Macro Developments and Factor Performance

In what was a decidedly volatile quarter for many asset classes, not least US stocks, Chinese shares’ relatively muted performance—declining by just under 1% in local currency terms—belies a number of significant developments on global macro and geopolitical fronts that we see as playing directly into key narratives unfolding for China’s economy and markets this year. Among those were a rather chaotic rollout of the Trump administration’s trade policy in the lead-up to and aftermath of America’s so-called “Liberation Day” on April 2nd, economists’ mounting concerns that the US could be heading for a recession, and continued investor anxiety over IT spending after China’s DeepSeek demonstrated the viability of lower-cost generative AI models earlier this year.

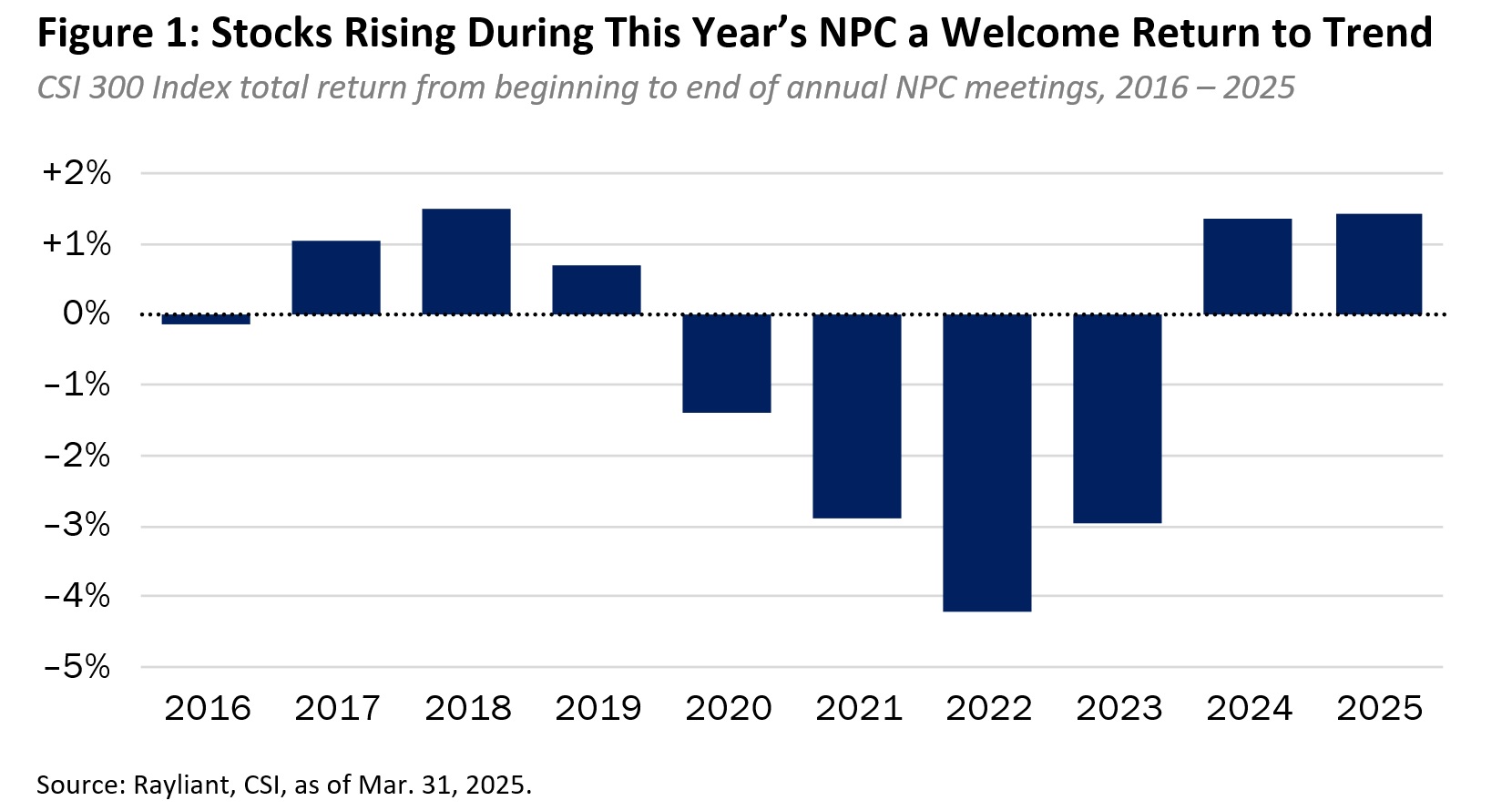

We’ll get to the implications of those developments, but let’s start by considering what was perhaps the most impactful item on the domestic calendar in Q1: the National People’s Congress (NPC), which took place in early March. Indeed, in last quarter’s commentary, we highlighted this annual “Two Sessions” meeting—at which official economic targets are set and new initiatives rolled out—as having the potential for some market-moving headlines. To be fair, the odds of Beijing dropping policy bombshells or firing the stimulus bazooka are always long in the case of highly choreographed political events like the NPC, and these meetings didn’t yield any earthshattering news. That said, we saw the content as definitively positive, and onshore investors seemed to agree, sending the CSI 300 Index up around 1.5% during the week over which the NPC took place, representing the best return to a Two Sessions gathering in the last seven years (see Figure 1, below).

Among positives coming out of the meetings, policymakers set some headline-grabbing targets, announcing a growth objective for 2025 GDP of “around 5%”, placing the general budget deficit for the year at 4%—a figure higher than the record 3.6% deficit established in response to the pandemic—and aiming for 2% inflation which, although it might not seem particularly ambitious, is a ten times higher than the 0.2% rise in China’s CPI for 2024. While enthusiasm for homegrown tech development was once again a major focus of officials’ talking points throughout the NPC, boosting domestic demand came in as the number one priority. While the Two Sessions strategizing was somewhat light on specifics and investors will certainly be looking for serious follow-through in the months ahead, measured fiscal stimulus enacted since last year already seems to be showing up in the data, including March retail sales, up 5.9% year-over-year versus a consensus 4.3% forecast, helped by home appliance trade-in programs. With stronger-than-expected first-quarter GDP growth of 5.4% in the bag and Q2 underway, China macro data have been full of positive surprises (see Figure 2, below), contrasting with a US economy that has begun to underperform much richer expectations.

