Chart Of the Week

Chinese SOEs may be worth revisiting - Jun 16, 2025

Alex Chu

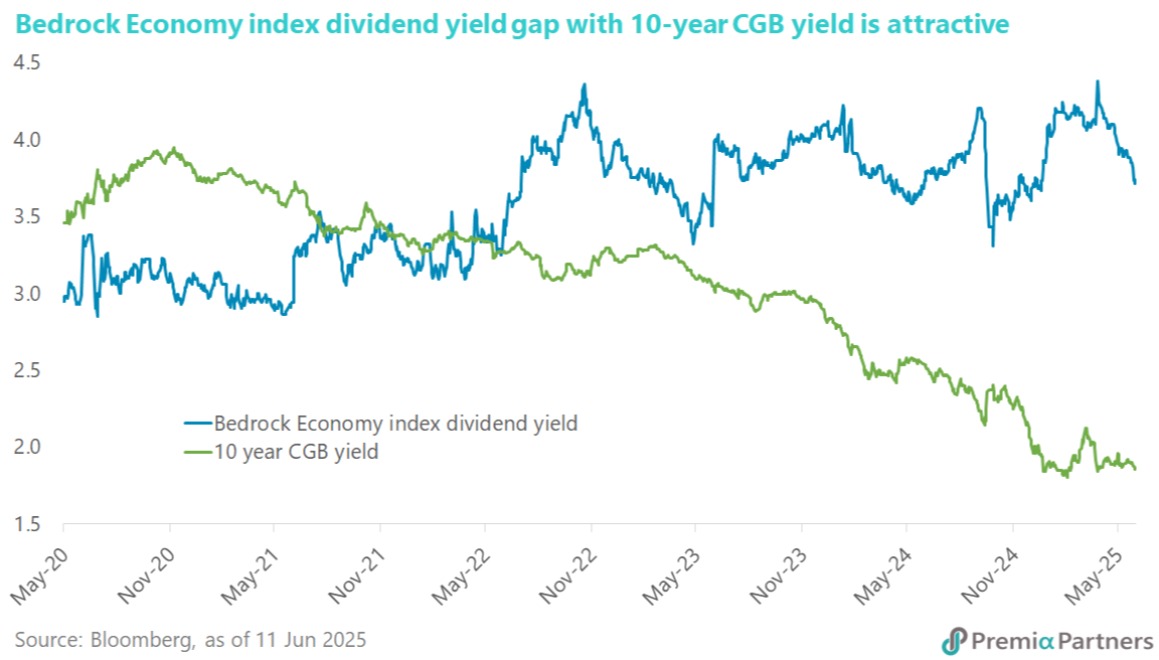

Chinese state-owned enterprises (SOEs) may gain traction again amid Chinese government’s commitment to stabilize the capital market, market value management implementation, and attractive yield against the government bonds. Central Huijin, often considered to be the national team, is approved by CSRC to be the new controlling shareholders of 8 small to mid-size financial companies, with an aim to stabilize the capital market and mitigate potential risks. Investors are also anticipating further policy support for the financial sector, expected to be announced at the Lujiazui Forum in Shanghai. This led to the strong capital inflow to nonbanking financials and outperformance of the sector. Moreover, a couple of SOEs have revealed their market value management plans or valuation improvement plans. Local brokers believed this trend will continue and gain momentum in the rest of this year, leading to the revaluation of these SOEs. On the short-term yield, China’s one- and three-year bonds fell to a four-month low due to heavy purchases of state banks. Onshore traders speculated that the PBOC was involved in the purchases. The PBOC’s potential purchases is one of the tools to bring liquidity to the market. As the bond yield drops and liquidity increases, the relatively higher SOE’s dividend yield would look appealing to investors, further supporting their share prices. To capitalize the above trend and diversify from growth related stocks, investors may consider our Premia CSI Caixin China Bedrock Economy ETF, which places a significant emphasis on SOEs, accounting for over 70% of its portfolio, benefiting from the government support and the potential high dividend yield.

Foreign interest in China's bond market remains strong - May 26, 2025

David Lai , CFA

CFA

Foreign interests in China’s bond market shown sustained growth, with foreign institutions holding over RMB4.44tn in Chinese bonds by the end of Apr. This marks the third consecutive month of increased foreign investment, signaling confidence in the country’s financial stability. Notably, China government bonds (CGBs) comprised the largest portion of these holdings—RMB2.11tn or 47.5%—demonstrating their appeal as secure and attractive assets. The improving sentiment is underscored by the continued rise in demand for renminbi assets. In Apr alone, foreign investors added a net US$10.9bn to their holdings of domestic bonds. Despite a modest foreign exchange deficit, China’s overall foreign exchange market has remained stable, supported by a strong trade surplus in goods, which hit a four-month high of US$31.6bn. Further bolstering investor confidence, Chinese banks are expected to see a periodic surplus in foreign exchange sales, aided by supportive monetary policies such as interest rate and reserve requirement ratio cuts. Progress in high-level Sino-US trade negotiations and a temporary easing of tariffs also contribute to a more favorable investment climate. The growing foreign appetite for CGBs highlights their strength as stable, long-term assets. Backed by strong macroeconomic fundamentals and improving trade dynamics, China’s bond market continues to present attractive opportunities for global investors seeking diversification and steady returns.

