Macro Developments and Factor Performance

After three consecutive years of negative market performance, onshore Chinese stocks staged quite a comeback in 2024, finishing the year up over 18%. What drove the rally? Exactly what we have long suspected would stoke a strong rerating of Chinese equities, and a theme that will be familiar to regular readers of this commentary: policy stimulus. Beijing’s dual announcements in late September of a sweeping plan to enact monetary and fiscal support sent stocks in the CSI 300 up by 25% in the five trading sessions before China’s Golden Week festivities, negating fourteen months’ worth of losses in only a week’s time to close out Q3. Justiwhat investors were looking for to help make up for a long stretch of lackluster post-pandemic performance.

Unfortunately, though stocks leapt again coming out of the extended market holiday—rising nearly 6% on October 8th since the mainland exchanges closed at September’s end—the rest of Q4 turned out to be a letdown, with mainland stocks shedding around 2% over the final three months of the year. Given how emphatically Chinese stocks responded to policymakers’ calls for stimulus in September, it is understandable that a perceived lack of follow-through by Beijing through the remainder of the year prompted investors to reevaluate their enthusiasm coming into the fourth quarter.

Now, it is not as though there weren’t things to be positive about on the policy front post those dramatic announcements in Q3. In December, for example, we witnessed a Politburo in which the change in tone was palpable, with officials publicly acknowledging domestic demand weakness and elevating “boosting consumption” to a top priority. Days later, at the once-a-year Central Economic Work Conference (CEWC), policymakers announced a shift in the nation’s monetary stance since the last year’s meeting from “moderate” to “appropriately accommodative” and a change in China’s fiscal posture from “appropriately aggressive” to “more aggressive”. Sure, that language may not seem overly enthusiastic, but it is a big move, marking the first time Beijing has taken such a stance in either area of policy since the Global Financial Crisis.