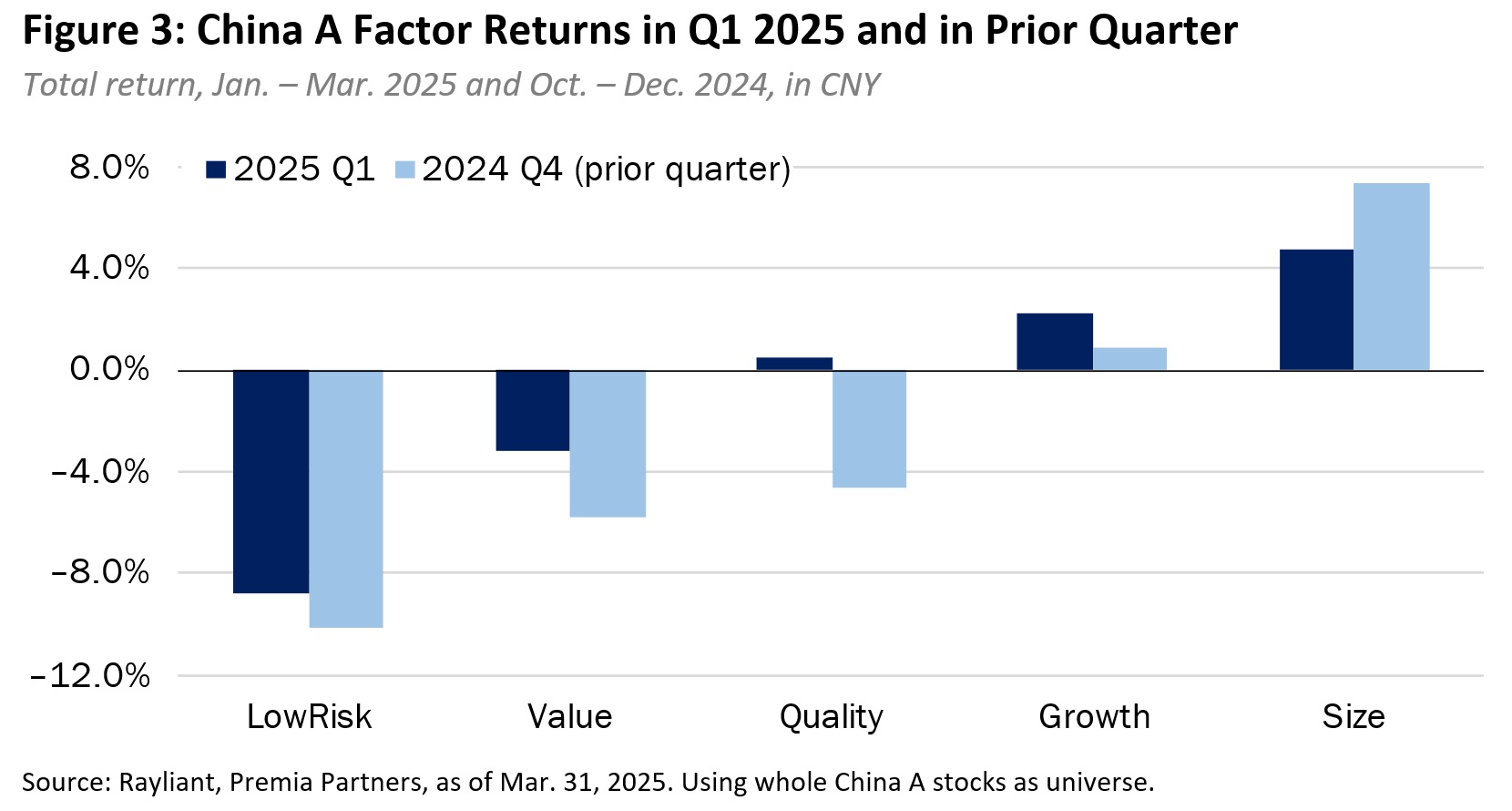

Factor exposures turned out to be a mixed bag in Q1, though they generally followed trends set last quarter, with ‘value’ stocks and those exhibiting lower volatility extending their losing streak, while growth stocks and small companies’ shares continued to outperform, and the broader set of stocks with solid fundamentals was essentially flat versus shares in lower-quality companies (see Figure 3, below). In part, factor returns over the last three months reflected the most prominent theme on the minds of onshore investors over that period, and one we just mentioned was reinforced at March’s NPC meetings: the potential for disruptive innovators in China’s domestic tech sector—stocks, one imagines, would not be found in a low-risk value portfolio!

That theme also helps to explain another strong quarter for the size factor, as China’s ‘little giants’—small and medium-sized enterprises in the tech manufacturing sector, thrust into the spotlight in response to the excitement over DeepSeek—found themselves singled out by policymakers at the NPC for support. Small stocks, we should note, are also favored by onshore retail investors, disproportionally benefiting from increased trading activity. Moreover, they have been increasingly targeted by China’s ‘National Team’ in recent rounds of state buying meant to support Chinese stocks in the face of shocks from Trump 2.0 tariff threats.

