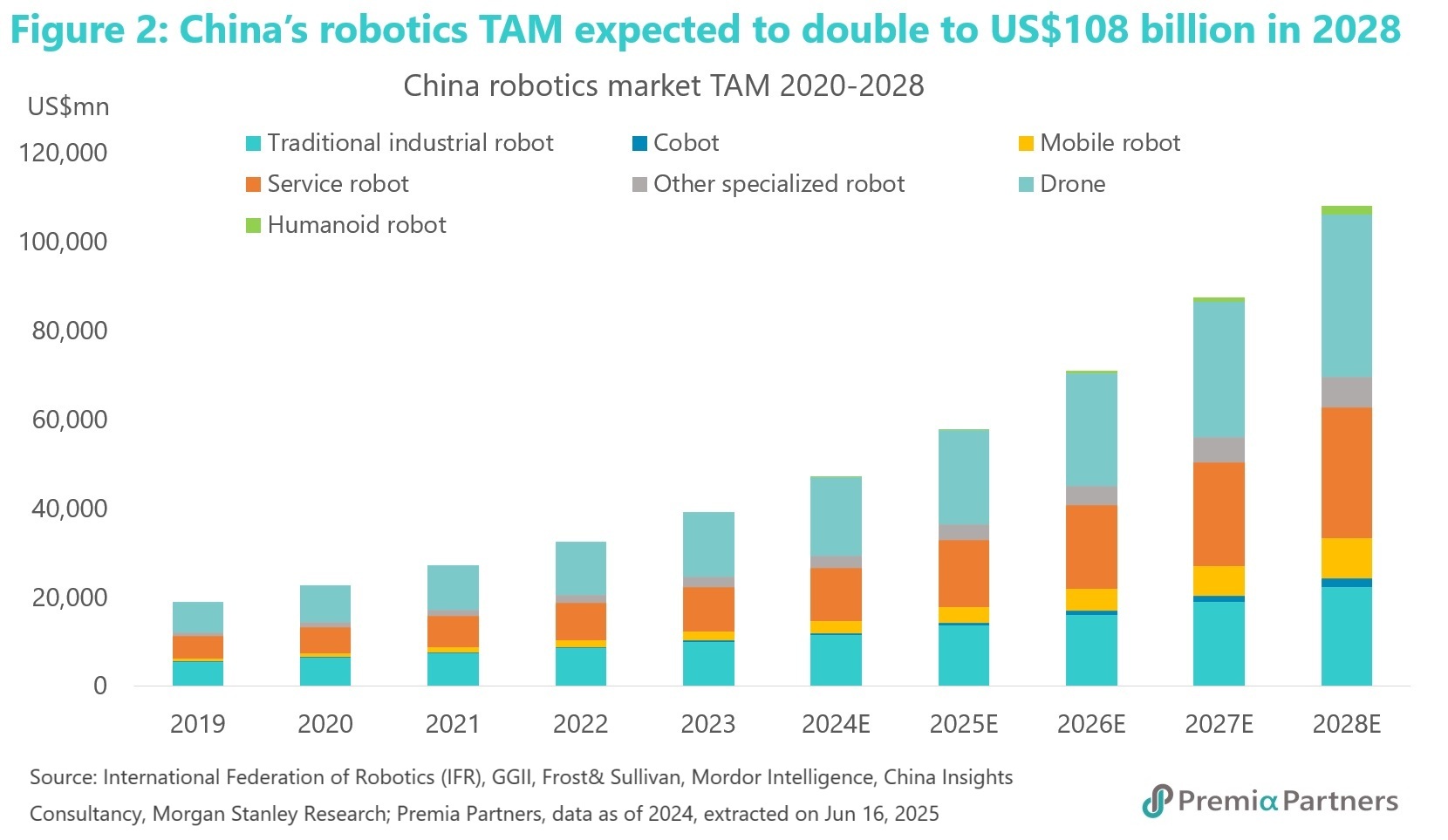

Morgan Stanley estimates that the overall market for robotics in China will more than double between 2024 and 2028, from US$47 billion to US$108 billion. Looking further out, Morgan Stanley estimates that the market for humanoid robots will grow by a CAGR of 88% to US$5 trillion by 2050. Collaborative robots are set to grow at 45% CAGR between 2025 and 2028, autonomous robots and automated guided vehicles are set to grow at 35% CAGR, service robots at 25% CAGR, and drones at 20% CAGR.

