Investors may finally see a reasonable outperformance of China market in 2023 after the challenging time in the past twelve months. Wall Street banks are joining in chorus to upgrade China to outperform on the reopening expectation after the country implemented strict COVID measures for almost three years. More Mainland Chinese cities have rolled out relaxation in pandemic controls, while the local research group suggested that Omicron variants are much less risky than its predecessors.

All these confirm a directional change for the government’s response towards the pandemic. Externally, the inflationary pressure is reducing, and the dollar strengthening is closer to an end. Given these major shifts in market landscape, investors should no longer wait on the sideline but act now to load up China exposure.

While year 2022 was challenging around the world, for China it was also a year of inflection when a lot of factors coincided leading to abrupt surge in fear or risk premium triggering even the question of whether China is investable – even though it is now mostly a moot point as analysts and allocators hastily posting upward re-ratings.

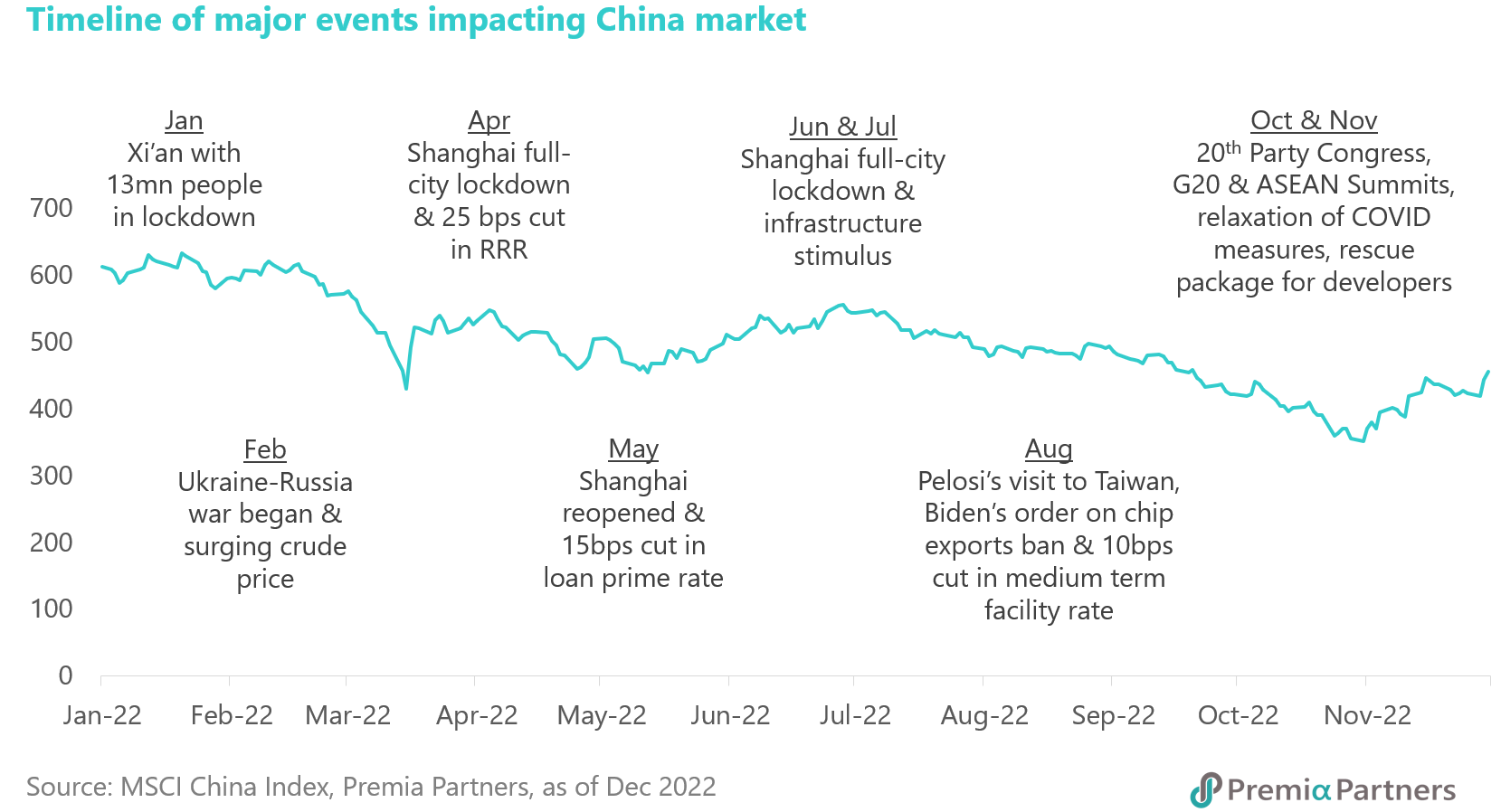

China started the year with the full lockdowns of Xi’an and Shanghai. About 150 prefecture-level cities with a population over 280 million have faced partially or fully lockdown since then. The recurring movement restrictions have led to a substantial slowdown in economic activities nationwide, dragging the country’s GDP growth to as low as 0.4% YoY in the second quarter of the year.

