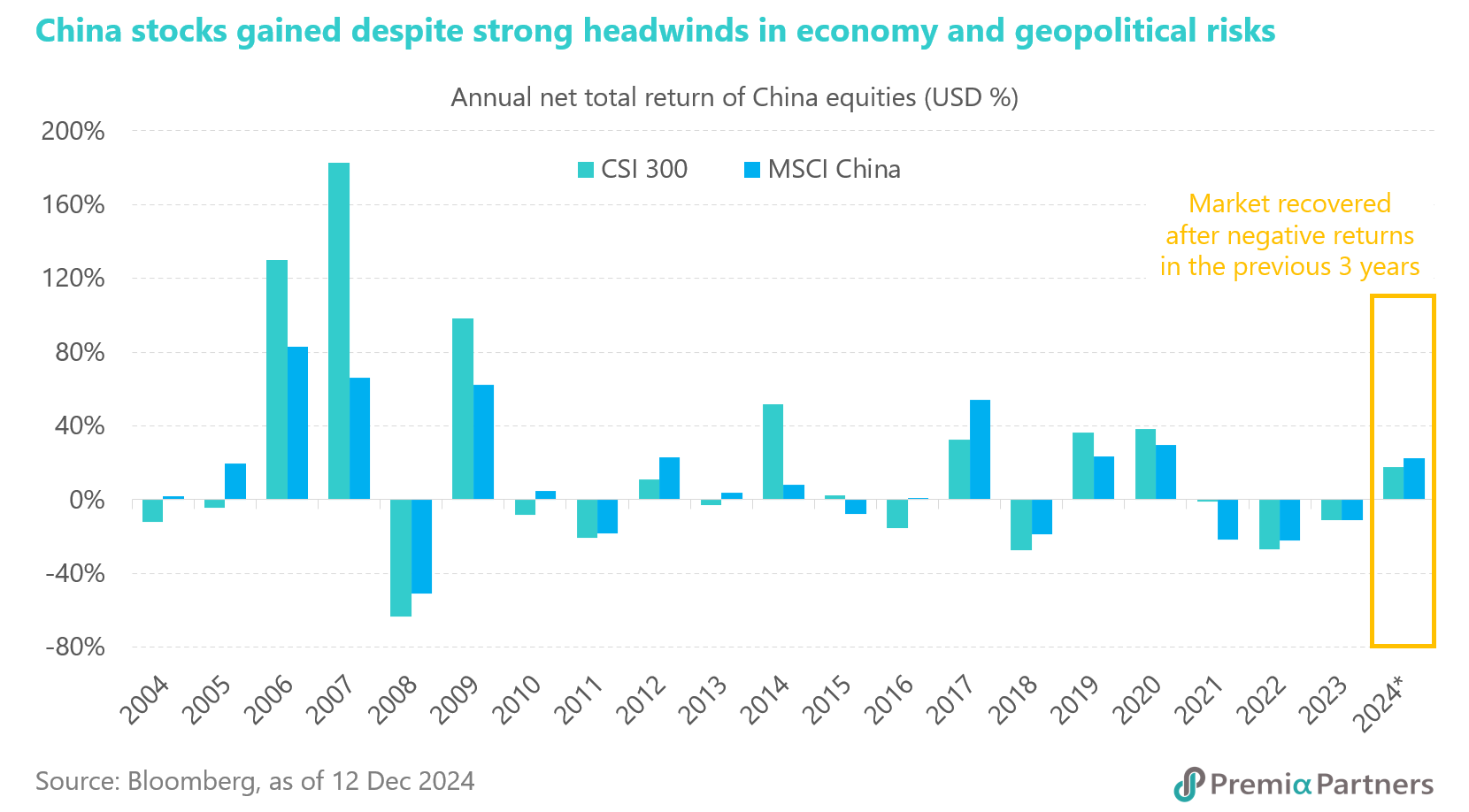

Investors should tune up their optimism for China market in 2025 after Chinese equities staged a remarkable recovery in 2024 whilst bond market continued its multi-year bull run, defying economic headwinds and renewed geopolitical uncertainties spurred by Donald Trump’s return to the US presidency. Despite slowing GDP growth, China’s equity markets posted robust double-digit gains, while the bond market rallied significantly, propelled by a notable drop in the nation’s yield curve. These developments reflect a fundamental shift in the government’s economic and monetary policy strategy, marking a decisive pivot toward growth-focused structural changes.

