Market sentiment turning the corner

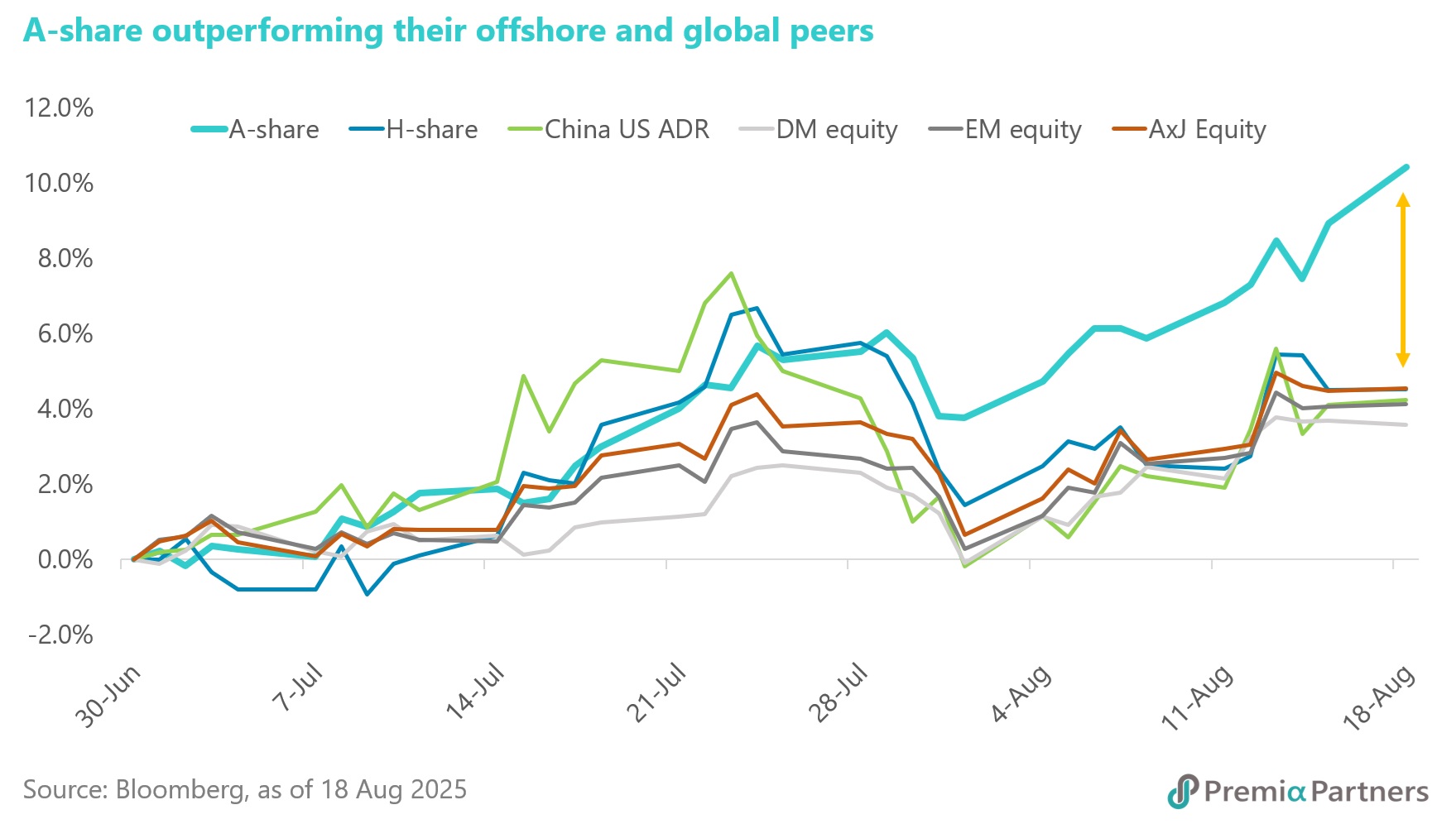

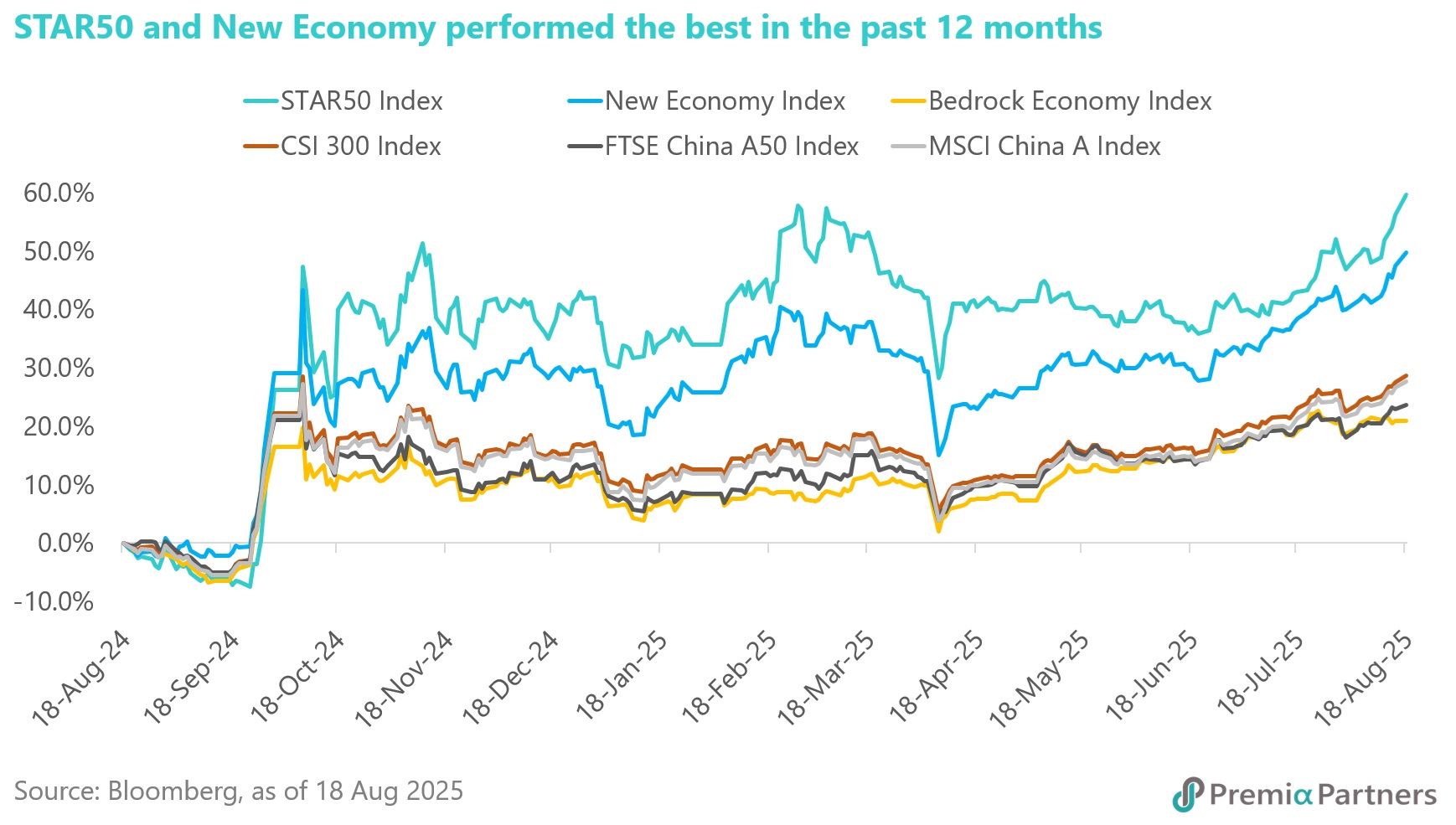

China’s A-share market has shown meaningful resilience and outperformance since the start of the second half of 2025, with investors largely shrugging off weak macroeconomic data. This shift suggests that market participants are becoming more forward-looking, focusing on structural growth opportunities rather than backward-looking economic headlines.

In efforts to combat deflation and promote higher-quality growth, the central government launched a campaign on July 1st to crack down on excessive competition and reduce outdated capacity. Initial market interpretations centered on ending price wars in sectors such as EVs and food delivery. However, after headlines about steel and solar companies curbing production, investors began to speculate that this “anti-involution” campaign could extend across industries with overcapacity. Some even compare the initiative to the supply-side reform of 2016, which triggered a year-long rally in the steel sector. Importantly, the campaign reinforces the market’s preference for industry leaders, innovators, and high-quality growth sectors positioned to benefit from policy support and industry consolidation.

