Despite persistent global macroeconomic headwinds—including renewed US-China tariff tensions and the drag of geopolitical narratives—it's crucial for investors to filter out the noise and adopt a long-term, fundamentals-driven perspective. While headlines may amplify short-term volatility and uncertainty, they often mask the deeper structural shifts underway within China’s economy and equity markets.

Beneath the surface of short-term turbulence lies a compelling growth narrative. China continues to undergo a significant transformation, evolving from an export-driven, industrial economy to one powered increasingly by domestic consumption, advanced manufacturing, and innovation. This transition is supported by deliberate policy frameworks, including fiscal incentives, R&D subsidies, and regulatory reforms aimed at fostering homegrown technological breakthroughs and attracting capital into strategic sectors.

At the heart of this transformation is a robust innovation engine. China is rapidly becoming a global leader in areas such as green energy, semiconductors, artificial intelligence, and biotech. Supported by world-class infrastructure, a deepening talent pool, and an increasingly sophisticated domestic investor base, Chinese equities—particularly those tied to innovation-led industries—offer attractive long-term potential. While cyclical challenges remain, the structural tailwinds in technology and policy-driven modernization suggest that China’s stock market is not only resilient but increasingly positioned for sustainable, innovation-led growth.

- AI and Large Language Models (LLMs): Rapid progress with practical deployment

Chinese tech firms are rapidly scaling their capabilities in artificial intelligence, particularly in large language models tailored for enterprise and industrial use. A standout example is DeepSeek, an AI startup founded in late 2023, which quickly gained national prominence. By early 2025, DeepSeek’s R1 model was delivering competitive performance at just US$1 per million tokens—a fraction of global counterparts—marking a key step in making advanced AI both scalable and cost-effective. Its latest model features a greater depth of reasoning, and its overall performance is now approaching that of leading models, such as OpenAI’s o3 and Google’s Gemini 2.5 Pro.

The deployment of AI in real-world industrial applications underscores its structural impact. Over 100 hospitals across China are now using DeepSeek-powered diagnostic systems, particularly for rare diseases and imaging analysis. Separately, Cambricon has introduced the Cambricon-LLM, a chiplet-based hybrid architecture designed for on-device inference of LLMs. This architecture combines a Neural Processing Unit (NPU) with a dedicated NAND flash chip, utilizing in-flash computing and on-die error correction codes (ECC) to efficiently handle large-scale AI computations.

- Semiconductors: Building domestic capabilities across the stack

Semiconductors remain a cornerstone of China’s innovation agenda. While US export restrictions have posed near-term challenges, China has not stopped in accelerating domestic breakthroughs. Huawei’s founder Ren Zhengfei downplayed the impact of US export restrictions on China, saying domestic firms can use techniques like chip packaging or stacking to achieve similar results to advanced semiconductor technology. Nvidia’s CEO Jensen Huang recently said that the gap between US products and Chinese alternatives is decreasing, with Huawei’s upcoming Ascend 910D AI chip similar in performance to Nvidia’s H200. Meanwhile, China is launching its CloudMatrix 384 AI server, signaling confidence in homegrown performance computing.

China is also making significant strides in semiconductor equipment, particularly in areas once monopolized by foreign firms. SiCarrier, a Shenzhen-based company, recently unveiled etching and deposition tools that enable production of 5nm chips using multi-patterning techniques—circumventing the need for restricted EUV lithography. Shanghai Micro Electronics Equipment (SMEE) has launched the SSA800 DUV lithography machine and is currently prototyping an EUV system expected in 2025, reflecting a maturing domestic ecosystem from chip design to fabrication tools.