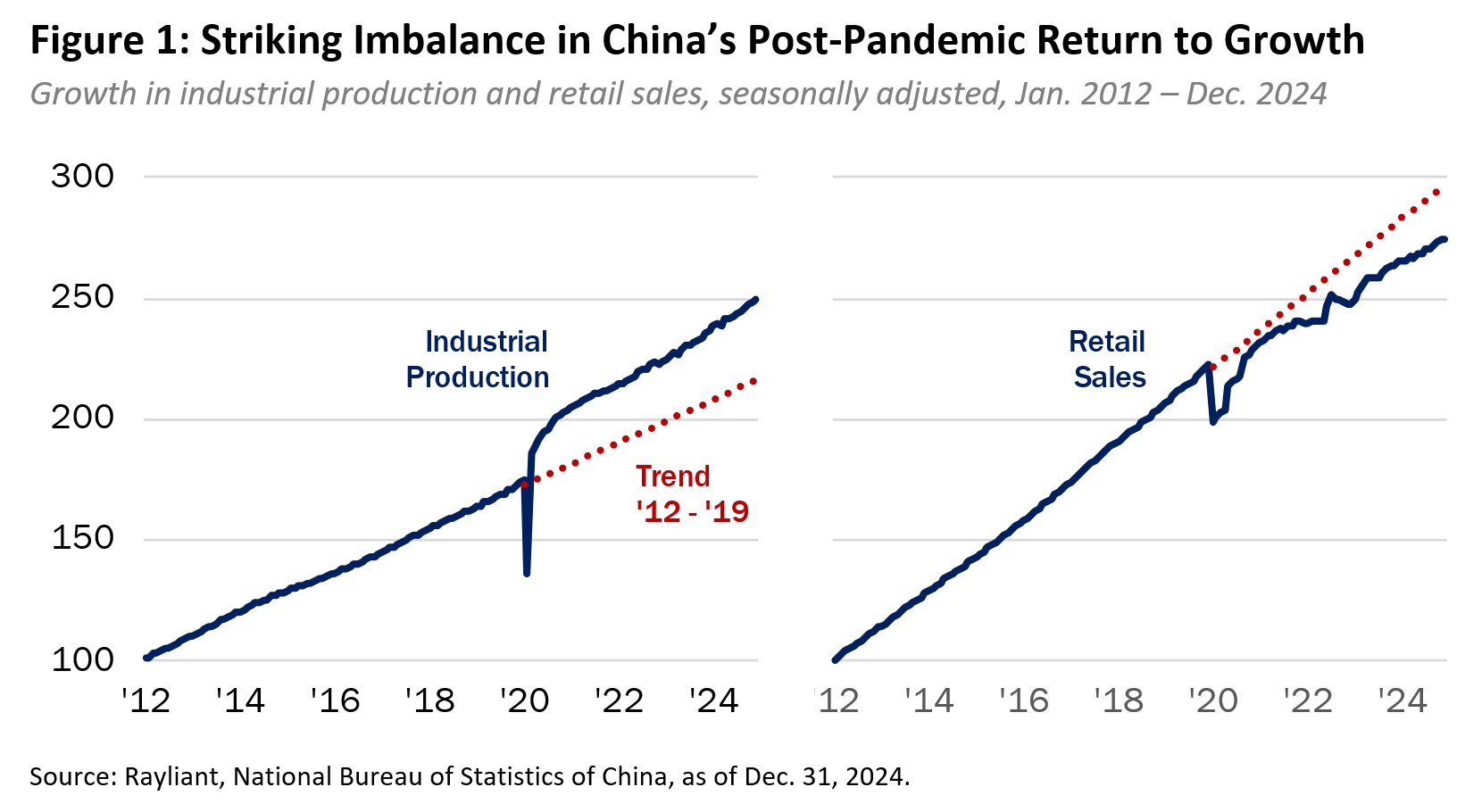

Like the Politburo session preceding it, last December’s CEWC also saw plenty of attention directed toward soft domestic demand, featured as the first major policy issue recognized at the meeting. Looking at China’s post-COVID growth, it is obvious that consumer confidence is precisely where the problem lies, with expansion of manufacturing—the principal beneficiary of major policy support, thus far—handily exceeding the past decade’s trend, as retail sales staggers far below its pre-pandemic growth path amidst a continued slump in household sentiment (see Figure 1, below). Though many investors felt renewed optimism at the end of September that Chinese authorities were on the verge of strong fiscal stimulus to address flagging consumer spending, in the absence of clear next steps for a forceful implementation, enthusiasm has since waned.

