“Change is the law of life, and those who look only to the past and present are certain to miss the future”, said John F. Kennedy. This explains the rationale regarding the latest update of the underlying index of Premia FactSet Asia Innovative Technology ETF (3181.HK). The change will not only help the strategy capture the rising trend of Metaverse but also keep investors’ interests aligned with the evolving innovation in this region.

What is the index update about?

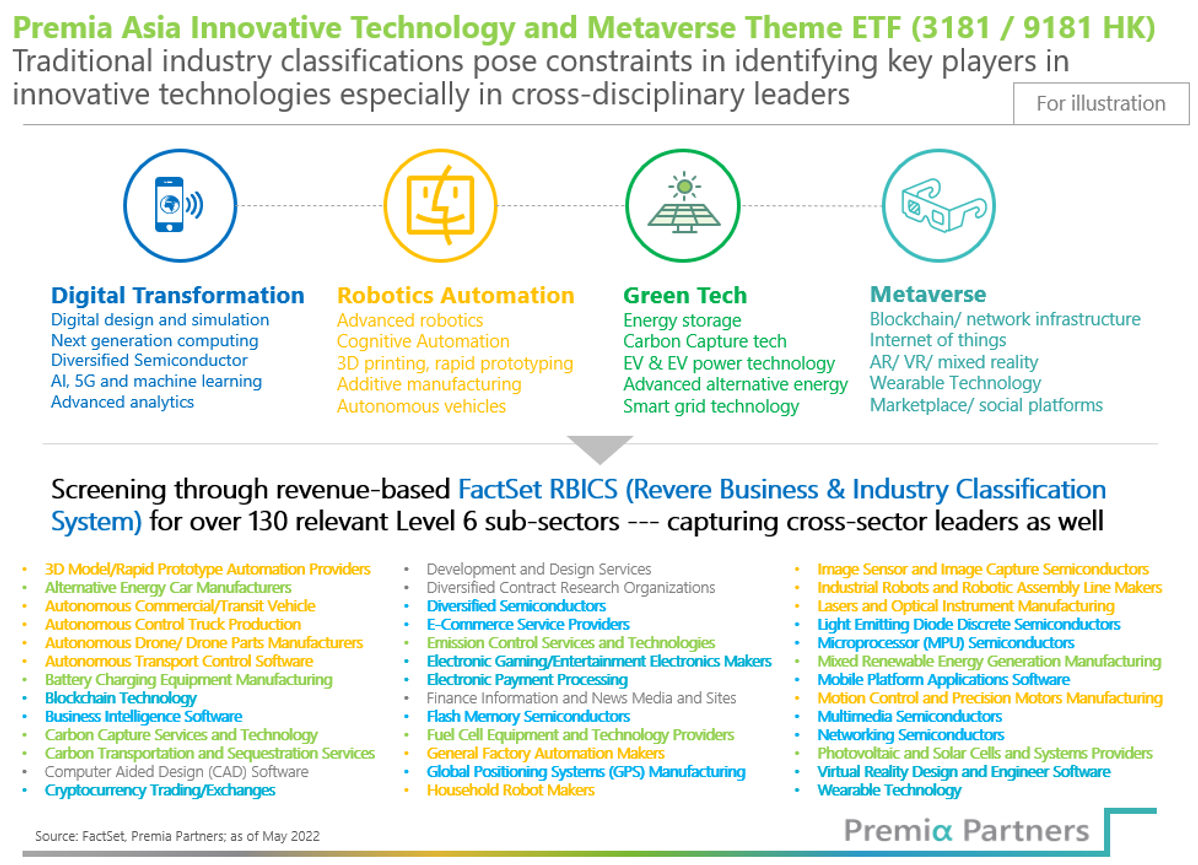

Recently, the Metaverse has developed so rapidly that itself has become so significant among all the up-and-coming trends and could be a standalone theme. In fact, many of the metaverse related sub-sectors have been among the FactSet L6 RBICS covered by our Premia FactSet Asia Innovative Technology Index (AIT) since inception. To facilitate better understanding of the index, our index provider, FactSet thus refined the focus of the AIT index to better reflect the core elements and spirits of the index, and renamed the index to Premia FactSet Asia Metaverse and Innovative Technology Index (AMIT), effective from June 10, 2022.