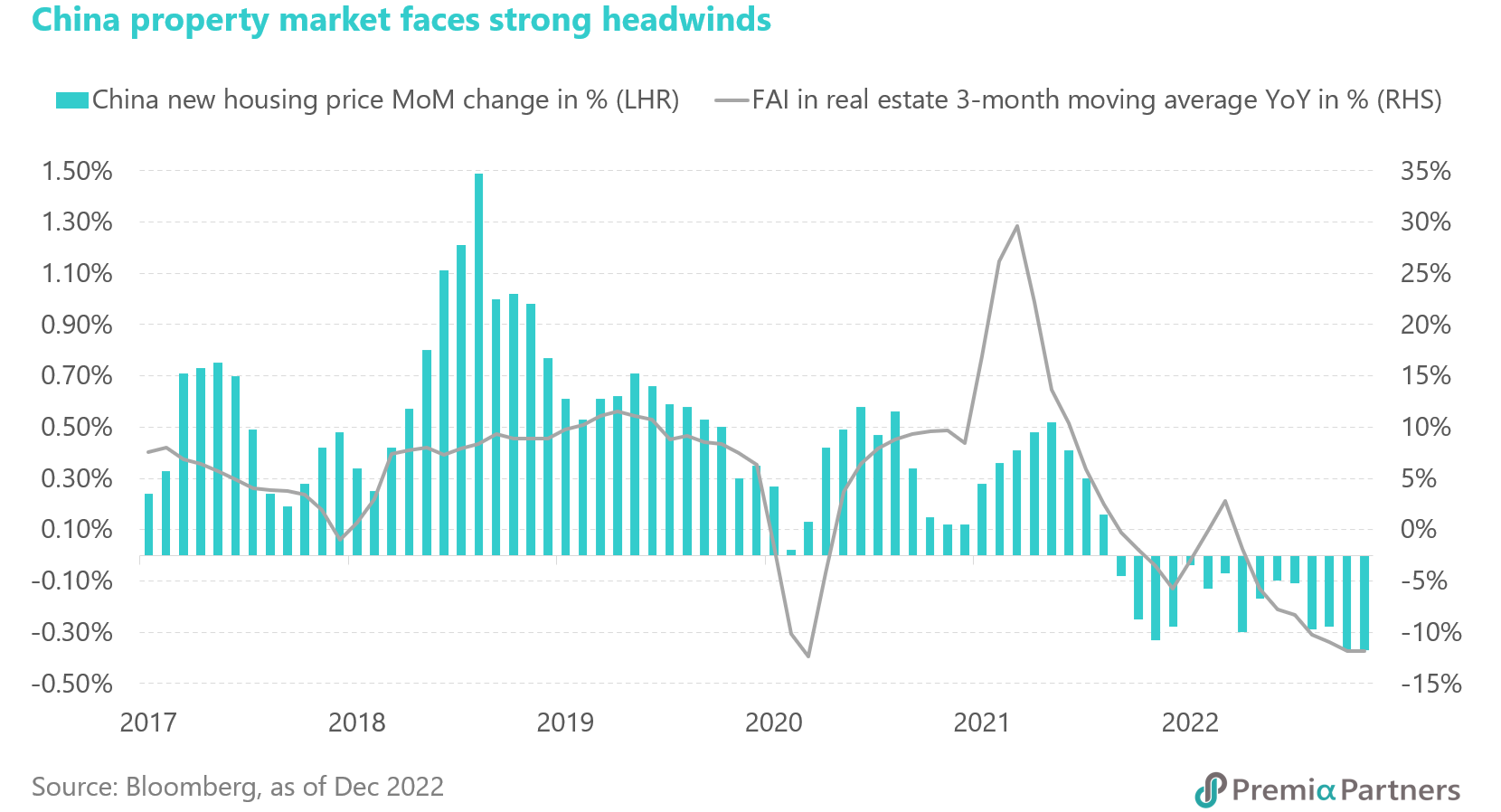

The real estate market is also affected by falling traffic and lower buying interests. Home prices have fallen consistently throughout the year and developers face difficulties in financing their projects. The property bond defaults have reached to a new high, with both high-yield and investment-grade dollar issues trading at distressed levels.