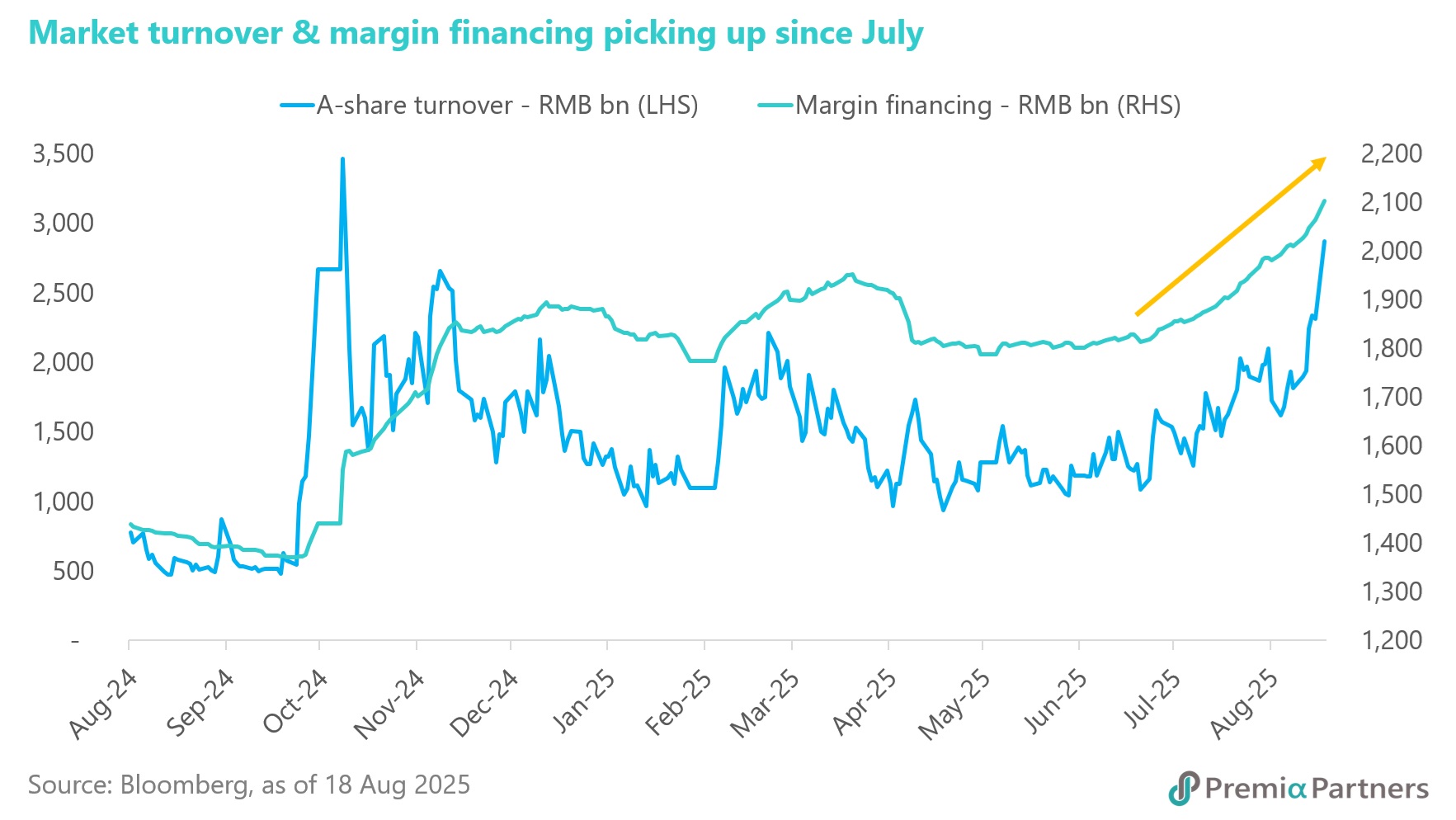

Signs of improving sentiment are evident. Margin financing is climbing, market turnover is rising, domestic insurers are increasing equity allocations, and onshore mutual funds are seeing a recovery in inflows. Together, these dynamics underscore that risk appetite is returning to China’s onshore markets after a prolonged period of caution.

We believe this momentum is not temporary but supported by multiple structural and cyclical drivers:

- Shareholder returns and asset rotation – Stable cash dividends and corporate share buybacks are bolstering confidence. At the same time, persistently low bond yields are encouraging investors to rotate from fixed income into equities.

- Global positioning still light – International investors remain meaningfully underweight in Chinese equities. Should A-shares continue to outperform, the pressure to close this allocation gap could fuel further inflows.

- Renminbi stability with upside potential – The RMB has been trading in a narrow band with signs of appreciation ahead. Markets are now pricing the currency at around 7.0 against the dollar over the next 12 months, providing further comfort to global allocators.

- Attractive relative valuations – The China AH premium is at a five-year low, while A-shares trade at a ~30% discount to global equities on a 12-month forward PE basis. This valuation gap offers meaningful room for catch-up.

- Policy conviction and clarity – The July Politburo meeting reinforced China’s commitment to pro-growth, pro-innovation, and pro-capital market policies, pledging timely reinforcement to achieve the ~5% GDP growth target. Looking ahead, the Fourth Plenum in October will outline priorities for the 15th Five-Year Plan (2026–2030), focusing on high-quality growth, technological innovation, consumption and structural upgrading.

Together, these factors lead to a market environment that is not only stabilizing but building toward a more durable uptrend.