As illustrated in our previous article, “Who are the metaverse natives in Asia?”, the original index methodology has already captured the Metaverse theme, as it is classified under Digital Transformation, one of the three major themes. However, after the enhancement as laid out as follows, the refreshed index will be in a better position to capture the Metaverse theme in a more systematic and sustainable manner.

What has been updated in the index?

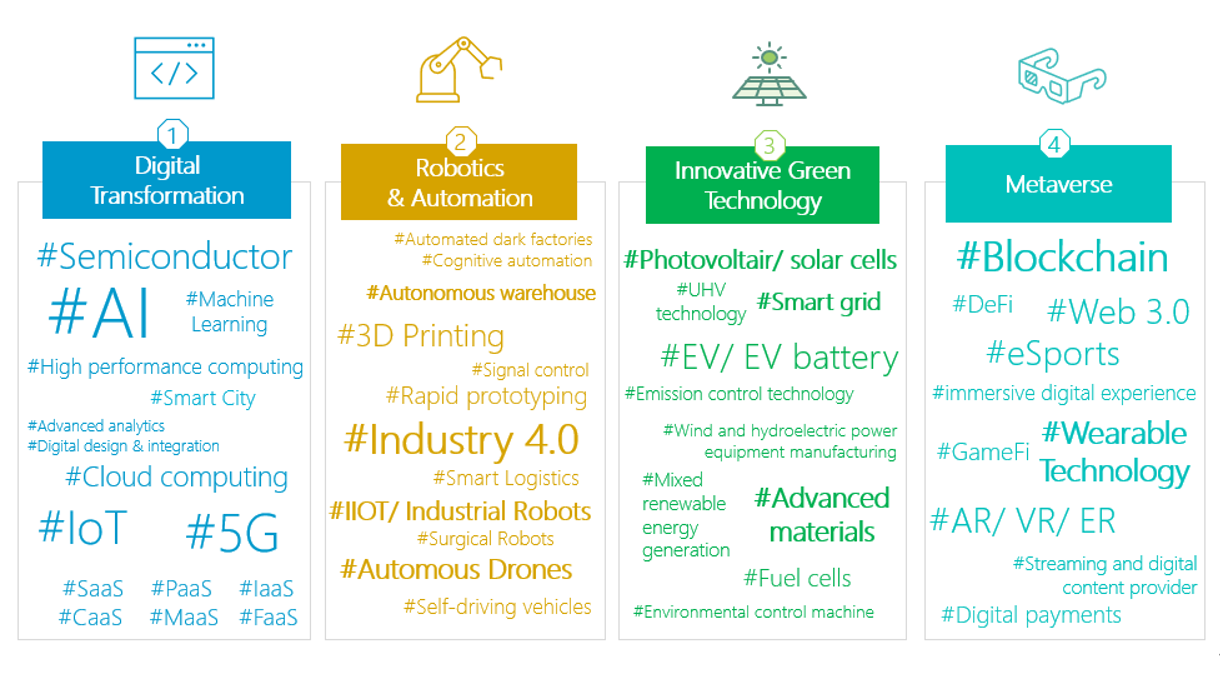

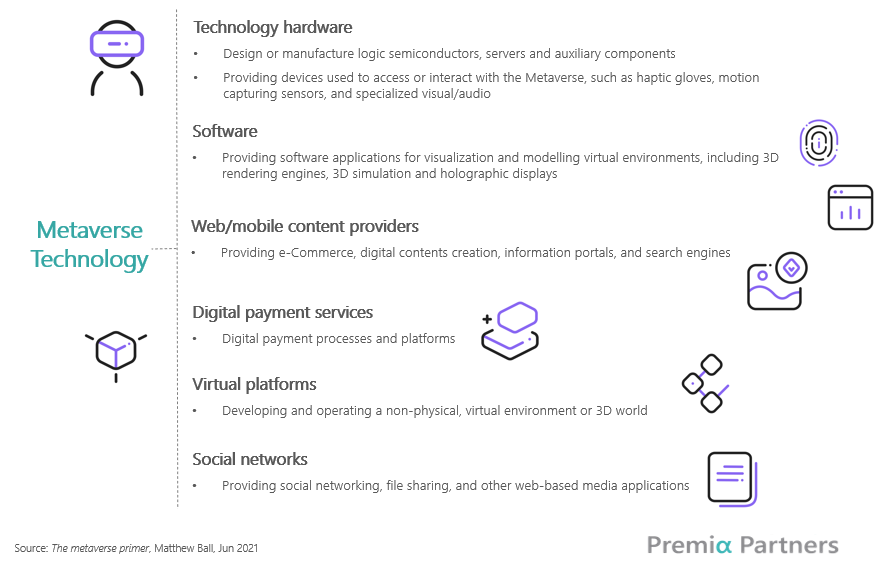

Originally, AIT uses FactSet’s Revere Business & Industry Classification System (RBICS) to identify companies by their revenue breakdown involved in three major themes: Digital Transformation, Health & Life Science Innovation, Robotics & Automation. These themes have included more than 130 industries. As stated above, some of the industries in Digital Transformation were also related to the Metaverse theme. So, the most straightforward way to include the Metaverse theme more systematically is to review the list of RBICS industries. But before we could delve into the list, we have to define the Metaverse, at least as best as we could, to know which RBICS industries should be added or deleted.

The Metaverse is the next-generation Internet and world wide web, which consists of areas such as technology hardware, software, web/mobile applications, web/mobile content providers, digital payment services, virtual platforms, and social networks. Based on these defined areas, 11 new industries, such as Diversified Technology Hardware, Internet Department Store and Online Game Websites and Software, are added.

At the same time, since our index could consist of only 50 constituents with equal weighting, we were torn between the Metaverse and other innovation technology themes. As a result, we reviewed the remaining industries in Digital Transformation, as well as those in Health & Life Science Innovation and Robotics & Automation, and further subdivided them into more concise themes such as Smart EV, Semiconductor, New Energy Technologies, Industry 4.0, Robotics and Automation, and Biotechnology that have innovative technology focus.

