Gold – why isn’t it shining in this crisis?

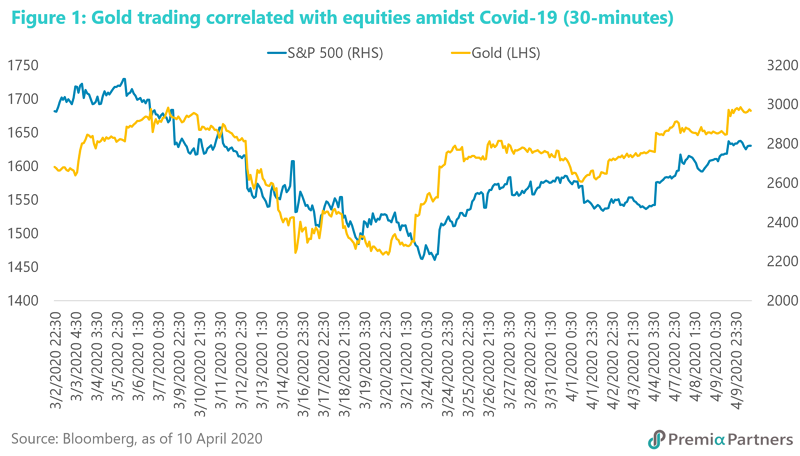

The market performance of gold in the midst of the COVID-19 crisis has left its fans a little puzzled. From a peak of USD 1703 on 9 March, it retreated to USD 1451 on 16 March - a 15% decline. That’s pretty nasty for a week’s “work”. Of concern to asset allocators, the price of gold has tended to move in line with equities since late February. When VIX peaked and turned down from 19 March, gold bottomed and rallied along with the S&P 500.

China consumer demand affected by COVID-19. One factor cited by the World Gold Council for the early March drop in the price of gold was the decline in demand from China. Consumer demand for gold in China, which usually requires face-to-face interaction, likely declined significantly amidst the COVID-19 outbreak. China accounted for 30% of the global consumer demand for gold last year.

Recent swings have also coincided with Dollar funding stress and global risk appetite. According to reports, investors have been liquidating their gold positions to meet margin calls on equities positions.

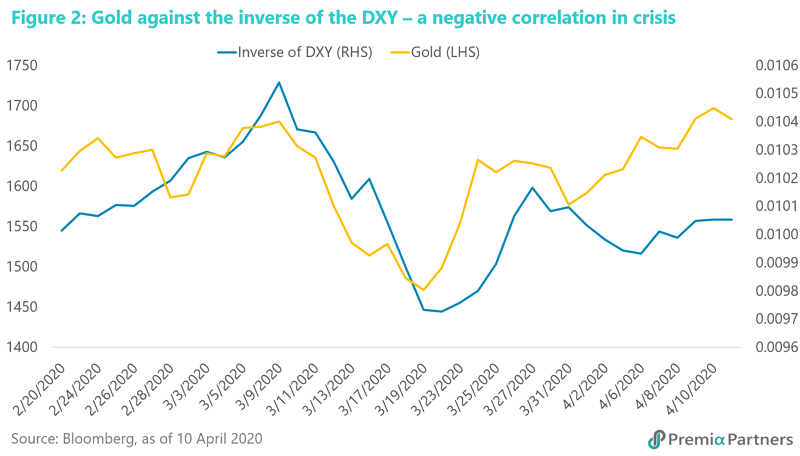

Another way to look at this is through the lens of Dollar funding stress amidst extreme risk aversion and collapsing risk asset markets. As the US Dollar Index DXY surged in the first half of March, gold traded inversely, falling sharply – in line with equities.

As Dollar-funding stress eased in the final week of March – in response to the Federal Reserve expanding its swap lines with other central banks – DXY fell back, sending both equities and gold up.

In the longer term, the price of gold is likely to be determined by whether the aftermath of COVID-19 is inflationary or deflationary. So what happens after these risk-on/risk-off swings? There are two parts to the answer, depending on the time frames.

The idea that gold performs well in all crises is too simplistic. It depends on the nature of the crisis.

In general, gold does better in an inflationary environment than in deflation. Advocates who argue for gold in deflation usually speak in terms of gold’s “buying power”, not its nominal price.

Immediate aftermath of COVID-19 is likely to be deflationary. Over the next 6 months, as the market digests the damage to the global economy caused by COVID-19 shutdowns, gold is unlikely to perform well.

COVID-19 is likely – at least initially – to be deflationary. Wars destroy capital/productive capacity and the end of war releases demand – hence creating excess demand relative to supply, and hence inflation. The “war” against COVID-19 however destroys demand while leaving capital/productive capacity intact and idle.

It destroys more than current demand. COVID-19 is also destroying savings and wealth, or future demand. COVID-19 will be deflationary in 2020 and possibly in 2021.

Gold will shine again as central banks attempt to inflate away huge national debts. At some stage in the future, as central banks print more and more money in an attempt to inflate away the debt that their shareholders in the government have accumulated, there will be inflation and a time for gold to shine.

For now, cash is King – especially US Dollar cash. Gold will shine when investors lose confidence in the US Dollar. Right now, the reverse is true. There is still high demand for US Dollars. If risk asset markets resume falling, there is little reason to hold gold. The value of everything else will then be falling relative to cash. Unlike gold, cash has no mark to market risk.