Faced with a challenging economic backdrop, President Xi Jinping and the nation’s top policymakers unveiled a series of aggressive measures aimed at stabilizing key sectors and spurring market confidence. This shift was characterized by a blend of monetary easing, housing market stabilization and initiatives to develop the capital markets.

To address liquidity concerns and stimulate borrowing, the People’s Bank of China (PBOC) implemented a reserve requirement ratio (RRR) cut and trimmed benchmark interest rate. These moves injected fresh liquidity into the financial system, fostering favorable conditions for credit growth. Meanwhile, measures to revitalize the housing market—a sector long perceived as a drag on the economy—were rolled out. These included relaxed mortgage terms, lower down payment requirements, and the removal of home-buying restrictions in major cities. Together, these steps sought to halt the prolonged downturn in the property market.

The government also reinforced its support for private enterprises, long considered the backbone of China’s economic engine, while easing restrictions on foreign investors. A key element of this strategy was the shortening of the "negative list," which outlines sectors restricted or prohibited for foreign investment. This demonstrated a renewed commitment to opening China’s markets and attracting global capital.

In a bold move to shore up the equity markets, authorities introduced a RMB 500 billion facility enabling institutional investors to purchase stocks. Additionally, mechanisms were established to allow banks to provide loans to listed companies for share buybacks and shareholding increases. These interventions underscored the government’s unprecedented involvement in stabilizing and promoting the capital markets, aiming to restore investor confidence and sustain upward momentum.

