31% year-on-year growth in global EV sales – great news for battery makers who benefit from around a third of the cost of electric vehicles. Global EV (Battery Electric Vehicles and Plug-in Hybrid Electric Vehicles) sales surged to a record high of 30.5% year-over-year in September, primarily driven by robust demand from China (47.9% year-on-year growth), the United States (4.3%) and Europe (4.2%), according to Rho Motion data. Batteries, accounting for a substantial 25%-40% of an EV’s total costs, have emerged as the biggest beneficiaries of this massive surge in EV growth.

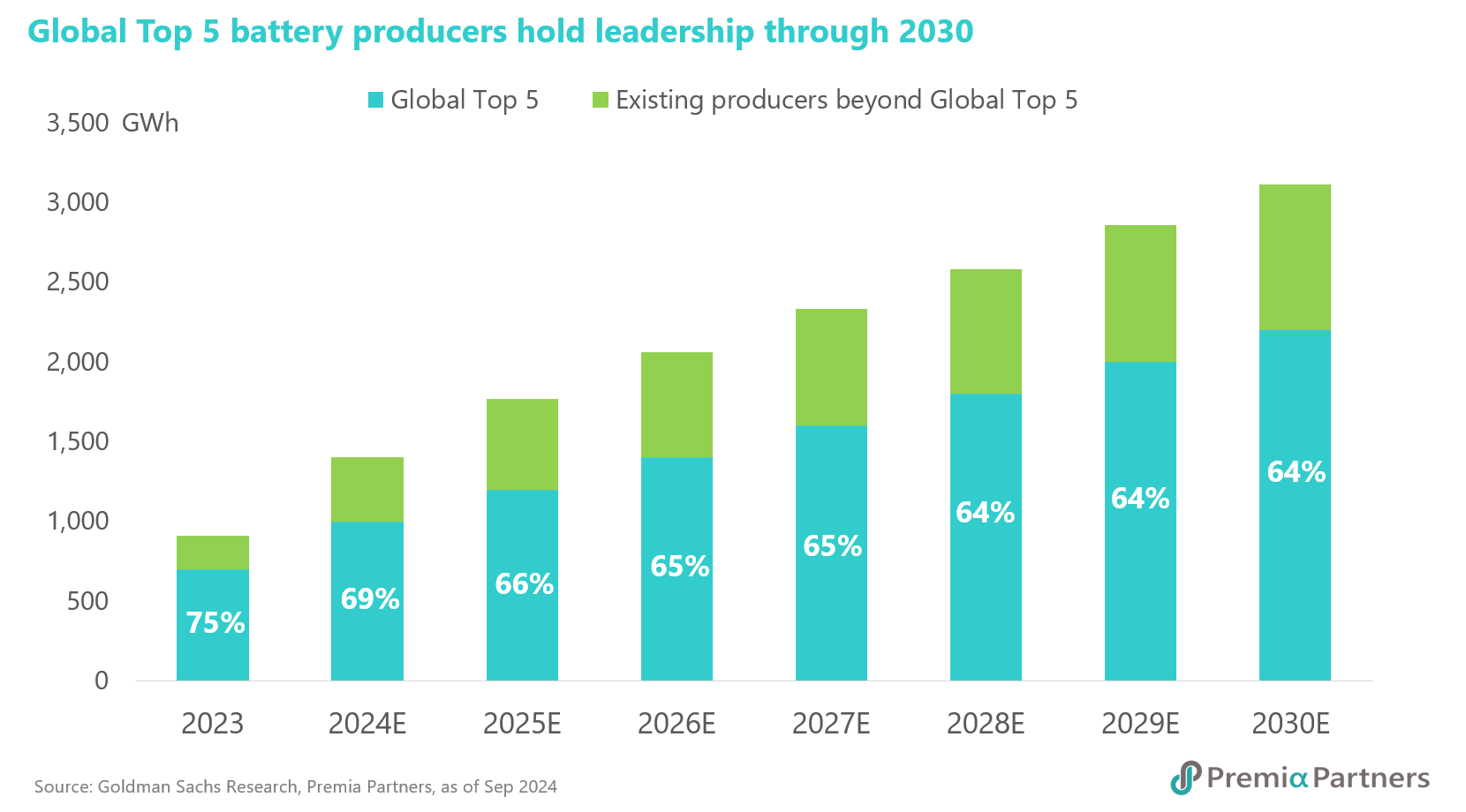

The world’s five biggest players continue to hold about two thirds of the global battery market. The top five global players—CATL, LGES, BYD, Panasonic and Samsung SDI—are poised to maintain a combined 65% global market share through 2030, supported by a virtuous cycle of massive R&D and capex, as highlighted in Goldman Sachs' latest research.