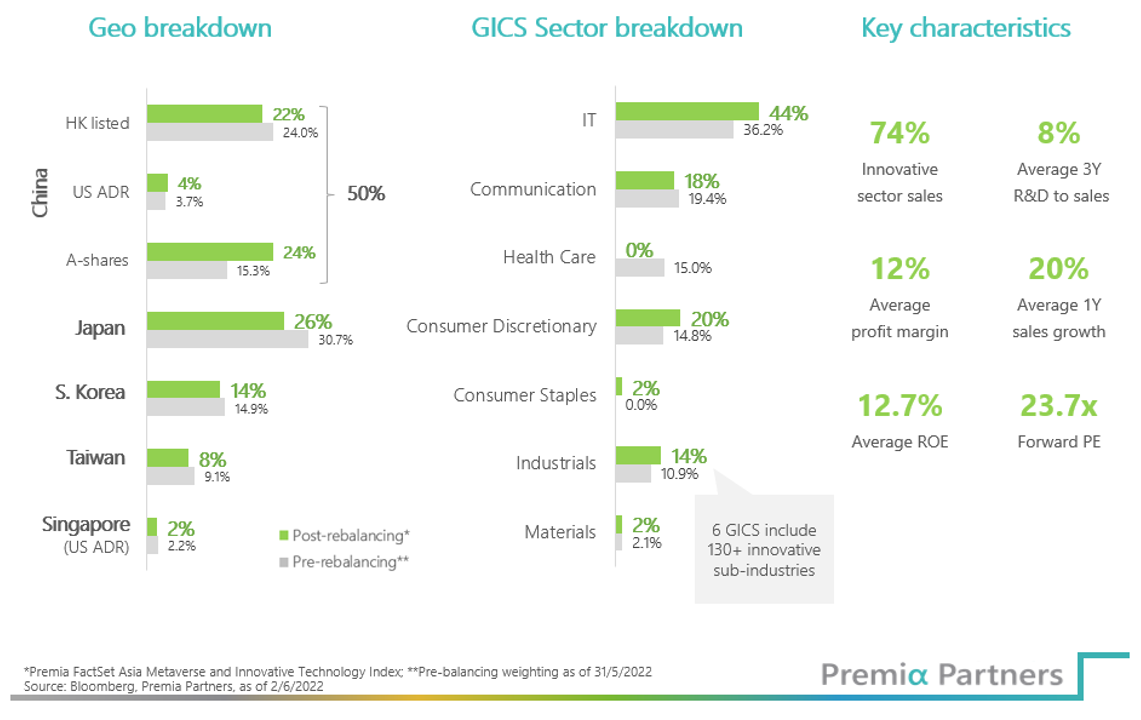

What does the index look like after the update?

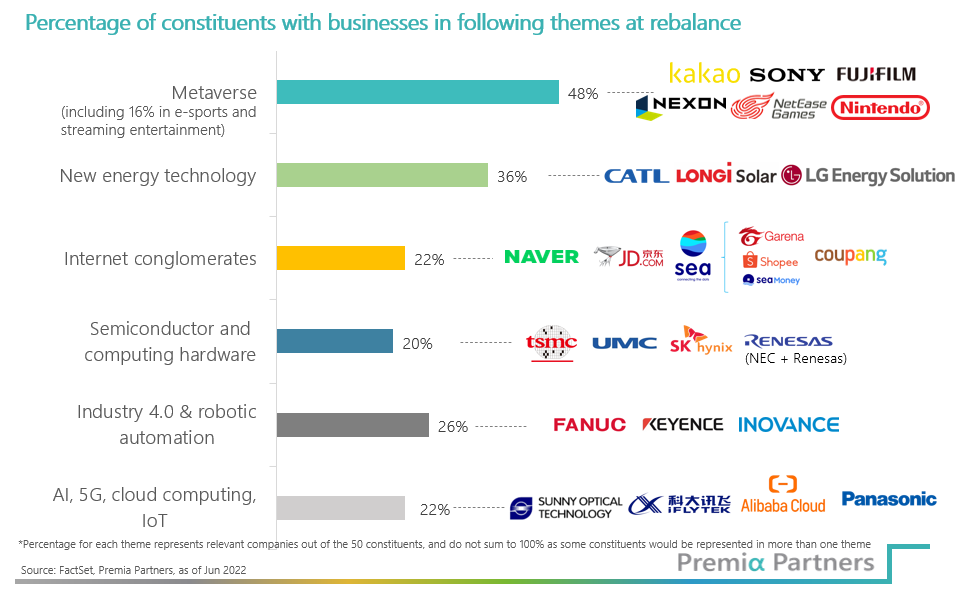

After the update, the index has more weighting on other innovative technology themes, such as New Energy Technologies, Smart EV and Semiconductor (which we categorize as “Green Technology” above), while the weighting with Metaverse related businesses increased slightly 48%.

