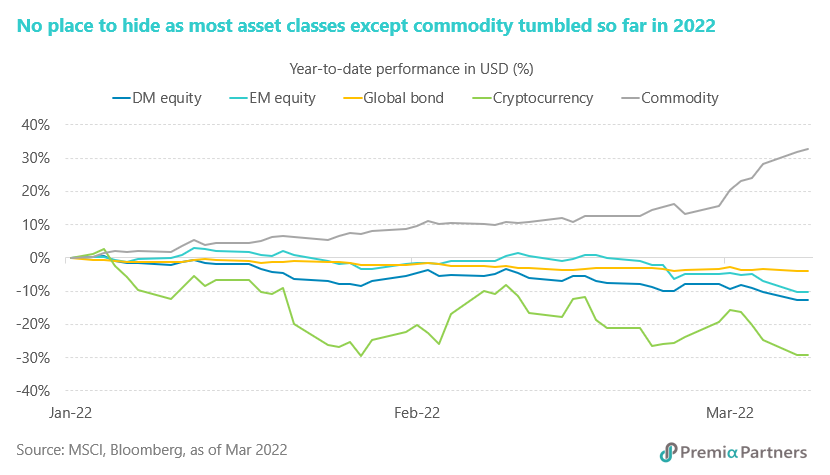

Finding a safe haven to avoid the market turbulence in the short-term becomes a burning question for all of us, especially at this time when the traditional safe haven sovereign bonds in developed markets are facing headwinds from imminent rate hikes. This is even more a challenge for long term investors and allocators given scarcity of appropriate assets for matching their long duration liabilities. At Premia, we believe China government bond (CGB) is an instrument that may meet the criteria – yield earning, potential capital gains, low volatility and strong fundamentals.

