THE BULLISH “V-SHAPE” OF NEW vs. OLD ECONOMY EXPOSURES

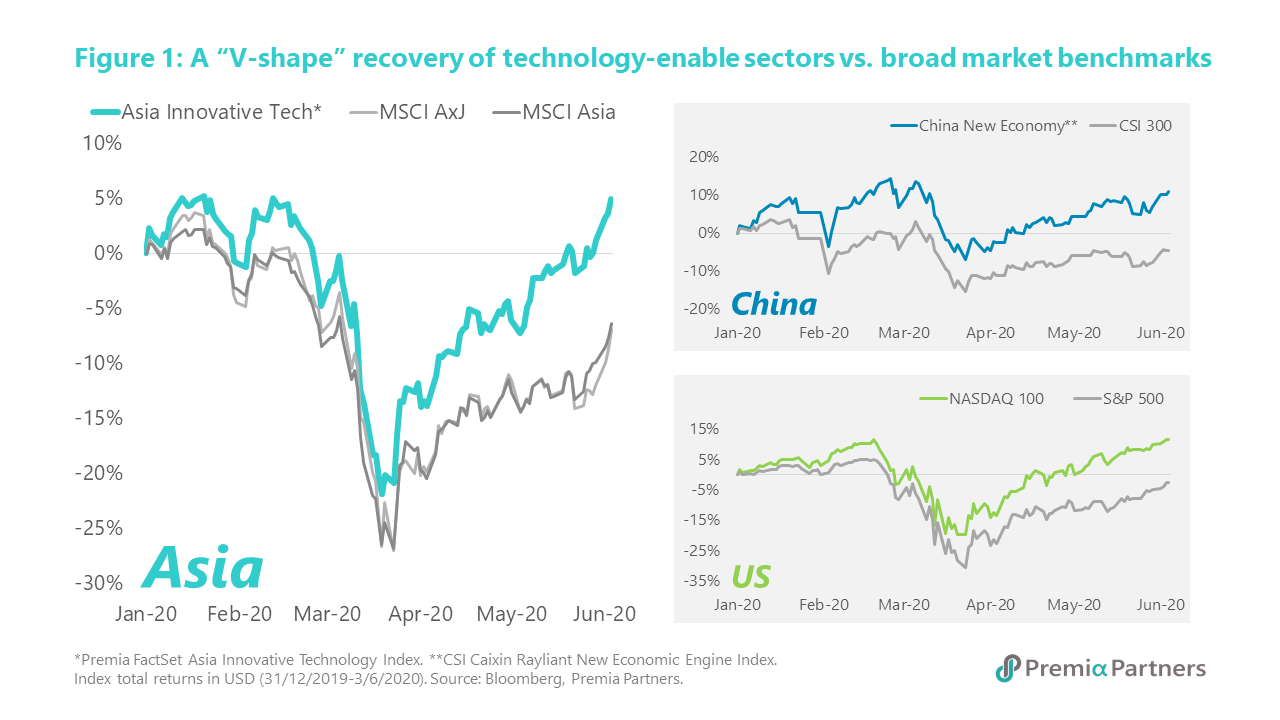

We often talked about a “two-speed” economy for China, yet the COVID crisis has proved that new economies, especially those enabled by technology and innovations, are stand to be more resilient and faster to recover across the world. If we consider the NASDAQ and our flagship China New Economy Strategy to be the “new world” for the US and China respectively, one would have seen the “New” has significantly outperformed the “Old” (or broad market) in the first five miserable months of 2020. A similar pattern can be observed if we compare our Premia Asia Innovative Technology (AIT) strategy with the broad MSCI Asia x Japan index or the MSCI All Country Asia Index (Figure 1). Thus, our AIT strategy indeed served its objective as a basket of innovation leaders in Asia.