A constructive outlook on China's housing market - Apr 28, 2025

David Lai , CFA

CFA

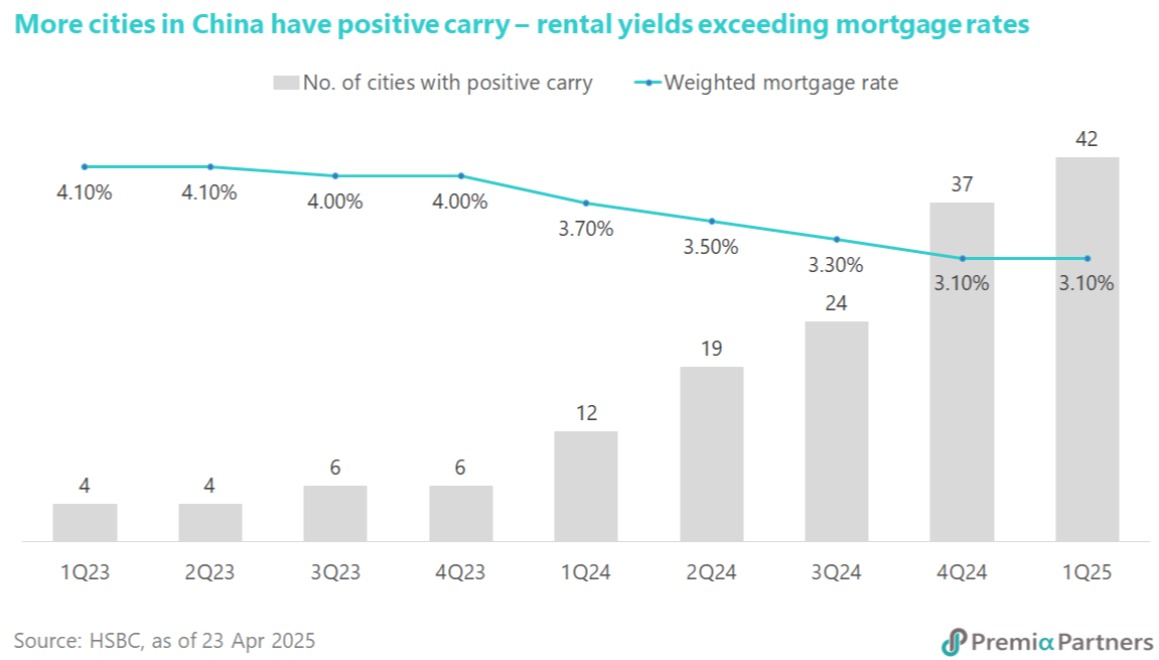

An increasing number of analysts are reaffirming a constructive outlook on China’s housing market, as supportive policies help shift the narrative from crisis to structural recovery. According to HSBC, a combination of factors—including supply constraints, credit normalization, and policy convergence—is driving a turnaround in the property sector. The average home mortgage rate has dropped to a record low of 3.1%, down significantly from 5.6% in 2021. In Q1 2025, rental yields exceeded mortgage rates in 42 out of 129 major cities, compared to just 12 cities a year earlier, resulting in a positive cost of carry. Additionally, household mortgage burdens have eased, with the mortgage-to-income ratio falling to 42%—a decade low—from 57% in 2021. For developers, funding costs are also at record lows. State-owned enterprise (SOE) operators now face average borrowing costs of 3.46%, with some construction loans as low as 1.8%. This sharp reduction in interest expenses is helping restore profitability, ensure project completion, and free up capital for land acquisition. On the inventory front, 14 cities saw over a 20% drop in housing stock between April 2024 and March 2025, with Shenzhen’s inventory hitting a three-year low. Meanwhile, the offshore bond market is beginning to reopen for quality issuers facing near-term dollar bond maturities. For instance, Greentown China and Beijing Capital Land successfully returned to the primary market in March, raising a combined US$1.45 billion—breaking a two-year issuance drought. Investors seeking exposure to this segment can consider the Premia China USD Property Bond ETF, which has delivered a solid 8.9% return year-to-date.