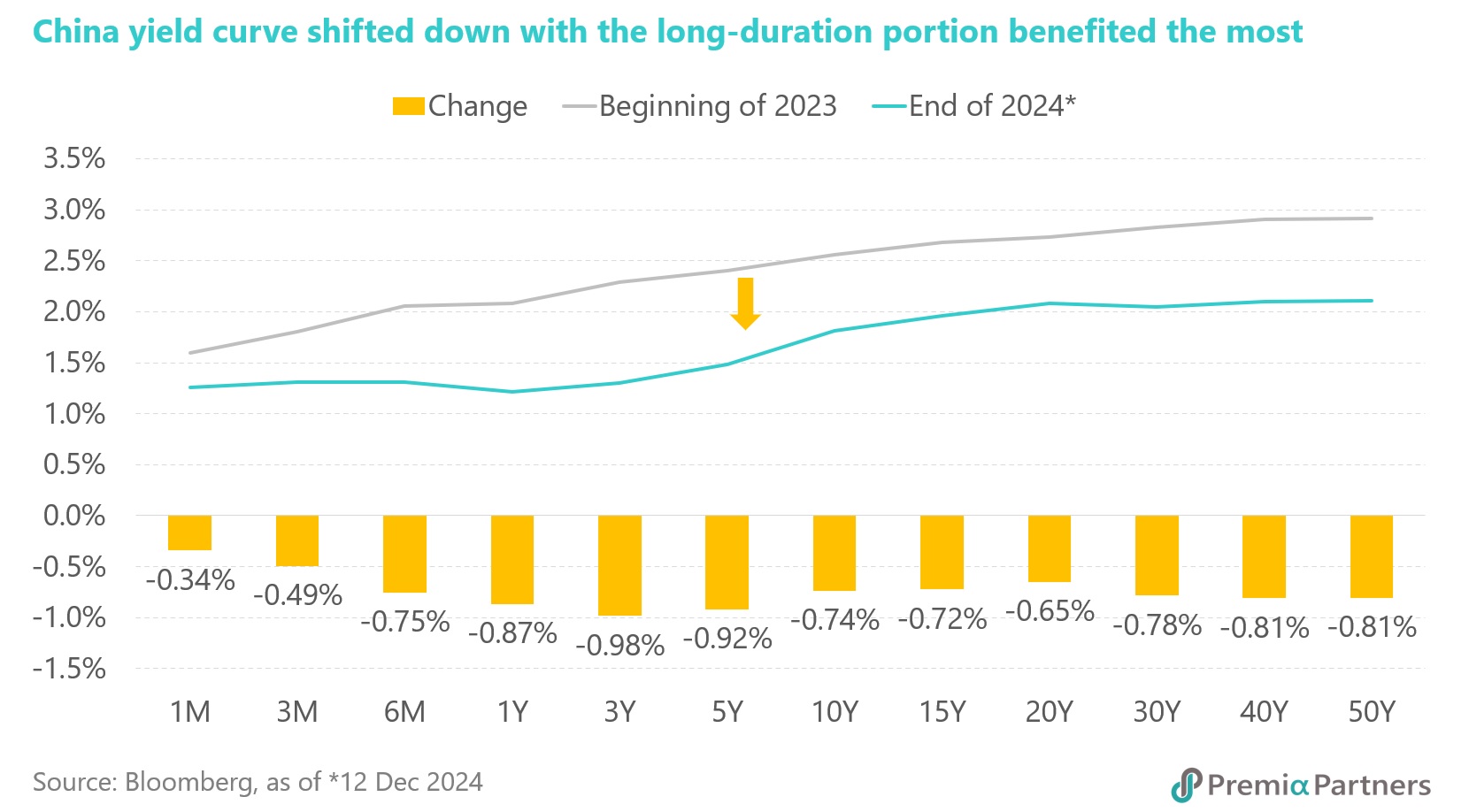

China’s bond market benefited significantly from these policy shifts, with yields falling to multi-year lows. The yield curve’s downward trajectory was a direct outcome of the PBOC’s monetary easing measures and the broader accommodative stance. Lower yields translated into higher bond prices, driving a rally that attracted both domestic and international investors seeking safe, long-duration assets.

These developments suggest a concerted effort by Beijing to ensure that both the equity and bond markets remain vibrant and resilient. By combining monetary easing, fiscal incentives and structural reforms, the government has signaled its commitment to overcoming economic challenges and fostering a more balanced growth model.

The outlook of China markets appears increasingly optimistic. Policymakers have laid a strong foundation for continued growth through proactive interventions and structural changes. With monetary and fiscal policies expected to remain accommodative, and targeted support for strategic industries and private enterprises, China’s equity and bond markets may maintain their upward trajectory. These bold measures not only stabilize the economy but also reflect the leadership’s long-term vision for a more open, innovative and dynamic financial system.

These measures have had an immediate impact, restoring confidence in the equity and bond markets. As these policies take full effect in 2025, they are expected to create sustained growth opportunities.

China’s inflation remains tame, paving the way for policy flexibility

China’s inflationary pressures remain subdued as consumer prices edge up only marginally, with the Consumer Price Index (CPI) holding steady between 0.2% and 0.6% year-on-year. On the industrial front, factory-gate deflation has extended into its 26th consecutive month, with the Producer Price Index (PPI) falling by 2.5% year-on-year in November, a slower decline compared to October’s 2.9% drop. While these falling prices continue to erode corporate earnings and dampen consumer spending, they also provide policymakers with considerable latitude to ease monetary policy further.

