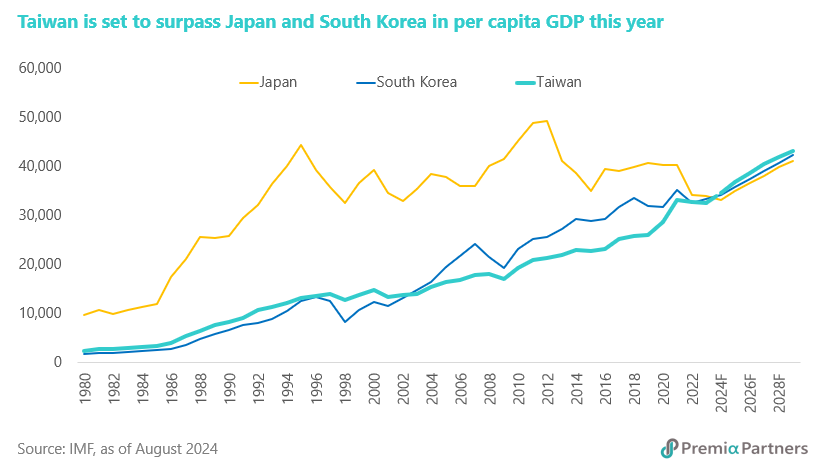

Taiwan’s economy has seen impressive growth, emerging as the wealthiest in per capita terms in North Asia according to the International Monetary Fund (IMF). It is set to overtake Japan and South Korea this year, and that lead is likely to widen in coming years. This growth is closely linked to the semiconductor industry, which is poised to nearly double its market size from USD 527 billion in 2023 to over USD 1 trillion by 2030. The driving forces behind this surge include the rise in AI-driven smartphone replacements and increased AI PC penetration. Additionally, the megatrends of automation, the Internet of Things (IoT), 5G, AI, and electric vehicles (EVs) are expected to sustain this growth trajectory.

Impressive market performance and growth prospects

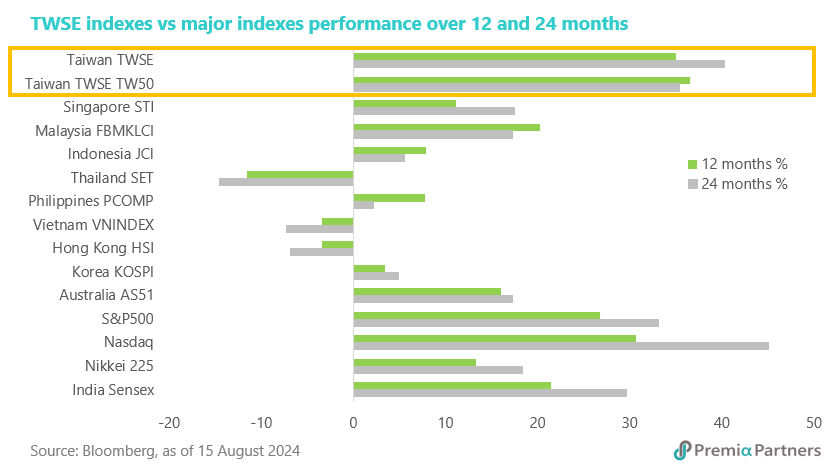

Taiwan’s stock market has reflected the strength of its semiconductor sector. Over the past 12 months, the TWSE Index and the TWSE Taiwan 50, 30% Net Capped Index saw remarkable gains of 35% and 37%, respectively. These indices outperformed all major Asian markets and beat both the S&P 500 and Nasdaq 100 over similar periods. The semiconductor cycle's recent upturn has contributed to this outperformance, with global semiconductor sales growing by 18.3% in the second quarter of 2024 compared to the same period in 2023.

Analysts predict that Taiwan’s stock market will continue to deliver strong earnings growth, with the TWSE Index expected to achieve a 12-month forward EPS growth of 29.4%. This rate is nearly double the projected 15.0% growth for the S&P 500 and higher than the Nasdaq 100's 22.0%. The TWSE Taiwan 50, 30% Net Capped Index is also forecasted to see a 22.5% increase in earnings over the next year.