Index Performance and Outlook

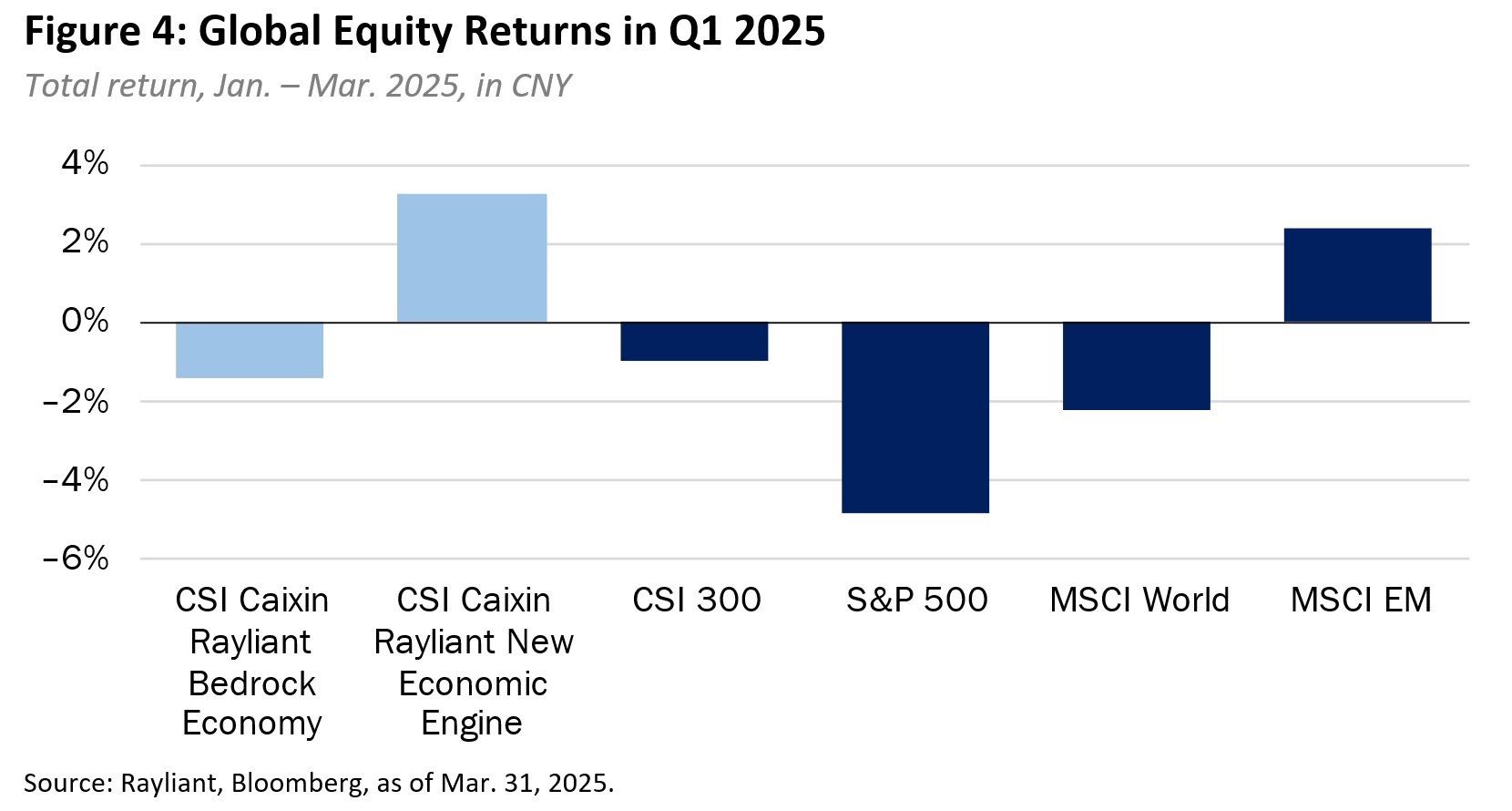

As mentioned, the experience of mainland Chinese stocks in the CSI 300 Index over the three months ending March 31st, 2025—declining by a modest 1.0% (CNY)—seemed tranquil relative to moves in equities across other global markets in the first quarter (see Figure 4, below). US stocks were among the weakest of major equity markets in Q1, with investors moving risk-off in response to the perceived stagflationary impact of Trump 2.0 tariff policies, DOGE layoffs and White House assaults on the Fed’s independence, along with continuing concerns over the sustainability of AI capex underpinning lofty tech valuations. Outside of the US, DM stocks performed better, with UK and European shares posting positive returns for the quarter, buoying the MSCI World Index, down only 2.2% (CNY) in Q1. The MSCI Emerging Markets Index added 2.4% (CNY) in Q1, though that number is a bit deceiving, being almost entirely driven by stellar performance among offshore Chinese tech shares; the MSCI Emerging Markets Ex China Index was off by 2.3% (CNY) for the quarter.

Weighed down by negative Value and Low Risk exposures, the CSI Caixin Rayliant Bedrock Economy Index (tracked by Premia’s 2803 HK/9803 HK ETFs) slightly underperformed the broader A shares market in Q1, declining by 1.4%, while the CSI Caixin Rayliant New Economic Engine Index (tracked by Premia’s 3173 HK/9173 HK ETFs) again managed to buck negative beta in onshore Chinese stocks, posting another strong gain in Q1, up 3.3%, boosted by its tilt toward outperforming high-quality Growth stocks. Both strategies continued to benefit from exposure to the Size factor in the first quarter. At the sector level, selection effects accounted for the vast majority of New Economy alpha in Q1, with strong stock picking among IT and Industrial Stocks—not surprising, given some of the themes discussed above—making the greatest contribution; only selections within the Materials and Consumer Discretionary sectors detracted from performance over this period. Within the Bedrock strategy, selection among Materials stocks was likewise challenging, as was an overweight to Energy, the CSI 300’s worst performing sector in Q1, with good stock picks among Financials and Consumer Discretionary shares helping to limit the strategy’s downside.

