A historic fiscal policy shift is on the horizon, with the general budget deficit set to surpass the 3% threshold by 1 percentage point, reaching 4%. In support of economic growth, the government will issue large-scale special treasuries and more local government bonds. These measures will help fund key areas, such as major infrastructure projects, equipment renewal plans, old consumer goods trade-in programs, and efforts to reduce inventory in the property market. Additionally, RMB 500 billion in treasury bonds will be issued to bolster large commercial banks’ capital, enhancing financial stability.

In his Government Work Report, Premier Li Qiang outlined China’s focus on developing high-quality productive forces and accelerating the establishment of a modern industrial system. The government’s priorities include emerging industries, future technologies, upgrading traditional sectors, digitalization, and reforms in education, science, technology, and talent mechanisms. According to Bank of China International (BOCI), the key areas identified for growth include:

- Key Industries: Emerging sectors like commercial spaceflight and the low-altitude economy; future industries such as bio-manufacturing, quantum tech, embodied intelligence and 6G; digital industries; and modern service industries.

- Digital Economy: Intelligent connected new-energy vehicles (NEVs), AI-powered devices, smart robots, and intelligent manufacturing equipment, along with widespread 5G applications, industrial internet, and nationwide computing power.

- Green Industries: Recycling, renewable materials, zero-carbon parks, emissions trading, and the low-carbon transformation of coal plants.