At the same time, China’s Internet platforms, similar to their global peers, saw a rapid deceleration in consumption demand, resulting in the slowest growth since listing. Most of them have to either trim their workforce first time in history or reduce their exposure in non-core businesses. The ADRs’ delisting from the US market continues to be an overhang among Chinese equities, with the regulators from both countries have yet to reach a deal over the audit arrangement.

The geopolitical risks heightened after the US House Speaker Nancy Pelosi visited Taipei in August, sparked a series of military exercises in the Taiwan Strait. The Biden administration’s export bans of semiconductor chips and other high-tech equipment to China put more pressure to the fragile market condition.

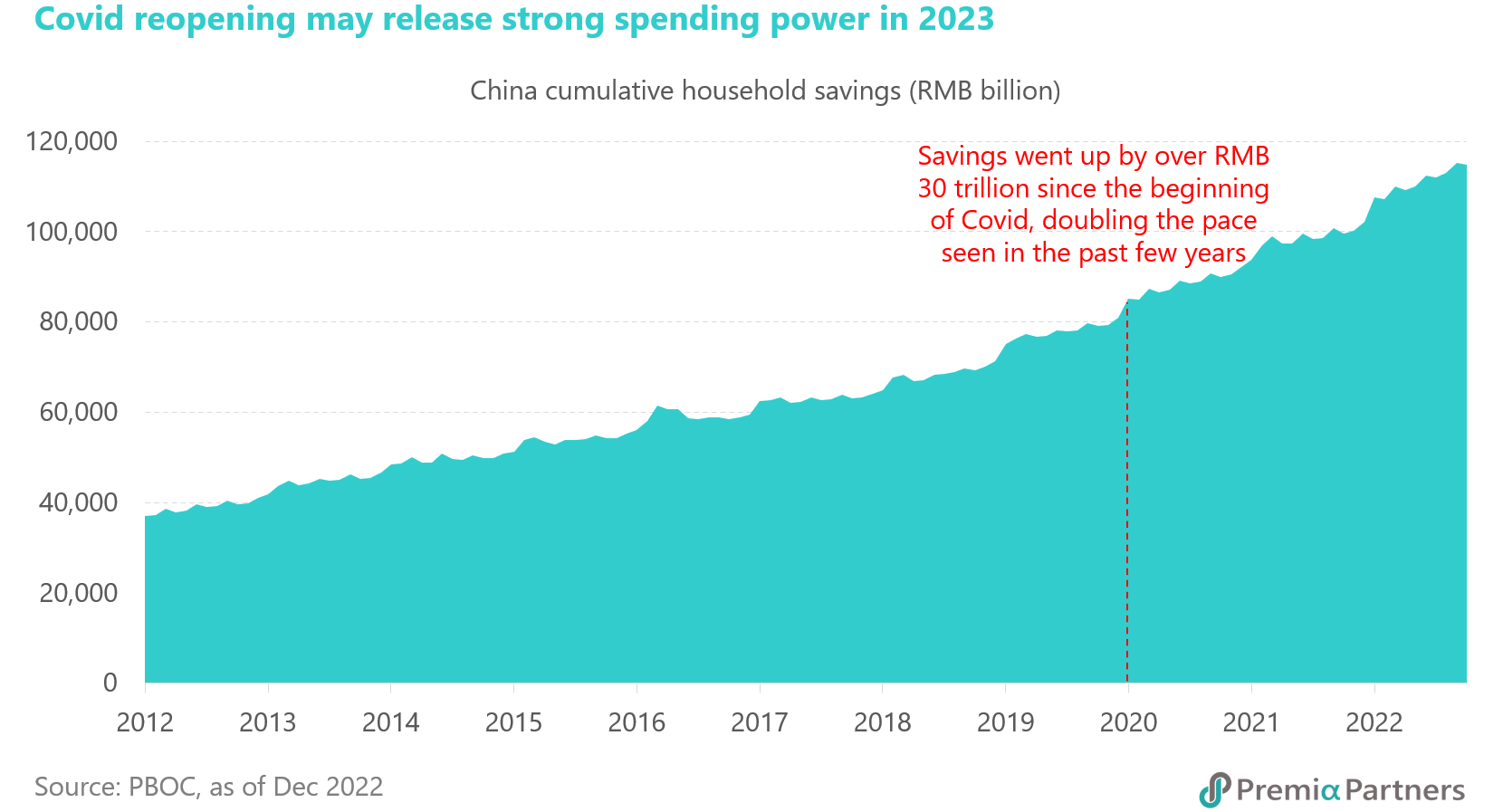

That said, the tide is turning with more catalysts to help support China market perform well in 2023. First and foremost, there are more signs for a gradual but firm reopening in China with relaxed COVID-related measures, such as reducing the quarantined period for new arrivals and scrapping circuit breaker bans for incoming flights. Tier one cities like Beijing, Shanghai, Guangzhou and Shenzhen have scrapped the strict PCR testing for entering public venues despite the recent rising COVID cases. In addition, the possible outcome from the surging cases so far is the accelerating daily vaccination doses, with the latest number tripled the trough level seen in October. Higher vaccine penetration should provide a strong foundation for the eventual full reopening. Investors should look beyond any COVID-related noises/hiccups in the next few months and focus on what the normalized economic growth of China can offer in the medium term.

Another optimistic change is coming from the property market given the recent successful fund-raising activities of the developers. Analysts previously estimated that the property slump would cost the nation’s banking system as much as RMB 1.5 trillion in losses in loans, bonds and other assets.

The authorities, however, have finally pressed the right buttons to help fix the problem in the past couple of months. Developers are permitted to access to about 30% of their pre-sales funds for project construction and debt repayment. The onshore bond financing channels have resumed after the state-owned China Bond Insurance stepped up to be the ultimate guarantor, letting a handful of property firms to offer yuan debts with sensible coupon rates around 3.3%.

The National Association of Financial Market Institutional Investors said that nearly 100 developers are in the application pipeline. Large Chinese banks have pledged at least RMB 1.28 trillion in new credit to property developers after financial regulators asked them to stabilize lending to the real estate market. On the offshore space, more builders will look for opportunities to do equity financing after Country Garden and Agile have managed to sell new shares. Besides, regulators encouraged lenders to negotiate with homebuyers on extending mortgage repayment and emphasized that buyers’ credit scores will be protected. The capital market has begun to turn more positive to the industry, with China property stocks and dollar bonds rebounded from their recent bottoms by 59% and 88%, respectively.

