- What are the consensus return expectations for China A this year? Why?

The consensus aggregated 12-month target price for A-Share has been in an uptrend since the end of 2022, indicating a potential return of more than 20%, according to Bloomberg. The 12-month forward EPS was also revised upwards during the same period, mainly due to the end of the COVID zero policy and the China reopening. As the National People’s Congress concluded and the top government officials unveiled, more supportive economic measures would roll out to achieve the 5% growth target. We expect the target price and the EPS will continue to be revised upwards by analysts. Investors may pay attention to the reform/revaluation of the SOEs, as well as the technology sector, such as the semiconductor and the new energy, that is urged by President XI to achieve self-reliance.

- Where are we in China’s reopening recovery trajectory?

We are at the initial stage of the recovery trajectory as the official reopening only began in early December. Due to the significant COVID spreading right after the removal of social distancing and the Lunar New Year effect, China has just resumed economic activities gradually since February. That said, all macro indicators have shown encouraging signs, with PMI reaching 52.6, retail sales bouncing back from negative to 3.5% YoY, total social financing growth accelerating to 9.9% YoY, and even property sales seeing its first positive YoY change in 21 months. Most of the economists have been revising their forecasts for China’s GDP growth this year, lifting the consensus estimate from 4.8% in late last year to the current 5.3%. The newly elected leadership team in charge of the economic development has emphasized the government’s priority in promoting economic growth. On a positive note, analysts see the moves to keep central bank Governor Yi Gang, Finance Minister Liu Kun and Commerce Minister Wang Wentao in place were pragmatic ones that should boost investor confidence at a time of uncertainty, given the suggestion of policy consistency.

- Why hasn’t the revenge consumption happened yet?

This is by far the most frequently raised topic probably. Since the news of the abrupt pivot away from COVID zero policy, investors have been waiting for revenge consumption to happen overnight. And still waiting. What are stalling consumers from spending? First of all, it was timing. Having recovered from the massive COVID waves in Dec/ Jan since the reopening, and then the Lunar New Year holiday in Feb, China's consumers have already started spending actually, though initially more towards services and experiential items. In fact, the recently released Year to Feb retail sales figures indicate a stronger YoY recovery of 3.5%, suggesting a stable start to the year. For big ticket items and overall recovery of consumption volumes, the slower pace of recovery can be attributed to several factors.

