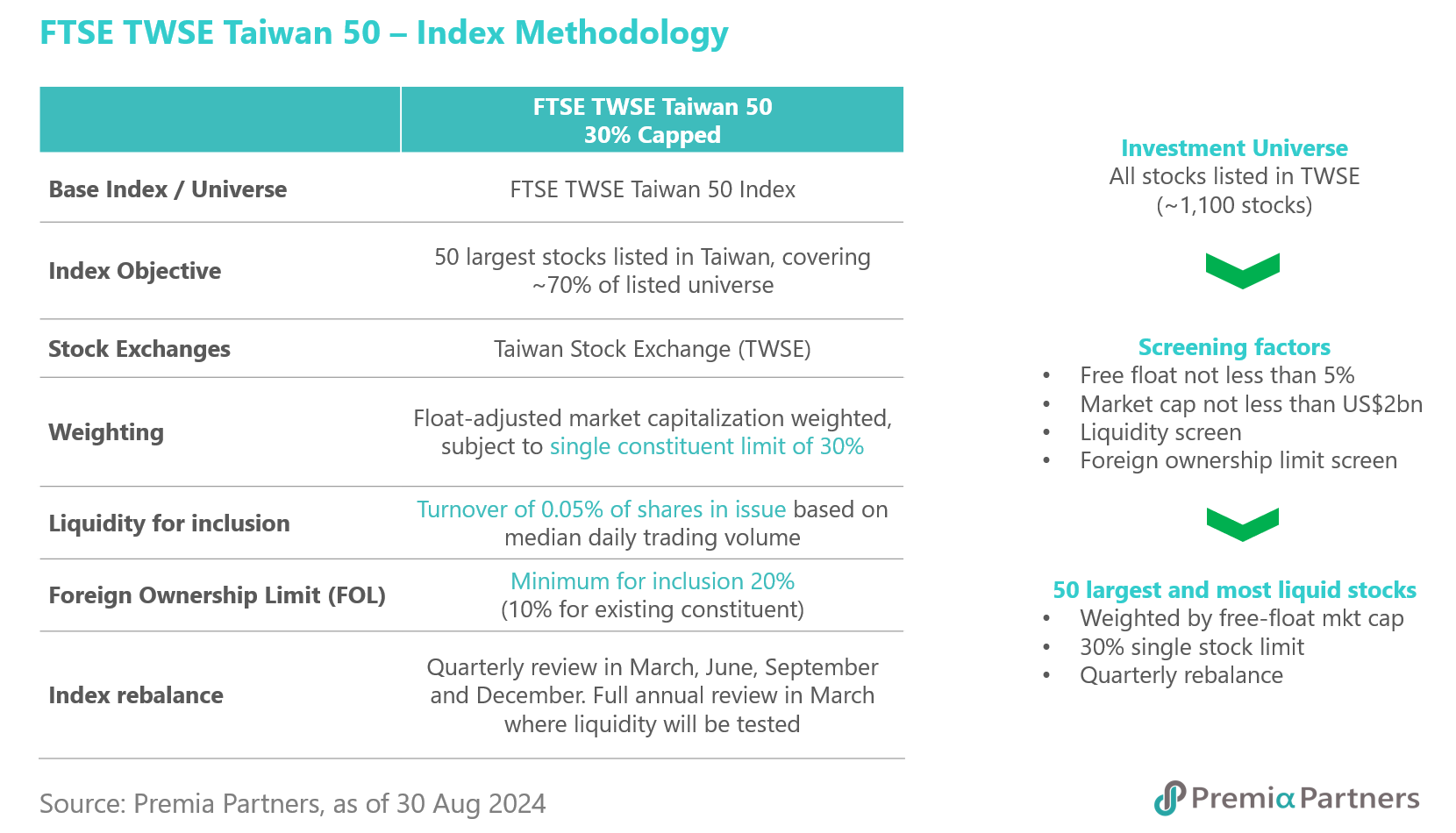

The HKEx-listed ETF tracks FTSE TWSE Taiwan 50 30% Capped Index USD (NTR) (the underlying index), which is a diversified basket of 50 leading companies listed on the Taiwan Stock Exchange, covering at least 70% of the market exposure. Following a straightforward cap-weighted index methodology, the rule-based strategy starts with a screen for the 50 largest and most liquid stocks from a universe of over 1,100 stocks in the market based on factors including free float market capitalization, liquidity level and foreign ownership limit availability. The index is then weighted by float-adjusted market capitalization, with a single constituent cap of 30%, and is rebalanced quarterly to reflect the most updated market conditions.