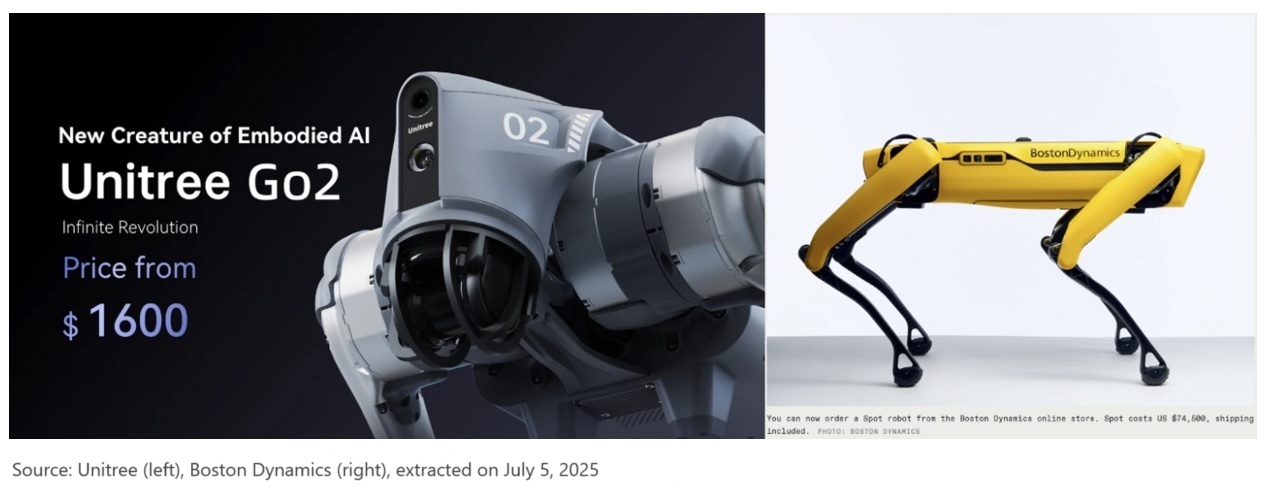

China’s unassailable advantages are its economies of scale, supercharged adaption rates, its low costs, and its supply chain dominance. As examples of the massive cost advantage: It costs 2.2 times more in the US than in China to manufacture a robotic arm of similar specifications. China’s Unitree Go2 quadruped robot starts at 1/54 the price of a similar Spot robot offered by Boston Dynamics.

To gain exposure to China’s stunning growth in robotics and its wide economic moats in this industry, investors may consider our Premia China New Economy ETF and Premia China STAR50 ETF.

Explosive growth that seemed to “come from nowhere”. Nine years is all it took for China to “come from nowhere” in robotics to overshadow the rest of the world. China’s stock of operational robots had been growing steadily since 2005. But that growth suddenly accelerated in 2012, and went almost vertical from 2015, overtaking Japan, the US, Germany and South Korea by 2016, according to research by the Stanford Center on China’s Economy and Institutions. The robot density ratio – the number of robots per 10,000 workers – rose fourfold in China in just six years, between 2017 and 2023 (Figure 1). Robot density in China went from 25th in the world in 2015 to 3rd last year. China now accounts for around one out of every two robots installed around the world each year.

According to the International Federation of Robotics, domestic suppliers accounted for almost half the annual installation of industrial robots in 2023, up from 29% in 2015. The drivers for this explosive growth include China’s broader industrialisation, its push up of the value chain, labour shortages, rising wages, the rise of AI/integration of AI with robotics, and government policy support. Notably, the supercharged growth from 2015 coincided with the Chinese Government’s Robotics Industry Development Plan of 2016-2020.

