With growing interest of viewing China equities as a standalone building block and gradual inclusion of China-A shares into global equity benchmarks, investors increasingly seek for efficient approaches to generate excess equity returns in China A shares. Smart beta multifactor investing into China A shares is still young, and our very own Premia ETFs launched in 2017 were the world’s first two fundamental multifactor China A-shares ETFs.

How did factors perform, especially throughout the recent market roller coasting amid the US-China trade dispute? In this piece, we re-cap the research on China A fundamental factors and share the recent observations on factor performances.

1. FACTOR INVESTING IN CHINA A-SHARES

Our senior advisor Dr. Jason Hsu and his research team at Rayliant Global Advisors spent years studying the anomalies in Chinese A-shares. Their research founded the basis of the index methodologies of our Premia CSI Caixin China Bedrock Economy ETF (2803 HK) and Premia CSI Caixin China New Economy ETF (3173 HK).

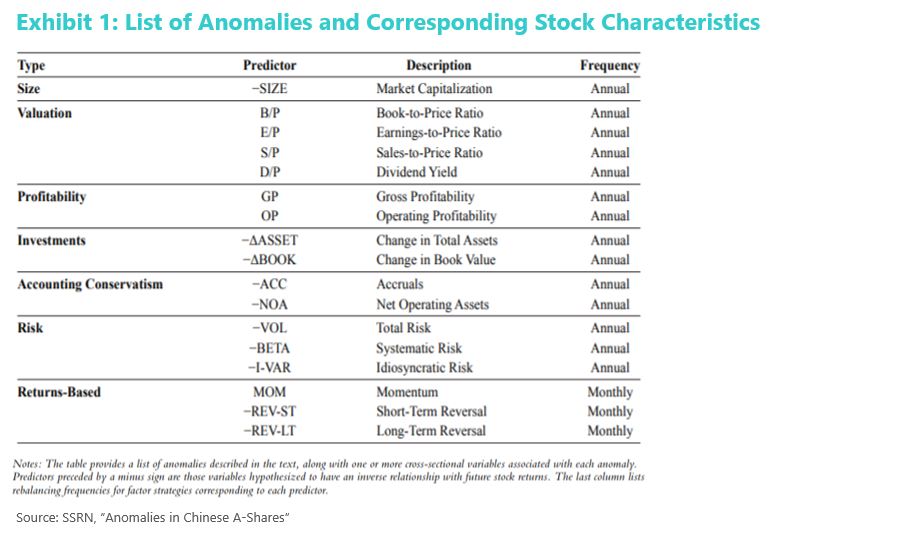

Modern investing world has identified numerous factors beyond the traditional Fama-French 3-factor model. While some may argue that many so-called factors are based on datamining, we are not getting into a debate here but rather presenting the ones focused in Dr Hsu’s study (Hsu, Viswanathan, Wang and Wool, 2017). The factor coverage in the research as shown in Exhibit 1 is threefold: those from the extended Fama-French 5-factor model (Value, Size, Investments, Profitability), the popular and widely discussed factors of Low Volatility and Momentum, and a China-specific consideration of earnings quality (Accruals and Net Operating Assets) based on findings from China’s unique accounting conservatism.

The research examines the factors’ behavior over a full sample period (from 1995 to 2016) and a recent sample period (from 2008 to 2016) and concluded, on an individual factor strategy basis, as follows:

Value: A strong value effect over the full sample, but substantially weaker in the recent sample; partially due to the sensitivity of value strategies to the 2008 global financial crisis, and partially attributed to changes in accounting standards.

Size: A very strong size effect in A-shares; however, inflated valuation in small-cap stocks was observed by the end of the sample.

Momentum / Reversal: Trading intermediate-horizon momentum strategy failed to deliver positive returns while the short-term reversal factor was extremely profitable.

Low Volatility: Over the full sample period, higher risk predicted lower future returns for A-shares, and beta correlates negatively with future performance. A likely explanation is that the large population of Chinese retail investors demand for lottery-like payoffs, which pushes the prices of risky shares too high

Accruals/NOA: High accounting conservatism predicted lower future stock returns based on the study. Given clear evidence of earnings management by Chinese firms and large population of unsophisticated retail investors who typically fail to account for such as a driver of profits to the accruals strategy, the factors based on accounting conservatism were particularly effective.

Investments: Little evidence found for the asset growth anomaly in the full sample, but a slightly stronger effect were observed in recent years. The large portion of SOEs in China A-shares are subject to policy burden beyond maximizing shareholder value and tend to undertake inefficient investment, or even present overinvestment risks.

Profitability: Evidence for more profitable companies should outperform less profitable firms is quite weak in China A-shares. However, one of the principal benefits of the profitability factor is its complementary nature to a traditional value factor as first stated by Novy-Marx [2013]. This also held true in the A-shares sample examined, supporting profitability-based signals as useful addition to a multifactor strategy.