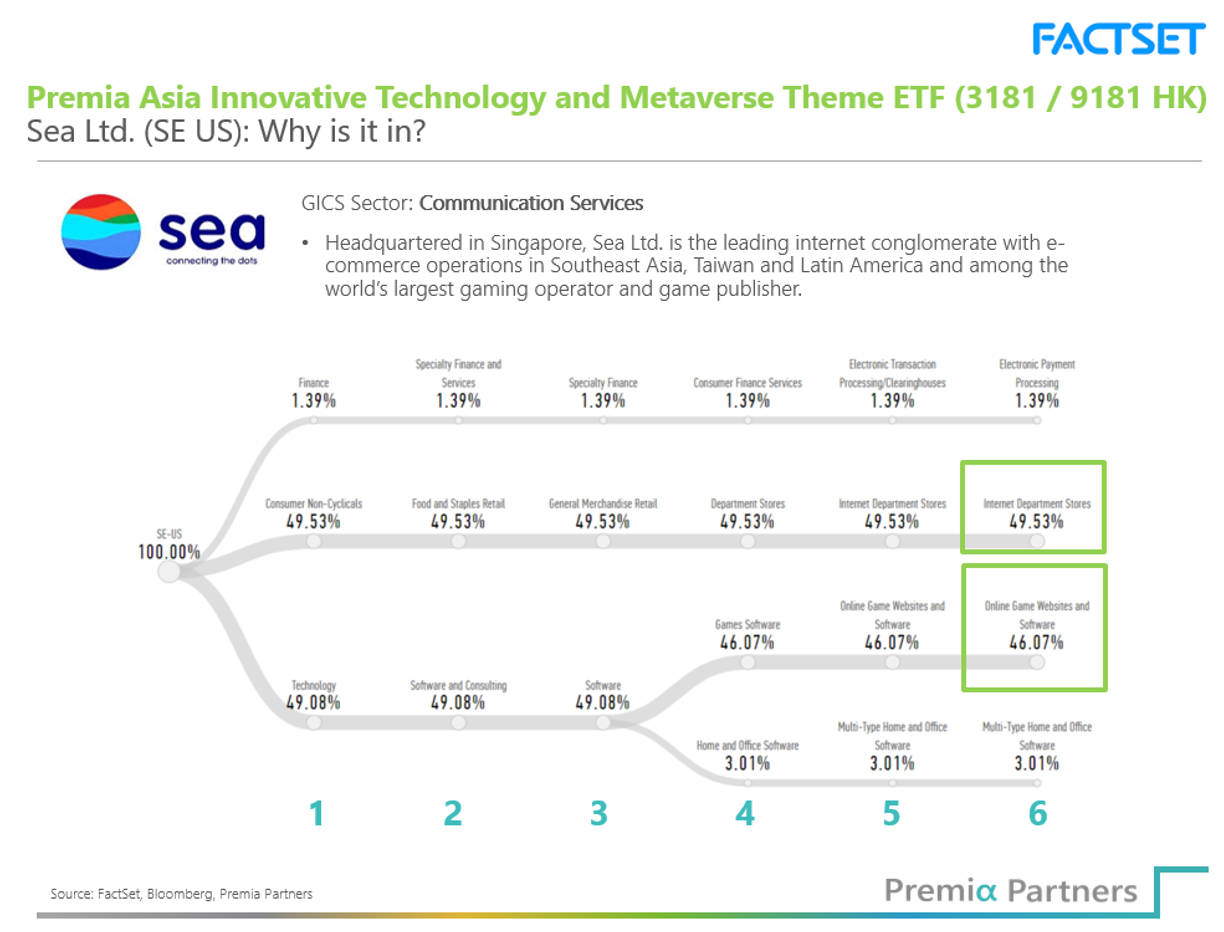

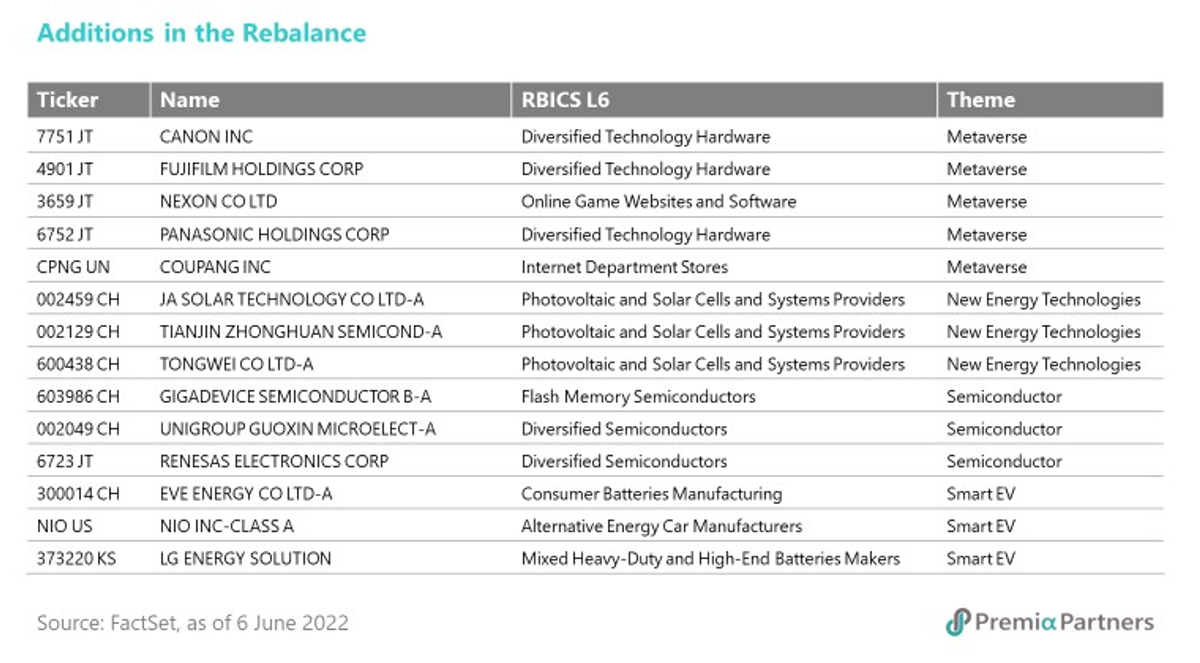

Of the 14 newly added securities, only 5 of them are a consequence of the Metaverse theme inclusion. Their specific RBICS industries, falling under the broad definition of Metaverse by the Index Provider, are listed below for reference. “Diversified Tech Hardware” relates to companies producing hardware that will enable the digital experience of Metaverse users, whilst “Internet Department Stores” and “Online Game Websites and Software” companies are building the innovative experiences within. The other newly added names are related to New Energy Technologies, Semiconductor, or Smart EV themes, that have passed the criteria on the R&D and revenue growth metrics.