MEGATREND GROWTH + DIVERSIFICATION = THE SECRET SAUCE of AIT’s RESILIENCE

By its thoughtful design in built, the Premia FactSet Asia Innovative Technology Index was created to be diversified across Asia geographies (i.e. beyond China), and across sectors (i.e. beyond GICS = IT: see Technology-enabled innovations: Reshaping Asia growth & GICS reclassification & its impact). In addition, the strategy takes an equal-weighted approach so that the weights for emerging innovators would not be penalized against the established mega-cap giants.

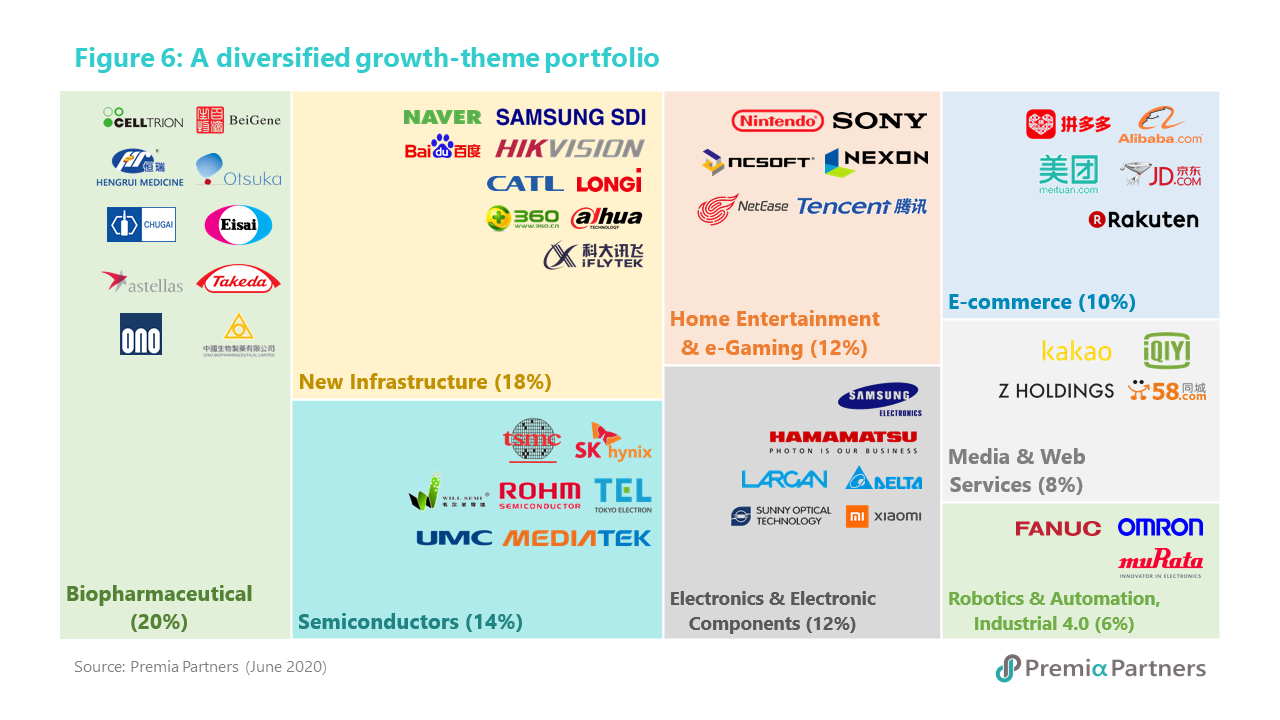

From the sector perspective, the 230+ granular business segments qualifying as “Innovative Sectors” per index methodology are broadly categorized under the 3 themes of: Digitalization, Robotics & AI, and Health & Life Science. Today, we examine at the index holdings screened with what we defined as “Innovators” in a different lens with the some of the latest emerging growth themes.