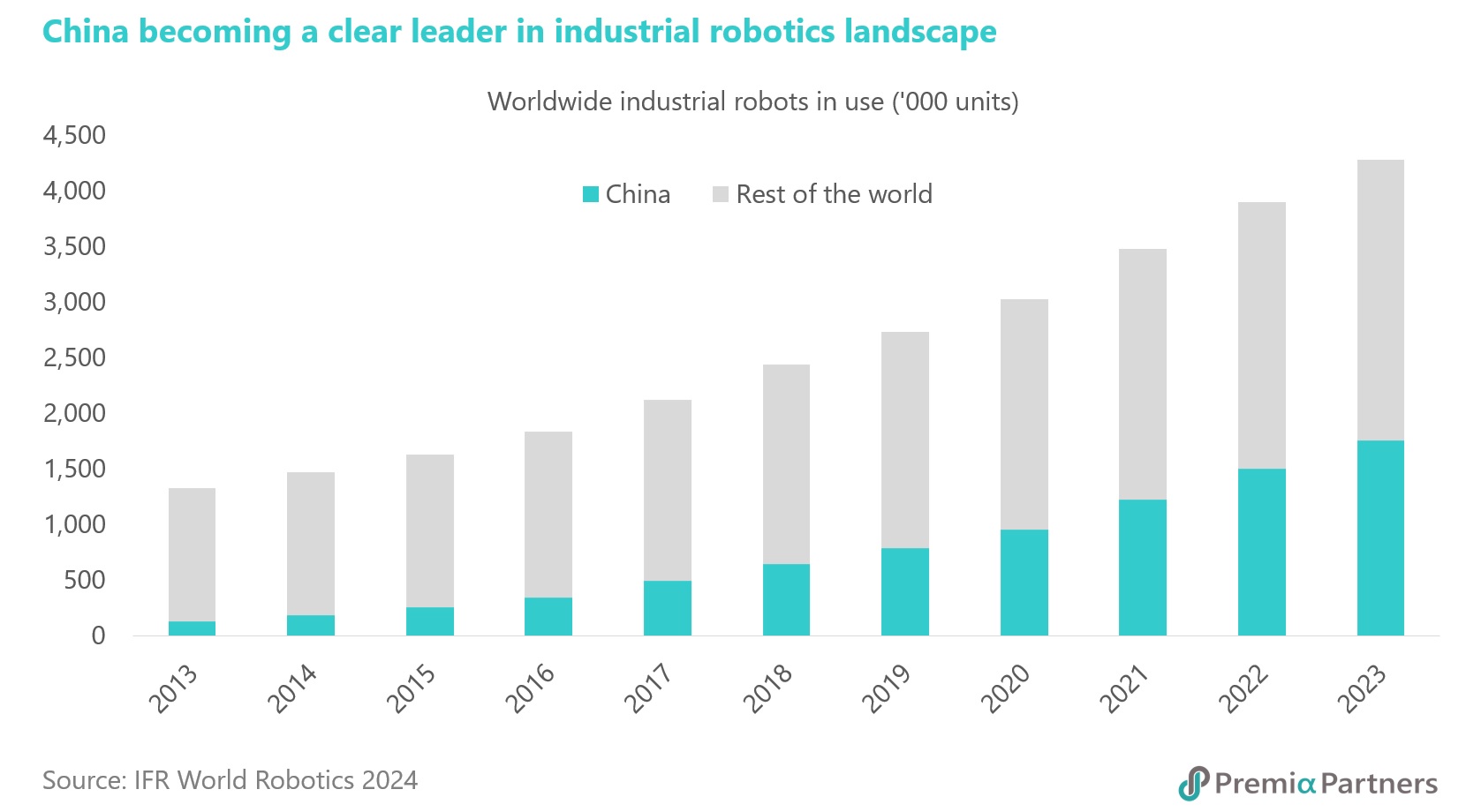

- Robotics and automation: A national priority in industrial modernization

China is aggressively scaling robotics and automation as a pillar of smart manufacturing. With a state-backed RMB1tn investment plan spanning two decades, China now accounts for over half of global industrial robot installations, most of which are domestically produced.

The country is also advancing in humanoid robotics, with firms like Unitree Robotics and EngineAI developing high-mobility models for manufacturing and public services. A landmark moment came with the world’s first humanoid robot half-marathon in Beijing in April 2025, where 21 robots ran alongside 12,000 human participants—an event showcasing integration of robotics into everyday society. Moreover, Shanghai’s Kylin Training Ground, China’s first heterogeneous robot training center, reflects long-term state planning in AI-robotics convergence.