Dominance in global semiconductor industry

Taiwan’s semiconductor industry has created formidable “moats” around its market position, producing approximately 64% of the world’s semiconductors and 90% of the most advanced chips. This market leadership is the result of decades of substantial investments in foundries, testing, packaging facilities, and research and development. Taiwan’s enjoys significant economies of scale, which translate into cost efficiencies and robust industry relationships.

Taiwan’s dominance is underpinned by its seamless integration across the entire ecosystem, which includes IC design, foundries, and packaging and testing. Upstream, three of the top ten IC design companies by revenue in 2022 were Taiwanese: Mediatek, Realtek, and Novatek. They were listed alongside Qualcomm, Broadcom, Nvidia, and AMD. In the midstream segment (foundries), the market share is well known: TSMC held a dominant 61% market share as of the end of 2023, far surpassing Samsung (11%) and Taiwan’s UMC (5%), which ranks fourth. Downstream (packaging and testing), six of the world’s top ten companies by revenue in 2022 were Taiwanese. While investment in foundries is the well-recognized big-ticket item, there has also been strong growth in capital expenditures for IC packaging and testing, with a compound annual growth rate (CAGR) of over 6% from 2016 to 2021.

Deep customer relations with the biggest players

Given its market share, the Taiwanese semiconductor industry unsurprisingly has well embedded relationships with some of the biggest tech names in the world including Apple, NVIDIA, AMD, Qualcomm, Broadcom, and Intel. And these customers are highly or almost entirely dependent on Taiwan for their semiconductors.

A big attraction is Taiwan’s chip companies’ pure play status, with no conflicts of interests. Indeed, there is very little choice outside of Taiwan for the global tech giants looking for pure play foundries. Taiwan had 78% of the world production from pure-play foundries last year. Samsung, the nearest competitor to TSMC, not only produces semiconductors for other companies but also designs, manufactures and sells its own ICs and consumer electronic products. It would have the added burden of reassuring semiconductor and consumer electronics customers of the effectiveness of the “Chinese Walls” between different parts of its organisation.

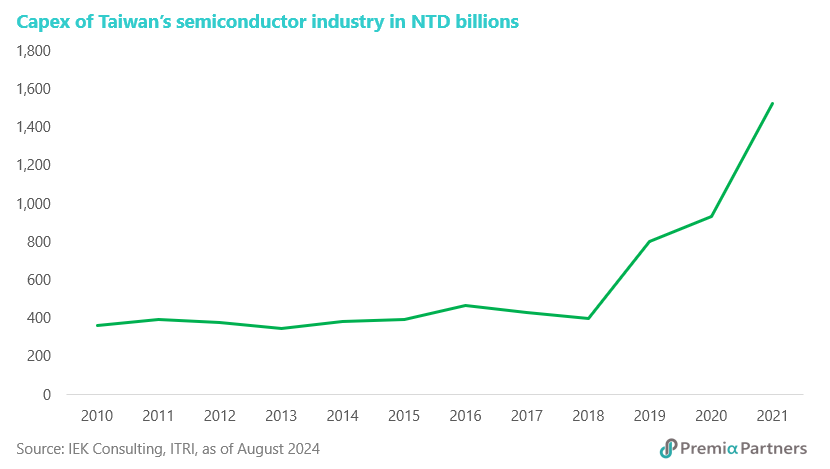

Willingness and ability for further investment

Taiwan's commitment to maintaining its semiconductor leadership is evident in its significant capital investments. Between 2010 and 2021, Taiwan invested NTD 8 trillion in foundries and testing facilities and NTD 2 trillion in R&D. The cost of building semiconductor fabs has surged, with estimates now ranging between USD 15 billion to USD 20 billion, compared to around USD 2 billion in 1995. For example, Intel’s website reckons it would cost USD 10 billion and 3-5 years to build a fab. And that was the original reported cost estimate for its two Arizona fabs. But the latest reports suggest there have been delays and massive cost blowouts. The two fabs will now cost around USD 15 billion each instead.