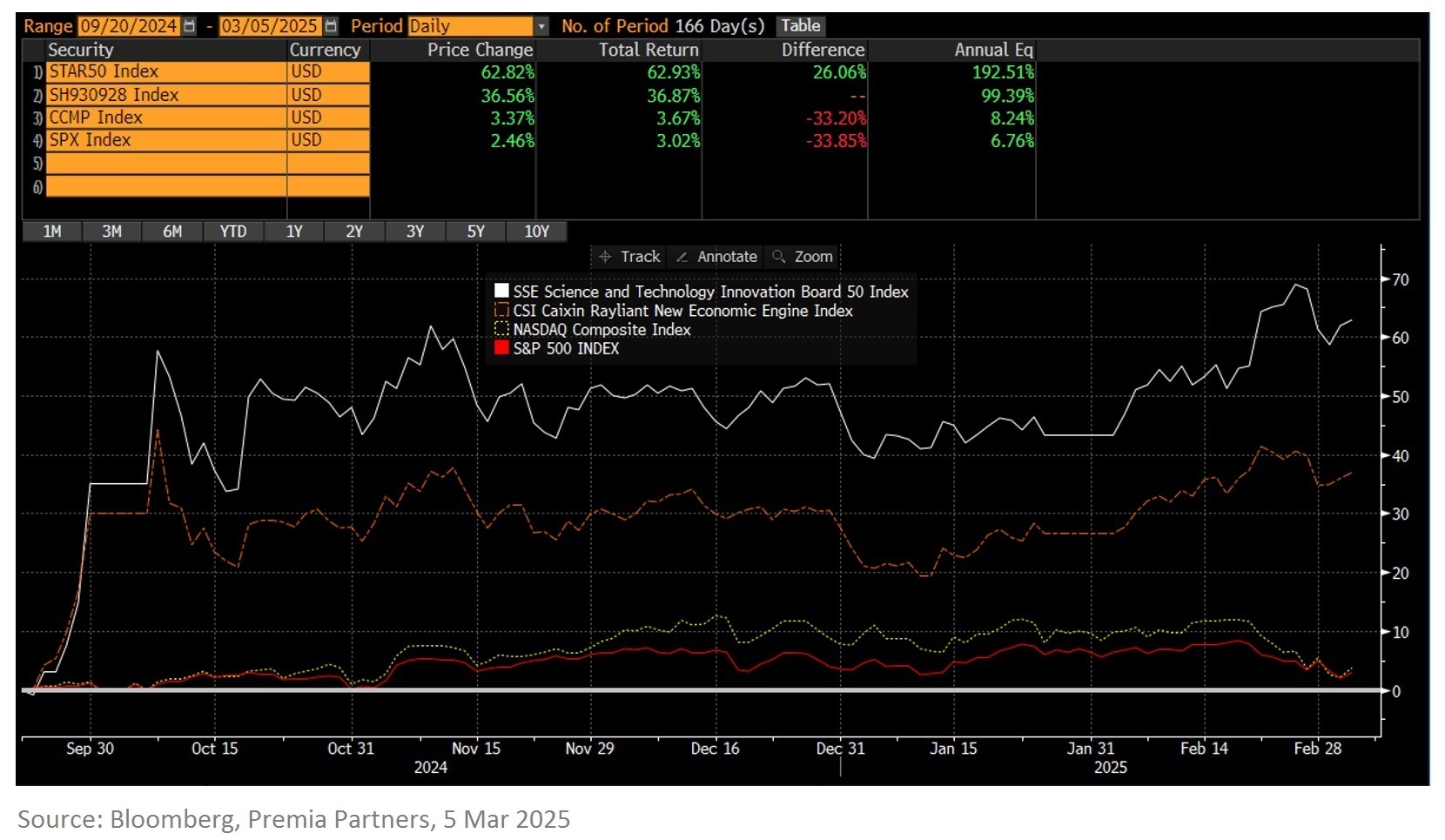

Market has reacted to the announcement positively, with Chinese stocks continued their outperformance against the global equities. Wall Street’s optimism is growing. Goldman Sachs predicts double-digit gains for Chinese stocks in the next 12 months, attracting up to USD 200 billion in net inflows. Meanwhile, Bank of America notes that China’s shift from a "tradable" to an "investable" market is gaining traction.

Since China’s market rebounded in September following a policy shift by the Politburo to support the economy, the government has sent consistent signals of support. A symposium with business leaders, hosted by President Xi Jinping, reinforced the government’s commitment to revitalizing the private sector and rebuilding market confidence. Attendees included major figures from high-tech manufacturing, including AI, robotics, semiconductors, internet services and electric vehicles. Notably, Jack Ma’s attendance highlighted the government’s endorsement of the private tech sector, restoring investors’ confidence towards Chinese equities.

A-shares have underperformed in the past few weeks compared to Hong Kong and ADR markets, as international investors have primarily targeted offshore-listed Chinese companies for quick accessibility and familiarity. Besides, the availability of offshore Chinese equities for short-selling means that any short-covering activities could trigger a sharper short-term rebound. That said, we anticipate that risk-on sentiment will extend to onshore investors in the next phase of the rally. Key factors include:

- Increased liquidity from domestic monetary easing.

- Rising demand for low-risk fixed-income assets, driving yields to historical lows.

- Long-term institutional investors, including pension funds and insurance companies, increasing their A-shares allocations.

- Policy-supported stocks in sectors like semiconductors, robotics and AI, which are largely exclusive to the onshore market.