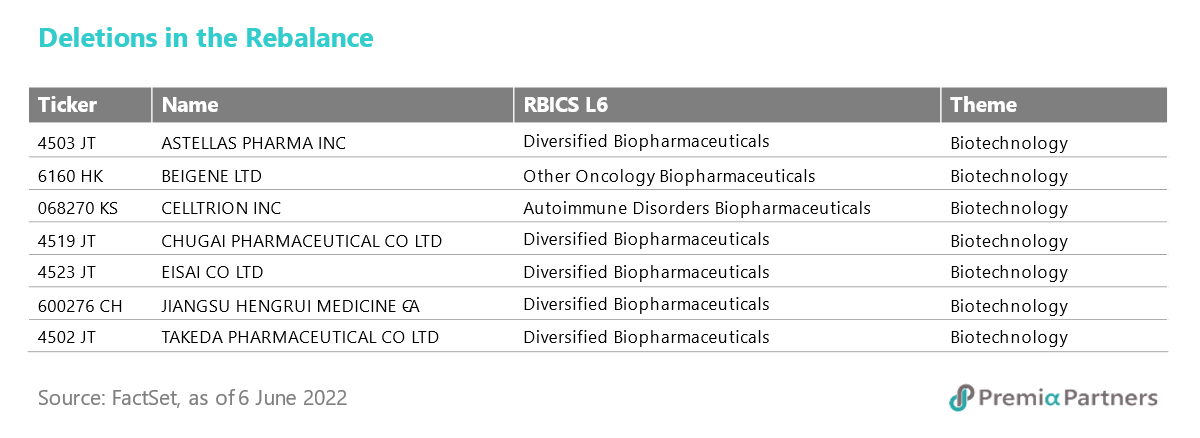

Of the 14 deleted securities, 7 of them are a consequence of streamlining the definition of Innovative Technology to focus on Information Technology. They are all classified under Biotechnology and thus no longer fit the screening criteria. The remaining 7 removals are Innovative Technology companies that have fallen short of meeting the final list as a result of trading volume, R&D, or revenue growth metrics not passing the criteria.

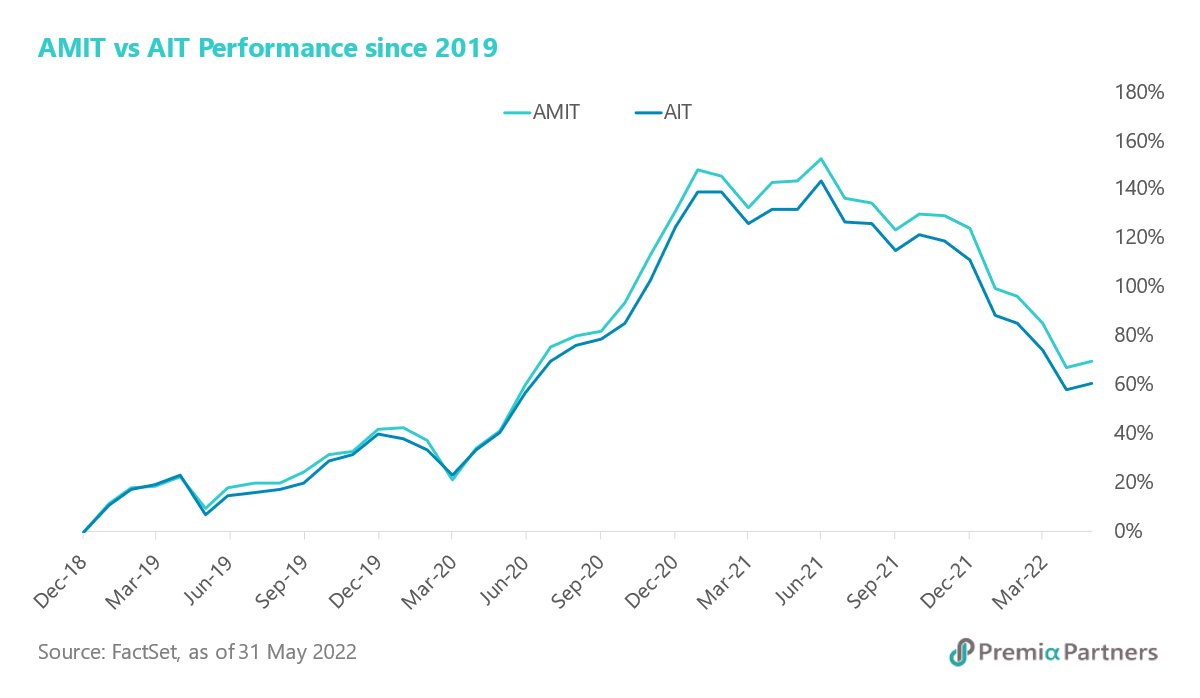

The performance between AMIT and AIT may look similar in the last few years, but we believe that AMIT could better capture the growth opportunities of the Metaverse. Our ETF, Premia Asia Innovative Technology ETF, had also changed its name to Premia Asia Innovative Technology and Metaverse Theme ETF on the same date, 10 June 2022, as the underlying AMIT index. Investors, who are interested in Innovative Technology and in particular the Metaverse, may consider investing in Premia Asia Innovative Technology and Metaverse Theme ETF.