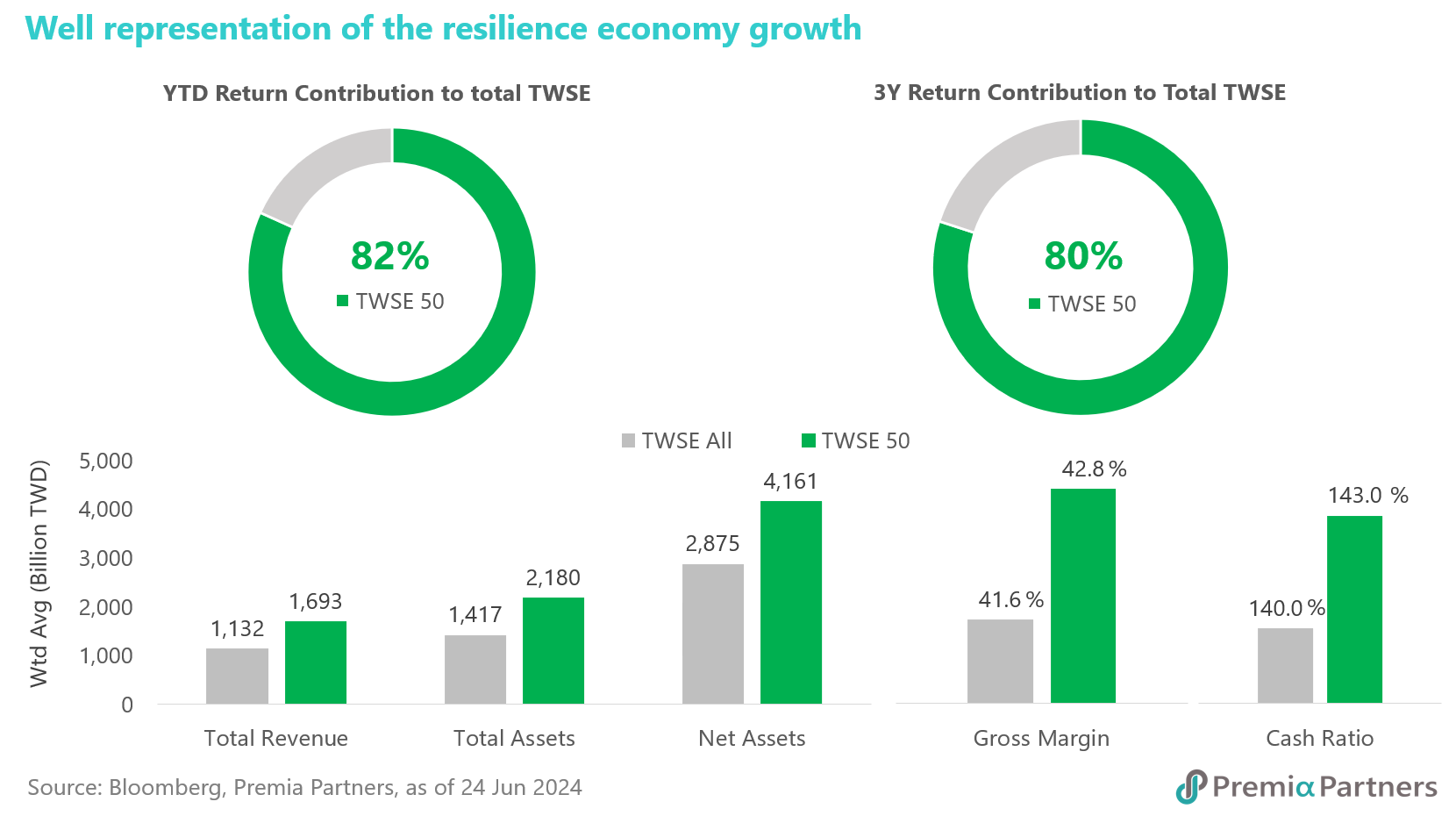

The resulting portfolio features 50 companies representative of the large cap leaders listed in Taiwan, with strong fundamentals, contributing to approximately 80% of the returns from the TWSE listed universe over various time horizons – year-to-date, 1 year, 3 years and 5 years. On a weighted average basis, the selected companies are not only better in total revenue, total assets and net assets, but also superior in gross margin and cash ratio. We believe that the portfolio is a well representation of Taiwan’s resilience economic growth driven by technology led developments. Global hyperscalers have been making significant investments in AI infrastructure, and this has created a large market for chips and data centers, with Taiwan companies at the center. Capex does not appear to be slowing down so far in 2025 either. Consensus forecasts earnings for the underlying index are expected to grow by 28.1% in 2024 over last year’s low base, followed by 18.2% in 2025.

