Factor Performance

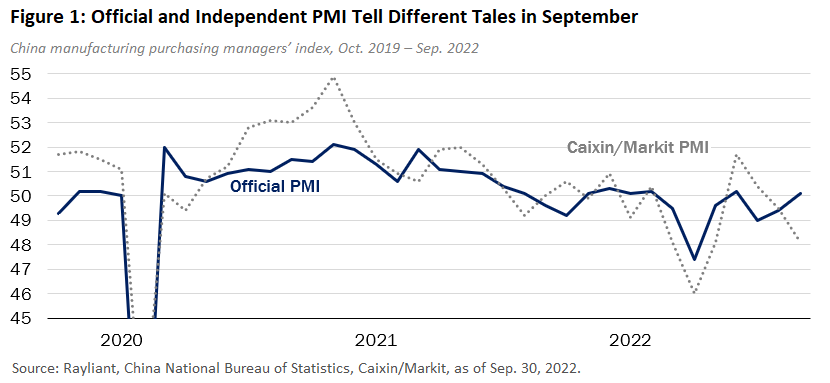

Before diving into a discussion of factor drivers of Q3 performance, it is useful to take a step back and consider the macroeconomic backdrop in China’s mainland market. Throughout 2022, investors’ primary concern and the principal drag on equity returns has been a perceived slowdown in growth for the world’s second-largest economy. Those looking for clues in China’s official PMI release in September and comparing it to the widely tracked and independently produced Caixin/Markit China PMI (see Figure 1, below) might come away with more questions than answers, as the state survey popped from 49.4 to 50.1—suggesting a return to growth in the final month of the quarter—while the independent number slipped meaningfully, from 49.5 to 48.1, seemingly more in line with prevailing macro headwinds.

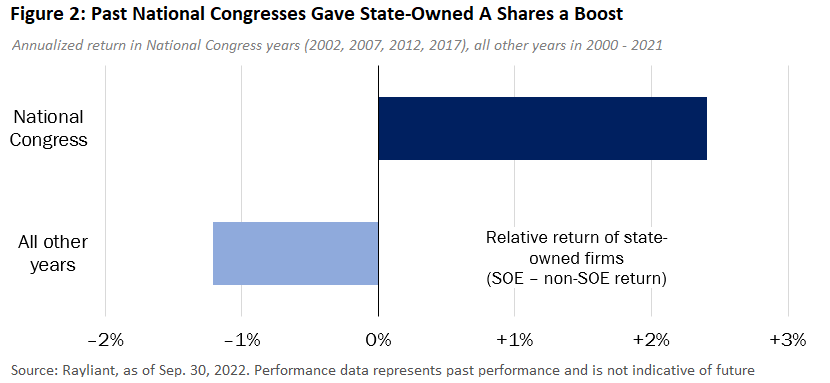

In fact, the divergence in September largely reflects a bias in the official survey sample away from companies in coastal regions, which disproportionately suffered from softening export volume as the rest of the world tightened its belt in the last few months, as well as a higher weight in state-owned enterprises (SOEs), which have been a relative bright spot among onshore stocks this year. For one thing, SOEs have found themselves in line for a much bigger share of China’s growing fiscal stimulus, with much of the nearly US$150 billion in new policy support announced in Q3 directed toward infrastructure spending, which tends to benefit larger state-owned firms. SOEs have also enjoyed special treatment in recent months, often qualifying for exemptions from COVID restrictions and energy rationing that resulted from a summer heatwave. Along these lines, we note that SOEs in the CSI 300 have delivered roughly 5% outperformance versus non-SOEs in Q3. This is consistent with our finding that in past National Congress years—when one might expect state-owned firms to take the spotlight and reap greater policy support—SOEs have historically delivered alpha (see Figure 2). Indeed, eight of the bedrock economy strategy’s top ten performers in the third-quarter were state-owned companies.