The geopolitical risk premium is expected to come down further after Chinese leaders have proactively reestablished China’s strategic relationship with OECD and ASEAN countries, strengthening the ties during the ASEAN Summit in Phnom Penh, G20 Summit in Bali and Asia-Pacific Economic Cooperation Summit in Bangkok. The back-to-back meetings were seen as President Xi playing diplomatic catch-up after being largely absent from the international stage for years. Most importantly, the highly anticipated Xi-Biden in-person meeting turned out to be rather constructive to the market, with both leaders expressed an openness to restoring channels of communication and repairing a relationship that was once labelled as a second Cold War. It certainly slows down the deterioration of their relations and brings optimism to the investors.

Investors, who may have concern about any military actions in Taiwan strait, may now take comfort after the latest meeting between Chinese Defense Minister Wei Fenghe and his US counterpart, Lloyd Austin. The State Department also confirmed that Secretary of State Antony Blinken will visit China in near term to follow up the discussion between high-level government officials.

Besides, market will probably see greater clarity over the China ADR delisting and internet scrutiny in the next few months. The US regulators gained good access in their review of auditing work done in US-listed Chinese firms during a seven-week inspection, according to a few close sources. It should be a key step forward in resolving the dispute over the financial disclosure, with some analysts claiming that the US Securities and Exchange Commission would soon declare all China-based audit firms compliant with the PCAOB requirements and remove all Chinese ADRs from the conclusive list of delisting.

Simultaneously, Chinese government began to show mercy on Internet platforms, with more games getting approval from the National Press and Publication Administration, including Tencent receiving its first commercial game license in 18 months. The PBOC is reportedly preparing a fine of about USD 1 billion for Ant Group, indicating the wind-down of a years-long regulatory battle for the fintech giant. During the second half of the year, Didi Global was fined USD 1.2 billion for cybersecurity violations and Alibaba was fined a record USD 2.5 billion for antitrust infractions. These penalties might turn out to be a welcome development for the industry, drawing a clear framework for the regulatory environment and moving forward for capital market activities such as IPO plans.