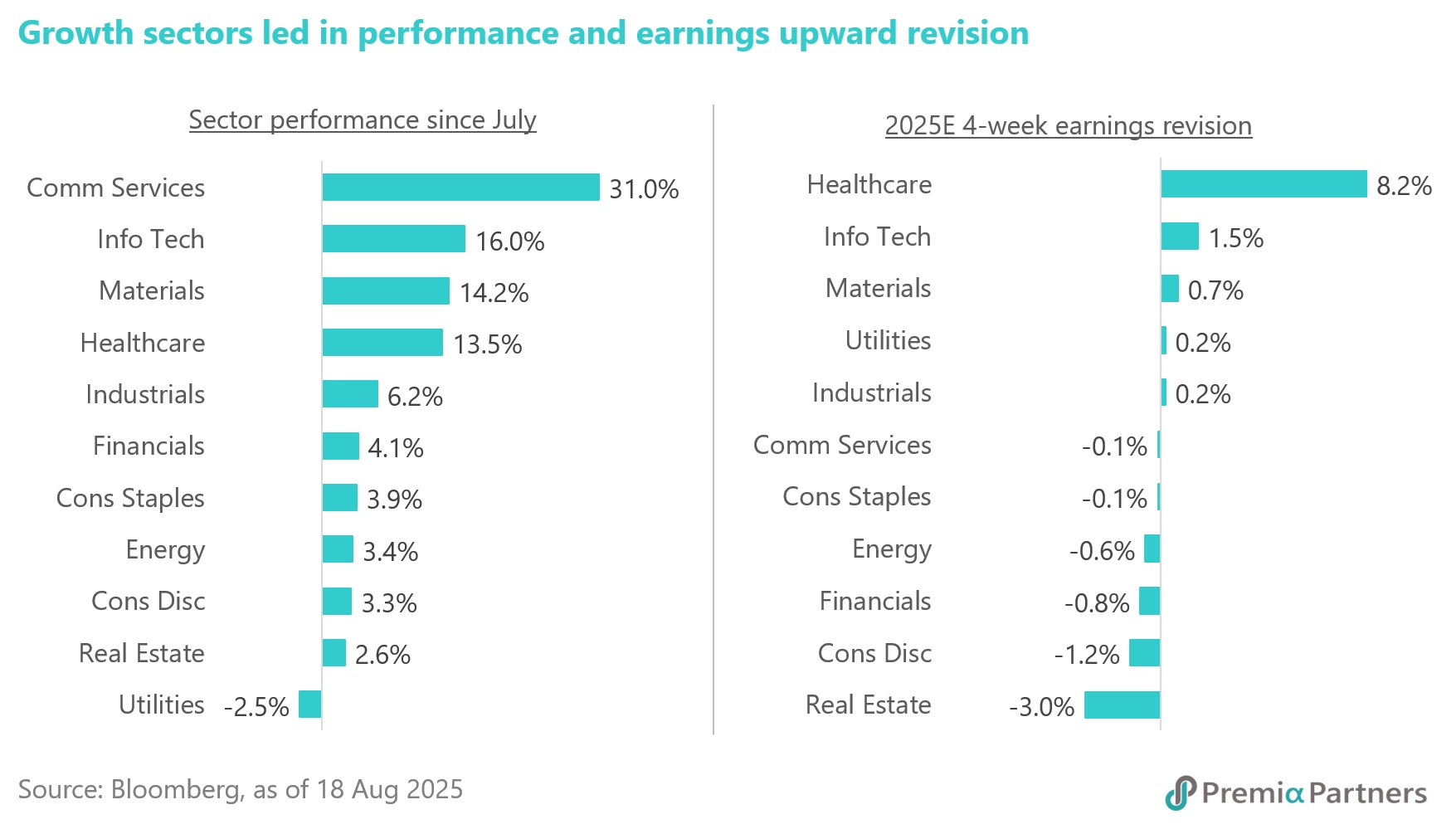

Growth sectors leading the way

Market leadership has already begun to shift decisively toward growth-oriented sectors. Since July, industries such as communication services, IT, healthcare, and industrials have outperformed defensive sectors like utilities and consumer staples. This reflects a broadening investor appetite for companies positioned to benefit from innovation, industrial upgrading and long-term consumption trends. On earnings, while the overall market has yet to see broad-based earnings upgrades, sectors including healthcare and IT recorded the strongest upward revisions in the past four weeks.