Asia credits may carry on their outperformance - Apr 07, 2025

David Lai , CFA

CFA

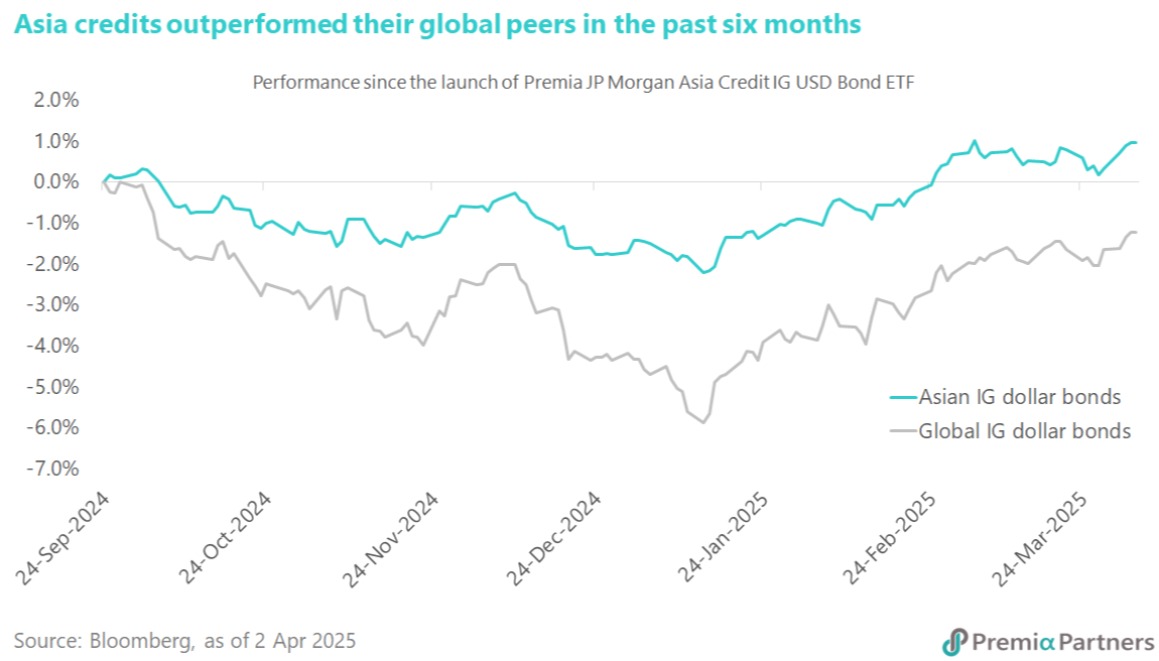

With US trade policy still in flux, markets are grappling to assess its immediate impact on credit profiles and spreads. In this context, Asia’s investment-grade (IG) dollar bonds appear well-positioned. Despite many regional economies running substantial current account surpluses with the US, companies issuing in the offshore USD bond market are typically less exposed to this trade dynamic. Analysts suggest the intensifying trade war could see 10-year US Treasury yields fall towards 3.5%, with US credit spreads likely to widen by the end of the year. While this would put pressure on Asian credit spreads, investors need not adopt an overly bearish outlook. The relatively high headline yields provide a useful buffer against mark-to-market volatility. According to HSBC estimates, Asia’s credit market would only face losses if headline yields rise above 6% by year-end, a scenario requiring both wider spreads and a sharp increase in Treasury yields — a combination unlikely unless the US experiences stagflation. If the decline of American exceptionalism persists, it will disproportionately affect US assets. On the other hand, Asia’s credit market benefits from several key advantages: shorter spread duration, robust regional investor demand, and a lower beta issuer profile compared to other emerging markets. These factors suggest that excess returns in Asia’s IG dollar bonds will likely continue to outperform their global peers.

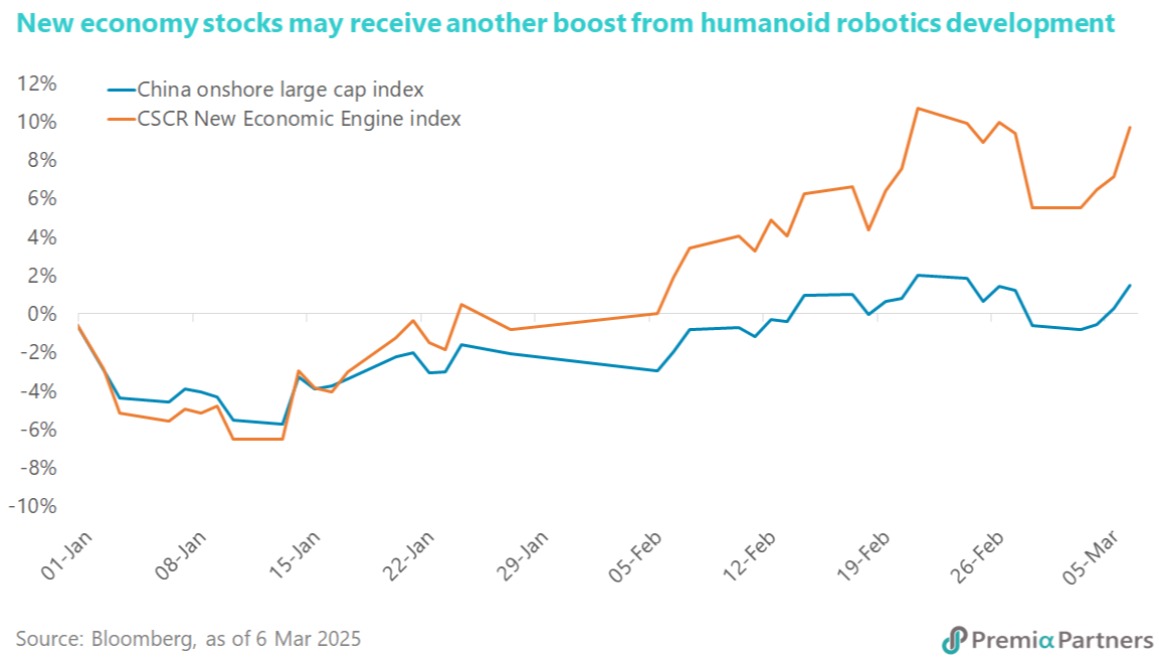

Humanoid robotics is set to be the next wave of growth opportunities - Mar 10, 2025

Alex Chu

Humanoid robotics is set to be the next wave of growth opportunities for AI-related companies, driving substantial demand across the supply chain—from advanced manufacturing to semiconductors and high-performance batteries. Recent developments highlight this potential: the MIIT held a seminar to advance the humanoid robot industry; Unitree Technology showcased its advanced robots at the Shanghai GDC; the NDRC committed to enhancing AI policy systems at the Two Sessions; and China Mobile, Huawei, Leju jointly release humanoid robots loaded with 5G-A technology. HSBC's research projects significant growth in this sector, estimating market expansion from US$ 900 million in 2025 to a staggering US$ 73 billion by 2034, reflecting a compound annual growth rate (CAGR) of 63%. They also predict a reduction in humanoid robot costs from approximately US$ 58,000 per unit to US$ 20,000 by 2032, driven by an 11% annual decline, enhancing market expansion through economies of scale. Our Premia CSI Caixin China New Economy ETF offers a diversified approach, mitigating risk while capturing growth potential. With broad exposure to sectors like semiconductors and renewable energy, it ensures participation in China’s AI growth story without over-reliance on any single technology.