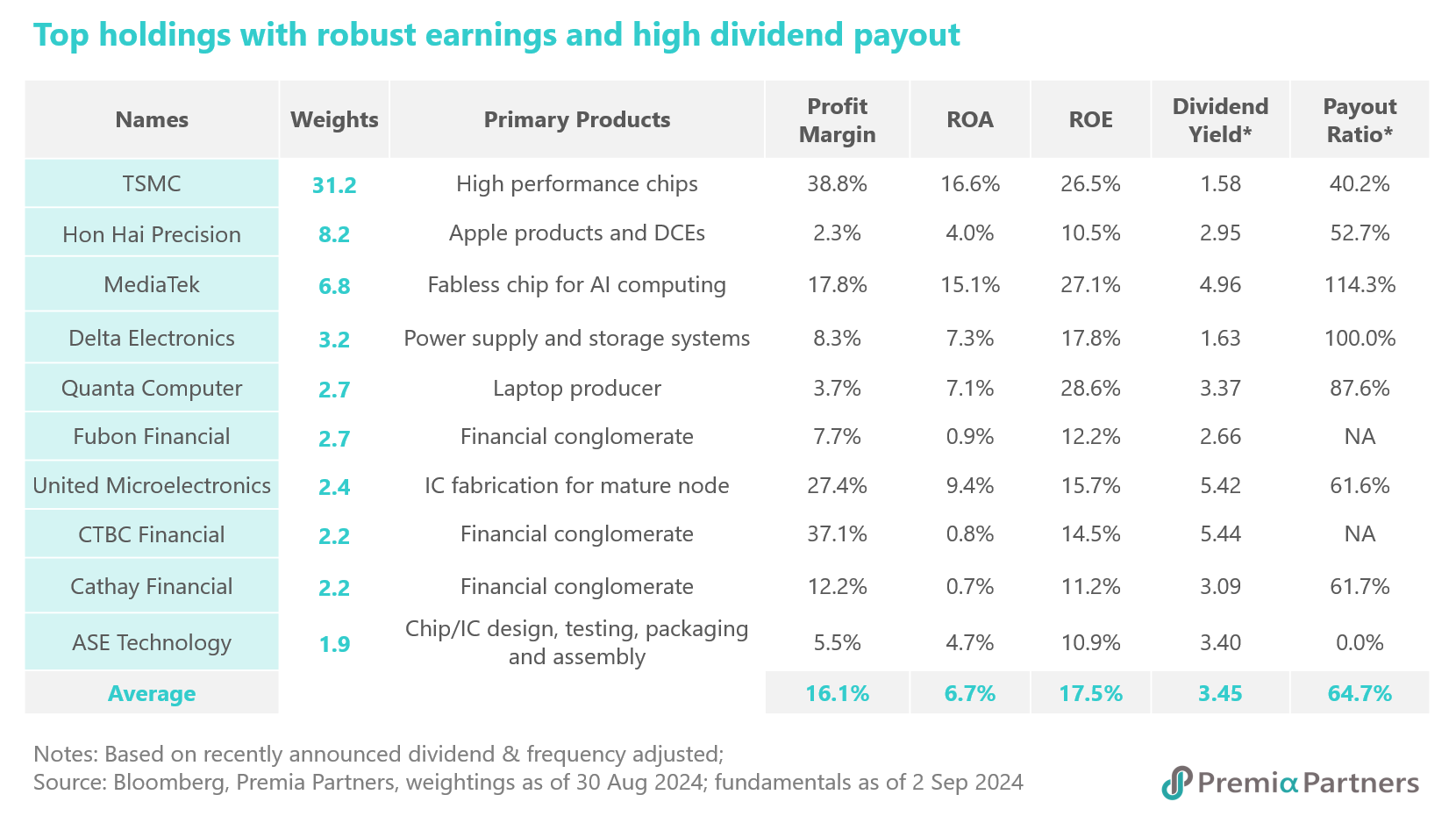

Sector-wise, information technology accounts for the majority of the portfolio with a weight of 69.6%, while financials have a significant exposure with a weight of 19.2%. Materials, communication, consumer staples, industrials, consumer discretionary and energy take up the rest of the stakes. In addition to TSMC which is the company with largest market capitalization in Taiwan overtaking also global peers such as Intel and Samsung, and is the top holding of the portfolio capped at 30% of the single stock limit; Hon Hai Precision and MediaTek each accounts for high-single-digit weight, followed by about 2%-3% weight in the next seven largest stocks among the top 10 positions. Fundamentally, these key holdings show solid financial metrics and are reflective of the major drivers of the stock performance in Taiwan – at the portfolio level the basket exhibits 16.1% in profit margin, 6.7% in return on asset, 17.5% in return on equity, 3.45% in dividend yield, and 64.7% in dividend payout.

Highlights of some of the top holdings

TSMC: It’s the world’s largest semiconductor foundry with revenue three times bigger than the trailing number two Samsung Electronics. It dominates the high-end chips segment with a 90% market share in AI chips and 67% in advanced node foundry orders. TSMC is also a sole supplier of Apple and Nvidia for their advanced chips. It offers a unique and strong moat from massive R&D investments over the years, which is challenging for competitors to replicate given enormous CAPEX and years to build. Market sees the company as the major beneficiary of AI wave and semiconductor cycle bottoming out due to new demand from AI driven high performance computing and AI-equipped mobile devices.