Most brokers have upgraded China lately, expecting the market to outperform in 2023 amid COVID reopening, fiscal and monetary stimulus. JPMorgan voiced out the swift decline in Chinese equities is disconnected from fundamentals and presents a buying opportunity for investors. Jefferies views China as a counter-cyclical force in 2023 just as the rest of the world tries to stave off recessions. Morgan Stanley suggests the market will gradually reflect the benefits from a full reopening, the release of pent-up consumption demand, macro stabilization and improving job market.

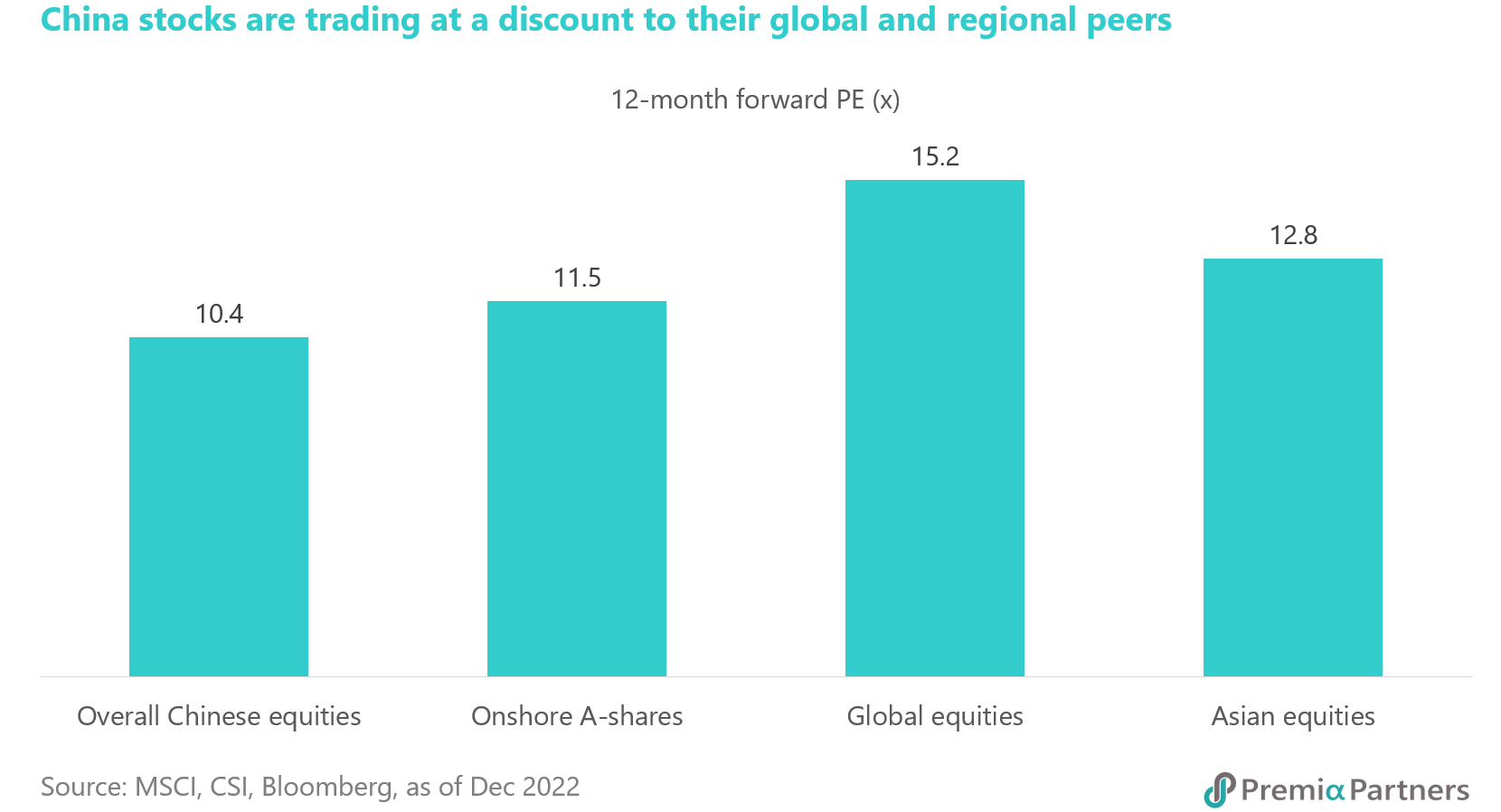

Goldman Sachs sees China market to have a double-digit return in the next 12 months, calling a rebound in both onshore and offshore stocks as the dollar peaks with the Federal Reserve pivoting. The country’s GDP growth will likely accelerate in the second half of 2023 after the economy weathers the initial negative impact exiting its COVID Zero strategy in spring. Valuation-wise, the overall Chinese equities and the A-shares are trading at 10.4x and 11.5x, respectively, in forward 12-month PE, as compared to global equities’ 15.2x and regional peers’ 12.8x.