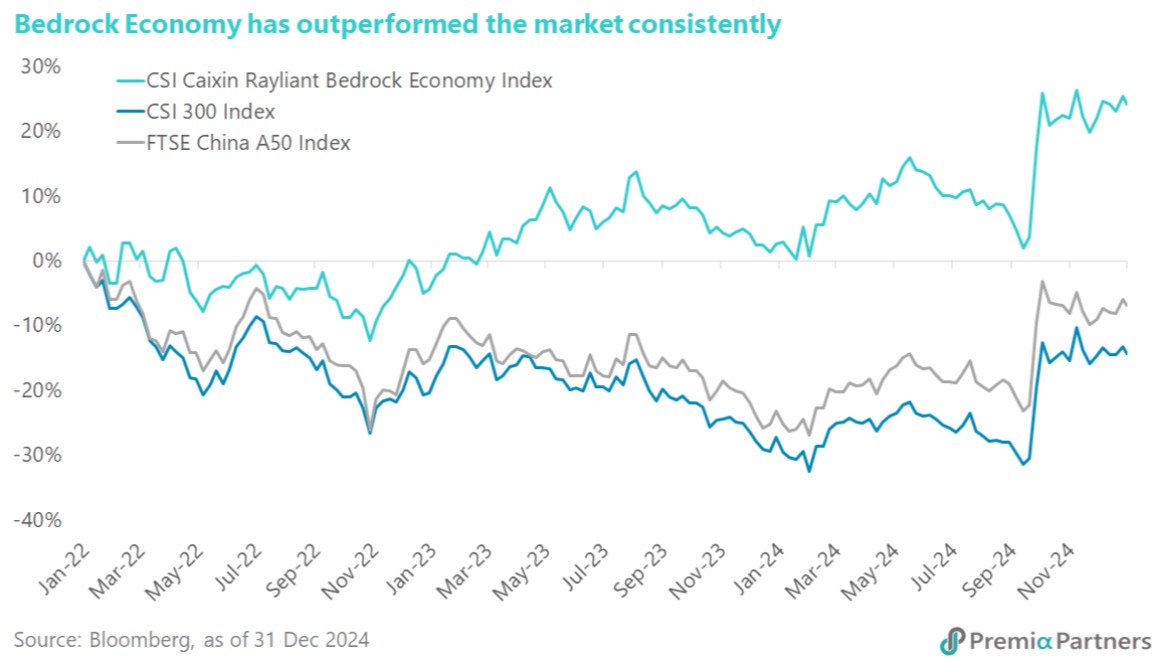

Multifactor strategy works well in China market - Jan 13, 2025

David Lai , CFA

CFA

Over the past 12 months, nearly 4,000 listed companies in the onshore Chinese market have announced a record RMB 2.35 trillion in dividends, according to China Securities Journal. Cash dividend payments have steadily increased, with the dividend payout ratio rising by 10 percentage points to 36.7% in 2024. In addition, more than 2,100 companies have revealed share buyback plans, totaling a record RMB 163 billion. Looking ahead, Goldman Sachs forecasts that the combined total of dividend payments and stock repurchases in 2025 will surpass RMB 3 trillion. This trend underscores a growing focus on enhancing investor returns in the Chinese market. The Chinese government has been advocating for higher and more consistent dividend payouts since the release of the "Nine-point guideline" in April, aimed at bolstering investor confidence in the domestic A-share market. In response, the People's Bank of China (PBOC) introduced a RMB 500 billion swap facility, enabling brokerages, asset managers, and insurers to access funding more easily by exchanging risk assets such as stock ETFs and blue-chip stocks for highly liquid assets like treasury bonds and central bank bills. Additionally, the government launched a RMB 300 billion relending program to encourage share buybacks and increases in corporate ownership. As a result, the consistent outperformance of our Premia CSI Caixin China Bedrock Economy ETF, which focuses on multifactor strategies including value and quality, is likely to continue in the medium term.

