Macro Developments and Factor Performance

In last quarter’s year-end 2023 commentary—which must have seemed gloomy given struggles in China’s economy and a corresponding sell-off in Chinese equities throughout most of the year—we concluded on a more positive note, suggesting that early action in mainland stocks to kick off 2024 felt a lot like capitulation on the part of investors, while policymakers’ support for the stock market and increased focus on stimulating the economy suggested better times ahead on the macro front. By the end of Q1, things seemed to be playing out much as we had expected: the CSI 300 Index was up over 3% and policymakers had officially rolled out a fairly ambitious “around 5%” growth target for the year at their closely watched annual Two Sessions meeting in Beijing at the beginning of March.

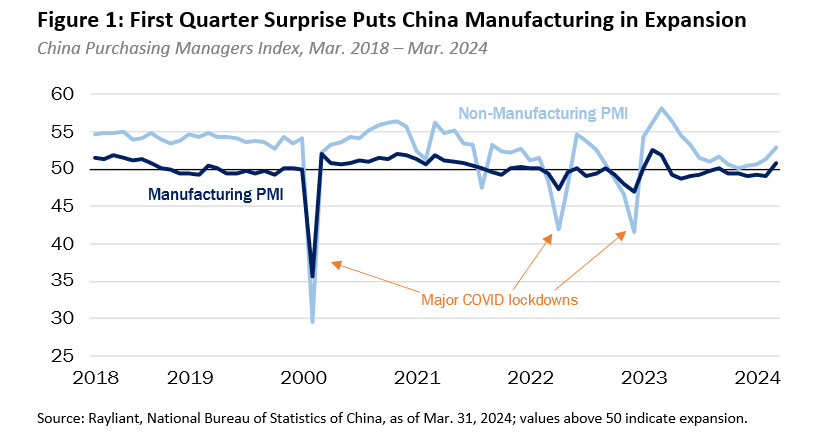

Going into 2024, we noted that the mood toward China’s economy and stock market seemed to be overly negative, characterized not just by big foreign outflows, but also remarkably poor domestic investor sentiment. We find such conditions are ripe for upside surprises. First-quarter GDP, revealed in mid-April, was a prime example, clocking in at 5.3% year-over-year: way ahead of a Reuters poll of economists who expected growth of just 4.6%, higher than the prior quarter’s 5.2% growth, and comfortably above the government’s full-year bogey. As we have mentioned before, “around 5%” was easier to beat last year because of the base effects associated with large-scale 2022 lockdowns—a softer comparison in year-over-year calculations—so in making that target official, we believe policymakers have credibly committed to being more active on the fiscal front this year. For evidence that Beijing means business, one need look no further than China’s March Manufacturing PMI (see Figure 1, below).

While services in China have been booming since authorities lifted public health restrictions and the economy opened up at the beginning of 2023, manufacturing had languished as businesses and consumers could not see fit to invest and consume against a backdrop of weakness in global trade and uncertainty in the domestic economy. No matter how much liquidity the People’s Bank of China (PBoC) injected on the monetary side, there was not much demand for that liquidity in the real economy. In the final month of the first quarter, however, China’s official PMI showed manufacturing activity jumping into ‘expansion’ territory at 50.8—another of those positive surprises we’re seeing, as economists polled by Reuters were forecasting manufacturing to remain just barely in contraction at 49.9.

