Contrary to the western world where Healthcare is a more mature sector, in emerging markets a number of healthcare industries are in fact “new economy” sectors given the economic development and demographic trends. In fact, due to convergence of factors such as expansion of the middle income class, aging population and more recently the pandemic outbreak, related dollars spent and overall healthcare needs have increased significantly in China as has been globally as well.

This is one of the megatrends for China supporting the investment thesis for healthcare sub-sectors such as biotech, medical equipment, medical beauty, contract research (CRO) and testing, etc. in particular, which have seen significant growth and policy support in recent years, consider especially that the majority of the big ticket equipment and expensive drugs applied in China are still imported – something the government is very keen to develop local expertise for to allow for more affordable services for more people in need. Meanwhile, as in most countries, these are also highly regulated sectors for safety and consumer protection reasons. High growth biotech and medical equipment companies also typically have high upfront R&D expense requirements. On the other hand, the government has also adopted central procurement for hospitals with regards to a list of critical and important medicines and medical consumable items to ensure affordability. These inevitably would squeeze profitability for the operators when price ceilings are set.

With this backdrop, selection of the appropriate sub-sectors and growth leaders would be important for a sector that also tend to exhibit higher volatility and valuation multiples than mature, established industries.

In our Premia CSI Caixin China New Economy ETF (3173.HK), healthcare has always been one of the top-weighted sectors and now has a total exposure of around 27% from 65 names. In fact, many leading healthcare companies by nature often exhibit high quality fundamentals, with solid financials, light-asset models and high growth, making them ideal candidates to pass the strict selection processes including the quality factor screen under the ETF’s underlying index methodology.

In this article, we would like to further categorize these companies and see how they fit into the new economy theme that could benefit from the aging population and ongoing innovation.