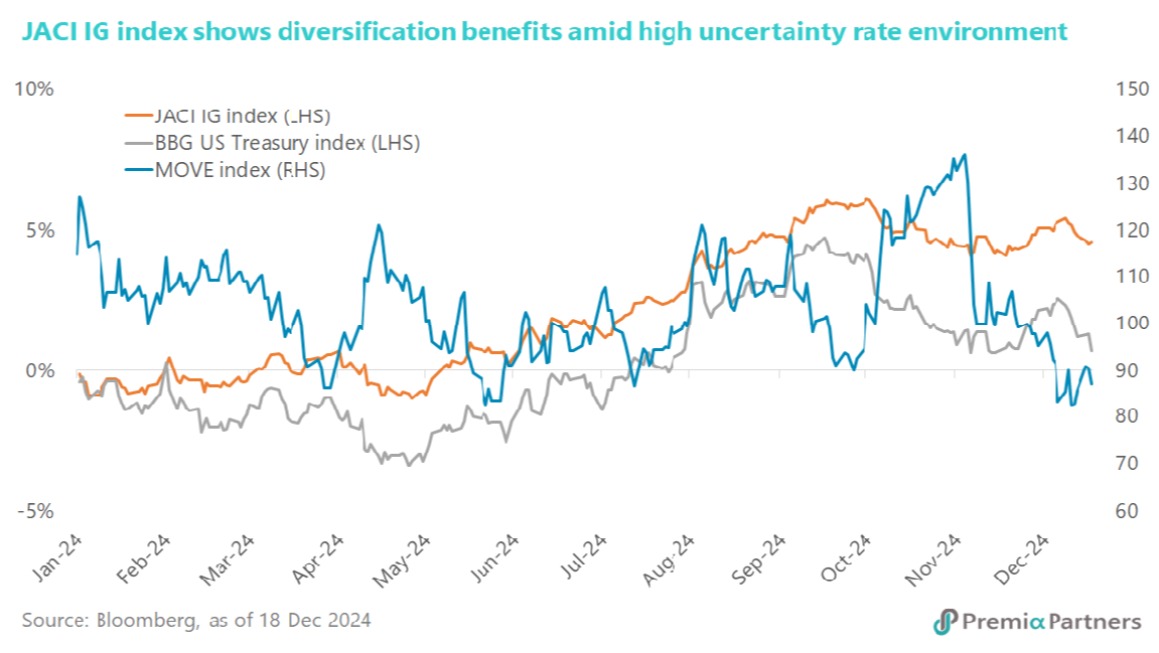

Asian USD IG bonds show superiority over the US Treasuries - Dec 20, 2024

Alex Chu

Asia Investment Grade (IG) USD bonds continued to demonstrate more resilience performance compared to US Treasury bonds, which have not shown a significant rebound even as the MOVE index has substantially declined back to its year-low levels after the US presidential election. This trend may be attributed to ongoing investor concerns regarding the uncertainties that President-elect Trump may bring starting in January. In contrast, investors increasingly view Asia IG bonds as a safe choice, as evidenced by the narrowing spread against US Treasury bonds, which has reached the lowest level in the last decade. The spread may have room to tighten further as China shifts to a “moderately loose” monetary policy and expands fiscal spending, likely leading to lower local bond yields. This environment enhances the attractiveness of Asia IG USD bond yields. Diversifying a bond portfolio with Asia IG USD bonds may not only reduce volatility but also enhance returns. For those interested in including Asia IG bonds in their portfolios, our Premia J.P. Morgan Asia Credit Investment Grade Bond ETF, featuring a low expense ratio of just 0.23% per annum, stands out as a viable investment vehicle.