At the time of their release, the Premia CSI Caixin China Bedrock Economy ETF (2803 HK) and Premia CSI Caixin China New Economy ETF (3173 HK), which tracks the CSI Caixin Rayliant Bedrock Economy Index (“Bedrock”) and CSI Caixin Rayliant New Economic Engine Index (“NEE”) respectively, were the world’s first two fundamental multifactor China A-shares ETFs. By the end of March 31, 2019, total assets in the two ETFs reached over 1 billion RMB.

2. OUT-OF-SAMPLE FACTOR PERFORMANCE THROUGH RECENT MARKET VOLATILITY

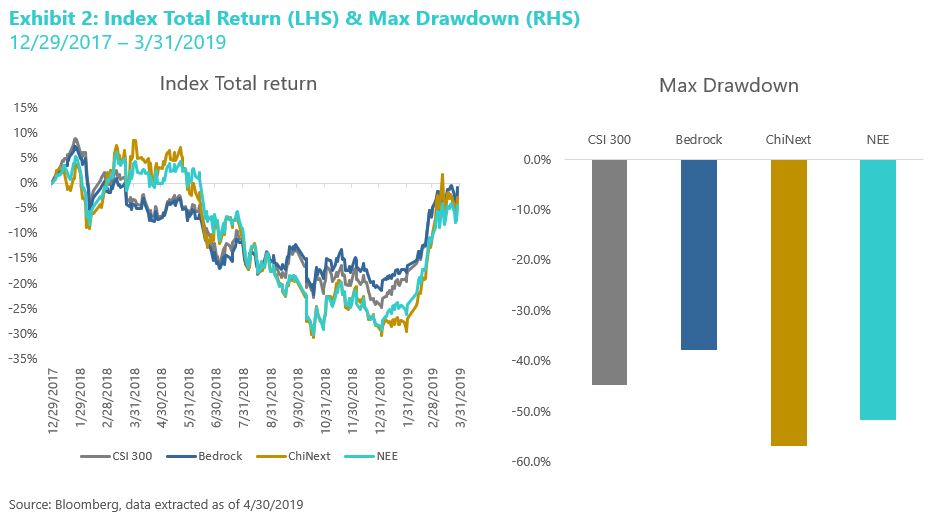

It’s been over a year since the inception of our fundamental multi-factor China A-shares strategies. Shortly after we getting out of the gate, the market experienced a steep dive down, followed by an upward rally in Q1 2019 recovering almost all the loss happened in 2018. Throughout this exciting if not nerve-racking ride, we saw our multifactor approaches demonstrated stronger resilience compared to peer indexes.

2.1 DEFENSIVE FACTORS IN PLAY: QUALITY & LOWRISK

From the last trading day of 2017 to end of Q1 2019, Bedrock and NEE have outperformed CSI 300 and ChiNext, respectively. With LowRisk characteristics in methodology design, both the Bedrock and NEE strategies have shown lower magnitude of maximum drawdown than their respective peers over this period.

With help from Rayliant, we examined in detail the five factors that are either explicitly defined in the fundamental screening or implicitly given exposure per index methodology design.

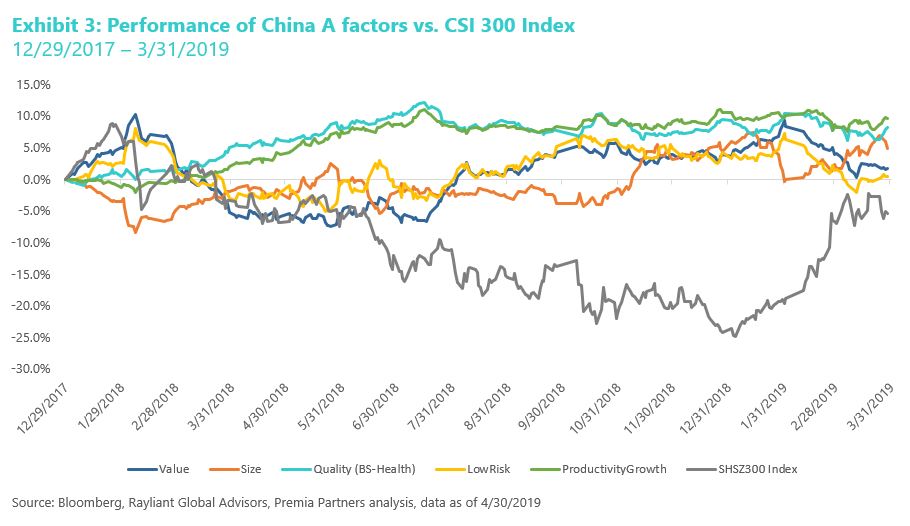

Contrary to the overall market performance, all 5 China A factors returned positive figures had one invested in any or a combination of them. However, investors should be aware that the restrictions on shorting of China A stocks make these single factor indexes not directly investable. While not able to eliminate beta and capturing all possible factor premia with long/short approaches, the multi-factor smart beta approach we employed aims to ease through downtimes with lower drawdown and capture a combined factor alpha over the market beta over the long term.