CATL and BYD entrench their positions as the world’s number one and two battery makers. China leads the way in lithium iron phosphate (LFP) and ternary (NCM) lithium batteries, which accounted for 71.4% and 28.5%, respectively, of the country’s total installed capacity of power batteries in the first nine months of the year. This represents year-over-year growth of 42.4% and 21.2%, respectively.

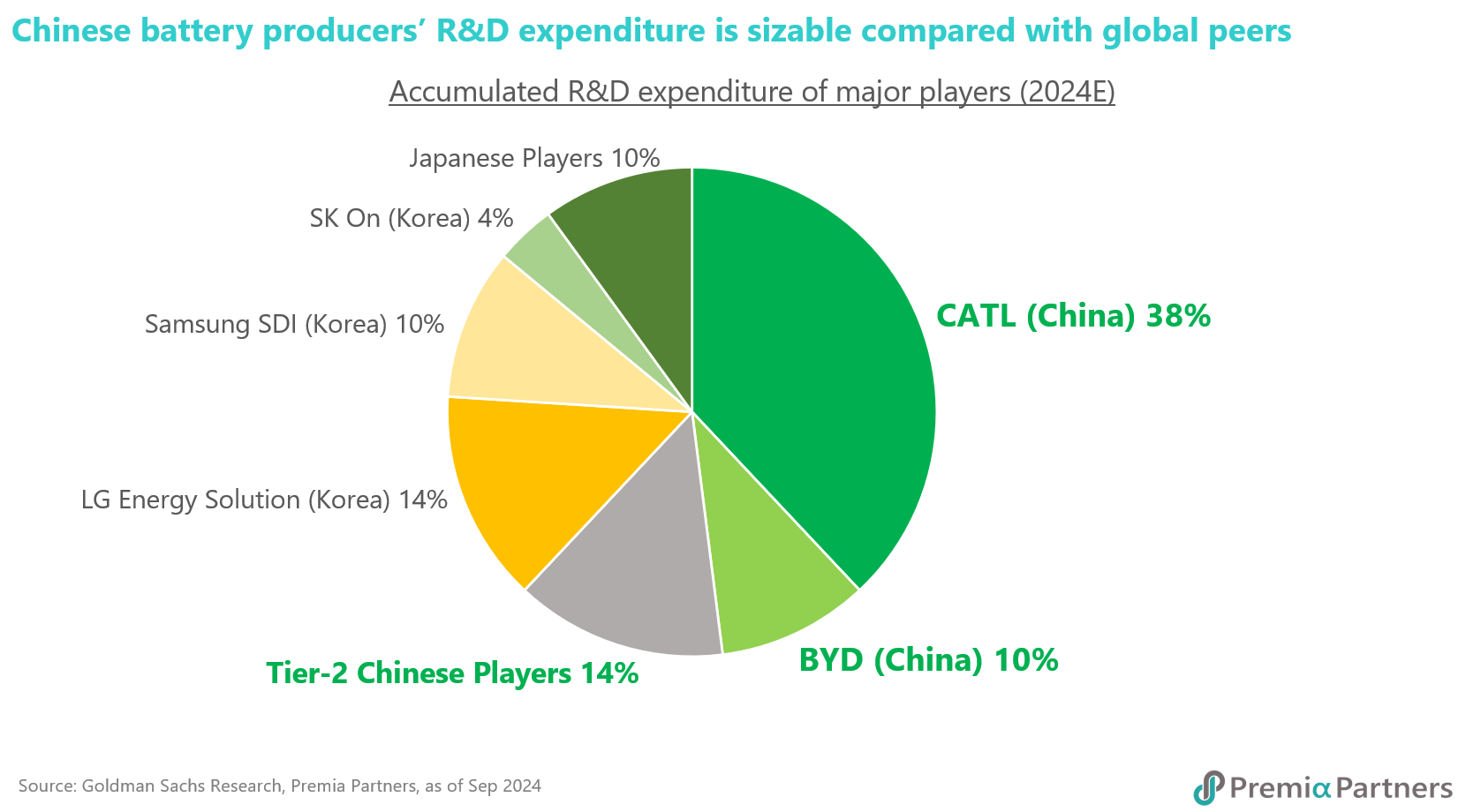

CATL and BYD solidified their positions as the world's first and second largest EV battery manufacturers, with installed capacities of 157.69 GWh and 84.84 GWh, respectively, during the same period. Goldman Sachs recommended Buy for CATL and BYD citing their continuous efforts in differentiating product families by enhancing performance while simultaneously driving down costs through technological advancements. In short, the strong is getting stronger.