Politburo signals “All-In” approach to economic growth

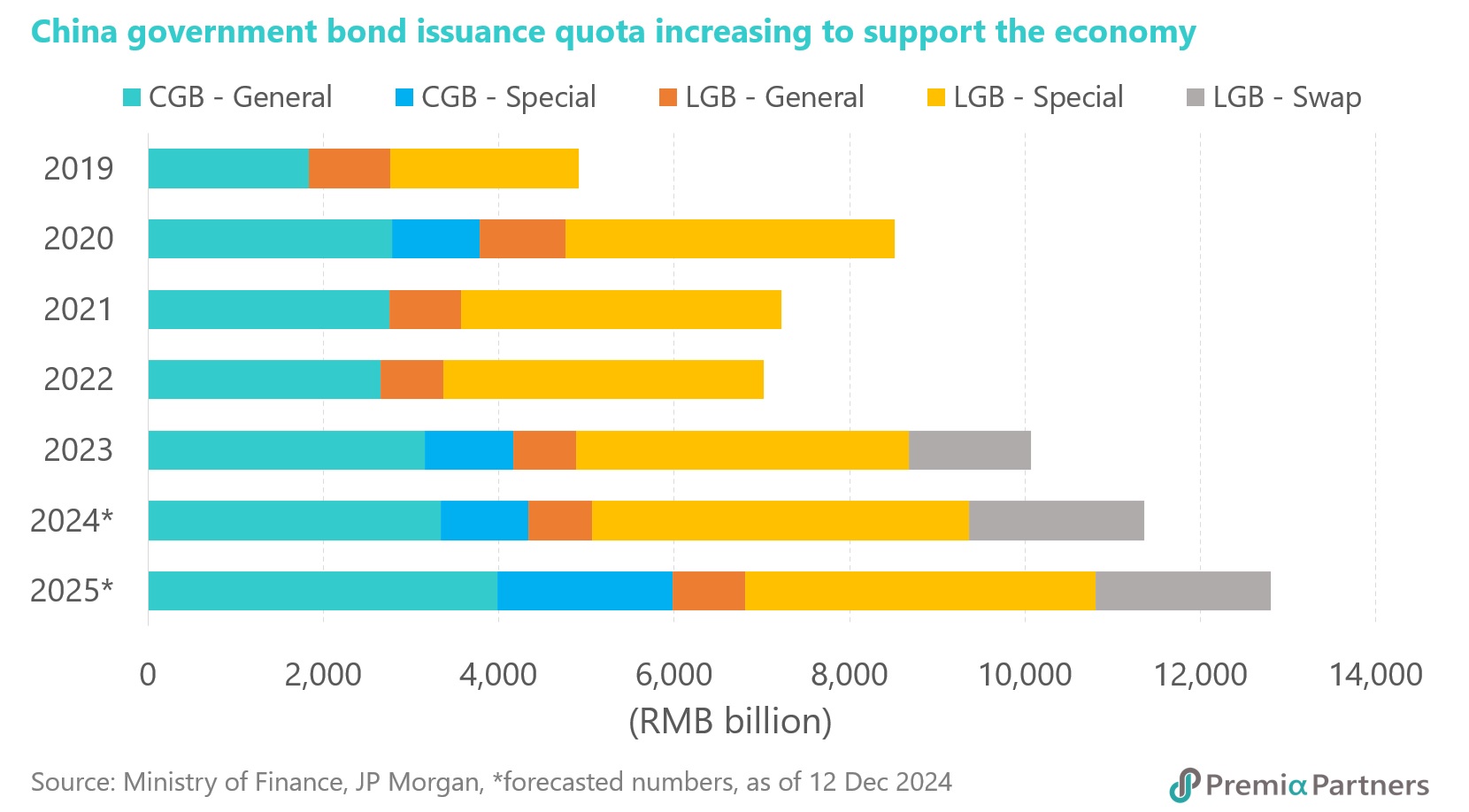

Beijing is set to take an aggressive stance in driving growth as President Xi Jinping’s decision-making Politburo signals a shift to a “moderately loose” monetary policy in 2025, as reported by state news agency Xinhua. This represents a departure from the “prudent” strategy upheld for nearly 14 years. The leadership has also called for a “more proactive” fiscal policy, spurring expectations of a wider fiscal deficit beyond the current 3% target, likely to be formalized at the National People’s Congress in March. Economists anticipate further rate cuts, supported by a comprehensive monetary and fiscal package to reinvigorate China’s economy.