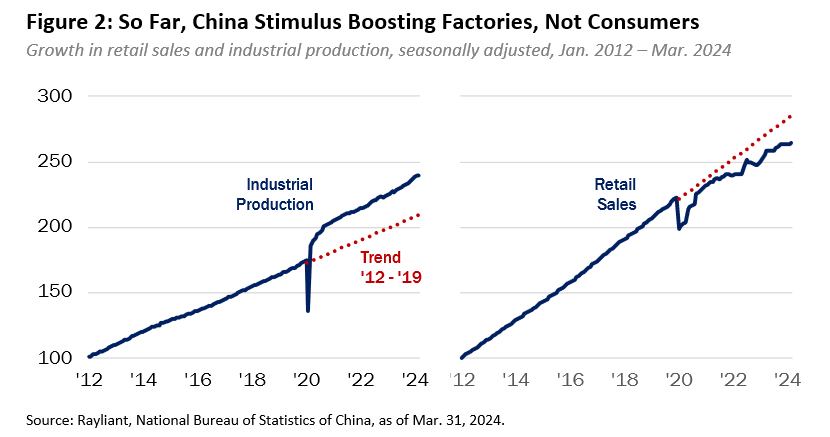

Despite some better-than-expected numbers to start 2024, there are still plenty of doubters, leaving ample potential upside for those with high enough conviction in China’s recovery to allocate now. In fairness, many of the concerns raised about economic progress thus far seem quite valid to us. Because consumption, investment and exports have been so weak over the last year or so, deflation is a serious problem for policymakers in China, not least because it contributes to the lack of uptake in liquidity the PBoC has been pumping in. While it has been encouraging to see a state-backed drive to boost factory activity yield results—China’s Q1 GDP release showed a 6.1% year-over-year jump in industrial production—retail sales have lagged their pre-COVID trend (see Figure 2, below). Of course, if Beijing follows through on a greater push this year to address the consumer side, it could make for even bigger upside surprises for those counting China’s consumers out since the pandemic.

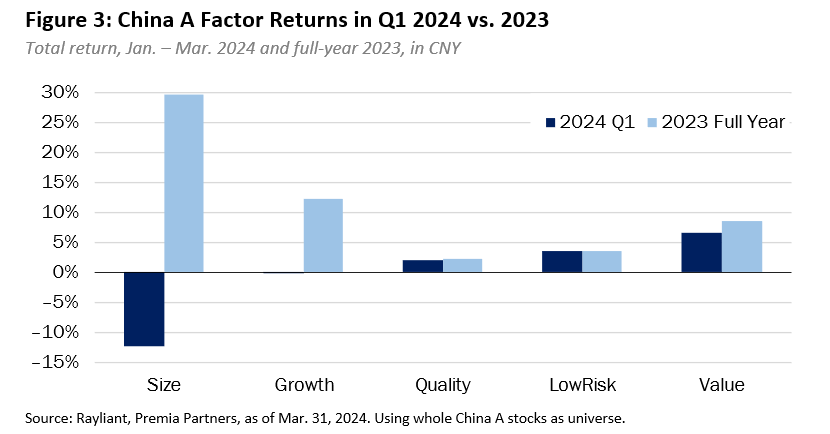

Count us optimistic that further impact of the stimulus already undertaken, not to mention the strong motivation provided by that 5% full-year GDP target to do more on the consumer side, will lead to a continuation of the ongoing recovery in China’s economy. With sentiment still very weak and plenty of domestic and foreign investors on the sidelines, we see a continued tailwind for Chinese stocks: especially when managed more selectively. Along those lines, there was plenty of factor alpha to be earned in the first quarter (see Figure 3), with Value and Low Risk—usually bigger performers in down markets, which was certainly the case last year—showing the strongest results, alongside stocks with favorable Quality characteristics. The Growth factor, among last year’s best performers, was essentially flat in Q1, while a tilt toward smaller stocks produced extraordinarily poor performance to begin 2024, a stark contrast to the Size factor’s stellar 2023 returns.

While it is not a huge surprise to see a factor earning nearly 30% excess returns in the span of a year exhibit some mean reversion and give part of those spectacular gains back, small-cap stocks were under unusual pressure in the first quarter of 2024 for two reasons. First, activity this year by China’s so-called ‘National Team’—a state-affiliated market support mechanism we discussed at some length in last quarter’s commentary—conferred most of its benefits on large-cap as opposed to small-cap stocks. The more acute cause of a sell-off in smaller stocks, however, was China’s much-discussed first-quarter “Quant Quake”: a case of high-frequency traders with big bets on smaller Chinese stocks finding themselves on the wrong side of regulatory changes and being forced to unwind those positions. Those events led the Size factor, a very crowded trade after a year’s worth of strong performance, to falter in Q1. Interestingly, the same dynamics turned out to benefit Low Risk and Value exposures, providing a textbook example of the benefits to our indices’ multi-factor construction.