On the macroeconomic front, the PBOC should maintain a relatively loose monetary policy on the back of the stable pricing pressure, with CPI hovering at around 2% and core CPI expanding at less than 1%. The recent weak PMI data supports the call for additional cuts in interest rates and required reserve ratio for banks. With exports likely to weaken in the coming months, a corresponding pickup in domestic demand will be needed for the growth recovery. The contraction in retail sales should only be a temporary phenomenon as the online sales have generally held up steadily throughout the pandemic.

With people’s daily life less affected by the COVID restriction going forward, consumers will probably release their spending power in discretionary items such as automobiles and home appliances. Any improvement in the housing market may also help generate a strong wealth effect for boosting consumer confidence and also related demands for home appliances and consumer discretionary items. Also related to this would be the EV, IoT and sports ecosystem which tend to show a positive correlation with the new home purchases. Meanwhile, there was a wider divergence in fixed asset investment as infrastructure investment remained robust to partially offset the weak property investment. It was reported that Ministry of Finance has front-loaded special local government bond quota that can be used to support the construction of infrastructure, new energy and high-tech projects.

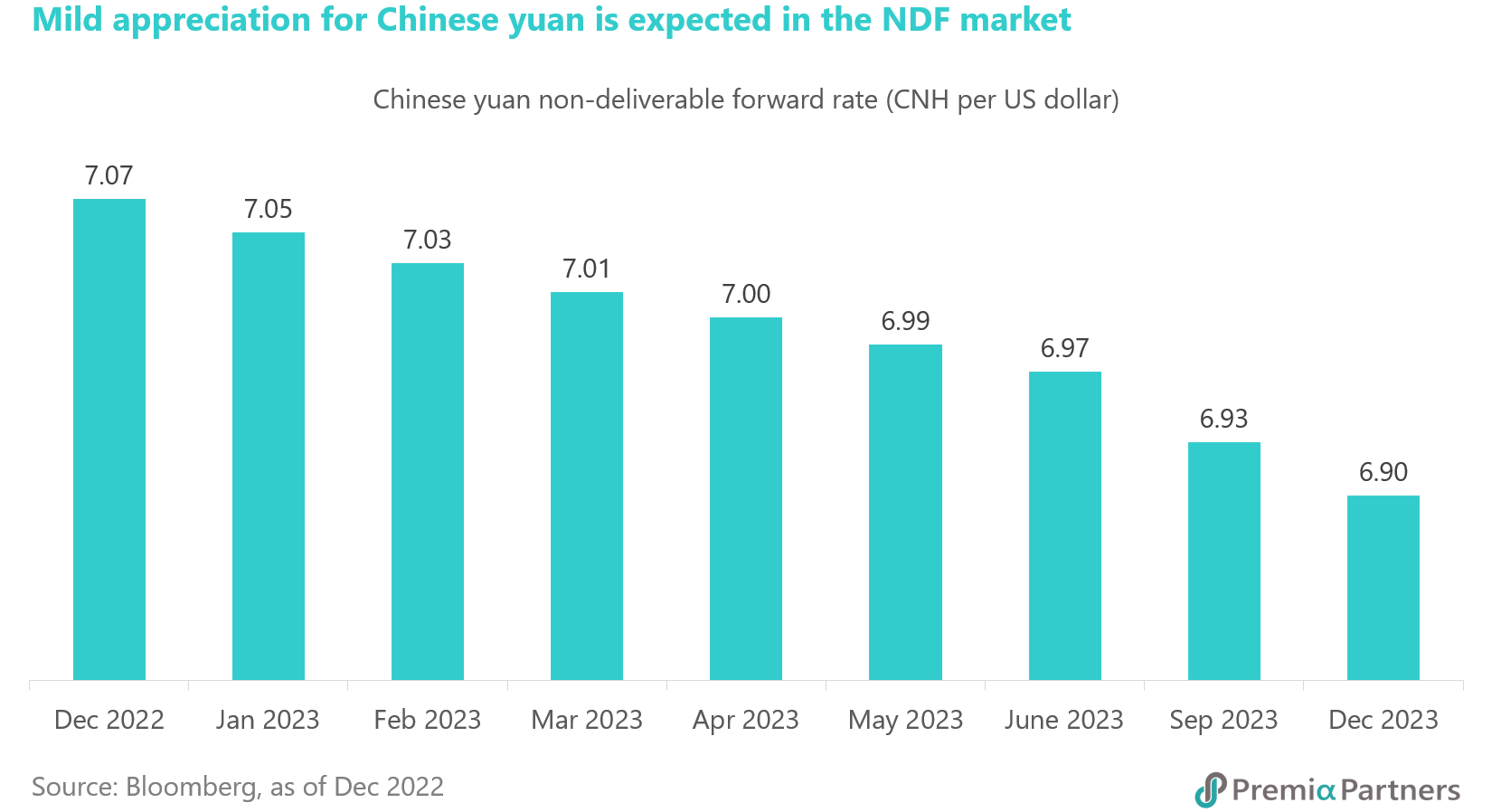

The Fed also started to moderate from its hawkish tone, as the risks of recessions or hard landing of US economy become more tangible after the successive rounds of aggressive rate hikes. Instead, the offshore non-deliverable forward market is pricing a mild appreciation in the next 12 months that Chinese yuan will trade at 6.80 per dollar in December 2023. The yuan’s steady pace of internationalization is reflected through increased use in global trade and transactions.

Based on the data from the Society for Worldwide Interbank Financial Telecommunication (SWIFT), the Chinese yuan has retained its position as the fifth most active currency for global payments by value in September, accounting for a market share of 2.44%. Its weight in the International Monetary Fund’s Special Drawing Rights currency basket has increased from 10.92% to 12.28% during a review in May, showing the wider adoption of yuan in international payment, settlement, reserves, investment and financing. Morgan Stanley estimates the yuan will account for 5 %to 10% of global foreign exchange reserve assets by 2030, making it the world's third-largest reserve currency, only next to the US dollar and the euro.