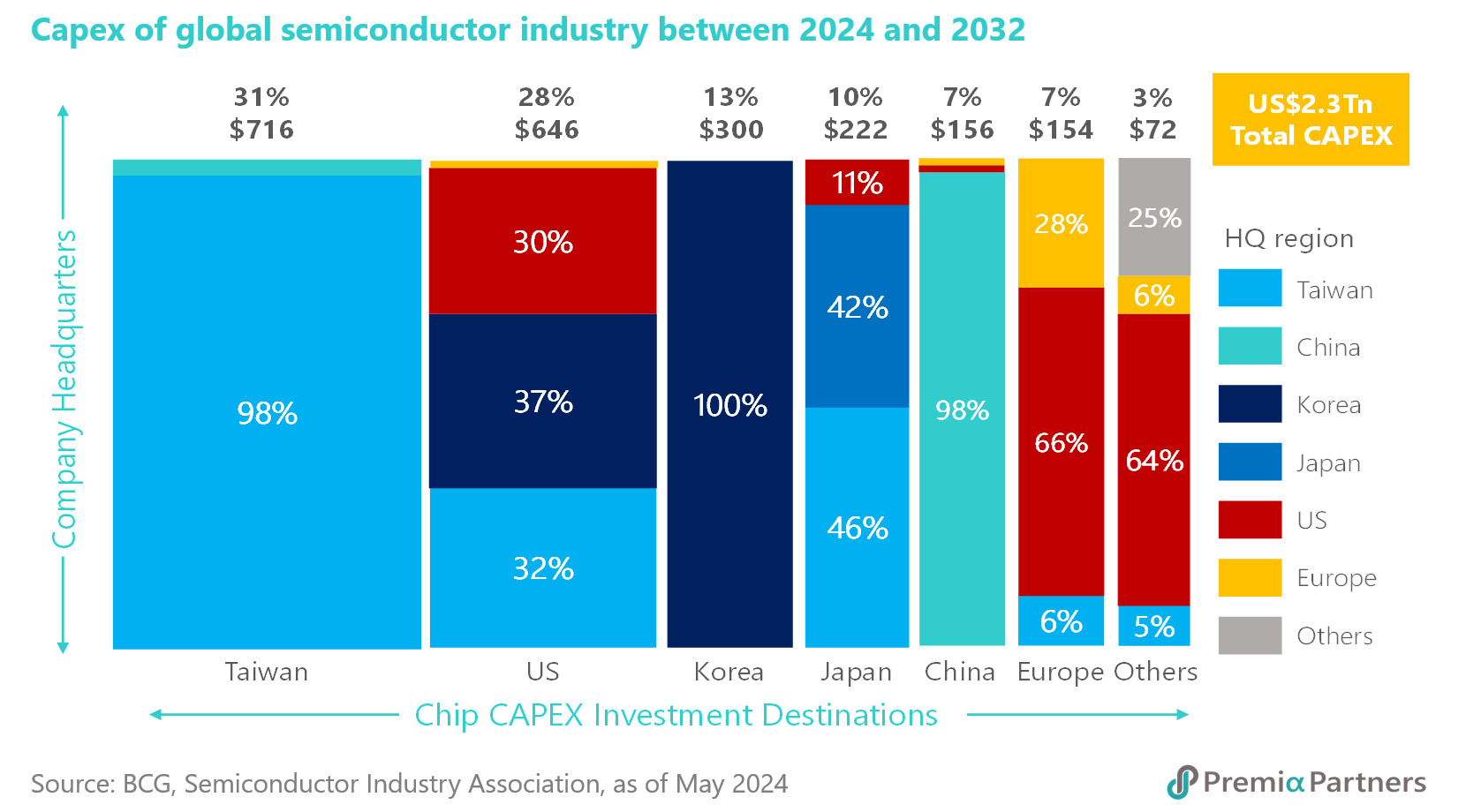

Despite these rising costs, Taiwan continues to attract substantial investment. Nearly a third of the global investment planned for semiconductor development between 2024 and 2032 is expected to be directed towards Taiwan – around USD 716 billion out of USD 2.3 trillion. And almost all of that will be made by Taiwanese companies.