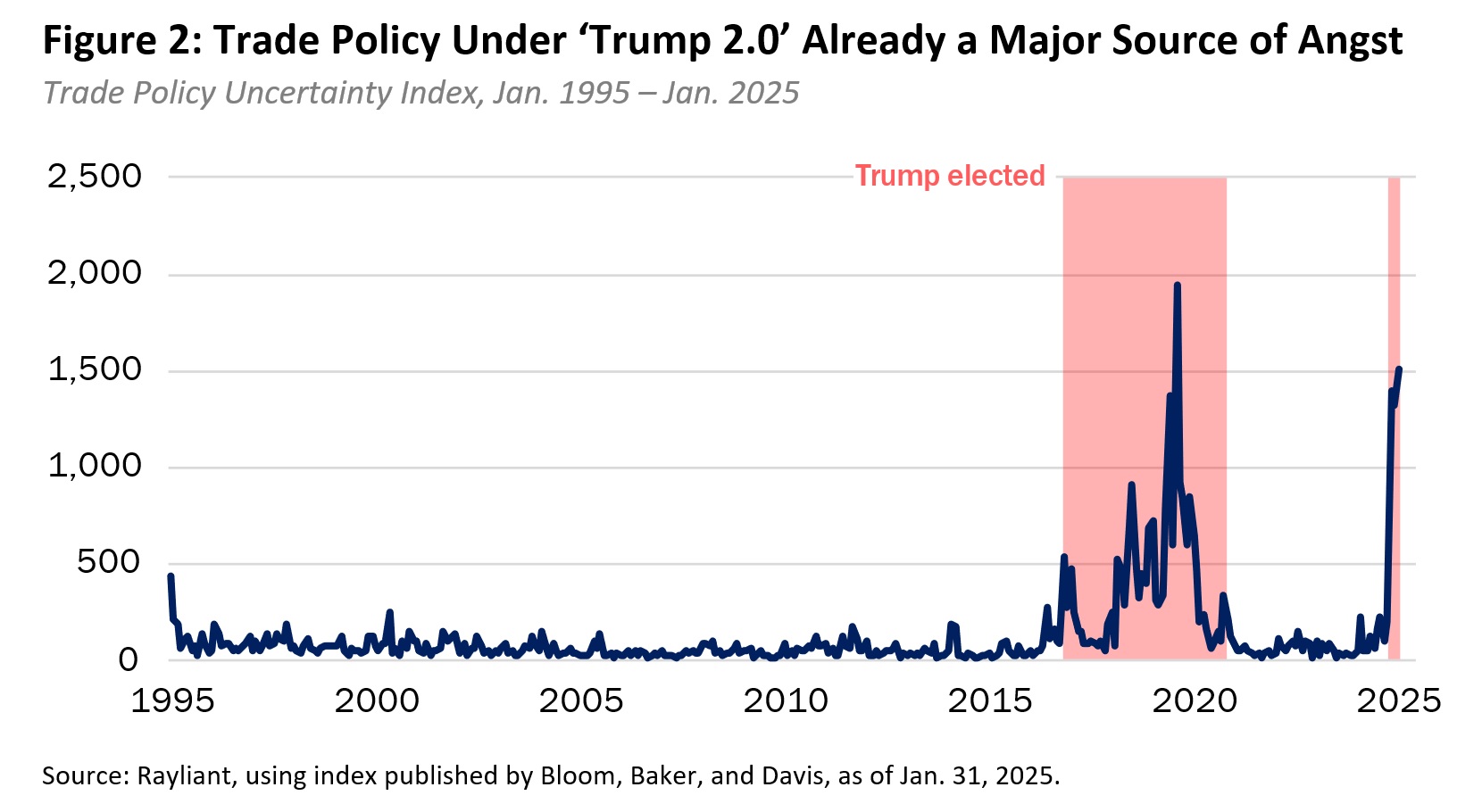

Looming large over the disappointing trend in the right panel above are anxieties over damage China’s real estate deleveraging campaign has done to properties—the principal store of Chinese households’ wealth—along with geopolitical uncertainty. US relations with China were not exactly cordial under Biden’s watch, but trade policy uncertainty has reached new heights with Trump’s reelection last November, according to measures based on news headlines, which show tariff fears as high as they were toward the end of the former president’s first term (see Figure 2, below). Those tariffs also bear on China’s uneven macroeconomic recovery, representing a clear threat to the one obvious bright spot in China’s economy of recent years: exports of factory output, depicted in the right panel of the previous plot. That vulnerability, apparent in data on new export orders from Caixin China PMI, falling in each of the last two months, highlight just how important it is that policymakers quickly rekindle domestic demand.