- Green tech & renewables: Dominating the clean energy frontier

China continues to lead the global energy transition, driven by structural shifts in renewables. In 2024, the country installed more solar power capacity than the rest of the world combined, tripling its pace from 2022 to reach 333 GW. By early 2025, China had already added 72 GW of new solar—up 18% year-on-year. Today, wind and solar generate over 25% of national electricity, showcasing how deeply embedded clean energy has become.

China is also innovating in renewable hardware. Dongfang Electric constructed the world’s tallest wind turbine (340 meters) off Fujian’s coast, capable of powering 55,000 homes. In energy storage and EVs, firms like CATL and BYD dominate global markets. Notably, BYD's new 1,000 kW ultra-fast charger enables rapid EV charging, while sodium-ion batteries are being deployed in electric scooters, expanding battery innovation beyond lithium.

- Healthcare and biotech: Pioneering precision medicine and robotics

China’s healthcare and biotech sectors are undergoing rapid transformation, driven by breakthroughs in precision medicine, medical robotics, and increasing global partnerships. A landmark example is the world’s first remote, non-invasive throat surgery performed by Fudan University’s ENT team using an AI-powered transoral robotic system. Conducted across provinces, this operation highlights China’s leadership in integrating medical robotics with 5G infrastructure to expand access and efficiency in care delivery. Chinese biopharma firms are also accelerating globally relevant innovation. Akeso Biopharma’s Penpulimab received simultaneous approvals in both China and the US in 2025, marking a milestone for homegrown biologics and underlining the sector’s rising global competitiveness.

International collaborations are deepening. In March 2025, Merck signed a licensing deal with Jiangsu Hengrui Pharmaceuticals worth up to US$2 billion for HRS-5346, an oral Lipoprotein(a) inhibitor in Phase 2 trials, granting Merck global rights outside Greater China. Similarly, Pfizer entered a US$1.25 billion agreement with 3SBio for rights to an experimental cancer drug, SSGJ-707, outside China. These partnerships signal a broader trend: Western pharma companies are increasingly turning to Chinese biotech innovators for cost-effective, cutting-edge therapies—facilitating faster global access to next-generation treatments.