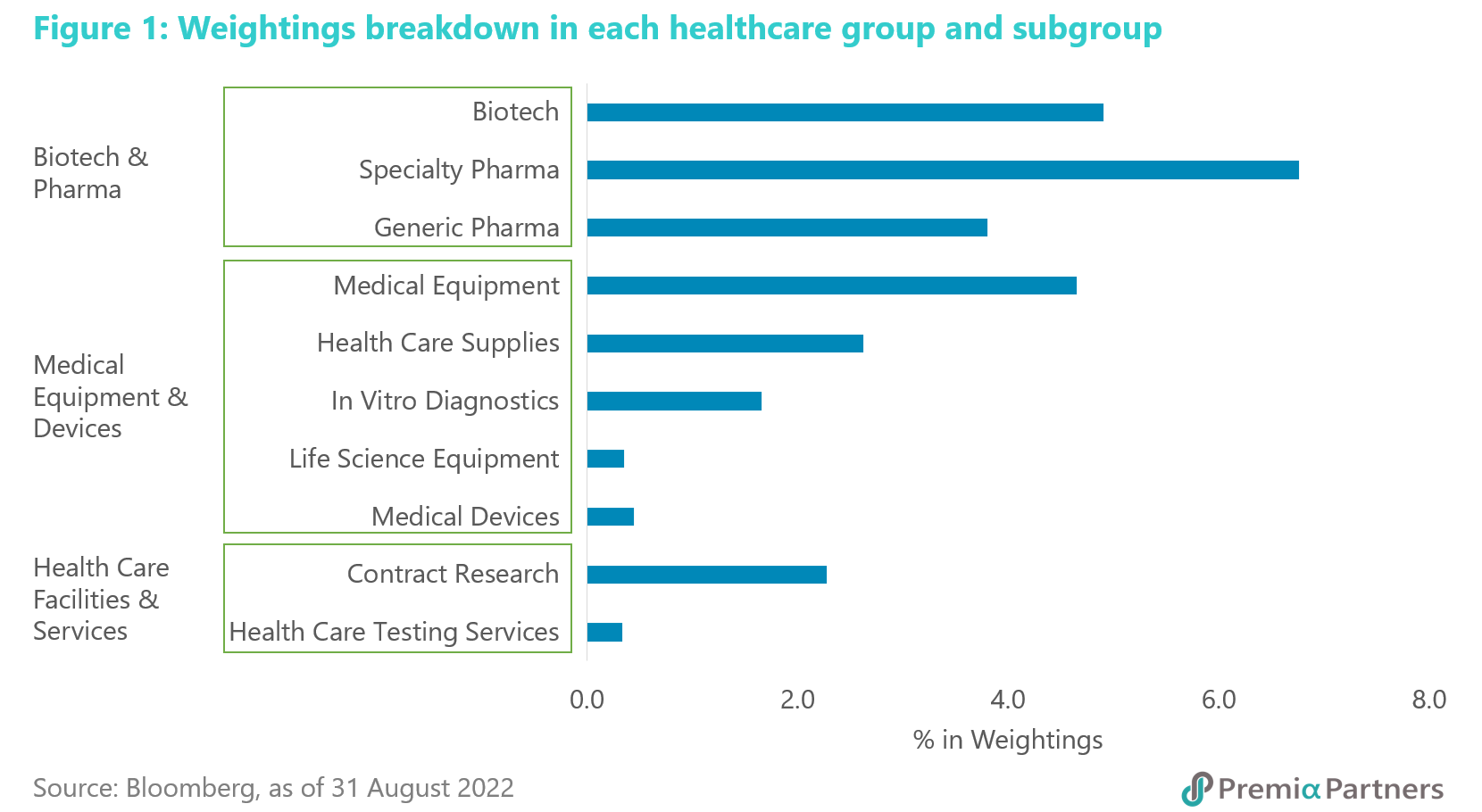

With the help of the Bloomberg Industry Classification Standard (BICS), we may classify the healthcare companies held by the ETF into three main groups: Biotech & Pharma, Medical Equipment & Devices, and Health Care Facilities & Services. They could then be further divided into ten subgroups. Below is the distribution of the 65 healthcare companies within the three main groups and ten subgroups.