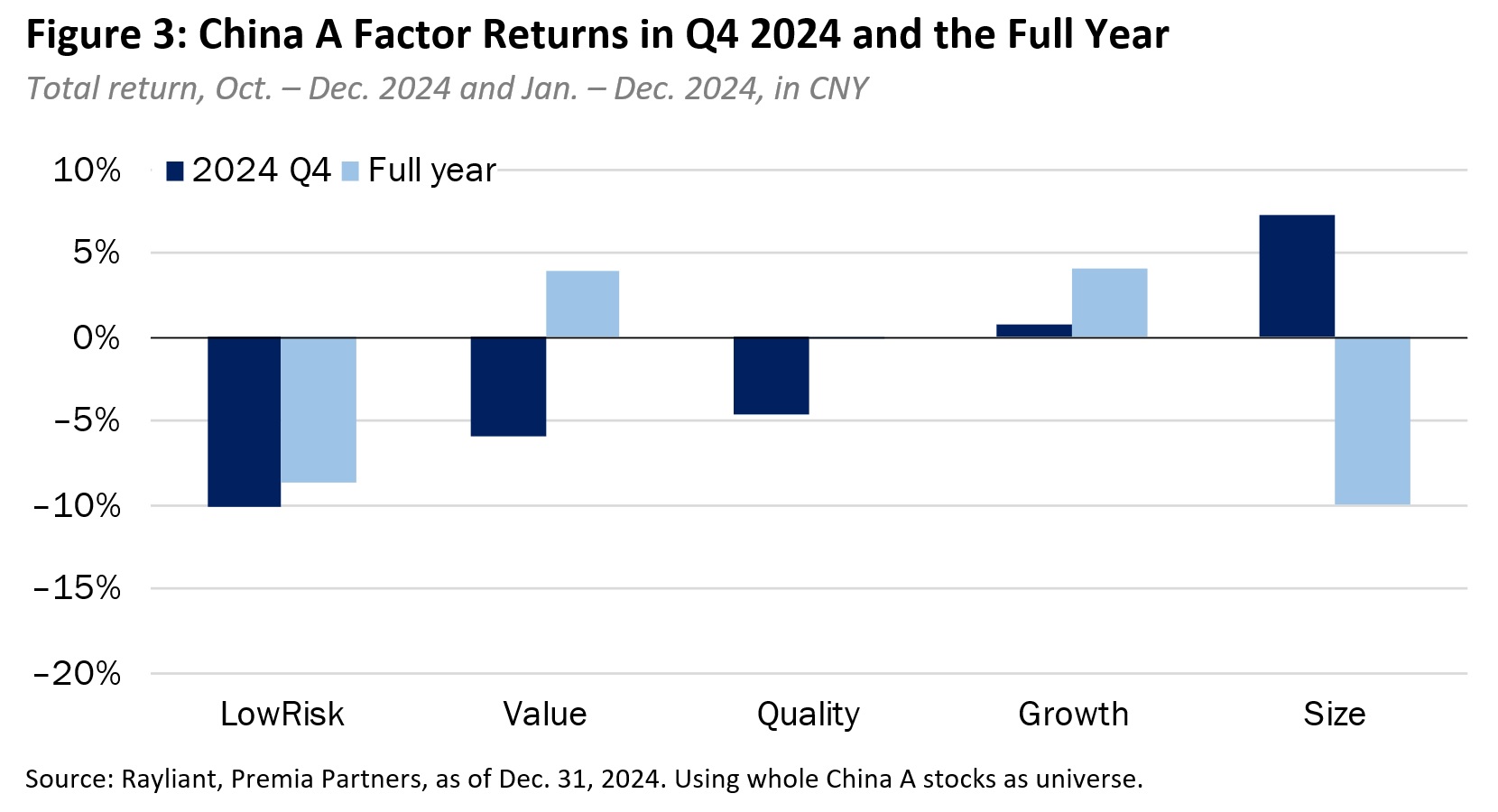

Shocks like those just described presented a challenge to many China A factor exposures in the fourth quarter, especially tilts toward lower-volatility stocks, those scoring well on valuation, and those with strong quality characteristics (see Figure 3, below). High-quality growth stocks were one exception, outperforming for the second month in a row amidst ongoing enthusiasm in Q4 for the technology theme. Size also outperformed through the last few months of 2024, largely benefiting from a surge in retail trading activity in the wake of September’s policy blitz, with individual investors staying true to form and bidding up prices in smaller names, even as sentiment toward the broader market gradually cooled going into year-end. Even so, the last six months’ rally in small caps was not enough to salvage a disappointing first half for the size factor, while value and quality growth exposures—something of an odd pair—ultimately turned out to be the only broad factor exposures in the black for the full year.