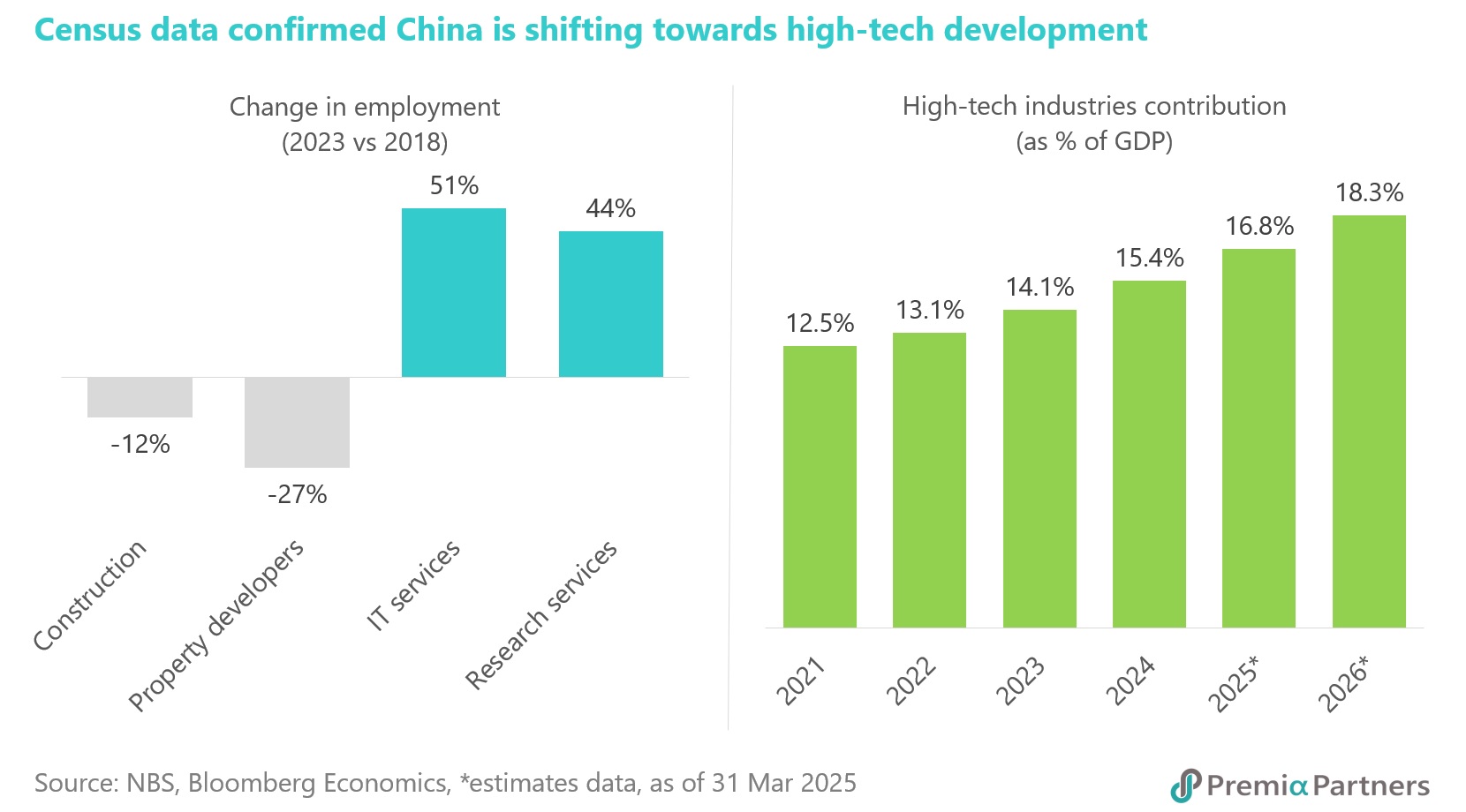

Structural tailwinds driving an innovation-led economy

From semiconductors to green energy, AI to robotics, and biotech to automation, China is pushing forward a coordinated strategy for technological self-reliance and industrial leadership. Rather than episodic gains, these reflect long-term structural tailwinds supported by massive capital allocation, focused R&D, and state-industry synergy.

While short-term volatility and geopolitical tensions may cloud sentiment, the underlying innovation ecosystem in China is accelerating, and with it, a new era of productivity, competitiveness, and opportunity is unfolding. For investors and strategists willing to look beyond the noise, China’s innovation-led transformation represents a compelling, long-term structural growth story.