Real estate: Inventory reduction at the heart of housing turnaround

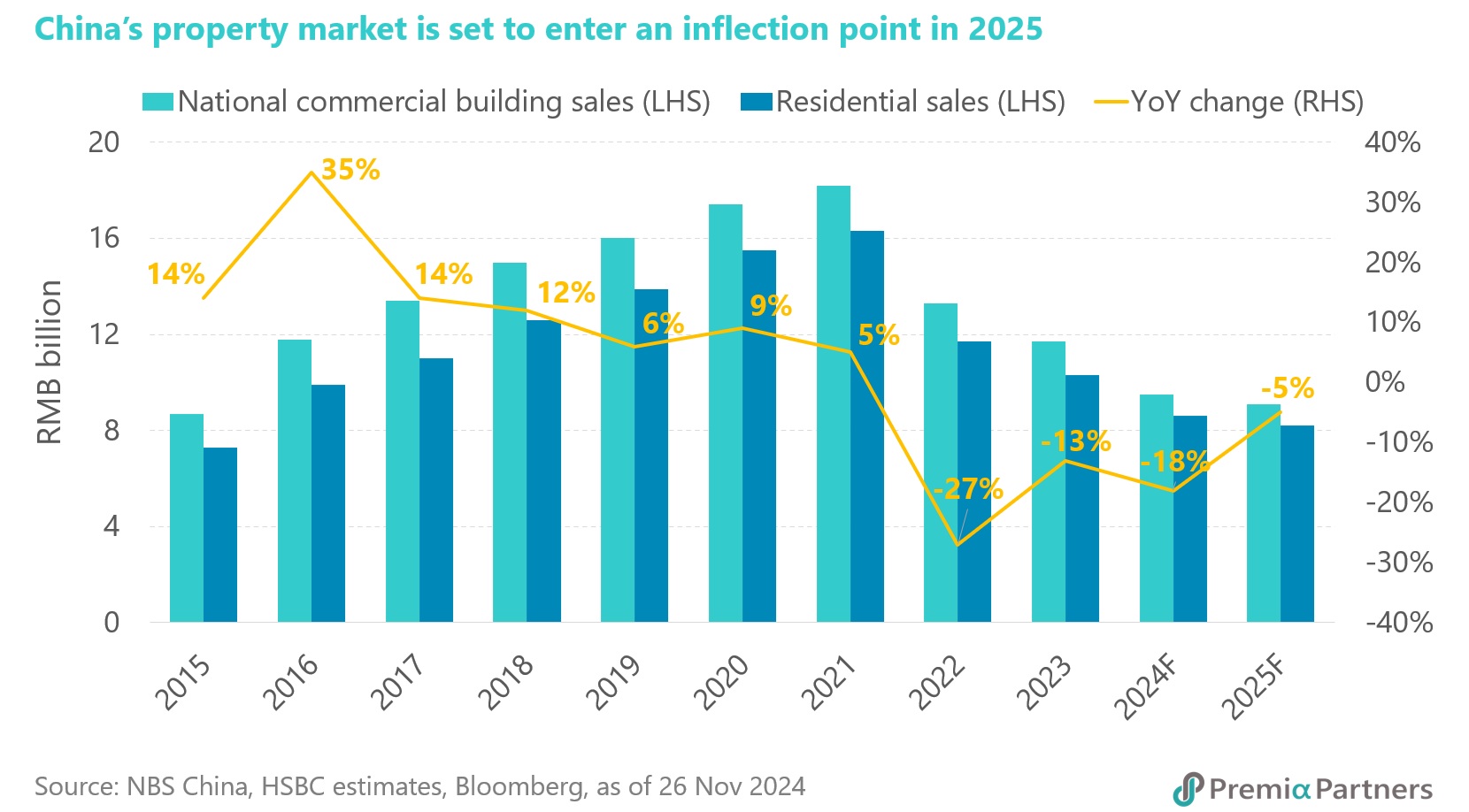

China’s troubled property sector may finally be turning a corner as Beijing rolls out fresh measures to tackle mounting housing inventories. A new initiative encourages local governments to purchase unsold homes and convert them into public and rental housing. This solution aims to halt the protracted negative spiral in the sector.

Progress is also being made on funding. The PBOC has introduced a 300-billion-yuan relending facility, while the Ministry of Finance has allowed special local government bonds to support housing inventory purchases. According to JPMorgan, allocating 10-15% of annual special bond quotas for this purpose could inject 2-3 trillion yuan over the next three to five years, providing crucial funding to sustain the housing recovery.