2.2 FACTOR ROTATION

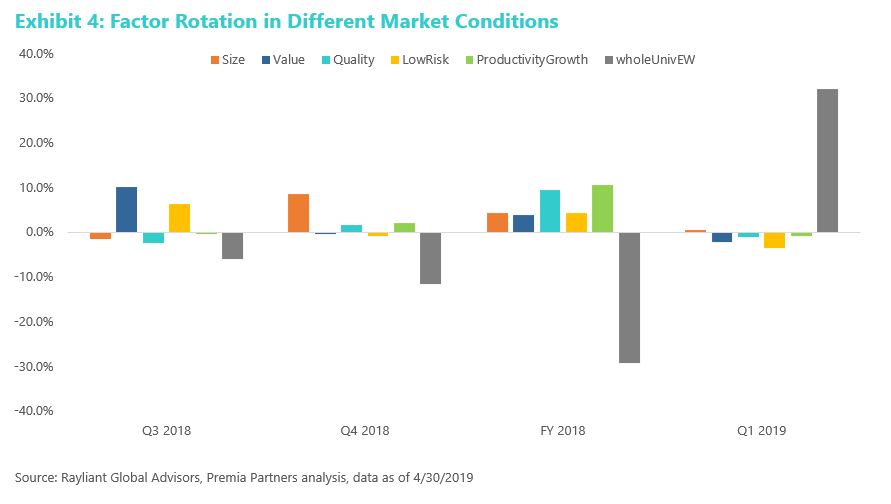

Factors are not magic wands and no single factor can always outperform. A closer look at the factor performances help to illustrate the rotation of factor performances at times of different market conditions. The past year’s ups & downs along with changes in fundamentals plus external shocks was particularly interesting – as factors turned out to be more likely on a ferris wheel than a roller coaster.

As seen in Exhibit 4:

The Quality factor which was defined based on fundamental metrics measuring balance sheet health (NOA, accruals, debt coverage ratio, cash ratio, profit margin) and the ProductivityGrowth factor (combining R&D, investments, profitability metrics) used in NEE’s final weighting rule were the best performing factors in 2018.

LowRisk is a rather cyclical factor, it performed well in 2018 due to a flight-to-safety in Q3 2018, but the trend diminished in Q4 and reversed in Q1 2019 as the market recovers with easing economic conditions and improved market confidence

Unlike the case in US markets or the empirical long term findings, the Value factor showed strong positive correlation to LowRisk over the period. Apart from a natural tilt toward the Financials sector led by the so-called ‘national team’, we believe this could also attribute to the sharp decline of high beta/vol stocks during the market correction that the book-to-price (B/P) spread falls significantly, and the high-beta stocks thus trade at a relative discount to low-beta stocks with respect to B/P as discussed by Dr. Garcia-Feijóo in his paper on Low-Volatility Cycles.

Size is one of the strongest long-term performing factor in empirical studies on China A shares; however in a short period of only 5 quarters, we observed that this Size factor return was impacted not only by its own valuation but also by the national team’s intervention as they often buy mega-caps only at market bottoms. Only in the 1st quarter of 2019, small size had a slight advantage in the market rebound.

Unlike the previous quarters where we see at least one factor with significant positive return, Q1 2019 is mostly a market rebound where the market factor (aka beta) contributed the most compared to any single factor.

While a sophisticated investors may be capable of perfect rotation timing using a combination of single factor strategies, we believe our fundamental multifactor approach is more resilient for risk-minded asset allocators especially with the level of government-led market intervention and external shocks from the US-China negotiations that this market is exposed to.

3. PREMIA FUNDAMENTAL MULTI-FACTOR CHINA A STRATEGIES

China Bedrock: Defensive Quality

Our Premia CSI Caixin China Bedrock Economy ETF (2803 HK) is a multifactor blue-chip strategy that aims to capture high quality contributors to China’s real economy with intended factor exposures to Value, (Economic) Size, Quality and LowRisk. For details about the methodology, please refer to Introduction to Bedrock

China New Economy: Quality Growth

Our Premia CSI Caixin China New Economy ETF (3173 HK) is a multifactor strategy designed to capture the rising trends in technology advancement, urbanization, rising middle class, and aging population. The strategy starts with all A-shares stocks in the “new economy” sectors – a concept first raised by Premier Li Keqiang in 2013 – followed by fundamental screening of asset-light and financially healthy companies. For detailed methodology, please refer to Introduction to New Economy

Related ETFs