Emerging ASEAN outperformance in a storm

ASEAN equities are continuing to outperform in relative terms against Developed Markets, as a regional expression of the global value trade. That reflects their better valuation relative to their earnings growth prospects, compared to Developed Markets.

However, as DMs slide deeper into bear markets, some tweaking of the ASEAN trade – as a pure Emerging Market play – might achieve even better relative outperformance. Further, as our Senior Advisor Say Boon Lim suggests, investors with the flexibility for a spread trade might consider a long on Emerging ASEAN paired with a short against global growth (mostly US tech) or cyclical stocks.

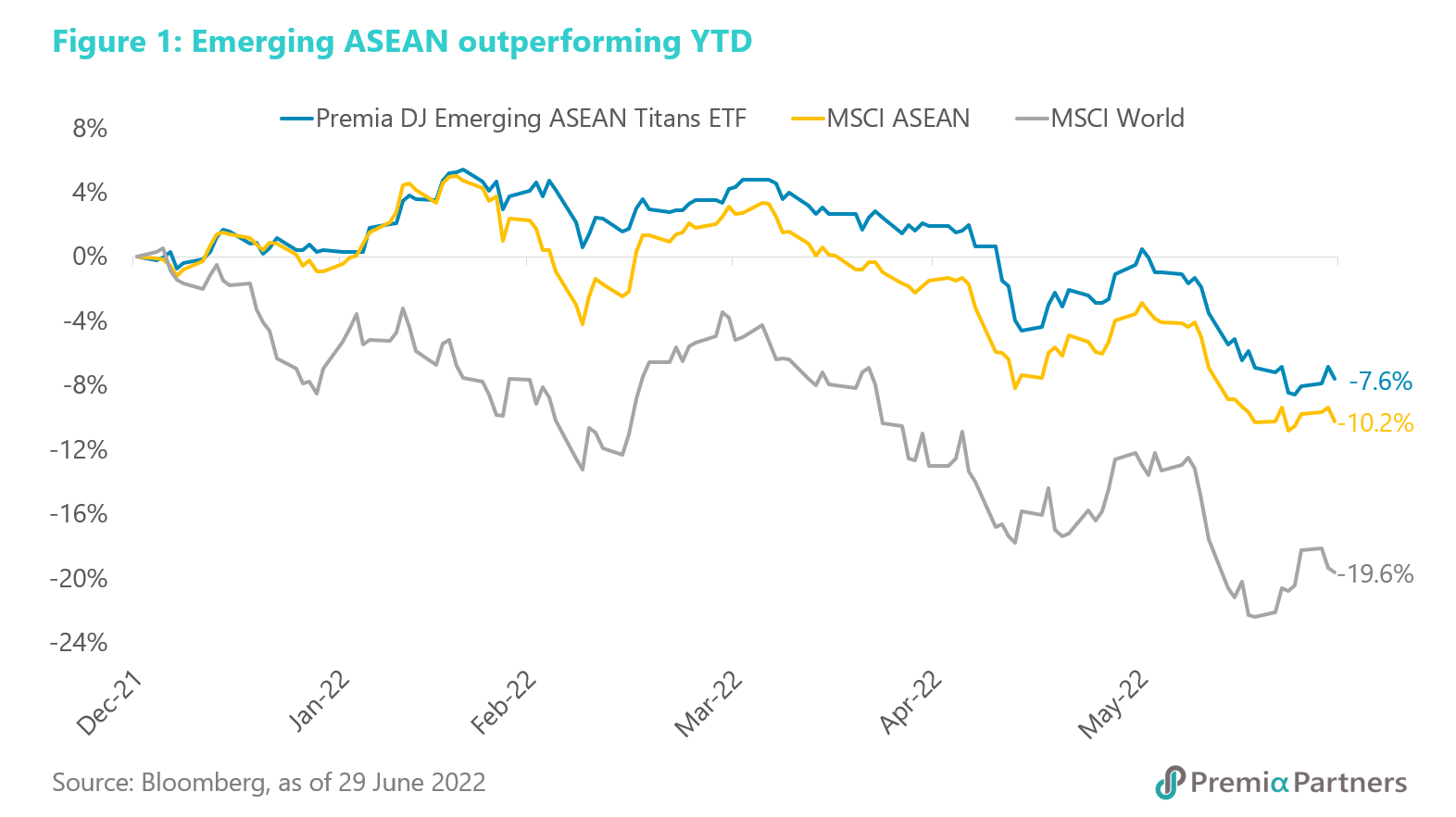

Emerging ASEAN – outperforming amidst a global risk-off environment. ASEAN has been one of the most defensive markets in the world since the onset of the bear market in the US, Europe and Japan – outperforming the Developed Markets (DM) by a wide margin. But note how a pure Emerging ASEAN play – that is, excluding Singapore – would have improved that relative outperformance even more.