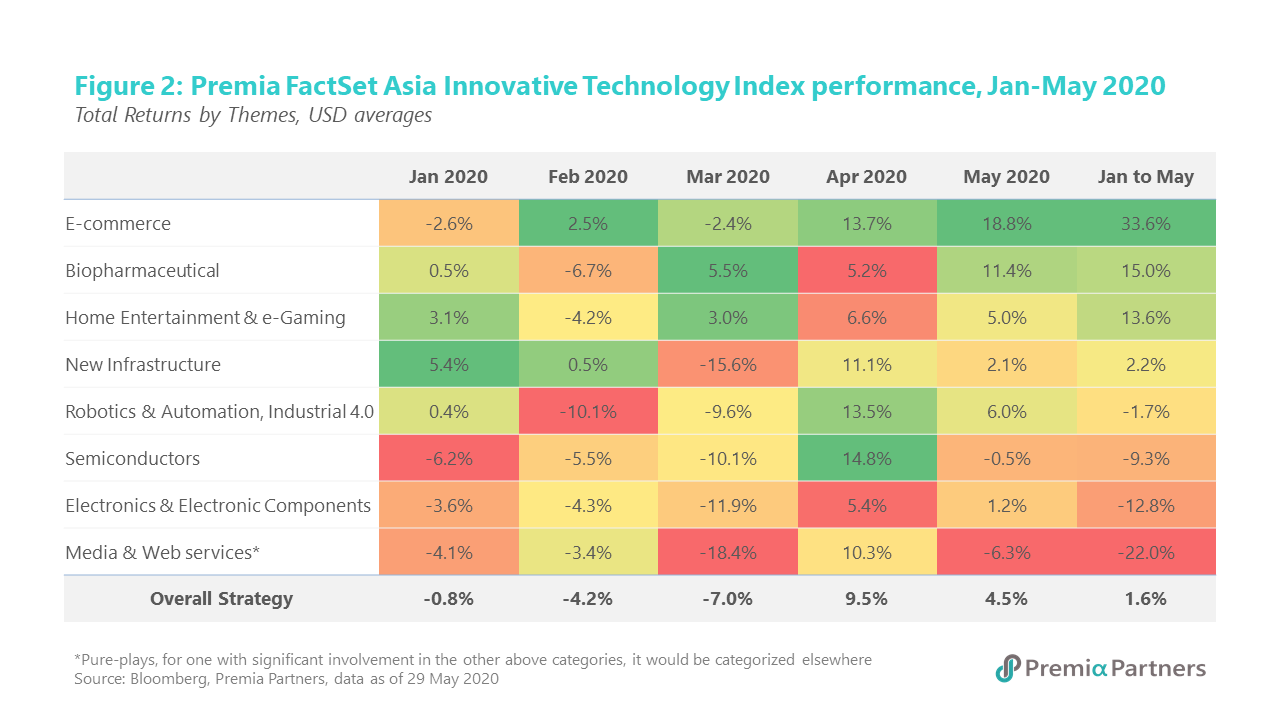

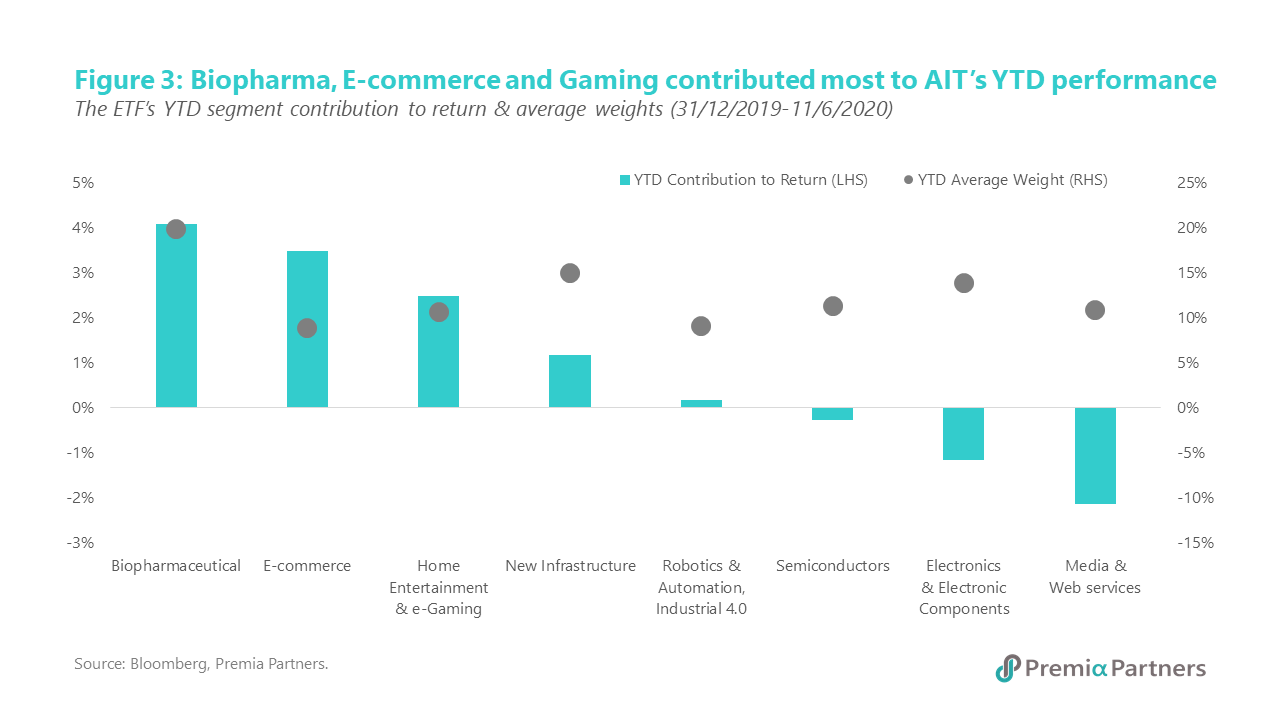

In our previous article: Asia opportunities turbo-charged by COVID behavioural changes, we highlighted a handful themes that we believe were to be COVID-accelerated including e-commerce, industrial IoT and cloud computing. Apart from the four e-commerce leaders we hold (Alibaba, JD, PDD, & Rakuten) that generated an impressive 5-month average return of 33.6% as consumptions shifted significantly from offline to online, the figure above also illustrated a very interesting heatmap of “sector rotation” among some of the themes throughout the COVID crisis (Figure 2). In particular, the biopharmaceutical exposure we have in AIT acted a solid cushion amid market volatilities. While remaining some “defensive” characteristics, the top technology-enabled healthcare holdings in Asia also demonstrated their strong quality growth characteristics. The average return of our 10 biopharmaceutical companies was over 15% YTD - which also made this segment the top performance contributor to our AIT strategy, followed by e-commerce and gaming (Figure 3).