High household savings signal consumption potential

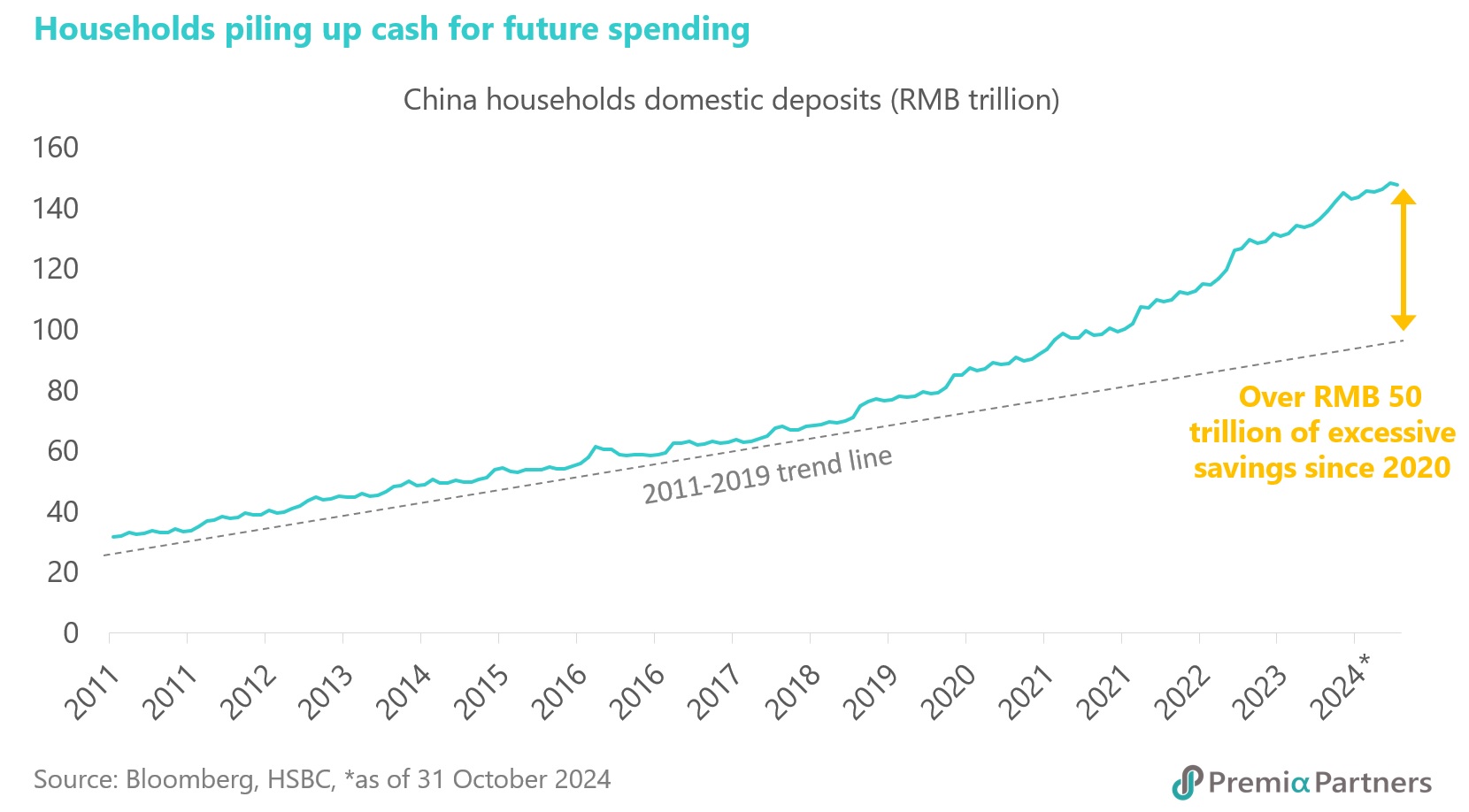

China is charting a progressive course to boost domestic consumption, beginning from structural measures such as subsidies for durable goods and job creation through investments to tentatively voucher issuance for dining, travel and sports. For only the second time in at least a decade, the top officials made “lifting consumption vigorously” and stimulating overall domestic demand their top priority. Meanwhile, the nation’s households have amassed substantial savings, with about RMB 148 trillion sitting in bank deposits—an amount that dwarfs the entire A-share market’s size.

Analysts suggest that stabilizing housing prices could reverse the negative wealth effect seen in recent years, unlocking the potential for a surge in consumer spending. Coupled with high liquidity across banks, these factors present a foundation for stronger domestic consumption in the near term.

US tariffs threaten China’s exports, prompt calibrated retaliation

The re-election of Donald Trump and the prospect of heightened US tariffs loom as major risks for China’s export sector in 2025. Chinese exports to the US totaled USD 506 billion in 2023, accounting for 14.1% of the nation’s total exports. A tariff hike from 20% to 60% could potentially slash exports to the US by 40%, with non-linear effects exacerbating the impact.

In response, China has begun leveraging its dominance in global supply chains. This includes restricting exports of rare materials with military applications and targeting US and European drone production by limiting key components. Anti-dumping investigations have also intensified. Analysts say these retaliatory moves are carefully calibrated to maintain leverage without triggering significant blowback on China’s economy or bilateral ties.