Market sizing – on a hyper-growth trajectory. Morgan Stanley estimates that China’s total addressable market (TAM) for robots, not just industrial robots but all robotic segments, is likely to double to US$108 billion by 2028 from US$47 billion in 2024, which was already 40% of the global total robot market (Figure 2). A deeper dive into the market segments reveals hyper-growth is concentrated in next-generation intelligent systems – Cobots, mobile and service robots, drones and humanoid robots – beyond traditional industrial robots fixed in assembly lines.

Collaborative robots, or "cobots," designed to work alongside humans, are set to expand at a phenomenal 46% CAGR from 2025 to 2028. Mobile robots, including autonomous mobile robots (AMRs) and automated guided vehicles (AGVs), are revolutionizing logistics to grow at 35% CAGR. Service robots, performing non-industrial tasks to assist humans in commercial settings, will grow at 25% CAGR, and drones, as the single largest category, are projected to grow at 20% CAGR. Humanoid robots, although not mass-produced so far, are estimated to have 88% CAGR potential to turn into a US$5 trillion market by 2050, when taking into consideration both to-B (business-to-business) and to-C (business-to-consumer) applications.

Unassailable advantages in supply chain efficiency and production costs across value chain. China is uniquely positioned to capitalise on this historic opportunity. This is a logical extension of China’s recognised achievements in its broader industrialisation. As a recent Bloomberg Opinion article puts it: “The nation’s strengths in electric vehicle and tech manufacturing have given it easier access to vast supply chains required for humanoid components. And Chinese robotics firms are emulating the DeepSeek-led open-source approach that has resulted in a collaborative innovation ecosystem.”

Key factors constraining robot popularization have revolved around costs and the supply chain, areas where China holds advantages and economies of scale, mirroring the explosive growth seen in batteries, solar and the burgeoning EV market.

On the cost front, a SemiAnalysis report gave this example of the advantage in China: manufacturing a robotic arm of comparable specification in the US would cost 2.2 times more than in China. In fact, even "Made in USA" components rely heavily on China-made parts and materials. US producers lack feasible, scalable alternatives.

Further illustrating this cost discrepancy, Chinese robotics pioneer Unitree offers its Go2 quadruped robot from RMB9,997 (~USD$1,375), a staggering 1/54 the price charged by Boston Dynamics for a similar Spot robot (~USD$74.5k). Critically, Unitree boasts over 90% self-sufficiency in core components (motors, reducers, controllers, sensors, main control systems, and batteries), effectively avoiding technology blockade risks.

Supply chain strength manifests in cluster effects and full industry chain coverage in China. Consider DJI (which holds 80% share of the global commercial drone market) versus US-based GoPro as an example: Shenzhen's mature electronics supply chain allows DJI to source virtually any component needed within 0.5 to 2 hours, enabling rapid iterations. In contrast, GoPro's dispersed manufacturing requires weeks per iteration, a time lag preventing it from competing effectively with DJI on product performance and cost.

Further, robot motors often use permanent magnets for efficiency, requiring rare earth elements dominated by China (90% market share). Globally, China supplies around 80% of batteries at production costs roughly one-third lower than North America and Europe. This accelerates significantly the localization process within China's robotics industry.