Investment opportunity: Attractive valuations and strategic positioning

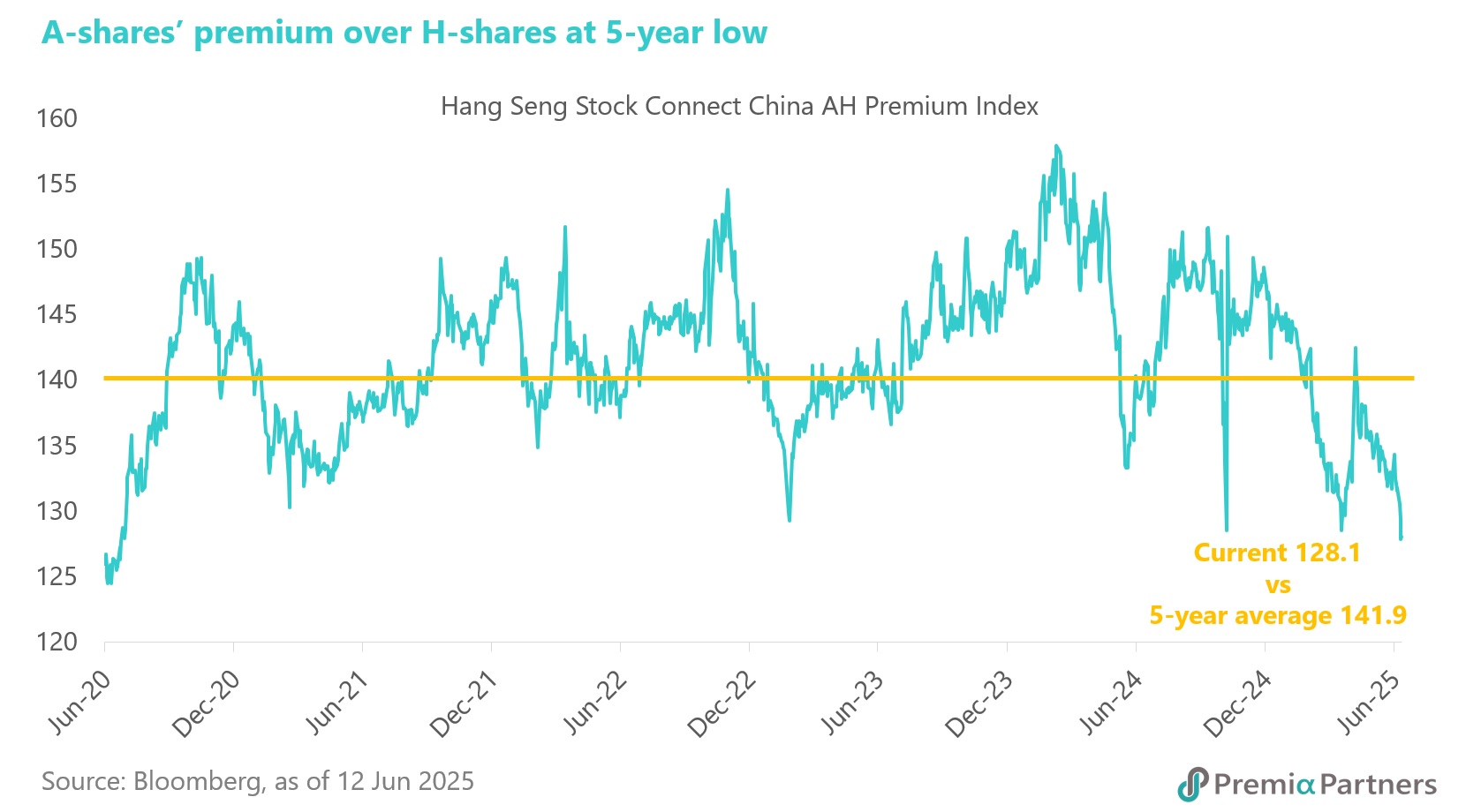

Despite concerns around economic deceleration and external pressures, Chinese equities have become fundamentally attractive from a valuation perspective. Major sell-side brokers, such as Goldman Sachs, Morgan Stanley and J.P. Morgan, have been upgrading China’s market outlook in recent months, citing a confluence of policy support, resilient earnings in key sectors, and a more pragmatic regulatory environment. Valuation multiples remain deeply discounted relative to global peers, providing an asymmetric risk-reward setup for long-term investors.

Among domestic equity classes, the A-share market stands out as particularly compelling. A-shares provide broader access to sectors critical to China’s push for technological self-reliance, including advanced manufacturing, semiconductors, clean energy, and robotics. Furthermore, the A-H premium is now at a five-year low, reinforcing the relative value of A-shares versus their H-share counterparts and offering a timely entry point.