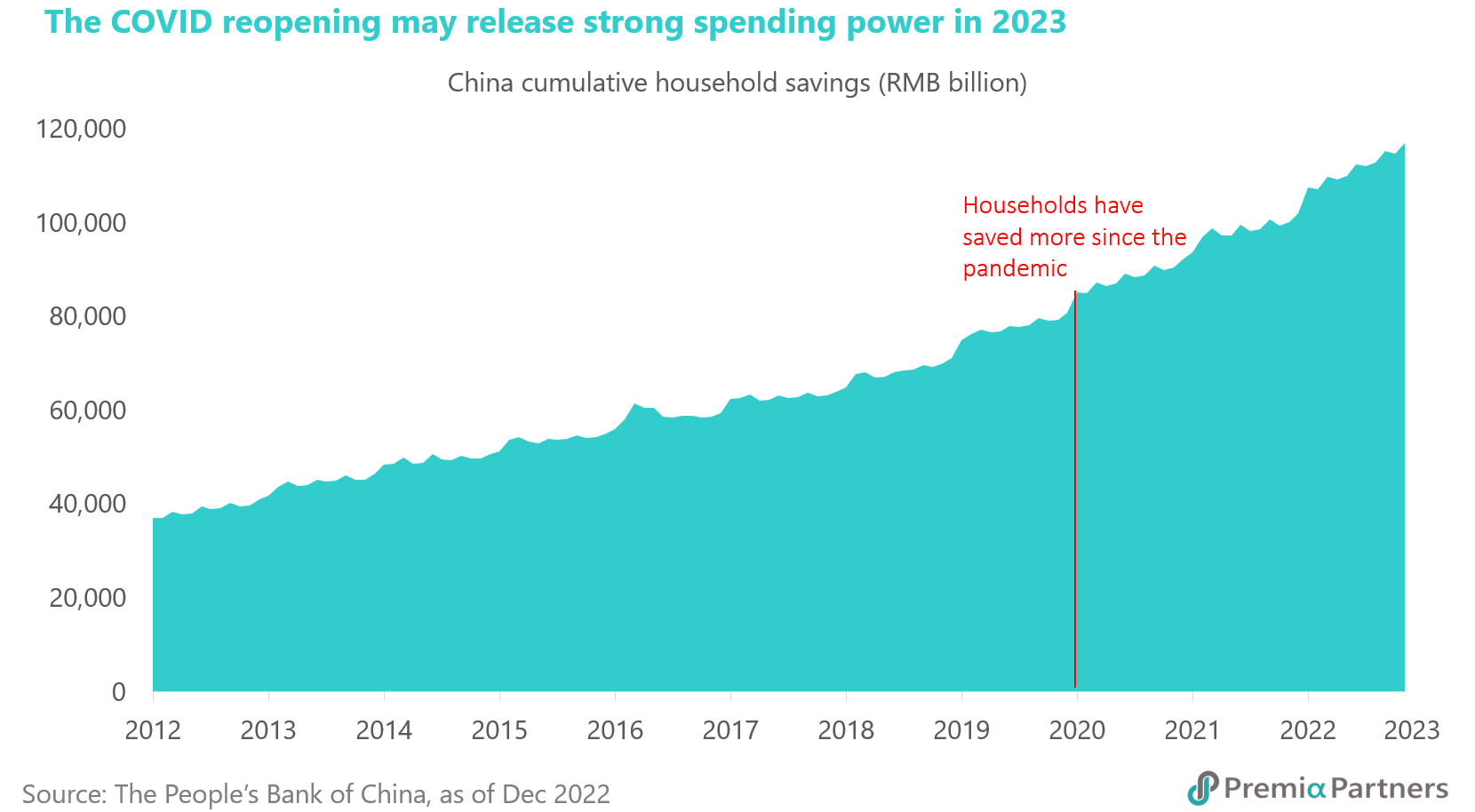

- Culturally Chinese tend to be savers and more cautious spenders, and consumption is taking a longer recovery trajectory as most people are still in the mode of saving for rainy days (storing grains in case of famine 积谷防饥) at the initial stage of reopening. Chinese households amassed over US$2.6 trillion savings in 2022 according to China’s National Bureau of Statistics. Restoration of consumer confidence likely would trail restoration of business confidence and signals of economic recovery.

- Wealth effect from property market The deteriorating real estate sector other than dampening business confidence, has also significantly reduced psychological wealth for consumers as it typically is the biggest ticket asset for most households. That said, the Chinese government has introduced extensive funding programs to stabilize the property market. As a result, 55 out of 70 cities saw month-to-month increases in home prices in February, higher than the 36 observed in January.

- Government stimulus just started. Unlike some countries, the Chinese government did not release massive helicopter money or relief subsidy during the pandemic. It was only until recently that the government started to ramp up more efforts to booster consumption via local government vouchers and launched a national consumption campaign in March to booster demand for discretionary categories such as automobiles and home appliances.

- There has definitely been significant change in consumer behaviours in China as People are also observed to be prioritizing travel/ experiential spends than luxury good spends, and increasing focus on value-for-money spending. In addition, there has also been a shift towards domestic brands, rational consumption (理智消费), and the pursuit of lifestyle experiences over the past few years especially among young consumers. Consumers are doing less impulsive spending and in general are more conscious to spend more rationally and more keen for bargains/ good deals going forward (thus while JD/ Tmall remain the leaders, Pinduoduo and livestream shopping players like Douyin, gained significant popularity given their social e-commerce, bargain hunt features, and similarly Adidas is losing favour to Nike or Fila for design and Anta and other local brands on quality and value).

- Even luxury consumers have changed. Research conducted by Oliver Wyman showed 70% of China's luxury consumers used local sales assistants to facilitate purchases while 40% communicate with the sales staff at least once per week ("When I would go to Paris, I couldn't ask the Paris sales people to keep a bag for me, but now here we can”). In fact, global luxury brands have been heavily investing in enhancing shopping experience in China in the last few years, responding to changing consumer behaviours in China and increasing trend of international localism. Daxue Consulting analyst expects that in the long run “domestic luxury consumption will account for 70% of the Chinese luxury consumers’ spending, and a mere 30% from abroad” (versus 70% pre-pandemic) . In 2021, Hainan alone accounted for 13% of China's domestic luxury spend, versus 6% pre-pandemic, and tax regulations are set to continue to loosen - as only 13% of Chinese citizens have a passport, a tax-free domestic destination is enormously attractive for many more Chinese consumers.