Focus on shareholder returns whilst foreign ownership is low

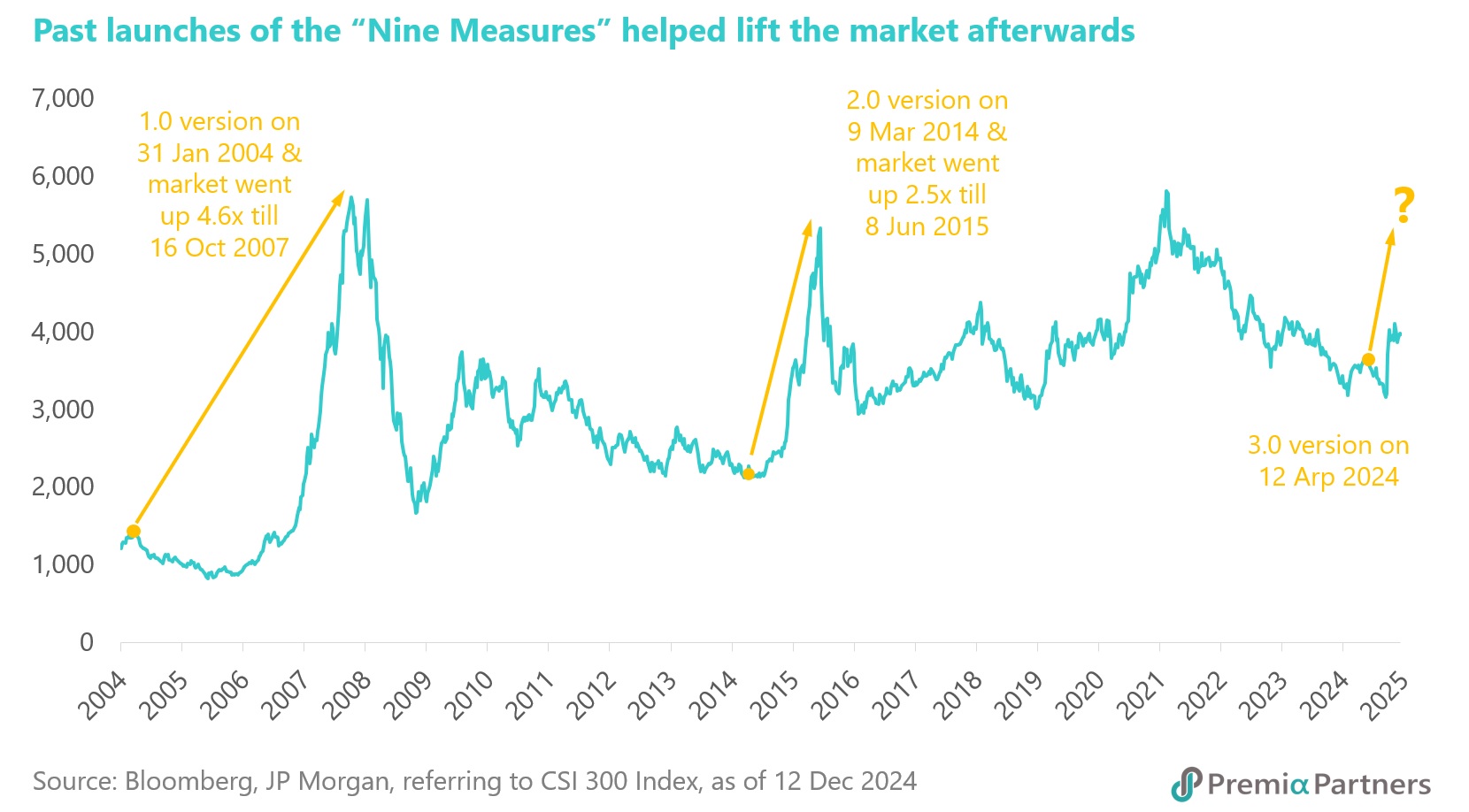

China is now emphasizing greater corporate efficiency as shown by the once-every-decade “Nine Measures” capital markets policy, which focuses on strengthening capital market supervision, raising the quality of listed companies through better shareholder returns, and enhancing shareholder protection. Almost 1,700 A-share companies have spent over RMB 160 billion buying back shares in 2024, a significant step-up from RMB 91.3 billion the previous year. Better corporate governance, specifically a focus on increasing returns to shareholders through dividends, buybacks and enhanced returns on equity, constitutes a potential added source of return in a complex macro environment.