Index Performance and Outlook

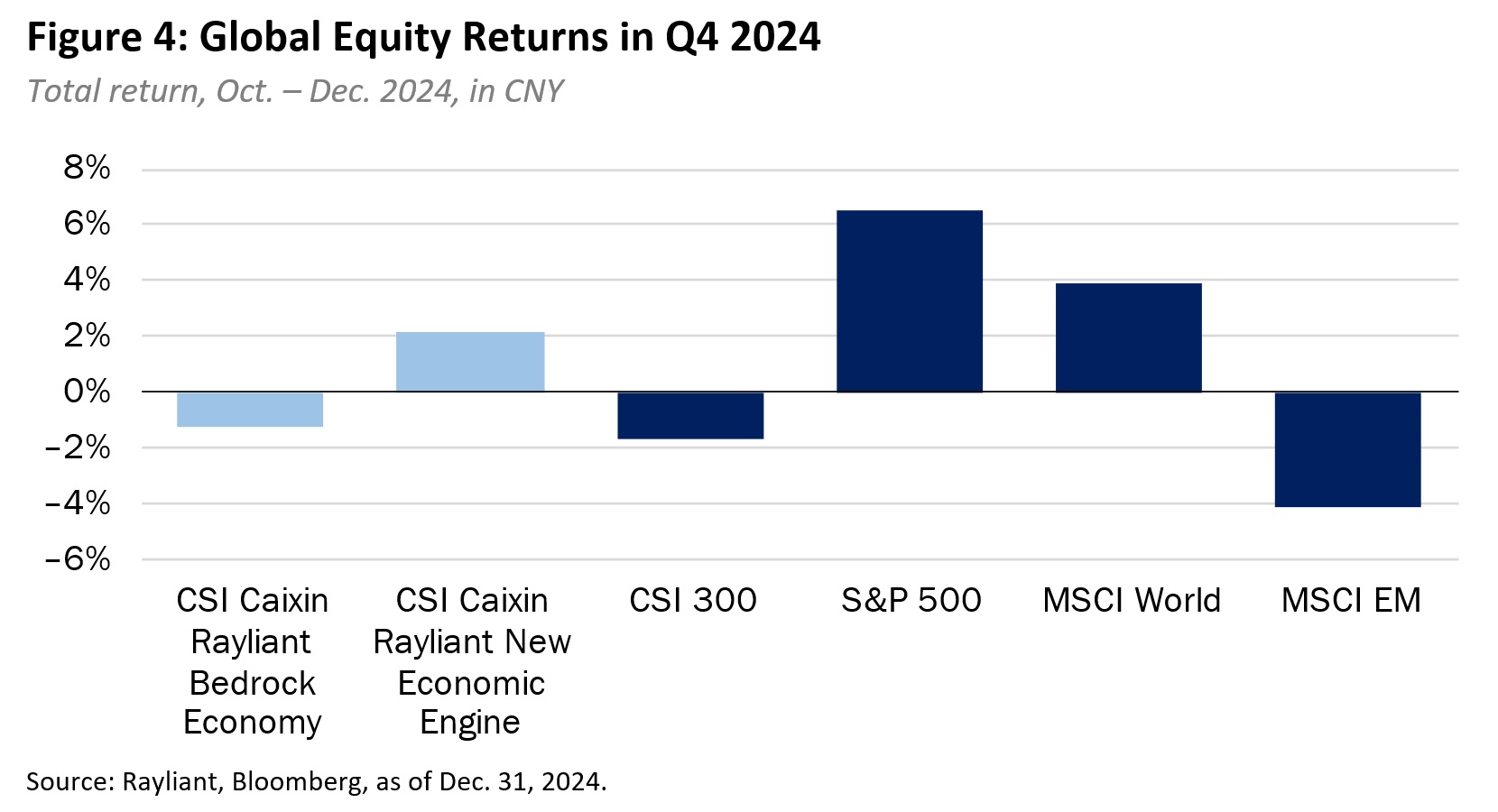

While Chinese stocks retreated a bit last quarter, with the CSI 300 Index declining by 1.7% (CNY) over the three months ending December 31st, 2024, US shares in the S&P 500 Index continued a remarkable winning streak, closing out Q4 with a 6.5% return (CNY) and a gain of 28.5% (CNY) for the full year (see Figure 4, below). Following its first rate cut of the cycle in September, the Fed made two addition quarter-point reductions in its benchmark rate at its November and December meetings, though the US central bank’s tone toward the pace of future easing turned a bit more hawkish by year-end. It turned out to be Republicans’ “red wave” victory in November that fanned risk-on sentiment in Q4, as investors anticipated impending tax cuts and deregulation to be tailwinds for an already strong US economy. News of Trump’s reelection was not as kind to international stocks, with equities in the MSCI World ex-USA and MSCI Emerging Markets indices falling by 3.7% (CNY) and 4.1% (CNY), respectively, on concerns that another of Trump’s campaign promises, crippling tariffs on some of America’s biggest trading partners, would soon jolt supply chains as they had in his first term.