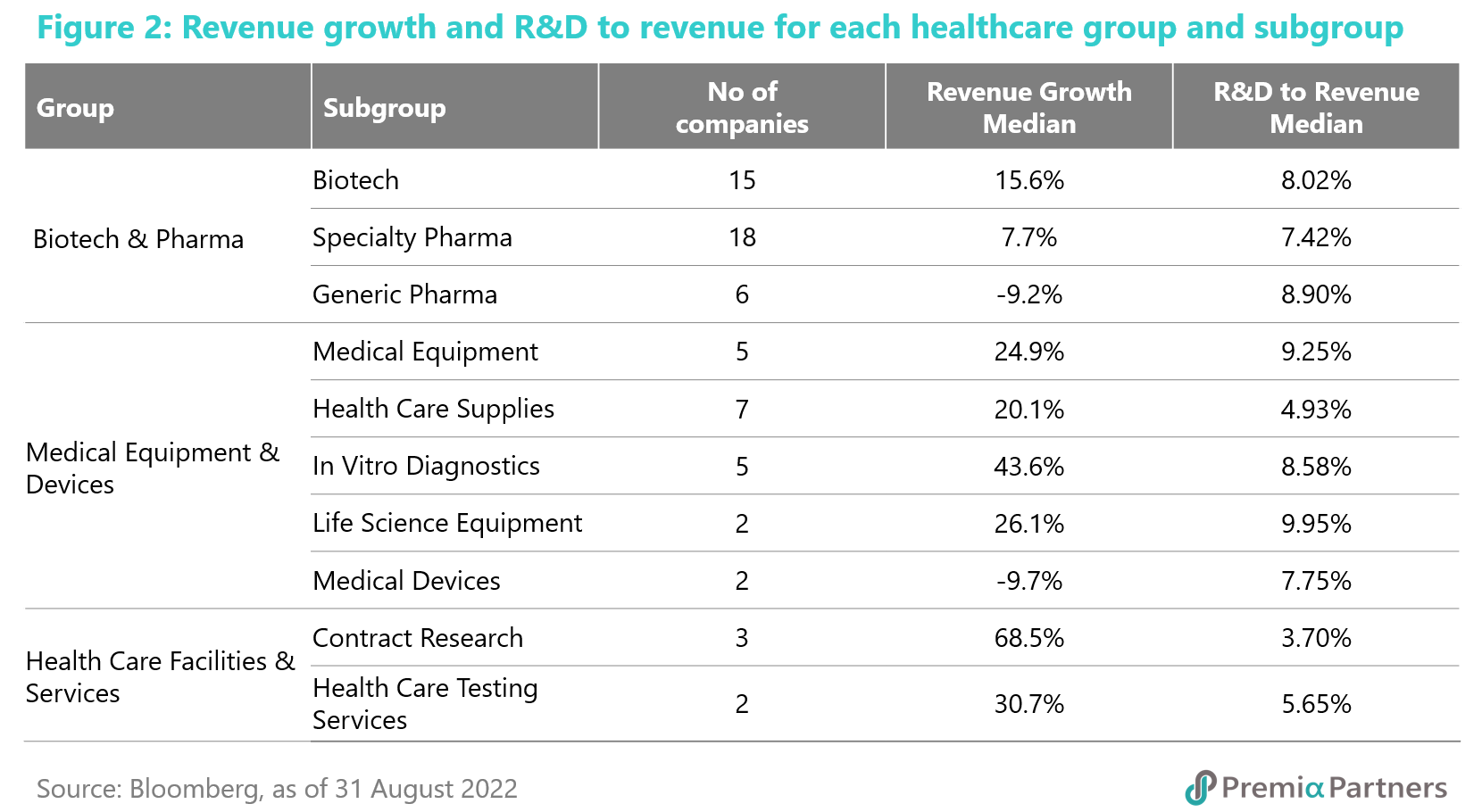

Since the earnings season of China A-shares for the first half of 2022 (1H22) has just come to an end, we would use the year-on-year revenue growth as a gauge to see if the companies of each subgroup in the ETF could maintain their growth trend in this period. At the same time, we would also look at the R&D expenses to revenue ratio to see if these companies have invested sufficiently to stay innovative and competitive.

Biotech & Pharma

Biotech & Pharma consists of Biotech, Specialty Pharma and Generic Pharma, accounting for the ETF’s weights of 4.9%, 6.8% and 3.8% respectively.