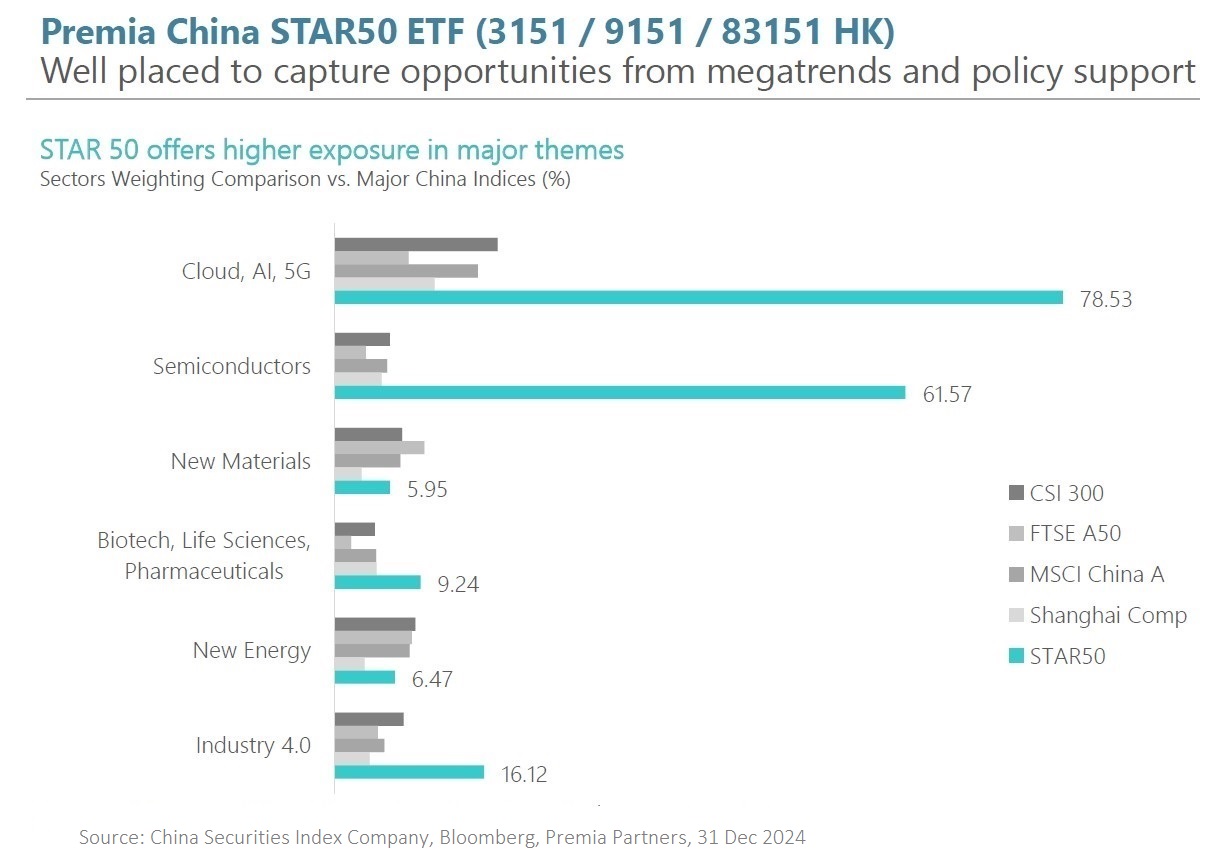

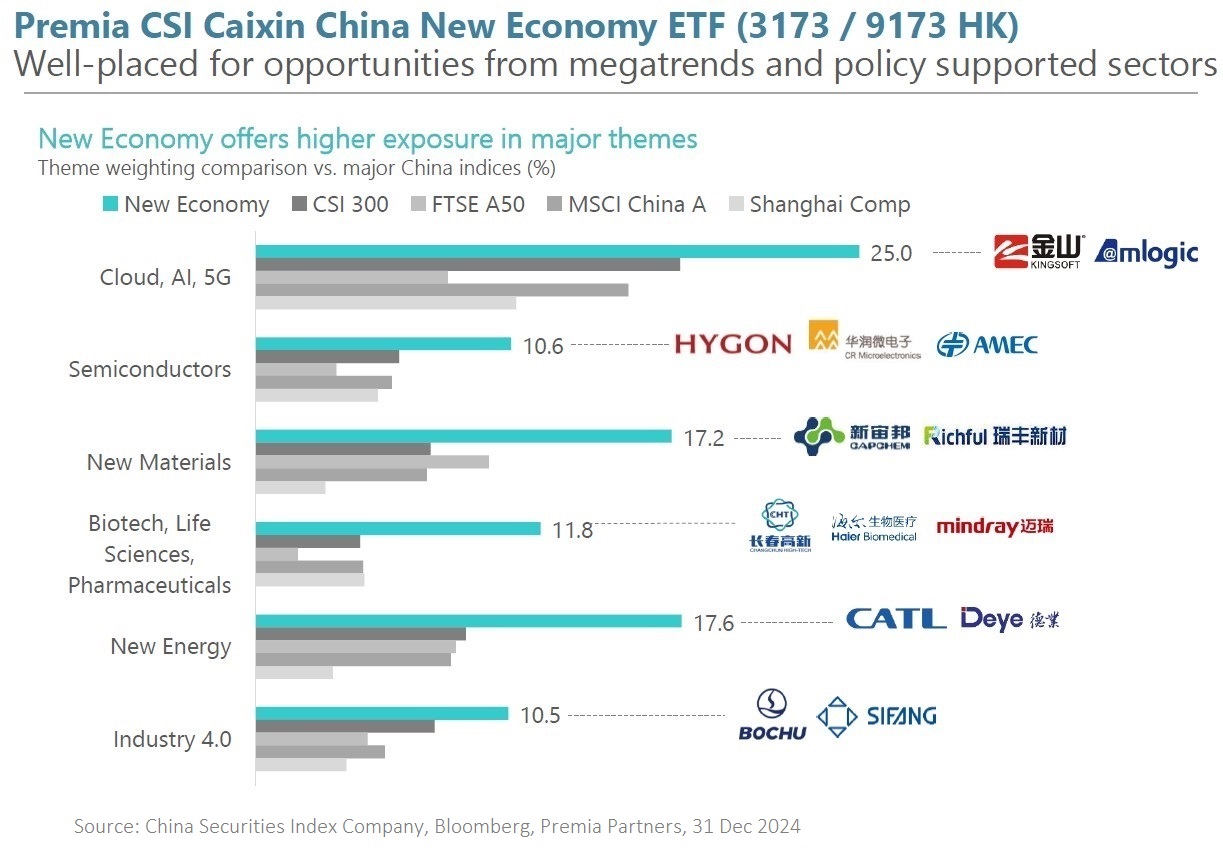

Now is an ideal time to increase exposure to Chinese equities, particularly in the policy supported segment. China’s determination to strengthen its technological base is intensifying, especially in AI, semiconductors, robotics and biotech. This push is partially driven by the rising tensions with the US, which may lead to tighter restrictions on technology transfers and higher tariffs. At the same time, China’s leadership in emerging industries like electric vehicles, renewable energy and lithium batteries underscores its competitive position in high-growth sectors.

For investors looking to tap into these opportunities, funds such as the Premia China STAR50 ETF and Premia CSI Caixin China New Economy ETF offer targeted exposure. The former focuses on 50 leading innovators in cutting-edge industries, while the latter provides a diversified portfolio of around 300 firms in new economy sectors.