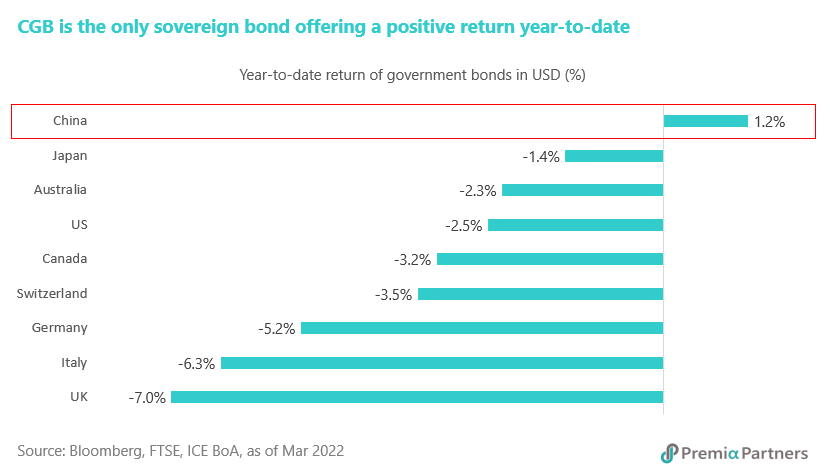

Strong year-to-date performance

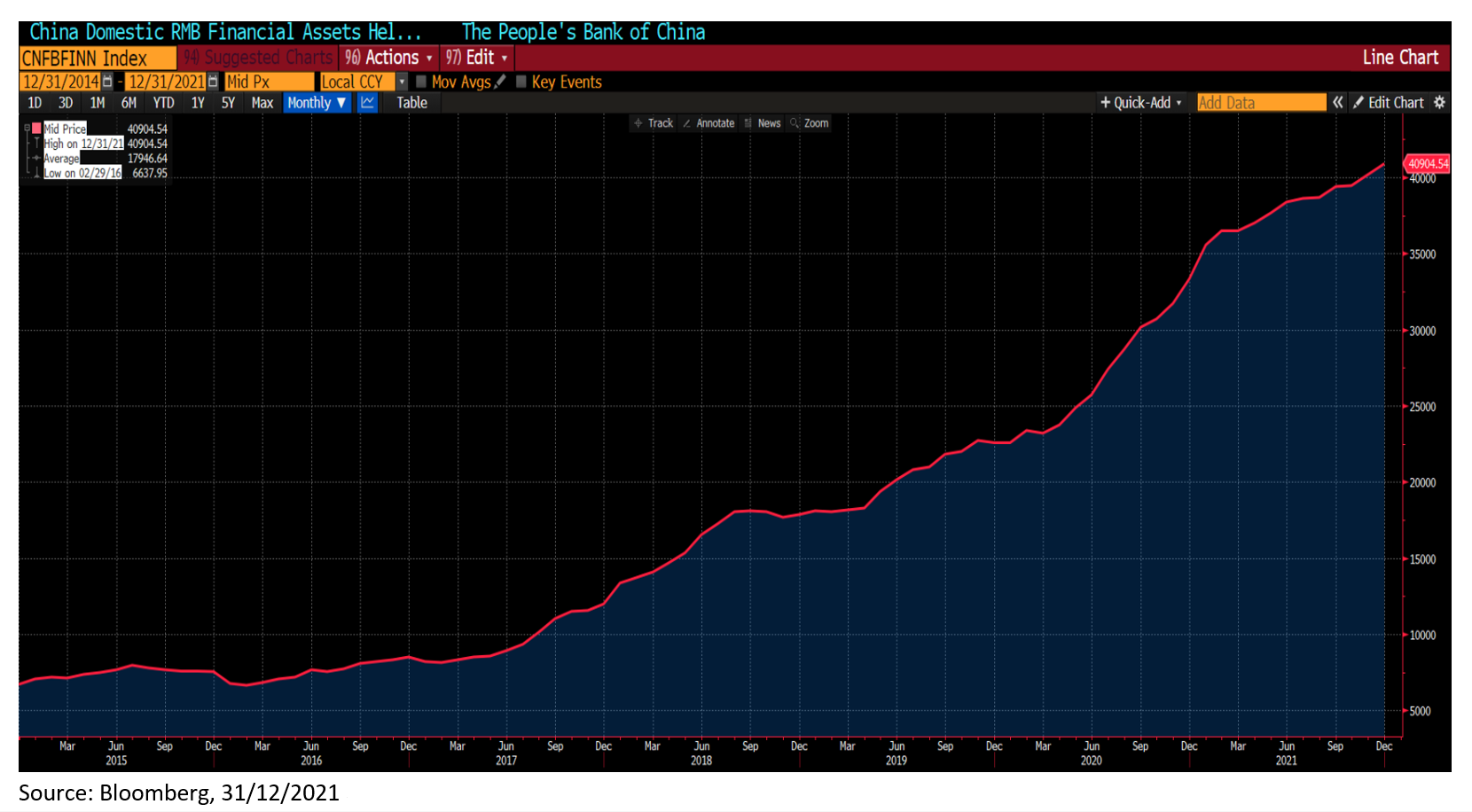

First and foremost, CGB has shown a superior performance with a positive return of 1.2% year-to-date, against the losses recorded among most government bonds worldwide, including the US treasury, UK gilt, German bund and Japan government bond. If extending the measurement to a period of the past 12 months, CGB would show an even better gain of 9.4% versus the -1.0% for the US treasury and -5.0% for the global government bond index tracked by Bloomberg. China is already the world’s second largest onshore bond market and the third largest sovereign bond market. Offshore investors have been accumulating CGB with the total holdings have reached RMB 2.45 trillion at the end of 2021, an increase of 30% from the level the year before and more than double the amount three years ago. The recent inclusion of CGB to FTSE’s World Government Bond Index is expected to generate around USD 130 billion of inflows over three years since last October. Analysts see adding CGB in a portfolio is not only generating a decent net return but also reducing the overall risk parameters.