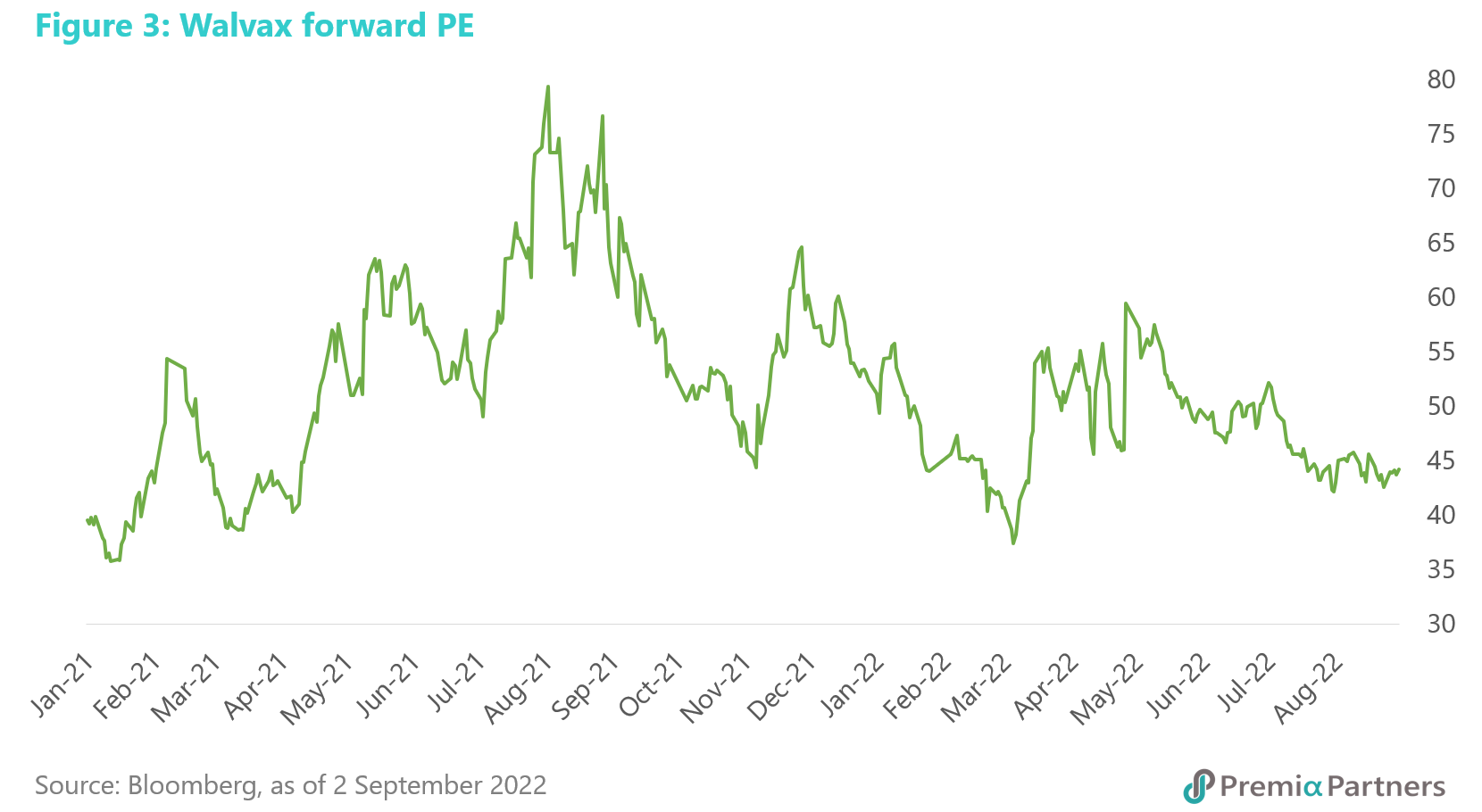

Biotech “includes companies that specialize in discovering, developing and patenting novel pharmaceuticals”. Typically, these companies have high R&D investments, primarily focus on drug discovery and development, and rarely carry out vertical diversification. Due to the biotech’s make-or-break nature, the revenue growth of this segment in 1H22 shows a wide range of dispersion from -69.4% to 74.0%. One of the representative biotech companies is Walvax Biotechnology Co Ltd. (300142 CH), which produces pneumonia and HPV vaccines, recorded 74% in revenue growth and 17% in R&D expense to revenue ratio. As the hype on the COVID-19 vaccines fades in the market, the valuation of the segment is back to a more reasonable level. For example, Walex is now trading at a forward PE multiple of ~44 times, as compared to almost 80 times a year ago.

Specialty Pharma companies “engage in less risky drug development, such as reformulations and branded generics”. Within the ETF, some of these companies may leverage on brand building to serve the mass consumer market, such as Pien Tze Huang (600436 CH) and Imeik Technology (300896 CH), which recorded decent revenue growth rates in 1H22 of 14.9% and 39.7% respectively. The overall median revenue growth of Specialty Pharma is positive and sits between Biotech and Generic Pharma.

Generic Pharma “includes companies that specialize in manufacturing generic pharmaceuticals and their active ingredients”. This segment saw a drop in revenue in 1H22 as the government has enlarged the coverage of the centralized procurement program that aims to lower the drug prices. Their share price may face some regulatory headwinds; however, the long-term growth prospect remains intact as the aging population would provide a sustainable demand for generic drugs. One of the representative generic pharma companies is Changchun New & High Tech (000661 CH), which recorded 17.5% in revenue growth and 10.3% in R&D expense to revenue ratio.