The race in which TSMC is leading

Samsung Electronics was ahead of TSMC by a few months in production of 3nm chips. But it struggled with lower-than-expected yields rendering the chips only suitable for niche markets, most notably crypto currency mining. A few months later, TSMC started producing its own 3nm chips. However, because TSMC’s products had higher yields and were regarded as more reliable, they were more widely used than Samsung’s. That was in 2022.

Korean media outlet, Chosun Daily wrote: “As most companies are likely to place their orders with Taiwan’s TSMC, the world’s biggest contract chipmaker, the market share gap between TSMC and South Korea’s Samsung Electronics is projected to widen further. Industry insiders say Samsung Electronics’ contract manufacturing division’s prototypes have lagged behind TSMC’s in terms of yield and power efficiency, costing it an early lead in the 3nm race.”

Fast forward to today: Recent media reports say TSMC is ahead of schedule in its plans for its 2nm chips and started trial production in July, with Apple tipped to be planning to use them for its iPhone 17. If the media reports are correct, TSMC could get a head start in 2nm chip production ahead of Samsung, which was reportedly planning production of 2nm chips in 2025.

The semiconductor cycle has turned

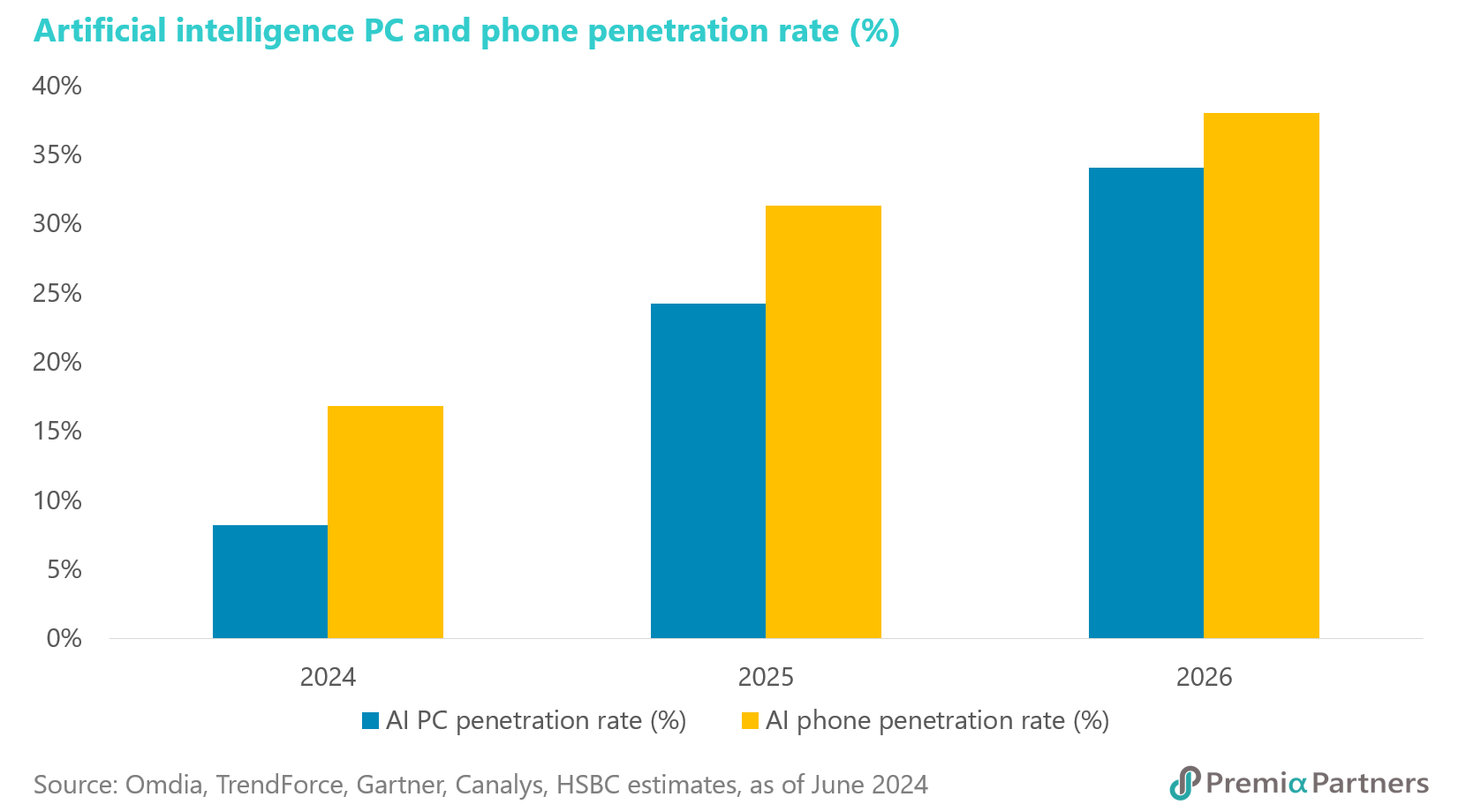