Resilience of Asian USD Investment Grade Credit - Nov 27, 2024

Research & Analytics

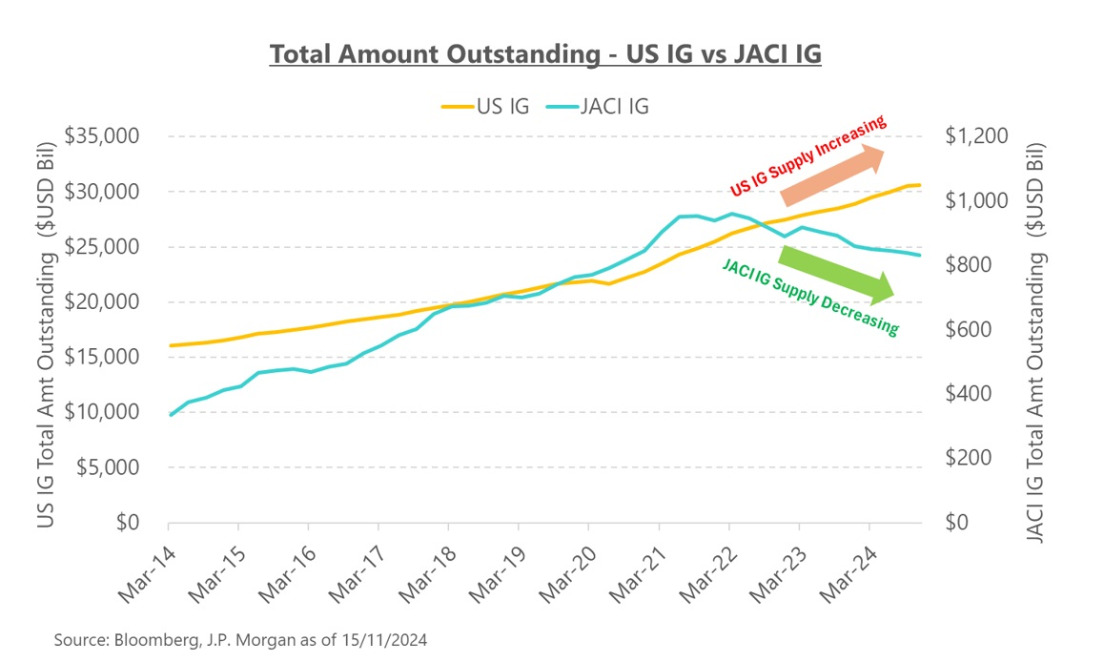

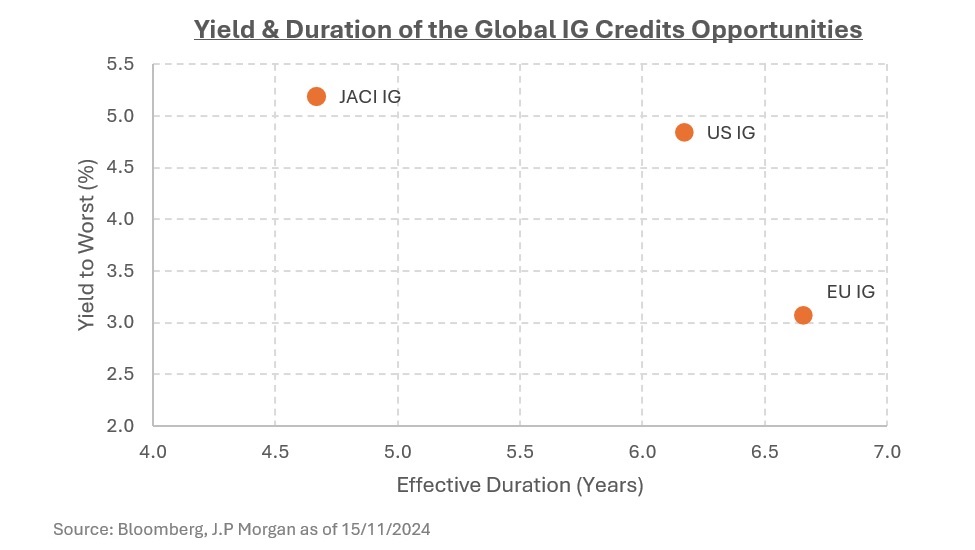

Asian US dollar IG credit has been outperforming the US IG and EU IG both year-to-date and over a three-year horizon due to several favourable factors, including attractive yields and a supportive issuance dynamic amongst Asian issuers.

With the election settled, among the many policies laid out in Trump 2.0, two key issues that have concerned global investors are the US debt outlook and the impact of tariff to global growth, particularly in European countries.

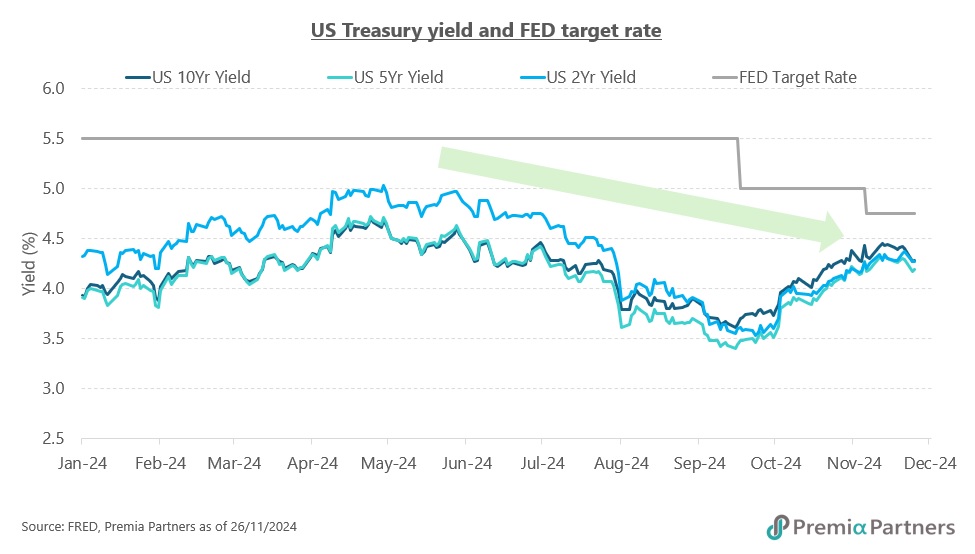

Since election settled in early November the market focus has shifted to the projected debt level of the US government. Back in March 2024, the US Congressional Budget Office (CBO) published a report on the long-term budget outlook for 2024 to 2054, highlighting that the US debt-to-GDP ratio is projected to reach a staggering 200% by 2050. This increase will be driven by rising spending programs, which will require the government to issue more US Treasuries. The rising debt trend, coupled with recently released strong U.S. economic data, has caused major concerns among global investors, pushing U.S. yields higher across the curve recently.

In fact, over the last few years when yields increase, it become less appealing for Asian issuers to issue new debt in US dollars. As a result, when yields rise, the supply of Asian dollar credit diminishes, leading to tighter credit spreads and further enhancing the performance of existing bonds. For instance, during mid-November China issued USD denominated government bonds at a very tight spread, which began trading with a negative spread.

Currently, the rate cut cycle has begun, and yields have been trending lower, which could enhance the attractiveness of Asian dollar credit even further. However, looking ahead, expectation for future yields are characterised by volatility. While the recent appointment of Scott Bessent as the new US Treasury Secretary is viewed positively for the bond market – suggesting potential fiscal restraint – investors remain concerned about the trajectory of the US fiscal deficit and projections on the Debt-to-GDP. This backdrop creates a climate of uncertainty among investors, who may increasingly prefer the relative stability offered by Asia dollar credit amid these challenges.