Fundamentals of key growth segments

Biotech & Healthcare

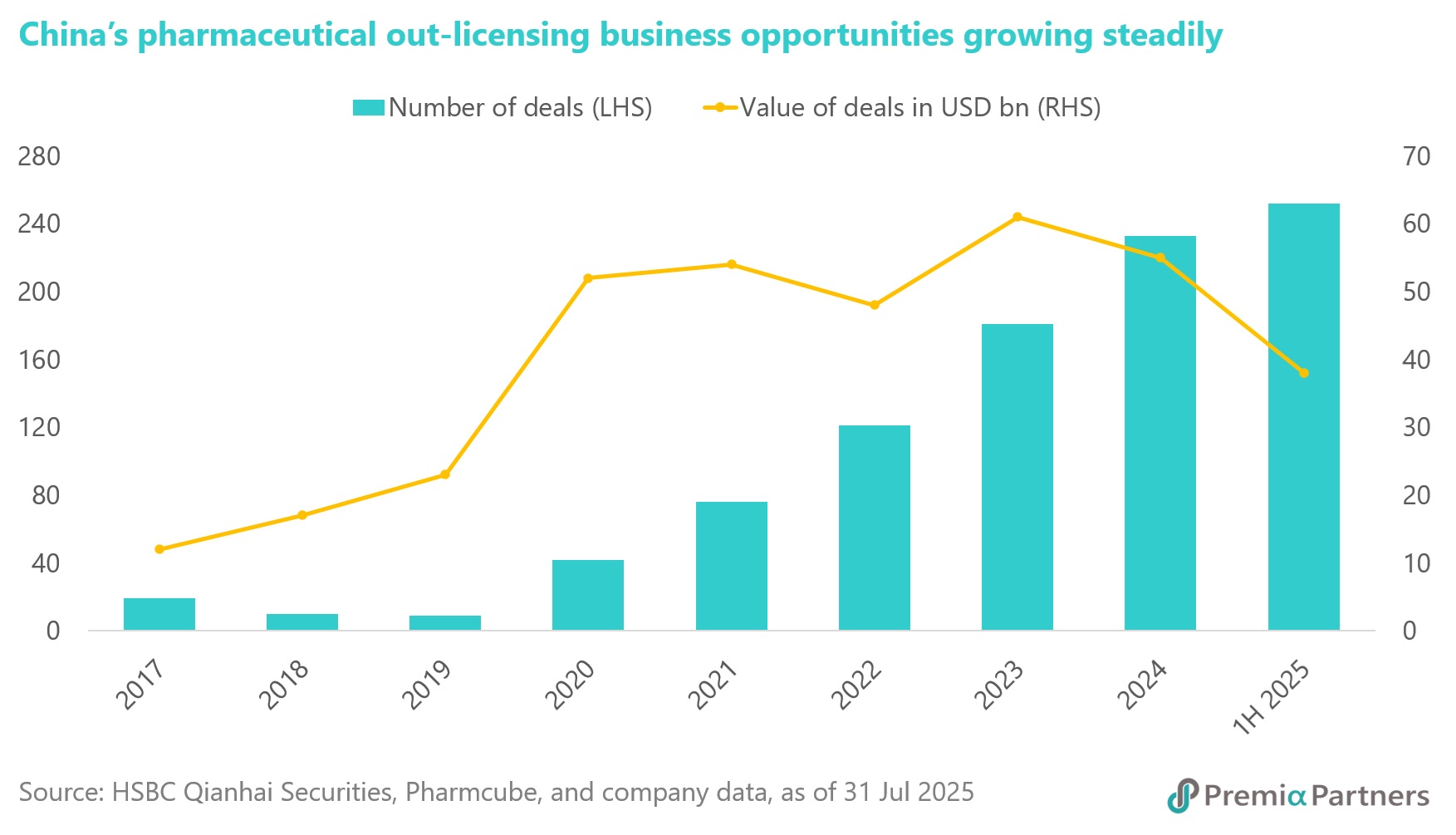

Chinese Premier Li Qiang recently reiterated the importance of high-quality sci-tech empowerment and policy support to upgrading of China's bio-medicine industry. In fact, China’s biotech and healthcare sector is evolving rapidly into a global platform for innovation and integration. The country is not only addressing large unmet domestic needs but is also becoming increasingly relevant to global pharmaceutical development.

- Pharma out-licensing trend – Chinese biotech firms are entering into landmark licensing deals with multinationals. For instance, 3S Bio’s license-out agreement with Pfizer underscores the global recognition of China’s innovation pipeline.

- Earnings re-rating potential – Analysts expect continued sector re-rating supported by:

- Steady revenue booking from out-licensed innovative drug assets recognized by global players;

- Multiple clinical readouts at upcoming WCLC and ESMO conferences (Sep–Oct 2025), which should open additional BD opportunities;

- Supportive policies for clinical trials and milder-than-expected national insurance pricing reforms;

- Easing financing conditions and rising demand for overseas trials, benefiting contract research organizations (CROs).

Overall, the healthcare sector is well-positioned for structural earnings growth, with innovation, policy support and global integration driving long-term upside.