Medical Equipment and Devices

The second largest group in the healthcare of the ETF would be Medical Equipment & Devices which consists of five subgroups: Medical Equipment, Health Care Supplies, In Vitro Diagnostics (IVD), Medical Devices and Life Science Equipment, accounting for the ETF’s weights of 4.7%, 2.6%, 1.7%, 0.4% and 0.4% respectively. Since Medical Devices and Life Science Equipment are relatively small, we would focus on the other three subgroups here.

Medical Equipment “includes companies that manufacture health care equipment for cosmetic surgery, radiation therapy and imaging, medication monitoring and delivery, and dental”. Some leading players like Shenzhen Mindray Bio-Medical Electronics (300760 CH) may also be involved in other high growth segments like IVD. The revenue growth rate is quite decent in this segment due to strong domestic demand and increasing exports orders.

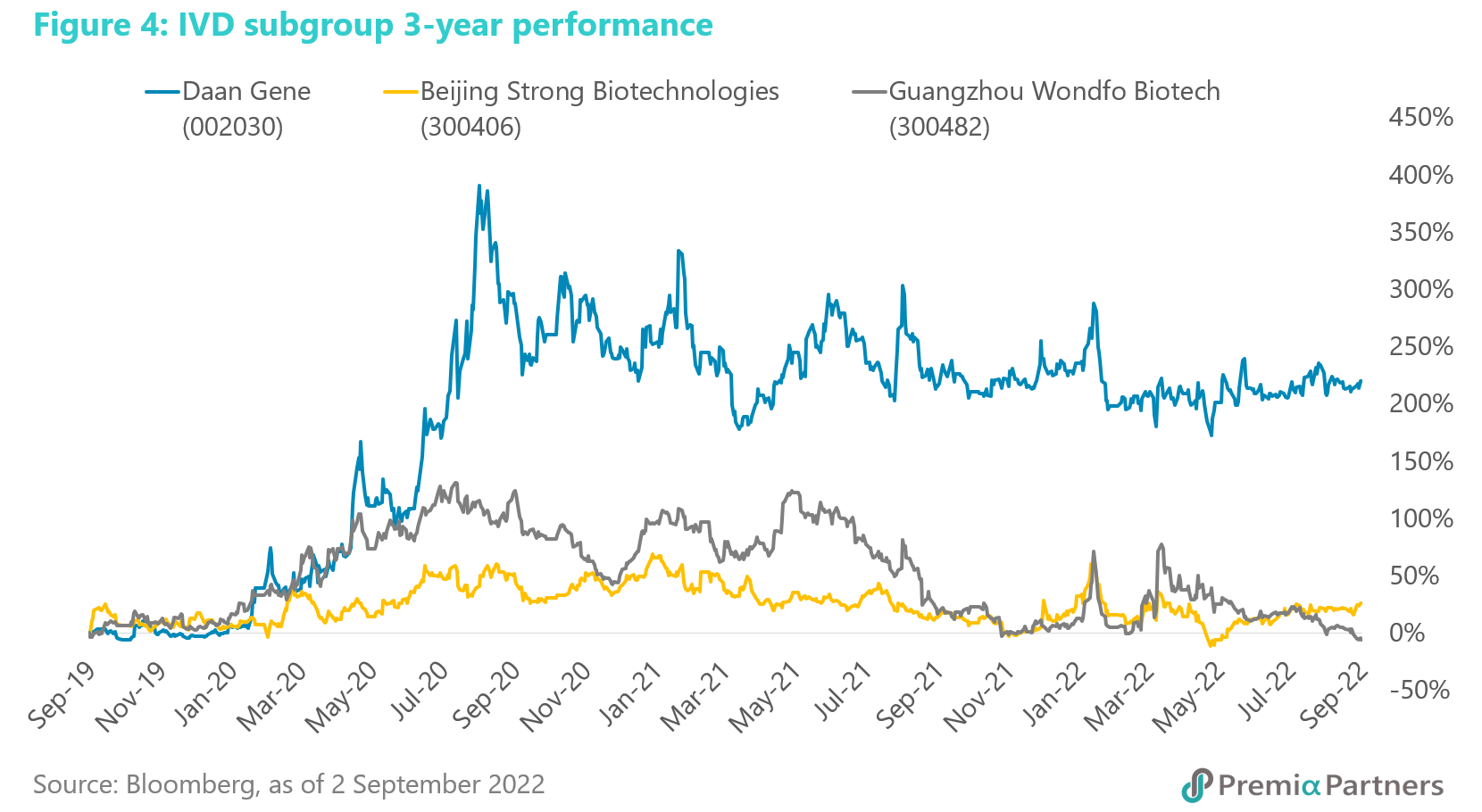

IVD “includes companies that manufacture in-vitro diagnostics substances that are used for diagnostic tests in test tubes, petri dishes and machines”. One of the representative companies is Daan Gene Co Ltd (002030 CH), which researches, develops, manufactures and sells fluorescence polymerase chain reaction (PCR) diagnostic kits and related medical equipment. PCR can be used in diagnosing various viruses, including COVID-19. Due to the mass testing of COVID-19 in China, most of the IVD companies recorded a substantial increase in revenue growth. The market has priced in the future growth quite aggressively in the past two years, so it is not surprising to see their underperformance so far this year. On the other hand, the R&D expense to revenue ratio of IVD still maintains at a relatively high level compared to other subgroups, even though the revenue has ballooned in 2022 1H, showing that the companies are still optimistic about the long-term growth prospect of the industry.

Health Care Supplies “includes companies that manufacture surgical appliances, supplies, and ophthalmic goods.” This segment has similar revenue growth as Medical Equipment. One of the representative companies is Jafron Biomedical (300529 CH), which specializes in producing disposable hemoperfusion that has a wide range of usage, even in treating patients with severe COVID-19 symptoms. The health care supplies companies focusing on producing protective gloves have seen a slump in revenue as they face falling demand with lower product prices.