On the tariff front, the broad tariff would likely erode Eurozone GDP by approximately 1% as the biggest European countries such as Germany and France are also the most exposed to trade. Analysts from Goldman Sachs and JPMorgan are forecasting a fragile recovery in the Euro area, which would lead to further ECB rate cuts. While the duration would benefit EU IG in light of the rate cut, some of the gains may be offset by the heightened downgrade risks with the lower growth outlook and sluggish activity as reported by Fitch Ratings. Return is further eroded for dollar-based investors as a lower ECB policy rate will likely lead to depreciation in the euro and therefore losses due to currency exposures. Recently, we observed some of this trend as the Euro weakened from ~1.10 to ~1.05 against the US dollar in just a month, currency effect detracted almost 4.0% from returns during that period, and more rate cuts are expected to come.

Given these dynamics, we believe Premia J.P. Morgan Asia Credit Investment Grade USD Bond ETF (9411 HK) is a better opportunity set and a very cost efficient allocation tool with total expense ratio of only 0.23% p.a. and is not subject to US withholding tax. The ETF consisted of high-quality USD bonds by investment grade sovereign, quasi-sovereign, and corporate issuers from Asia ex-Japan region:

- Comparing to both US IG and EU IG, JACI IG’s lower duration and higher yield presents a better risk trade-off between yield and duration.

- Comparing to US IG, JACI IG’s lower new issuance should provide a better price dynamic while maintaining a higher yield

- Comparing to EU IG, JACI IG provides 2% higher yield and without the currency risks

To facilitate investor access primary market liquidity, we have also worked with our business partners to keep the creation/ redemption fee to only US$250 per trade and creation/ redemption size to 50,000 units only (~US$500,000) which are a fraction of typical levels for other USD credit bond ETFs.

BBG Ticker | Abbreviation | Long Name |

JPEIJAIG Index | JACI IG | J.P. Morgan Asia Credit Index - Investment Grade in USD |

LBUSTRUU Index | US IG | Bloomberg US Aggregate Total Return Index in USD |

I02503US Index / LP06TRUU Index | EU IG | Bloomberg Pan-European Aggregate Total Return Index in USD (unhedged) |

SBWGU Index | WGBI | FTSE World Government Bond Index USD (unhedged) |

IDCOT20 Index | UST 20Y | ICE US Treasury 20+ Year Bond Index USD |

IDCOT7 Index | UST 7-10Y | ICE US Treasury 7-10 Year Bond Index USD |

Historical context on the coming CNY 10 trillion China bond issuance - Nov 11, 2024

Research & Analytics

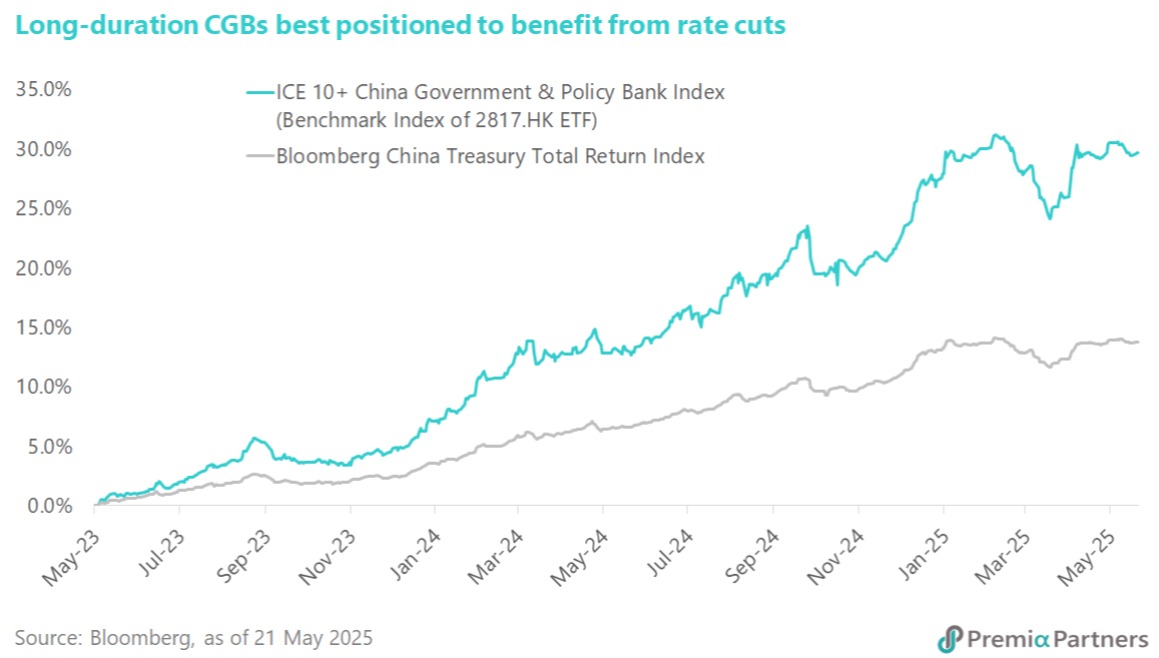

Long-term market rates, such as 10y/30y CGB yields, drifted lower in Oct after the sharp rise in late Sep. But short-term bond yields moved sideways, resulting in modestly flatter yield curves. One most frequently asked question on China rates is the size and composition of the fiscal package and its impact on rates.