Solar Energy

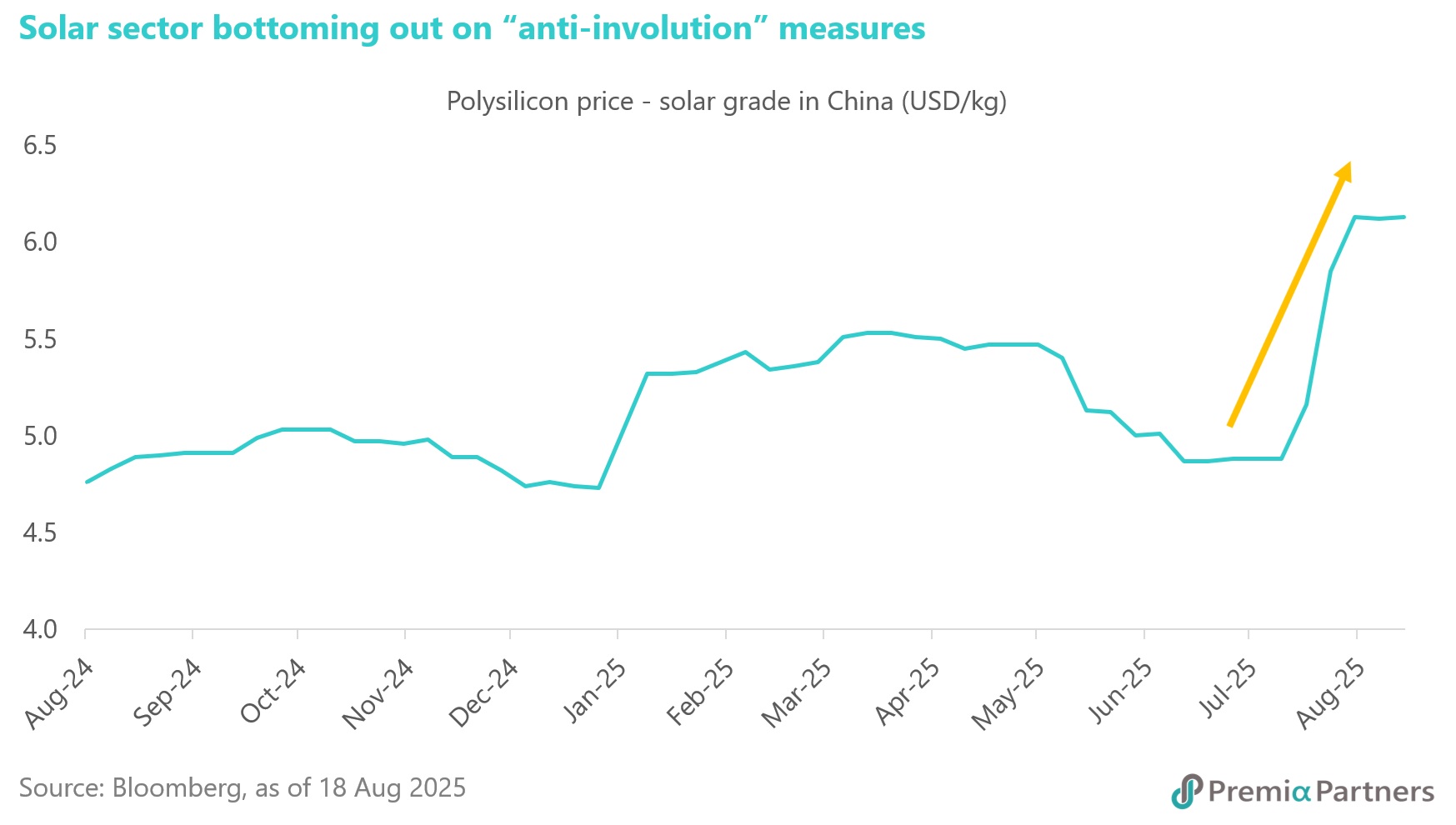

After a challenging period of oversupply and falling margins, China’s solar sector is entering a phase of industry consolidation and rationalization.

- Government-backed buyout of excess capacity – Market leaders, with government support, have initiated a plan to purchase and shut down low-tier polysilicon production. The first wave involves six producers exiting with a combined 0.7mt of capacity (~350GW p.a.). While initial reductions are below expectations, negotiations are ongoing and further consolidation is highly likely.

- Polysilicon price rebound – Spot prices have already rebounded 37% from their June lows, indicating that the market recognizes the impact of supply rationalization.

- Toward coordinated production – The emerging structure resembles an “OPEC” for polysilicon, where leading producers coordinate production and pricing to stabilize cycles.

As industry consolidation progresses, leading solar companies stand to benefit from improved pricing power, healthier margins, and a more sustainable growth trajectory.