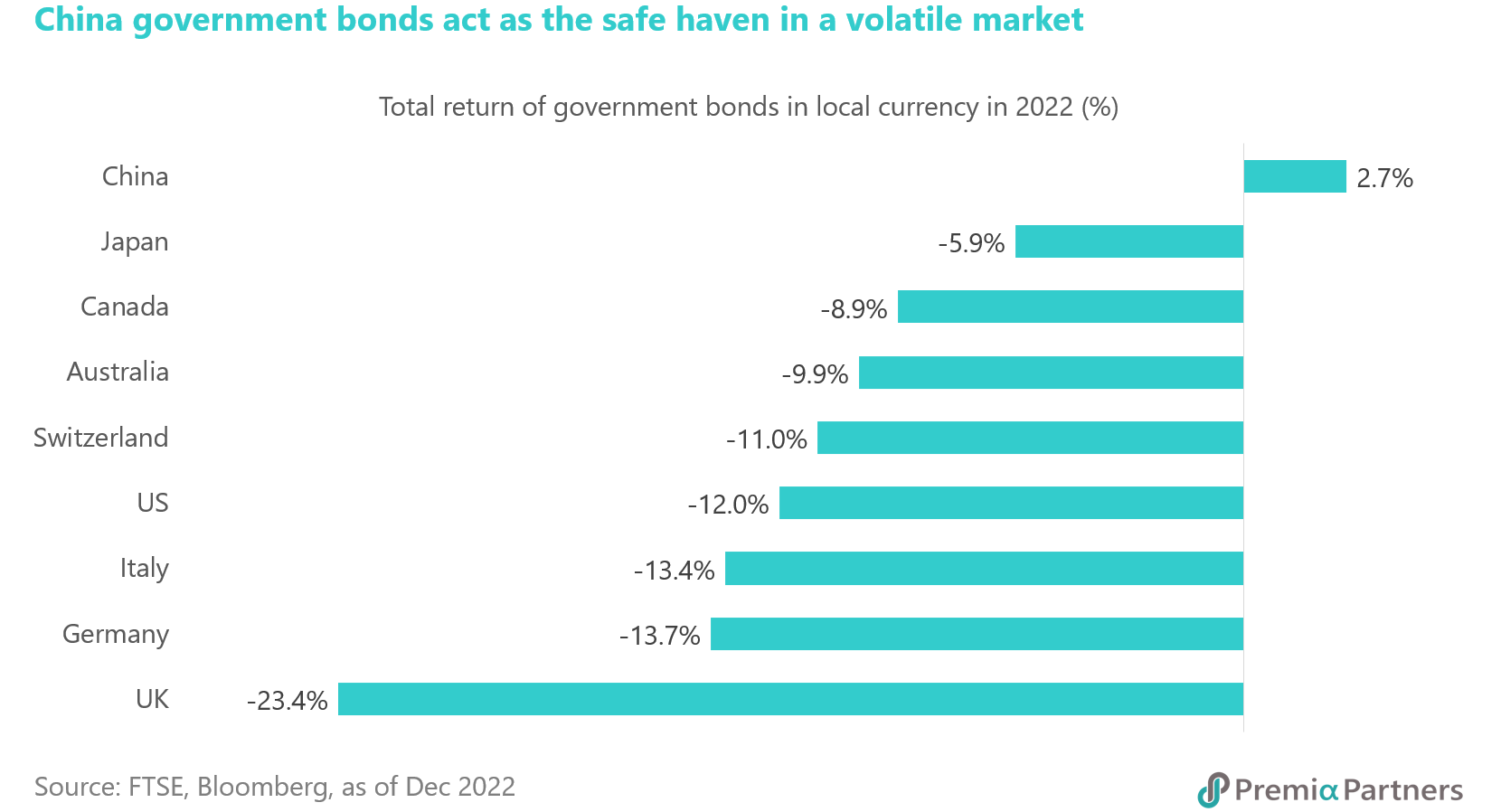

On the fixed income side, China government bonds (CGBs) may continue to do well in 2023 after being the safe haven, providing a decent positive return of 2.7% in the past twelve months. Major government bonds including US treasuries, UK gilts, German bunds, Swiss government bonds and Japanese government bonds have failed collectively and recorded negative returns between -5.9% and -23.4% in 2022.

The rate hike cycles aboard seem getting closer to an end, but market volatility may stay high for a while given the uncertainty in global energy prices and food supply. The evolvement of Ukraine-Russia war can be a wild card, while the lasting impact of the rising labor costs to the general inflation remains an unknown. For investors looking for reasonable yields and stability, CGBs will still be a preferred choice. The moderately accommodative monetary policy ahead should benefit the long-duration portion of CGBs the most.

We believe 2023 would be a year more favourable for A-shares overall from strategic allocation point of view - especially policy tailwinds aligned, strategic growth sector leaders that are under policy and funding support measures as well as tax subsidies (hardcore tech, green economy, advanced manufacturing, healthcare, biotech and medical equipment, etc.). We also expect to see increasing mention of ‘growth’ and corresponding efforts from the government now, as one of the top priorities running up to the Two Sessions in Mar 2023.

The 3 Premia China A-shares ETFs China Bedrock Economy, China New Economy and China STAR50 are well placed to capture the different reopening themes and strategic growth rally, and are very complementary to traditional offshore China or active China strategies for portfolio completion and diversification. Meanwhile with the recovery of the CNY and property sector and continued monetary easing environment, our long duration CGB and USD property bond ETFs would be good tools to capture the related opportunities also.

ETF | Trading counters | Market | Strategy |