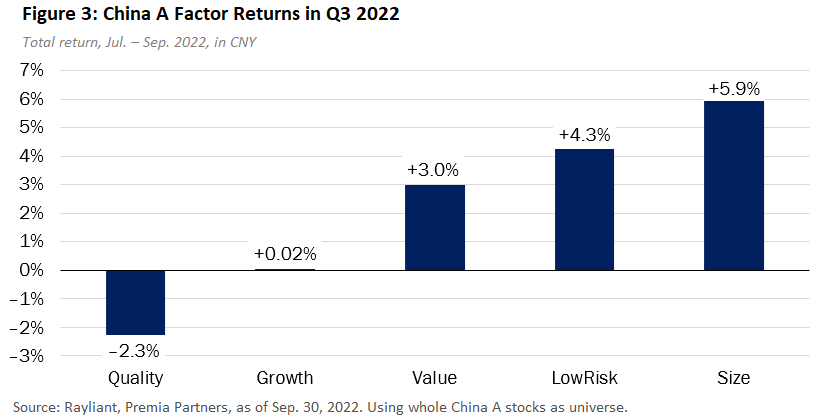

At the factor level (see Figure 3), we find that Size was the biggest outperformer in the third quarter, on the back of especially strong alpha in July, when newly launched index futures on the CSI 1000 Index stoked a relative rally in small-cap companies. Given the sharp losses suffered by Chinese equities during Q3, it is little surprise that Low Risk—the poorest performer among factors in the prior quarter—was among the best A shares factor exposures over the last three months. Value was another predictable winner in the third quarter, with stocks already trading at bargain prices holding up well versus companies with stretched valuations going into the downturn. The only factor showing negative alpha in Q3 was Quality, a modest outperformer in the second quarter, which dipped in the three months ending September, as firms with strong fundamentals lagged their low-quality counterparts.

Index Performance and Outlook

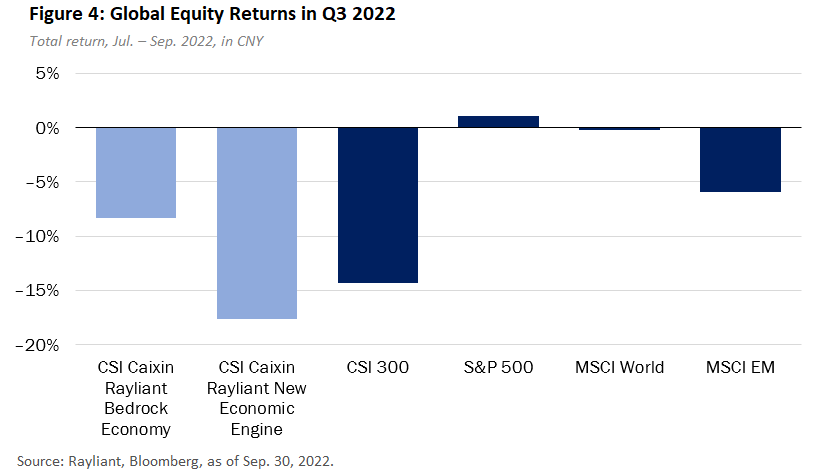

At the market level, increased likelihood of a global recession over the last three months, the impact of China’s strict COVID policy on businesses and consumers, and a continued slide in nation’s real estate market stifled the usual exuberance of domestic stock traders, leading to a steady decline in A shares over the past three months. The CSI 300 Index returned -14.3% (CNY) in Q3, while the U.S. stocks in the S&P 500 actually gained 1.0% on a combination of extreme dollar strength—the S&P 500 lost -4.9% in USD terms—along with a weaker-than-expected July CPI print and hope on the part of investors that central banks would see growth slowing and sooner pause their rate hikes.

The CSI Caixin Rayliant New Economic Engine Index and the CSI Caixin Rayliant Bedrock Economy Index, tracked by Premia’s 3173 HK/9173 HK and 2803 HK/9803 HK ETFs, returned -17.7% and -8.4%, respectively. The new economy strategy lagged the CSI 300, given the profile of growth stocks in its universe, which tend to be underweight Value and Low Risk factors, two of the best-performing exposures of the quarter. By the same token, the bedrock economy index strongly outperformed the CSI 300 Index by +5.9% in Q3, capitalizing on a rotation from growth to value and its low beta to the market downturn. Both strategies benefited from a measured tilt toward small cap stocks. The new economy portfolio’s largest overweight was to Health Care stocks, which happened to be the second-worst performing sector in the CSI 300 Index in the third quarter. The bedrock economy strategy’s top sector-level performers were overweights to Real Estate and Energy, the latter of which was the strongest sector in the CSI 300 Index in Q3, and the only sector with a positive return for the quarter.