UMC: It’s the first semiconductor foundry founded in Taiwan in 1980, focusing on mature, legacy chips that Taiwan currently has a 44% global market share, followed by China’s 31%. UMC is a global leader in OLED display driver used in smartphones with quality clients, such as MediaTek, Qualcomm, Intel, and Apple, etc. As a critical player in the mature node between 22nm and 65nm, UMC continues to enhance product offerings and maintains its differentiation from others by forming a strategic partnership with Intel on 14nm node. The stock also offers a high dividend yield of close to 5.5%, appealing to income-seeking investors in a rate-cutting environment. Its consistent management emphasis on profitability, cash flow stability and long-term agreements with customers.

Delta Electronics: It’s the global leader in power system solutions for EV charging systems, data centers, ICT infrastructure, PV inverter, industrial automation, smart buildings, and specialty property facilities. It’s close to 40% market share in global server power supply market. Goldman Sachs estimates Delta’s AI-related revenue could account for ~11% of its total revenue this year, potentially rising to 20% in 2025 to surpass the EV sector as the company’s primary growth engine. Delta Electronics is also one of the most recognized sustainability leaders from Asia for its contribution to climate change and water security. Its 63.8% subsidiary Delta Electronics Thailand is listed on Stock Exchange of Thailand.

Hon Hai Precision: It’s the largest contract manufacturer of consumer electronics in the world with around 40% market share and an annual revenue of close to USD 200 billion. The company is best known Apple supplier with 50% revenue contributed by iPhone, Macbook, and iPad. Analysts see it as one of the major beneficiaries in the upcoming AI-powered Apple product upgrade cycle. Its other main customers include Amazon, Huawei, Dell, Lenovo, HP, Asustek, Microsoft, and Alphabet, etc. Hon Hai Precision is also involved in the production of upstream components, such as electronic connectors, semiconductor packaging, and metal casings for smartphones through its listed majority-owned subsidiaries Foxconn Industrial Internet and FIH Mobile. The company has expanded into new growth segments, including EV, digital health, robotic, and AI data server.