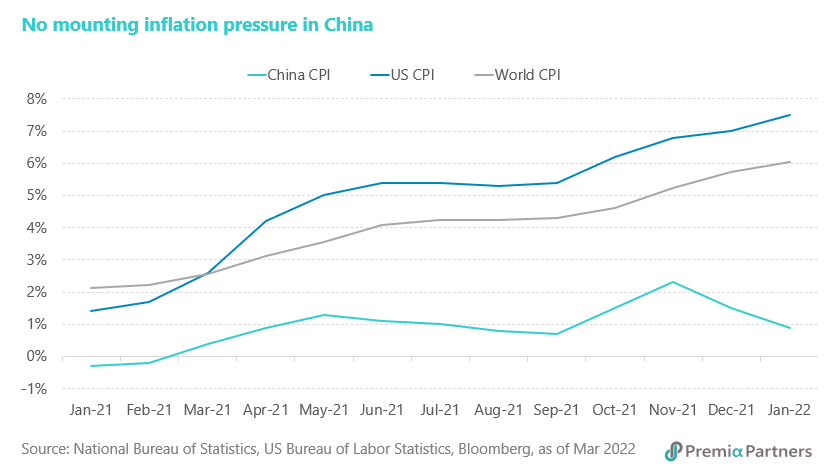

Favorable rate cycle in China

The market is pricing in an accelerated rate hike cycle in the US with the latest CPI and core CPI standing at 7.5% and 6% respectively. Indeed, most developed markets face a similar situation that tightening monetary policy is one of the top priorities for the central banks. These potential hawkish rate movement will be harmful for the bond holders in a result of higher yields and lower prices. Fortunately, China does not face the same problem. The latest inflation is 0.9% only, even lower than the 1.5% seen in the prior month. That explained the bold rate cut actions done by the PBOC earlier this year.

For the first time since April 2020, China’s central bank lowered the interest rate of the one-year medium-term lending facility, a key policy rate, by 10 basis points to 2.85% in order to reduce corporate financing costs. The interest rate of seven-day reverse repurchase agreements was also trimmed by 10 basis points to 2.1%. The record-high total social financing in January reiterated the consistency of the authority’s loosening stance. The PBOC pledged to keep its monetary policy flexible and responsive to changing economic conditions, with an overriding objective of achieving stability, while the market expects reduction in both interest rates and deposit reserve ratio in the next few months.

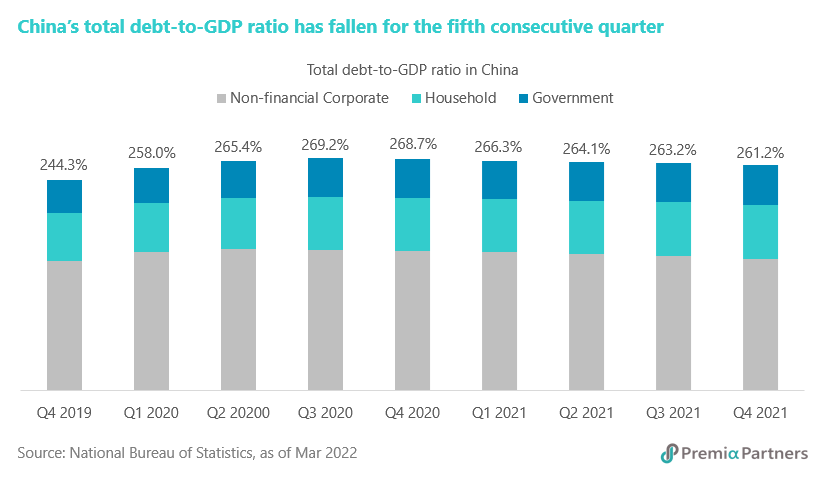

Solid fiscal position backing

Fundamentally, the solid fiscal position of China provides a firm foundation backing the CGB with the sovereign credit ratings of A1 from Moody’s and A+ from Fitch/S&P’s. Last year, China posted a current account surplus of USD 224 billion, the highest since 2013, and a record capital account surplus of USD 83 billion. Meanwhile, China’s total debt as a percentage of GDP declined for the fifth consecutive quarter, even as the country’s economy faced strong headwinds including a housing-market slump and sporadic virus outbreaks. The country’s leverage ratio peaked at 268.7% in the fourth quarter of 2020 and then fell to 261.2% in the last quarter. Looking into the breakdowns, the non-financial corporate debts contributed to the major reduction, government debts increased slightly whilst household debts stayed largely flat.

The reduced debt level should create room for ramping up monetary easing and allow the financial system to increase support in case there is an economic slowdown. During the National People’s Congress, China sets an economic growth target of about 5.5% for 2022 and a lower-than-expected budget deficit projected to be 2.8% of GDP, as compared to the budget deficit forecasts of 3.2% in 2021 and 3.6% in 2020.