Index Performance and Outlook

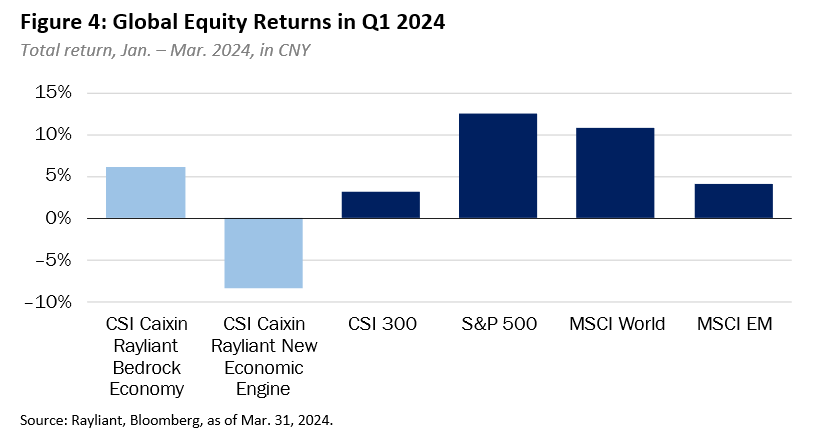

In a typical quarter, most investors would consider the CSI 300 Index’s 3.1% (CNY) gain enviable, though the first quarter of 2024 was far from typical, and China’s broad market return lagged other major global markets we were tracking (see comparison in Figure 4). Indeed, although Q1 data on consumer prices from the U.S. showed inflation to be stickier than policymakers had hoped—which led to a hawkish turn in the Fed’s messaging and to yield markets easing off beginning-of-year predictions of up to six rate cuts in 2024—sentiment toward risk assets surged higher, as investors chose to view the glass as half full: judging U.S. economic strength as portending higher likelihood of a global soft landing and doubling down on the artificial intelligence theme. Consequently, the S&P 500 added 12.5% for the quarter (with Magnificent 7 stocks therein posting an astounding 19.1% return), while developed markets in the MSCI World Index returned 10.9%, and MSCI EM Index constituents were up 4.2%.

On the back of a respectable benchmark return, results for the CSI Caixin Rayliant China A indices were mixed in Q1. The CSI Caixin Rayliant New Economic Engine Index (tracked by Premia’s 3173 HK/9173 HK ETFs) returned -8.3% for quarter, while the CSI Caixin Rayliant Bedrock Economy Index (tracked by Premia’s 2803 HK/9803 HK ETFs) posted a market-beating positive return of 6.2%. Marked weakness in the Size factor, which had been a big tailwind in 2023, naturally presented a challenge to both strategies in the first three months of 2024, with flat performance for Growth signals unable to make up the difference for the New Economy index, while Value and Low Risk performance bailed out Bedrock and contributed to its alpha for the quarter. Underperformance by the New Economy strategy resulted from a significant overweight to Health Care—a sector which we see as representing a meaningful growth opportunity in China, but one which struggled in Q1—as well as weak selection within the Materials and IT sectors. The biggest contributors to Bedrock strategy outperformance were an underweight to IT stocks and an overweight to the Energy sector, offsetting weak selection among Materials stocks.

Although China’s positive performance in Q1 still lagged other global markets, nearing the end of April, we find Chinese stocks holding their own during what is shaping up to be a rough quarter for U.S. equities. We indicated before that we are among those believers in China’s recovery who see a wide chasm between expectations for U.S. and Chinese stocks, and who find greater value in the latter amidst extremely negative sentiment and lingering doubts as to China’s policy path entering 2024. Given our team’s deep China focus, we believe we have a good grasp on what Beijing is trying to accomplish, and we imagine many casual observers of the world’s second-largest economy have some reasonable misunderstandings about policymakers’ approach to rekindling growth which, in turn, likely contribute to a lack of faith in the longer-term prospects for Chinese stocks.