To provide a bit more colour, recent news reports of additional RMB10 trillion to be issued over next few years. This includes RMB6 trillion raised by selling special sovereign bonds over three years starting in 2024, and RMB4 trillion raised through local government special bonds over the next five years. To provide context for how much RMB6 trillion represents, since 2021, the issuance of China Treasuries (including special sovereign bonds) has increased from ~RMB6.7 trillion to ~RMB11 trillion in 2023. As of September 2024, a total of ~RMB9.7 trillion China Treasury bonds has been issued; however, yields declined on both the long and short ends of the yield curve.

This trend suggests a strong domestic market capacity to absorb the new RMB6 trillion bond issuance. The robust demand for Chinese Treasuries is attributed to several factors such as : (1) Aggressive monetary easing by the PBOC; (2) PBOC’s active interventions such as the RMB200 billion net purchase during October and outright reverse repurchase agreements with primary dealers; (3) increasing retail investor acceptance of CGB as safe assets versus bank deposits given the low bank deposit rates.

With banks as anchor investors, long-term government bond yields tend to remain relatively stable compared to short-term yields. Curve shape therefore depends on the PBOC's liquidity management in the interbank market. A larger-than-expected approval of government bond issuance quota for the rest of the year is more likely to drive front-end rates higher, resulting in a bear flattener.

In light of this bond issuance landscape, and also the higher likelihood of RMB taking a more steadily managed depreciative path under Trump 2.0 to booster exports, Premia China Treasury & Policy Bank Bond Long Duration ETF (9177 HK) remains a good trade which does not hold special sovereign bonds, meaning its maturity distribution will not significantly increase to the 30-years and 50-year maturity bonds due to the special bond issuance.

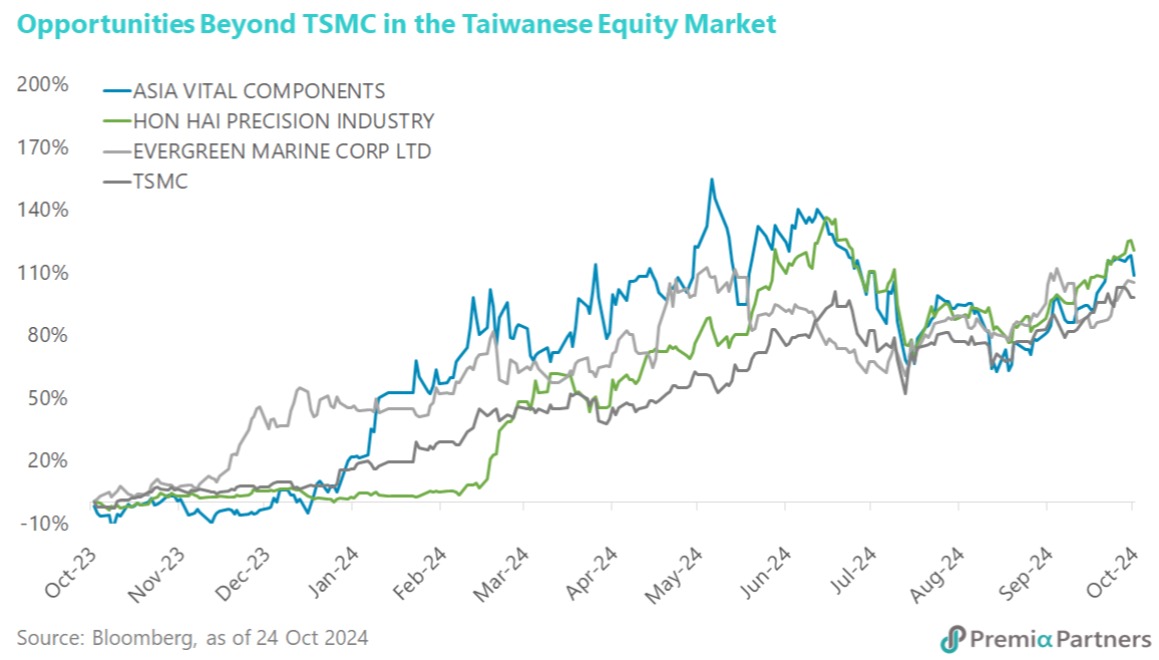

Opportunities beyond TSMC in Taiwan - Oct 31, 2024

Alex Chu

While TSMC remains the focal point of the Taiwanese equity market and AI-themed investments, there are other Taiwanese stocks that have outperformed TSMC over the past year. Notably, a few companies within the FTSE TWSE Taiwan 50 30% caped index have surpassed TSMC’s performance. One of the standouts is Asia Vital Components Co. (AVC), which has seen remarkable growth of over 108%. AVC specializes in a range of thermal solutions, including liquid cooling products that have become essential for maintaining CPU temperatures in AI servers. As CPU power density increases due to the rise of generative AI, traditional air-cooling systems are becoming inadequate. According to Goldman Sachs estimates, the penetration of liquid cooling technology is projected to rise to 20% in 2025, up from just 4% in 2022. This trend is likely to continue as AI development drives the adoption of liquid cooling in data centers and server markets, providing not only thermal efficiency but also reducing electricity costs. The payback period for liquid cooling systems can shrink to just 1 to 3 years, depending on electricity costs. The market hype and extensive news coverage surrounding TSMC may overshadow other opportunities amid this technological shift and other emerging trends. Investing in a broad-based portfolio could provide better risk-adjusted returns. We believe our Premia FTSE TWSE Taiwan 50 ETF, which focuses on Taiwanese equities market - an important part of the ongoing AI development supply chain and comprises nearly 70% information technology stocks - will be a diversified approach for investors to capitalize on the AI theme.