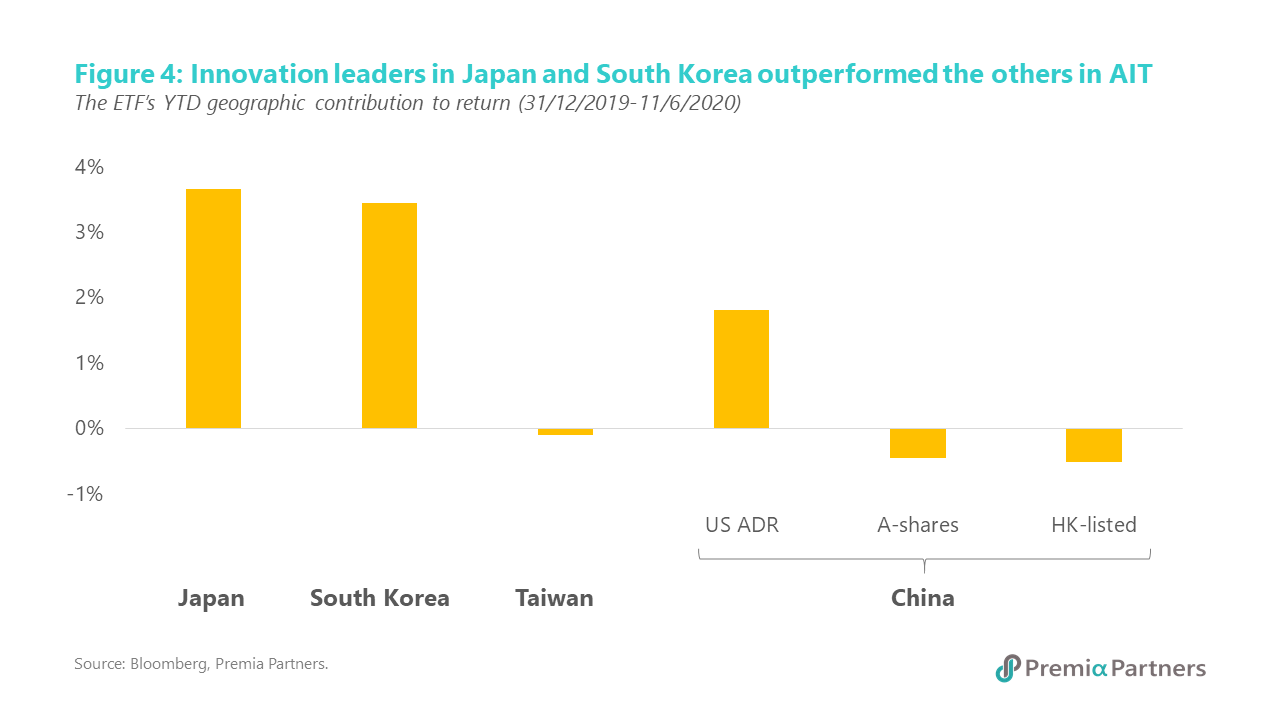

Similarly, our AIT strategy is also geographically agnostic across the Asia region by its design. It currently has exposure to China (consisting of onshore A-shares, US ADRs and Hong Kong listed stocks), Japan, South Korea and Taiwan. The geographic diversification is intended to capture the overall secular growth of technology-enabled innovations in all Asia economies. Similar to our belief against using merely traditional GICS for identifying tech-related stocks, the traditional geographic division of DM vs. EM does not well represent the clustering effect of cultural similarities and economic activities for Asia if we thoughtlessly exclude Japan or Korea, especially when it comes to technology and innovation. On the other hand, our AIT is not a China-only strategy, or even narrower as A-shares-only or offshore-China-only. While China is a main growth engine of technology-enablement and innovation, it is not the only place with innovation and growth in Asia. On the contrary, a China-only strategy would potentially lead to greater country-specific risks, which may not be desirable when there has been an escalation of geopolitical risks around the world.