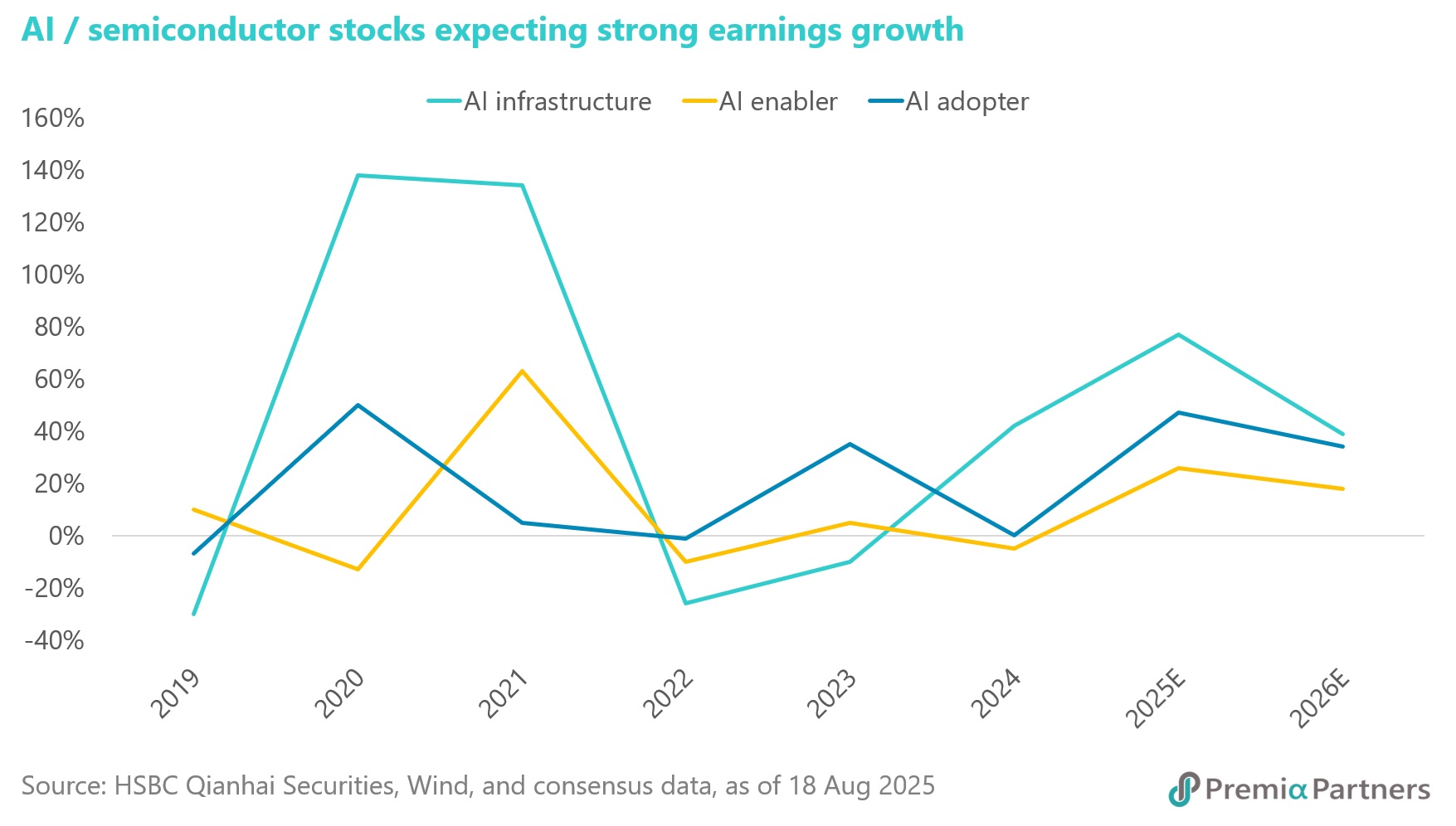

Artificial Intelligence (AI)

AI has become the most powerful structural theme in China’s A-share market, attracting both domestic and international capital.

- Institutional allocation trends – In 2Q25, domestic institutions increased AI infrastructure allocations by 2.4ppts, while foreign institutions raised allocations by 0.7ppts. AI enablers now account for over 11% of northbound fund holdings — the largest segment within the AI value chain.

- Stock-level inflows – Heavy fund buying has centered on optical module leaders like Eoptolink, Innolight, and Tianfu Communications, while semiconductor leaders such as NAURA Tech and SMIC also attracted strong northbound flows.

- Earnings growth drivers –

- Capex upcycle from cloud service providers, supported by resumed access to advanced AI chips;

- Expanding AI penetration — with 68% of A-share companies mentioning “AI” in annual reports;

- Accelerating consensus earnings growth across the AI value chain.

We believe AI will remain a dominant multi-year investment theme, supported by both cyclical capex momentum and structural adoption trends.