In many ways, October’s 20th National Congress of the Chinese Communist Party (NCCCP)—the once-every-five-years meeting of policymakers to appoint a new government and set an agenda for the next half-decade, which ran from October 16th to 22nd—serves as a better demarcation between “what came before” and “what comes after” than the end of the calendar quarter. While commentators on the Congress have tended to get caught up in the noise of political theater performed in Beijing’s Great Hall of the People, investors with experience in the region were parsing news of the event for indications of China’s forward policy that might have relevance for A shares in the months and years ahead.

One clear theme that will develop in a profound way over the next five years, which plays directly into the new economy strategy, is China’s commitment to technological self-sufficiency. Given supply chain vulnerabilities exposed since the pandemic began, as well as ongoing tension with the U.S.—including moves this year by the Biden administration to “contain” China’s ascension by restricting its access to semiconductors—Chinese policymakers rightly see the country’s technological development as not only a source of economic growth, but a matter of grave strategic importance from a geopolitical perspective. Within the chip sector there is much room for China’s footprint to expand—and many stocks that might reap the benefit of state subsidies along those lines. Of course, in a market saturated with amateur retail traders who gravitate toward obvious growth themes, just as important as picking winners is avoiding overhyped names in the technology sector, underscoring the strategies’ use of quality-oriented factors.

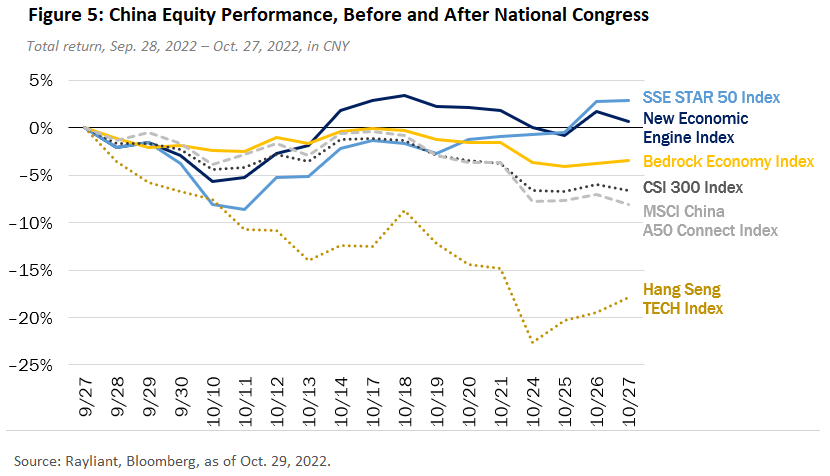

The market’s negative reaction to the last day of the Congress, when President Xi’s third term was confirmed and a new slate of party leaders was announced, suggests unease on the part of investors—particularly those trading Chinese shares offshore—as to the future of China’s economy and stock market. While there were certainly a few surprises in the makeup of this term’s Politburo Standing Committee, there can be no doubt that the NCCCP’s conclusion finally gives policymakers the necessary mandate to push forward with stimulus and initiatives to drive a real economic recovery. While this shift in priorities and its fundamental impact won’t happen overnight, we’re confident current valuations offer investors an excellent entry point for broad participation in China’s expansion. Indeed, as the below Figure 5 shows, growth stocks in the new economy fund and Premia China STAR50 ETF quickly reversed as investors processed facts on the ground and more positively assessed the path forward. Along those lines, we see the bedrock economy and new economy ETFs in a strong position to intelligently capture a recovery as fiscal stimulus and policy support ramp up in the next five-year chapter of China’s growth story.

*****************************************************************************************************

Dr. Phillip Wool is the Managing Director and Head of Investment Solutions at Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.