In terms of absolute returns, the Premia Dow Jones Emerging ASEAN Titans 100 ETF (2810 HK / 9810 HK) had been in positive territory on a year-to-date basis until the second week of May. While it had gone negative since, the loss has been much better contained at -7.6% YTD, versus -10.2% for MSCI ASEAN, and -9.6% for the MSCI World.

A pure regional emerging market focus – thereby excluding Singapore – has boosted performance. 9810 HK’s outperformance against MSCI ASEAN is due in part to its exclusion of Singapore, which has underperformed over the past three months. Part of that might have been due to the rapid rise in the 10-year Singapore Government bond, from 1.75% at the start of the year to 3.0% currently. That was the fastest rise in the 10-year government bond yield among the ASEAN-5 over the last six months. Of course, others in the ASEAN-5 will also likely see higher rates and yields in coming months. However, the nature of Singapore’s economy – where it imports almost all its consumption and is very open to international financial flows – makes it much more exposed to global inflation and rising rates.

Apart from the impact of rapidly rising rates and yields, the inclusion of Sea Limited in MSCI Singapore (at 12.6% weight) and MSCI ASEAN (4% weight) added to both indices’underperformance vis-à-vis 9810 HK.

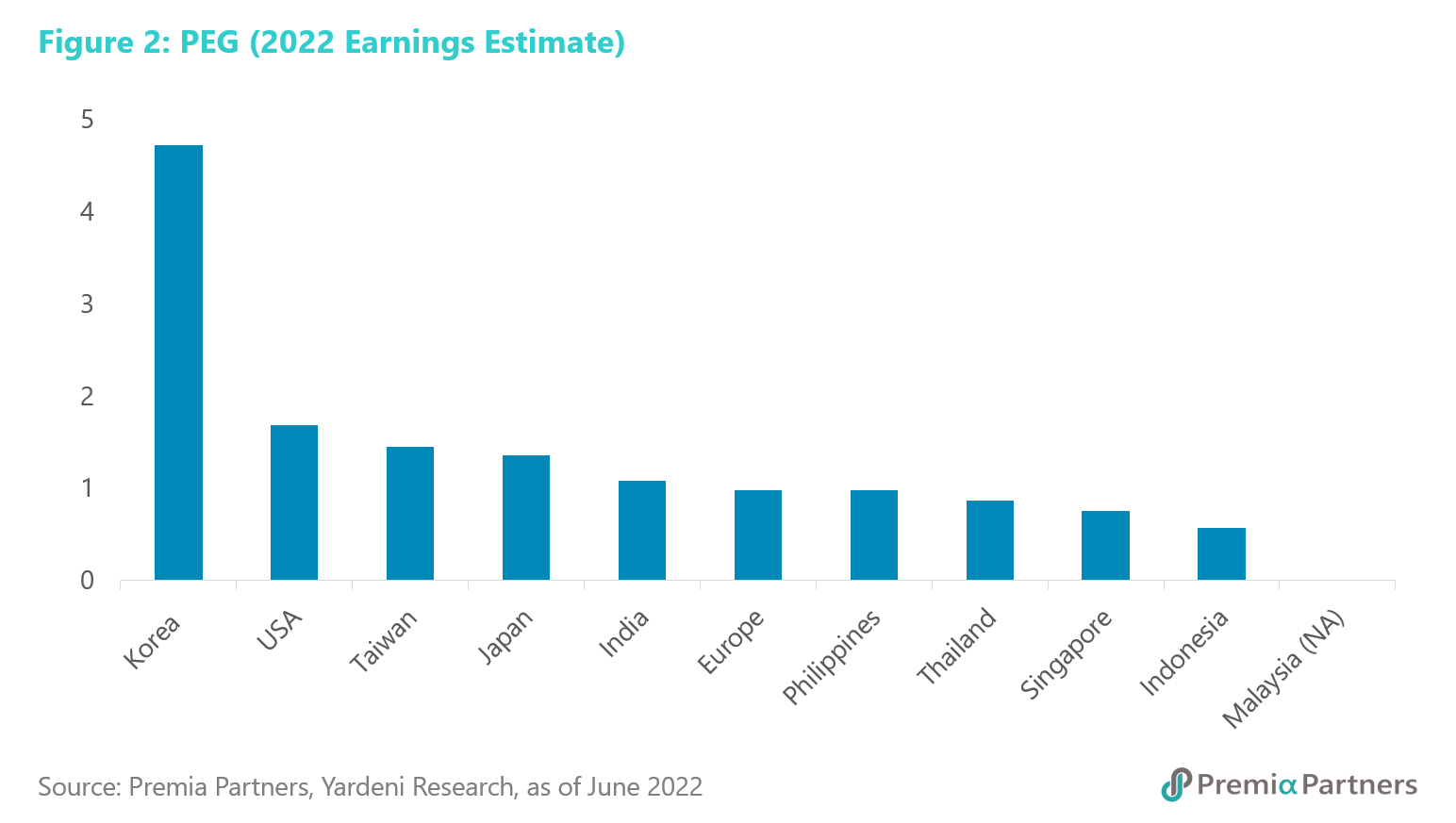

There are immediate valuation drivers and longer-term economic growth drivers for the Emerging ASEAN trade. ASEAN markets generally offer some of the lowest PEG (PE to Growth) ratios in the world. The exception is Malaysia, where the MSCI Malaysia earnings estimate for 2022 is negative.