The chip industry hit its trough in 2023 and then began to trend up early this year, with the upturn likely extending through to 2026-2027. The Semiconductor Industry Association (SIA) recently announced that global sales grew a stunning 18.3% in 2Q24 over 2Q23. The WSTS (World Semiconductor Trade Statistics) organisation recently estimated 16.0% growth in 2024 over 2023, with 12.5% growth expected for 2025. A big source of demand over the next two years will likely be an AI-driven smartphone replacement cycle, running in tandem with a surge in AI PC-penetration rates.

Global electronics procurement, distribution and supply chain manager, the Astute Group recently said: “This upward trajectory is not expected to slow down anytime soon.” This optimistic view is supported by semiconductor industry information platform TechInsights, which recently forecasts that global semiconductor sales should double in seven years. The number is in line with the estimates from McKinsey and CapGemini.

Spillover effects into economy and financial sectors

The semiconductor industry’s high value-add has substantial positive effects on Taiwan’s broader economy. The sector’s value-added rate was reported at nearly 75% in 2021, reflected in TSMC’s impressive 66% average EBITDA margin. For comparison, TSMC’s EBITDA margin for the year ending June 2024 was 67%, surpassing Nvidia’s 62% and significantly higher than Apple’s 34% and AMD’s 18%.

Such a high value-added rate has large spillover implications for the rest of the economy. The Taiwanese Government reported that in 2022, the output value of Taiwan’s semiconductor industry was NTD 4.89 trillion. But as a result of its spillover effect, the sector created an extra output value of NTD 4.04 trillion.