Mutual fund and hedge fund positions in Chinese equities have dropped back to low levels following a brief wave of net buying during the recent market rally. Global mutual funds’ exposure to China is now at the 8th percentile relative to their 10-year historical averages, while hedge funds’ positioning sits at the 11th percentile. Despite this retreat, September's market movement suggests that foreign inflows can swiftly return to drive gains if economic fundamentals improve. Analysts point to policy support designed to mitigate downside risks to growth as a key factor that could underpin a moderate recovery in valuations for A-shares. Currently, A-shares trade at a forward 12-month price-to-earnings (P/E) ratio of 13.1 times, compared to the global equities’ average of 18.6 times. Looking ahead, consensus estimates forecast earnings growth for Chinese equities of 9 per cent in 2025 and 13 per cent in 2026, offering potential for longer-term upside if supportive measures take hold.

Key investment themes in 2025

China is poised to accelerate development in core technologies as its economic strategy pivots toward innovation and self-reliance, spurred by shifting global dynamics and strategic priorities. Meanwhile, dividend-paying equities, long-duration bonds and a recovering housing sector are gaining prominence as policymakers signal a "moderately loose" approach to monetary policy in 2025.

A high-stakes push into hardcore technology - Beijing’s resolution to strengthen its technological foundations is set to deepen, particularly in artificial intelligence, semiconductors, robotics and biotechnology. The urgency stems partly from renewed tensions with the US following the return of Donald Trump, with the market bracing for tighter restrictions on technology transfer and potentially higher tariffs.

At the same time, China’s dominance in the supply chain of emerging industries, such as electric vehicles, renewable energy and lithium batteries, demonstrates the success of years of focused investment. This has positioned the country as a leader in these high-growth segments, ensuring it remains competitive despite external pressures.

For investors seeking exposure to this trajectory, funds such as the Premia China STAR50 ETF and Premia CSI Caixin China New Economy ETF provide targeted opportunities. The former focuses on 50 leading innovators in cutting-edge industries, while the latter offers a diversified basket of approximately 300 firms across new economy segments.

Dividend-yielding equities gain favor in a low-rate environment – As China embarks on multiple rate cuts in 2025, traditional savings instruments such as bank deposits may lose their appeal, pushing investors toward higher-yielding alternatives. Dividend-paying mid- to large-cap stocks with robust fundamentals and stable balance sheets are likely to benefit from this shift.

The Premia CSI Caixin China Bedrock Economy ETF, a multifactor strategy emphasizes value, quality and low volatility, presents a compelling option for navigating varying market cycles. Its consistent outperformance—cumulatively 30 percentage points above the benchmark over five years—underscores its resilience and attractiveness as interest rates decline.

Bullish bets on long-duration government bonds – China’s pivot to monetary easing has invigorated its sovereign debt market, with analysts predicting record-low yields. Institutions such as Tianfeng Securities and Standard Chartered Bank forecast 10-year bond yields could fall to as low as 1.5%-1.6% by the end of 2025. These projections are supported by expectations of policy rate cuts ranging from 40 to 60 basis points and potential reductions of up to 250 basis points in the RRR.

For investors, the Premia China Treasury and Policy Bank Bond Long Duration ETF stands out as a vehicle to capture these trends, focusing on the long end of China’s yield curve, which is most sensitive to policy shifts. A dollar hedge version of the ETF is also available for those who would prefer not to expose to Chinese yuan.

Stabilization in the housing sector – China’s property market, long a source of economic instability, is showing signs of a meaningful turnaround. Despite concerns about an oversupply of vacant homes, steady inventory reductions since 2021 are beginning to reshape the landscape. New housing starts, a key indicator of future supply, remain subdued, accelerating the destocking process.

Recent policy measures, including local government purchases of unsold homes for conversion into rental or public housing, are expected to stabilize property prices by late 2025. Analysts at Goldman Sachs and HSBC foresee a gradual recovery, with state-owned developers expected to consolidate their market shares due to superior funding access.

Nomura’s 2025 Asia Credit Outlook projects a “bumpy uptrend” in Chinese property USD bonds, akin to 2024, suggesting cautious optimism. The Premia China USD Property Bond ETF, which excludes defaulted bonds and focuses on viable issuers, offers a prudent choice for investors seeking exposure to this recovery theme.

In conclusion, China’s equity and bond markets are set for a dynamic 2025, underpinned by a supportive policy environment and emerging structural opportunities. While challenges such as geopolitical risks and weak domestic demand persist, the government’s proactive stance on monetary easing, housing stabilization, and consumption growth is creating a foundation for sustained market performance. Investors should focus on strategic themes—from hardcore technology to dividend plays and long-duration bonds—to navigate and capitalize on the evolving landscape of China’s capital markets.