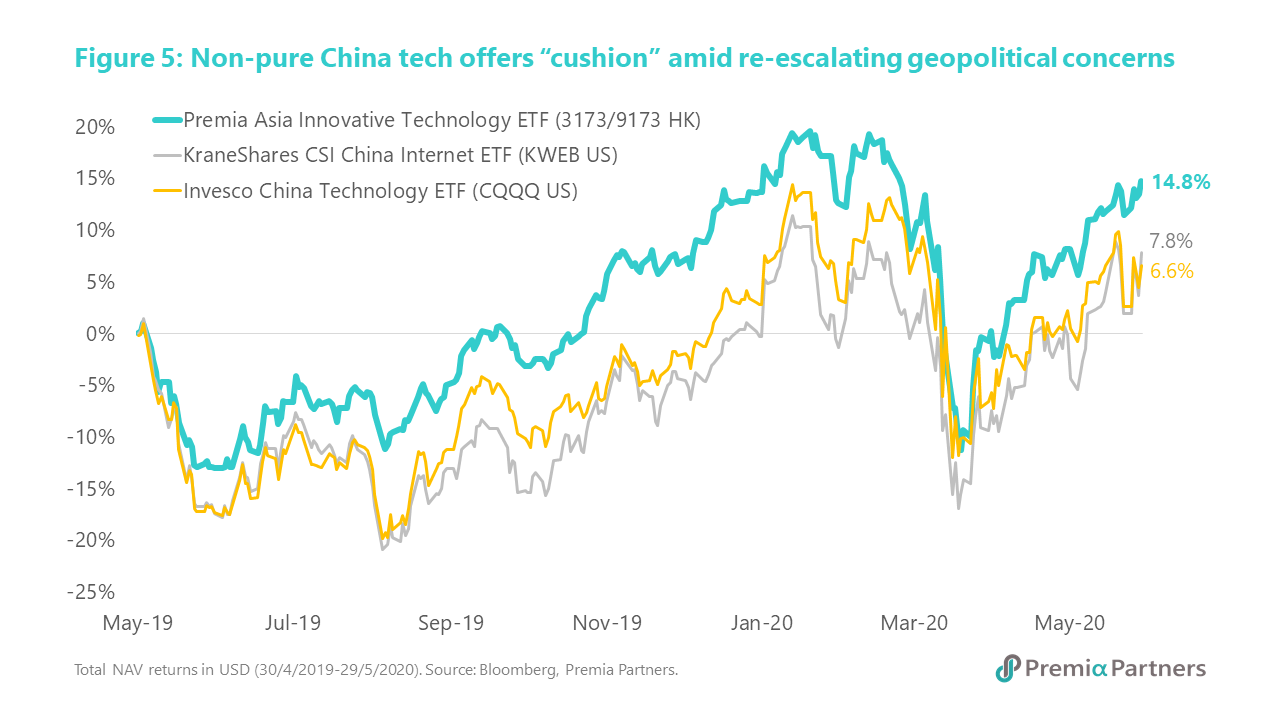

As a matter of fact, the Japanese and Korean exposures contributed the most to AIT’s performance YTD as seen in Figure 4 above. The geographical and sectoral diversification benefit also extends to AIT’s performance against other popular China technology strategies. Now is roughly about just one-year time since the last time President Trump made announcement about banning Chinese technologies (e.g. Huawei); during this horizon to the recent re-escalation, we saw AIT outperformed 7.0% and 8.2% vs. CQQQ and KWEB, respectively (Figure 5).

LOOKING FORWARD - HOW IS AIT A (MORE) RELEVANT INVESTMENT CASE

With COVID lockdown significantly changing people’s behaviour, transforming how business operates, and accelerating the adoption of innovation across many sectors as we discussed in Asia opportunities turbo-charged by COVID behavioural changes, we believe our AIT strategy is well-positioned for post-COVID growth and it can be utilized in a few useful cases:

1. A Tactical Shift from Pure Offshore China Internet – with re-escalating geopolitical uncertainties between US and China, AIT also serve as a good alternative as a replacement or tactical complement for risk diversification to those currently holding pure China internet exposures while maintaining the strong growth prospects.

2. A New Economy Allocation for Broad Asia – in a world of two-speed economy - a tale that would only be further accelerated by the COVID pandemic - the AIT strategy can be considered as a new-economy proxy for broad Asia. For investors using broad market allocations tools for Asia or EM, this could be a time to reconsider the global allocation as the world reconfigures to a new norm.

3. A Standalone Diversified Growth Portfolio – the equal-weighted basket of 50 leading innovators in Asia represent a diversified, high-quality portfolio that captures long-term secular growth themes, including #biopharmaceutical, #newinfrastructure and #e-commerce (Figure 6).