Noting that Low Risk, Value and Quality exposures all suffered in the fourth quarter, it was little surprise that the CSI Caixin Rayliant Bedrock Economy Index (tracked by Premia’s 2803 HK/9803 HK ETFs) exhibited negative performance—albeit posting a smaller loss than the broader market, declining by 1.2% over the last three months, helped in part by the portfolio’s tilt toward the outperforming Size factor. The CSI Caixin Rayliant New Economic Engine Index (tracked by Premia’s 3173 HK/9173 HK ETFs) likewise benefited from a tilt toward small-cap stocks, but also saw a contribution from the Growth factor, solidly outperforming the CSI 300 Index with a gain of 2.2% for the quarter. At the sector level, action in the technology sector turned out to be the primary source of alpha for the New Economy strategy, with an overweight to IT stocks and strong selection within the sector marking the two greatest contributors to outperformance, alongside good stock picks among Industrials. An underweight to IT was conversely the biggest sector-level headwind to the Bedrock strategy, though an overweight to Financials, an underweight to Consumer Staples, and strong selection within the Materials sector more than made up for it.

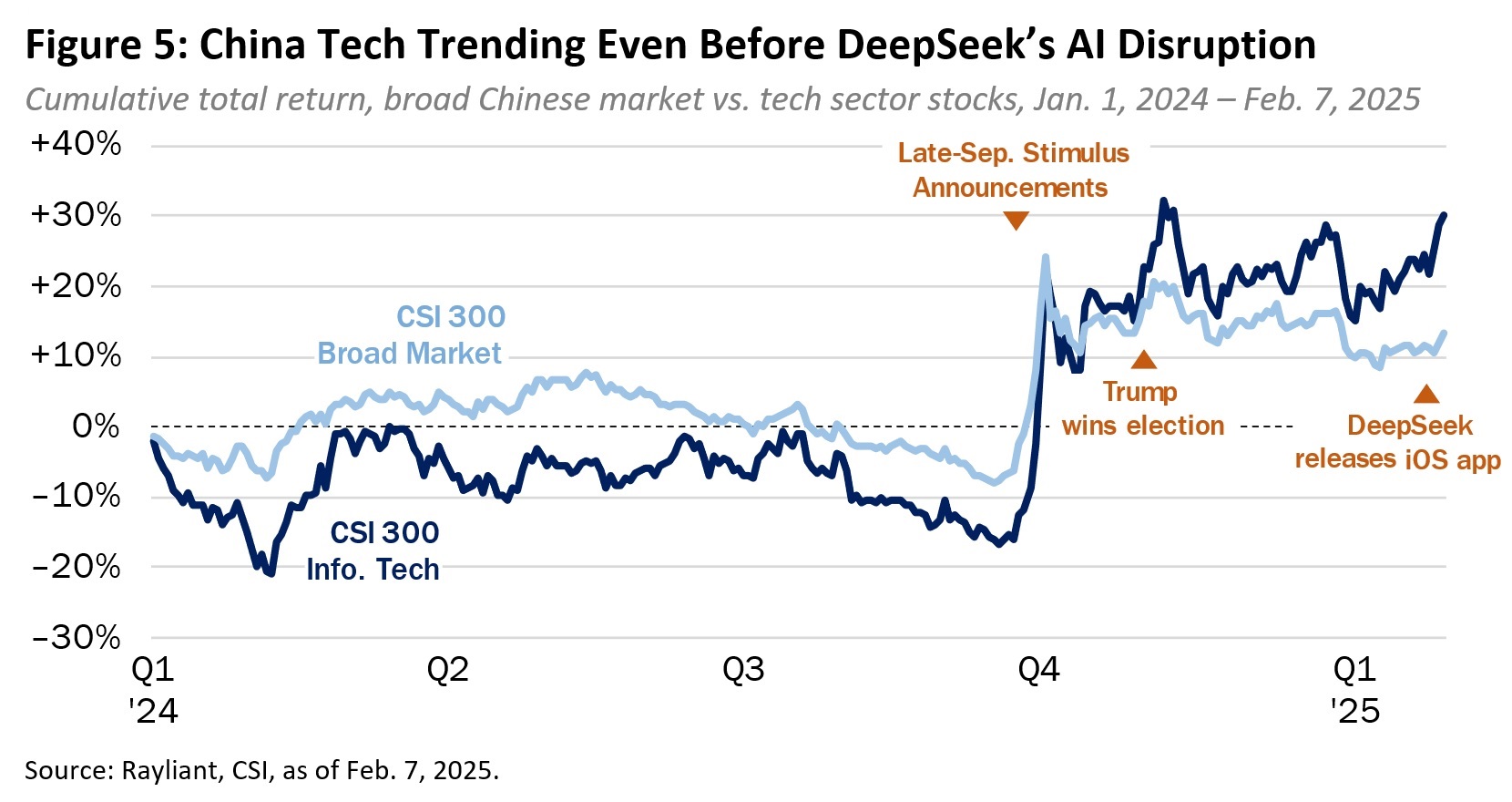

In fact, technology has remained a focus for investors in China and a source of outperformance entering the new year, as any one of the millions of users who downloaded Chinese developer’s DeepSeek AI Assistant app in late January would know (see Figure 5, below). The product of a mainland tech startup launched in 2023 by Liang Wenfeng, co-founder of the China-based high-frequency quant shop High-Flyer, DeepSeek is a generative AI model trained on older Nvidia chips Wenfeng hoarded before US sanctions went into place, based on a series of breakthroughs that reportedly allowed the group to train its model for roughly $6 million: a tiny fraction of the costs incurred by first-movers like OpenAI. Despite valid questions as to just how low the training costs were—and how much DeepSeek’s development leaned on ChatGPT and other earlier advances in the space—the disruption showcases both the vibrance of innovation within China’s tech industry, and the ability of those firms to gradually overcome the hurdle of America’s policy of technological containment.

Going forward, we expect China to continue delivering high-tech surprises, not least because policymakers, recognizing the existential risk of a US-imposed technological isolation, have been relentlessly promoting innovation-driven quality manufacturing in areas like semiconductors and AI—something explicitly cited as another key policy issue during last December’s CEWC. We naturally expect policy support amongst industries ranging from EV and solar to chips, industrial automation, and pharmaceuticals, not to mention a focus on quality, to benefit sector and factor tilts inherent in both the New Economy and Bedrock portfolios.