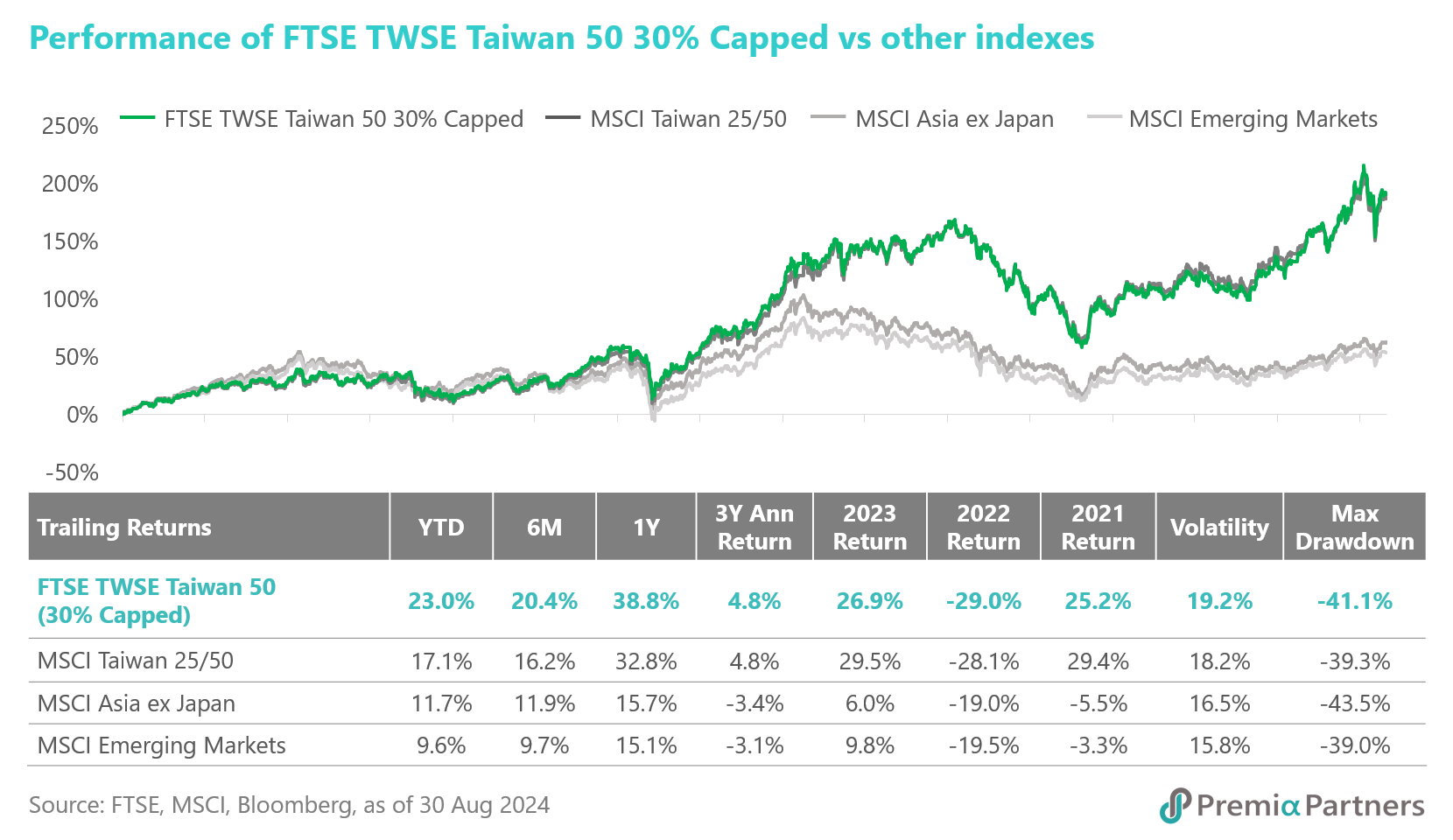

It's essential to evaluate the performance of the underlying index to assess its effectiveness in translating market fundamentals into investment returns. Since 2017, the FTSE TWSE Taiwan 50 30% Capped Index has delivered outstanding returns, significantly outperforming both regional index and overall emerging market benchmark. Notably, in the first eight months of this year, it surpassed MSCI Taiwan 25/50, MSCI Asia ex-Japan, and MSCI Emerging Markets by 5.9%, 11.3%, and 13.4% points, respectively, highlighting its consistent strength and reliability.