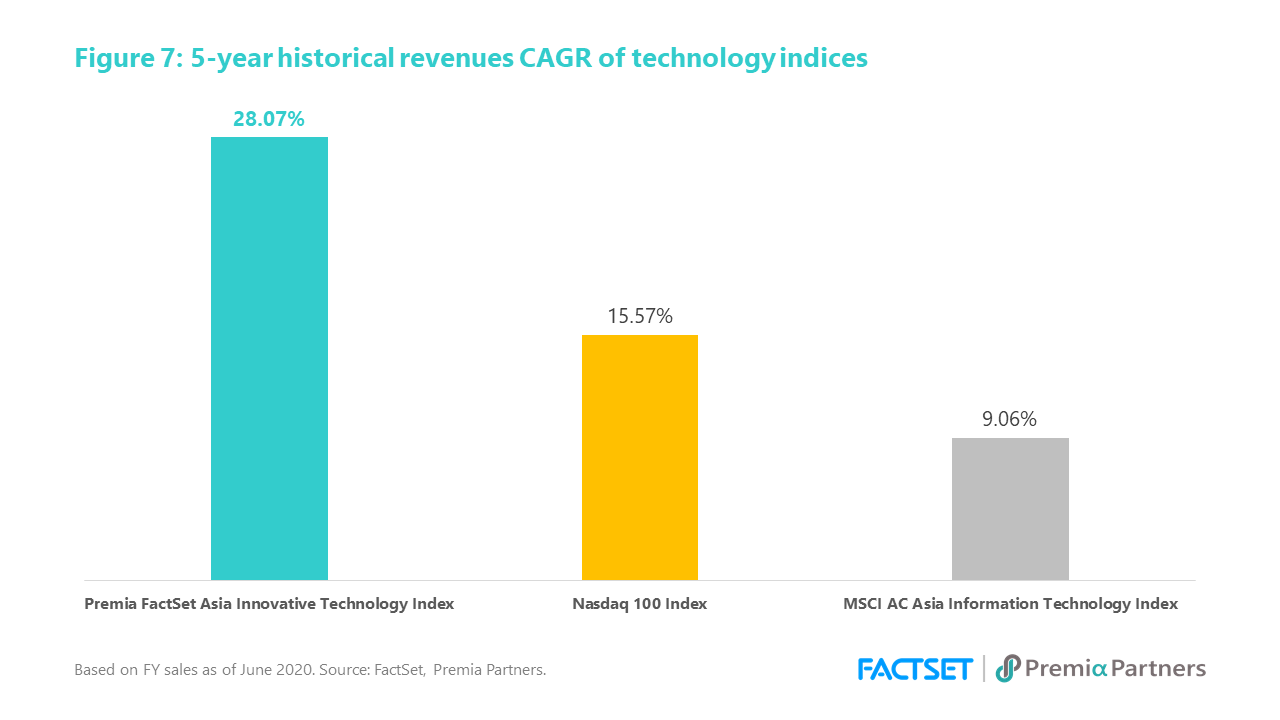

4. A Complement to QQQ or other US-centric Growth Strategies – NASDAQ / QQQ is often the go-to-choice for many growth investors, yet technology and innovation in Asia has been growing at an exponential pace with the Asia market becoming too big to ignore when it comes to growth & Innovations. In Figure 7, we compared the top line revenue growth of the holdings in the Premia FactSet Asia Innovative Technology Index versus that of the Nasdaq 100 Index and MSCI AC Asia Info Tech Index. While QQQ does have the familiar Chinese ADR names of Tencent, Alibaba, Baidu and JD.com (commonly known as the BATJs), the combined weight is less than 1.5% - too little to capture the growth prospects of Asia innovations. Over the last one-year period, our AIT strategy outperformed QQQ by nearly 7% with a correlation of 83%. The underlying indexes’ correlation over the last 3 years is 72% (compared to 93% of QQQ vs. SPY).