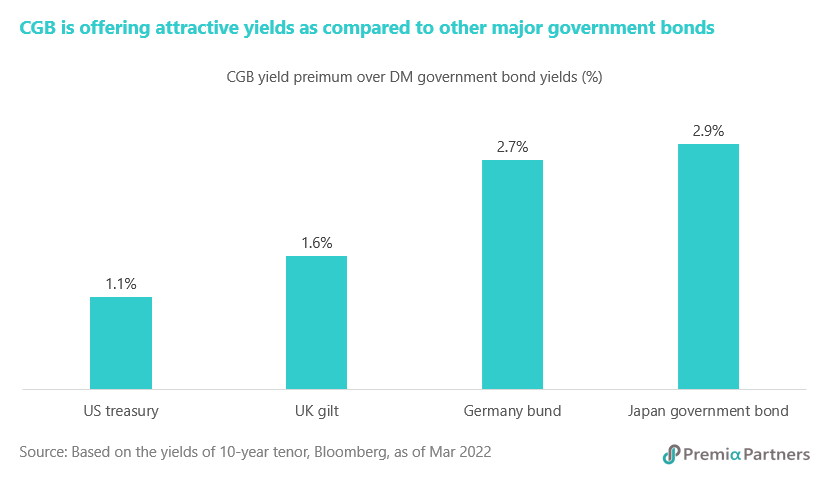

Higher absolute yield but lower volatility

China’s yield curve is still offering significant premiums over other countries across tenors, e.g., the yield of 10-year CGB is standing at 2.83% versus 1.74% in the US, 1.25% in the UK, -0.07% in Germany, 0.12% in Switzerland and 0.14% in Japan. If adjusting the yield levels by the inflations faced in different countries, the gap will be enlarged further with CGB giving a real yield of 1.93% whilst almost all the rest sitting in the negative yield territory.

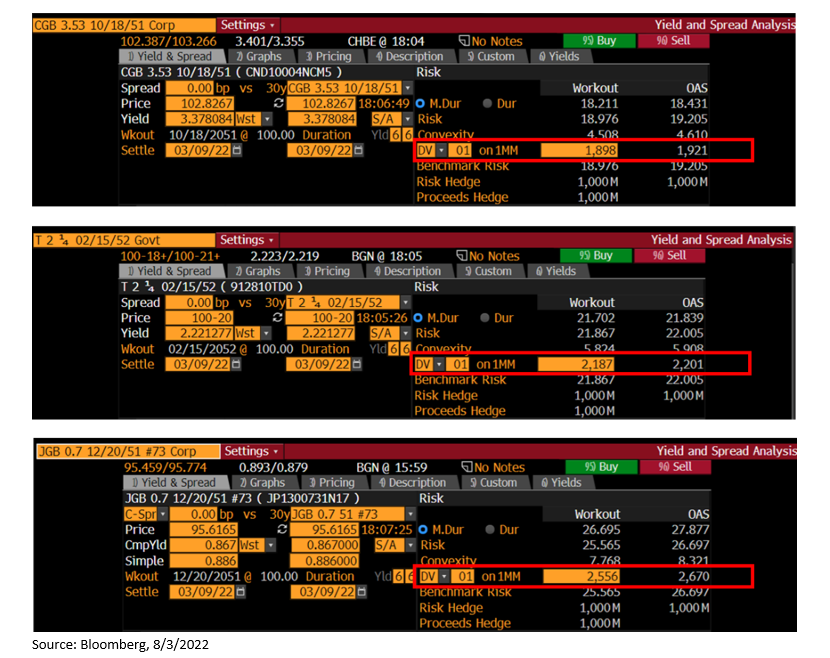

Volatility-wise, CGB is among the ones subject to less pricing swings in the past. Taking the sensitive long duration bond as an example, the 30-year CGB has a 360-day volatility of 6.7 as compared to 37.6 in the US, 65.6 in the UK and 30.5 in Japan. Another advantage for adding CGB in a portfolio would be its low correlation with other fixed income instruments. The historical correlation of long duration CGB is only 0.19 with the US treasury, 0.10 with the US credit, 0.06 with European credit and 0.15 with Asian credit. This diversification effect could be particularly useful in a stressed scenario.