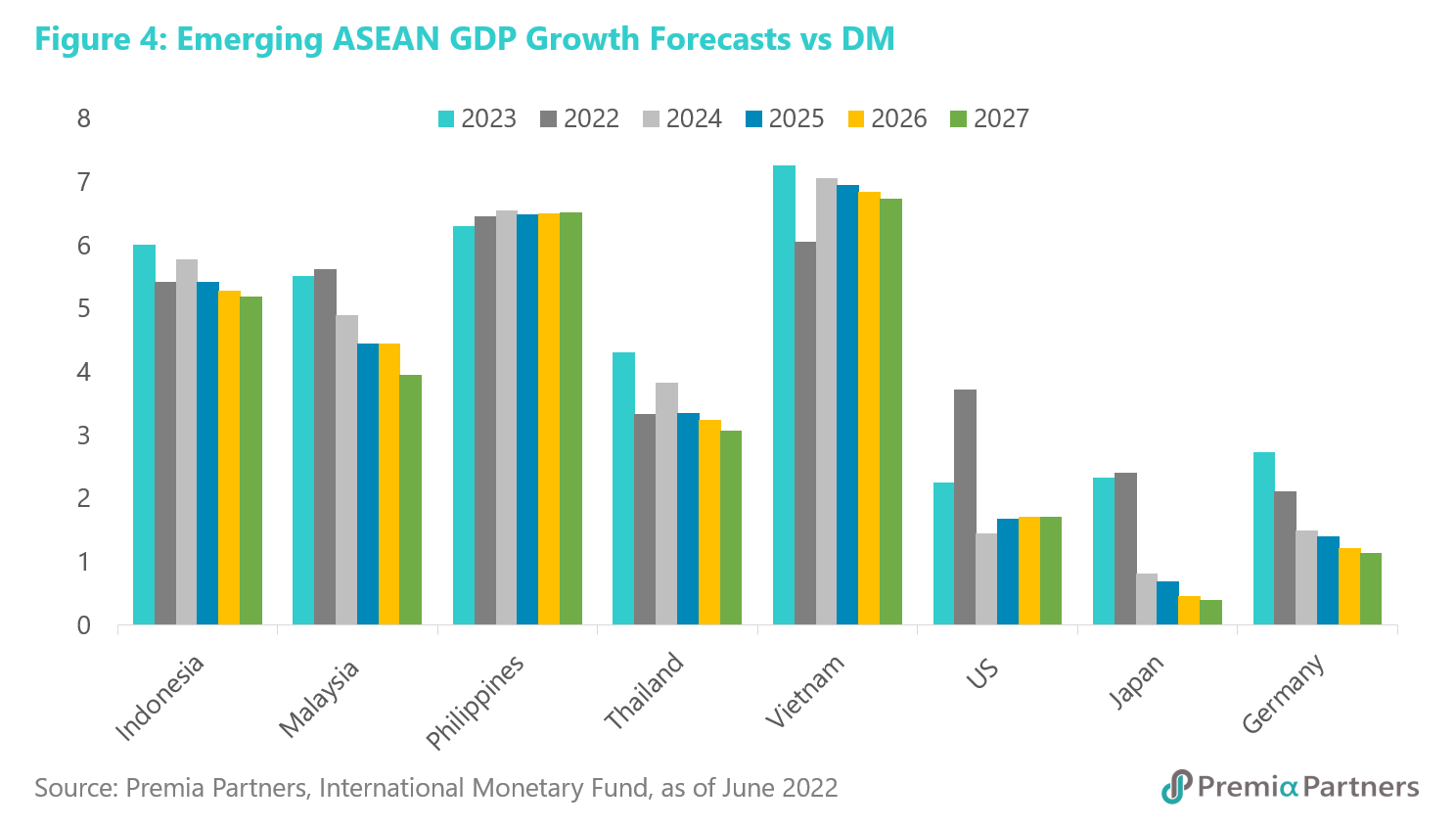

On the economic front, the longer-term outlook is also supportive of corporate earnings relative to the Developed Markets.

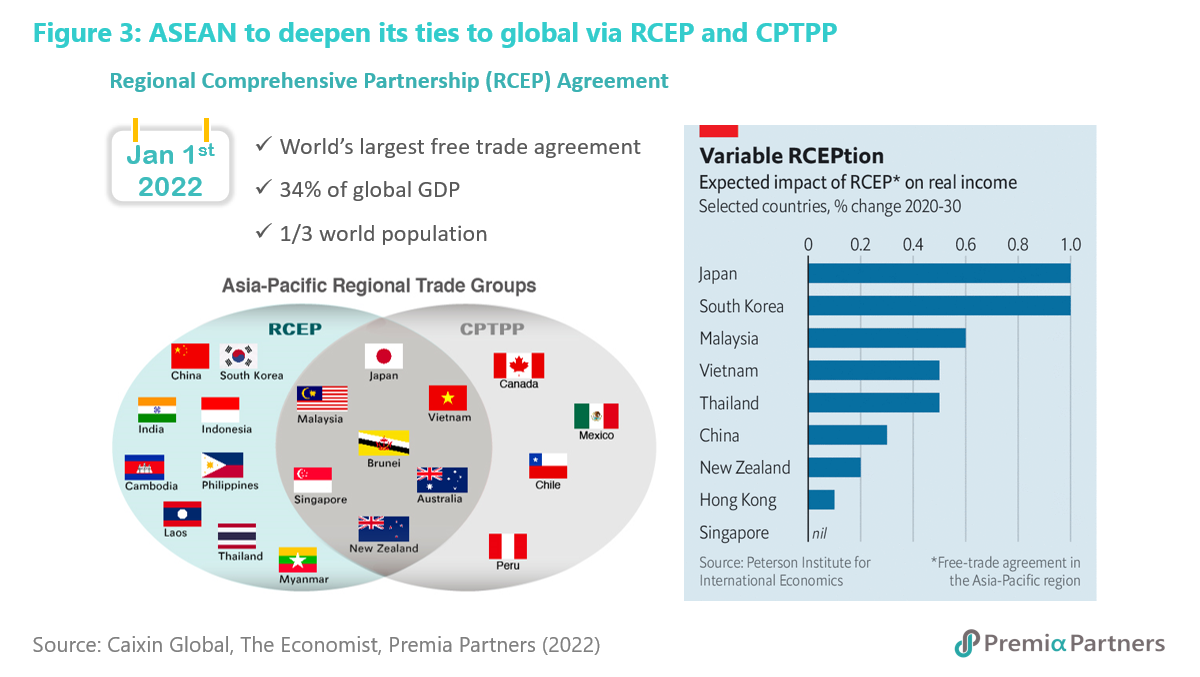

In fact, global trades would be important tailwinds for Emerging ASEAN countries, as major beneficiaries of the Regional Comprehensive Partnership (RCEP) Agreement, Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and an expanding list of bilateral free trade agreements (FTAs).