Technological advancements solidify Chinese battery makers’ dominance. Solid-state batteries, the next-generation technology, have the potential to revolutionize the energy storage landscape by offering benefits such as higher energy density, faster charging and enhanced thermal stability. Chinese battery players are well-positioned to commercialize this technology within the next 3-5 years.

Industry leaders like CATL and BYD have invested heavily in R&D for a decade and have formed strategic industry collaborations to bring solid-state batteries closer to commercialization. This is evidenced by the establishment of the China All-Solid-State Battery Collaborative Innovation Platform (CASIP) consortium in January this year, with the aim to drive the development of a robust supply chain by 2030. This alliance brings together top battery manufacturers, including CATL, FinDreams Battery (a BYD subsidiary), CALB, EVE Energy and Gotion High-tech, along with key players from the automotive industry, government, and academia to capitalize on an US$18 billion market by 2030.

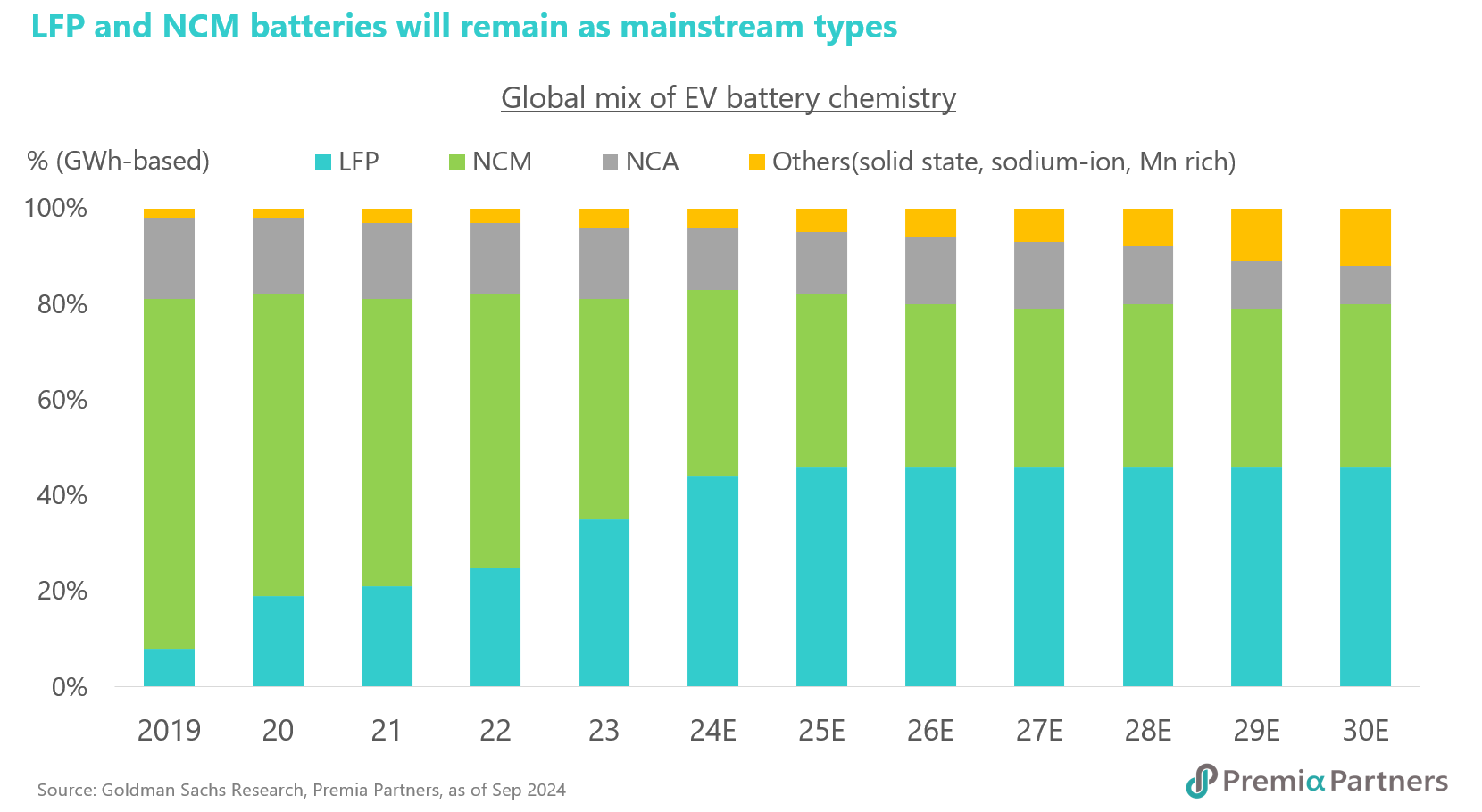

LFP batteries emerge as a mainstream choice. LFP batteries remain a popular choice due to their affordability, stability, cyclical life and cost-effectiveness, despite their lower energy density. Recent innovations, such as CATL's Shenxing Plus and BYD's second-generation blade battery, have addressed this limitation by offering substantial improvements in energy density for battery electric vehicles (BEVs). CATL's Shenxing Plus, the second generation of the Shenxing battery in 2023, with approximately 30% higher energy density compared to mainstream batteries, can achieve a driving range of 1,000 kilometers on a single charge and recover over 400 kilometers of range in just 10 minutes of fast charging thanks to 53% and 38% growth in R&D investment in 2023 and 2024E. Additionally, Shenxing Plus can be charged to 80% in 30 minutes even at temperatures as low as -10°C, demonstrating its upgraded performance in low temperatures compared to the previous version.

On the other hand, CATL's newly launched battery Freevoy, unveiled as the world's first hybrid vehicle battery, is poised to capture the growing demand for plug-in hybrids with "BEV-like" experience. The battery, which is essentially an LFP battery integrated with sodium-ion technology, breaks through the limitations of both pure lithium-ion and sodium-ion batteries by supporting a pure electric range of more than 400 kilometers, enabling a range of more than 280 kilometers with only 10 minutes of charging, and providing reliable performance in cold conditions down to -40°C.