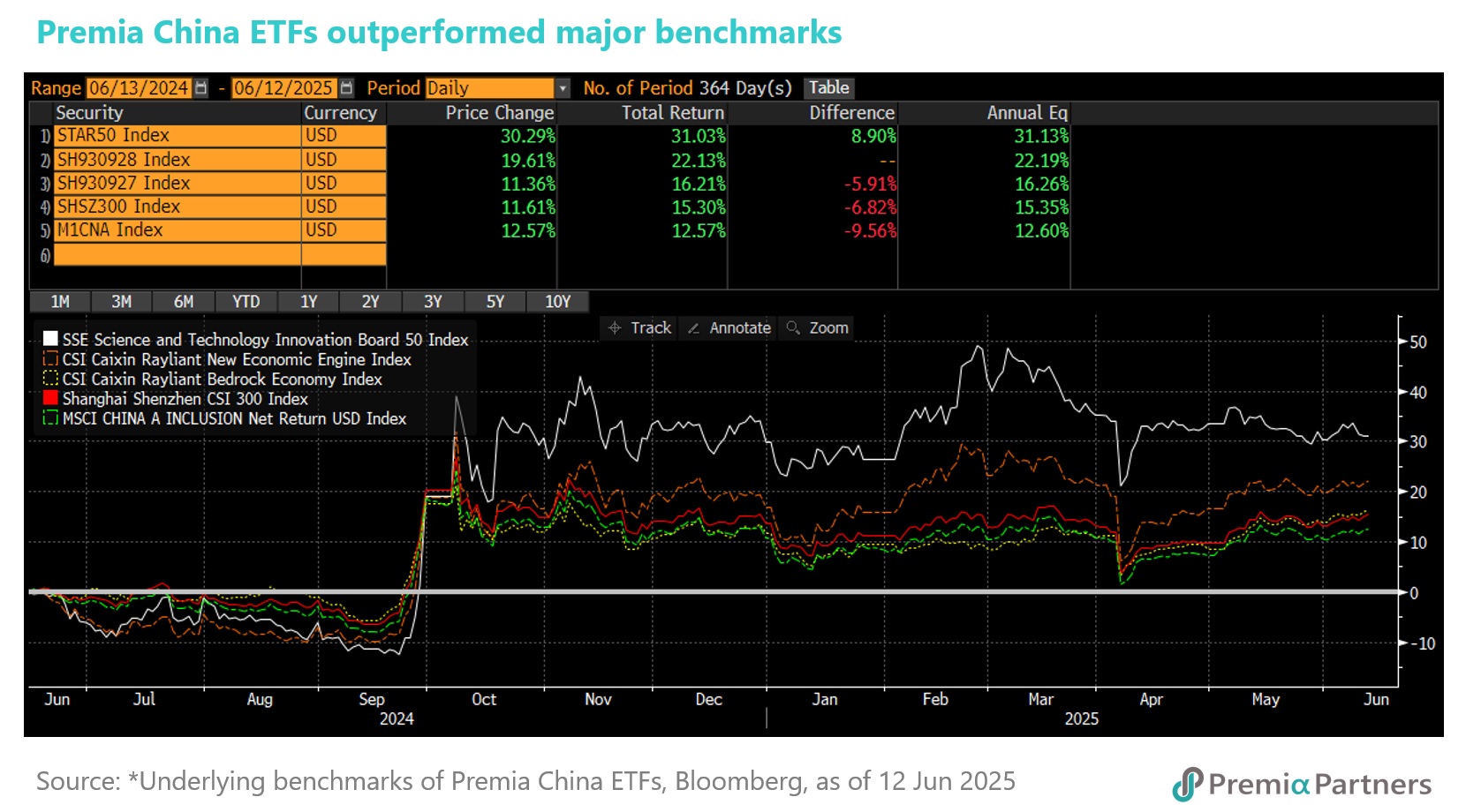

Accessing the opportunity: Targeted exposure through Premia China ETFs

For investors seeking to position themselves effectively in China’s structural growth story, Premia’s suite of China-focused ETFs provides efficient, diversified, and targeted access. The Premia CSI Caixin China New Economy ETF offers exposure across high-growth sectors aligned with China’s long-term megatrends—such as industrial automation, digital transformation, green energy, and healthcare innovation—through a diversified basket of high-quality companies and many of which are still trading at attractive valuation at or below historical average as the cohort starts breaking out from corrections for growth companies in the recent years.

For those looking to concentrate on the next wave of China’s industrial and technological rise, the Premia China STAR50 ETF focuses on hardcore technology champions listed on the STAR Board, the Nasdaq-style platform that houses many of China’s most innovative firms. This ETF is particularly well positioned to benefit from ongoing policy support for domestic champions in semiconductors, AI, and advanced manufacturing. In addition to the recent IPO of Insta360 which leads the global action camera market and was the largest STAR board IPO year to date this year, the pipeline of unicorns lining up for STAR board listing provides a very strong tailwind for the strategy.

For the prudent investors navigating today’s volatile macro environment, the Premia CSI Caixin China Bedrock ETF offers a multi-factor approach emphasizing value, quality, low volatility, and size. This strategy is designed to generate alpha while mitigating downside risks, making it an optimal choice in uncertain markets and a conservative core allocation with robust dividend yield and better resilience from market drawdown.

In sum, China’s A-share market—backed by structural innovation, supportive policy, and now very attractive valuations—presents a compelling opportunity. The key lies in selective exposure, and Premia’s ETF offerings provide investors with the precision and diversification needed to capture China’s next phase of growth.