So far, we have not said too much about tariffs, though trade has arguably been the most riveting theme on investors’ minds so far this year: beginning with Trump’s first salvo hitting Canada, Mexico and China in early February, then continuing through a series of confusing ‘will he or won’t he’ fits and starts, before finally settling into what is felt like a game of chicken between Trump and Xi—with the US president’s behavior intermittently moderated by bursts of panic from Wall Street. While tariff uncertainty has undoubtedly been a principal contributor to the S&P 500’s weak performance over the last few months, we believe an understanding of Beijing’s response sheds some light on the past and future of some of those key factors underlying onshore China equity market performance.

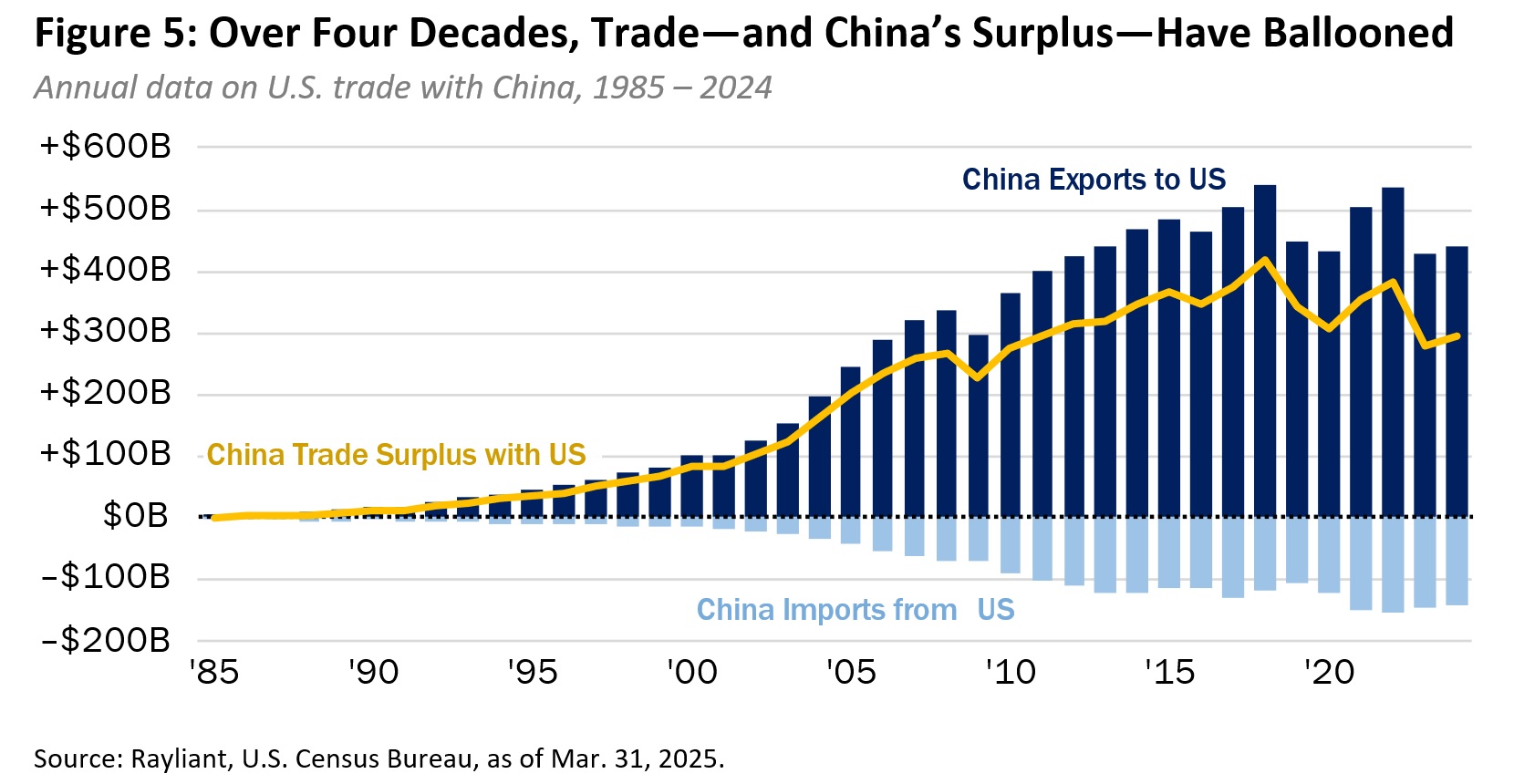

Motivating Trump’s attempt at rekindling a trade war with China that initially kicked off during his first term is what most would agree is a very lopsided trading relationship between the two nations (see Figure 5, below). Over the last forty years, China-U.S. trade has expanded dramatically, with American demand for Chinese goods persistently outstripping its exports to China by a wide margin, leading to a hefty surplus for China and an uncomfortably large trade deficit for the United States. In our view—one shared by the vast majority of economists—trade has been good: it has allowed American consumers to buy lots of stuff they want very cheaply, and has helped American companies boost profits by optimizing supply chains to cut costs. On the other hand, the deficit below is uncomfortably large and was growing at an unsustainable rate, so it is also easy to see why China has become a prime target for a politician with an agenda labeled “America First”.

Yet, it is not just Trump concerned with the big imbalance in the chart above: Recognizing that China has built out a manufacturing capacity which massively exceeds its domestic households’ ability to consume, Xi has been ardently pushing for “high-quality” sources of growth—e.g., tech innovation and high-value manufacturing—to put his economy on a more sustainable footing for the future. Naturally, a transition like that takes time, and although this year’s NPC was chock-full of references to elements of the plan, we imagine Beijing would be quite happy to continue expanding its economy through the usual channel, export growth, while those longer-term adjustments play out. By cutting off the exports-driven lifeline keeping China’s growth respectable in the meantime, US policymakers are motivating Beijing to accelerate these economic shifts. How? By subsidizing China’s high-tech industry and applying stimulus to kickstart domestic demand, making up for a shortfall in foreign tech coming in and manufactured goods going out.