BYD, the world's largest NEV manufacturer, has capitalized on supportive government policies to capture mass-market demand to develop premium brands. With a comprehensive product portfolio and robust in-house capabilities, BYD's second-generation blade battery delivers a pack-level energy density of 190 Wh/kg, surpassing the 140-150 Wh/kg of its predecessor.

NCM batteries evolve to capture the high-end market. NCM batteries, benefiting from continuous technological advancements, have expanded their high-energy density capabilities, enabling longer battery duration, faster charging speeds, and cooler temperatures, comparable to next-generation solid-state batteries. They are now the preferred choice for high-end electric vehicles. CATL's Qilin battery targets a pack-level energy density of 255 Wh/kg, representing a significant 30% increase over mainstream NCM batteries. This has enabled it to maintain a strong foothold in the high-performance luxury vehicle segment, partnering with major customers including Seres (together with Huawei), Li Auto, Nio, and BMW, etc.

Rising demand fuel rapid overseas revenue growth. Global expansion has generated growing cash flows for Chinese battery manufacturers. Goldman Sachs forecasts that CATL's overseas sales volume will continue to grow at a 22% CAGR until 2030. The company's Hungarian plant is on track to begin production in 2025, and its collaborations with Tesla, LG Energy Solution and GM in the United States are progressing steadily. CATL remains confident in the European market and aims to become a major supplier to European OEMs' new EV pipelines. Additionally, the company recently expanded its energy storage systems (ESS) product line into the EU and UK markets, offering easy integration and installation for both industrial and distributed applications.

BYD's overseas sales are projected to account for 22% of total revenue by 2030, nearly quadrupling from 8% in 2023. The company has expanded its presence to over 80 markets and established manufacturing facilities in Thailand, Hungary and Turkey. With plans to further penetrate emerging markets in the Middle East and South America, BYD aims to leverage its competitive pricing and high-quality products to cater to local consumer preferences.