Truth be told, we also found the fascinating story behind DeepSeek—a homegrown China tech success story—was a very welcome departure from what we see as an overly gloomy narrative when it comes to the China growth space. Take the prospect of US tariffs, for example, one of the most recent sources of negative sentiment toward stocks in China (and across the emerging markets, for that matter). We have long believed the Trump administration will use trade threats largely as a bargaining tool, with the ‘bark’ being significantly worse than the ’bite’ when all is said and done. That view was borne out in early February, when a campaign promise of 60% levies on Chinese goods was dialed down to a mere 10% additional duty.

Though that is not likely to be the final word on US-China trade, we should also note that circumstances are very different today than they were in 2018. Not only have supply chain adjustments reduced the percentage of China’s direct exports to the US from 20% back then to around 15% today, China’s currency is substantially weaker and its stock market significantly cheaper, with traders who suffered through tariff-induced volatility in Trump’s first term having already baked in quite a lot of pessimism entering the second. Some will also remember that the initial A shares sell-off resulting from the 2018 trade war gave way to a sharp rebound in Chinese shares the following year.

In addition to creating what in our view is still an extremely compelling entry point for contrarian value and bargain-seeking growth investors, another upshot of overly negative sentiment is that there is plenty of money on the sidelines, waiting to plow back into Chinese stocks to chase performance and contribute to a rally when the tide turns. Indeed, that seems to be the case onshore, where a 500-billion yuan swap facility created by the People’s Bank of China last October to underwrite institutional investors’ purchases of Chinese stocks had only been utilized to the tune of 50 billion yuan by year-end. Data from Goldman Sachs showed that while foreign hedge funds had dipped in and out of Chinese stocks amidst the excitement going into Q4, offshore long-only fund managers had largely not ventured in at all.

What are some things that might catalyze a revaluation and broader rush into Chinese equities? Certainly, any upside surprises in terms of US policy toward China could be a gamechanger, and Trump’s inviting Xi Jinping to his inauguration seems to suggest we ought not rule it out! More probable, though, is a stabilization of the property market in the year ahead, which seems to us more likely than not, creating a positive wealth effect that boosts domestic confidence: good for consumer spending, as well as driving more onshore investors into the market. We remain convinced that decisive fiscal policy support is a matter of ‘when’ rather than ‘if’—perhaps at the National People’s Congress (NPC)in March—and we expect that push to disproportionately benefit mainland-listed stocks, as well as shares in strategic areas mentioned before: those in the Bedrock index, driving China’s real economy, as well as engines of innovation that make up the New Economy portfolio.

*****************************************************************************************************

Dr. Phillip Wool is the Global Head of Research of Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.