THE NEW GLOBAL GROWTH PARADIGM: A PREMIA MODEL PORTFOLIO FOR CONSIDERATION

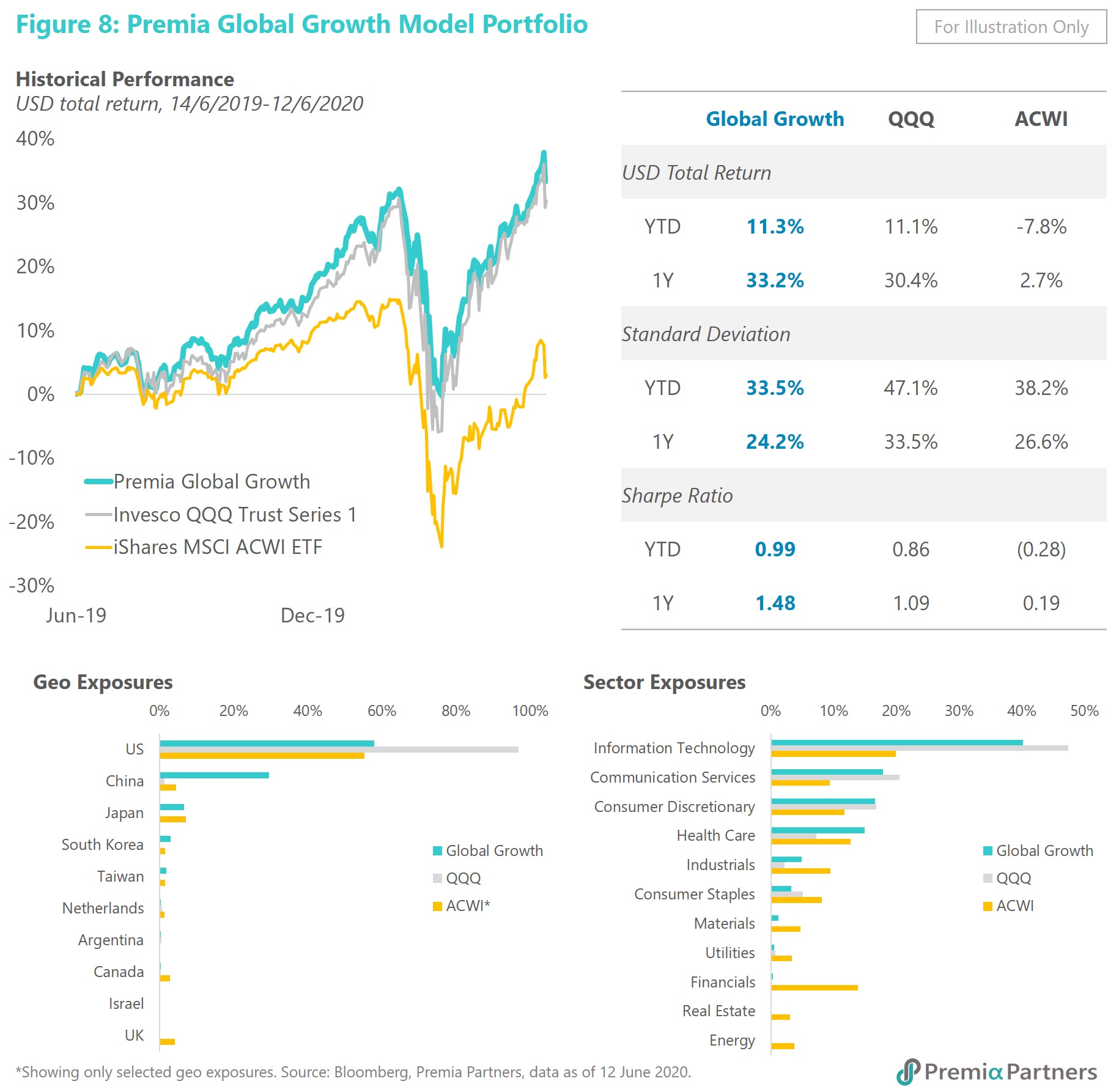

Apart from ETF issuance, we also provide managed portfolio solutions to professional investors at Premia Partners. Below is a snapshot of our model portfolio that makes use of QQQ, AIT, and our flagship China New Economy Strategy to portrait and capture global growth opportunities:

For more information about our Premia Asia Innovative Technology ETF (3181HK/9181 HK) or our portfolio solutions, please feel free to reach out.

*all data as of 6/12/2020 unless otherwise stated