So rather than V-shaped revenue spending, we believe consumption recovery this time will be steady and become more visible towards Q2 through the year, as economic recovery gains pace.

Source: What to expect from Chinese consumers in 2023 and beyond, Oliver Wyman report, Jan 2023

- Culturally Chinese tend to be savers and more cautious spenders, and consumption is taking a longer recovery trajectory as most people are still in the mode of saving for rainy days (storing grains in case of famine 积谷防饥) at the initial stage of reopening. Chinese households amassed over US$2.6 trillion savings in 2022 according to China’s National Bureau of Statistics. Restoration of consumer confidence likely would trail restoration of business confidence and signals of economic recovery.

- Why hasn’t the property sales recovery happened yet? Is the worst for housing market behind us?

The residential property sector has exhibited a strong bounce back, growing by 3.5% YoY YTD, following a decline of 28.3% in Dec. This confirms that the real estate market is gradually recovering, with early signs of improvement in house prices observed in major cities. However, weak mortgage lending volumes in Feb suggest that the sector still has a long way to go. While property transactions appear to be stabilizing, and the worst appeared to be behind us, the sector continues to face various challenges that could delay sales. 1. Confidence for housing price appreciation. This is a critical factor in driving more immediate property sales, as people are still trying to decipher how property as an asset class would fare especially in the context of the top-down position that “houses are for living in and not speculating with”. Despite the potential for significant demand generated during China's ongoing urbanization process (~65.2% in 2022), housing price growth may not be as rosy as it was in the past. 2. Credibility of developers in delivering projects as many of them are still struggling with fundraising and bond repayment schedules. Consequently, people are more concerned about the progress of construction and unfinished properties. This has led to an apparent divergence between quality and distressed developers, with only the former able to raise funds from multiple channels and guarantee construction and delivery. Fortunately, China's "high-quality development path in 2023" emphasized in the Two Sessions offers continued support to high-quality developers. In addition to relaxing the "three red lines" policy to provide more opportunities for developers to upgrade their business models, the government also introduced the private equity fund scheme in February, providing additional funding channels for developers for projects. Developers with focus on sustainable growth models with digitalization, ESG and smart city/ intelligent ecosystem elements are said to be more likely to receive funding and access land resources.

- Is inflation a concern? Would the PBOC turn hawkish like its western peers?