3173.HK 9173.HK | China A-share | It leans towards stocks with light-asset models, stronger financial positions and better growth prospects in information technology, healthcare, consumer discretionary and communications. New economy space is clearly benefiting from policy support and showing a clear roadmap in medium-to-long term. | |

3151.HK 83151.HK 9151.HK | China A-share | It tracks the top 50 stocks listed in the Shanghai Stock Exchange Science and Technology Innovation Board, a specialized platform to grow and incubate innovative, technology-enable national champions in strategic policy supported sectors that needs intensive research and development input. | |

2803.HK 9803.HK | China A-share | This multi-factor approach emphasizing value, quality and low volatility is appropriate for investors trying to profit from the sector rotation from time to time. Its diversified basket with a balanced sector exposure may help generate alpha performance potentially when market is narrowing the deep discount offered by the value stocks, particularly the SOEs. | |

Premia China Treasury and Policy Bank Bond Long Duration ETF | 2817.HK 82817.HK 9817.HK 9177.HK | China onshore RMB bond | It invests fully in Chinese government and policy bank bonds with A1 ratings, which is not subject to the high volatility in the credit markets. The long duration exposure will not only have an absolute higher yield but also capture any mark-to-market gains on potential downward movement of the yield curve if market expects further easing in near-term. A dollar-hedged unit class is also available. |

3001.HK 83001.HK 9001.HK | China offshore USD bond | It provides easy access to a basket of diversified dollar bonds issued by leading Chinese real estate firms. The features of single issuer group’s cap, short maturity and senior claims would enable the fund to minimize the potential drawdown in recent wave of credit defaults. Investors may consider using it for bargain hunting the distressed bonds with quarterly dividend distribution from the ETF. |