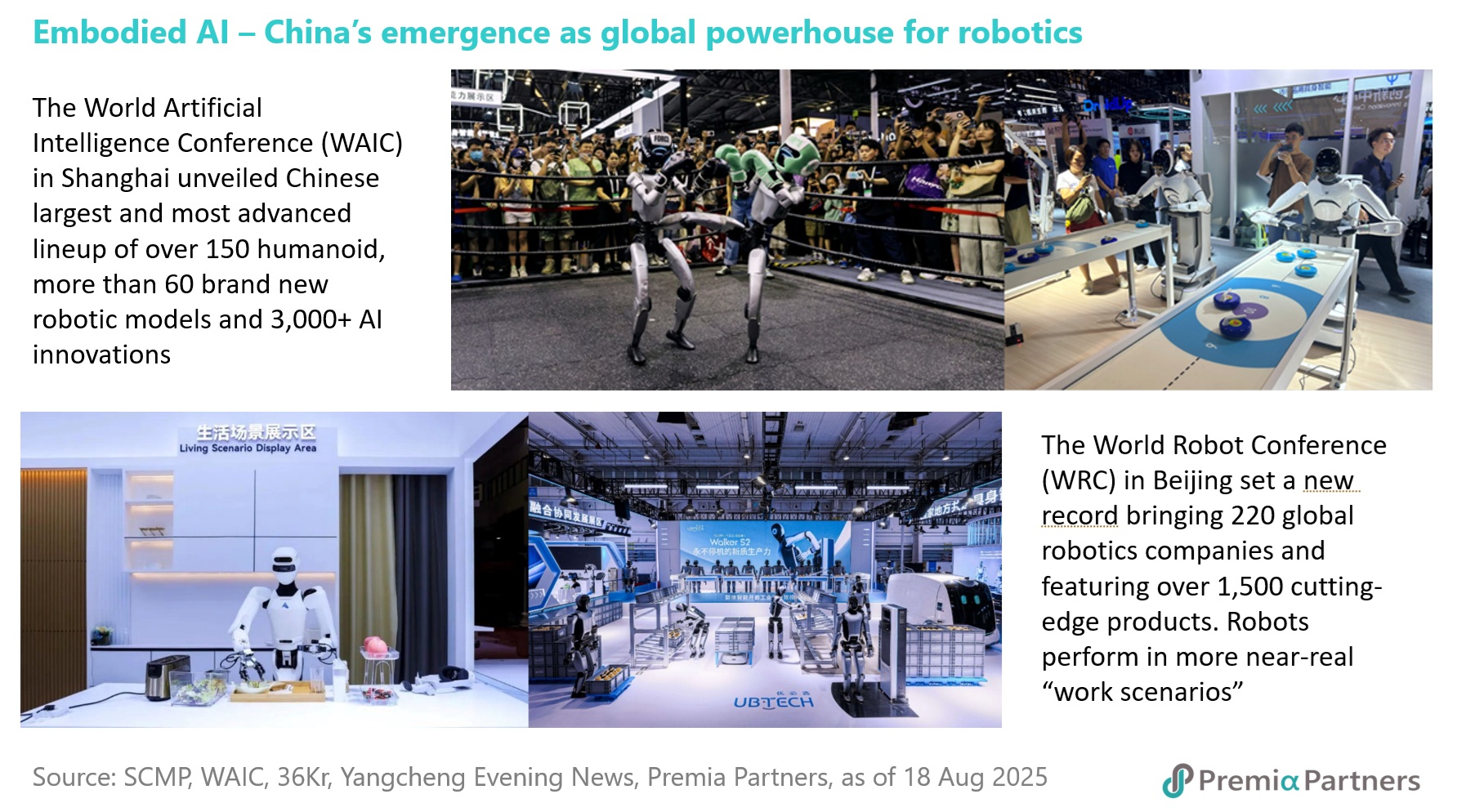

Embodied AI, Robotics & Industrial Automation

China’s robotics industry is able to quickly move from concept to commercialization, supported by industrial upgrading, availability of its highly efficient and integrated manufacturing prowess and sizeable domestic demand amid aging population and rising labour costs. Coupled with its AI development, China with the full fledged manufacturing ecosystem and cost scalability, is very well placed to lead as global powerhouse for humanoid robots and industrial robotics as embodied AI applications.

- Commercial transition – At the World Robot Conference (WRC) 2025, 220 companies showcased over 1,500 products, shifting focus from demonstration to active commercialization with negotiations around pricing, delivery, and maintenance.

- Application breadth – Humanoid robots, industrial robots, and service robots are being deployed in real work scenarios including handling, picking, collaborative operations, and medical rehabilitation.

- Healthcare robotics – Companies such as Fourier are deploying rehabilitation robots in top-tier hospitals, with therapists able to centrally control multiple robotic systems.

- Industry growth momentum – China’s robotics industry revenue rose 27.8% YoY in H1 2025, with industrial robot output up 35.6% and service robots up 25%.

This sector is becoming a critical enabler of China’s “Industrial 4.0” transformation, benefiting from both demand-side adoption and strong policy support for automation.

Premia ETFs as the best proxies for China growth and ideal for asset allocation and portfolio completion

With sentiment improving, structural catalysts building, and growth sectors leading the market higher, the case for increasing exposure to China A-shares is compelling. Valuations remain attractive, global positioning is still light, and fundamentals in innovation-driven sectors continue to strengthen.

For investors seeking efficient exposure to this opportunity, two Premia ETFs stand out as best-in-class tools:

- Premia China STAR50 ETF – Provides concentrated exposure to 50 leading innovators in hardcore technology, including semiconductors, advanced manufacturing, and other strategic emerging industries. It represents the highest-quality names within China’s STAR Board, often referred to as China’s Nasdaq equivalent. Many up and coming hard tech and robotic companies such as Unitree Robotics, Moore Threads are also in preparation of their STAR Board IPOs.

- Premia CSI Caixin China New Economy ETF – Offers balanced, diversified access to 300 companies across life sciences, renewable energy, industrial 4.0, digital transformation, and other key new economy sectors. It provides a broad-based approach to capture China’s structural growth drivers.

Together, these ETFs serve as the most efficient proxies for investors to participate in the ongoing rally in China A-shares, with focused exposure to the growth-oriented themes shaping China’s economic future.