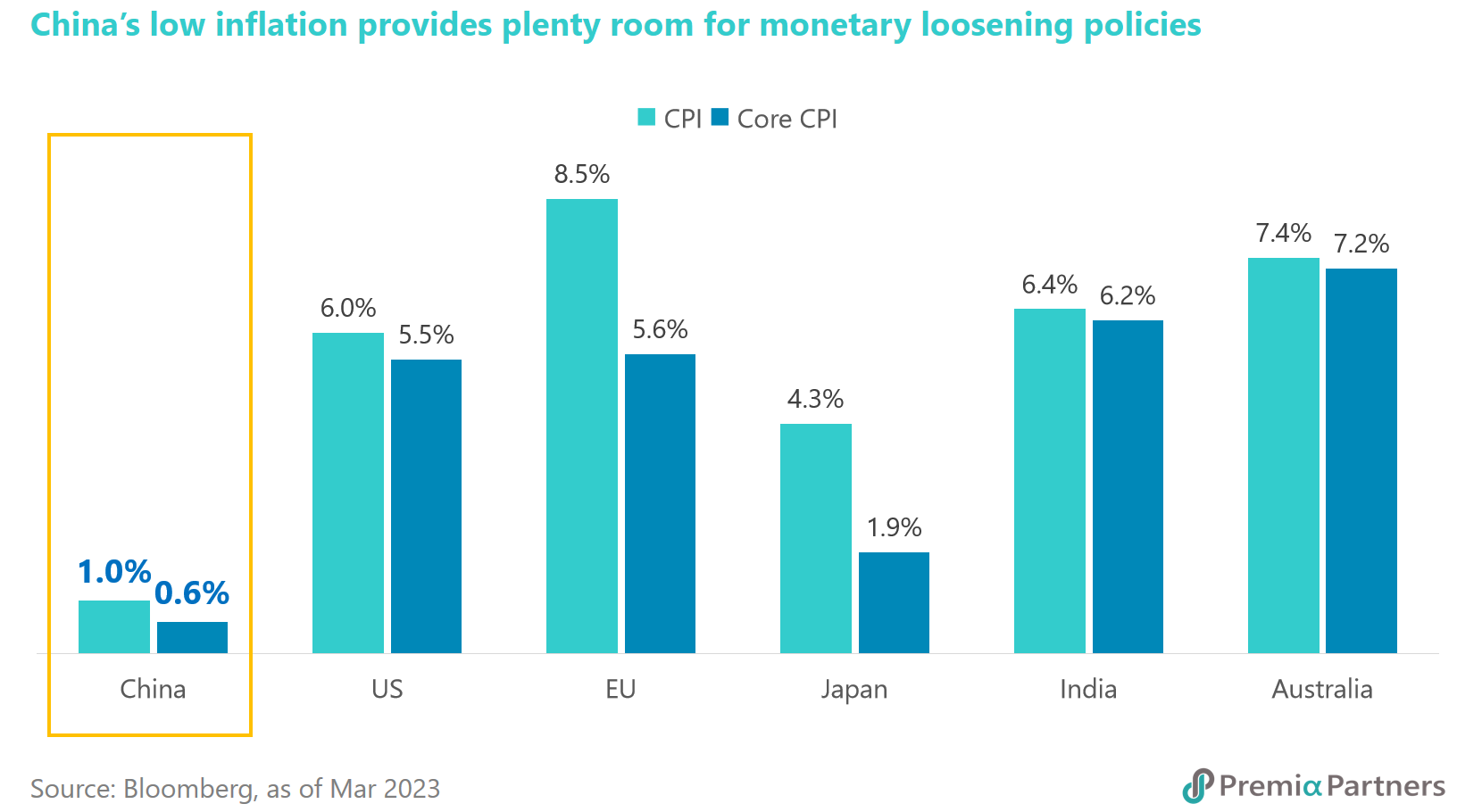

On pricing pressure, the economic recovery may lift the onshore inflation, but China will not suffer from the high pressure as seen in other economies due to (1) no structural wage increases as labour market is not tight at all, (2) global commodity price is on a downtrend without any more COVID-related logistics/production hiccups, and (3) weakening demand from developed economies on recession threats. The latest CPI and core CPI are standing at 1% YoY and 0.6% YoY respectively, confirming inflation should not be a concern in near-term. Economists are seeing no chance for the PBOC to make any rate hikes for China this year. Instead, there is a probability for an interest rate cut in coming months to support the economy if needed.