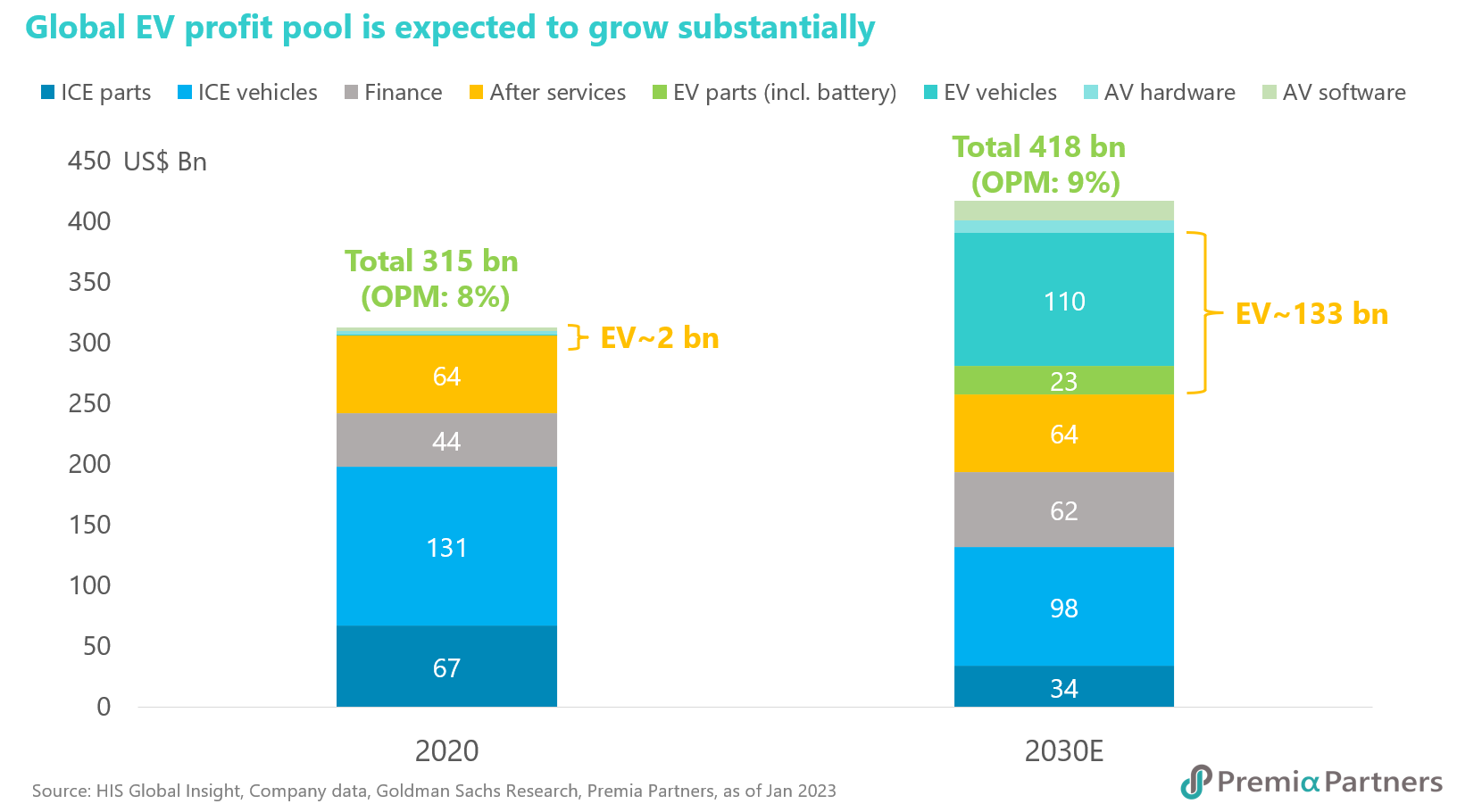

Growing profit pool for the entire EV ecosystem. The growing demand for electric vehicles will drive growth and profitability throughout the EV ecosystem, from battery manufacturers such as CATL and BYD to upstream materials and downstream OEMs. Goldman Sachs predicts that not only will profits from EV parts (including batteries and inverters) increase from US$1 billion to US$23 billion over a decade, but EV OEMs will also experience a massive significant increase in profits, from US$1 billion to US$110 billion. The entire supply chain will create synergies and new value driven by the trend towards vehicle electrification and sustainable carbon-zero emissions efforts.

Investors seeking exposure to the burgeoning EV ecosystem would find Premia ETFs especially relevant: our Premia CSI Caixin China New Economy ETF (3173. HK) features as the top holding CATL, the world's largest EV battery manufacturer, making up 14.8% of the ETF's weight. Additionally, our Premia Asia Innovative Technology and Metaverse Theme ETF (3181. HK) features major EV players like BYD, Li Auto, Nio, Xpeng, Seres Group and Xiaomi, collectively comprising 14.7% of the ETF's holdings. Both ETFs offer a well-rounded approach to investing in Asia's technological advancements:

- Premia CSI Caixin China New Economy ETF focuses on high-growth companies with robust fundamentals and earnings, benefitting from dual circulation strategies, green economy initiatives and technological independence. It has delivered strong returns, with an 14.7% USD NAV return in the last six months as of Nov 8, 2024.

- Premia Asia Innovative Technology and Metaverse Theme ETF invests in innovative technology leaders across Asia, including companies in semiconductors, biotech, internet, EV supply chain, eSports/Metaverse and industrial automation. This diversified strategy has also outperformed the market, with a 14.1% USD NAV return in the last six months as of Nov 8, 2024.