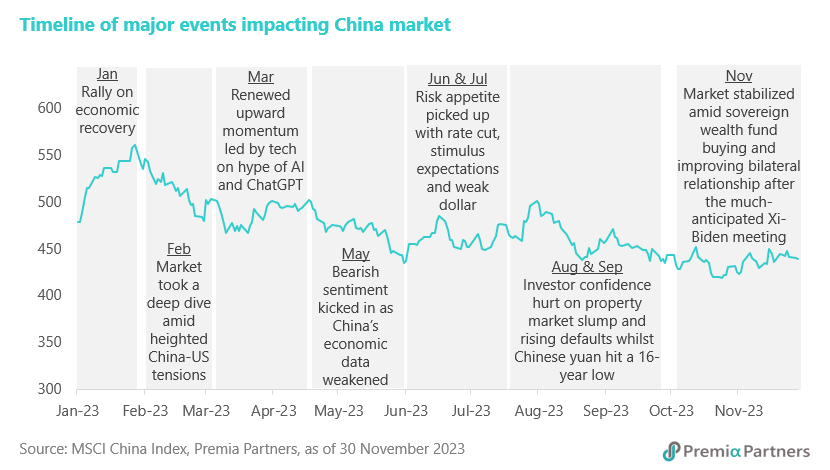

Chinese equities had a promising start in 2023, seeing a double-digit gain as a pivot toward market-friendly policies and expectations of an economic revival outweighed the Fed’s hawkish stance. The improving fundamentals and the sell-side’s bullish recommendation drove a strong rally at the beginning of the year.

Market then took a 180 degree turn due to the rising conflicts between China and the US, which proposed new rules to restrict American companies from financing the development of advanced technologies within Chinese borders. The aggressive rate hike cycle in the US and the unexpected slowdown in China economy added pressure to the fragile stock market. Simultaneously, the rising defaults among the leading Chinese private property developers, including Evergrande and Country Garden, and the depreciating yuan further dampened investors’ confidence. Market finally stabilized toward the year-end after the sovereign wealth fund’s purchase in the A-share market and the in-person meeting between President Xi and President Biden during the APEC summit.

Beijing has been acting more proactively in supporting economic growth in the past few months, with fiscal measures leading the way. The authorities announced a rise in the fiscal deficit with the issuance of RMB 1 trillion in sovereign bonds for infrastructure spending. Since the issuance of the special treasury is very rare and has happened only three times in 1998, 2007, and 2020, analysts interpret this as a turning point for policymakers moving to a more aggressive stance for stimulus. This likely involves a more holistic approach to fiscal budgeting, which will help balance the responsibility between the central and local governments. It also indicates a change with the central government willing to take up more leverage on its balance sheet. For 2024, China will likely set the general budget deficit ratio closer to around 4%, similar to the 2023 one, providing countercyclical support and promoting longer-term growth.

On monetary policy front, it is rational to assume the direction will remain accommodative, lifting credit demand and facilitating the ongoing fiscal spending. In addition to the two rounds of reduction in interest rates and required reserve ratio (RRR) since last May, the People’s Bank of China (PBOC) has been increasing liquidity injections in recent months through the issuances of medium-term lending facilities (MLF) and open market operations. In November, the PBOC injected RMB 600 billion of MLF, the largest monthly injection in 7 years. The central bank governor stressed tolerance for slowing growth in the short term as the country is undergoing a rebalancing and transitioning away from the traditional model, but he is confident the economy will enjoy healthy and sustainable growth in 2024 and beyond.

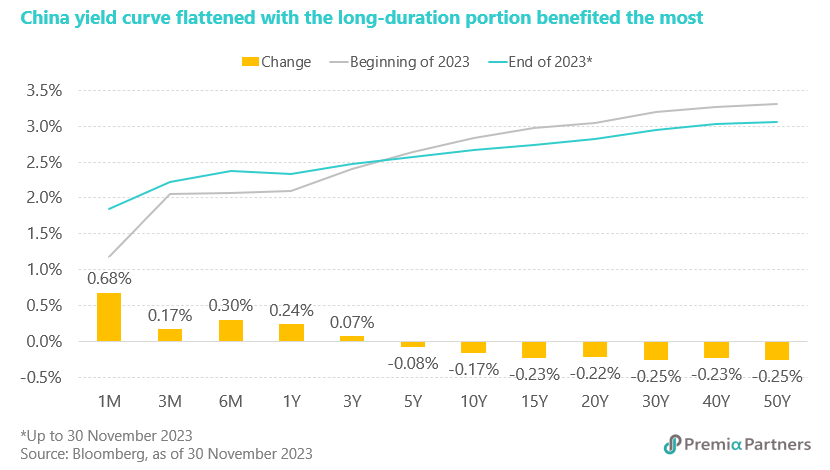

China, unlike most other developed and emerging economies, is not threatened by any inflationary pressure. Instead, the latest consumer prices dipped back below zero and the producer cost declines deepened. Deflation usually affects investor confidence as companies record income in nominal terms and face higher debt servicing pressure. It also dampens consumption demand as households would delay purchase on expectations that prices may fall in future. The PBOC, therefore, will not only maintain its supportive stance in monetary policy but also introduce stronger stimulus measures, encouraging capital investment and consumer spending. Economists forecast there will be room for an additional 100-basis-point cut in RRR and a 20-basis-point reduction in interest rate in the next twelve months. The long-duration China government and policy bank bonds may likely benefit the most from the change, repeating the decent return from the flattened yield curve in 2023.