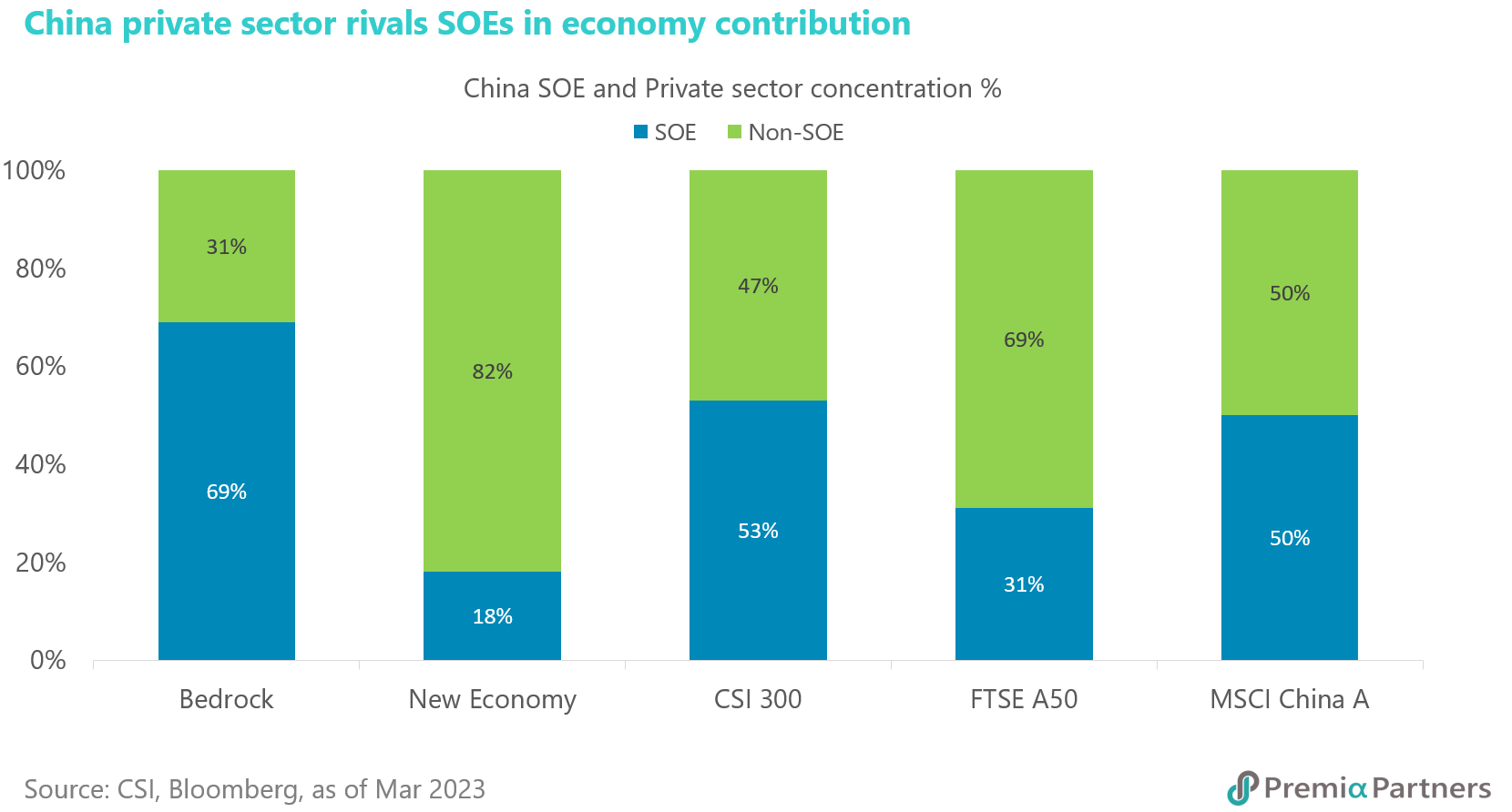

- Is the government supporting only SOEs going forward? Or new Premier Li Qiang’s pro-growth stance for private sector at the recent press conference for real?

China new Premier Li Qiang reaffirmed in his debut the government's unwavering commitment to promoting equal rights for both private enterprises and SOEs, with particular emphasis on supporting small and micro-sized businesses. Economists anticipate that under Premier Li's leadership, and given his successful track record in supporting private businesses, China will achieve its 5% growth target this year. In alignment with Premier Li's directives, PBOC announced its facilitation of bond financing for private companies on Mar 15 and several local government released support for tech innovation in the private sector. Notably, China has been gradually reducing the tax and fee burden on enterprises, with a total reduction of 4 trillion yuan in 2022. Given that the private sector contributes more than 50% of the country's tax revenue, 60% to national GDP, 70% to innovation, 80% to urban employment, and over 90% to total registered entities, the private sector's contribution is indispensable in achieving balanced economic recovery in China.

- Can export still be a growth driver for China?

China will remain as one of the world’s leading manufacturing bases, with exports continuing to be a growth driver. Although the market has been suggesting that some multinational companies are planning to move their production lines out from China, the country’s competitive edge remains solid over its peers. China has spent the past few decades building a scalable ecosystem involving modern infrastructure, an efficient regulatory environment, and supportive central and local governments. It may probably take equivalent if not longer time to set it up in other countries. The higher operating costs and the structural change in the economy has been pushing Chinese exports to higher valued added categories, as well as fast tracking industrial automation in China in unprecedented speed – and this also significantly enhances China’s competitive advantages in scalability, total cost management and enterprise digitalization. For example, China overtook Germany as the world’s second largest auto exporter last year, lagging only Japan. Developed markets such as Belgium, Australia and the UK were among the top ten destination of cars made in China. The major contribution for the jump came from the innovative and value-for-money electric vehicles, an illustration on how Chinese exports have been evolving over time.