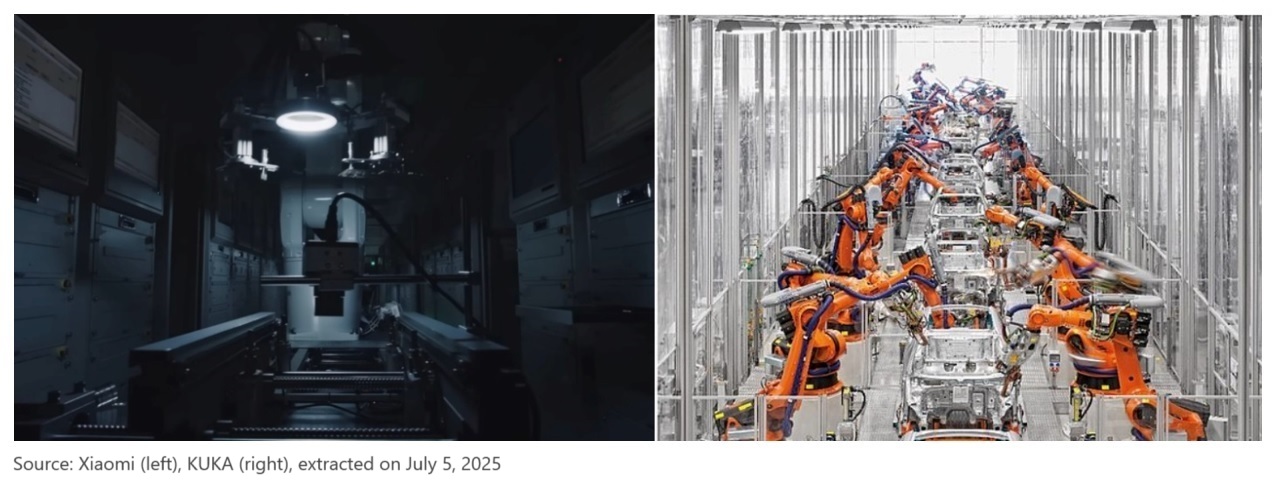

This rapid growth in China's robotic capabilities not only makes robots more cost-effective and expands applications – it also boosts production efficiency and addresses labour shortages. Xiaomi's fully automated "lights-off factory" is a prime example, producing smartphones 24/7 at one per second with no human involvement. KUKA's Guangdong factory manufactures robots using robots, targeting a production time reduction from one per half-hour to one per minute (figure 2).

AI-powered integration: living with robots. The low-cost AI wave ignited by DeepSeek is extensively enriching and reshaping the landscape across various sectors, from automotive manufacturing and healthcare to e-commerce, telecom and search engines. Humanoid robots, empowered by AI, are transitioning from laboratories into broader public interaction – dancing, delivering food, running marathons, accompanying the elderly, serving as security guards, etc. China is now at the industrialization inflection point for humanoid robots, beyond which lies large-scale commercialization.

US influencer Speed's China trip demonstrates the potentials. His experiences – riding BYD's Yangwang U8 on water, dancing with EngineAI robots, receiving food delivery from Meituan drones, test driving EHang autonomous eVTOLs (a flying car), watching drone performances – vividly showcase China already living in this “new world”, one where robots can fully integrate into the daily life of humans and replace them in more environments, representing a further step towards general-purpose robot popularization.

Conquering bottlenecks: China’s self-sufficiency drive. Currently, apart from the "brain" (i.e. chips) which still relies on foreign high-end AI processors, nearly all humanoid robot body components can be domestically produced in China. However, in the near future, the semiconductor bottleneck may also be overcome. Huawei is reportedly testing its Ascend 910D technology, potentially surpassing Nvidia’s H100 AI training chip. Its previous generation 910C, capable of achieving 60% of the H100's performance for inference tasks, is scaling towards mass production this May, and is positioned as a key alternative following Nvidia H20 restrictions.

The coming phase of rapid expansion. Even amidst layered tariffs and technological barriers, China’s robotic industry demonstrates resilience, moving towards widespread commercialization, massive scale deployment, and broader application spectrum expansion. The annual World Robot Conference in Beijing this August, which will feature over 200 exhibitors and more than 100 new products, is set to showcase further China’s robotic advancements. The upcoming 15th Five-Year Plan is approaching, with more opportunities unfolding in diverse sectors such as education, elderly companionship and pharmaceuticals.

For investors seeking to capitalize on this theme, Premia New Economy ETF (3173/9173.HK) and Premia STAR50 ETF (3151/9151.HK) would be very well placed to capture the opportunities. These provide exposures to emerging sectors like Cloud/AI (23%/77% portfolio weights), semiconductors (13%/61%), and Industry 4.0 (10%/15%), while benefiting also from the very vibrant pipeline of IPOs of many of these sector leaders – including for instance Unitree Robotics which has started its process for STAR Board listing. Note these ETFs have delivered robust YTD USD returns of 11% and 7.6% respectively as of July 29th.