DV01 (Dollar value per 1 basis point which measures interest rate risk of bond or portfolio of bonds by estimating the price change in dollar terms in response to change in yield by a single basis point) of CGB is much lower than 30-year US Treasury or JGB.

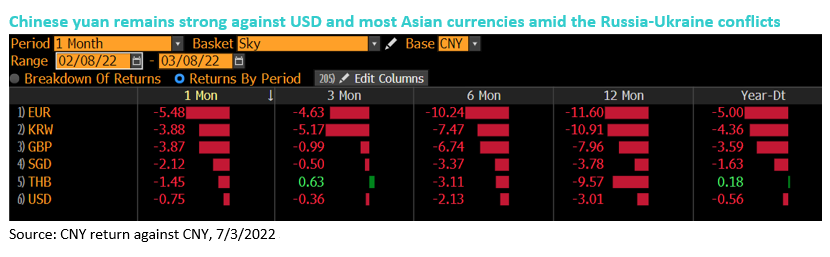

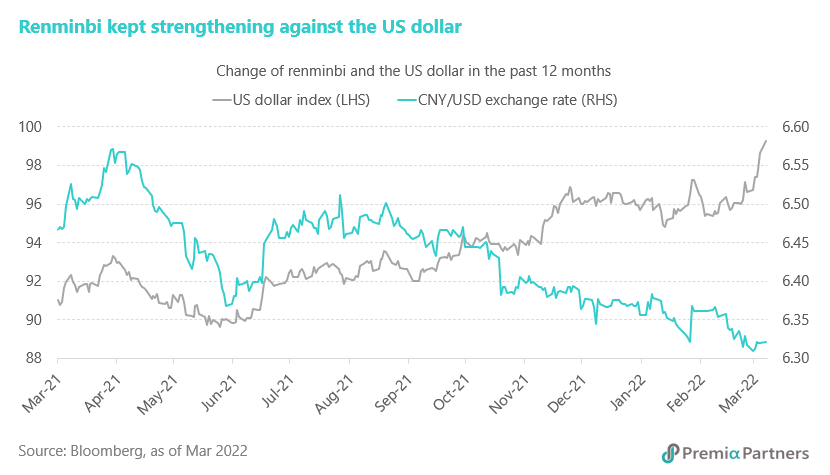

Resilient RMB with increasing adoption

Under the Ukraine-Russia war, the RMB exchange rate has remained strong. The strong domestic exports and high foreign exchange settlement are the basis for the RMB to maintain its resilience, and the RMB’s improved international status also helps enhance its liquidity. RMB internationalization is proceeding steadily at present, and the RMB’s market share in the international payment system is steadily increasing.

According to data disclosed by SWIFT, the proportion of the RMB in global payments jumped to 3.2% in Jan 2022; the total amount of RMB reserves has been rising steadily, and by the end of 3Q21, the proportion of the RMB as the official reserves of various countries rose to 2.66%, the highest level since being one of the five currencies within the International Monetary Fund’s Special Drawing Rights. From the investment perspectives, RMB assets would remain attractive to offshore institutions due to the reasonable valuation of the stock market, relatively high bond yields, and low correlation between RMB and overseas assets.

Premia China Treasury and Policy Bank Bond Long Duration ETF (2817.HK) was launched in mid-April 2021, recording a positive return of over 11% since then. The following features of the ETF will help investors capture the promising outlook of CGB whilst staying away from the market volatility:

- Sovereign debts backed by Chinese government: 100% investing in China treasury and policy bank bonds with A1/A+ sovereign credit rating

- Attractive yield and yield spread with US treasury: Attractive yield of ~3.3% and ~100-200bps historical yield spread with 30-year US treasury

- Convenient access to long duration Chinese government securities: Unique exposure for investors with long duration asset-liability management or diversification needs

- Cost efficient: highly transparent fee structure with all-in total expense ratio (TER) of only 0.28% per annum

- Operationally efficient: Listed on Hong Kong Stock Exchange with intraday liquidity and minimal operational hassle

- Multi-currency trading counters: Investors may trade the same underlying ETF through RMB, HK dollar and the US dollar