- What are new energy and green tech opportunities in China?

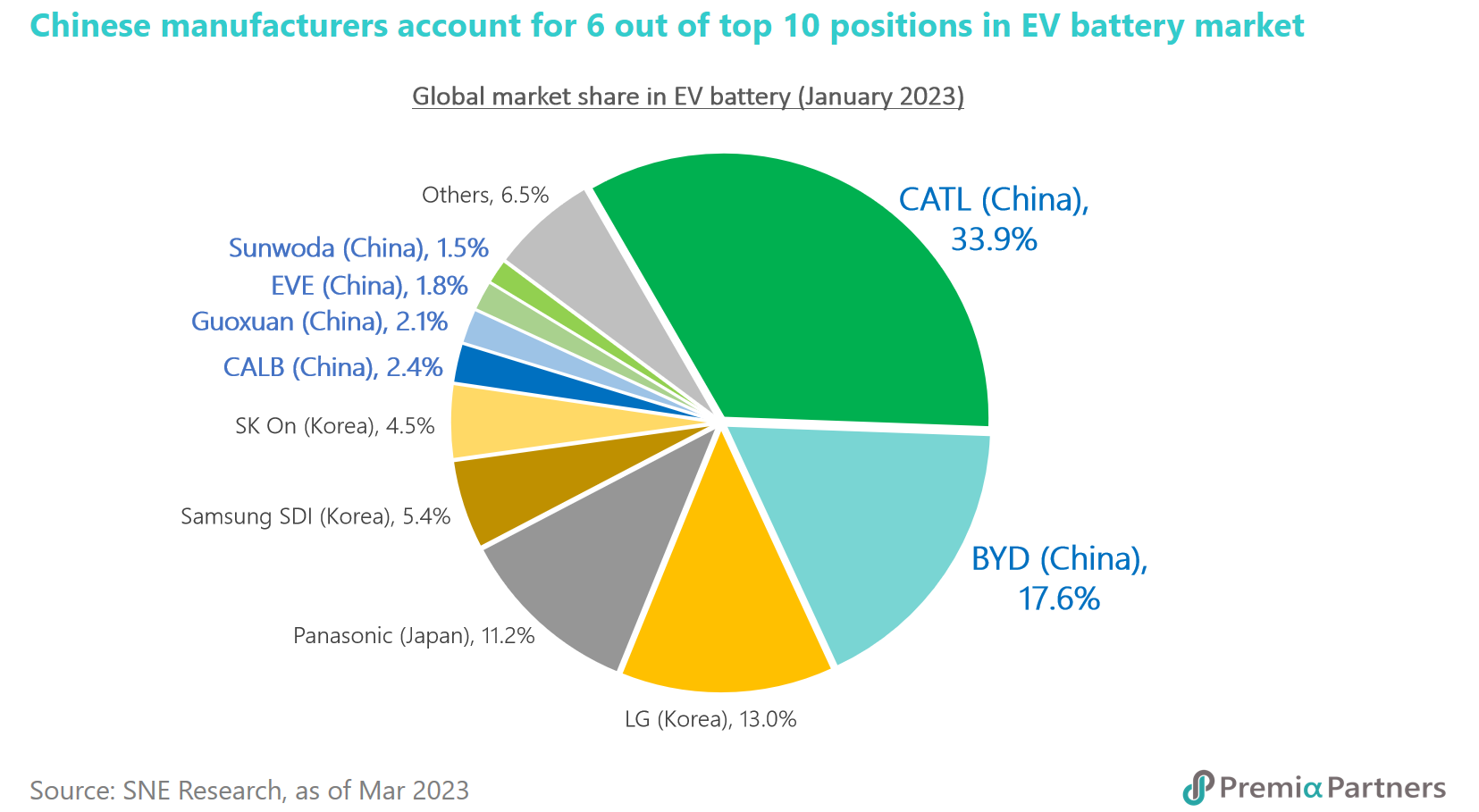

China targets to generate 33% of its electricity from renewable sources by 2025, up from 28.8% in 2020, according to the new "five-year plan" for the renewable sector, which should provide long-term growth for renewable energy companies in solar, wind and hydropower. Apart from domestic growth, China plays an essential role in the global green technology supply chains. According to IEA, China manufactured over 80% of global photovoltaic panels and three-quarters of lithium-ion batteries. Some leading Chinese companies in solar energy equipment are Longi Green Energy, Trina Solar and Tongwei, while those in EV batteries are CATL and BYD. This is not a coincidence as China has abundant resources of raw materials, such as rare earth metals. If the world would like to achieve carbon neutrality by 2050, China is likely to benefit from the growing demand for renewable equipment. Renewable energy and new materials sectors form a substantial portion in our Premia CSI Caixin China New Economy ETF and Premia Asia Innovative Technology and Metaverse Theme ETF.

- What are the other key sectors to focus on in 2023 for China investors? Are China tech investable now?

China’s president Xi Jinping vowed to “drive innovation and self-reliance in science and technology, upgrade the industrial sector, and promote low-carbon development” in the “two sessions”, which is in line with the mission and vision of the STAR market. Among the high-tech industries supported by the STAR market, the chip industry may be the first mover as China has assigned a new chief for the state-backed chip investment fund, National Integrated Circuit Industry Investment Fund, and the market expects that there will be a renewed push to pour resources into the local semiconductor industry amid the U.S. clampdown on China’s access to critical semiconductor technology. Mass production of chips would require high-end equipment that could automate the process, which is another strategic industry supported by the STAR market. On the other hand, the biotech industry is also a key sector in tackling the new normal in the post pandemic world and the ageing population.

- What are the positive and negative risk factors to monitor for China?

Positive risk factors

- Macroeconomic data: The normalization of economic activities in coming months/quarters should provide strong fundamentals to support the stock market performance. We have already started to see some green shoots from the latest data set.

- Corporate earnings: Upward revision may come after the annual result season. With the gradual increasing consumer and business confidence, corporate management and analysts will turn more optimistic on the business outlook.