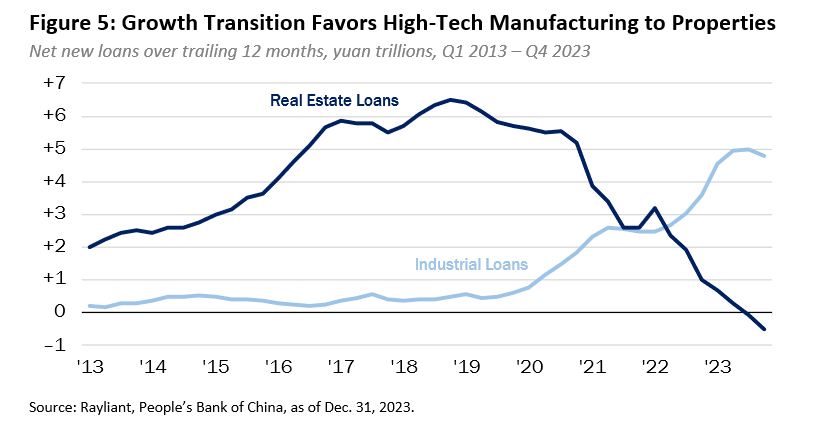

One of the keys to interpreting restraint on the part of China policymakers—understanding, for example, why there has not been a straightforward bailout of the property sector, which has clearly been a big problem over the last few years—is recognizing that Beijing does not just seek growth, but more specifically high-quality growth. That is a message that has come through loud and clear in key policy announcements: at the Central Economic Work Conference we discussed in last quarter’s commentary, for example, or the Two Sessions meetings mentioned above. It is also something we see reflected in the data. Loan growth, for instance, has been strong among firms in China’s industrial sector, but weak in the real estate space (see Figure 5, below), as authorities maintain a commitment to deflating what they see as overly geared speculation among real estate developers and promoting truly productive areas of China’s economy, like the high-tech manufacturing taking center stage in China’s growth transition.

Ultimately, amidst concern over China’s struggling property market, worries about the nation’s geopolitical tensions with the US, and FOMO thinking around the Magnificent 7 and American tech stocks’ gravity-defying rally, Beijing’s pursuit of higher-quality growth is a theme we believe investors cannot afford to ignore. It is a trend we expect will benefit mainland stocks at the heart of China’s economic transformation more so than offshore stocks among Hong Kong listings and U.S. ADRs. While we see the policy tailwinds associated with areas like semiconductors and A.I. as obviously boosting firms in the new economy, we also expect big upside in more traditional blue-chip sectors of China’s manufacturing space, with industrial exposure to the “new three” green industries—solar, batteries and EV—providing ample opportunity to participate in China’s return to a different kind of growth. We view strategies like those represented in the New Economy and Bedrock indices, with intelligent tilts toward low-priced shares and high-quality growth stocks trading at reasonable valuations as presenting an even better way to access a transition we believe is still in its early innings.

*****************************************************************************************************

Dr. Phillip Wool is the Global Head of Research of Rayliant Global Advisors. Phillip conducts research in support of Rayliant’s products, with a focus on quantitative approaches to asset allocation and return predictability within asset classes, as well as the design of equity strategies tailored to emerging markets, including Chinese A shares. Prior to joining Rayliant, Phillip was an assistant professor of Finance at the State University of New York in Buffalo, where he pursued research on quantitative trading strategies and investor behaviour, and taught investment management. Before that, he worked as a research analyst covering alternative investments for Hammond Associates, an institutional fund consultant. Phillip received a BA in economics and a BSBA in finance and accounting from Washington University in St. Louis, and earned his Ph.D. in finance from UCLA, where his research focused on the portfolio holdings and trading activity of mutual fund managers and activist investors. Premia CSI Caixin China New Economy ETF and Premia CSI Caixin China Bedrock Economy ETF track the CSI Caixin Rayliant New Economic Engine Index and CSI Caixin Rayliant Bedrock Economy Index respectively.