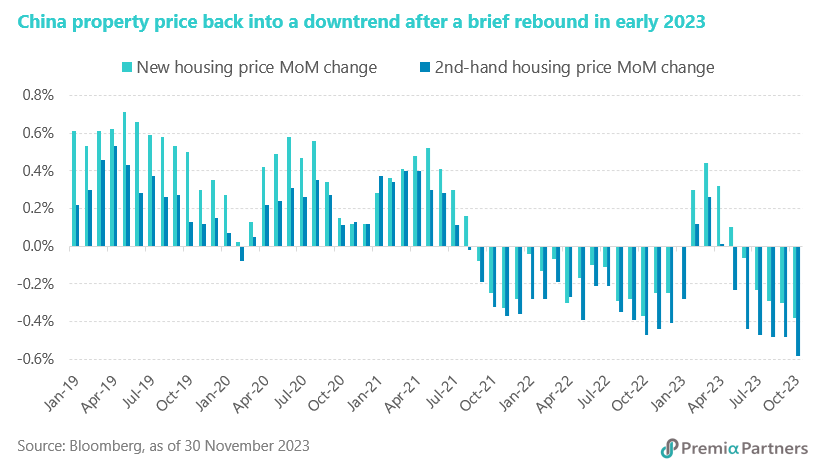

Real estate sector, accounting for about 30% of the country's overall output, remains one of the major drags in China economy, with sluggish home sales and diminishing new investment. National property sales went down 4.9% YoY in the first ten months of 2023 whilst the industry’s fixed asset investment fell 7.8% YoY in the same period. Besides, investors are worried about the rising defaults among the developers in the offshore bond market. As many as 35 of the 50 developers with the most outstanding dollar bonds have missed payments on such debt. So far, property firms accounting for 40% of Chinese home sales have defaulted on their debt obligations since 2021, according to JPMorgan. Those defaulted companies, mostly private, have issued around USD 110 billion worth of high-yield offshore bonds. That’s why the market sees the urgency for the government to save the real estate sector, otherwise the crisis will pose significant risks to the banking industry and weaken consumer confidence.

The regulators are reported to draft a list of 50 developers eligible for a range of financing, the nation’s latest effort to put an end to the property crisis. It is intended to guide financial institutions as they weigh support for the industry via unsecured short-term loans, debt, and equity financing. Some private-owned developers, such as Country Garden, China Vanke and Longfor Group, are expected to be on the list, indicating that China is expanding its rescue scope from the “systemically important” state-backed firms. In its Third-Quarter Monetary Policy Report, the PBOC said it encouraged more cities to lower or abolish the mortgage rate floor for first-time home buyers since the start of the year. As of the end of September, the rate moderation has affected more than RMB 22 trillion of existing loans for first-time home buyers, with the weighted average interest rate lowered to 4.27 percent after the change, down 73 basis points on average compared to before the change. It helped borrowers save up to RMB 170 billion in interest payments, benefiting 150 million individuals. All these actions underscore the government’s determination to stop the contraction in real estate investment and to put the economy back on the long-term growth track.

Regarding the China-US geopolitical tensions, it seems both governments are now seeking to establish a sense of stability of the world’s most critical diplomatic relationship, which has plunged to its lowest point in 50 years. The crucial face-to-face meeting between President Xi and President Biden at the Asia-Pacific Economic Cooperation summit alone could not resolve the extensive list of grievances between the two superpowers. This high-stake diplomatic encounter, however, is still meaningful as the agreement on re-opening communication channels at both military and civilian levels could be a vital step in amending the deteriorating bilateral relationship. It might serve as a foundation to prevent relations from spiraling out of control and lay the groundwork for addressing broader challenges in the future. From an investment perspective, the meeting demonstrates that full decoupling if off the table and puts a cap on geopolitical risk premium to Chinese assets.