In fact, while some foreign observers of the NPC were disappointed in another “around 5%” GDP growth target as insufficiently ambitious, as mentioned before, we saw it as an encouraging bogey for 2025. In part, that is because those base effects of recent years that made 5% year-over-year growth a soft target are long gone. But an even bigger factor is the pinch trade barriers will put on exports, which had been one of Beijing’s most reliable supports for GDP growth amidst weak domestic activity. Although we still believe Trump’s tariff threats are ultimately a means of getting China to the bargaining table, that will not happen overnight. To make up for lost time and avoid falling short of its official target this year, Beijing will likely need to ramp up the stimulus in 2025—and not just injections of liquidity on the monetary side, but the kind of fiscal support that will boost confidence on the part of households and businesses and get everyone spending.

Why haven’t policymakers already unleashed a larger stimulus package? Once again, we can probably chalk that up to the ongoing tariff drama. In last quarter’s commentary, we shared a graph of what was then record-high US trade policy uncertainty—and it has only gotten worse since we published that note—which has given Beijing a good reason to hold off on rolling out domestic policies to counteract America’s attack on trade. In some sense, Xi is waiting to see which cards Trump decides to play before committing to a strategy of his own. Along those lines, we expect that as Washington’s approach and likely endgame become clearer, Beijing will be more comfortable formalizing its response.

So, major policy support is, in our view, more a matter of timing and, given undemanding valuations for mainland Chinese stocks—even before tariff risk became top news—we believe it will be worth the wait for investors allocating near the heights of tariff fear. For investors seeking to capture a policy-driven rebound in onshore equities, the NPC offers some clues as to sectors worth considering. Without a doubt, Beijing is betting that investments in advanced technologies are the key to greater economic self-reliance and less susceptibility to US business cycles and policy shocks, setting up high-quality growth plays in the new economy strategy to benefit. Likewise, broader measures to boost consumer and business confidence and get China’s domestic economy really moving again, should serve as a shot in the arm to companies in the blue-chip bedrock portfolio. As volatile as stocks can be amidst periods of heightened macro and geopolitical stress, we expect investors who show patience now will be rewarded when the uncertainty inevitably resolves.

*****************************************************************************************************

Dr. Phillip Wool is the Global Head of Research of Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.