Health Care Facilities & Services

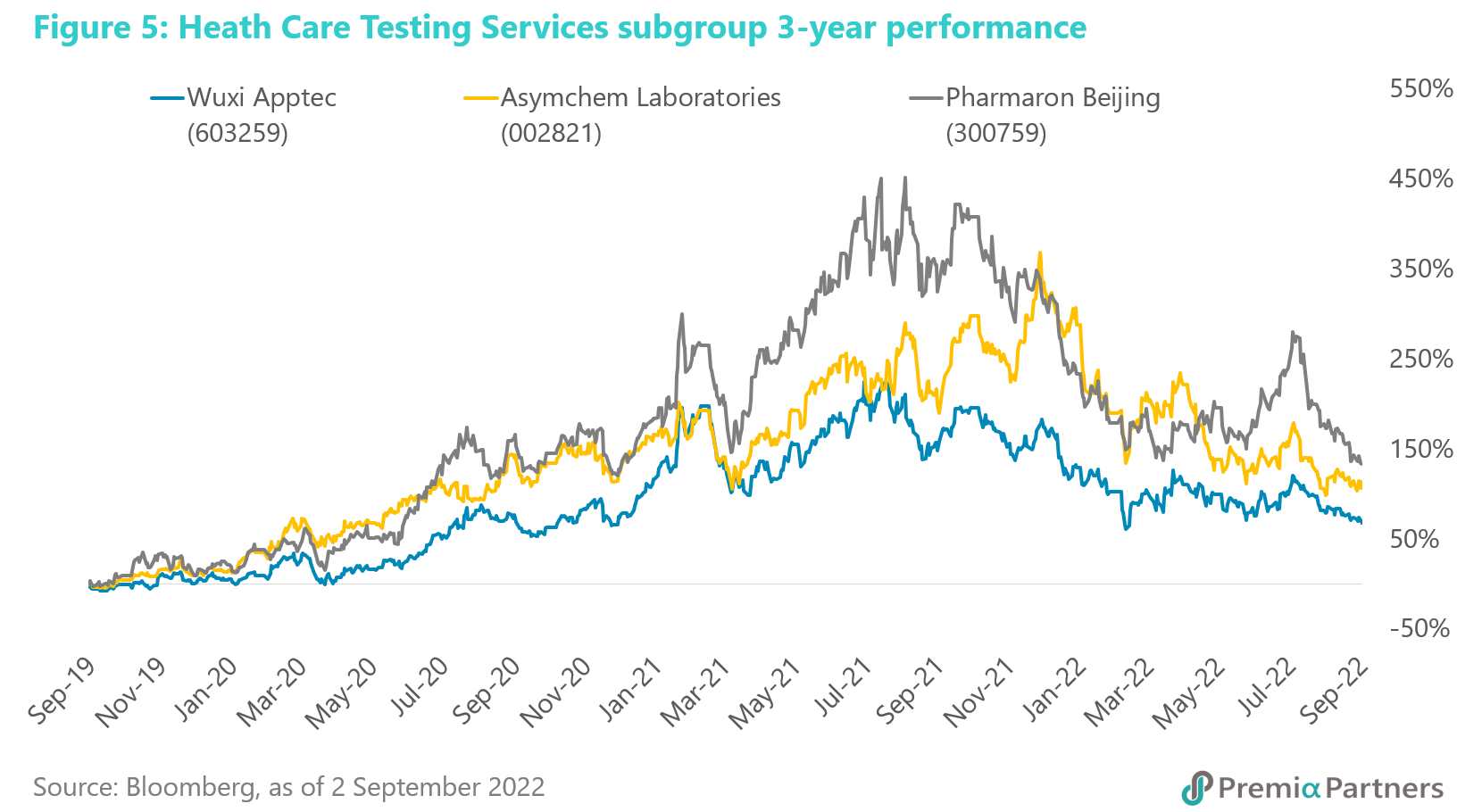

The final group is Health Care Facilities & Services which consists of Contract Research and Health Care Testing Services, accounting for the ETF’s weight of 2.3% and 0.3% respectively. Since Health Care Testing Services only has a minor exposure in the ETF, we would focus our discussion on Contract Research. The revenue growth is quite consistent throughout the Contract Research segment ranging from 41.1% to 187.2%, as China supports the outsourced drug discovery and development industry. Wuxi Apptec (603259 CH) is a clear leader in drug testing and validation services. One of the key concerns in this segment is its relative high reliance on the overseas market, highlighting the revenue may be affected by the global economic slowdown and mounting geopolitical risks. Indeed, the US President Biden signed an executive order to bolster domestic biomanufacturing and reduce reliance on “Contract Development and Manufacturing Organization” services aboard. Analysts do not see any immediate impact to the related Chinese firms though. It is challenging for US pharmaceutical and biotech companies to shift the manufacturing to the US completely to compensate the higher operating costs, while building up the infrastructure and industry know-how cannot happen overnight. The USD 1 billion assigned in the executive order for investment over the next five years seems to provide insufficient incentives for the change.

Conclusion

Most of the subgroups in healthcare continued their decent growth in 1H22 despite the challenging economic environment, confirmed that the sector offers tremendous investment opportunities as one of the major focuses in the new economy. At the same time, we see that the R&D expenses maintain at a decent level, showing the companies are willing to invest in order to stay ahead of the innovation curve.

In terms of the stock performance, the sector shot up to an unprecedented level in 2020 as investors priced in aggressively on the COVID-19 event, so the share price eventually came down in the past 18 months to a more reasonable level that could be supported by the fundamentals. The long-term growth and innovation trend remains intact, and it may be the right time to re-enter the market for long-term capital gain. On a risk-adjusted return basis, investing in a basket of them should be an optimal solution.

As such, investors may consider our Premia CSI Caixin China New Economy ETF (3173.HK), which not only provides an exposure to healthcare but also invests in a range of other new economy sectors such as information technology, industrials, consumers and materials, to capture various long-term growth trends in China market.