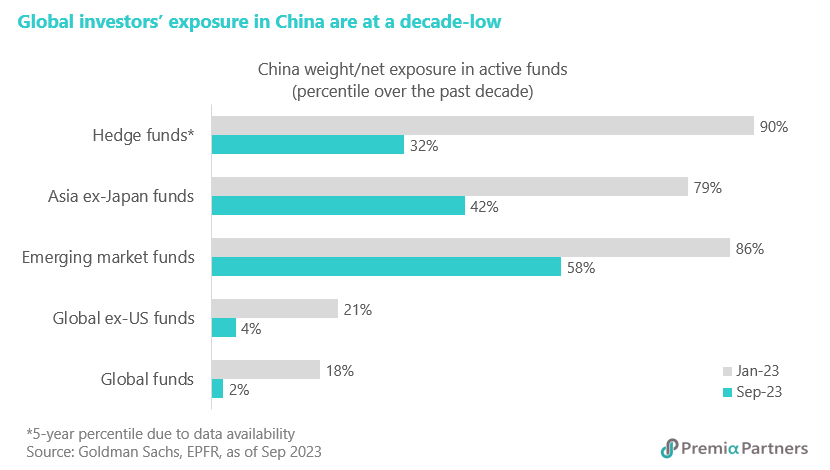

A moderate geopolitical environment may not necessarily lure back international investors to China market immediately, but it is certainly one of the considerations that may move the needle. In particular, the current exposure in China among global funds is so low that any slight positive changes may help bring in decent net inflows. According to Goldman Sachs, active global, emerging market, and Asia ex-Japan mandates with an aggregate AUM of USD 0.9 trillion are underweight Chinese equities by 400 basis points, better than the all-time lows of 490 basis points during the pandemic in October 2020. But the improvement from the historical trough is driven by China's reduced index weights in the benchmarks opposed to increases in allocation. In fact, both mutual and hedge funds globally are running with multi-year low allocations in Chinese equities. Active funds' notional exposures are close to a 5-year low, while hedge funds have halved their net exposures from the historical peak, bringing their total risk in China down to similar levels in 2018 and just marginally above the recent trough in late 2022.

Domestically, A-share equity-focused mutual funds are setting aside 13.3% of AUM in cash, a notch higher than the historical average of 12.7% over the past 5 years. The average daily market turnover of both Shanghai and Shenzhen stock exchanges in the second half of this year has fallen to RMB 543 billion, as compared with RMB 641 billion in the first half. The onshore funds’ high cash ratio and reduced market turnover illustrate that market sentiment remains low. The latest symbolic investment in banking stocks and ETFs by state-owned Central Huijin signifies the government’s desire to maintain market stability and boost investor confidence. The sovereign wealth fund has a history of intervening during times of extreme turbulence, buying stocks after bubbles burst in 2008 and 2015. The authorities have also cut handling fees for stock transactions and stamp duty, while President Xi made his first known visit to the PBOC since he became president a decade ago, underscoring Beijing’s increased focus on shoring up the capital market.

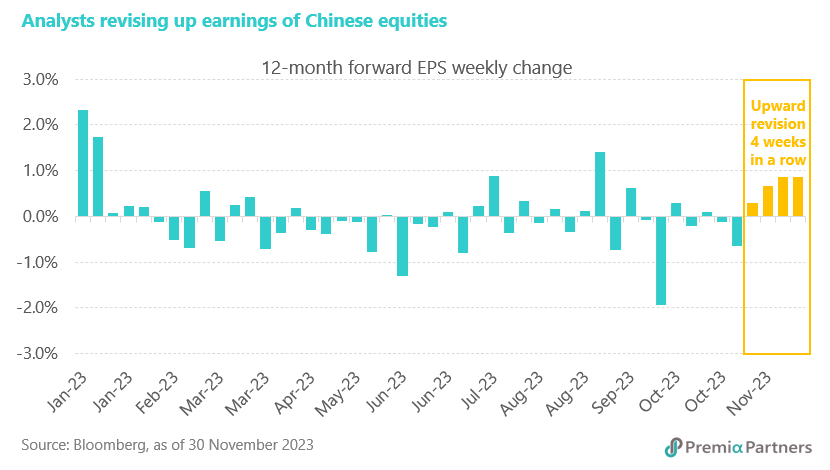

Valuation wise, Chinese equities are trading at an attractive level as compared with their historical average or their peers’ multiples in the global market. The 12-month forward price-to-earnings ratio (PER) of MSCI China Index and CSI 300 Index are 9.3x and 10.5x, respectively, about 16%-22% discount of their 5-year average. At the same time, the regional and global equities are trading at 12.5x and 16.9x forward PER. Bloomberg has recently reported that a growing band of global fund managers are calling time on the relentless selloff in Chinese assets. The excessive pessimism that hammered everything from stocks and yuan to corporate bonds has run its course, paving the way for a long-awaited market turnaround as policymakers take firmer action to revive the economy. The latest Bank of America global fund manager survey also shows less concern over China’s real estate crisis. It is getting hard to justify for institutional investors to maintain a massive underweight position on China anymore. The fundamentals of China listed companies have begun to show improving earnings profiles toward the year-end, with analysts revising their 12-month earnings per share estimates for 4 consecutive weeks.

Although nobody can time a market bottom accurately, it is no doubt that the beaten-down Chinese assets do offer a good value proposition amid accelerating policy support, improving geopolitical condition, and light positioning of international investors. We would like to summarize our thoughts by sharing Charlie Munger’s final words on China.