According to the International Monetary Fund (IMF), GDP growth over the period 2022-2027 would average around 5.5% for Indonesia; 4.8% for Malaysia; 6.5% for the Philippines; 3.5% for Thailand; and 6.8% for Vietnam, compare that with 2.1% for the US; 1.2% for Japan; and 1.7% for Germany.

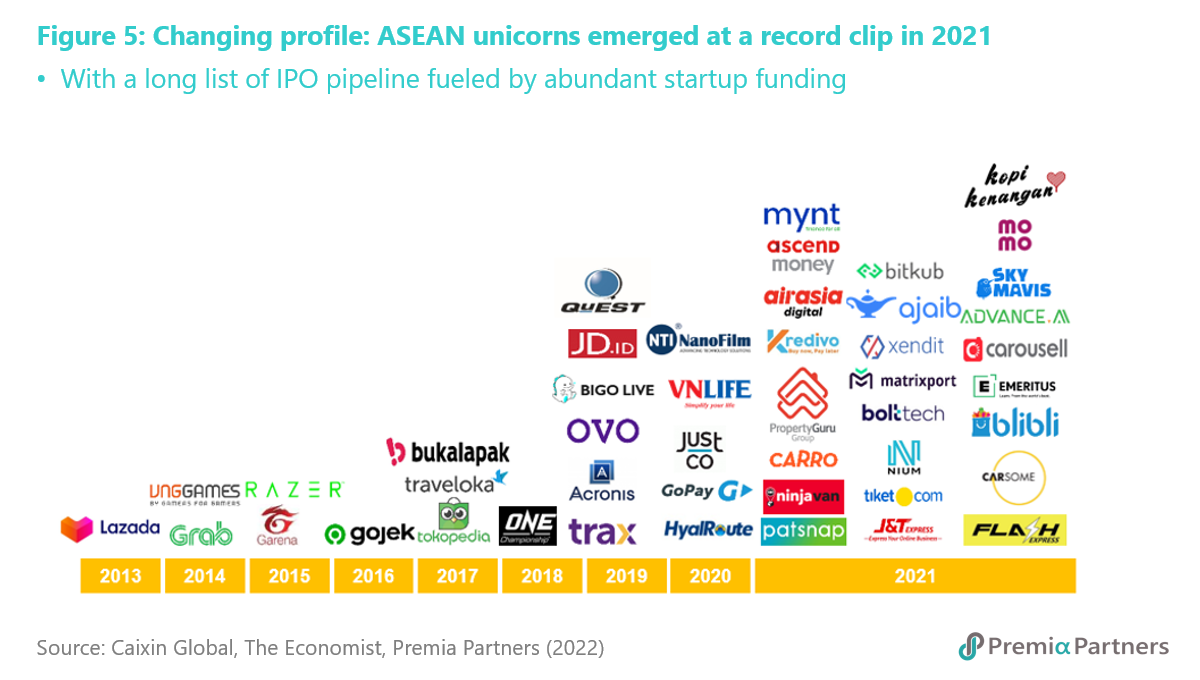

It is also worth noting during the previous year of the regulatory crackdown on China tech players, ASEAN tech companies emerged as beneficiaries as capital flows were redirected to the region. The long and expanding list of ASEAN unicorns is also quickly changing the listed landscape in the region, especially Indonesia, from the traditional economy focused universe to a more balanced and vibrant mix of traditional and new economy companies.