- Market valuation: PE multiples of Chinese equities remain attractive after the rebound earlier. On average, Chinese equities are trading at a discount of around 20-30% to their counterparts in the developed/emerging markets.

- Fund flows: China is not yet an overcrowded trade, with more potential inflows once market sentiment improves. Even though regional and emerging markets fund managers may be equal- or over-weighted China, most of their global/US peers are waiting on the side-line.

Negative risk factors

- China’s property market slump: If the downward spiral continues, it may cause a widespread of credit defaults and pose a systematic risk to the financial system. Fortunately, both central and local governments have been introducing more supportive measures to help stabilize the industry, while quality developers are able to solve liquidity issues with equity and bond issuance.

- Heightened geopolitical risks: Market may price in higher risk premium if there is a material deterioration in the bilateral relationship between China and the US. That said, there is not much incentive for both parties to escalate the US-China conflict further in coming months – China has just settled for the new leadership whilst the US is 19-month away from the presidential election. The US politicians may play China cards in future, but it seems too early to do it this year.

- Bank run in the US: The recent collapses of a couple of mid-size banks reveal the hidden bombs in the US market, which may lead to reduced appetite in all risky assets including Chinese equities. The resumed dollar hugging is not favourable to emerging markets traditionally. The authority, however, has implemented drastic measures to help calm the market.

10 most frequently asked questions for China investors and allocators

Mar 17, 2023

HOME > insight > 10 most frequently asked questions for China investors and allocators

China markets witnessed strong rally since Oct 2022 trough upon China reopening and covid policy pivot, and we start to see investor flows rotating from offshore to A-shares which are expected to outperform with a longer run for rally. Where are we in China’s reopening trajectory? Who are the policy supported sector leaders well placed to outperform? These are the common questions frequently asked by our clients. In this article, we discuss the 10 most frequently asked questions that came up in our recent conversations with investors and allocators, and share more color about pockets of opportunities as China reopening evolves into the second act for economic growth recovery.

赖子健 , CFA

CFA

朱荣熙

研究团队