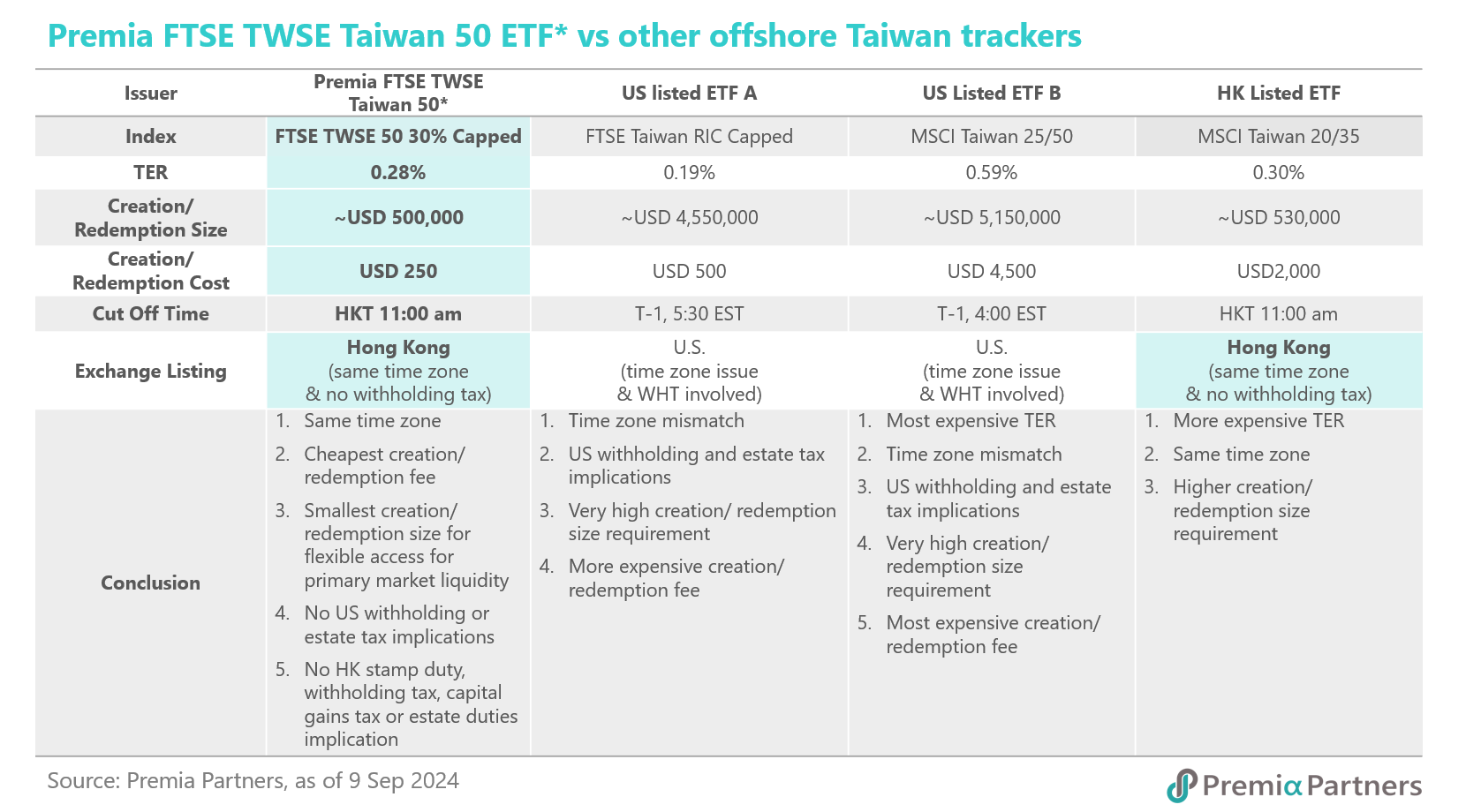

In addition to a stronger index track record, Premia FTSE TWSE Taiwan 50 ETF offers the best operational efficiency with institutional grade features. It trades in the same time zone as its underlying market, and thus allows investors to react to underlying market movements in a much more timely fashion, while also potentially minimizing tracking errors and premium/discount aberrations.

To facilitate primary market access by investors, we have also worked to keep the creation/ redemption the lowest in the market at only USD250 per trade, which is a fraction of the costs charged by other offshore listed Taiwan trackers. In addition, we also incorporated a small basket size of about USD 500,000, to provide investors with flexibility and low-cost access through primary market transactions. As the Premia ETF is listed on HKEX, unlike other US listed Taiwan ETFs, it is also not subject to US withholding or estate tax, and enjoys the benefit of Hong Kong as a tax efficient market – i.e. without stamp duty, capital gains tax or estate duties implications, making it an ideal one-ticker trade for allocators to capture opportunities in Taiwan, without being limited also to limited number of ADRs that often trade in premium.

As investors and allocators continue to position for relevant opportunities in the AI/ semiconductor supply chain, as well as reconfigure for optimal asset allocation for Asia ex-Japan, the Premia FTSE TWSE Taiwan 50 ETF would be a very handy and efficient tool for investors to implement ideas in a simple, one-ticker trade that is cost-efficient and in time zone.