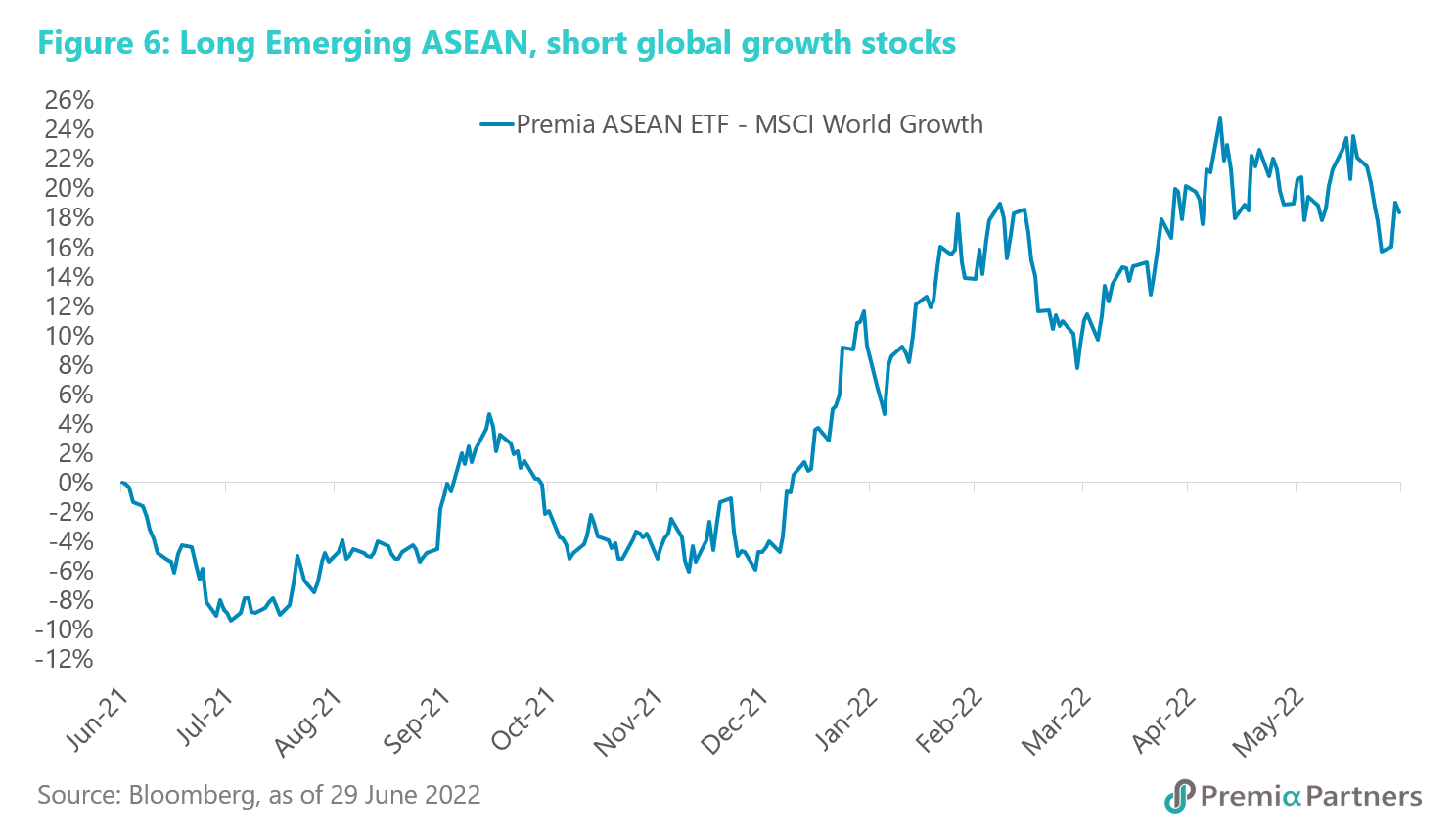

A long-short variation could be considered for more flexible and risk-tolerant investors. If investors believe as we do, that the US is likely to head into a recession, the historical average decline of around 40% tells us we are possibly only half-way through that on the S&P 500. Further, if rates are to rise further, growth stocks (particularly tech stocks) are likely to be more at risk of losses than value stocks because of the former’s so-called earnings duration risk. Our proxy for global growth stocks is the MSCI World Growth Index which has a 37% weighting in tech. It is almost 68% in the US market.

So, one possible trade is a long on Emerging ASEAN – as a regional value play – with a short against growth/tech stocks. Using 9810 HK as a proxy for Emerging ASEAN, that strategy would have started delivering gains from around August of last year.

The dynamics which have been driving that outperformance of 9810 HK against MSCI World Growth – overvaluation of growth stocks, inflation and rising rates – will likely remain in place for the rest of this year.