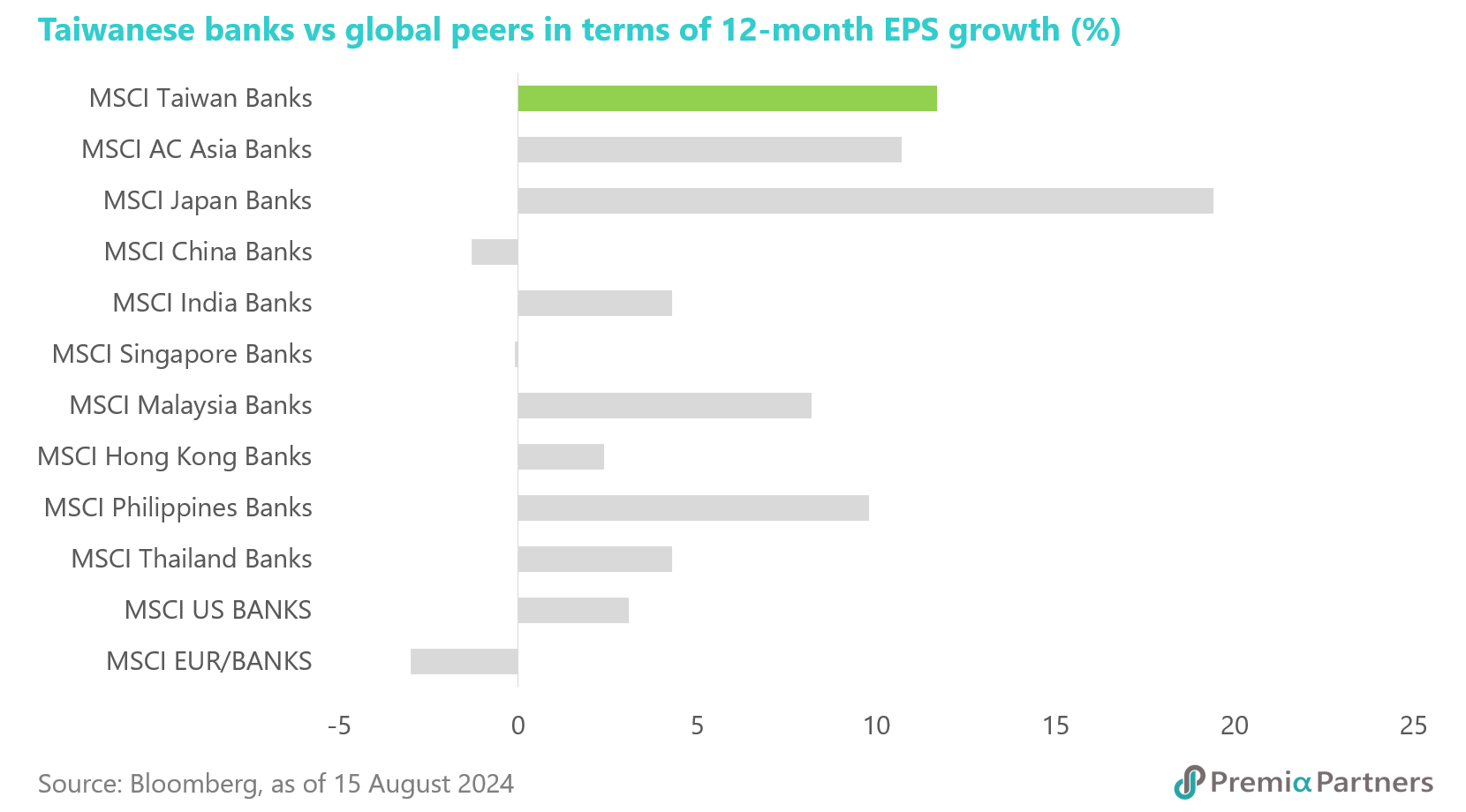

The Taiwanese financial sector has seen remarkable growth, with pre-tax profits increasing by 94% year-on-year in the first five months of 2024. Taiwanese banks are expected to experience earnings growth nearly four times that of their US counterparts. More broadly, the financial sector – which includes banking, securities and futures trading and insurance – has just recorded a staggering 93.5% increase in pre-tax profits for the five months to May this year over the same period last year, to turn in a record high earnings figure of NTD 483.9 billion.

Attractive investment opportunities and market valuation

Despite its impressive performance, the Taiwanese stock market remains an attractive investment destination. The TWSE Taiwan 50, 30% Net Capped Index offers a dividend yield of nearly 2.7%, higher than the Nasdaq 100’s 0.8% and the S&P 500’s 1.3% as of 31 July 2024. This yield, coupled with the index's strong price performance, makes it a compelling option for investors.

In conclusion, Taiwan has emerged as a quiet but powerful force in the global technology sector, driven by its dominance in semiconductors. Taiwan strategic investments, coupled with its integral role in the global tech supply chain, have propelled it to the forefront of market performance and economic growth. As the semiconductor market continues to expand and evolve, Taiwan’s leadership in this space ensures it will remain a significant player on the global stage.